Aleo Mainnet Launch Turns "Heavenly King" into "Heavenly Perish"? Miners Cry Foul

TechFlow Selected TechFlow Selected

Aleo Mainnet Launch Turns "Heavenly King" into "Heavenly Perish"? Miners Cry Foul

After the mainnet launch, Aleo failed to gain community approval and instead faced widespread skepticism on social media, especially from miners who voiced strong criticism.

By Frank, PANews

Aleo, a high-profile project that raised over $200 million, has long attracted attention. On September 18, 2024, Aleo officially launched its mainnet and finally disclosed its token economics. However, despite the mainnet launch, Aleo failed to win community approval and instead faced widespread criticism on social media, especially from miners. Many users took to social platforms to express their disappointment, calling it yet another example of a "king" turning into "doomed."

A High-Profile Project with Every Advantage

Founded in 2019, Aleo aimed from the outset to build a private, permissionless, and programmable platform. Officially, its core technologies include Proof of Succinct Work (PoSW), the Leo programming language, AleoBFT, and Varuna. These components together form a Layer 1 blockchain network centered on privacy, leveraging zero-knowledge proofs combined with PoW, PoS, and the AleoBFT consensus mechanism. In technical terms, Aleo resembles an L1 blockchain that fuses Ethereum’s and Solana’s consensus models while being enhanced by zero-knowledge technology.

The founding team is classically academic, with key members hailing from UC Berkeley and prior experience at top Silicon Valley firms such as a16z, Coinbase, and Amazon. With such a star-studded team and innovative vision, fundraising came easily: $28 million in Series A funding in 2021, followed by $200 million in Series B funding in 2022, valuing the project at $1.45 billion. Backers included prominent names like a16z, SoftBank, Kora, and Coinbase.

However, the team's development progress has been sluggish. The final testnet wasn’t released until May 2024. After announcing mainnet launch in 2023, then pushing it to January 2024, the release was delayed again until September. During this time, Aleo missed out on the early bull market wave that boosted other projects, leaving early miners—who had invested time and resources—frustrated and waiting.

In short, whether judged by team pedigree, technological ambition, or investor lineup, Aleo had every advantage. Had it launched faster, it might already be considered a top-tier new public blockchain.

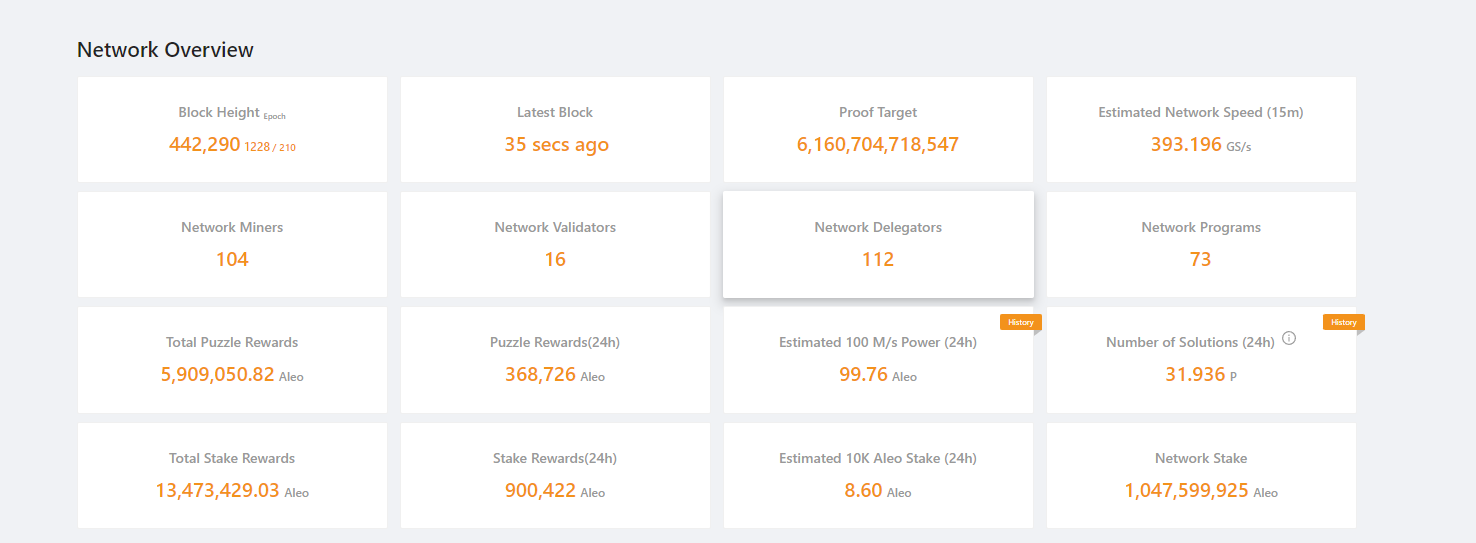

Since Aleo’s official data platform does not display specific wallet address counts or daily transaction volumes, direct assessment of ecosystem activity is difficult. We can only infer ecosystem development through indirect indicators.

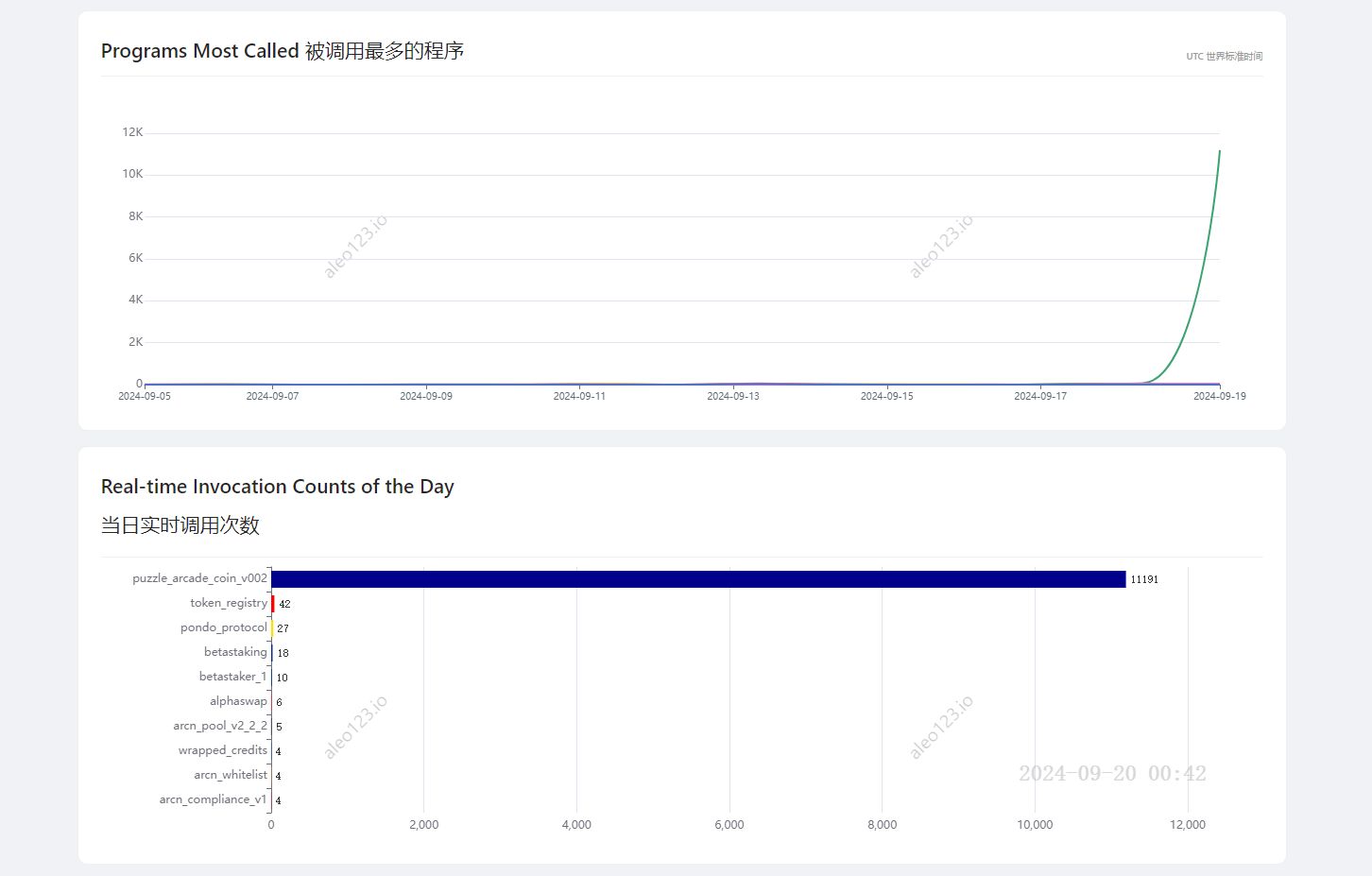

Puzzle Wallet is the most frequently used application on Aleo. On September 19, Puzzle saw more than 10,000 invocations—a dramatic surge. This spike likely resulted from Aleo’s announcement on September 18 that users could claim airdropped tokens via Puzzle Wallet. Prior to that date, daily program calls on Aleo rarely exceeded 100. According to Puzzle’s official promotion, the wallet now has over 30,000 users.

Aleo founder Alex Pruden stated on social media while celebrating the mainnet launch: “This achievement would not have been possible without the efforts of dozens of employees, hundreds of ambassadors, and thousands of community members.” Based on available data, however, actual ecosystem engagement remains low. That said, the number of ecosystem projects is respectable—over 50 so far.

Locked Airdrops and Plummeting Prices Hit Miners Twice

Despite the delayed mainnet launch, Aleo’s over-$200-million war chest led many farming groups and mining communities to view it as a potential winner. Major mining pools such as Bitmain and F2Pool even offered Aleo test token mining services early on, prompting many miners to commit computing power for pre-mining.

Data from Aleo’s official explorer shows the mainnet went live as early as September 5, though no official announcement was made. Some alert miners began deploying mining operations during this window. Off-exchange prices for newly mined tokens briefly approached $9, while the official mainnet launch wasn't announced until September 18. This discrepancy sparked suspicion within the community, with some accusing the team of conducting insider pre-mining or giving VCs a head start.

A miner involved in early Aleo mining told PANews that due to uncertainty about whether these mined tokens would be recognized, they didn’t deploy significant hashing power. Still, by early September, off-chain traders were already buying Aleo tokens at around $9 apiece. At a rate of 1.5 tokens per day using an RTX 4090 GPU, daily earnings would amount to roughly $13.5, meaning hardware costs could be recovered in about 158 days. If the token price rose to $20, ROI could come in under three months. Such projections fueled strong expectations among miners.

This optimism collapsed on September 16, when Aleo officially unveiled its tokenomics. The initial supply was set at 1.5 billion tokens, with mining expected to increase total supply to 2.6 billion over ten years. At $9 per token, the implied initial market cap would reach $13.5 billion—placing Aleo among the top ten crypto projects, surpassing established chains like TRON and ADA.

For a project with only tens of thousands of user addresses, this valuation appeared wildly inflated. Consequently, Aleo’s price plummeted after the tokenomics release, falling to as low as $3.4. As of September 20, Aleo’s market cap stood at approximately $5 billion, still ranking it within the top 20 cryptocurrencies by market value.

The sudden price drop drastically reduced miner profitability, potentially extending payback periods to a decade when factoring in electricity and operational costs.

Additionally, early testnet participants were promised rewards—34% of the total token supply allocated to early supporters. However, these rewards are subject to a one-year lock-up period for both U.S. and non-U.S. recipients (a phrasing reminiscent of Lu Xun’s famous line: “There are two jujube trees in my backyard”). This news dealt another blow to miners eager to recoup their investments.

Ironically, Aleo—which aims to become the premier privacy-focused blockchain—required full KYC for airdrop claims, asking users to upload ID documents, proof of address, and selfies. This requirement triggered strong backlash from the community.

Did Capital Get Paid First? Community Skepticism Grows

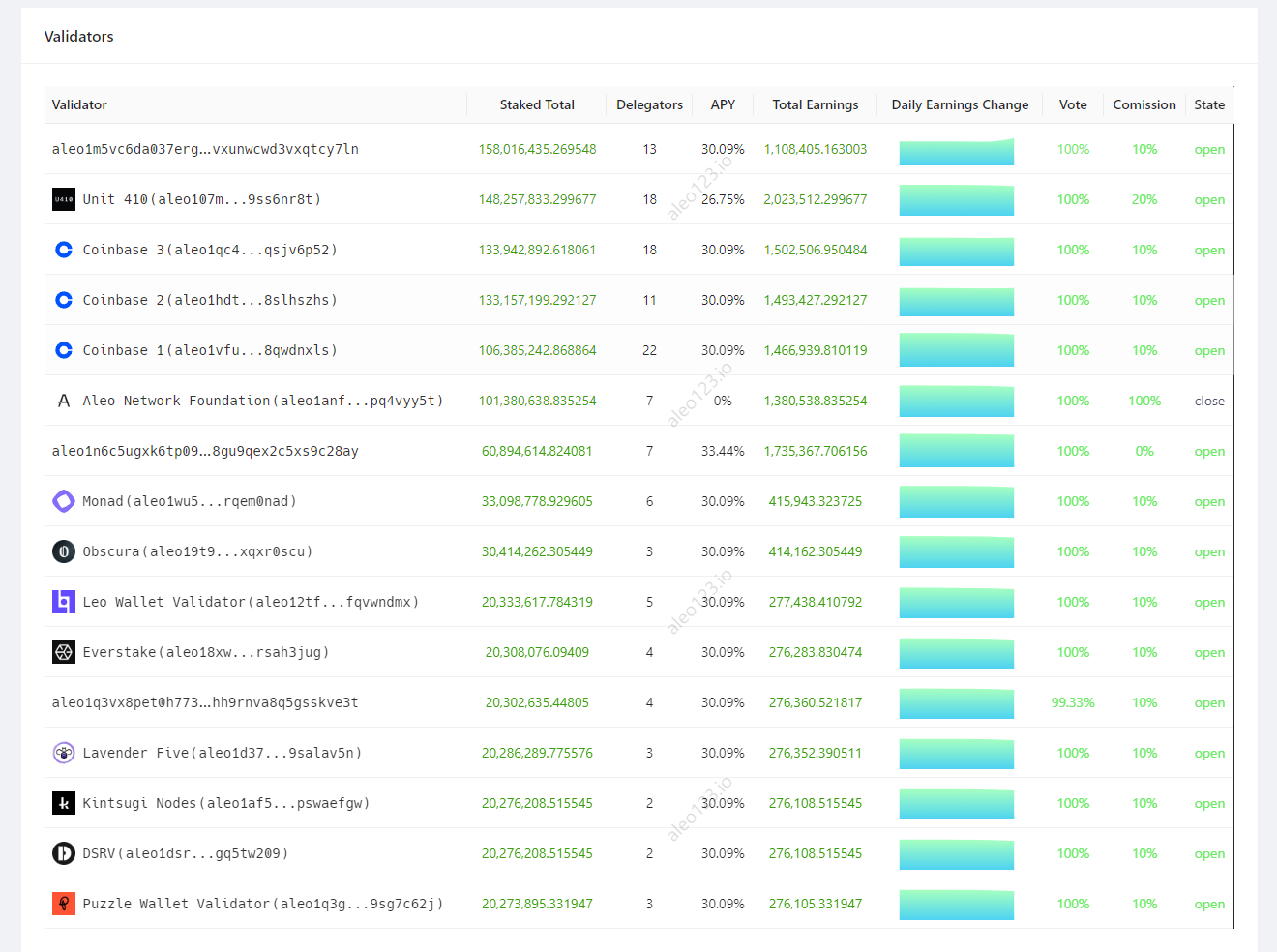

According to Aleo’s latest documentation, becoming a mainnet validator requires staking at least 10 million Aleo tokens—an amount far beyond the reach of ordinary users, especially given the limited circulating supply at launch. Yet users observed that 16 validators were already active upon mainnet launch, most of them early investors.

Although investor tokens are also locked for one year, they can directly stake these locked tokens as validator collateral. Crucially, daily staking rewards are not subject to lock-up and can be freely traded immediately.

Data as of September 20 shows the top validator has earned over 1.1 million Aleo tokens, while the lowest has received over 270,000. Most validators belong to early backers or affiliated entities, including Coinbase, unit410, and the Aleo Foundation.

Many community members suspect this setup allows capital to recover costs first, while retail investors are left holding the bag. Meanwhile, self-funded miners must grapple with electricity and equipment costs over extended payback periods.

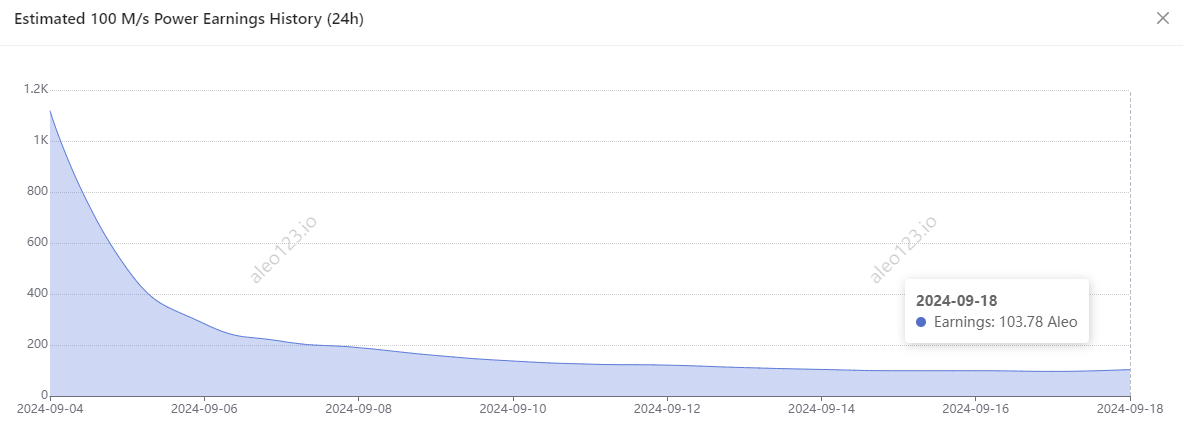

Looking at mining dynamics, difficulty rose exponentially before the tokenomics announcement. Afterward, possibly due to miner exits, difficulty began to decline.

Social media sentiment toward Aleo has shifted from endorsement to skepticism. Twitter user @alexlizeros commented: “From this doomsday-level project ALEO, we can see: sometimes big doesn’t mean profitable—it brings bigger losses!” After KOL @Supervellear posted a critical thread about Aleo, he was blocked by founder Alex Pruden on social media. @alexlizeros listed concerns over mainnet delays, locked airdrops, and excessive valuation, concluding: “When you don’t know where liquidity will come from, you yourself become the liquidity.”

To date, Aleo’s official team has not responded to these community criticisms. Given current social sentiment and token performance, regaining market confidence may require more transparent explanations and tangible goodwill gestures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News