From Inception to the Future: A Deep Dive into Aleo

TechFlow Selected TechFlow Selected

From Inception to the Future: A Deep Dive into Aleo

This article provides an in-depth analysis of the Aleo project, covering various aspects from its inception to future development, including team introduction, technical analysis of the project, ecosystem updates, performance of network participants in recent testnets, and future points distribution.

1. Project Overview and History

Aleo is a Layer-1 blockchain focused on privacy through zero-knowledge proofs (ZKPs), aiming to provide highly private smart contracts and decentralized applications. Zero-knowledge cryptography enables parties on a decentralized network to prove knowledge of certain information without revealing the underlying facts that make it true. By leveraging zero-knowledge proofs, Aleo allows applications to update the blockchain ledger without sharing personal data, while nodes can verify the validity and integrity of private data without exposing the original data—achieving off-chain generation of zero-knowledge proofs and efficient on-chain verification (ensuring transaction succinctness).

The Aleo team consists of world-class cryptographers, engineers, designers, and operations experts from renowned companies such as Google, Amazon, and Meta, as well as research universities including UC Berkeley, New York University, and Cornell University. The core development team operates under Provable Inc., co-founded by Howard Wu, Collin Chin, and Raymond Chu—all alumni of UC Berkeley.

Howard Wu is co-founder and CEO of Provable. He has made significant contributions in the fields of zero-knowledge proofs and elliptic curve cryptography, with notable works including Zexe and DIZK adopted by protocols like Ethereum and Zcash. A graduate of UC Berkeley, he holds expertise in cryptography, computer security, and verifiable computing, and previously worked as a software engineer at Google.

Collin Chin and Raymond Chu, also Provable co-founders and UC Berkeley alumni, play key technical roles. Collin leads the development of Leo, Aleo’s programming language, and serves part-time as Chief Operating Officer. Raymond contributes to the development of validator node software such as snarkVM and snarkOS.

Aleo's current CEO is Alex Pruden, a West Point graduate who served as an officer in the U.S. Army Infantry and Special Operations. He was introduced to blockchain during internships at Coinbase and GGV Capital between 2017–2018. After earning his MBA from Stanford in 2019, he joined a16z, where he indirectly helped lead a16z’s Series A investment in Aleo.

Michael Beller, Aleo’s CFO, graduated from Cornell University and brings extensive experience from founding asset management startups, serving as a senior advisor with deep traditional finance background.

2. Technical Analysis

Key components of Aleo include:

• Leo Language: Aleo provides a privacy-focused programming language called Leo. It enables developers to build privacy-preserving smart contracts while ensuring data integrity without compromising user privacy.

• snarkVM and snarkOS: snarkVM enables off-chain computation with only the result verified on-chain, improving efficiency. snarkOS ensures secure execution of data and computation and supports permissionless functionality.

• zkCloud: Offers a secure and private off-chain computing environment for programmable interactions among users, organizations, and DAOs.

2.1 Consensus Architecture

Aleo’s proprietary consensus algorithm, AleoBFT, combines mining with proof-of-stake (PoS)—where validators follow PoS and zero-knowledge (ZK) provers follow proof-of-work (PoW). The PoW mechanism in Aleo involves the network generating a random ZK circuit every epoch (currently approximately every 20 minutes). Miners must try different nonces as inputs to compute all variables (witnesses) in the circuit, derive the Merkle root of the witness, and check whether it meets the mining difficulty requirement.

The PoS consensus model is based on DiemBFT, which requires multiple rounds of computation to reach consensus. A leader first proposes a block. Validators then vote for the next round’s leader. Once quorum is reached, the new leader creates a quorum certificate and includes it in the next block proposal. Stakeholders contribute to consensus and block production but do not directly participate in ZK proof generation—the computational work is handled by ZK provers.

2.2 Consensus Process

At the consensus protocol level, provers and validators are responsible for producing computation results (solutions) and creating blocks that aggregate these solutions. The process works as follows:

1. Provers compute puzzles and generate solutions, broadcasting them across the network.

2. Validators aggregate transactions and solutions into the next block, ensuring the number of solutions does not exceed the consensus limit (MAX_SOLUTIONS).

3. Solution validity is confirmed by checking that its epoch_hash matches the latest_epoch_hash maintained by validators, that the prover’s computed proof_target aligns with the network-wide latest_proof_target, and that the total number of solutions in the block remains within the allowed limit.

4. Provers who submit valid solutions receive consensus rewards.

3. Ecosystem

Aleo’s current ecosystem primarily consists of DeFi applications leveraging zero-knowledge proofs (ZeFi) and infrastructure development tools. Notable ZeFi projects include Privx Exchange, Arcane Finance, AlphaSwap, and Staking.xyz.

Privx Exchange, Arcane Finance, and AlphaSwap are privacy-focused trading platforms. Privx employs an innovative design combining a Central Limit Order Book (CLOB) with on-chain smart contracts to mimic traditional exchange experiences. Arcane Finance and AlphaSwap implement DEX functionality using the common AMM model.

Staking.xyz is Aleo’s official staking portal, providing users with a dashboard to manage and monitor their staked assets, along with regular updates and detailed reports on validator performance.

Infrastructure development tools include Obscura, IZAR Bridge, and two wallet applications—Puzzle Wallet and Avail Wallet:

• Obscura is a platform designed to simplify the development of privacy-oriented applications. By offering RPC endpoints, APIs, and SDKs, it lowers the barrier for developers building on privacy blockchains. Its infrastructure includes Aleo RPC API and Mina’s GraphQL API.

• IZAR is a privacy-preserving cross-chain interoperability protocol between Ethereum and Aleo. By introducing more validators and utilizing a zkSNARK-based multi-signature design—with a planned Timelock mechanism—IZAR aims to create a more secure and privacy-centric cross-chain protocol and governance model.

• Puzzle Wallet and Avail Wallet are both Aleo-compatible wallets. Puzzle Wallet primarily operates as a Chrome browser extension, while Avail supports mobile and desktop clients.

4. Network Participants and Rewards (Miner Incentive Analysis)

Aleo’s network participants consist of three distinct roles: delegators, provers, and validators.

Delegators are participants who lock up Credits to support Aleo’s network security. Similar to stakers in other decentralized networks, delegators delegate a portion of their Aleo Credits to validators to assist in consensus validation and earn staking rewards in return. The minimum delegation amount to qualify for rewards is 1 Aleo Credit, though actual reward distribution requires a minimum of 10 Aleo Credits.

Provers (ZK miners) are specialized infrastructure participants in the Aleo network. They support the network via proof-of-work (PoW) by solving the Coinbase puzzle. The higher the efficiency and quality of the solution generated for the Aleo Coinbase puzzle, the greater the chance of receiving Aleo Coinbase rewards (in Credits). For a given Coinbase puzzle, multiple provers can receive proportional rewards based on the proof_target value of their submitted valid solutions. Additionally, provers allocate 1/3 of their Coinbase solution reward to validators as an incentive for participation and reward eligibility.

Validators are infrastructure service providers on the Aleo network who ensure network security by participating in the proof-of-stake (PoS) mechanism within AleoBFT. They validate and confirm transaction blocks, achieve consensus according to the protocol, and include proofs provided by provers when creating new blocks, earning validation rewards in the process. To become a validator, one must possess 10 million Aleo Credits and run a validator node using the snarkOS software.

4.1 Aleo Credit Distribution

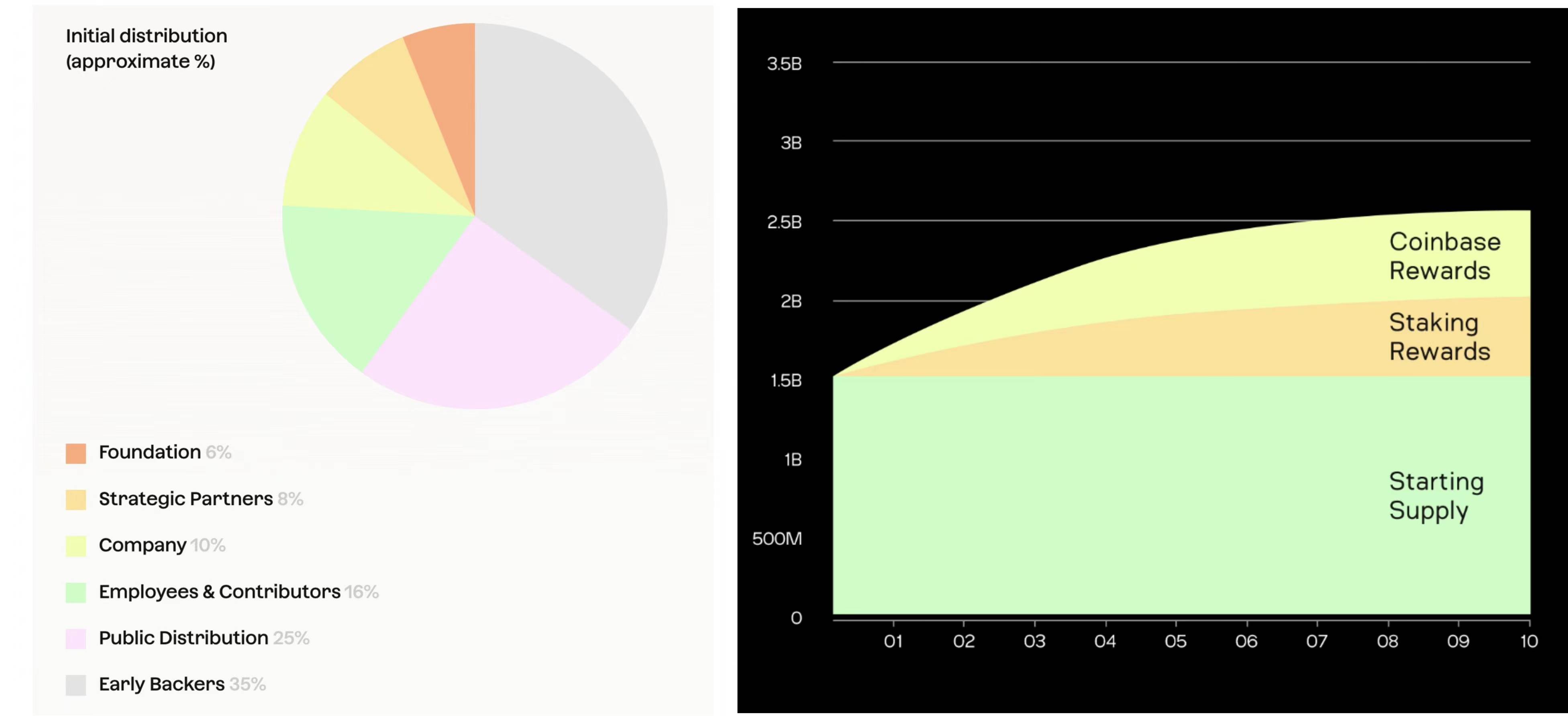

• Initial supply at launch: 1.5 billion Aleo Credits. Allocated as follows: early supporters (35%), public distribution (25%), employees and contributors (16%), company (10%), strategic partners (8%), and foundation (6%).

• After mainnet launch, Aleo Credits will be distributed as rewards to ZK provers and validators. Coinbase rewards for provers and validators will decline linearly over approximately 10 years.

• Validators will permanently receive a fixed block reward (currently set at 23 Credits per block).

Circulating Supply

• Total circulating supply grows to 2.6 billion Aleo Credits within 10 years and doubles over approximately 21 years as rewards continue to be issued.

Inflation

• Credit inflation rate declines over time—from around 12% in the first year to 2% by the 10th year—and gradually approaches 0% thereafter.

Figure 1: Distribution of initial Aleo Credit allocation; Figure 2: Expected inflation of Aleo Credits over 10 years

Figure 1: Distribution of initial Aleo Credit allocation; Figure 2: Expected inflation of Aleo Credits over 10 years

4.2 Relationship Between PoS and PoW Rewards

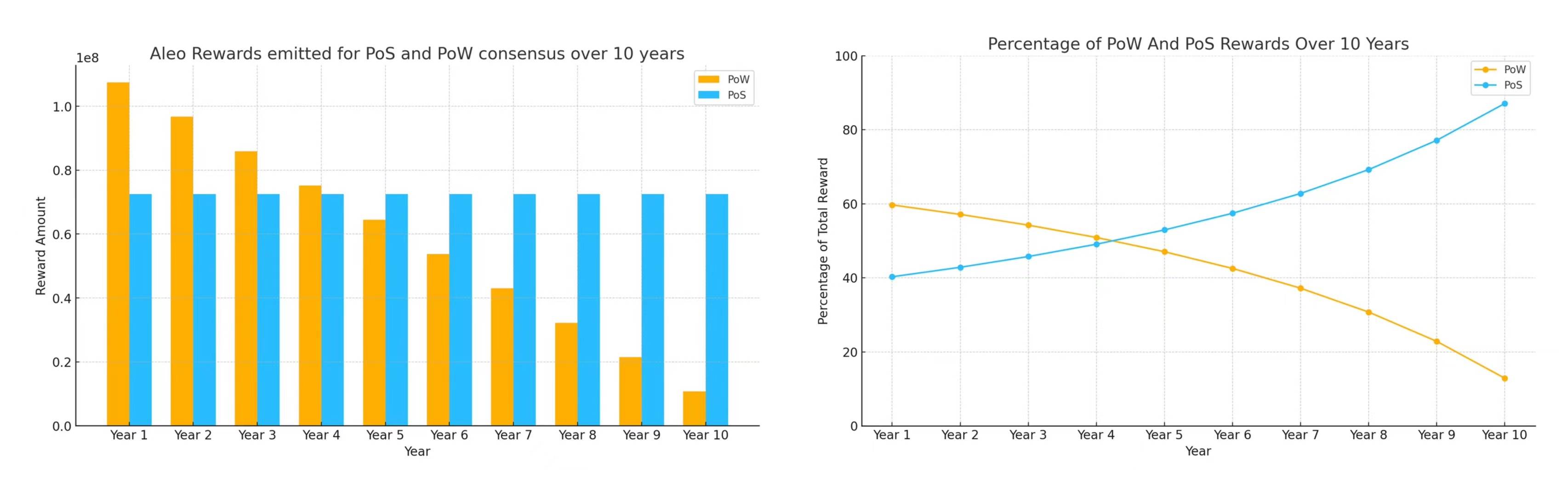

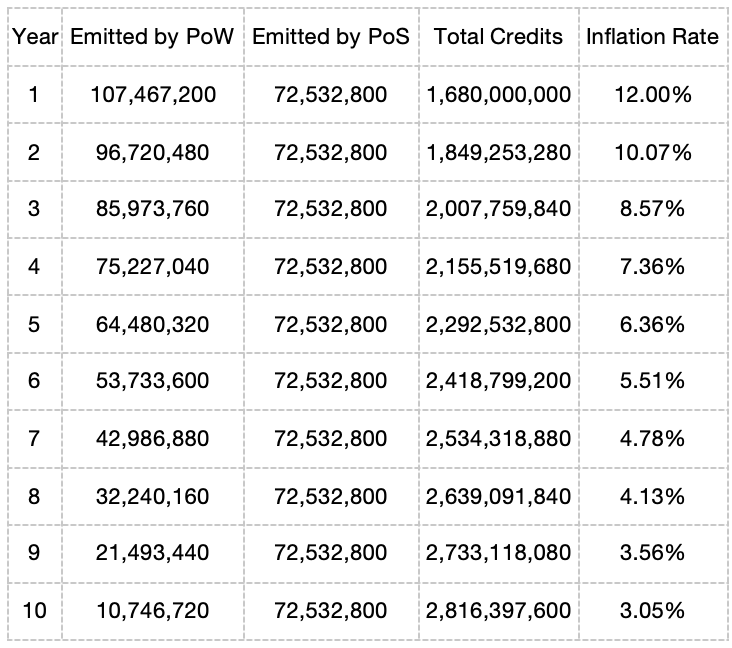

In the latest beta testnet version, the Aleo team adjusted the reward split between Proof-of-Stake (PoS) and Proof-of-Work (PoW). The validator’s share of the block reward from puzzle-solving was reduced from 1/2 to 1/3, while provers now receive 2/3 of the block reward.

Initially after mainnet launch, PoW will play a significant role in the Aleo network. However, over time, the block rewards released through puzzle-solving will gradually decrease, while the fixed block rewards for validators will maintain constant weight (remaining at 23 Aleo Credits per block).

The chart below illustrates the projected changes in quantity and proportion of Aleo Credits released via PoS and PoW over the next 10 years:

Below is our projection based on partial official data of annual Aleo Credit growth and corresponding inflation rates over the first 10 years following initial issuance:

In the long term, Aleo’s credit distribution will shift from initially favoring provers toward a model increasingly favorable to delegators and validators. After 10 years, no further credits will be released via PoW consensus, and network rewards will follow PoS-based issuance.

4.3 Beta Testnet Key Data

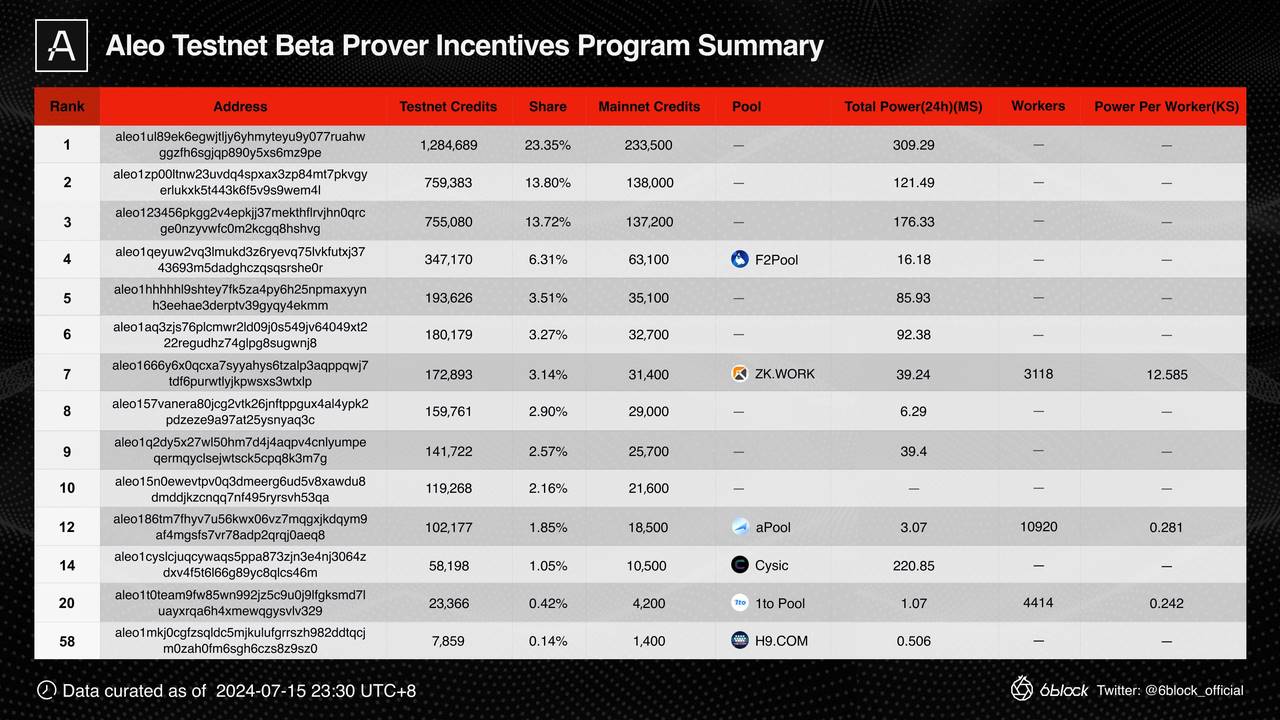

The Beta testnet was the final incentivized testnet before mainnet launch, running from July 1 to July 15, aimed at validating the new puzzle mechanism through a prover incentive program. It has now concluded.

The Aleo Foundation allocated 1 million mainnet Credits to provers. Each prover receives mainnet Credits proportional to their testnet Credit earnings during the incentive period. The minimum reward threshold is 1,000 mainnet Credits; provers earning less are ineligible.

Below is our summary of the top 10 Aleo addresses by Credit accumulation during the Beta testnet, compared with pool data for some known addresses:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News