Understanding FBTC: The Pioneer of Fully-Backed BTC Synthetic Assets, Extending Capital Efficiency Across the Broader Crypto World

TechFlow Selected TechFlow Selected

Understanding FBTC: The Pioneer of Fully-Backed BTC Synthetic Assets, Extending Capital Efficiency Across the Broader Crypto World

When competition within the BTC ecosystem becomes increasingly intense, projects seeking liquidity and yield externally are more worth paying attention to.

Crypto investment is an art of following the money, and alpha opportunities often lie within funding developments in the primary market.

Reports show that during the first quarter of this year, the most concentrated area among publicly announced fundraising projects was the BTC ecosystem. The fact that Babylon, a Bitcoin staking protocol, raised $70 million reflects VCs' bullish sentiment toward this emerging trend.

However, within the BTC ecosystem itself, Bitcoin's scalability and capital efficiency still need improvement. For instance, BTC’s presence in DeFi remains minimal—especially when compared to its massive market cap.

But if you shift your perspective—considering how other ecosystems can benefit from the momentum of the BTC ecosystem and how BTC value can spill outward—the picture changes dramatically.

Capital is inherently mobile. While the current BTC ecosystem successfully attracts liquidity inward, assets rarely flow outward.

Other chains still host large numbers of active users. Is there a way to extend BTC’s yield-generating capabilities and capital efficiency across these ecosystems? Moreover, with widespread long-term bullish expectations for BTC—and miners holding onto their coins—the opportunity cost of idle funds becomes increasingly significant.

Everyone urgently needs more productive avenues for their capital.

Therefore, at a time when competition intensifies within the BTC ecosystem, projects seeking liquidity and yield “beyond” it become particularly worth watching.

Recently launched FBTC is exactly such a project. It allows your assets, regardless of which chain they’re on, to participate in various Bitcoin-based yield sources through FBTC—a token 1:1 pegged to BTC.

This gives rise to a new concept—Omnichain BTC.

Against the backdrop of rising Bitcoin value and the emergence of innovative Bitcoin yield mechanisms, this new concept opens up even greater opportunities.

Meanwhile, the project has received contributions from leading industry infrastructure and technology platforms such as Mantle and Antalpha Prime.

Can a fully cross-chain Bitcoin asset like FBTC be competitive in the market? And what potential returns should we pay attention to?

wBTC: The Biggest Solution, Not the Best One

Why should we pay attention to synthetic assets like FBTC? Let’s first examine the current state of BTC assets outside the native Bitcoin ecosystem.

Starting from the core logic—"assets need to move outward"—you’ll find that the largest and most representative example of BTC flowing outward is wBTC (Wrapped BTC), an ERC-20 token on Ethereum that is 1:1 pegged to BTC.

But recently, wBTC has found itself at the center of controversy, facing a trust crisis—after BitGO, the entity behind wBTC, announced plans to relinquish control over wBTC, sparking widespread debate about the future security of its control rights.

Beyond this turmoil, wBTC’s performance within Ethereum’s rich asset landscape and mature DeFi use cases has also been underwhelming.

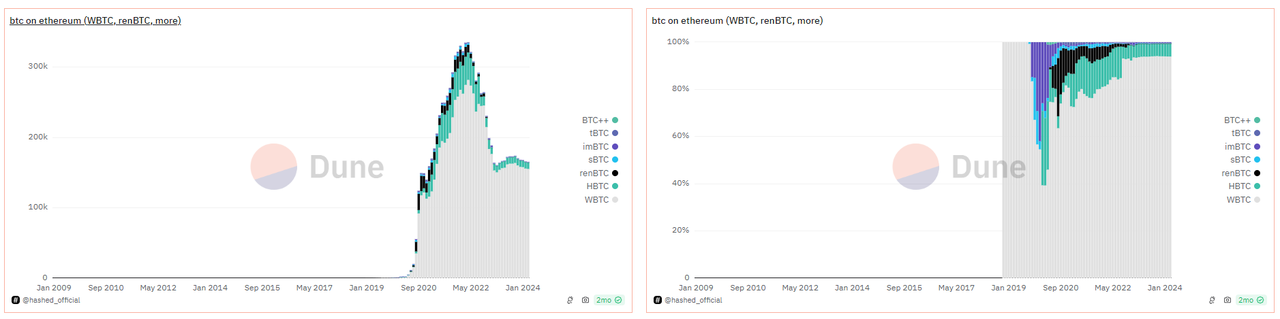

Public data shows that on Ethereum, wBTC leads by a wide margin in both absolute asset value and market share compared to other synthetic BTC assets;

but this does not mean wBTC leads equally in user experience, mechanism design, or yield generation.

First, wBTC suffers from poor on-chain liquidity and relatively low trading volume and depth on centralized exchanges. Beyond concerns over ownership transition, what users care about most is wBTC’s low yield—such as its inability to support Bitcoin yield scenarios in the Babylon ecosystem or CeDeFi products.

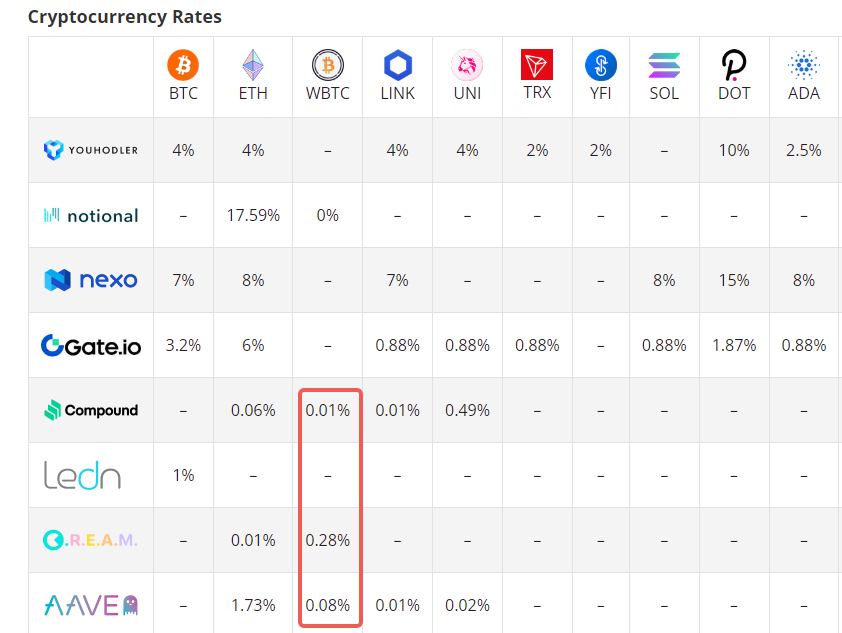

As shown below, wBTC clearly lags behind other crypto assets in terms of yield returns.

For example, on Compound and AAVE, wBTC offers only 0.01%–0.08% returns.

Clearly, for synthetic BTC-type assets, wBTC is currently the biggest solution, but not the optimal one.

Whether for Ethereum or other ecosystems, capital utilization never sleeps. The market always demands better alternatives to challenge wBTC—one that excels in:

-

Better asset yields, offering more income-generating opportunities;

-

Higher capital efficiency and liquidity, reducing friction when synthetic BTC moves and ideally connecting with more blockchains;

-

Greater decentralization and trustlessness, ensuring safer minting of synthetic BTC.

Additionally, total value locked (TVL) in BTC-related ecosystems accounts for only 4% of the BTC token market size—far lower than ETH’s 75% TVL relative to its own market size.

Therein lies greater opportunity for additional ERC-20 synthetic BTC assets.

And this is precisely the foundational rationale for the existence of FBTC.

FBTC: Pioneer of Omnichain Synthetic BTC

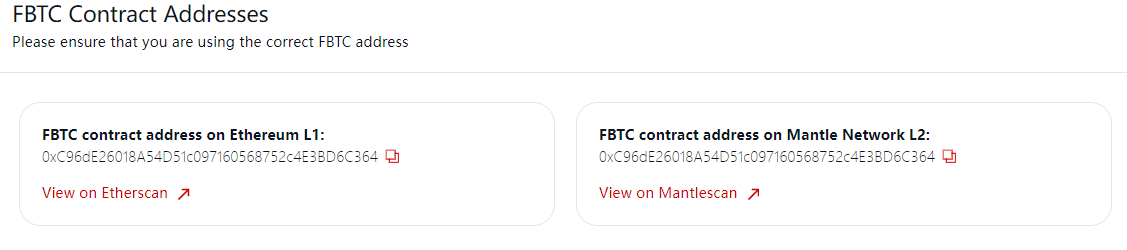

To define it clearly, FBTC is a new type of synthetic asset pegged 1:1 to BTC; more importantly, it supports omnichain BTC circulation.

Currently, FBTC will initially launch on ETH, Mantle, and BNB Chain, with plans to expand to more networks later.

So what does being 1:1 pegged to BTC actually mean?

In simple terms, when you deposit BTC into a designated address, an equivalent amount of FBTC (e.g., in ERC-20 format) is minted on any chain of your choice. You can then use FBTC to earn yield across various DeFi applications.

To summarize quickly, FBTC’s key advantages include:

-

Multi-party custody: FBTC uses multiple MPC (multi-party computation) custodians.

-

Joint technical and organizational assurance: FBTC minting, burning, and cross-chain bridging are managed by a security committee and a TSS (Threshold Signature Scheme) network operated by security firms.

-

Transparent reserves: Proof of FBTC reserves can be audited in real-time and monitored by third-party security companies.

-

Locked FBTC can direct underlying BTC as collateral or participate in Babylon staking.

-

User trust: Built by well-known entities deeply rooted in blockchain ecosystems and Bitcoin financial institutions, trusted by many miners and builders.

-

Governance tokens used as incentives.

But to go deeper, let’s look at FBTC’s specific product design to understand how it works.

For most ordinary crypto users, you don’t need to grasp complex technical details. Just ask yourself three questions to get a clear sense of FBTC:

Where do I deposit BTC? Where does BTC go? Who secures the deposit and withdrawal process?

Corresponding to these three questions, FBTC’s design is — BTC chain custody address + target chain smart contract + off-chain modules.

-

BTC chain custody address: Enables BTC deposits

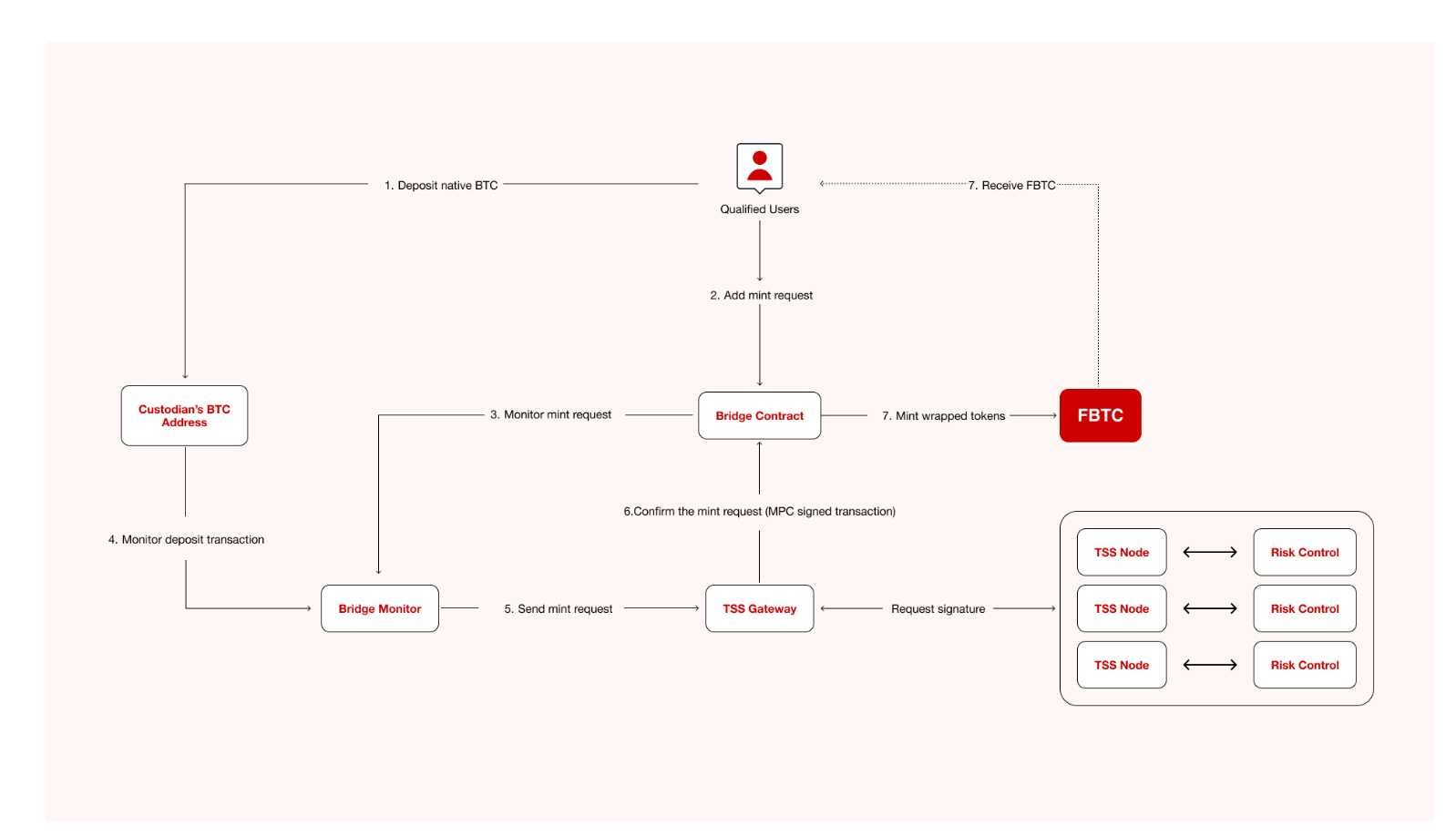

To use FBTC, the system first generates a Bitcoin network deposit address for each qualified user. These addresses are controlled by MPC multi-sig nodes (details on node security design below).

Once a qualified user deposits BTC into their address, FBTC is issued to the corresponding user on the target chain.

Thus, the total amount of BTC locked in MPC wallet-controlled addresses matches the total supply of FBTC on the target chain—one deposited, one locked, one minted.

-

Target chain smart contracts: Enable BTC generation and mapping across ecosystems

How does BTC deposited into the custody address get delivered to the target chain?

This necessarily involves a bridge smart contract that manages assets for qualified users and handles cross-chain operations and FBTC issuance. Think of it as pre-written code governing the supply and transfer of synthetic asset tokens.

-

Off-chain modules: Ensure smooth deposit and minting processes

With BTC entering the system and smart contracts issuing synthetic assets on target chains, other components play crucial roles too.

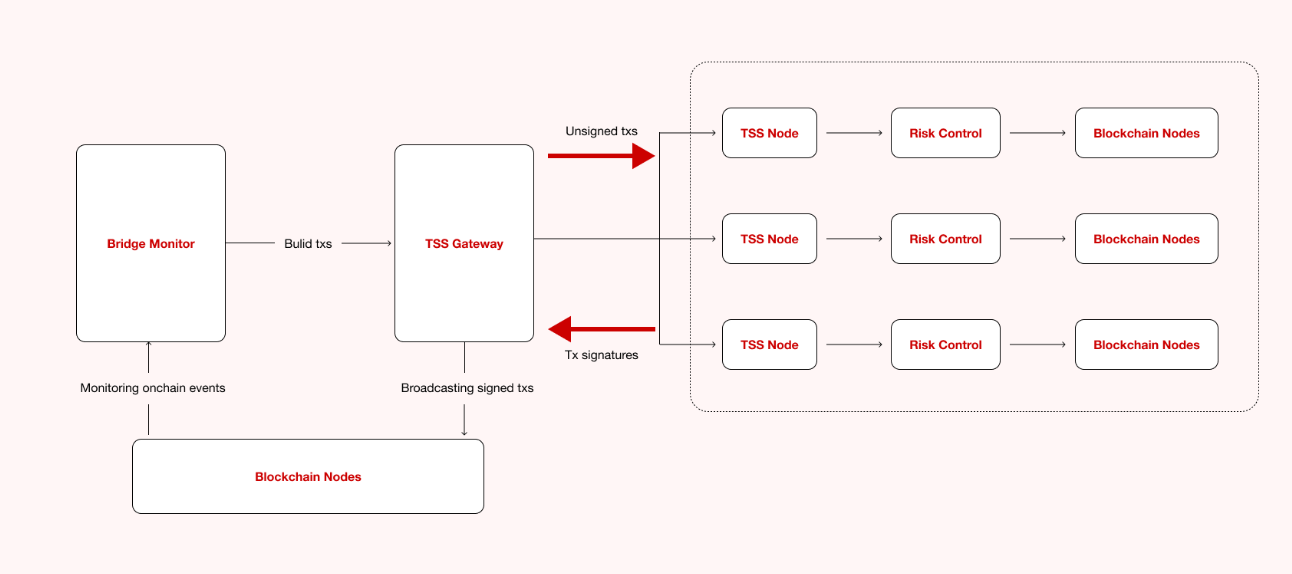

In the FBTC system, modules like the bridge monitor, TSS gateway, TSS nodes, and risk controls each perform distinct functions, collectively ensuring the full lifecycle from BTC to FBTC (and vice versa).

For example, the bridge monitor tracks on-chain events like new mints, burns, and cross-chain requests; the TSS gateway coordinates the signing process to ensure transaction completion; and TSS nodes use distributed signature mechanisms, each running independent risk control modules to decentralize overall asset risk.

Even more important than the technology are the design and roles of participants.

In this process, assets deposited into MPC addresses are managed by custodians, with key shares held by multiple trusted institutions. FBTC issuance occurs in a decentralized manner under limited risk controls.

Moreover, not all users can mint FBTC directly. This is where the concept of "qualified users" comes in—only eligible entities, institutions, and merchants can mint FBTC, similar to a delegate-agent model. Once merchants mint FBTC, regular users can subscribe rather than mint directly.

Currently, FBTC’s official website provides access points where users can swap FBTC via different DeFi protocols, but the circulating supply depends entirely on minting by these qualified users.

This is a pragmatic consortium model—trusted institutions form an initial alliance to ensure safety and smooth operation during early stages, gradually progressing toward full decentralization.

An Example: Quickly Understand FBTC Minting and Burning

If the above roles and technical designs still feel abstract, let’s walk through a concrete example of how FBTC is minted and burned.

Suppose Alice wants to convert her 1 BTC into 1 FBTC on Ethereum:

-

Transfer initiation: Alice sends 1 BTC to the MPC custody address provided by the FBTC system.

-

Mint request: Alice interacts with the FBTC bridge contract on Ethereum to request minting 1 FBTC.

-

Request monitoring: The bridge monitor detects Alice’s mint request and confirms the 1 BTC deposit transaction.

-

Request forwarding: The bridge monitor forwards Alice’s mint request to the TSS gateway.

-

Transaction signing: The TSS gateway coordinates multiple TSS nodes to jointly sign the transaction using MPC algorithms, verifying both the deposit and mint request.

-

FBTC minting: After confirmation, the FBTC token is minted and sent to Alice’s Ethereum wallet address.

In this example, both technical and governance layers ensure a seamless and secure process—all transparent to end users:

When a qualified user (like Alice) deposits BTC into the custody address, that address is an MPC wallet jointly managed by multiple custodians. Any withdrawal requires co-signature from multiple parties—no single custodian can access the BTC alone, preventing theft.

The bridge monitor ensures every step is strictly supervised.

The TSS gateway coordinates multiple TSS nodes to sign transactions. Using threshold signature schemes (TSS), they jointly approve transactions—ensuring FBTC minting or BTC withdrawals occur only after meeting all security and validation criteria.

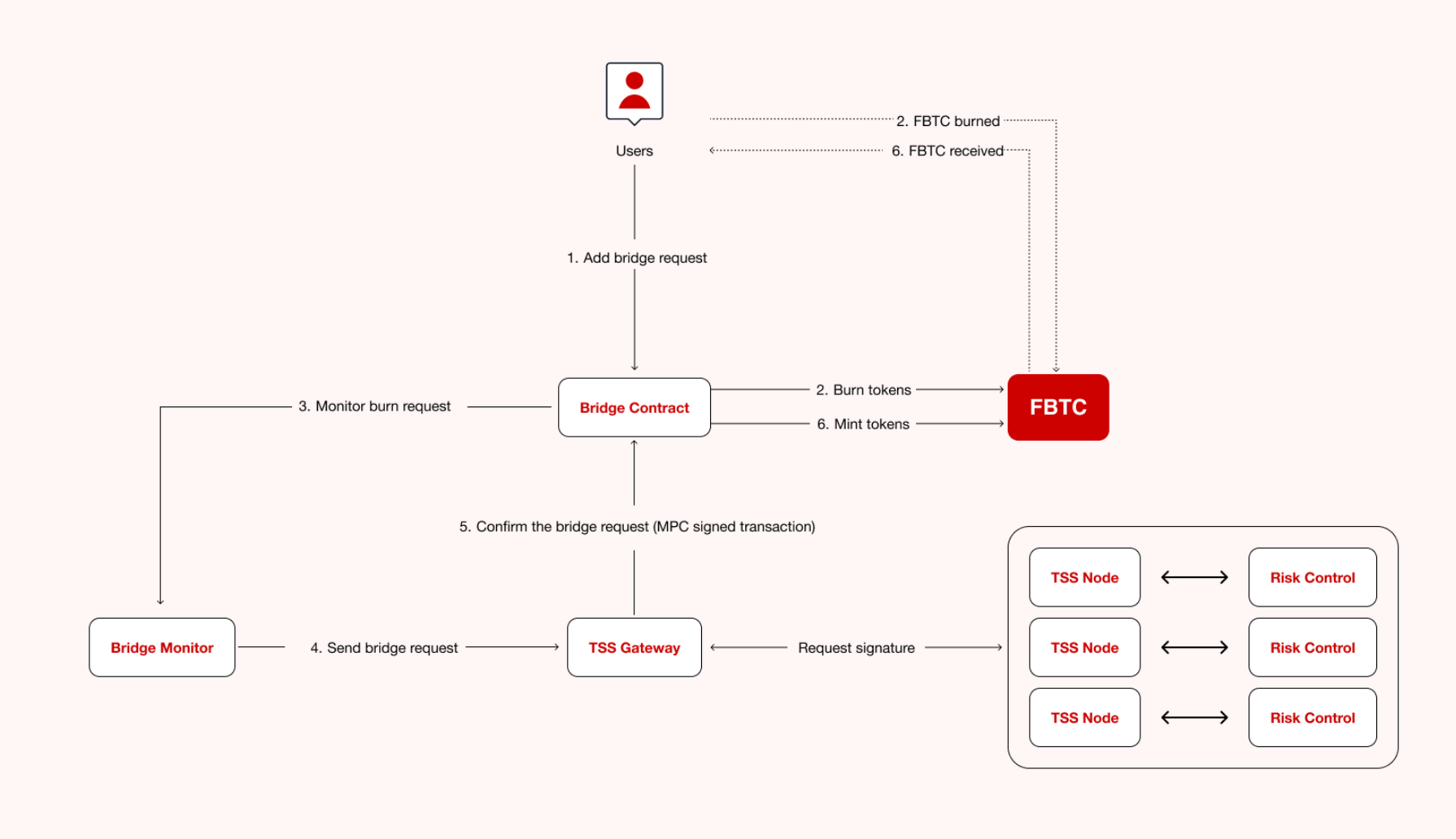

Another advantage: With this mint-and-burn mechanism, cross-chain transfers of FBTC become much easier.

Similar to the minting process, suppose Bob initiates a request to transfer 1 FBTC from Ethereum to BSC.

The bridge contract on Ethereum burns Bob’s 1 FBTC, reducing FBTC supply on Ethereum. The bridge monitor detects this event and relays it to the TSS gateway.

Finally, the TSS gateway calls the bridge contract on BSC to confirm the cross-chain operation. Once confirmed, Bob receives 1 FBTC on BSC.

Same process, same security. Each cross-chain operation is jointly verified by multiple nodes, eliminating single points of failure and malicious risks, enabling seamless transfer of synthetic BTC assets across different blockchain networks.

Better Resources Build Better Assets

From the above design, FBTC’s technical architecture isn’t complicated—the principle of “in and out” is clear.

For cross-chain synthetic assets, technology and security set the floor—but resource coverage defines the ceiling.

I believe better resources create better assets: Simply put, assembling resources, integrating forces, and building broad partnerships are key to the success of FBTC or similar projects.

After all, for FBTC to succeed, it needs people to adopt it, use it, promote it—and the ability to mobilize these people and resources.

So what exactly are these “resources”?

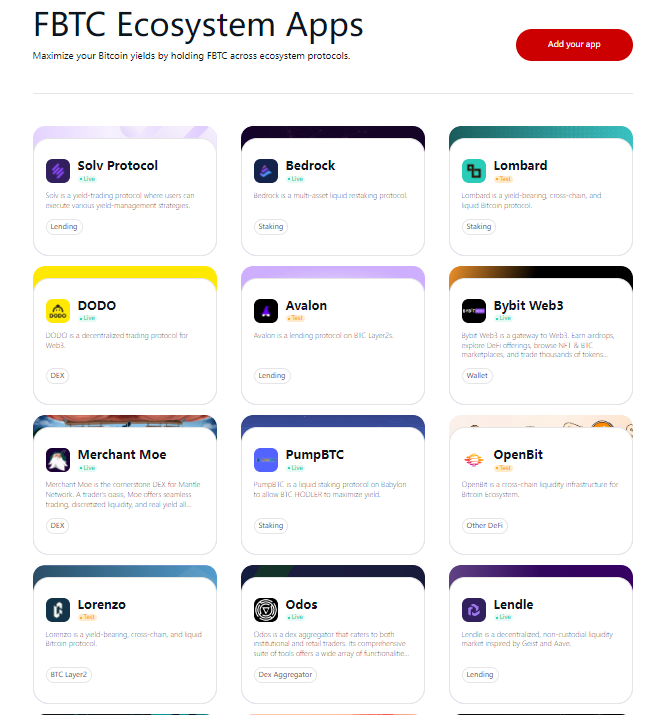

An asset like FBTC cannot circulate by itself. You must attract and integrate multiple partners—DeFi protocols, cross-chain bridges, exchanges, custodians, etc.

Their participation enhances credibility and expands use cases, driving adoption and circulation of FBTC.

So the question becomes: Does FBTC have the capability and advantages to secure these resources?

For Mantle, as an L2 solution, it naturally integrates more easily with various DeFi protocols—lending, liquidity mining, DEXs—which are already part of its native ecosystem.

This not only provides more yield opportunities for FBTC holders but also strengthens FBTC’s utility and market demand.

Currently, FBTC has secured 24 partner projects—clear proof of its connectivity strength:

-

Babylon ecosystem: solv, pumpbtc, bedrock, pell network, lombard, satlayer, etc.

-

On-chain DeFi: merchant moe, agni, dodo, Init, etc.

-

CeDeFi: avalon finance, bouncebit, etc.

-

New chain projects as yield magnets: fuel, mezo, bob, botanix, etc.

For a cross-chain synthetic asset, this seed group of partners plays a vital role in FBTC’s cold start, injecting initial liquidity into the market.

Meanwhile, Mantle’s treasury holds billions in assets—making it a well-known deep-pocketed L2. I suspect a portion of this capital will be allocated to partnership development and promotion, representing non-trivial scale potential.

While no official incentive campaigns have been announced yet, we can wait and see if more participation opportunities emerge.

Antalpha Prime, a core contributor driving continuous BTC ecosystem development, provides technical safeguards for BTC infrastructure.

Lastly, Cobo is an early infrastructure provider for the project. With solid expertise in digital asset custody and management services, Cobo brings strong security and MPC capabilities—ensuring safety and reliability in FBTC custody and cross-chain operations, enhancing trust and transparency.

Cobo is also among the first custodians to offer Babylon staking.

Let professionals handle specialized tasks. By leveraging complementary strengths across organizations, we can unlock a new era for synthetic BTC assets.

Recently, FBTC officially launched on July 12. Public data shows its on-chain circulation rapidly grew to $70 million within a month. We expect to see new diversified yield options emerge in Q3:

Based on Ethereum and Mantle, beyond staking/restaking rewards on these mainnets, depositing FBTC into partner yield protocols enables additional APY through lending and staking mechanisms.

Currently, FBTC is live on BSC and will soon expand to other major and emerging public chain ecosystems.

Additionally, to encourage FBTC holding, the Ignition Sparkle Campaign—a points-based engagement program—will launch by the end of August, laying groundwork for potential airdrops. Interested users can visit the official website for details.

Conclusion

Crypto assets never sleep. The pursuit of higher yield and liquidity is an unceasing heartbeat.

Those who provide better services for asset flows will benefit most from them—much like gas stations thriving alongside highways and fast lanes.

Judging from its product design and initial roadmap, FBTC acts as a refueling station for BTC assets—revitalizing and connecting yield opportunities beyond the native BTC ecosystem through omnichain synthetics.

But without taking small steps, one cannot travel a thousand miles. Whether FBTC becomes the preferred choice for discerning crypto users will depend on future market strategies and execution.

Founding on security, linking via omnichain, maximizing yield—FBTC’s business has a promising future ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News