Where has the山寨 season gone? The crypto stock market tells you

TechFlow Selected TechFlow Selected

Where has the山寨 season gone? The crypto stock market tells you

The real "altcoin season" is unfolding in the crypto stock market.

Author: Alana Levin

Translation: TechFlow

There are many questions surrounding whether this crypto cycle will see an "Alt Season." Some are looking toward January 2024 or 2025, expecting significant appreciation in non-Bitcoin crypto assets (altcoins), even reaching all-time highs.

In previous cycles, a strong rise in Bitcoin's price typically triggered similar performance in many long-tail crypto assets—sometimes even outperforming Bitcoin. However, in recent years, this pattern has not repeated. Currently, Bitcoin’s market dominance stands at 58%, steadily rising since November 2022.

Will this cycle skip Alt Season altogether? Or is Alt Season simply delayed? Or perhaps… is Alt Season already quietly unfolding in an entirely different market, without us noticing?

My intuition says it's the last one. The real Alt Season is playing out in the crypto stock market.

What defines a typical Alt Season?

-

Rising prices attract new capital → But where does this new capital come from?

-

Rising prices trigger profit rotation → But who is realizing profits, and where are those profits being redeployed?

Today, there is indeed fresh capital eager to enter crypto—but it comes more from institutions than retail investors. In contrast, retail tends to be fast early adopters, while institutions are more cautious and often require external legitimacy as a catalyst. And that legitimacy is now emerging: in 2024, the U.S. SEC approved spot Bitcoin and Ethereum ETFs; SEC Chair Atkin recently announced "Project Crypto"; Nasdaq CEO Adena Friedman publicly endorsed equity tokenization. The list goes on.

Institutions are entering with fresh capital—and I suspect most of it is flowing into crypto stocks rather than crypto assets. The stock market is far more familiar and accessible to institutions. They already have established operational infrastructure (custody, compliance processes, dealer relationships, etc.), whereas buying crypto directly may require building entirely new capabilities. Buying stocks falls within their mandate—while directly purchasing crypto tokens, especially long-tail assets, may fall outside it.

As a result, institutional capital is being directed toward crypto-related stocks. For example:

-

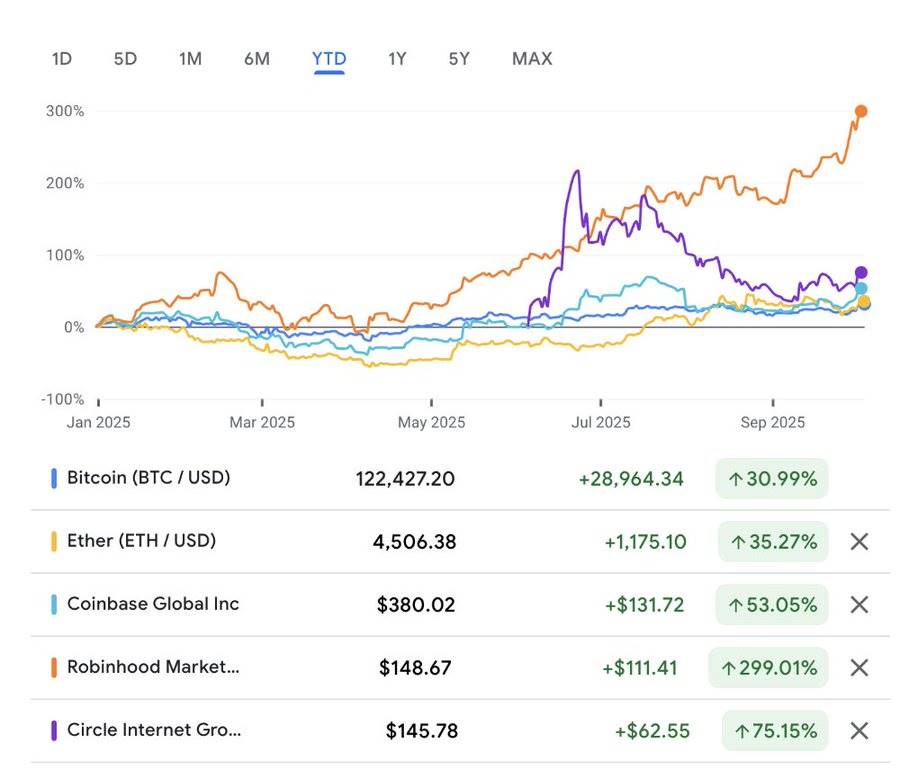

Coinbase is up 53% year-to-date;

-

Robinhood is up 299%;

-

Galaxy is up 100%;

-

Circle is up 368% since its June IPO (or 75% if measured from closing price on first trading day).

By comparison, Bitcoin is up 31%, Ethereum up 35%, and Solana up 21%. Crypto stocks are clearly outperforming.

The picture remains similar when looking at performance since Bitcoin's bottom on December 17, 2022.

There are reasons to believe this trend will continue. A wave of upcoming crypto stock IPOs is expected, and more late-stage companies may file for public listings in the coming years.

As in a typical Alt Season, not all assets will perform well. I expect some rotation—traders may take profits from overvalued assets (such as CRCL, currently trading at 26x price-to-sales) and redeploy capital elsewhere.

In crypto markets, we often see shifting themes—markets rotating from DeFi assets to gaming tokens, then to AI-related tokens. The crypto stock market may follow a similar path: an Alt Season could involve capital moving from stablecoin-related stocks to exchange stocks, then to digital asset reserve firms (or other trends).

I believe the crypto stock alt season may ultimately resemble a historical alt season more closely than any future alt season in the native crypto market, for several reasons:

-

Asset concentration. Currently, only a small number of stocks offer exposure to crypto. This mirrors earlier crypto cycles, when buyers saw fewer than 100 attractive tokens. This contrasts sharply with today’s native crypto market—home to millions of tokens, leading to much more dispersed capital deployment.

-

Leverage utilization. Many native crypto lending platforms collapsed in the last cycle, and we haven’t seen their rebuilding yet. However, stock investors can use leverage, meaning market booms could be more pronounced (but crashes potentially more severe).

We may eventually see an Alt Season in native crypto assets. But it will take time—new sources of marginal capital need time to build the operational capacity required to invest in crypto assets.

So for now, this may not be the Alt Season many were waiting for—but regardless, we’re in an Alt Season.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News