Deconstructing ZetaChain: Why 2024 Is the Breakout Year for the "Chain Abstraction" Sector?

TechFlow Selected TechFlow Selected

Deconstructing ZetaChain: Why 2024 Is the Breakout Year for the "Chain Abstraction" Sector?

"If modularity is a 'vertical integration' strategy, then chain abstraction is a 'horizontal integration'."

Author: Hao Tian, Chain Insights

Recently, the launch of the airdrop by cross-chain interoperability Layer 1 blockchain @zetachain has drawn market attention to the "chain abstraction" sector. What is chain abstraction? Where lie the challenges of omnichain interoperability? And what are the core features of ZetaChain? In my view, if modularity represents a "vertical alliance" strategy, then chain abstraction is a "horizontal alliance"—one of the key sectors to watch in 2024. Why? Let me share my understanding:

Whether vertical or horizontal alliances, both are forms of "coalition" strategy. Modularity combines fragmented blockchain development capabilities into modular components as a counterforce against monolithic general-purpose blockchains. Chain abstraction, on the other hand, integrates liquidity scattered across chains through interoperability, enhancing the experience for developers and users alike.

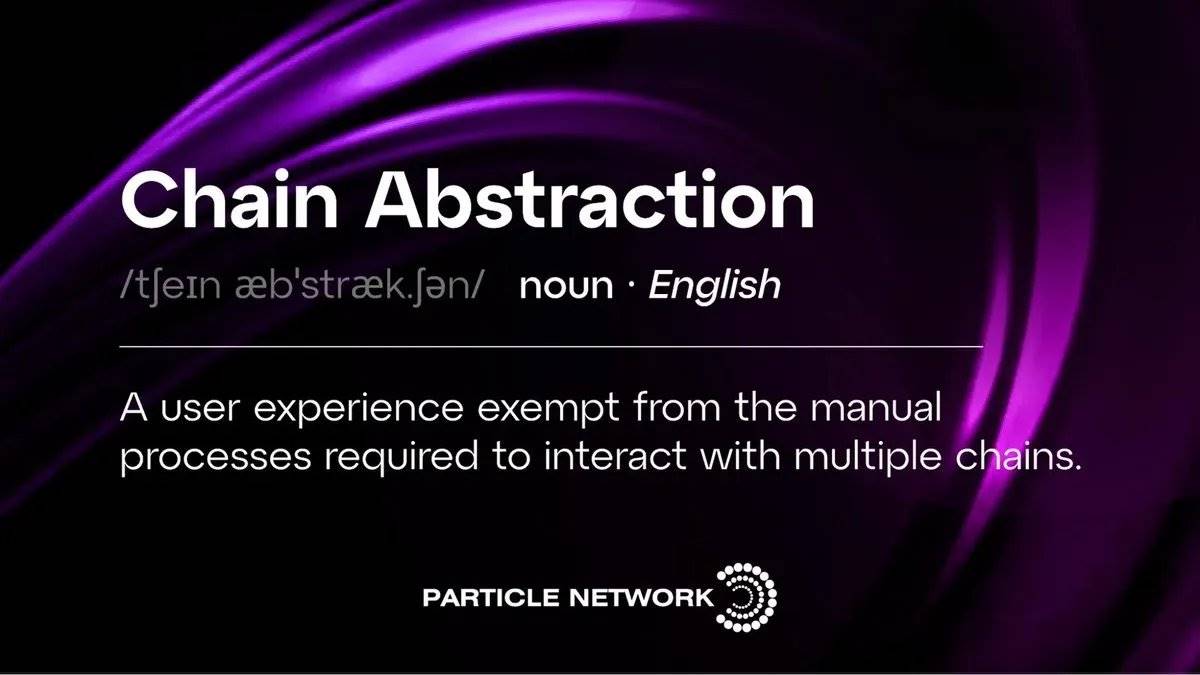

What is Chain Abstraction?

The concept of "chain abstraction" was introduced by a co-founder of Near. Simply put: modularity separates blockchain functionalities into distinct layers—settlement, data availability (DA), execution, rollup layers, etc. This has greatly fueled the boom in blockchain development, but it also leads to increasingly fragmented liquidity, applications, and user bases across chains, creating significant barriers for both ordinary users and developers.

Chain abstraction aims to solve cross-chain communication, asset transfers, and cross-chain smart contract calls (interoperability issues) by building universal, all-in-one smart contracts.

There are two main types of omnichain interoperability challenges:

1) Communication between non-homogeneous smart contract platforms—for example, how can Bitcoin, a UTXO-based non-smart-contract platform, establish effective communication with Ethereum, an account-based smart contract platform?

2) Cross-chain asset transfer without wrapping. Wrapping is a common bridge solution, but it incurs high transaction fees and friction, leading to significant capital inefficiency, and often introduces centralized risks due to multi-signature custodianship.

Can ZetaChain solve these two problems—and if so, how?

ZetaChain is a proof-of-stake blockchain built on the Cosmos SDK and Tendermint PBFT consensus engine. It can be viewed as an application-specific blockchain framework designed for interoperability—a so-called "chain within chains." It adopts a "blockchain of blockchains" (BOB) approach, where specific chains are embedded into an omnichain environment, providing frameworks across data, network, consensus, incentives, and contract layers to enable blockchain interoperability.

The core architecture of ZetaChain consists primarily of three components: Validators, Observers, and Signers.

-

Validators secure the network by staking ZETA tokens. They validate state transitions submitted by Observers from external chains through voting and receive token rewards in return;

-

Observers monitor full nodes of external blockchains to synchronize specific transaction logs, transfer events, and state changes, relaying this information to Validators responsible for finalizing consensus;

-

Signers handle identity verification for external chains. When asset transfers are involved, they participate in signing operations to ensure secure cross-chain asset movement.

Based on this foundational framework, ZetaChain effectively addresses the aforementioned omnichain interoperability challenges:

1) For asset transfers between EVM chains and UTXO-model chains like Bitcoin: Since Bitcoin lacks smart contracts, the only viable method is deploying light nodes and using MPC (multi-party computation) with ECDSA signatures. Because ZetaChain can hold TSS private keys and addresses, it enables smart contracts on ZetaChain to manage native Bitcoin assets directly. Here, Observers track and manage Bitcoin’s UTXOs, treating Bitcoin essentially as an asset settlement layer secured via multi-signature algorithms.

2) Most existing cross-chain bridges follow a model where assets are locked on Chain A and minted as wrapped tokens on Chain B. This approach not only locks liquidity within individual chains but also introduces friction and value loss during wrapping—criticized especially in DeFi use cases. To address this, ZetaChain introduces omnichain smart contracts and the ZRC20 token standard, enabling cross-chain transfers without wrapping. In simple terms: ZetaChain acts as an omnichain settlement layer ("chain within chains"). When Chain A initiates a transfer to Chain B, it first "settles" with ZetaChain; the settlement state is then synced to Chain B, which gains usage rights over the corresponding ZRC20 token—eliminating wrap-related friction and value loss.

3) Leveraging atomic transactions managed by smart contracts to enable native asset usage across external chains. For instance, this allows building cross-chain AMM DEXs where assets from each chain are first paired with ZETA. To exchange Asset X on Chain A with Asset Y on Chain B, one could first swap X for ZETA on Chain A’s pool, relay the ZETA balance info cross-chain to Chain B, then convert ZETA into Y via the Y/ZETA pair on Chain B. Compared to executing separate trades on each chain followed by bridging, this significantly reduces slippage and cross-chain friction—greatly benefiting DeFi protocols aiming for cross-chain deployment.

In Summary

Through this technical breakdown of ZetaChain, one can begin to grasp the significance of "chain abstraction" in today's blockchain ecosystem.

-

For B2B developers, it lowers the cost of cross-chain protocol deployment and enables unified liquidity management across chains. This consolidates market oversight while reducing security exposure—especially valuable in today’s modular, multi-chain landscape where omnichain operability becomes a necessary complement;

-

For end-users (C-side), chain abstraction simplifies interactions between users and backend protocols down to just using DApps—or even interacting solely through wallets. The wallet itself becomes a solver center that interprets and executes complex user intents across chains seamlessly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News