ZetaChain: An Underestimated Chain Abstraction Ecosystem

TechFlow Selected TechFlow Selected

ZetaChain: An Underestimated Chain Abstraction Ecosystem

The market has likely underestimated ZetaChain's potential to become universal infrastructure in the chain abstraction space.

Author: Gou, Foresight News

Towards the end of last year and at the beginning of this year, I wrote two articles introducing ZetaChain. A few months later, I’ve developed some new thoughts. Looking back at those earlier pieces—still largely theoretical—I realize there were certain points I hadn’t fully articulated or truly grasped about the essence of ZetaChain.

Over these past months, ZetaChain has achieved several notable milestones. On one hand, it plans to gradually add support for Solana, Ton, and Base, advancing its practical implementation of chain abstraction. Regarding Bitcoin (BTC), amid growing discussions criticizing WBTC for being overly centralized, ZetaChain has reaffirmed its commitment to supporting native Bitcoin applications in a decentralized manner.

On the other hand, major exchanges including OKX, Coinbase, and Crypto.com have either already added or plan to support ZETA staking. Infrastructure providers such as Alchemy, Ledger, Tenderly, MintScan, and Keplr are also progressively integrating support for ZetaChain.

In terms of protocol development, ZetaChain has upgraded its universal L1 blockchain components: the Gateway, UniversalKit, and new Localnet and Devnet. The Gateway enables Universal Apps to natively connect to any blockchain—including Bitcoin—enhancing user experience. UniversalKit provides ready-to-use React components for building Universal App interfaces, while Localnet and Devnet accelerate development cycles. According to data from ZetaScan, ZetaChain has attracted over 3.6 million unique wallets.

After reviewing Delphi’s research report on ZetaChain, I believe the market may currently be underestimating ZetaChain’s potential to become foundational infrastructure in the chain abstraction space.

What Does the Real ZetaChain Look Like?

In my previous article titled “How to Add Omnichain Interoperability to Bitcoin? ZetaChain Offers a New Answer,” I summarized ZetaChain’s cross-chain mechanism as follows: “Simply put, chains themselves serve as the trust guarantee for inter-chain message delivery. Once blocks containing relevant messages are packaged, confirmation is achieved—the security relying primarily on a large number of widely distributed validators and their staked assets.”

At that time, I understood ZetaChain as using the chain as a relay for cross-chain messaging. While not entirely incorrect, this explanation was somewhat inaccurate. Interestingly, ZetaChain’s actual mechanism turns out to be even more intriguing than previously described.

As noted in Delphi’s report, ZetaChain resembles an advanced version of THORChain—in Delphi’s words, “THORChain with smart contract capabilities.” But adding smart contracts dramatically expands its possibilities.

THORChain operates by using its native token RUNE as an intermediary: users trade Token A for RUNE on the THORChain chain, then swap RUNE for Token B. Both A and B originate from different blockchains (e.g., Bitcoin and Ethereum) but exist as bridged tokens on THORChain. This model isn’t as convenient as most current cross-chain solutions, yet it provides strong price support for the RUNE token. ZetaChain adopts a similar approach—instead of merely processing cross-chain information via a chain, it actually mints ZRC-20 tokens on ZetaChain to facilitate asset conversion.

We’ll return later to explain why this design opens up vast potential.

Data Test: ZetaChain Has Lower Cross-Chain Costs Compared to LayerZero and Wormhole

In the omnichain / chain abstraction space, comparisons with LayerZero and Wormhole are inevitable. Based on real-world testing, I found that ZetaChain’s mechanism—though seemingly more complex—actually results in lower slippage for certain cross-chain transactions.

LayerZero and Wormhole are essentially cross-chain bridges, supporting only the transfer of single-token types across chains—for example, moving USDT between different chains or transferring ETH between Ethereum and various L2s. In contrast, ZetaChain uses its own chain as a central hub and leverages internal liquidity pools to enable direct swaps of native assets across different L1s. For instance, you can instantly exchange native ETH on Ethereum for native BNB on BNB Chain, or native ETH for native SOL on Solana. The detailed process will be explained shortly, but from a UX perspective, this truly achieves “one-click trading.”

If LayerZero or Wormhole wanted to achieve similar token-to-token trades—say, converting ETH on Ethereum into BNB on BNB Chain—they would still require DEXs on the respective chains.

Currently, if you simply want to move stablecoins or ETH between EVM chains and L2s, LayerZero is a solid choice—though this advantage exists partly because ZetaChain currently supports fewer chains. However, when it comes to direct cross-chain trades between different tokens, ZetaChain clearly holds a significant edge. Let's use exchanging ETH on Ethereum for BNB on BNB Chain (ETH > BNB) as an example.

ZetaChain Transaction Fees

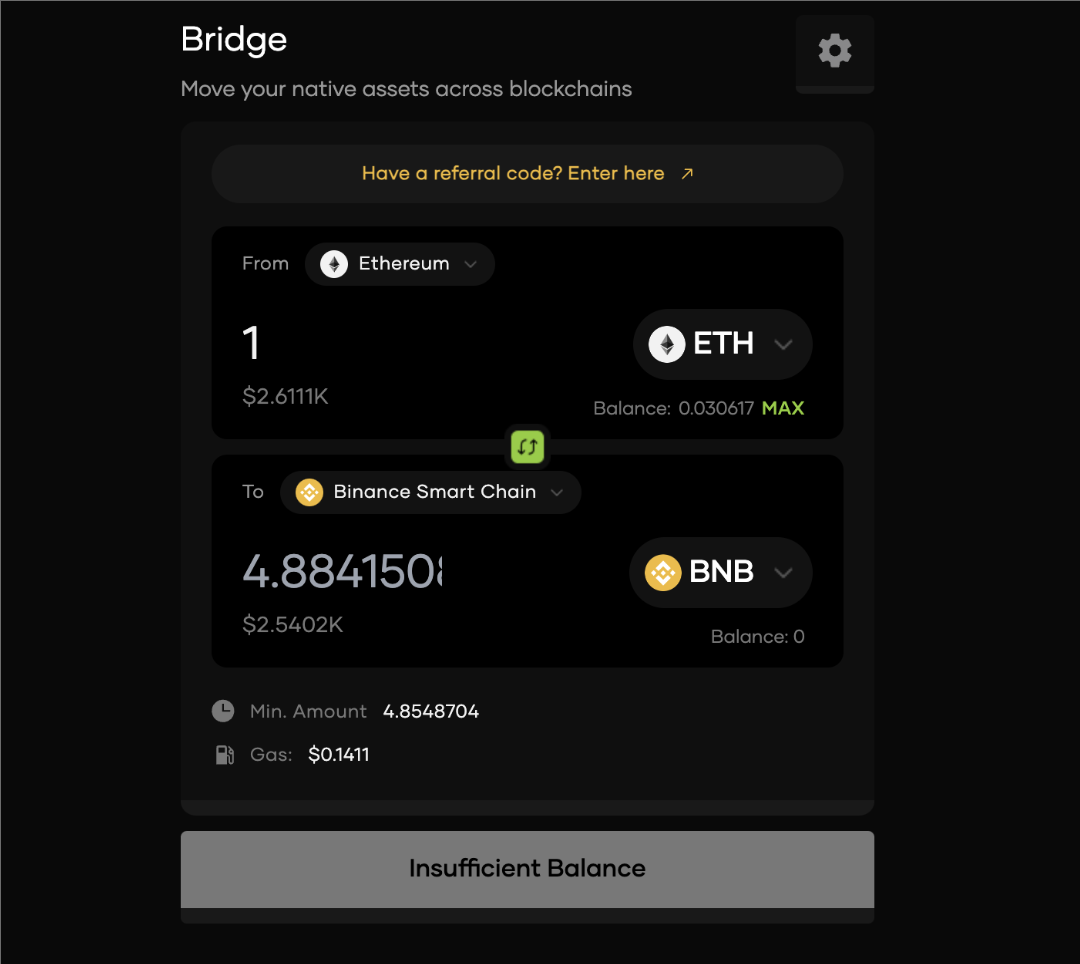

Using ZetaChain’s cross-chain path (via Eddy Finance), the cost to swap 1 ETH is approximately $0.30 (including both gas fees on ZetaChain and execution costs on Ethereum).

LayerZero and Wormhole Transaction Fees

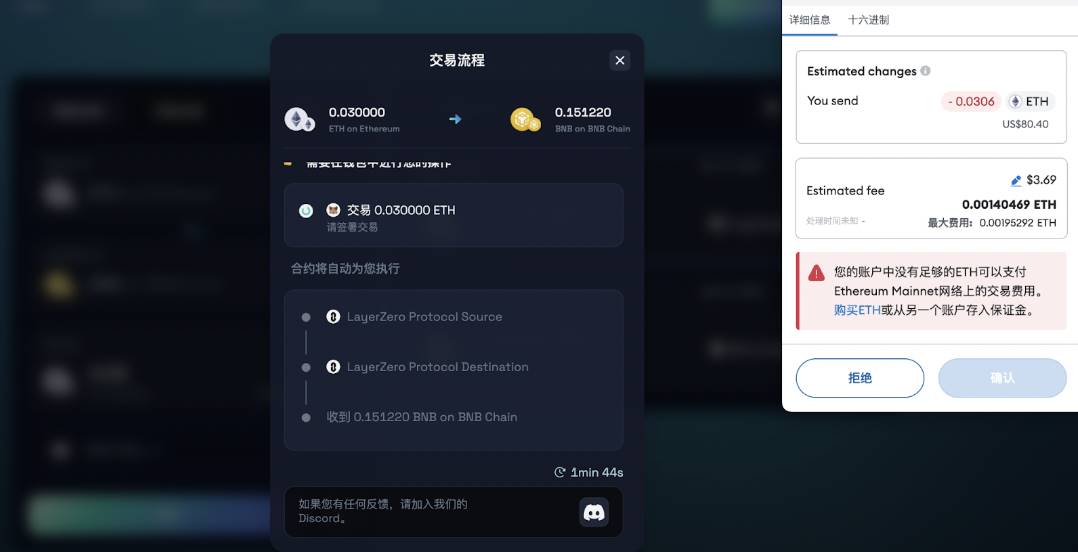

Under the same conditions, using OmniSwap (integrated with LayerZero), the total cost includes around $3.70 for swapping ETH to USDC on Uniswap on Ethereum:

My wallet only contained 0.03 ETH, but this does not significantly affect the actual Ethereum gas fee incurred.

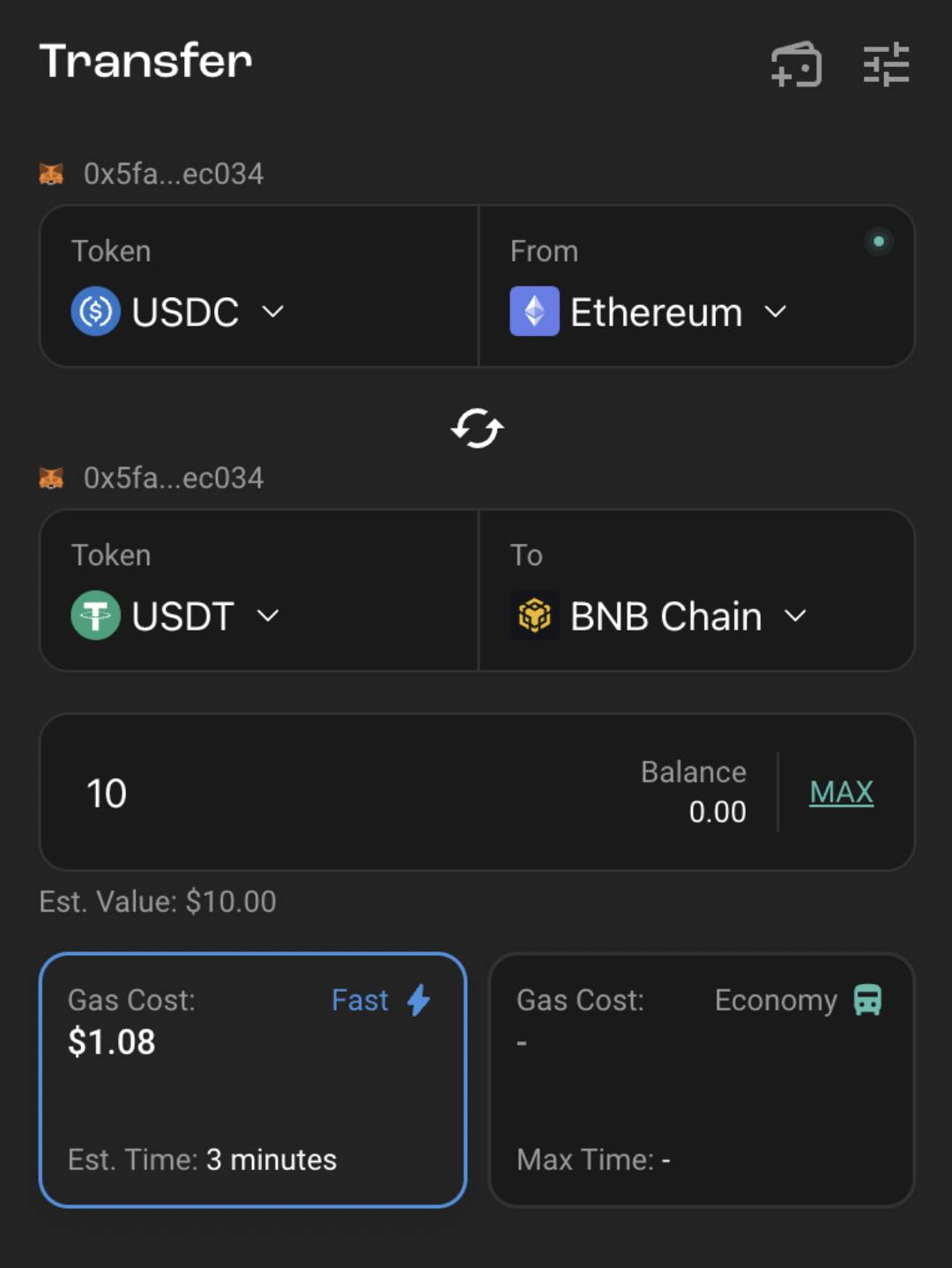

The cross-chain fee via LayerZero is about $1.50. Since LayerZero currently allows transferring part of the amount as gas on the destination chain, I assume OmniSwap includes PancakeSwap’s trading fee within the cross-chain cost. Stargate shows slightly lower fees than OmniSwap:

Thus, the total cost via LayerZero totals approximately $5.20—significantly higher than executing the same trade through ZetaChain.

For Magpie (integrated with Wormhole), gas fees are even higher—close to $10. When I took the screenshot, Ethereum gas was at 2 GWei, double the 1 GWei during the prior comparison between ZetaChain and LayerZero. As a result, Uniswap trading fees nearly doubled. The transaction path is almost identical to OmniSwap’s, differing only in whether the stablecoin transfer uses LayerZero or Wormhole, so further details are omitted.

Fee Difference Analysis

Why such a large discrepancy in fees? Let me break down the two paths.

Before explaining ZetaChain’s transaction flow, let’s clarify how Eddy Finance labels tokens:

-

Native assets are labeled by their original names—e.g., ETH refers to native ETH on Ethereum, and BNB means native BNB on BNB Chain.

-

ZRC-20 assets on ZetaChain, originating from different chains, are labeled in x.y format. For example, USDC.ETH denotes “USDC bridged from Ethereum to ZetaChain,” while USDC.BSC indicates “USDC bridged from BNB Chain to ZetaChain.”

The path for swapping ETH to BNB via ZetaChain is as follows:

-

ETH is bridged to ZetaChain via ZetaChain’s cross-chain contract and marked as ETH.ETH.

-

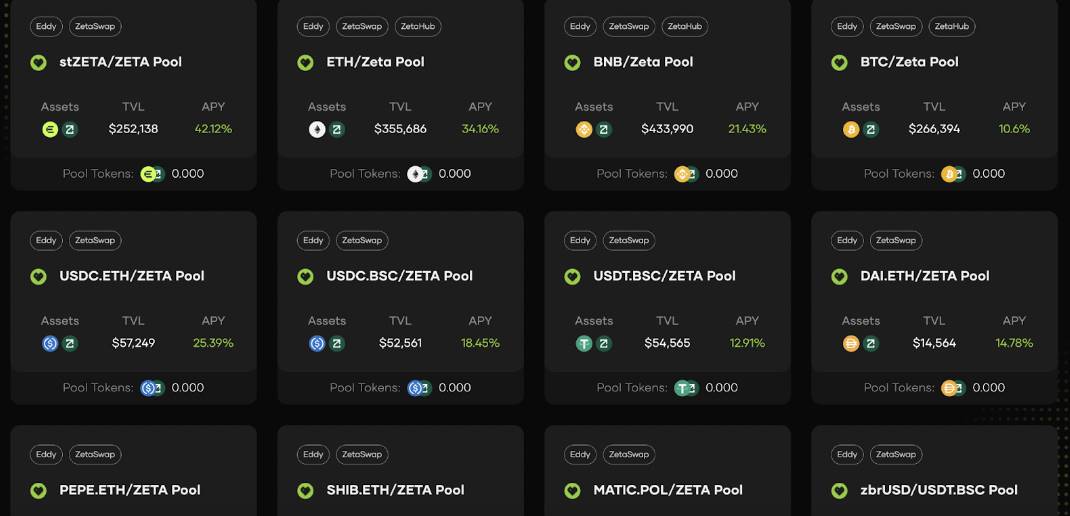

ETH.ETH is swapped for native BNB on ZetaChain (labeled BNB.BSC in Eddy). This occurs via an intermediate swap: ETH.ETH → ZETA → BNB.BSC, using liquidity pools on ZetaChain.

-

Finally, BNB.BSC is bridged back from ZetaChain to BNB Chain, delivering native BNB to the user.

This process incurs three types of fees: bridging ETH from Ethereum to ZetaChain, trading on ZetaChain, and bridging BNB from ZetaChain to BNB Chain. The initial bridge only creates a wrapped representation of ETH on ZetaChain, so the cost is minimal. Trading on ZetaChain itself consumes negligible fees—comparable to most EVM-compatible alternative L1s. Thus, overall costs remain very low.

In contrast, the LayerZero path for the same trade is:

-

Swap ETH for USDC on Uniswap (Ethereum).

-

Bridge USDC from Ethereum to BNB Chain as USDT via Stargate.

-

Swap USDT for BNB on PancakeSwap (BNB Chain).

This involves fees from Uniswap, Stargate’s cross-chain fee, and PancakeSwap.

Two key points stand out. First, even for simple stablecoin transfers (e.g., USDT from Ethereum to BNB Chain), Stargate must account for pool liquidity when calculating output amounts, increasing computational complexity—and historically leading to high cross-chain fees at launch.

In contrast, ZetaChain simply locks USDT on Ethereum and mints an equivalent amount on ZetaChain. Subsequent steps—such as trading USDT.ETH for USDT.BNB on ZetaChain and bridging to BNB Chain—involve only locking and releasing. Though more steps, resource consumption is low. Therefore, I speculate that once ZetaChain supports more tokens, its cross-chain fees could be lower than—or at least competitive with—Stargate’s.

You might argue the difference isn’t dramatic yet—after all, $5 may still be acceptable for many. But this data reflects periods when Ethereum gas was extremely low. During highly active periods like in 2021, the fee gap between these two models could become staggering.

Moreover, nearly all cross-chain projects—including LayerZero—charge dedicated cross-chain fees to sustain protocol operations. This leads projects like Axelar to disallow small transfers, where fees exceed the transferred value. ZetaChain, however, generates revenue through gas fees on its own chain rather than charging separate cross-chain fees, greatly reducing user costs.

The Positive Flywheel Effect from Token Utility

Delphi’s report on ZetaChain is highly detailed and worth reading in depth. Here, I highlight a subtle yet crucial point often overlooked: the positive flywheel effect created by token utility.

I rarely use the term “positive flywheel” because it’s often overused—but ZetaChain genuinely deserves it. In most cross-chain and omnichain projects, the native token adds little value beyond allowing stakers to earn a share of cross-chain fees.

ZetaChain breaks free from this conventional model. As mentioned earlier, its mechanics resemble THORChain, which explains why there are no direct liquidity pools between two non-ZETA tokens on ZetaChain.

This is where ZetaChain’s design shines. The actual cross-chain process involves first bridging tokens to ZetaChain, swapping them there, then bridging to the target chain. The bridging step itself is “lossless”—no liquidity involved, just a wrapping-like operation. On ZetaChain, all tokens must form liquidity pools with ZETA, meaning every trade becomes A → ZETA → B. ZETA thus becomes an indispensable component of every cross-chain swap. The more ZetaChain is used, the greater the demand for ZETA. Higher demand pushes up ZETA’s price, which increases liquidity on ZetaChain, thereby reducing slippage and improving efficiency.

Hence, lower fees drive more cross-chain activity, which increases demand for ZETA, raising its price, which further reduces slippage—a fully self-reinforcing positive loop. Even in bear markets, the fee advantage persists, helping maintain usage levels.

The slippage mentioned here ties back to my earlier point about market underestimation. While fees are low, when swapping 1 ETH for BNB, the actual BNB received via ZetaChain is noticeably less than via LayerZero. This is due to ZetaChain’s relatively shallow liquidity today, causing higher slippage for large trades.

Yet precisely this limitation makes ZetaChain’s liquidity a hidden goldmine. Combined with its support for non-smart-contract blockchains like Bitcoin and DOGE, the full power of this flywheel may not yet be visible in the current market. But should high-value-use cases like DeFi resurgence emerge, ZetaChain could rapidly unlock tremendous value alongside rising on-chain activity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News