Data on SolvBTC: Over 14,800 BTC on-chain, TVL exceeds $1 billion

TechFlow Selected TechFlow Selected

Data on SolvBTC: Over 14,800 BTC on-chain, TVL exceeds $1 billion

Including Merlin, SolvBTC's TVL exceeds 18,000 BTC, making SolvProtocol a leader in the BTCFi ecosystem.

Author: picnicmou

Translation: TechFlow

As BTCFi gains momentum, I’d like to share some statistics about a lesser-known project on CT—SolvProtocol.

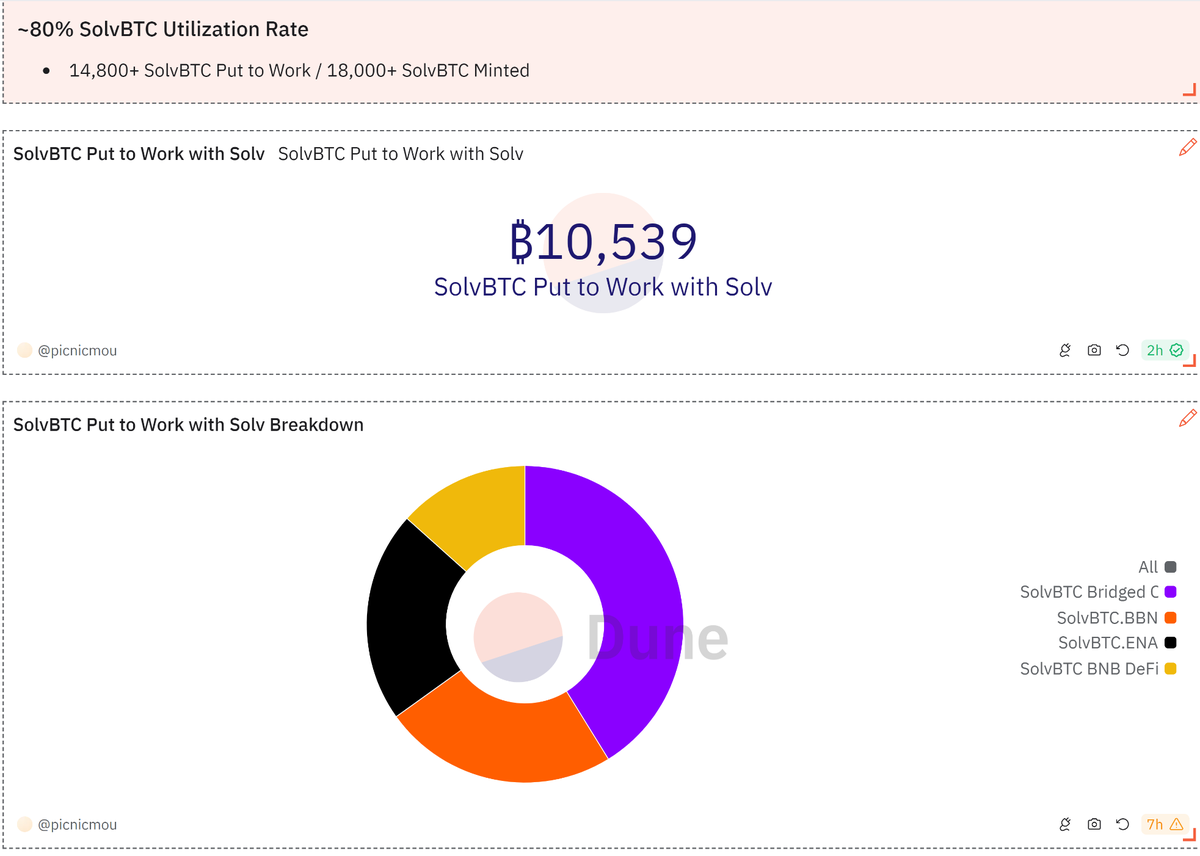

Solv is currently the largest Bitcoin staking protocol, with over 14,800 BTC already utilized on Solv.

The specific distribution of BTC used in Solv is as follows:

-

Over 4,300 BTC bridged for airdrop farming (including Linea, Scroll, Mezo, Fuel, etc.)

-

Over 4,700 BTC staked in SolvBTC’s liquid staking tokens (such as SolvBTC.BBN and SolvBTC.ENA)

-

Over 4,400 BTC bridged to Core DAO (not indexed on Dune)

-

Over 1,400 BTC deployed in BNB DeFi

This results in a utilization rate of approximately 80% for SolvBTC (14,800/18,000 SolvBTC), highlighting the significant utility of SolvBTC.

Let’s dive deeper.

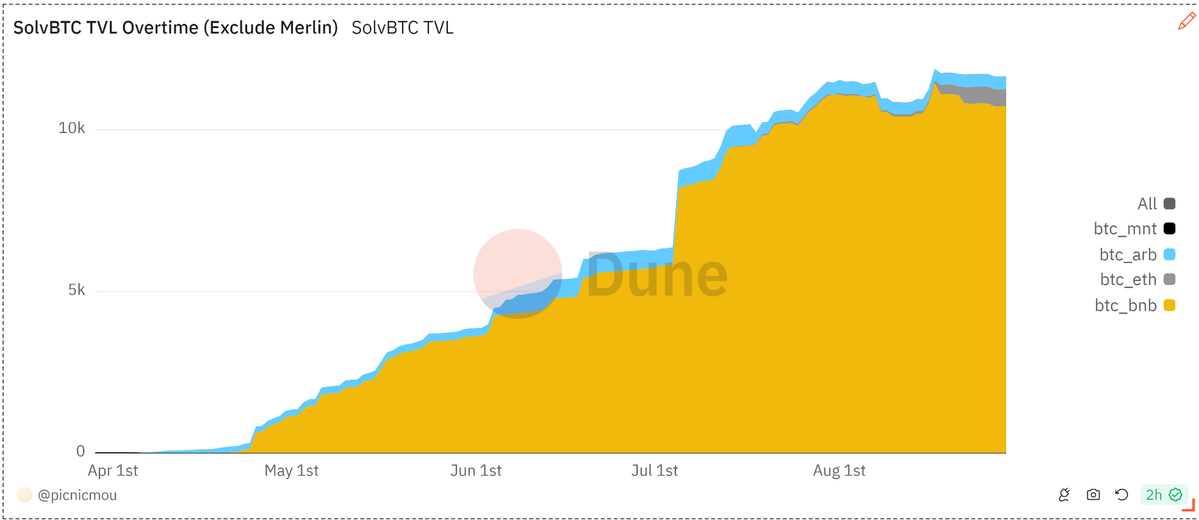

SolvBTC Supply (excluding Merlin)

Since its launch in April, SolvBTC supply has steadily grown, reaching a TVL of over 11,500 BTC.

Note: This does not include SolvBTC minted on Merlin Layer2, as Merlin is not indexed on DuneAnalytics.

With Merlin included, SolvBTC TVL exceeds 18,000 BTC, making SolvProtocol the leader in the BTCFi ecosystem.

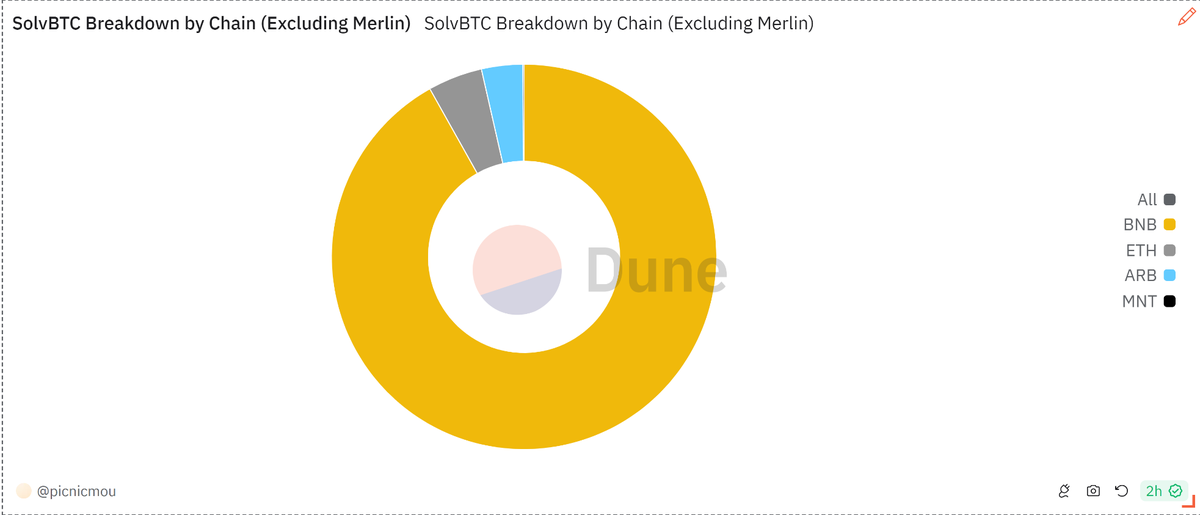

Distribution of SolvBTC:

BNBChain leads with over 10,000 SolvBTC minted.

Merlin follows closely with 6,600 SolvBTC (not shown in chart).

Ethereum and Arbitrum together hold over 800 SolvBTC, while adoption on 0xMantle remains low.

SolvBTC: Using Bitcoin for Airdrop Farming

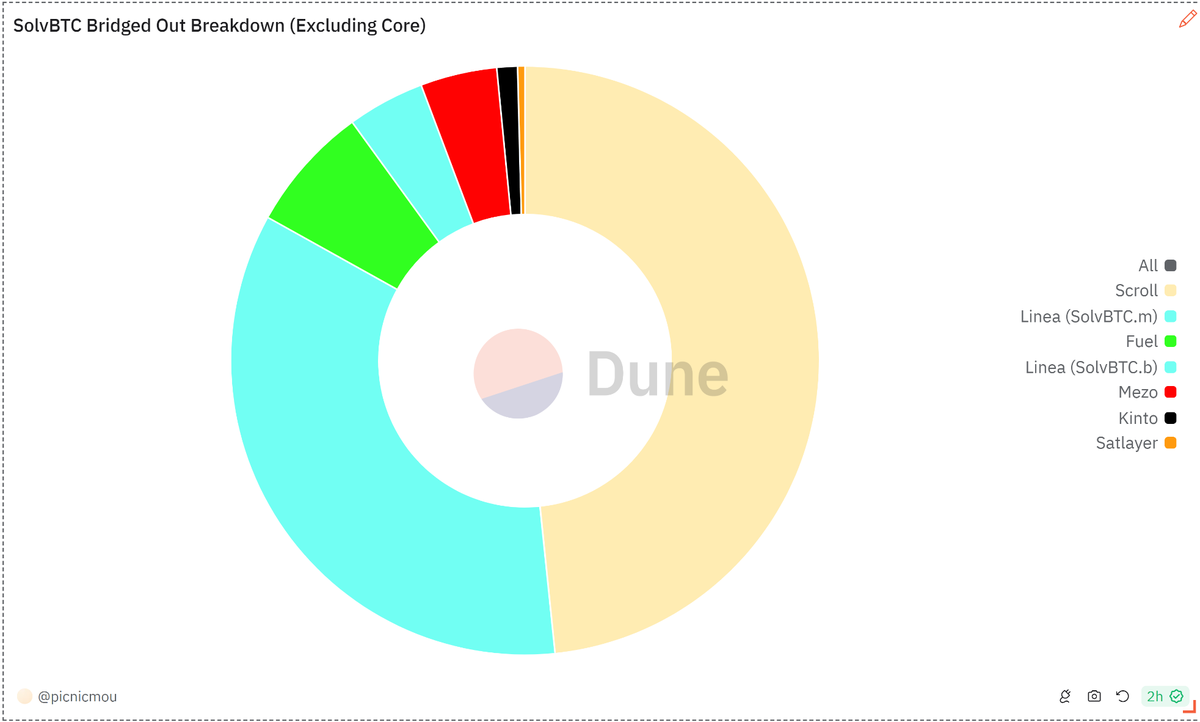

Over 4,300 SolvBTC have been bridged for airdrop farming, enabling Bitcoin holders to enter a space previously dominated by ETH.

With Vitalik and the Ethereum Foundation gradually stepping back from DeFi, why not try airdrop farming with Bitcoin?

Detailed breakdown of SolvBTC bridging:

-

Over 4,500 SolvBTC bridged to Coredao_Org for the Core Ignition Drop (not shown in chart)

-

Over 2,000 SolvBTC and 1,700 SolvBTC bridged to Scroll_ZKP and LineaBuild respectively

-

Over 400 SolvBTC bridged to emerging platforms fuel_network and MezoNetwork

Notes:

-

This analysis primarily focuses on SolvBTC and excludes SolvBTC.BBN deposited into Fuel and Mezo.

-

Core is not indexed on Dune, hence not displayed on the dashboard.

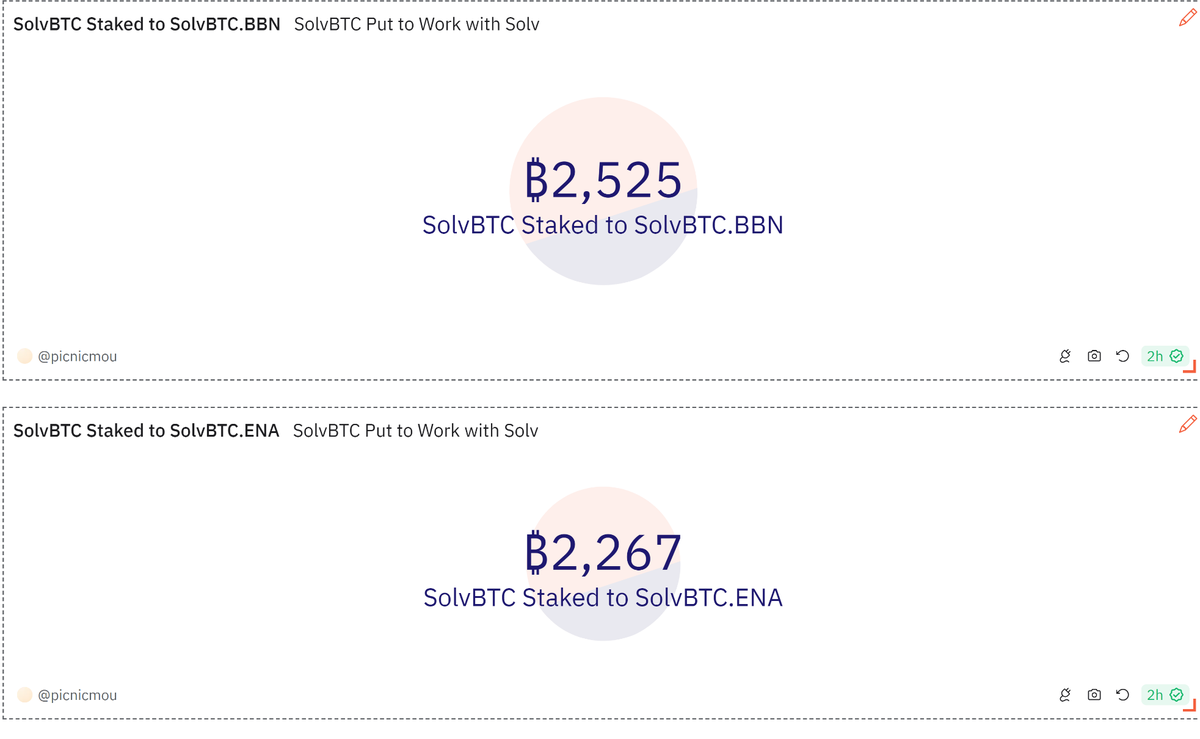

Distribution of SolvBTC Liquid Staking Tokens (LSTs):

-

Over 3,000 SolvBTC.BBN

-

Over 2,000 SolvBTC.ENA

SolvBTC.BBN is a liquid staking token representing BTC staked on babylonlabs_io. In Babylon’s Cap 1 program, Solv reached the maximum allocation of 250 BTC, making it the Bitcoin LST with the most staked BTC on Babylon.

SolvBTC.ENA is a liquid staking token for Bitcoin that represents exposure to the basis trading strategy at ethena_labs, allowing Bitcoin holders to earn Ethena yields and gain 10x SATs on borrowed stablecoins while maintaining BTC exposure.

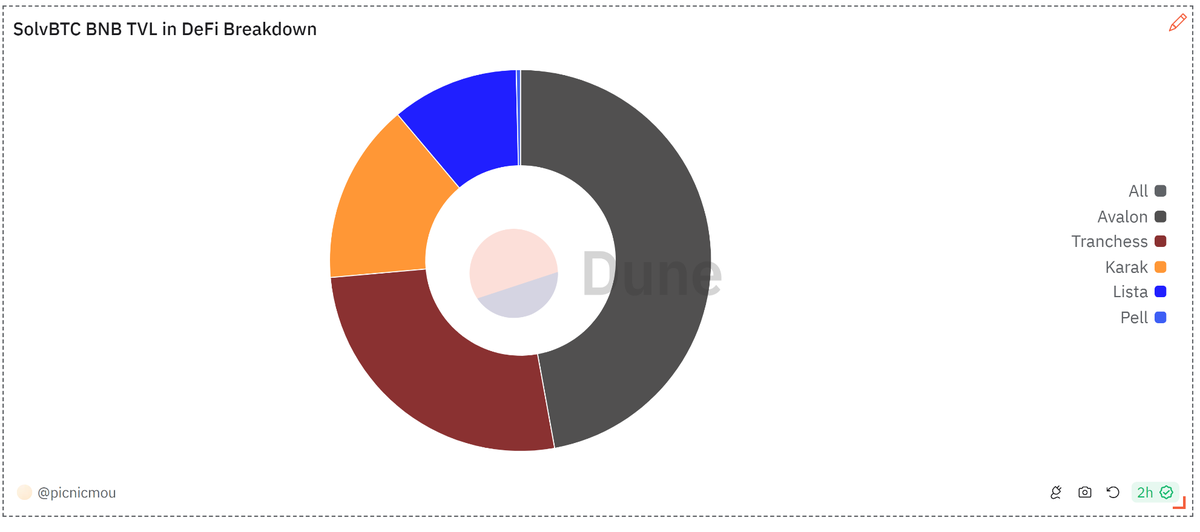

Building a Thriving BTCFi Ecosystem on BNBChain

With over 10,000 SolvBTC minted, BNB Chain has become a hub for BTCFi activity.

About 13% of SolvBTC are directly deployed into BNB’s DeFi protocols to earn additional DeFi yields.

TVL distribution of SolvBTC in BNB DeFi:

-

Lending protocol avalonfinance_: Over 600 SolvBTC provided, with annual yields up to 3%

-

Yield trading platform Tranchess: Over 350 SolvBTC split into PT and YT tranches

-

Restaking platform Karak_Network and stablecoin protocol lista_dao: Together capturing over 350 SolvBTC

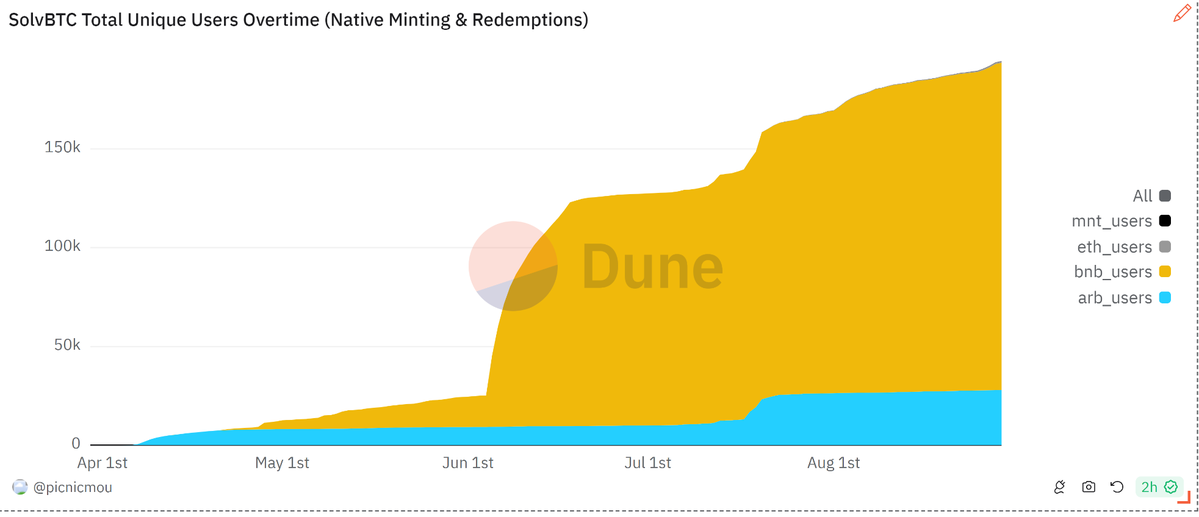

User Distribution (excluding Merlin)

Since the launch of SolvBTC, over 190,000 users have joined this ecosystem.

-

BNB Chain leads with over 160,000 users, benefiting from easy access via BTCB.

-

Arbitrum has over 25,000 users.

Notes:

-

Merlin is not indexed on Dune, so its users are not counted.

-

This analysis focuses on SolvBTC and excludes historical user data from Solv’s past products.

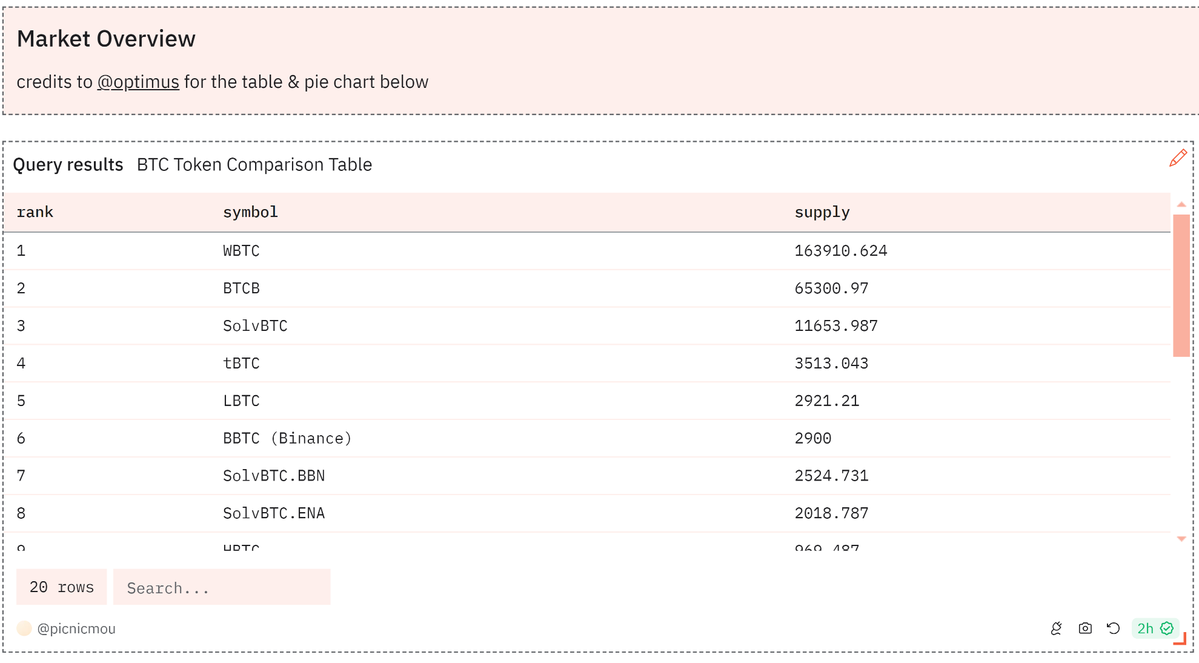

Market Overview

Despite controversies surrounding WBTC, there has been no major redemption. SolvBTC is emerging as a dark horse in the wrapped BTC space, offering Bitcoin holders convenient yield-generating opportunities.

Thanks to 0xOptimus for the BTC token comparison table.

Bitcoin Staking: Unlocking $1 Trillion in Economic Potential

The data makes it clear.

If you want to earn yield while holding your Bitcoin, SolvProtocol is your best choice.

Excited to see how this unfolds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News