TechFlow: ZetaChain – An All-in-One Infrastructure for Multi-Chain DApps

TechFlow Selected TechFlow Selected

TechFlow: ZetaChain – An All-in-One Infrastructure for Multi-Chain DApps

ZetaChain's primary function is to serve as the underlying infrastructure for cross-chain, omnichain interoperability.

Authors: Howe & Faust, Geeker Web3

-

ZetaChain is a Cosmos SDK-based PoS public chain whose blocks record cross-chain messages and data initiated on "external chains." Users can publish specially formatted messages on external chains like BTC—using principles similar to the Ordinals protocol—to convey their "intent" to the ZetaChain network;

-

Nodes on ZetaChain reach consensus on which messages to process and their processing order. Ultimately, using TSS (Threshold Signature Scheme), they generate digital signatures on target chains to release assets from shared accounts and trigger subsequent transaction steps.

(The current list of ZetaChain validator nodes includes many project teams and institutions such as OKX, HashKeyCloud, Dora Factory, etc.)

-

Since ZetaChain is EVM-compatible and supports smart contract deployment, omnichain DApp developers can directly write cross-chain message handling logic on ZetaChain without needing to deploy bridge asset contracts across multiple chains, significantly reducing development costs;

-

From the user's perspective, in theory, interaction is only required with contracts on ZetaChain rather than repeatedly engaging with bridge contracts between source and destination chains, thus saving on gas fees;

-

Similar to intent-centric projects that function as centralized asset custodianship chains, ZetaChain supports deploying asset contracts or DeFi protocols. Users can generate specific messages via DApp frontends on different chains to asynchronously invoke DeFi contracts or modify asset states on ZetaChain—including BTC chain accounts;

-

This effectively makes ZetaChain act as a unified custodian for omnichain asset accounts, although achieving this requires dedicated DApp frontends;

-

Currently, ZetaChain’s primary role is serving as foundational infrastructure for cross-chain and omnichain interoperability—both parsing and processing specific cross-chain messages and acting as an execution platform for multi-chain DApp logic—with a typical B-to-B-to-C business model.

Main Text: As the blockchain industry continues evolving, we are entering an era of interconnected multi-chain ecosystems. In this context, public chains with different characteristics have given rise to diverse application scenarios, offering users varied experiences. However, the issue of “isolated chain silos” has become increasingly severe. Accounts across different chains often cannot interoperate, leaving users’ omnichain assets fragmented and disjointed. This raises barriers to entry and greatly diminishes user experience.

Indeed, fragmentation and incompatibility among heterogeneous blockchains remain one of the main obstacles hindering growth in user adoption rates. The recent boom in the Bitcoin ecosystem further highlights the urgency of solving cross-chain interoperability challenges.

As Vitalik Buterin stated years ago: “Multi-chain is the future.” While coexistence of multiple chains has become inevitable, building bridges between heterogeneous chains remains problematic.

To address multi-chain interoperability, various solutions have been proposed—from LayerZero, Polyhedra, Map Protocol, Bool Network, to Cosmos and Polkadot. Recently launched ZetaChain also stands as a key player within the omnichain infrastructure landscape.

Below, we provide a technical overview of ZetaChain’s omnichain solution, explaining how it functions as underlying infrastructure for omnichain interoperable DApps by enabling cross-chain message parsing and processing.

Problems with Existing Cross-Chain Solutions

In essence, the simplest use case for a cross-chain bridge is transferring assets between different chains. For example, when moving assets from Ethereum to Polygon, you first deposit funds into a designated address on Ethereum, then receive equivalent funds on Polygon.

However, the problem lies in the fact that Polygon nodes cannot verify whether a deposit actually occurred on Ethereum. If someone falsely claims to have deposited $100 into the designated Ethereum address and requests withdrawal on Polygon, this creates a “phantom withdrawal” issue.

The crux of any cross-chain bridge is resolving this phantom withdrawal problem—ensuring every withdrawal request corresponds to a real deposit. At its core, this means proving on Chain B that N transactions related to the bridge truly occurred on Chain A.

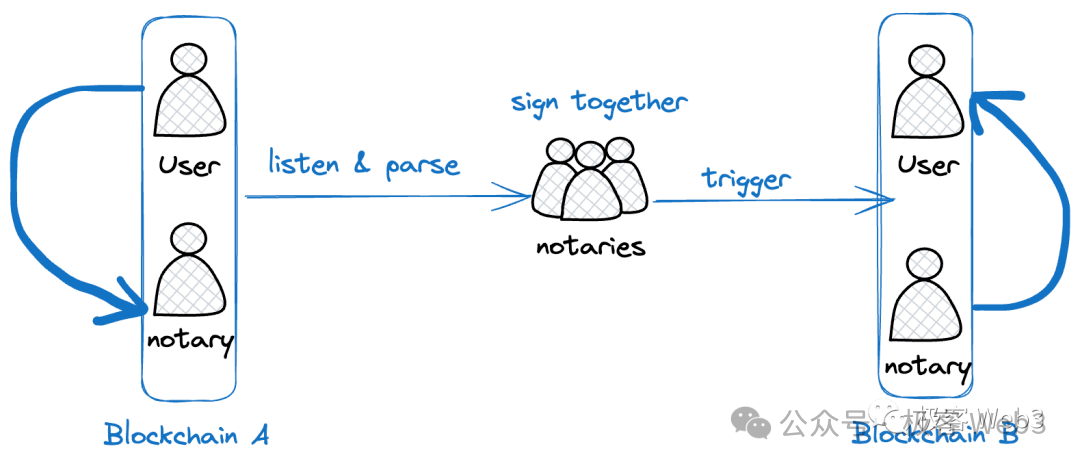

Most mainstream cross-chain bridges rely on notary mechanisms, employing a set of notary nodes that reach consensus through multi-signature or MPC signing. As long as a majority agree, the cross-chain action is approved and assets are transferred.

Some bridges adopt more secure methods such as hash locks or implement light clients of other chains via on-chain contracts, verifying validity using Merkle proofs or zk-proofs. However, these approaches tend to be costly, with expenses ultimately passed onto users as higher transaction fees. Therefore, most cross-chain bridges still opt for off-chain notaries using multi-sig models.

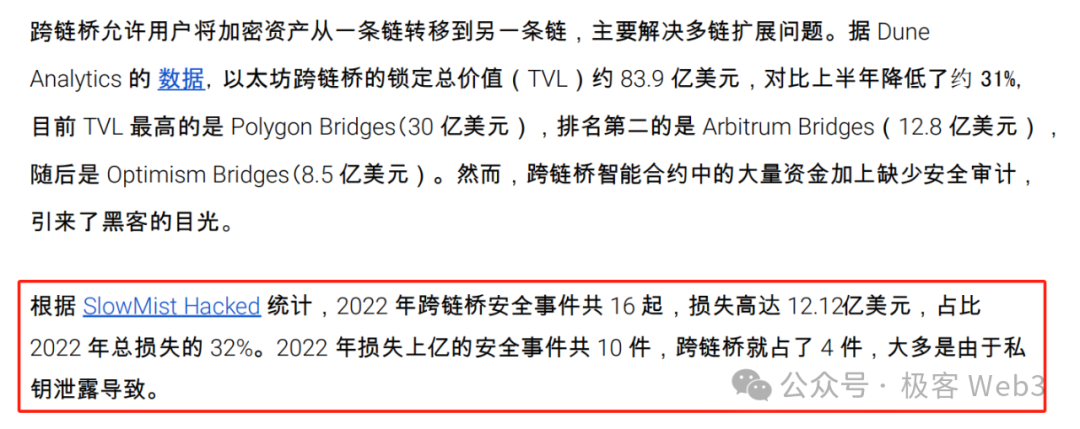

Notary-based bridges face significant risks: they are vulnerable to hacker attacks or insider theft. According to SlowMist Hacked, in 2022 alone there were 16 cross-chain bridge security incidents resulting in $1.21 billion in losses—accounting for 32% of total on-chain attack losses that year—highlighting the severity of bridge vulnerabilities.

Additionally, most existing bridge designs follow a Lock-Mint model—locking assets on Chain A and minting corresponding wrapped tokens on Chain B to enable cross-chain transfers. However, this approach involves multiple interactions with mapping contracts during deposits and withdrawals, leading to high gas friction and potential fund loss.

Moreover, many bridge solutions only support transfers between EVM-compatible chains. Cross-chain operations involving heterogeneous chains like Solana or Bitcoin are often limited due to differing technical standards, making development significantly harder.

Considering both security and cost issues, current mainstream bridge solutions often underperform and fail to ensure “native cross-chain” experiences. In today’s Bitcoin ecosystem, growing demand exists for native, seamless cross-chain interactions, calling for better alternatives. ZetaChain offers its own unique solution.

ZetaChain’s Role: Infrastructure for Omnichain Interoperable DApps

ZetaChain positions itself as foundational infrastructure for omnichain interoperable DApps, supporting various cross-chain applications through a classic B-to-B-to-C model. Using a PoS admission mechanism, any node staking assets can join the network as a notary. All PoS nodes participate in validating and processing cross-chain messages via TSS threshold signatures, enhancing overall security.

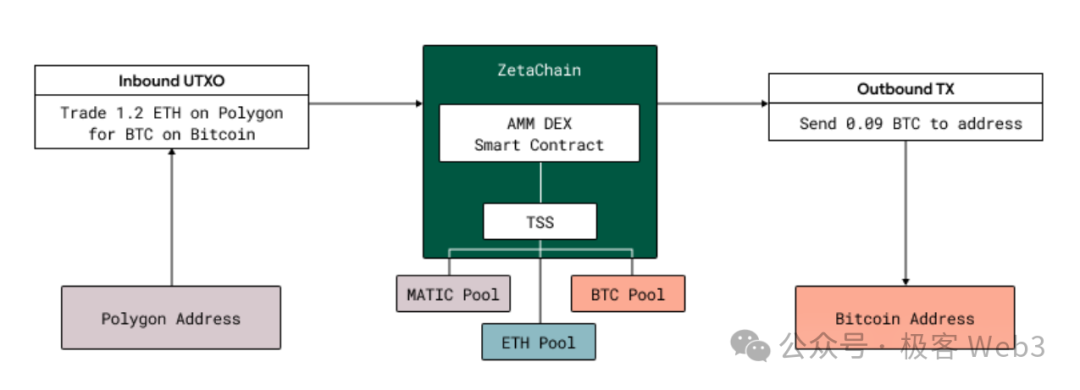

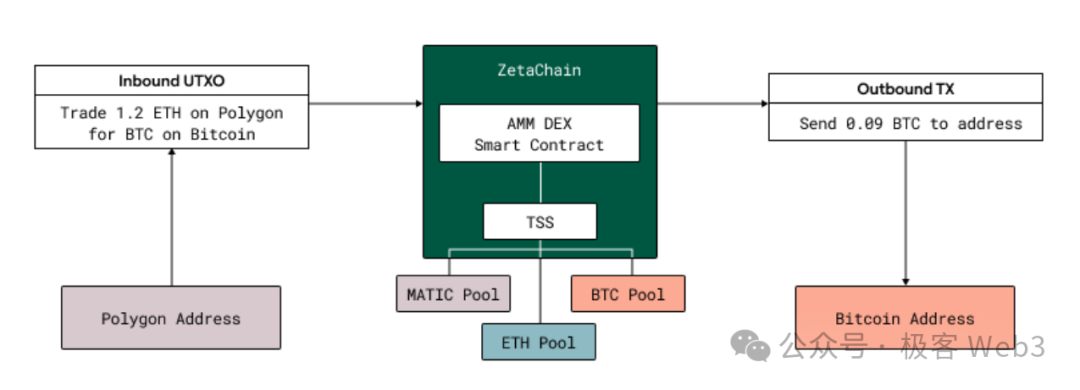

Meanwhile, ZetaChain supports deploying smart contracts containing asset-swap logic. Users can send specially formatted messages from any chain to invoke DeFi contracts on ZetaChain or supported chains—even indirectly calling Polygon DeFi functions from a BTC transaction. The result? Message passing and interoperability across disparate blockchains.

Omnichain DApps can deploy asset-swapping logic on ZetaChain to automatically exchange gas tokens across chains on behalf of users.

For instance, via certain omnichain DApp frontends, you could publish a specially formatted message on BTC—similar to how data is inscribed using the Ordinals protocol—indicating your intent to call a specific contract on Solana. This message would be detected by ZetaChain nodes.

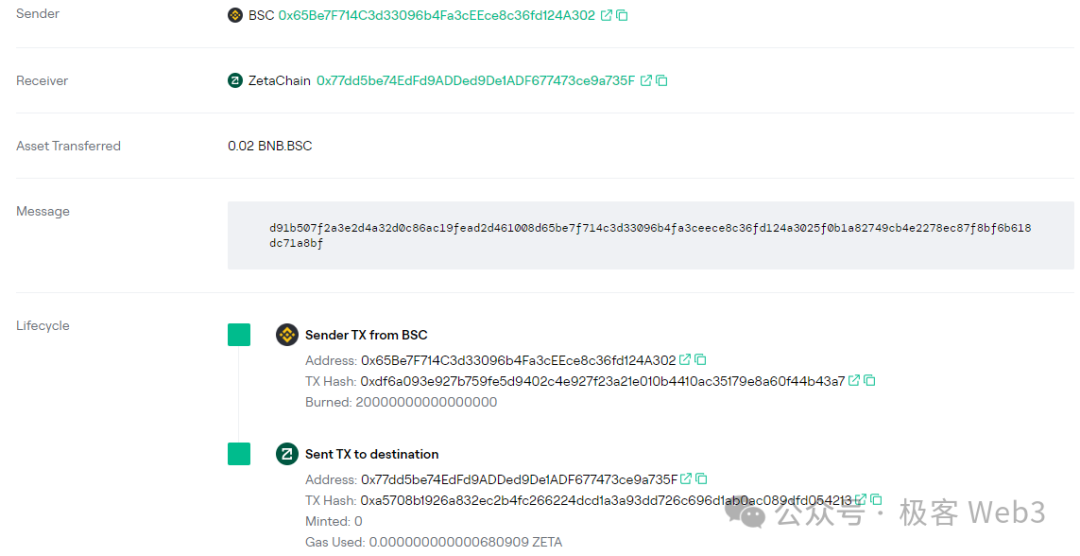

Then, an AMM contract on ZetaChain calculates the BTC-to-SOL exchange rate, releases the equivalent amount of SOL on Solana, executes follow-up contract calls, and finally sends your earned assets back to either your BTC or Solana address. This is what “omnichain interoperability” means—you initiate a single message on one chain and remotely trigger actions across multiple chains, though this involves several asynchronous message triggers behind the scenes.

We can think of ZetaChain as an “inter-chain settlement layer,” where any multi-chain interaction—such as invoking a DApp on Chain B from Chain A—is effectively settled first between Chain A and ZetaChain, then ZetaChain synchronizes the pre-processed result to the relevant account on Chain B to complete the operation.

The entire process avoids excessive interaction with mapping contracts and associated gas friction. Asset movement occurs through public accounts controlled by ZetaChain across different chains, eliminating the need for traditional cross-chain apps to repeatedly deploy wrapped asset contracts on each chain.

Currently, omnichain applications built on ZetaChain can avoid much complexity—no longer needing to painstakingly design mapping contracts across chains. All details regarding asset inflows and outflows between source and destination chains are handled (“outsourced”) by ZetaChain. In other words, developers only need to deploy cross-chain transaction logic once on ZetaChain.

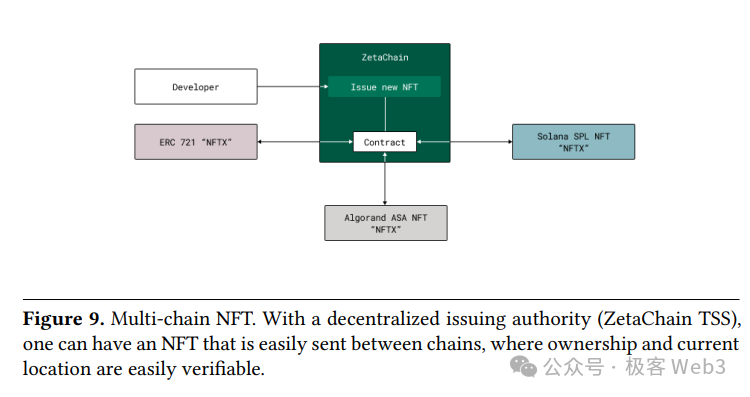

This enables different omnichain applications to easily support non-EVM chains like Solana, Algorand, Bitcoin, and Dogecoin, without having to develop dedicated cross-chain contracts for each chain.

Furthermore, ZetaChain supports deploying asset contracts or AA (Account Abstraction) accounts. Users across different chains can send specially formatted messages to interact with them, as if operating a unified omnichain account. This design concept is also seen in Particle Network’s Particle Chain, achieving the following outcome:

Users can centralize their asset records primarily on a single chain—either ZetaChain or Particle Chain. When needed, they can send invocation messages via DApp frontends on external chains to asynchronously call their asset contracts on ZetaChain, after which ZetaChain uses public accounts on external chains to transfer assets to the specified address or interact with designated DeFi protocols.

Of course, this entire series of operations requires specialized frontend DApps, meaning ZetaChain itself only provides the underlying omnichain infrastructure, while dedicated frontend interfaces are necessary to generate properly formatted messages.

ZetaChain’s Security Model: A Large Notary Node Network Based on PoS Staking

Ultimately, ZetaChain is essentially a notary node network specifically designed for cross-chain message processing. Built on the Cosmos SDK, it consists of numerous Validator nodes using PoS as an access control mechanism to prevent Sybil attacks and ensure base-layer security.

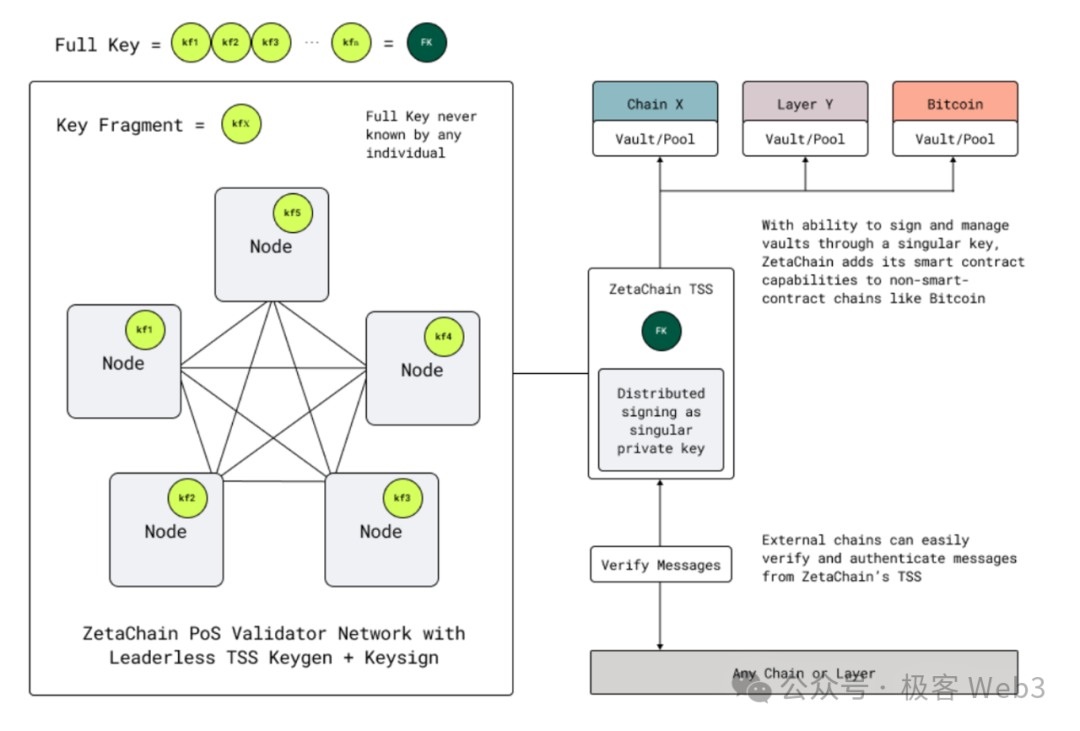

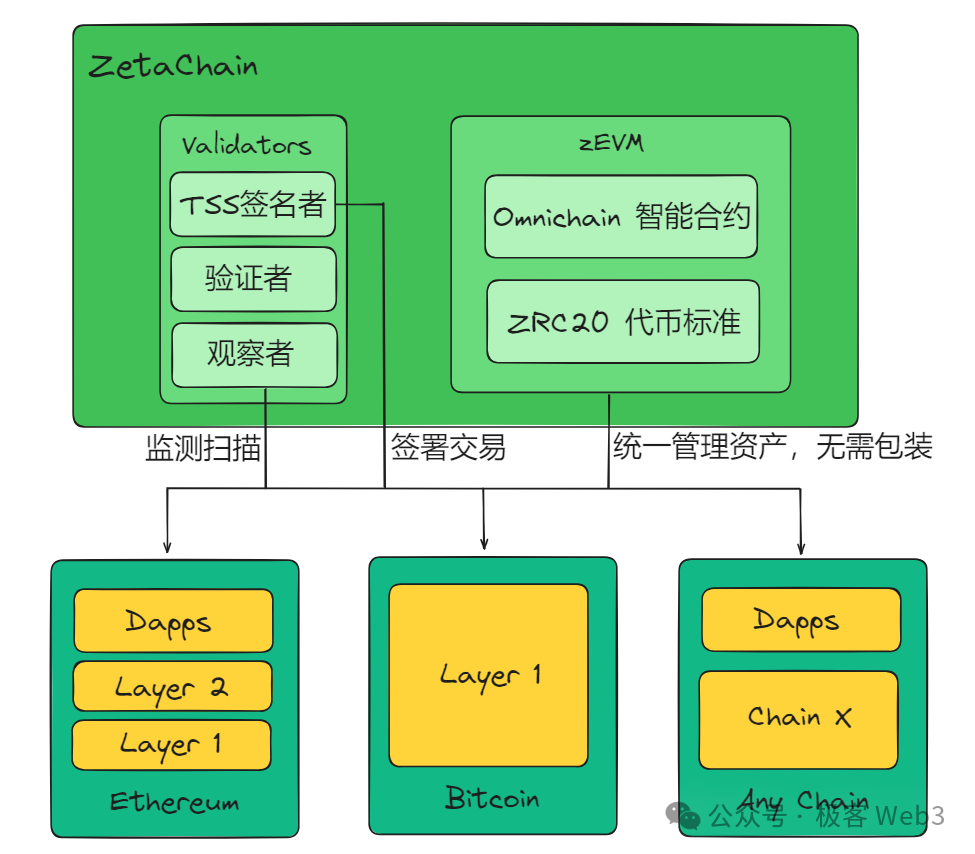

Validators serve as decentralized notaries within the ZetaChain network, detecting pending cross-chain requests on external chains and recording and processing them via consensus. Using TSS distributed key signing, ZetaChain generates transaction instructions on other chains.

In some ways, Validators perform tasks similar to those in notary-based bridges, but PoS staking enhances decentralization and trustlessness, mitigating Sybil risks.

(The current list of ZetaChain validators includes many project teams and institutions)

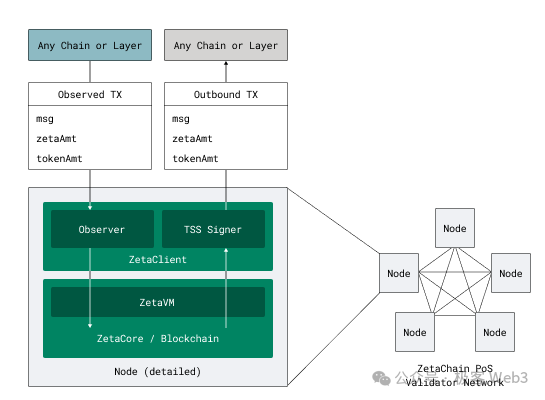

The ZetaChain Validator client comprises two modules: ZetaCore and ZetaClient. ZetaCore participates in block production and consensus on ZetaChain, while ZetaClient monitors events on external chains and signs outbound transactions.

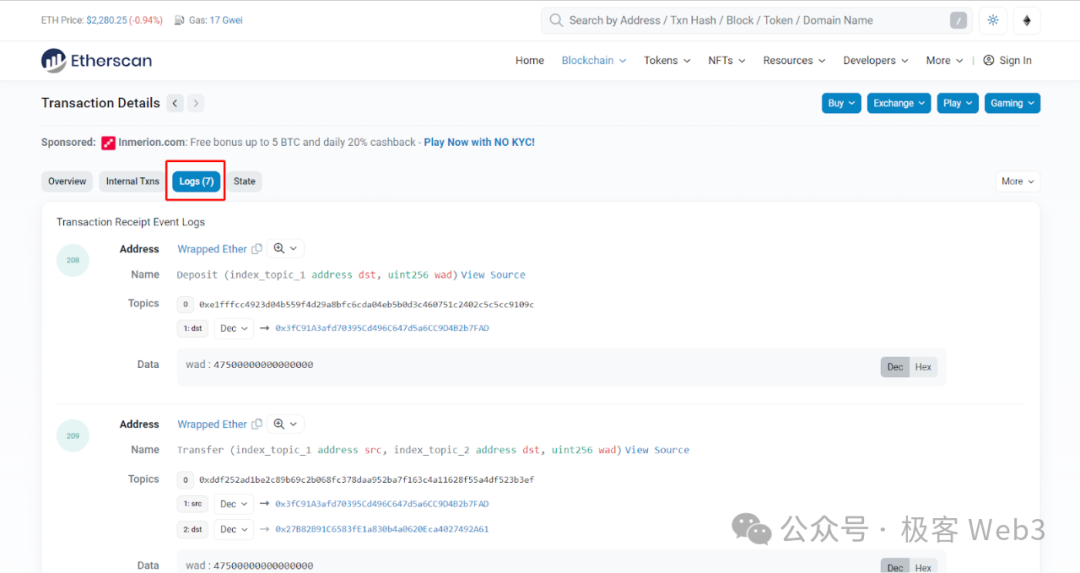

Here, “outbound” refers to sending transaction logs recorded on ZetaChain to “external chains” (i.e., any chain outside ZetaChain), thereby triggering corresponding actions on the target chain. The content typically includes the contract address, chain ID, and message payload specified by the user—similar to the Log section in Ethereum transactions.

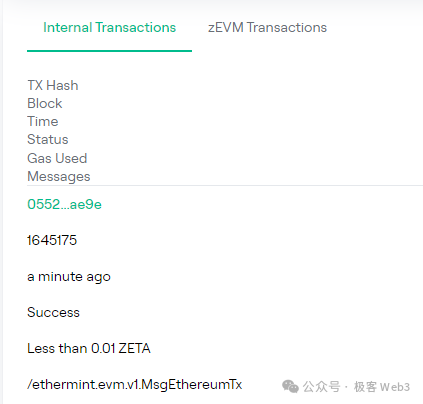

Conversely, “inbound” means recording relevant messages/transactions from external chains—such as cross-chain requests or invocations of smart contracts on zEVM—onto ZetaChain.

It should be noted that when running actual ZetaChain Validator nodes, the client code contains three modules: Validator, Observer, and TSS Signer. These modules have distinct responsibilities but are all part of the ZetaChain client.

Observer and TSS Signer Modules

First, all ZetaChain nodes include the “Validator” module, functioning similarly to validators in PoS chains—participating in block production and consensus. Additionally, nodes can vote on governance proposals proportional to their staked ZETA tokens. ZetaChain blocks contain records of all processed cross-chain activities and omnichain smart contract interactions—essentially log entries.

The “Observer” module in the ZetaChain client runs full or light nodes of other public chains to monitor specially formatted cross-chain transactions/messages. The Observer module operates in two modes: active and passive.

Individual ZetaChain nodes can choose to run their Observer module in either mode. The Observer continuously monitors whether any ZetaChain-related cross-chain messages/events exist on external chains. If so, it reports this to the Validator module. These observed cross-chain messages are submitted into ZetaChain blocks and confirmed collectively via consensus.

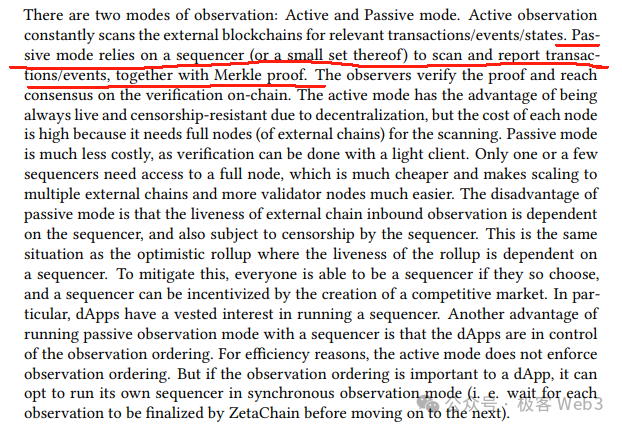

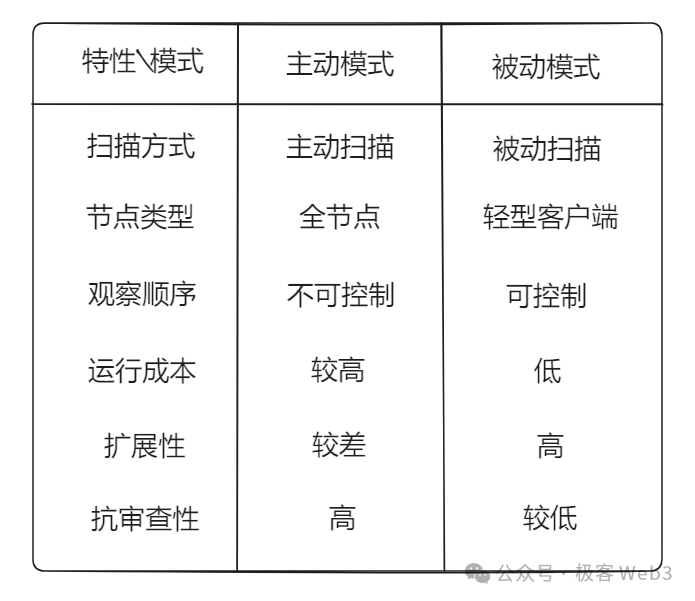

There are two Observer modes: active and passive. In active mode, nodes continuously scan transactions/events/state on external blockchains by running full nodes. In passive mode, nodes do not sync full external chain blocks but instead receive parsed cross-chain messages from other ZetaChain nodes.

However, even in passive mode, nodes sync block headers and use Merkle proofs to verify the authenticity of received cross-chain messages/transactions on external chains.

The advantage of active mode is strong censorship resistance, since most ZetaChain nodes independently sync external chain data. Any user interaction with ZetaChain will be detected as long as at least one node observes the request on the external chain.

However, active mode incurs higher operational costs, requiring not only the ZetaChain node client but also full nodes of external chains, constantly syncing and scanning data. In contrast, passive mode drastically reduces costs for ordinary observer nodes, as only select nodes run full clients of external chains, while others run lightweight clients without syncing full external blocks.

Thus, passive mode is cheaper and more scalable, facilitating integration with multiple external chains. However, its drawback is weaker observation liveness on external chains, relying on fewer nodes and offering poorer censorship resistance.

To mitigate this, ZetaChain incentivizes nodes to run the Observer module in active mode.

(In active mode, nodes must run full clients of external chains; in passive mode, only light clients are used, receiving cross-chain messages + Merkle proofs from active-mode ZetaChain nodes to verify validity)

TSS Signing

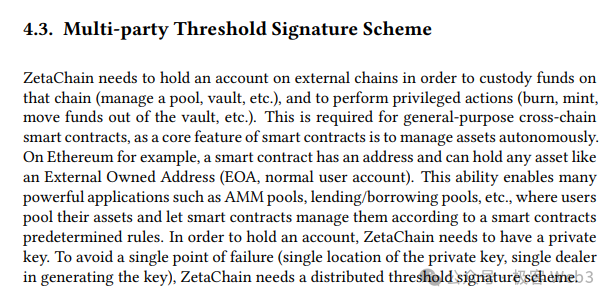

All cross-chain messages observed and verified by ZetaChain nodes eventually trigger a transaction on the target chain via ZetaChain’s public account address, initiating downstream operations. During this process, a digital signature must be generated on the target chain for the cross-chain transaction.

To ensure security and trustlessness, signature generation is shared among all ZetaChain nodes, each storing fragments of the signing key. These key shards are distributed across multiple signers—only when a supermajority sign can a valid transaction signature be produced on an external chain. No single entity or minority of nodes can ever represent ZetaChain to trigger transactions or sign messages on external chains.

(Under ZetaChain’s cross-chain model, only a public account address is needed on each chain—no need to deploy complex smart contracts)

ZetaChain uses TSS (Threshold Signature Scheme) for multi-signature operations. To external observers, the resulting transaction signature appears to come from a single private key, public key, and address. In reality, this private key is generated collaboratively from multiple secret shares without any intermediary, with each share stored locally on individual ZetaChain nodes. At no point can any single entity or small group reconstruct the full key or sign on behalf of the network.

Key generation and signing processes are completed via Multi-Party Computation (MPC), ensuring no participant’s secrets are exposed. ZetaChain nodes can generate transaction signatures for various chains. Beyond EVM compatibility, it adds remote smart contract invocation capabilities to Bitcoin/non-smart-contract chains—giving users the intuitive experience of BTC users directly calling DeFi functions.

This scenario is particularly suitable for multi-chain DeFi applications in the BTC ecosystem, as Bitcoin cannot natively support complex logic and must rely on external systems for remote contract calls. ZetaChain’s features perfectly suit BTC users who wish to interact asynchronously with DeFi protocols.

zEVM: A Unified Contract Platform for Omnichain DApps

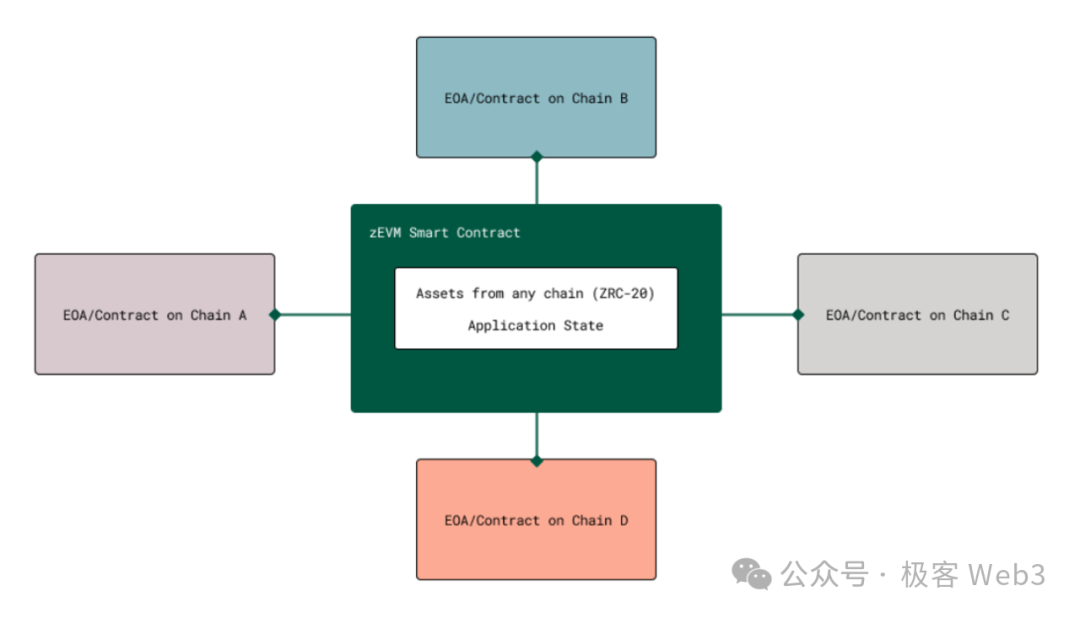

Unlike traditional cross-chain solutions requiring repeated deployment of mapping contracts across chains, ZetaChain allows deploying a smart contract once—on its own chain—to achieve omnichain functionality. Within ZetaChain exists an EVM-compatible execution layer called zEVM, where cross-chain smart contracts can be directly deployed.

zEVM supports the following features:

-

Anyone can send specially formatted transaction data on an external chain to invoke a contract on zEVM;

-

Contract logic on zEVM can control the content of outbound transactions generated on external chains.

These two extended capabilities enable general-purpose programming on zEVM, allowing deployment of custom business logic and atomic state modifications across chains. If a cross-chain operation fails on the target chain, ZetaChain can roll back changes made within its contract—effectively reverting the transaction as if nothing happened.

Additionally, omnichain DApps no longer need to deploy mapping contracts across multiple chains. By centralizing message-handling logic within a single ZetaChain contract, they avoid repetitive deployments across multi-chain networks.

This dramatically reduces development costs for omnichain DApps. From the user side, avoiding repeated interactions with mapping contracts lowers costs compared to mainstream bridges requiring multi-chain contract deployments.

Moreover, ZetaChain supports deploying dedicated DeFi contracts, ZRC-20 tokens, NFTs, and AA accounts, enabling state synchronization and unified asset management. This gives it the functionality of a centralized asset management (state recording) platform. No longer needing to manage assets across multiple chains opens up vast possibilities for future innovation.

Conclusion

From the above discussion, we now have a clearer understanding of ZetaChain’s identity as an “omnichain interoperability infrastructure.” Through the Observer module in Validator clients, it monitors specific messages/transactions on external chains, reports them to the Validator module, and reaches network-wide consensus on ZetaChain. After parsing the message data, it uses TSS to generate digital signatures and triggers subsequent transaction flows on target chains, enabling true omnichain interaction.

At the same time, omnichain smart contracts on ZetaChain allow near-native interactions across blockchains without relying on wrapped asset contracts, avoiding redundant contract calls and saving on transaction fees.

Moreover, because ZetaChain is EVM-compatible, any DApp developer or even individual user can deploy customized cross-chain message processing logic—enabling one-time deployment of omnichain DApp contracts. Developers no longer need to repeatedly deploy or update mapping contracts across chains, eliminating redundant work and development overhead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News