IOSG: Why has the era of "buy blindly" altcoin seasons become history?

TechFlow Selected TechFlow Selected

IOSG: Why has the era of "buy blindly" altcoin seasons become history?

The era of copycats will come, but it won't be like the 2021 copycat season.

Author|Jiawei @IOSG

Introduction

▲ Source: CMC

Over the past two years, market attention has been consistently drawn to one question: Will the alt season return?

Compared to Bitcoin's strength and ongoing institutionalization, the performance of most altcoins has been lackluster. The market capitalization of the majority of existing altcoins has shrunk by 95% compared to the previous cycle, and even newly launched tokens surrounded by hype are stuck in difficult conditions. Ethereum also experienced prolonged sentiment downturns, only recently showing signs of recovery driven by trading structures such as the "coin-stock mode."

Even against the backdrop of Bitcoin hitting new highs and Ethereum catching up with relative stability, overall market sentiment toward altcoins remains weak. Every market participant is hoping for a repeat of the epic bull run seen in 2021.

The author presents a central thesis here: the macro environment and market structure that enabled the broad, months-long, flood-like rally of 2021 no longer exist—not to say an alt season won't come, but rather it is more likely to unfold within a slow bull market and in a more fragmented, differentiated manner.

The Fleeting Miracle of 2021

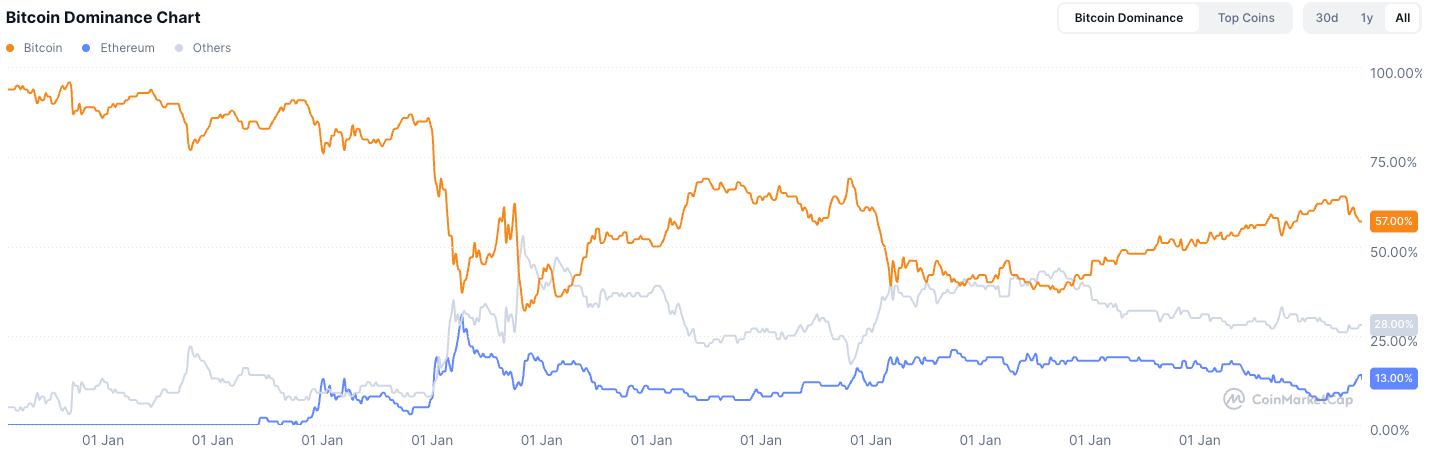

▲ Source: rwa.xyz

The external market environment in 2021 was highly unique. Amid the pandemic, central banks worldwide were printing money at an unprecedented pace, injecting this cheap capital into the financial system, suppressing returns on traditional assets, and suddenly leaving investors with large amounts of cash.

Driven by the search for higher yields, capital flowed heavily into risk assets, with the crypto market becoming a key destination. The clearest indicator was the explosive growth of stablecoin issuance, which surged from approximately $20 billion at the end of 2020 to over $150 billion by the end of 2021—an increase of more than sevenfold within the year.

Internally, after the DeFi Summer, infrastructure for on-chain finance was expanding rapidly. Concepts like NFTs and the metaverse entered mainstream awareness, while public chains and scaling solutions were still in their growth phase. At the same time, supply of projects and tokens remained relatively limited, leading to high concentration of attention.

Take DeFi as an example: back then, only a few blue-chip projects existed—Uniswap, Aave, Compound, Maker—and these few protocols could represent the entire sector. Investors faced fewer choices, making it easier for capital to coalesce and drive sector-wide gains.

These two factors created fertile ground for the alt season of 2021.

Why “Great Places Are Rare, Grand Feasts Hard to Recreate”

Setting aside macroeconomic factors, the author believes the current market structure has undergone several significant changes compared to four years ago:

Explosive Expansion of Token Supply

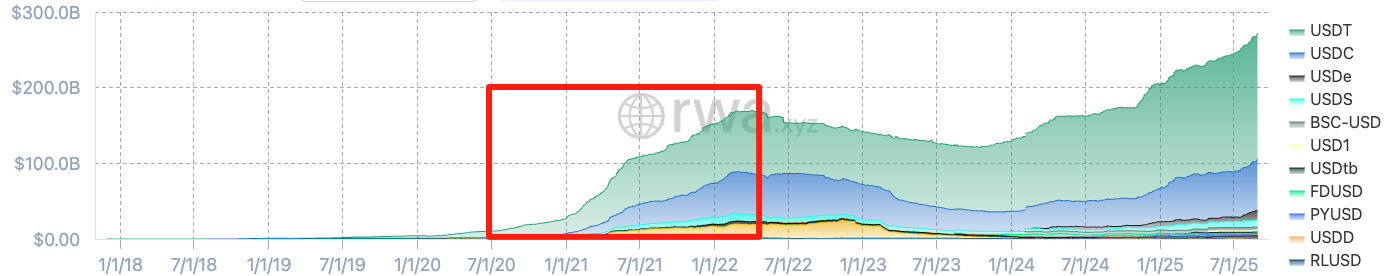

▲ Source: CMC

The wealth creation effect of 2021 attracted massive inflows of capital. Over the past four years, the booming venture capital landscape has silently driven up average project valuations. Combined with the prevalence of airdrop economies and the viral spread of memecoins, token issuance has accelerated dramatically, accompanied by rising valuations.

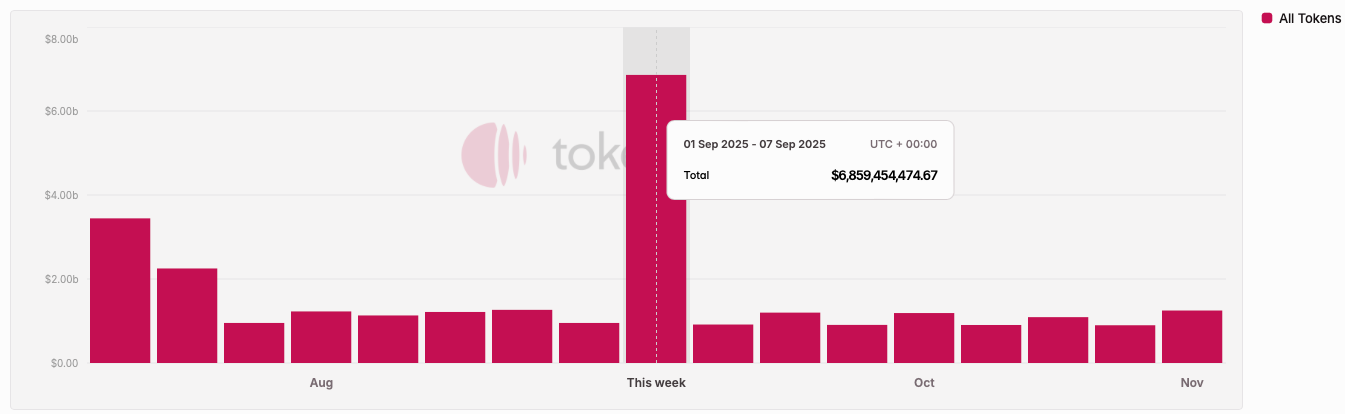

▲ Source: Tokenomist

Unlike in 2021 when most projects were already highly liquid, today’s mainstream projects (excluding memecoins) generally face significant token unlocking pressure. According to TokenUnlocks, over $200 billion worth of tokens are set to unlock between 2024 and 2025. This reflects the much-criticized industry condition of "high FDV, low float" in this cycle.

Fragmentation of Attention and Liquidity

▲ Source: Kaito

In terms of attention, the above chart randomly captures pre-TGE project mindshare on Kaito. Among the top 20 projects, we can identify at least 10 different niche sectors. If asked to summarize the main narratives of the 2021 market in just a few words, most people would say "DeFi, NFT, GameFi/Metaverse." In contrast, recent markets seem too fragmented to be captured so succinctly.

Under these circumstances, capital rapidly switches between sectors, with short durations. Crypto Twitter is flooded with endless information, and different groups mostly discuss disparate topics. This fragmentation of attention makes it difficult for capital to unite as it did in 2021. Even if one sector performs well, the momentum rarely spreads to others, let alone triggering a broad-based rally across the board.

In terms of liquidity, a foundational element of alt season is the spillover effect of profitable capital: liquidity first flows into major assets like Bitcoin and Ethereum, then seeks out altcoins with potentially higher returns. This overflow and rotation effect provides sustained buying support for long-tail assets.

This seemingly natural dynamic has not materialized in the current cycle:

-

First, institutions and ETFs driving Bitcoin and Ethereum price increases do not redeploy capital into altcoins. These funds prefer custodial and compliant top-tier assets and related products, marginally strengthening the suction effect toward leading assets rather than evenly lifting all corners of the market.

-

Second, most retail investors may not actually hold Bitcoin or Ethereum, having instead been deeply trapped in altcoins over the past two years, leaving them without surplus liquidity.

Lack of Breakout Applications

The狂飙 (rapid surge) of the 2021 market had some underlying support. DeFi brought fresh life to blockchain's long-standing application drought; NFTs extended creator and celebrity influence beyond the crypto sphere, with growth attributed to new users and use cases from outside (at least that was the narrative).

After four years of technological and product iteration, we find that infrastructure has been overbuilt, yet truly breakout applications remain scarce. Meanwhile, the market has matured, becoming more pragmatic and clear-headed—tired of endless narratives, it now demands real user growth and sustainable business models.

Without continuous influx of new participants to absorb the ever-growing token supply, the market can only fall into zero-sum internal competition, which fundamentally lacks the foundation required for a broad rally.

Envisioning This Cycle’s Alt Season

The alt season will come—but it won’t be the same as in 2021.

First, the basic logic of profit-taking capital rotation and sector rotation still holds. We can observe that once Bitcoin reached $100,000, its short-term upward momentum clearly weakened, prompting capital to seek the next target. The same applies after Ethereum's rise.

Second, under persistent market illiquidity, investors trapped in losing altcoin positions need ways to自救 (save themselves). Ethereum serves as a good example: has Ethereum's fundamental situation meaningfully changed this cycle? The hottest applications, Hyperliquid and pump.fun, aren't built on Ethereum; "world computer" is an old concept.

Facing internal liquidity shortages, the only option is to look outward. Driven by DAT, along with ETH’s more than threefold gain, many stories around stablecoins and RWA finally gained realistic grounding.

The author envisions the following scenarios:

Fundamentals-Driven Certainty Rally

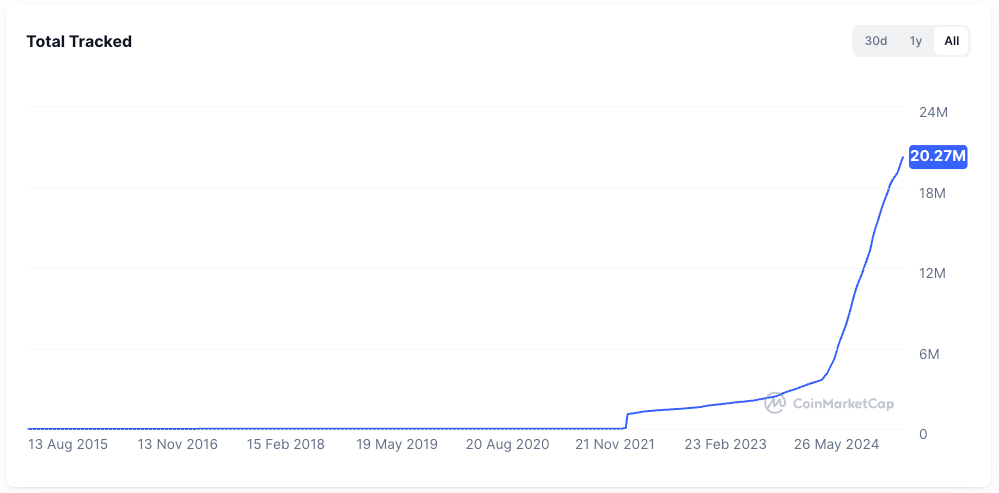

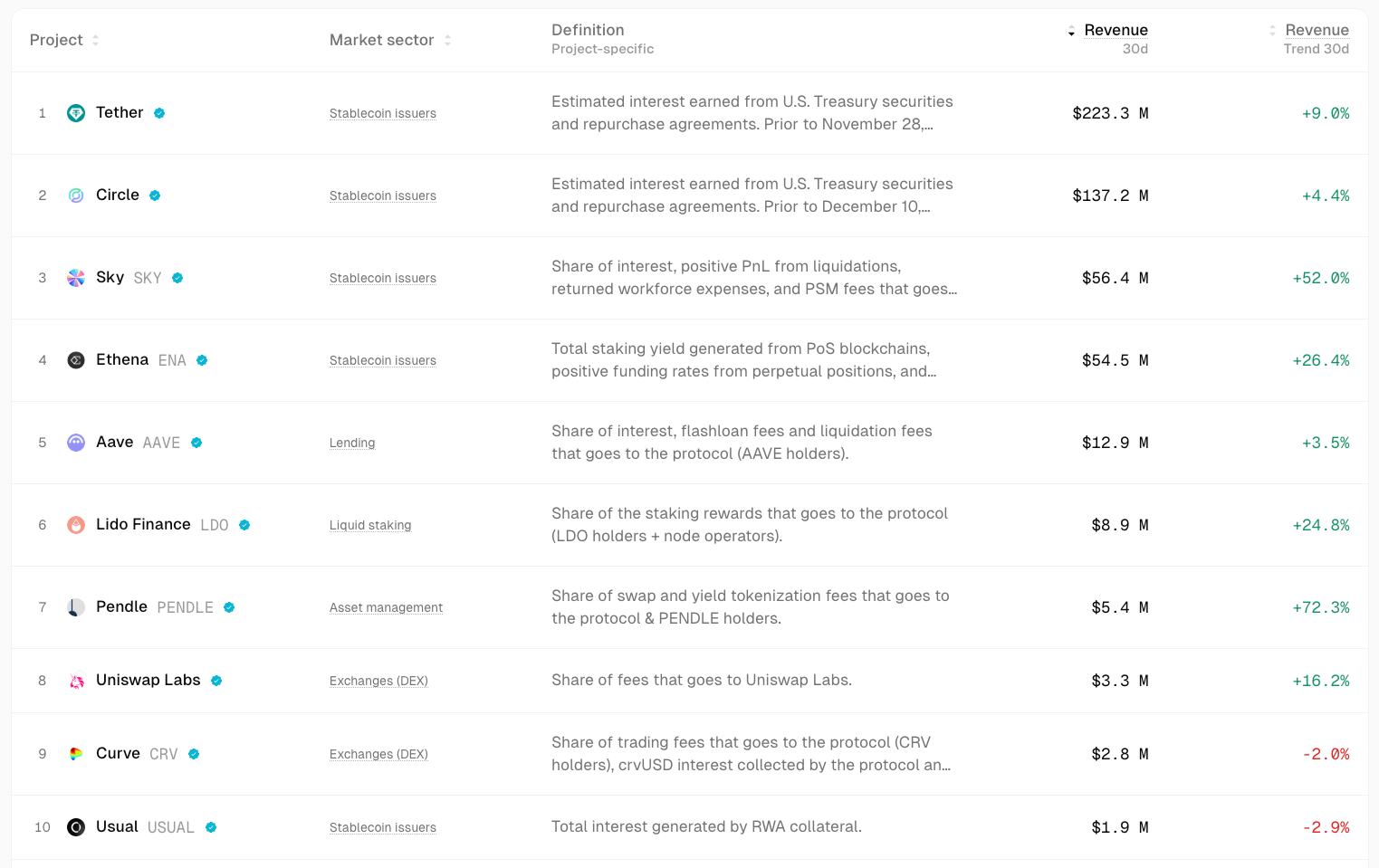

▲ Source: TokenTerminal

In uncertain markets, capital instinctively seeks certainty.

Capital will flow increasingly toward projects with strong fundamentals and product-market fit (PMF). Their gains may be limited, but they offer relative stability and high predictability. For instance, DeFi blue-chips like Uniswap and Aave have maintained resilience even during market downturns, while newcomers like Ethena, Hyperliquid, and Pendle stand out in this cycle.

Potential catalysts could include governance actions such as turning on fee switches.

These projects share a common trait: they generate substantial cash flows and their products have been thoroughly validated by the market.

Beta Opportunities in Strong Assets

When a major market theme (e.g., ETH) begins to rise, capital that missed the initial move or seeks higher leverage will turn to highly correlated "proxy assets" to capture beta gains—such as UNI, ETHFI, ENS. These can amplify ETH’s volatility but tend to have weaker sustainability.

Re-rating of Legacy Sectors Under Mainstream Adoption

From institutional Bitcoin buying and ETFs to the DAT model, the dominant narrative of this cycle is adoption by traditional finance. If stablecoin growth accelerates—say, quadrupling to $1 trillion—much of this capital is likely to partially flow into DeFi, driving a revaluation of its market worth. As crypto-native financial products enter the view of traditional finance, the valuation framework for DeFi blue-chips will be reshaped.

Localized Ecosystem Hype

▲ Source: DeFiLlama

HyperEVM, due to its persistently high discussion volume, user stickiness, and accumulation of new capital, may experience weeks to months of wealth effects and alpha during its ecosystem's growth phase.

Valuation Divergence in Star Projects

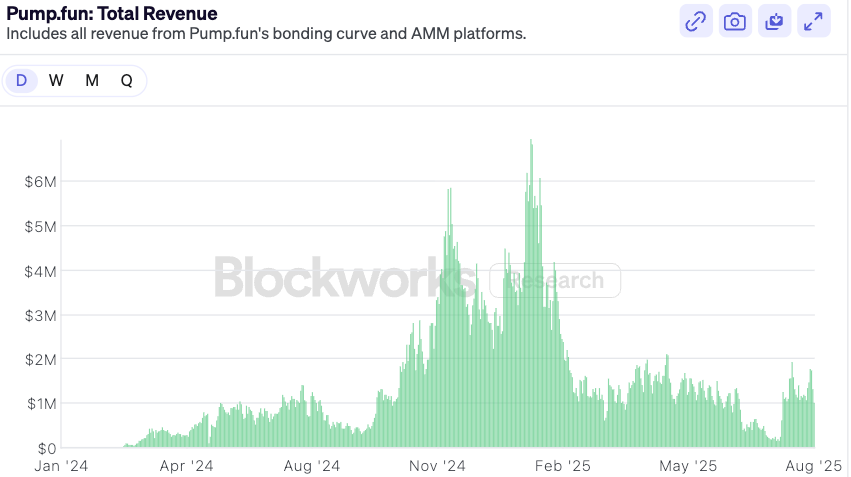

▲ Source: Blockworks

Take pump.fun as an example: after the emotional peak of token launch subsides and valuations retreat to conservative levels causing market divergence, if fundamentals remain strong, there may be room for recovery. Medium-term, pump.fun—as a meme leader with revenue-backed fundamentals and a buyback mechanism—could outperform most other top memecoins.

Conclusion

The 2021-style alt season, where one could blindly buy and profit, is now history. The market environment is becoming relatively more mature and fragmented—the market is always right, and investors must continuously adapt to these changes.

Combining the above analysis, the author concludes with several predictions:

-

As traditional financial institutions enter the crypto space, their capital allocation logic differs sharply from retail investors—they require explainable cash flows and comparable valuation models. This allocation logic directly benefits DeFi expansion and growth in the next cycle. To compete for institutional capital, DeFi protocols will become more proactive in implementing fee distributions, buybacks, or dividend designs within the next 6–12 months.

Going forward, pure TVL-based valuation logic will shift toward cash flow distribution models. We’re already seeing new institution-grade DeFi products, such as Aave’s Horizon, which allows collateralizing tokenized U.S. Treasuries and institutional funds to borrow stablecoins.

Amid increasingly complex macro interest rate environments and growing demand from traditional finance for on-chain yields, standardized, productized yield infrastructure will become highly sought-after: interest rate derivatives (e.g., Pendle), structured product platforms (e.g., Ethena), and yield aggregators will benefit.

The risk for DeFi protocols lies in traditional institutions leveraging their brand, compliance, and distribution advantages to launch their own regulated, "walled-garden" products that compete directly with existing DeFi offerings—a trend hinted at by Paradigm and Stripe’s joint launch of the Tempo blockchain.

-

Future altcoin markets may trend toward a "barbell" structure, with liquidity concentrating at two extremes: one end being blue-chip DeFi and infrastructure projects. These possess cash flows, network effects, and institutional recognition, absorbing the majority of capital seeking stable appreciation. The other end consists of purely high-risk preference assets—memecoins and short-term narrative plays. These carry no fundamental story but serve as highly liquid, low-barrier speculative instruments satisfying extreme risk-reward appetite. Projects in the middle—those with some product but insufficient moats and unremarkable narratives—may find their market positioning awkward unless liquidity structures improve.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News