Data Reveals 335 Binance Alpha Tokens: Has the "Altcoin Season" Really Arrived?

TechFlow Selected TechFlow Selected

Data Reveals 335 Binance Alpha Tokens: Has the "Altcoin Season" Really Arrived?

Only 5 tokens have seen gains of over 100% in the past week.

Author: Frank, PANews

With the surge of multiple Binance Alpha tokens, discussions about a potential altcoin season led by Binance Alpha have resurfaced.

Many users are debating on social media what logic might unlock hidden wealth. However, this so-called altcoin season is actually just a cognitive bias caused by a few outlier "rampage" projects. If we were to identify common traits among these wealth-generating tokens, what characteristics among Binance Alpha listings could be driving market performance?

PANews conducted a comprehensive data analysis of 335 tokens listed on Binance Alpha, examining dimensions such as market cap, blockchain distribution, trading pair types, and whether they conducted airdrops, to uncover the real secrets behind their success and answer one ultimate question: Has the much-talked-about Binance Alpha "altcoin season" truly arrived?

Altcoin Season May Be an Illusion: Only 5 Tokens Have More Than Doubled in the Past Week

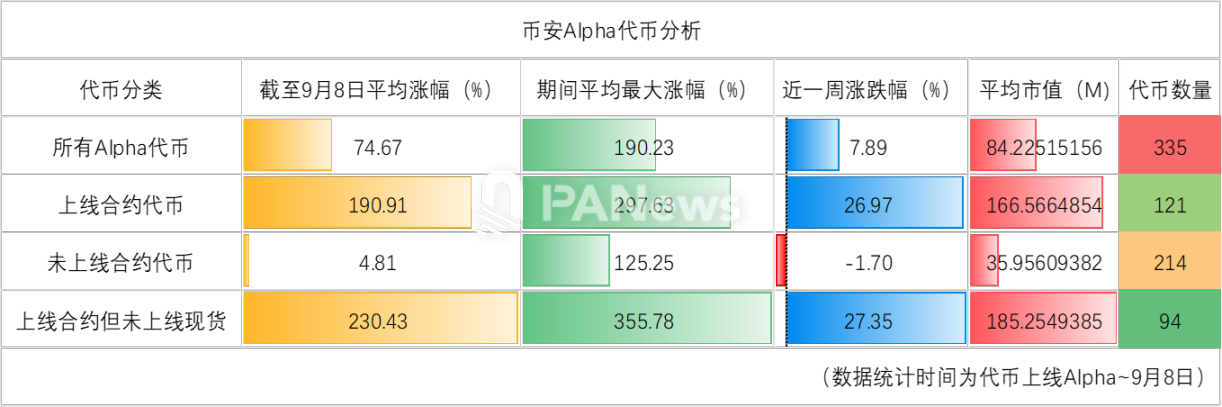

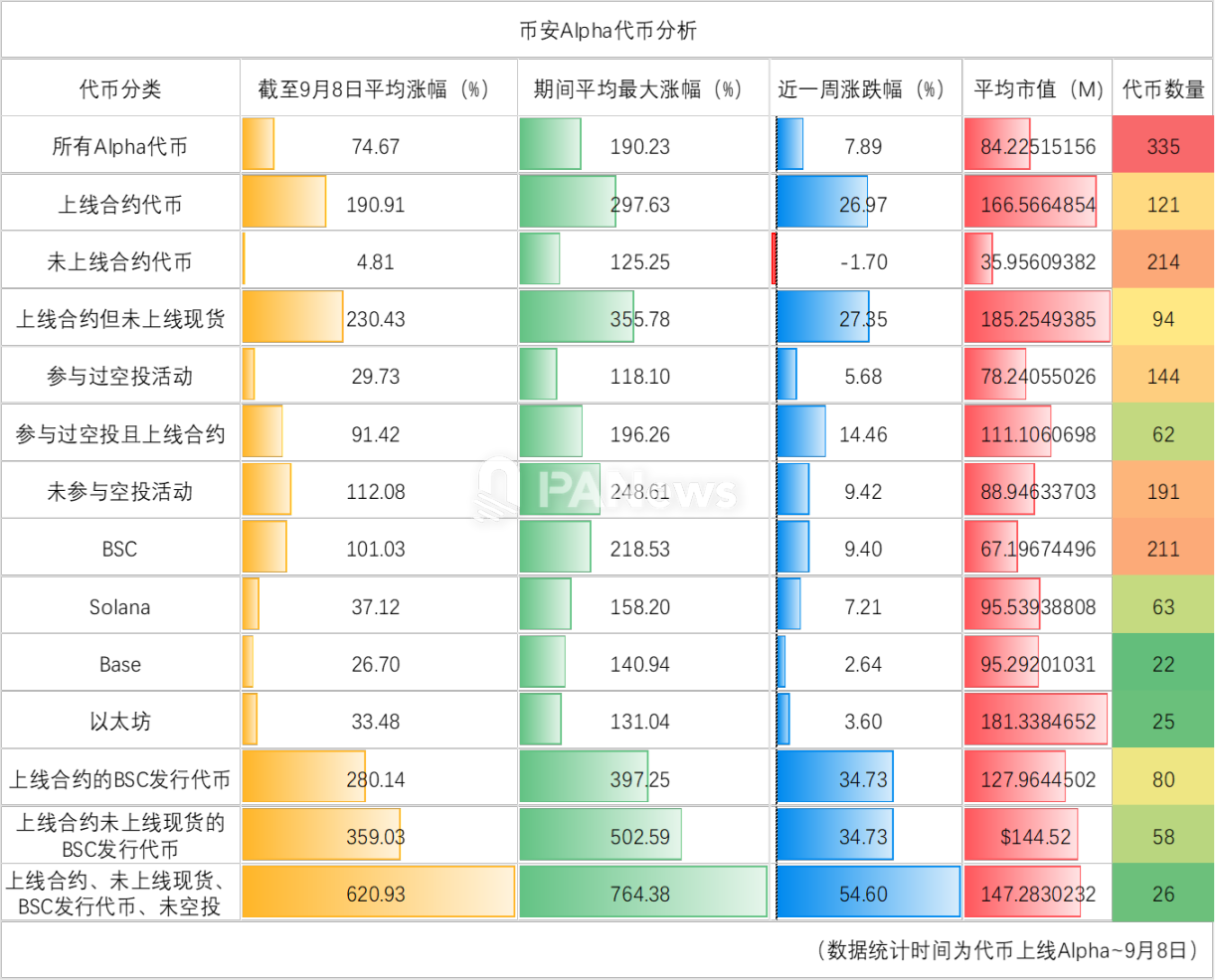

According to PANews' analysis of the 335 tokens launched on Binance Alpha, their market performance shows two core features: a widespread "post-listing price surge" and stark "performance polarization."

Widespread Surge Effect: Overall, these tokens have averaged a 74.6% gain since listing, with an average peak gain as high as 190%. This means most tokens experienced a strong rally after being listed on Alpha. Specifically, 120 tokens (35%) once doubled from their listing price, while only 19 tokens never surpassed their initial issue price.

Performance Polarization: However, long-term performance varies greatly. To date, although 146 tokens (43.5%) remain up, including 44 that have doubled, standout project MYX achieved an astonishing 123x return. At the same time, 81 tokens (24%) have dropped more than 50%, with maximum drawdowns exceeding 97%.

Market Cap Distribution: In terms of project scale, the average market cap is $84.22 million, with a median of $18.58 million. Projects with market caps above $100 million are the most numerous (48), followed by those between $10 million and $20 million. While there are small projects under $1 million in total value, mainstream Alpha projects still maintain a certain size.

Recent Weekly Data: In the past week, 141 tokens rose in price, with MYX leading at a 1064% weekly gain. However, only five tokens more than doubled over the past seven days. Statistically, the average weekly change for Binance Alpha tokens was just +7.8%, far below their all-time highs. Therefore, the idea of a recent breakout altcoin season on Binance Alpha may simply be a cognitive bias, lacking broad validity.

Do Tokens Listed on Futures but Not Spot See Greater Gains?

Another widely discussed topic on social media is whether tokens listed on Binance Futures—but not on Spot—tend to see larger gains.

Currently, only 28 tokens (8.3%) are available on Binance Spot, most of which are also listed on Futures. In contrast, 121 tokens (36%) are listed on Futures. There are 94 tokens listed exclusively on Futures without a Spot pair; these tokens saw an average 7-day gain of 27%, notably higher than the overall average. By comparison, tokens without Futures pairs posted an average gain of -1.7%, trending downward over the past week.

In terms of market cap, tokens without Futures listings average around $35.96 million, while those with Futures average approximately $160 million. Clearly, higher-market-cap tokens are more likely to be prioritized for Futures listing. Over the full cycle, tokens listed on Futures have seen an average gain of 190%, with an average peak gain of 297%, outperforming others. Meanwhile, tokens listed on Spot have gained only 45.77% on average since their Alpha listing.

In contrast, tokens listed on Futures but not on Spot have achieved an average gain of 230% and an average peak gain of 355%, confirming better performance under this condition.

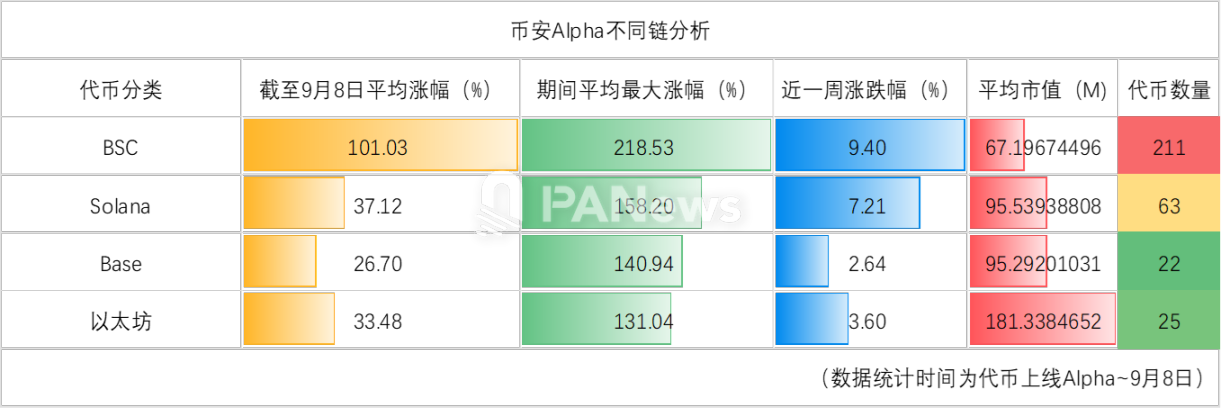

BSC Chain Shows Clear Home Advantage, Averaging Over 100% Gains

Does blockchain choice also impact performance?

By chain distribution: Base has 22 tokens, averaging a 26% gain; BSC has 211 tokens, averaging 101%; Ethereum has 28 tokens, averaging 33.4%; Solana has 64 tokens, averaging about 37%.

BSC, as Binance’s native chain, clearly enjoys stronger market favor and outperforms tokens on other blockchains.

Buy Old, Not New: Top Performers Were Mostly Listed Early

What do the best-performing tokens recently have in common?

1. BSC-based tokens dominate: Among the five tokens that gained over 100% in the past week, four are on BSC and one on Solana.

2. These are not newly listed tokens—they mostly went live in May or July, with only one launching on August 24.

3. Three of them are listed on Futures, but this doesn't necessarily indicate a direct link to higher gains.

4. Market cap distribution lacks significant statistical meaning—the five tokens range from hundreds of thousands to billions in value. However, four of them exceed $10 million in market cap.

Taking a broader view—analyzing all tokens that have gained over 100% since listing—offers more insight:

1. Market cap: Most exceed $10 million, and those above $100 million generally rank higher in gains.

2. 54.5% are listed on Futures—while notable, this does not prove a necessary link to high performance.

3. 56% were issued on BSC, and 22.7% on Solana—nearly 80% combined.

4. Launch timing shows clear patterns: April (12), May (4), June (3), July (16), August (6), September (3). Tokens listed in April, July, and August show stronger market performance.

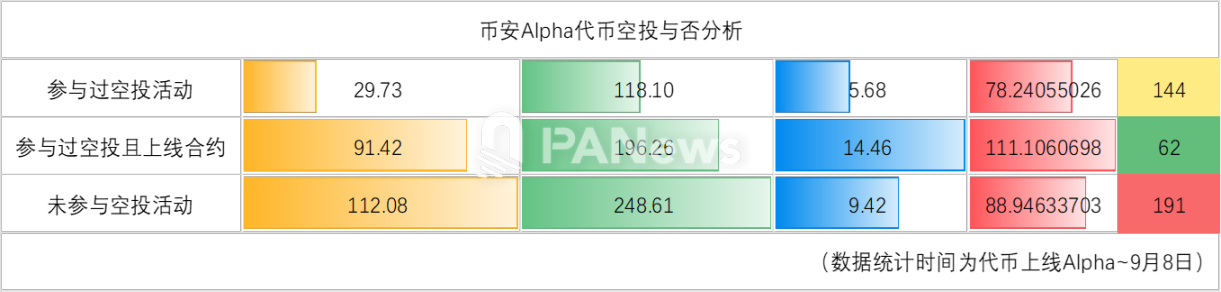

Does Conducting an Airdrop Hinder Price Appreciation?

Another point of market interest: How do tokens that participated in Binance Alpha airdrops perform? According to PANews, 144 tokens have conducted Alpha airdrops. Their average gain since launch is about 29%, underperforming the overall Alpha token average. Of these, 91 tokens are currently below their Alpha listing price, with maximum losses reaching 97%. However, in terms of peak gains, these tokens did experience a price surge post-listing, averaging a peak gain of 1235%. Notably, REX spiked 1457x due to a short-term anomalous candle. After removing such outliers, the average peak gain drops to about 118%.

Yet, when filtering for tokens that both conducted an airdrop and are listed on Binance Futures, the average gain rises to 91%, with an average peak gain of 196%. This outperforms the general airdrop cohort but still lags behind the overall Futures-listed group.

From this perspective, being listed on Futures appears to be one of the most critical positive factors for Binance Alpha tokens. Conversely, conducting an airdrop offers little price benefit—and may even have a negative effect.

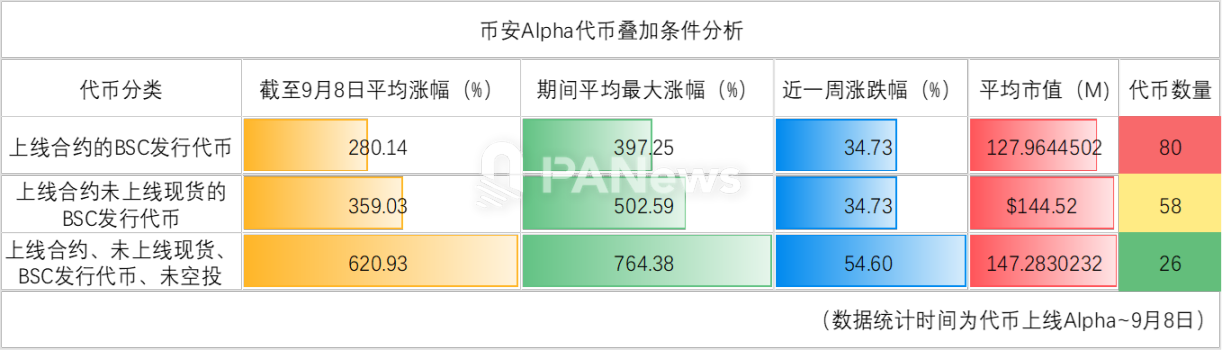

Optimal Combination: Listed on Futures, Not on Spot, on BSC, No Airdrop

Returning to our ultimate question: Which type of token performs best on Binance Alpha? Based on previous analysis, several favorable conditions emerge: listed on Futures, issued on BSC, no airdrop, and not listed on Spot.

Combining these factors: Tokens issued on BSC and listed on Futures already average a 280% gain—higher than Futures-listed tokens alone. Adding the condition of not being listed on Spot raises the average gain to 359%. The strongest combination—listed on Futures, not on Spot, no airdrop, and issued on BSC—achieves an average gain of 620% and an average peak gain of 764%, with a recent weekly gain of 54%. Nearly all metrics reach optimal levels under this profile.

Thus, we seem to have uncovered the formula for high-potential Binance Alpha tokens—only 26 meet all these criteria. Analyzing why, we find that being listed on Futures and issued on BSC are the most decisive factors, while the others act as supporting conditions. Ironically, these supporting advantages stem not from additional actions taken by the projects, but rather from omissions—specifically, not launching on Spot and not conducting airdrops.

Fundamentally, the underlying logic may be that airdrops flood the market with low-cost tokens, increasing sell pressure. Not listing on Spot but only on Futures makes these tokens inherently harder to acquire, limiting supply. For spot holders, price increases are always welcome. But for futures traders, these tokens’ higher volatility creates ideal conditions for short squeezes.

However, it's important to note that these findings are based on historical data and may suffer from overfitting. A major limitation of this study is the lack of categorization by token type or deeper project-level details, which could be even more influential. Therefore, these conclusions should not be used as direct investment advice. We hope this analysis serves merely as a starting point, offering readers a fresh perspective.

The current opportunity is not a bull market where blind buying leads to profits, but rather a structural market requiring careful selection and deep analysis. For investors, understanding the logic behind these trends is far more important than chasing headlines. Because in this highly volatile, futures-driven game, every opportunity comes hand-in-hand with risks that demand constant vigilance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News