Oak Grove Ventures Stablecoin Market Report: Innovation, Trends, and Growth Potential

TechFlow Selected TechFlow Selected

Oak Grove Ventures Stablecoin Market Report: Innovation, Trends, and Growth Potential

This study aims to analyze the stablecoin market landscape and the drivers of future growth.

Author: Oak Grove Ventures

For a long time, mass adoption of cryptocurrency has been the "holy grail" of the crypto industry, with payment systems serving as the bridge connecting this technology to the "real world." Traditional financial systems have long suffered from high fees, slow transaction speeds, and geographic limitations.

Cryptocurrency payments not only solve these issues but also offer significant advantages such as lower costs, faster processing times, borderless transactions, and more efficient and inclusive financial interactions. As the first report in this series on cryptocurrency payments, this study aims to analyze the current stablecoin market landscape and its future growth drivers.

Stablecoins play a pivotal role in the cryptocurrency payment ecosystem—they are the bridge between innovation and usability. By minimizing price volatility associated with fiat and other underlying assets, stablecoins provide a reliable medium of exchange for users and enterprises across both Web2 and Web3. Moreover, stablecoins are essential components of all crypto-native applications, including centralized exchanges, decentralized finance (DeFi) platforms, and wallets. Within DeFi platforms, stablecoins enable lending, borrowing, and yield-generating opportunities with stable value. In the B2B sector, traditional fintech companies are increasingly exploring stablecoin solutions to improve real-world business efficiency. Despite regulatory uncertainties in many regions, institutional capital is actively entering this space. In summary, stablecoins are critical in driving cryptocurrency toward mainstream payment adoption, meeting the needs of both the existing financial system and consumers.

Current Stablecoin Landscape

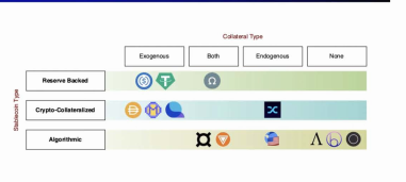

Stablecoins can broadly be categorized into three types—fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Recently, many new projects have adopted hybrid models that combine multiple asset types or use real-world assets (RWA) as collateral.

Overview of the stablecoin ecosystem, Source: Berkeley DeFi MOOC

Stablecoins are more active than ever before and continue to dominate the market.

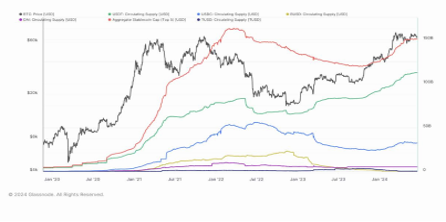

Data from Glassnode shows that by mid-2024, the total market capitalization of the stablecoin market—across multiple blockchains including Ethereum—had grown to over $150 billion. USDT accounts for approximately 74% of this market, USDC about 21%, with the remainder made up of various other stablecoins.

Total stablecoin supply, Source: Glassnode

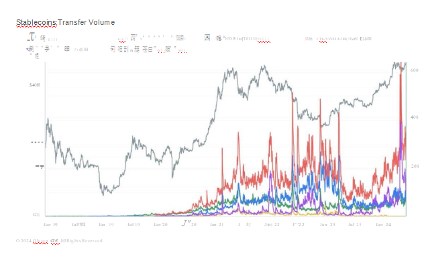

Trading volume figures vary; USDC and DAI show strong volume growth

It's important to note, however, that when discussing trading volume, different data sources may use varying methodologies—some of which may or may not account for zombie trades, outlier transactions, or maximum extractable value (MEV). For example, a report released by Visa in April 2024 indicated that, based on their methodology, USDC had already surpassed USDT in transaction volume despite still trailing significantly in market cap (21% vs. 74%). On Ethereum alone, although DAI’s market cap is smaller than both USDC and USDT, the report found that DAI leads among the three in trading volume—primarily due to flash loan mechanisms.

Stablecoin trading volumes, Source: Glassnode

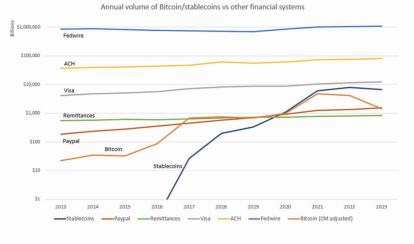

Stablecoin transaction volumes have already exceeded Mastercard and may soon surpass Visa.

In broader context, stablecoins have gained widespread acceptance—their combined transaction volume has surpassed Bitcoin and is approaching that of the second-largest card network, Mastercard. While Visa claimed in a recent report that over 90% of these transactions come from bots, we acknowledge that rising stablecoin usage and liquidity still carry meaningful impact.

Annual transaction volume: Bitcoin / stablecoins vs. other financial systems, Source: Visa

Current and Future Growth Drivers of the Stablecoin Market

Given that USDT and USDC continue to dominate the stablecoin market, we break down recent announcements from these two firms to identify the key current growth drivers. Looking ahead, we expect these primary drivers to persist, while initial DeFi market entry and ongoing DeFi innovation will further fuel stablecoin market expansion.

Stablecoins Beyond the Ethereum Ecosystem Are Rising

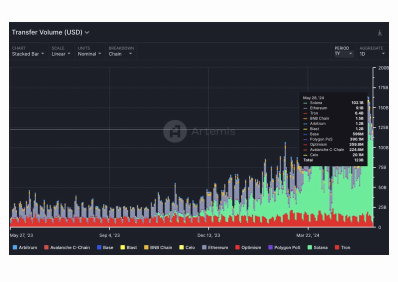

Since the first half of 2024, the transfer value of USDC on Solana has exceeded that on Ethereum. However, it should be noted that since most stablecoin transactions stem from MEV arbitrage, this volume may largely reflect high-frequency trading rather than organic user growth. Still, higher transaction volume indicates greater liquidity, which benefits DeFi activity—a factor worth considering.

Circle’s Cross-Chain Transfer Protocol (CCTP) enables secure transfers of native USDC across different blockchain ecosystems via mint-and-burn mechanisms. We expect this trend to continue with CCTP’s rollout. Since March 2024, Solana developers have been able to natively transfer USDC from Ethereum to other EVM-compatible ecosystems, including Arbitrum, Avalanche, Base, Optimism, and Polygon. Several Solana-based DeFi projects have already integrated CCTP early on. Support for non-EVM blockchains is expected in the future. USDC has also expanded issuance on ZKsync, Celo, and TON.

Source: Artemis

Strong Demand for Stablecoins in Emerging Markets

Emerging markets have played a crucial role in the development of USDT and USDC—the two largest stablecoin issuers globally—highlighting stablecoins’ roles in economic stability, financial inclusion, and cross-border transactions during periods of high inflation.

As local currencies depreciate, USDT has been widely adopted in emerging markets as a dollar alternative and has become the most trusted digital dollar in many such economies. For instance, in Brazil, USDT accounts for 80% of all cryptocurrency transactions in the country—mirroring trends in numerous other nations. This shift underscores the strategic importance of USDT in ensuring financial stability and accessibility in economies facing currency instability. In June 2024, Tether announced an $18.75 million investment in XREX, a Taiwan-based startup focused on cross-border payments for SMEs and B2B stablecoin settlements in emerging markets.

Innovation and Growth in the DeFi Market

Innovations in new applications are creating additional use cases for stablecoin-related financial activities. The emergence of liquid staking platforms like Lido Finance and perpetual exchange platforms such as Synthetix Perps (a new offering from Synthetix) provides stablecoin holders with yield-generating opportunities. In March 2024, Sparklend—a lending platform spun out from MakerDAO—issued so much DAI in recent weeks that it required authorization for additional lending capacity.

Ethena, the fastest-growing stablecoin in 2024, has partnered with centralized exchanges and DeFi platforms such as Lido Finance, Curve, MakerDAO, and Injective Protocol, forming an ecosystem with substantial yield potential and enhanced user experience.

Institutions Are Preparing to Enter the DeFi Market

With expectations of Federal Reserve rate cuts in the coming years, financial institutions now have stronger incentives to seek higher yields in DeFi markets.

Although DeFi startups remain in seed stages, we are seeing increased investment activity in the primary market from major players such as BlackRock, Fidelity, and Franklin Templeton—unlike the previous cycle. These funded DeFi startups have recently focused on liquid staking and risk-weighted assets.

These institutional giants are also beginning to explore on-chain activities. Franklin Templeton, a $14 billion asset management firm, launched a tokenized mutual fund on Polygon, competing with BlackRock, which previously launched a similar product on Ethereum.

Fintech Companies Are Issuing Their Own Stablecoins

Fintech companies—especially those with large payment networks—have strong incentives to launch their own stablecoins to enhance their offerings. PayPal launched PayPal USD (PYUSD) in August last year and began rolling it out to users of its Venmo payment service within weeks. In April this year, Ripple revealed plans to launch a USD-pegged stablecoin fully backed by U.S. dollar deposits, short-term U.S. Treasury bills, and other cash equivalents. Beyond dollar-pegged stablecoins, Nomura Holdings launched a yen-pegged stablecoin, Banco de Bogotá—the largest bank in Colombia—launched its own stablecoin COPW, backed 1:1 by Colombian pesos. In Europe, Société Générale, France’s third-largest bank, issued its euro-pegged stablecoin in December last year.

Growing Adoption of Synthetic Collateral (Including RWA-Supported Stablecoins)

Stablecoin projects are increasingly diverging from the traditional Collateralized Debt Position (CDP) model seen in the last market cycle. For example, Tether’s aUSDT is a synthetic dollar, over-collateralized by XAUT (Tether Gold), minted on Tether’s new open platform Alloy on Ethereum, allowing users to create collateralized synthetic assets. Other newer projects using RWAs as collateral are listed in the appendix below.

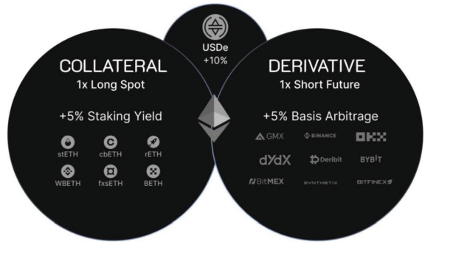

Another example is Ethena Labs’ USDe—the breakout star of 2024—which has attracted over $3 billion in total value locked (TVL) to date. USDe generates dollar-equivalent value and yield through two main strategies: leveraging stETH and its inherent yield, and taking short positions on Ether (ETH) to delta-hedge and capture funding rates from perps/futures. This strategy combines spot deposits of staked ETH (stETH) with corresponding short positions, effectively creating a synthetically delta-neutral CDP through partnerships with centralized exchanges (CEXs) like Binance and Bitcoin. Holding sUSDe (staked USDe) essentially becomes a base trade that balances spot stETH longs and ETH shorts in the market. This setup allows users to earn the spread between these positions, currently yielding around 27%.

Yield-bearing stable assets: Internet Bonds, Source: EthenaLabs Gitbook

Latest Technological Developments Enhancing Stablecoins

Bitcoin Ecosystem

Bitcoin scalability efforts have led to multiple Bitcoin Layer 2 chains and Layer 1 innovations (e.g., Runes). The growth of Bitcoin DeFi is also creating more use cases for native Bitcoin-backed stablecoins.

For example, RSK (Rootstock), a Bitcoin Layer 2 project, enables smart contracts on Bitcoin. With smart contract functionality, RSK opens the door to building stablecoins backed by Bitcoin. These stablecoins are pegged to fiat values but secured by Bitcoin, leveraging the security and trust of the Bitcoin network while providing users with price stability. A notable project built on RSK is Sovryn, which uses this advanced capability to offer users stablecoins pegged to fiat but protected by Bitcoin’s underlying network.

Stacks is a Layer 2 project that integrates smart contracts, decentralized applications (dApps), and Bitcoin. It builds stablecoins within its ecosystem, most notably USDA developed by Arkadiko Finance. USDA is a decentralized, crypto-collateralized stablecoin maintained by locking STX tokens (Stacks’ native token). Users lock STX in the Arkadiko Finance protocol to mint USDA. The protocol uses a “Proof-of-Transfer” consensus mechanism secured by Bitcoin to back the stablecoin and ensure its value. USDA’s stability is supported by over-collateralization, ensuring its value remains tied to real-world assets.

Interoperability Across Chains

Interoperability is crucial for stablecoin accessibility and adaptability. Recent advances in cross-chain solutions have significantly improved stablecoins’ ability to operate seamlessly across different blockchain networks. These developments allow users to transfer stablecoins effortlessly between platforms, fostering broader adoption and usage across the DeFi ecosystem.

-

Ondo Finance partnered with Axelar to launch Ondo Bridge, a cross-chain solution enabling native issuance of tokens like USDY across blockchain networks supported by Axelar.

-

USDC’s cross-chain protocol was developed in collaboration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP), significantly enhancing its utility and reach across multiple blockchains.

-

LayerZero’s OFT standard—and the recently launched stablecoin USDV—exemplify next-generation stablecoins that promote interoperability across multiple blockchain ecosystems, mitigating the risks of single-chain dominance.

Outlook: Impact on Native Crypto CeFi Platforms

We observe that stablecoins are a key strategic component for both Web2 and Web3 fintech companies, especially for crypto-native centralized finance (CeFi) platforms. We define crypto-native CeFi platforms as centralized entities offering services such as payments, trading, and lending within the crypto space. By integrating stablecoins or partnering with relevant providers, these platforms can offer customers more stablecoin options and attract new users.

Alchemy Pay, a leading payment solutions provider, has become a vital bridge between traditional fiat systems and the evolving cryptocurrency ecosystem. Its platform enables merchants and consumers to transact easily using both cryptocurrencies and fiat currencies.

Alchemy Pay’s expanded support for Celo-native USDC and USDT facilitates seamless conversion, reflecting the company’s commitment to offering diverse, stable, and reliable payment choices. In June 2024, Alchemy Pay also announced support for USDT on TON, expanding access for TON users.

Payment channels, Source: Alchemy Pay

Crypto.com, founded in 2016, has grown into one of the world’s largest cryptocurrency platforms. It also issues the Crypto.com Visa Card, enabling customers to spend directly from their crypto accounts in daily life. In 2021, Visa began testing the use of USD Coin (USDC) in financial operations. Through a pilot program with Crypto.com, Visa now uses USDC to settle obligations on its Australian Visa cards. Using USDC for settlement eliminates Crypto.com’s need to convert digital currency into fiat. This improves capital management and delivers additional business benefits.

Leveraging Visa’s USDC settlement capability, Crypto.com can:

-

Reduce prepaid funding time from 8 days to 4 days

-

Lower foreign exchange fees by 20–30 basis points

-

Focus on strategic initiatives instead of day-to-day operations

For issuers (crypto-native companies/exchanges and fintech firms):

-

Help drive more payment options and transaction volume

-

Support USDC conversions, improving capital efficiency in settlements

For acquirers:

-

Expand product offerings and acceptance, attracting crypto-savvy merchants and customers

-

Accept USDC payments and conduct on-chain transactions

[Appendix 1] Notable Market Projects and Case Studies

Collateralized Debt Positions (CDP): MakerDAO, Liquity, and Curve

Recently, several major stablecoin projects—including MakerDAO, Liquity, Curve, AMPL, and Frax—have made significant progress in enhancing their protocols and expanding their ecosystems. These projects have introduced new features, formed strategic partnerships, and integrated with additional blockchain networks, improving stability and utility while attracting broader user bases. Key developments and milestones over the past year include:

MakerDAO

1) GUSD PSM Adjustment: In June 2023, MakerDAO voted to adjust parameters of the GUSD Peg Stability Module, including lowering the maximum debt ceiling and reducing the fee rate to 0%.

2) Launch of Spark Protocol: In September 2023, MakerDAO launched the Spark Protocol, designed to enhance DeFi functionality within the ecosystem by integrating multiple stablecoins and optimizing yield.

3) New Collateral Types: In early 2024, MakerDAO introduced several new collateral types to the platform, including tokenized real estate and other real-world assets, diversifying and stabilizing DAI backing.

Liquity

1) Integration with Aave: In August 2023, Liquity announced integration with Aave, allowing users to use LUSD as collateral within the Aave ecosystem, increasing its utility and adoption.

2) LUSD on Optimism: In December 2023, Liquity deployed LUSD on the Optimism Layer 2 network, improving transaction speed and reducing user costs.

3) Protocol Upgrade: In May 2024, Liquity conducted a major protocol upgrade to enhance stability and security, including improvements to liquidation mechanisms and the stability pool.

Curve

1) Launch of crvUSD: In October 2023, Curve Finance launched its own stablecoin, crvUSD, aiming for deep integration with Curve’s liquidity pools and governance mechanisms.

2) Partnership with Yearn Finance: In January 2024, Curve partnered with Yearn Finance to optimize yield farming strategies by combining Curve’s liquidity pools with Yearn’s vaults.

3) Cross-chain Expansion: By June 2024, Curve expanded operations to multiple blockchains including Avalanche and Solana, increasing liquidity and user base.

AMPL (Ampleforth):

1) Launch of Geyser V2: In July 2023, Ampleforth launched Geyser V2, an upgraded liquidity mining program offering more flexible and generous rewards for providing liquidity on decentralized exchanges.

2) AMPL on Ethereum Layer 2: In November 2023, Ampleforth expanded to Ethereum Layer 2 solutions, improving scalability and reducing transaction fees for AMPL users.

3) Partnership with Chainlink: In February 2024, Ampleforth announced a partnership with Chainlink to leverage its oracle services for more accurate and decentralized data, improving AMPL’s adaptive supply mechanism.

Frax

1) Launch of Fraxlend: In September 2023, Frax Finance launched Fraxlend, a decentralized lending protocol enabling users to lend and borrow stablecoins at dynamic interest rates.

2) New Collateral Types: In December 2023, Frax added multiple new collateral types, including tokenized gold and synthetic assets, to back FRAX issuance.

3) Governance Token Upgrade: In April 2024, Frax upgraded its governance token FXS, adding new features such as staking rewards and improved voting mechanisms.

[Appendix 2] Evaluation Metrics for Stablecoins

Startup and Due Diligence Checklist

Investors are advised to assess emerging stablecoin issuers along two dimensions: mechanism design and partnership resources.

Mechanism Design: Focus on collateral-to-debt ratio, liquidation mechanisms, cross-chain support, etc.

Collateral Design: Composition, types, health, transparency, and stability of collateral

Partnerships: Access to major DeFi partners, early adopters, and expected liquidity

Market Cap: A high ratio reflects the stablecoin’s scale and market adoption. Generally, higher market cap indicates greater trust and usage.

Liquidity: High liquidity ensures minimal slippage during trading, which is crucial for maintaining the peg.

Collateralization: A high collateralization ratio determines the safety and stability of the stablecoin.

Redemption Mechanism: A sound redemption mechanism ensures convertibility back to underlying assets, maintaining trust in the stablecoin’s value. Metrics include associated fees and historical redemption success rates.

Adoption: Widespread adoption signals trust and practical utility within the ecosystem.

Transparency: Transparency builds trust among users and regulators.

Security: Strong security protects user funds and ensures the integrity of the stablecoin.

Community Support: A robust community can drive adoption and innovation.

[Appendix 3] Recently Funded Stablecoin Startups

1) Agora: https://www.agora.finance/

Agora Finance offers a yield-bearing stablecoin backed by VanEc, emphasizing regulatory compliance and actively securing necessary licenses. Currently, its services are limited to select markets outside the U.S.

Agora holds its reserve funds in trust and entrusts them to one of the world’s largest custodians, conducting regular audits to ensure high security. Assets are protected from bankruptcy, enhancing investor confidence.

Dragonfly Capital led the investment in Agora, signaling strong support and belief in its potential. Recent updates indicate Agora is expanding partnerships with financial institutions to enhance liquidity and accessibility, further solidifying its market position.

2) Midas: https://midas.app/

Midas launched a U.S. Treasury-backed stablecoin and plans to quickly introduce its stUSD token on DeFi platforms such as MakerDAO, Uniswap, and Aave. Midas leverages BlackRock’s purchase of Treasuries and Circle’s USDC to deliver a secure and stable digital asset.

Midas’ key partners include custody technology provider Fireblocks and blockchain analytics provider Coinfirm. Recent business updates show Midas is focused on integrating advanced security measures and expanding onto more DeFi platforms to maximize stUSD utility and adoption.

3) Angle: angle.money

Angle’s USDA stablecoin is backed by U.S. Treasury bills and tokenized Treasuries. Holders of USDA tokens receive a target yield of at least 5%, derived from reserve asset returns and lending platform revenues.

Angle is also building a foreign exchange hub backed by a16z to enable seamless conversion between USD- and EUR-pegged stablecoins. Recent developments include increased staking rewards, expanded FX hub to support more currency pairs, and strategic partnerships to enhance protocol security and user engagement.

4) Yala: https://yala.org/

Yala is revolutionizing Bitcoin liquidity through its innovative meta-yield stablecoin, YU. YU is a BTC-backed stablecoin that harnesses Bitcoin’s power in DeFi to generate yield across multiple blockchains.

Leveraging the Ordinals protocol, Yala issues YU directly on Bitcoin and integrates it with decentralized indexing networks and oracles via meta-protocols. This setup ensures borderless and accessible Bitcoin liquidity, allowing users to earn yield from various blockchain ecosystems without leaving the Bitcoin environment.

Yala’s latest developments include implementing mapping and minting mechanisms, enhancing users’ ability to seamlessly leverage cross-chain yields. This approach not only boosts Bitcoin’s utility in DeFi but also establishes Yala as a pioneer in the decentralized finance space.

5) BitSmiley: https://www.bitsmiley.io/

BitSmiley is building a comprehensive financial ecosystem on Bitcoin via its Fintegra framework, comprising a decentralized over-collateralized stablecoin protocol, a trustless native lending protocol, and an on-chain derivatives protocol. The first step is launching bitUSD, an on-chain stablecoin over-collateralized by Bitcoin, initially on the first BTC Layer 2 platform collaborating with BitSmiley, with plans to expand to other L2 solutions.

bitUSD will serve as the cornerstone of the BitSmiley ecosystem. Its over-collateralization mechanism resembles MakerDAO’s model, reducing unfamiliarity for DeFi users. Recently, BitSmiley received investments from OKX Ventures and ABCDE, underscoring the project’s credibility and potential in the DeFi space.

6) BitStable: https://bitstable.finance/

BitStable is a decentralized asset protocol built on the BTC network. The platform allows anyone, anywhere, to generate the $DALL stablecoin from collateralized assets within the BTC ecosystem. BitStable employs a dual-token system ($DALL and $BSSB) and a cross-chain compatible architecture. $DALL is a stablecoin (BRC-20) whose value and stability derive from the robustness of BTC ecosystem assets, including BRC-20, RSK, and the Lightning Network.

In BitStable’s vision, $DALL’s cross-chain capabilities will connect the Ethereum community with the BTC ecosystem. The total supply of $DALL is capped at 1 billion tokens. $BSSB serves as the platform’s governance token, enabling the community to maintain the system and manage $DALL. Additionally, BitStable incentivizes $BSSB holders through dividends and other mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News