ZetaChain Explained: A New Competitive Landscape for Multi-Chain and Cross-Chain Communication

TechFlow Selected TechFlow Selected

ZetaChain Explained: A New Competitive Landscape for Multi-Chain and Cross-Chain Communication

ZetaChain's core advantage lies in its cross-chain interoperability, enabling interaction between different blockchains.

Author: YBB Capital Researcher Ac-Core

ZetaChain (ZETA) is a Layer 1 blockchain designed to bridge the gap between various blockchain networks, leveraging the Cosmos SDK and Tendermint consensus mechanism to enable developers to build scalable interoperability applications. The platform allows decentralized applications (DApps) to leverage the capabilities of multiple blockchains to address current limitations in cross-chain protocols and achieve omnichain functionality. By using Omnichain smart contracts and the ZetaEVM engine, ZetaChain positions itself as an integration hub for seamless interoperability.

How ZetaChain Works

Image source: ZetaChain official website

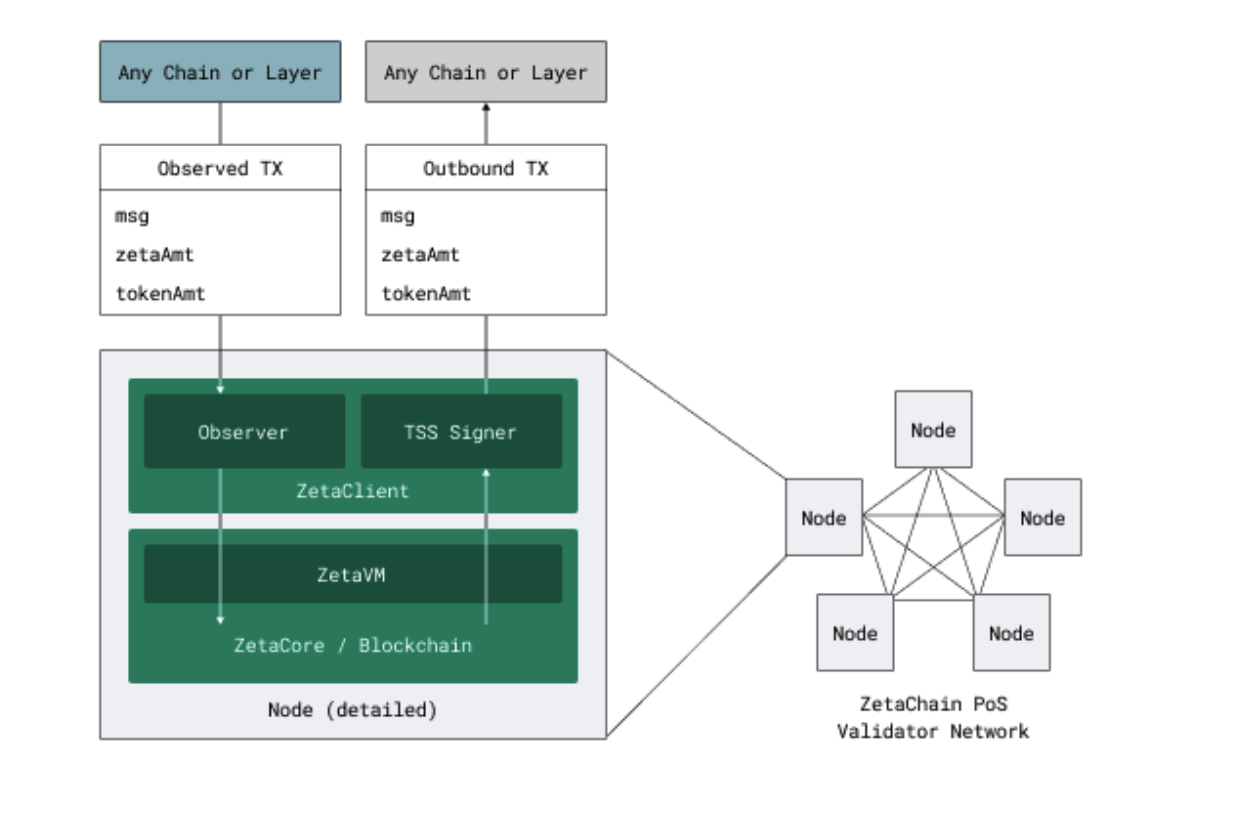

ZetaChain leverages the Cosmos SDK with the Tendermint consensus engine and a Proof-of-Stake (PoS) model, demonstrating unique omnichain interoperability capabilities. It uses its native token as gas fees and benefits from extending EVM-compatible smart contracts across chains. According to Jed Barker, ZetaChain operates as follows:

-

Omnichain Smart Contracts: At the core of ZetaChain are smart contracts capable of interfacing with multiple blockchains. These contracts are powered by the Ethereum Virtual Machine (EVM)-compatible ZetaEVM engine, enabling data interaction across different blockchains;

-

Seamless Asset Transfer: Simplifies asset transfers between blockchains without requiring complex bridges. This includes support for blockchains lacking native smart contract functionality, such as Bitcoin;

-

Cross-Chain Messaging: For simpler data exchanges (e.g., NFT transfers), ZetaChain offers cross-chain messaging functionality, facilitating lightweight data transmission across different networks;

-

Managing External Assets: ZetaChain extends its functionality to managing assets on other blockchains, applying smart contract logic to chains that typically lack this capability.

ZetaChain Architecture:

Like other architectures, Zeta provides numerous cross-chain messaging features, but its unique advantage lies in supporting full-chain EVM contracts—often described as “THORChain with smart contracts” or “Axelar with EVM.” Built using the Cosmos SDK and CometBFT consensus for a PoS blockchain, similar to THORChain, Zeta uses the ZETA token as the routing token for cross-chain message passing.

To clarify, ZetaCore is the client responsible for block production and running Layer 1. Similar to other PoS blockchains, ZetaClient handles cross-chain operations, and nodes must run both ZetaCore and ZetaClient. Zeta nodes perform three key functions: validation, observation, and signing—with each node operator fulfilling all three roles. This architecture enables two critical functionalities: Omnichain smart contracts and cross-chain messaging.

Image source: Delphi Creative

-

Validators: Standard CometBFT validators who stake ZETA and vote on blocks, just like other PoS chains;

-

Observers: Observers run full nodes of external chains, divided into sorters and verifiers. Sorters monitor events on external chains and relay them to validators, who then vote and reach consensus. The role of sorters is solely to ensure validity—any node can perform sorting. Running Zeta nodes is thus more resource-intensive than standard chains, similar to THORChain, which partly explains why THORChain has not added Solana support;

-

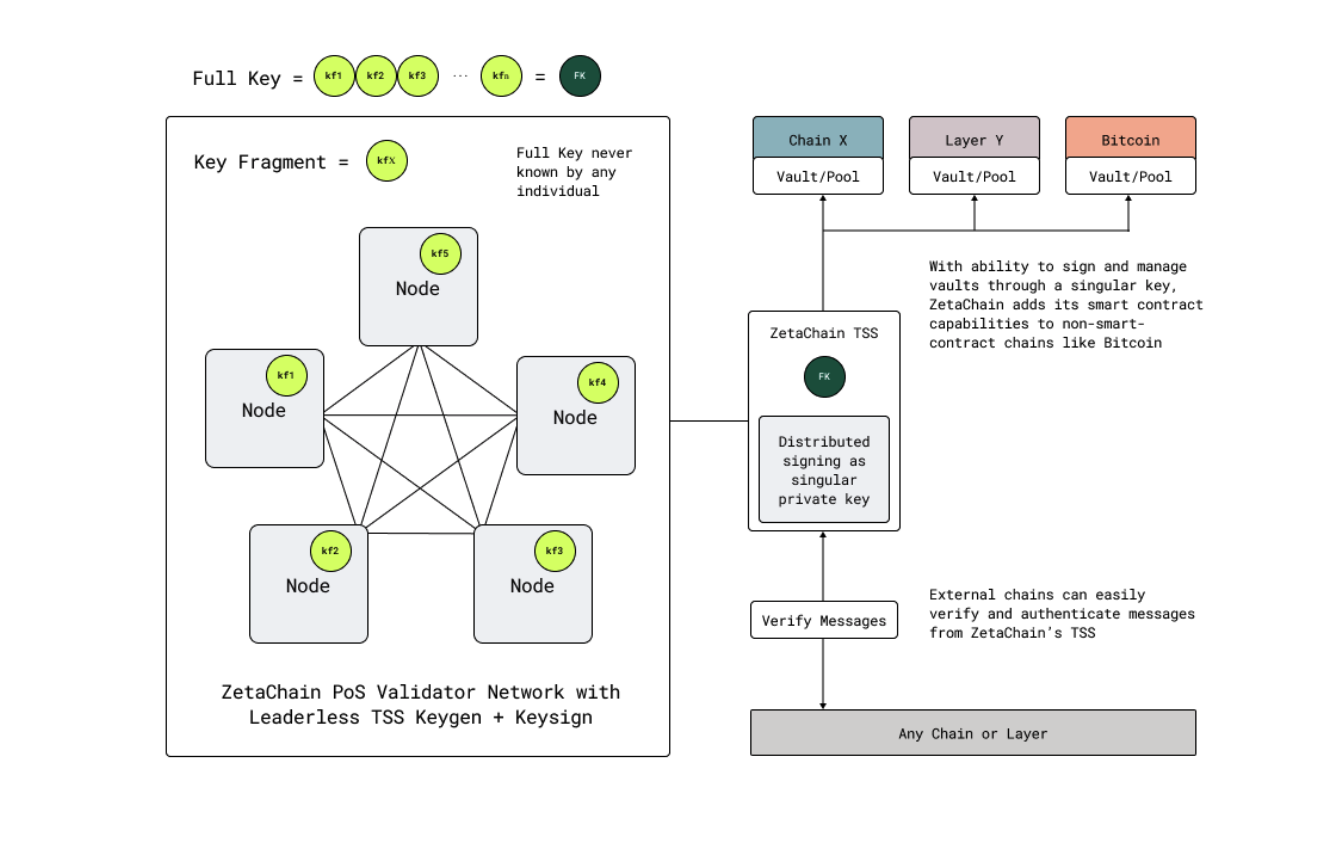

Signers: Nodes share ECDSA/EdDSA keys, where only a supermajority (2/3) can sign transactions on external chains. Signers represent how Zeta holds assets and signs messages on external chains. On smart contract platforms like Ethereum, they interact with smart contracts and custodied assets; they also manage assets on non-smart-contract chains like Bitcoin and Dogecoin. The diagram below illustrates the signing process from the whitepaper.

Image source: Delphi Creative

Cross-Chain Message Passing

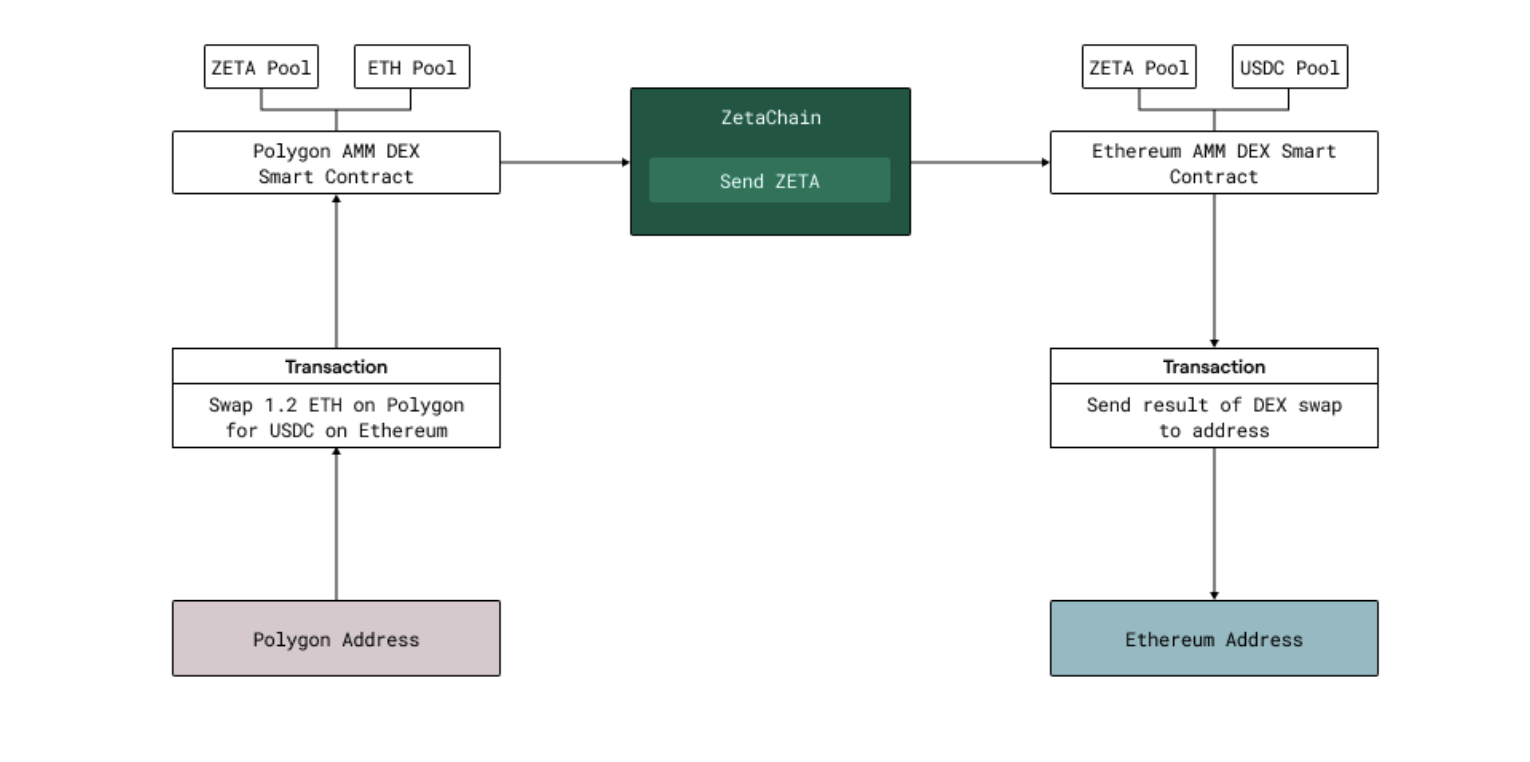

CCMP routes information between chains via ZetaChain as an intermediary. Other protocols such as LayerZero, Axelar, IBC, Chainlink CCIP, and to some extent THORChain, compete in this space. However, ZetaChain’s cross-chain messaging protocol relies on its native token ZETA—a fundamental distinction from competitors, since except for THORChain, others do not depend on their native tokens for value transfer. A whitepaper example—an omnichain DEX—clearly demonstrates ZETA’s role in messaging. In this scenario, a user wants to exchange 1.2 ETH on Polygon for USDC on Ethereum. The path is as follows:

-

Swap ETH for ZETA on a Polygon AMM;

-

Send ZETA to ZetaChain;

-

Route ZETA from ZetaChain to Ethereum;

-

Swap ZETA for USDC on Ethereum;

-

User receives USDC on Ethereum.

Image source: Delphi Creative

While logically feasible, this solution requires significant capital. To some degree, it lacks product competitiveness compared to intent-based protocols like Squid and UniswapX, and settlement rails like Circle's CCTP, which already dominate market share. Beyond capital efficiency, cross-chain messaging remains a highly competitive field.

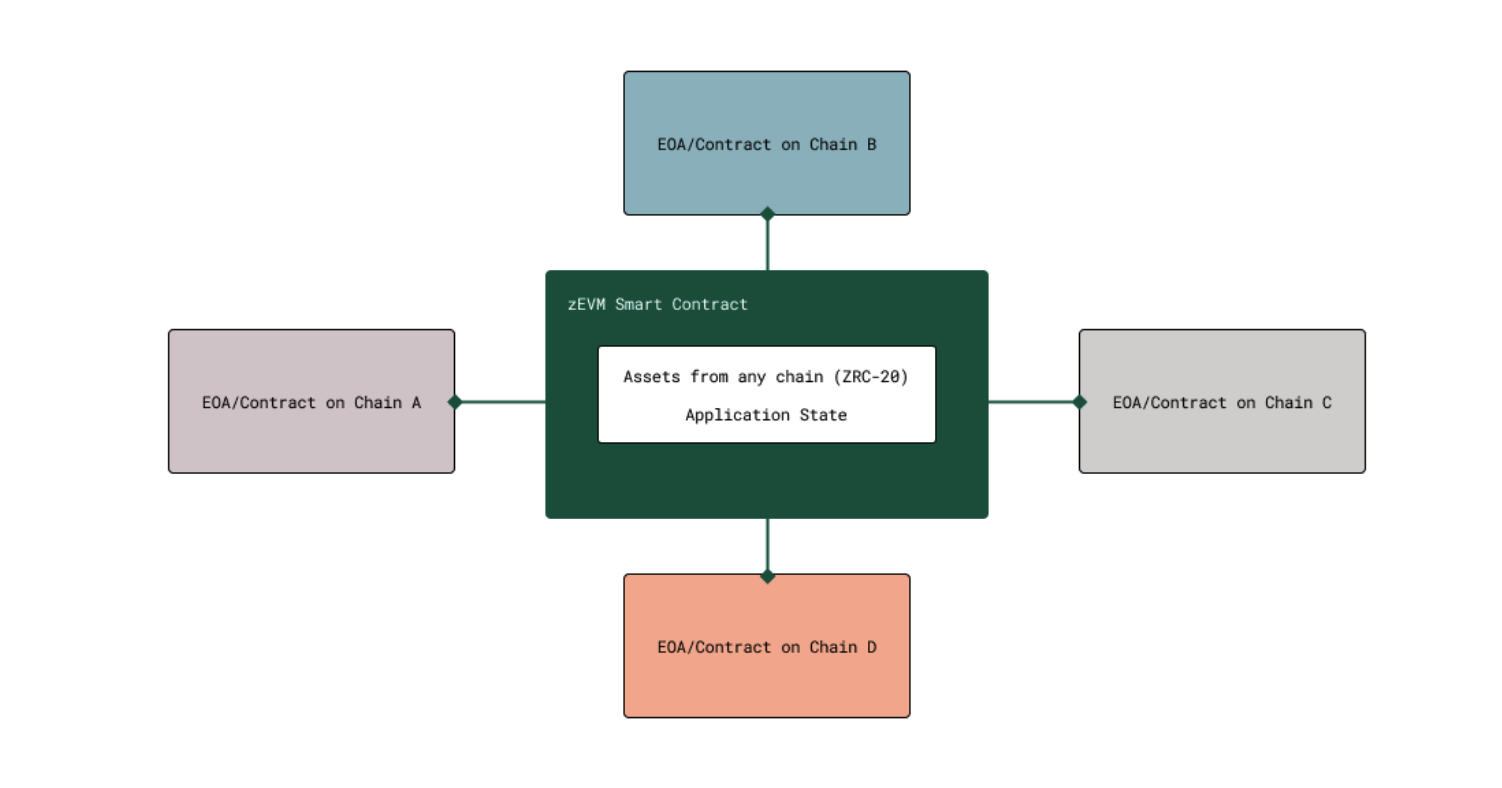

Omnichain Smart Contracts

Developers gain many advantages deploying omnichain smart contracts on Zeta beyond simply using Zeta and zEVM for transaction facilitation. First, it enables interaction with native assets that don’t inherently support smart contracts—such as BTC, DOGE, LTC. Second, because application state resides on Zeta, it reduces the attack surface for vulnerabilities and does not rely on ZETA token liquidity for value transfer. Among competitors mentioned above, only Axelar offers a similar product, though it uses CosmWasm instead of EVM and so far has seen no adoption.

ZetaChain’s omnichain smart contracts are supported by the TSS protocol, where validators run full nodes on external chains and share signatures, allowing them to custody assets on behalf of ZetaChain and its users. The zEVM can then manipulate these assets at will. Importantly, assets like BTC do not actually move from Bitcoin to Zeta; rather, they are transferred to addresses managed by Zeta validators and represented on ZetaChain—similar to how THORChain adds smart contract functionality atop protocol-custodied BTC.

Image source: Delphi Creative

With this architecture, Zeta can build many unique protocols, including but not limited to:

-

An omnichain CDP stablecoin backed by BTC;

-

Money markets supporting BTC, DOGE, LTC, and other non-smart-contract assets;

-

An omnichain Perp DEX;

-

An omnichain yield aggregator;

-

BTC AMMs.

Essentially, what sets ZetaChain apart—through the combination of zEVM and ZetaClient—is custody and control over assets on non-smart-contract chains. Most current cross-chain platforms serve as backend infrastructure, whereas ZetaChain can create its own crypto-economic ecosystem directly on ZetaChain.

Utility of the ZETA Token

ZETA is the cornerstone of the ZetaChain ecosystem, playing a pivotal role in functional programmability and governance. ZetaChain stands out for its interoperability and support for omnichain dApps, with key network activities relying heavily on ZETA.

Key utilities of the ZETA token include:

-

Network Incentives: ZETA incentivizes validators through block rewards, transitioning from a fixed pool to variable inflation. This system aligns validator interests with long-term network security;

-

Transaction Fees: Transactions within ZetaChain require ZETA to pay gas fees, which are distributed to validators and network participants. This mechanism prevents spam and DDoS attacks;

-

Cross-Chain Messaging and Value Transfer: For cross-chain transactions, ZETA is burned on the source chain and minted on the destination chain, eliminating the need to create wrapped assets;

-

Core Liquidity Pool: ZetaChain’s liquidity pools consist of ZETA and other assets, facilitating user trades and rewarding liquidity providers with fees and incentives;

-

Governance Role: ZETA holders participate in network governance, influencing key decisions and policy changes, ensuring community-driven development.

Overall, the multifaceted utility of ZETA supports ZetaChain’s security, efficiency, and decentralized governance, making it an essential component of the network’s functionality.

ZETA Tokenomics and Issuance

The initial total supply of ZETA tokens is 2.1 billion, with a planned inflation rate of approximately 2.5% per year after four years. Token distribution (see reference link 1) is strategically allocated across various ecosystem components:

-

User Growth Pool (10%): Aimed at expanding the user base through airdrops and community rewards;

-

Ecosystem Growth Fund (12%): Supports ecosystem development and assists partners and dApp developers;

-

Validator Rewards (10%): Provides block rewards, transitioning post-initial phase to inflation-based security incentives;

-

Liquidity Incentives (5.5%): Encourages liquidity in core ZRC-20 pools, crucial for efficient value transfer;

-

Protocol Treasury (24%): Funds operations, development, and ecosystem strengthening;

-

Core Contributors, Advisors, and Purchasers (22.5% and 16%): Reward contributions to ZetaChain’s growth and development.

Omnichain DEX

Unlike current fragmented cross-chain deployments, ZetaChain serves as a foundational layer enabling liquidity interoperability across all deployments. For example, a user on ZetaChain can deposit margin into a central contract and maintain positions on GMX. This represents Zeta’s core assumption for cross-chain applications (where position management resides on Zeta). In effect, users seeking to leverage GMX’s full liquidity would need to use ZetaChain.

Beyond execution quality, two key advantages emerge:

-

Similar to MUX aggregators (see reference link 2), asset orders can be split across various liquidity sources;

-

Access to more trading pairs without manually connecting all relevant chains.

Smart contracts on ZetaChain can directly deposit required collateral amounts to relevant chains along with instructions on how to use those assets. While technically achievable without ZetaChain, this improves user experience by enabling:

-

Inter-chain interactions;

-

Holistic management instead of isolated management.

DEX market leader UniSwap could theoretically shift its base from Ethereum to any other chain by deploying on ZetaChain and using the ZRC-20 standard, allowing users to swap in and out of any asset (on any chain) while hosting those assets on their preferred chain.

ZetaChain’s Competitors

LayerZero

Image source: LayerZero official website

In the cross-chain messaging market, LayerZero is ZetaChain’s biggest competitor. While not competing in the omnichain smart contract space, LayerZero holds a strong position in cross-chain messaging. Its main advantage comes from Stargate, followed by promoting adoption of its OFT standard (a new solution for cross-chain token transfers, simplifying and enhancing efficiency).

LayerZero Architecture

Briefly, LayerZero is a protocol enabling "user applications" to send messages between blockchains. The architecture consists of four main components:

-

User Applications: Contracts interacting with LayerZero endpoints to send/receive messages (e.g., Stargate);

-

LayerZero Endpoints: A series of smart contracts on different chains (currently supporting over 40+, see reference link 3). Endpoints allow user protocols to send messages via LayerZero’s backend, composed of four modules: Communicator, Validator, Relayer, and Library. The first three modules are standardized across chains, while the Library is customized per chain logic, enabling rapid addition of new chains;

-

Oracle: Responsible for reading block headers from one chain and sending them to another. Currently defaulting to Chainlink, but since September 2023, a new partnership with Google Cloud has replaced Chainlink as the default;

-

Relayer: Similar to oracle but fetches proofs instead of block headers. While apps themselves can act as relayers, in practice LayerZero manages this.

This design essentially functions as a 2/2 multisig, with the primary trust assumption being that Google Cloud and LayerZero won’t collude. Benefits of relying on off-chain components (like oracles and relayers) include lightweight, low-cost, and easily scalable architecture. The downside is dependence on two centralized entities, potentially exposing risks related to censorship.

Axelar

Image source: Axelar official website

Compared to LayerZero, Axelar’s structure resembles Zeta more closely, yet differs significantly. Like ZetaChain, Axelar is built on the Cosmos SDK. However, it does not directly host EVM, thus not supporting omnichain smart contracts like Zeta. Therefore, Axelar targets the cross-chain messaging market, similar to LayerZero.

Axelar Architecture

Axelar is a PoS chain with its own validator set and staking token AXL. Its components and information flow are as follows:

-

Cross-Chain GMP Requests: An API allowing applications to send arbitrary data across chains. These message requests are sent to the Axelar Gateway (an online platform or digital system leveraging blockchain technology to transfer cryptocurrency from one address to another);

-

Gateway: The first stop for cross-chain messages initiated by users/applications, routing from source to destination chain. On EVM chains, these are smart contracts; on Cosmos, they are application logic. Gateways are secured by Axelar validators using MPC, with shares weighted by AXL token delegation;

-

Message Processing & Relayer: Relayers listen for events (gateway messages) and submit them to the Axelar network for processing. While anyone can run a relayer, there are no incentives, so Axelar operates them;

-

Message Verification: Validators vote on messages received from relayers. Each Axelar validator runs a full node for each source chain, enabling verification of message validity. Compared to typical Cosmos PoS blockchains—which rely on light clients and IBC for message passing—Axelar validators require more resources. In this sense, scalability is lower than LayerZero, but decentralization is higher. Axelar incentivizes validators with additional staking rewards—the more chains they support, the higher the reward. Long-term, supported chains must generate sufficient fees from cross-chain activity, as token rewards for supporting over 50 full nodes may eventually deplete. Supporting every chain may not be feasible; instead, focus will cluster around major liquid chains;

-

Submitting Messages to Destination: Relayers listen for authorized messages from Axelar validators and push them to destination gateways. When target chains receive approved messages, payloads are marked as approved by Axelar validators. Now anyone can execute the payload;

-

Gas and Executor Services: Final step—Axelar deploys “Gas Receiver” contracts on EVM chains to pay destination chain gas fees and execute cross-chain payloads (sending them to intended applications). Users can pay with source chain gas tokens, while Axelar draws gas on the destination chain.

Overall, aside from supporting EVM on its own chain, its structure is similar to ZetaChain. In terms of security, Delphi Research considers it safer than LayerZero’s 2/2 model. Though not perfect, collusion risk between Google and LayerZero is extremely low (applications can run their own relayers).

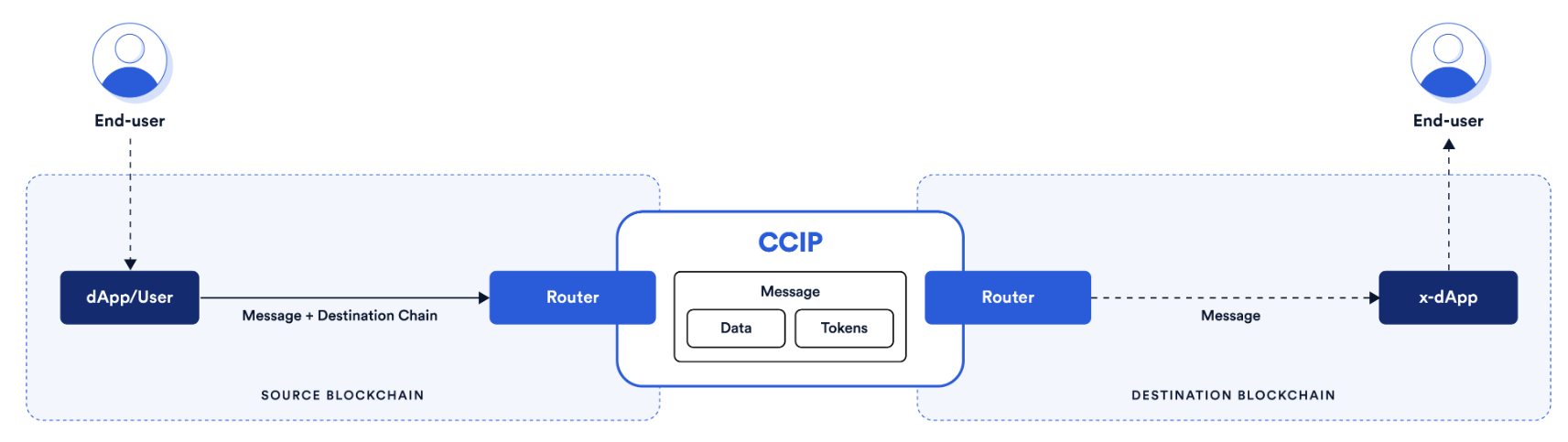

Chainlink CCIP

Image source: Chainlink official

CCIP differs little from other cross-chain messaging platforms—users send messages on one chain, forwarded to CCIP, then to the destination chain. CCIP’s distinction lies in its use of oracle networks and inclusion of another entity: the Risk Management Network (RMN).

CCIP is divided into on-chain and off-chain components.

On-chain Components

-

Router: Initiates cross-chain transactions. Routes transactions to destination-specific OnRamp contracts, receives messages from OffRamps on destination chains, and forwards to end users/contracts;

-

Commit Store: DON submits Merkle roots from the source chain to the destination chain. Merkle roots must be “certified” by the Risk Management Network;

-

OnRamp: One contract per chain (blockchain-to-blockchain). Verifies messages and tracks matters like token transfers/information, manages billing, etc. Monitored by Committing DON;

-

OffRamp: Similar to OnRamp, one contract per chain. Ensures message authenticity by verifying against committed and “certified” Merkle Roots via Execution DON, then relays information to Router;

-

Token Pools: Tokens can be “lock-and-mint” or “burn-and-mint,” depending on the token. Native gas tokens must be lock-and-mint since CCIP lacks minting rights. If integrated with CCTP, USDC can be burn-and-mint;

-

Risk Management Network Contract: Contains a list of RMN nodes that can “certify” (approve) or “fail certification” (disapprove) transactions.

Off-chain Components

-

Committing DON: Must monitor OnRamp contract events, wait for source chain results, create Merkle Root (signed by法定 committing DON oracle nodes), and finally write to CommitStore contract on destination chain;

-

Risk Management Network: A network of nodes performing double-checks on Merkle Roots submitted by Committing DON. They monitor OnRamp contracts and content published by Committing DON in CommitStore. If RMN does not “certify” (verify/confirm) the Merkle Root, CCIP freezes;

-

Execution DON: Similar to Committing DON, but monitors messages like RMN. Once RMN issues “certification,” Execution DON calls the OffRamp contract to complete the CCIP transaction on the destination.

Summary

In reality, breaking down silos between chains makes “multi-chain communication” and “cross-chain communication” the most pressing challenges. Compared to other solutions, ZetaChain’s core strength lies in its cross-chain interoperability, enabling seamless interaction between different blockchains and addressing current fragmentation and insufficient interoperability. It aims to allow omnichain dApps to natively interact directly with different blockchains without wrapping or bridging assets. However, security risks exist when external chains connect to ZetaChain, potentially exposing vulnerabilities to double-spending, censorship, rollbacks, hard forks, or chain splits.

Currently, LayerZero and Axelar lead in cross-chain messaging applications. However, it’s still early, and no single player has truly pulled ahead. While anticipating ZetaChain’s novel solutions, we also look forward to continuous iteration and innovation from LayerZero, Axelar, Chainlink CCIP, and other technologies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News