How far are we from a full-scale cloning season?

TechFlow Selected TechFlow Selected

How far are we from a full-scale cloning season?

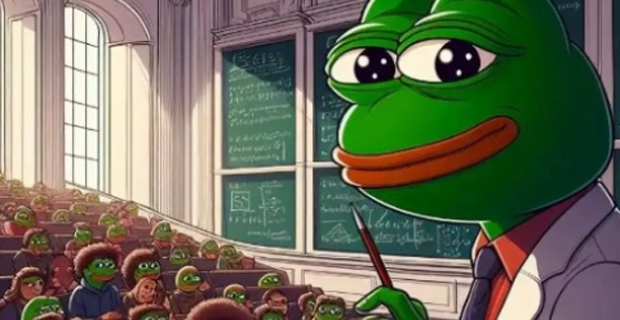

Bitcoin's market share has declined, while Ethereum's market share is rising.

Author: kkk, BlockBeats

On August 12, Ethereum surged past $4,700, hitting a four-year high. @CryptoHayes, who had previously cashed out profits last week, re-entered the Ethereum market on August 9. Bitcoin also reached a new all-time high, pushing the total cryptocurrency market cap to $4.2 trillion, igniting market sentiment.

Traditional markets are equally heated. Both the S&P 500 and Nasdaq 100 have hit record highs, as global liquidity accelerates into risk assets. The U.S. Dollar Index (DXY) has dropped below 98, opening the floodgates for more capital inflows into equities and crypto. This macro backdrop not only reinforces the upward trend but also steadily boosts investor confidence in high-risk assets.

Meanwhile, markets are nearly certain the Federal Reserve will cut interest rates at its September 17 meeting—probability close to 100%—lowering the benchmark rate to the 4.00%-4.25% range. This expectation provides additional fuel for liquidity-dependent markets, especially cryptocurrencies. Today, the wealth effect of the alt season has become a major talking point; the key question is when it will fully kick off.

Below, TechFlow compiles traders’ views on the current market outlook to offer directional insights for your trading this week.

@b66ny

BTC.D has recently shown a clear downward trend, retreating from prior highs to around 57.7%. Combined with ETH.D’s movement, I see this as a classic sign of capital rotation: funds are starting to exit relatively stable assets and shift toward higher-risk, higher-potential-return opportunities. Historically, sustained declines in BTC.D are often a prerequisite for the start of an alt season.

ETH.D reflects not only Ethereum’s strength but is also widely seen as a bellwether for the entire altcoin market. Currently, ETH.D is strong, with dominance recovering to 14.0%. Alongside ETH’s sharp price rise, ETH/BTC gained over 4% in 24 hours, signaling clear capital flow from Bitcoin to Ethereum.

This pattern follows the classic capital rotation playbook: first, BTC stalls or pulls back, prompting funds to move into ETH. ETH’s rise not only boosts market confidence but also creates conditions for further liquidity to enter the broader alt market.

The next indicator to watch is OTHERS.D (market cap share of smaller altcoins excluding top-tier assets like BTC and ETH). Currently, OTHERS.D remains in a prolonged consolidation phase, showing no explosive growth like ETH.D. This suggests that capital concentration is still focused on a few top-tier assets such as ETH. Although SOL also saw a notable rally today, reinforcing signs of capital rotation, the momentum has not yet broadly spread to high-risk, small-cap speculative sectors.

Considering these three indicators together, the market is likely in the early stage of rotation:

Already happened: BTC.D decline, capital spillover.

Happening now: ETH.D rise, capital flooding into ETH.

Yet to happen: OTHERS.D rise, capital spreading to small-cap alts.

@im_BrokeDoomer

Looking at the altcoin-to-Bitcoin market cap ratio since 2017, we’re currently at a critical support level near the lower boundary of the channel. This zone has historically been sensitive for capital entry, often coinciding with improving market sentiment and accelerated rotation. If this support holds, the altcoin sector could see a broad breakout, marking the official start of a new alt season.

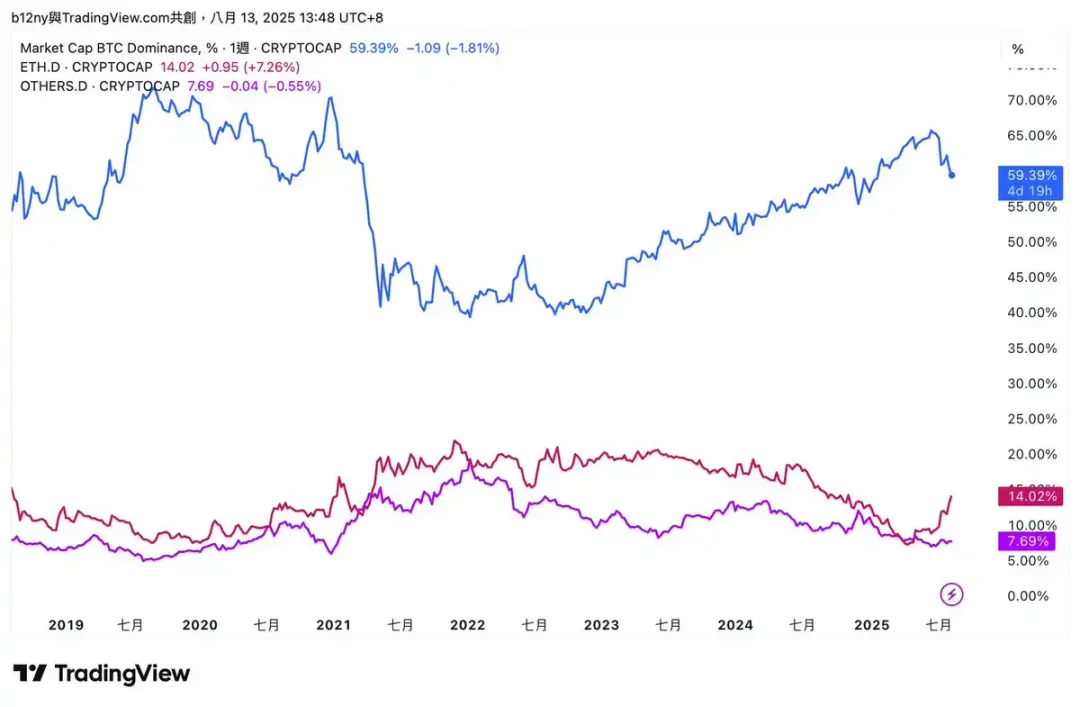

The typical alt season progression unfolds as follows: Bitcoin (BTC) starts rising → Ethereum (ETH) follows → BTC rallies again → ETH breaks all-time highs (ATH) → large-cap alts rise → BTC hits new highs → ETH and large-cap alts reach new highs together → mid-cap alts take off → small-cap alts explode across the board.

We are currently in the third phase, with ETH and large-cap alts hitting new highs. The subsequent surge in other alts is something to look forward to.

@ZssBecker

In the previous 2020 bull run, most altcoin narratives didn’t ignite immediately. Instead, they only took off after ETH broke its previous all-time high and tripled in price. At that time, capital flooded into new narratives—such as gaming—sending related tokens soaring 10x, 20x, or even 50x. The Sandbox briefly surged 80x, and even the weakest, most marginal gaming projects achieved double-digit gains. This phenomenon occurred mainly in the mid-to-late stages of the bull market, but once triggered, it became a concentrated burst of wealth creation.

I believe history will repeat itself in this cycle. We are still in the first phase of alt season—the BTC and ETH dominance phase. Only after ETH surpasses $5,000 and major alts achieve 2–3x gains will market capital aggressively chase the next narrative. The most likely candidates to lead the charge are AI, RWA, and gaming—three sectors where crypto has already demonstrated real-world integration and profitability, offering strong narratives and high return potential.

The last gaming narrative turned thousands of dollars into millions for countless investors. This time, with larger market capital and higher risk appetite, the capital surge will be even more intense once it begins. For investors, the key isn’t to rush in now, but to wait patiently and position early. The peak of alt season will only arrive when the narrative switch flips.

@lanhubiji

Understanding market structure makes it clear that alt season will come, but its form may differ significantly from the past two cycles. Previously, there were fewer altcoins and capital was relatively concentrated, leading to broad-based gains across almost all top sectors. Now, with over a million tokens in existence, competition is extremely fragmented, and capital cannot cover every asset.

This means we’re more likely to see a "localized alt season"—capital will concentrate in a few niches or individual tokens with strong narratives, strong communities, and strong liquidity, creating localized frenzies while the majority of tokens remain ignored. Opportunities still exist, but the odds of picking a winner are far lower than before. Right now, AI is the most promising sector.

@joao_wedson

The real alt season hasn't even begun yet. Smart money typically flows in this sequence: first from BTC to ETH, then into large-cap alts, and finally into mid- and small-cap tokens. The current market has only just entered the first half of this process. The true "alt frenzy" is still ahead—and could last all the way into November. In other words, the current rally is merely an appetizer; the main course hasn't arrived yet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News