How did Banana Gun drain millions of dollars from users and Ethereum validators?

TechFlow Selected TechFlow Selected

How did Banana Gun drain millions of dollars from users and Ethereum validators?

The monkey business continues.

Author: JUGGERNAUT

Translation: TechFlow

Last year, I published two short pieces exploring the origins of the Banana Gun Bot team.

These articles analyzed the on-chain flow of capital used to create Banana Gun Bot and raised some troubling questions about the developers’ background. When an anonymous developer behind a leading trading bot appears suspicious, the natural follow-up question is: In whose interest does Banana Gun Bot truly operate?

In the micro-cap market, 10 months is a long time. In fact, across the entire decentralized finance (DeFi) space, it’s also considerable. I sat down to reflect on how right (or wrong) my views on the Banana team were. The issues I found go far deeper than I initially imagined—and raise serious questions about how Ethereum may function in the future.

To set the context, let's look at some data.

Since May 2023, TG bots have been widely accepted within the DeFi ecosystem as a stable business model, making significant contributions to daily on-chain trading volume. Over the past year, TG bot transactions accounted for 20%–30% of Ethereum’s total transaction count. By June 2024, all TG bots combined accounted for 9.4% of Ethereum’s transaction volume and originated from nearly 5.3% of Ethereum wallets. Thus, TG bots like Banana have become major transaction initiators on Ethereum and play a significant role in its ecosystem.

Since June 2023, at least $5.25 billion in capital has flowed through the Banana Gun router. While part of this occurred on Solana, this places Banana second only to Maestro (the first mover in the space, ahead of competitors by over a year) and Bonk Bot (seen by some as a bet on the entire SOL meme coin ecosystem).

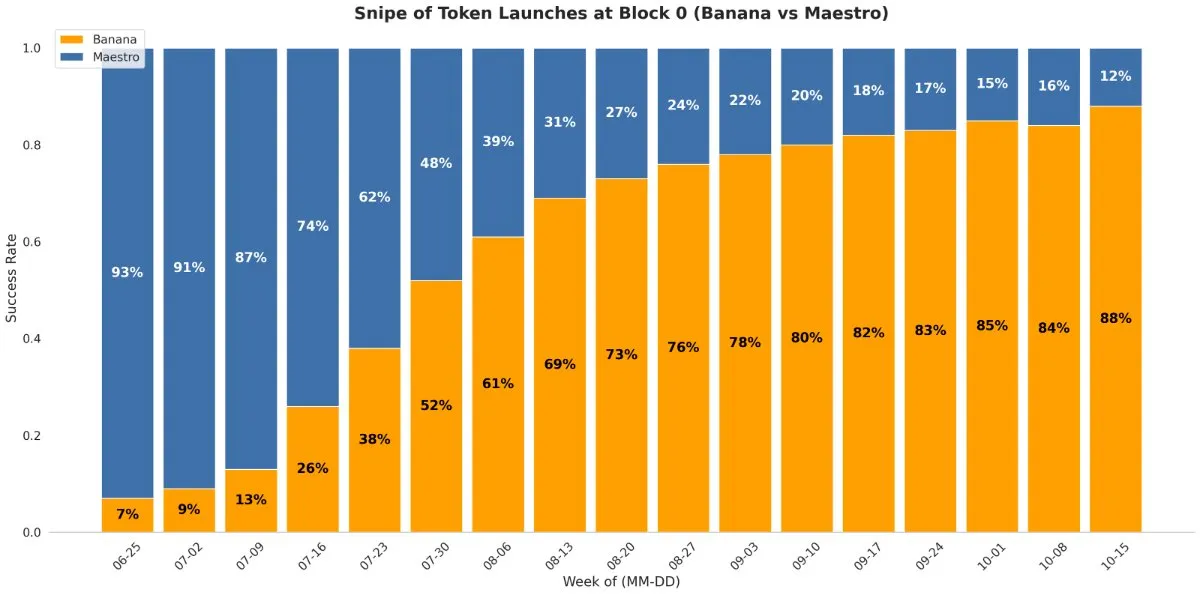

Observers have been puzzled by Banana’s rapid capture of market share. The primary reason for this overwhelming dominance lies in Banana Gun Bot’s success rate with snipe bundles. In its early days, Banana became the go-to bot for users who wanted to sniper—not just trade. In meme coins where lifecycles often last mere hours, being first into “block 0” is frequently the only thing that matters.

Simply put, block 0 refers to the block in which a token “opens trading” upon launch. Sniping at launch means your buy transaction must execute immediately after the developer’s “open trading” transaction. To achieve this, since late May 2023, Banana Gun has suppressed all competitors by “bundling” user bribes. These bundled transactions are more profitable for Ethereum builders because they enhance and aggregate tips paid to them.

Banana Gun’s strategy proved so effective that between June and October 2023, Banana Gun users went from controlling just 7% of block 0 dominance to winning 88% of the first bundles in the TG bot space—outpacing industry-leading bot “Maestro,” which had operated since mid-2022.

Source: The Scientific Crypto Investor and Duncan | Flood Capital

A new market reality is emerging—one in which ordinary meme coin investors are doomed to fail simply by choosing a Banana competitor. If you want in first, you must join a Banana block 0 bundle. Within Banana’s user base, a culture of high-bribe payments gradually formed—initially mocked on crypto Twitter but soon accepted as a fait accompli.

Source: Banana Gun TG

Indeed, Banana’s high-bribe culture is seen both as a hallmark of its commercial success and as a value indicator for $BANANA token holders. A key feature of Banana’s bribe culture is that even within bundled transactions, it remains a PvP (player-versus-player) competition, where well-capitalized users enter tokens first, while smaller bidders provide exit liquidity for top Banana users.

The Banana team themselves acknowledged that the bot was initially created for a small circle of “friends,” but was later opened to the public because their development team were apparently fervent decentralization communists.

Source: Banana Gun X Handle

Notably, allegations that the Banana team engaged in frontrunning by monitoring user bribes have never been clarified. Regardless, the second aspect of Banana Gun Bot’s snipe bundle dominance is now evolving into a case study for the entire Ethereum ecosystem.

Proposer-Builder Separation

When Advantage Becomes the Norm

In September 2023, the Banana Gun Bot team launched the $BANANA token, promising to share 40% of the revenue generated by the bot with users. By November 2023, Banana Gun Bot had captured over 90% of all block 0 snipes, far outpacing competitors in adoption and revenue generation. According to sources, by December 2023, the Banana team executed a masterstroke. In ETH meme coin trading, Banana leveraged its block 0 dominance and normalized high-bribe culture to exploit a long-theorized but previously unrealized systemic weakness in Ethereum, cleverly transforming its early lead in the TG bot market into an economic moat against competitors.

Understanding this process requires a basic grasp of how Ethereum operates post-merge—specifically, the concept of “Proposer-Builder Separation” (PBS). For non-technical readers like myself who want to learn about PBS, I’ve written a separate note available here.

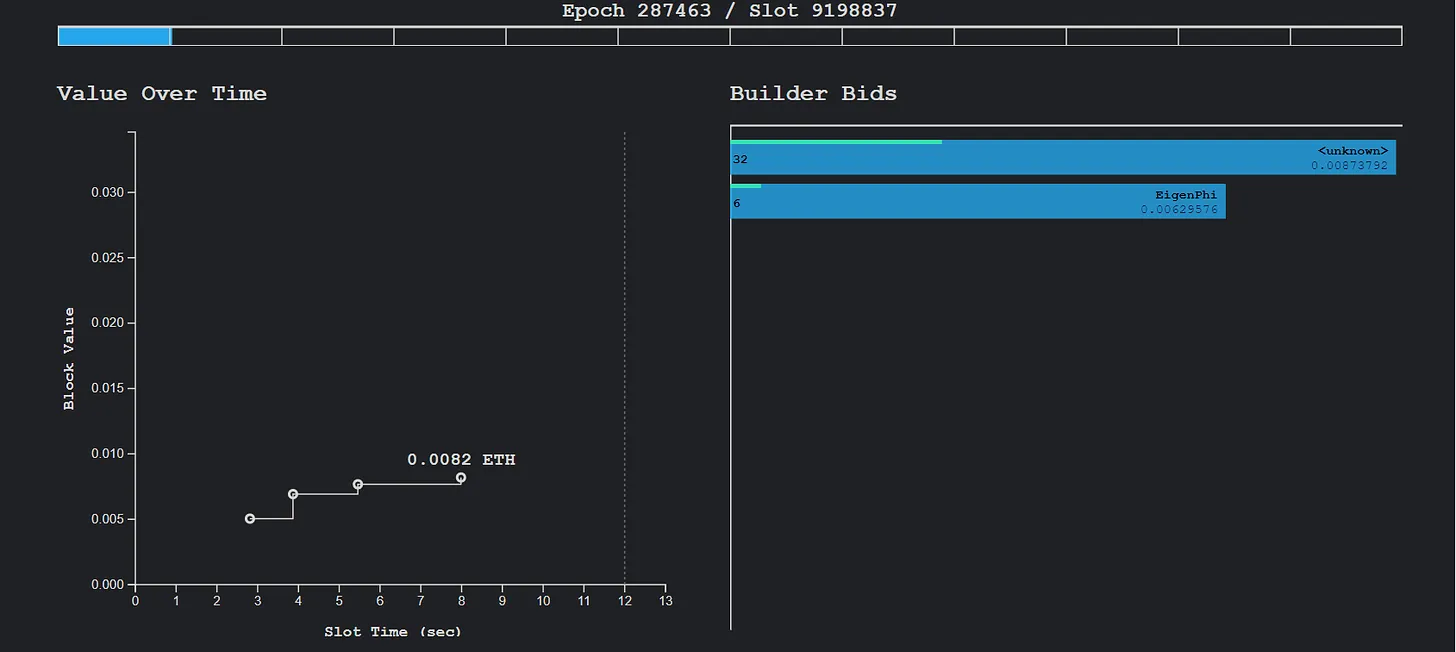

Typically, in a healthily competitive PBS-based block-building market, transactions initiated by TG bots are distributed among various builders. These builders pull pending transactions from the mempool, optimize them to maximize value, construct blocks, and bid to proposers to ensure their blocks are included. This real-time transaction process can be visualized live on Payload during a block’s 12-second lifespan.

Ideally, in an open, competitive bidding process, proposers earn maximum fees by selecting the highest bid from competing builders. Thus, value is redistributed back to the Ethereum ecosystem (since proposers stake ETH and secure the chain), while builders are compensated competitively (as they transfer most transaction fees to proposers).

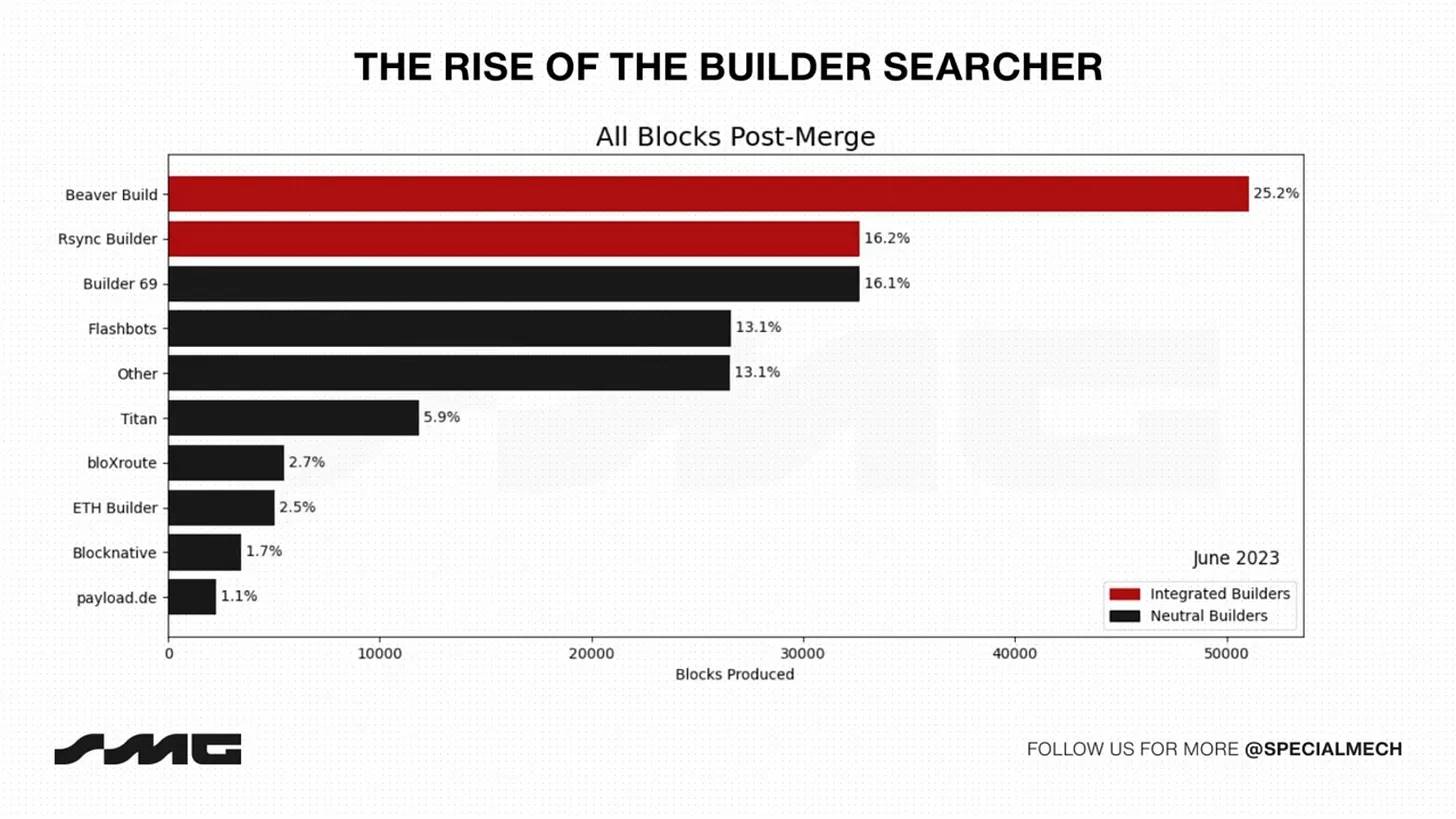

The problem is that the competitive nature of the block-building market can be constrained by multiple factors. Last year, the Special Mechanism Group (SMG) noted in their paper “Concentration Effects” (Gupta et al., 2023) that over time, a small group of sophisticated builders will naturally dominate PBS. Interestingly, they proposed in May 2023 that this concentration trend primarily stems from opportunities at the “top of the block,” such as CEX-DEX arbitrage.

The “top of the block” refers to the first few transactions executed in each block. CEX-DEX arbitrage involves professional traders exploiting price differences of tokens between centralized exchanges (like Binance) and decentralized exchanges (like Uniswap). SMG noted that advantages in PBS from top-of-block opportunities are largely monopolized by builders with rumored ties to high-frequency trading (HFT) firms, such as Manta, Rsync Builder, and Beaver Build. To validate their hypothesis, the SMG team compared these HFT-linked builders with others like Blocknative, Builder69, and Flashbots—high-volume but non-HFT builders. Ironically, SMG cited Titan Builder’s June 2023 paper, showing that top builders receive more order flow, enabling them to dominate PBS auctions.

Visualizing PBS advantage of HFT-backed builders

One key conclusion from SMG is that “builders earning more from the top of the block are willing to pay more for private order flow, as they need to win entire blocks to leverage their top-of-block edge.” Thus, SMG envisioned a scenario where savvy, HFT-funded builders could form a monopoly in PBS if granted exclusive access to private order flow. This would suppress smaller builders—just as Titan Builder speculated in its June 2023 paper (Titan’s public RPC launched only on April 17, 2023).

So what exactly is private order flow?

The rebellious rise of 2020 meme coins created a systemic issue for Ethereum—“MEV.” Over the past three years, transaction senders have increasingly avoided sending transactions to the public Ethereum mempool, opting instead for private mempools to avoid being frontrun by MEV bots. To some extent, private mempools offer protection for transaction senders and thus serve a public good. TG bot transactions are considered high-quality for MEV operators because users are typically advised to set high slippage to ensure successful execution in volatile tokens.

To guard against this, nearly 97% of TG bot transactions are routed through private mempools. However, this is not the type of transaction SMG referred to when warning about HFT firms monopolizing the PBS system. The “private order flow” SMG mentioned refers to order flow from a single transaction initiator sent exclusively to one builder.

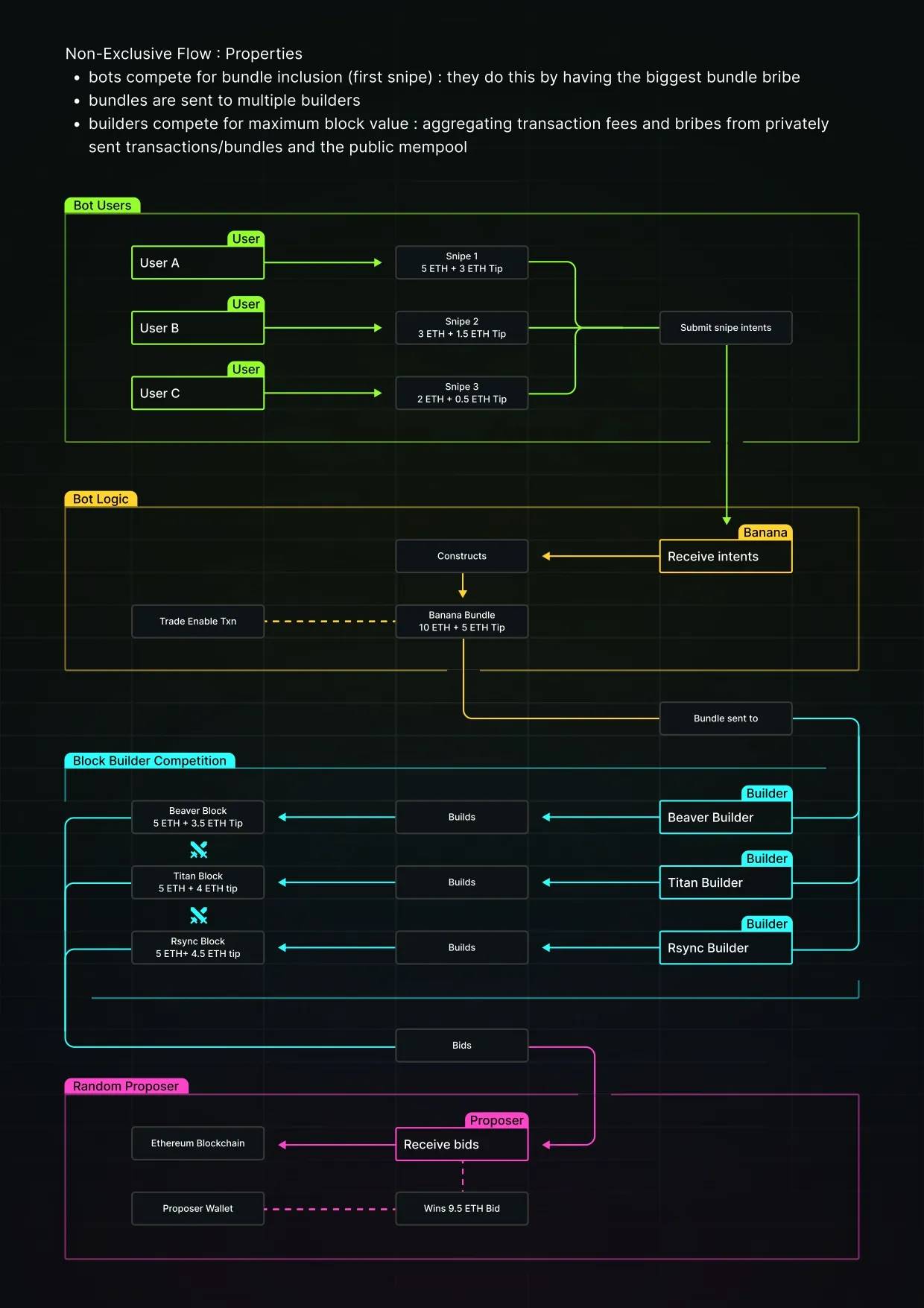

First, TG bots offer users more than just sniping—they also facilitate regular buy/sell trades, including limit orders on-chain. Yet Banana’s business model is deeply rooted in its “sniping” narrative. Its high block 0 bribe culture drives strong revenue streams. Therefore, Banana’s model relies on guaranteeing users entry into token trades before any competitor. Typically, to maximize the chance of success for a block 0 bribe bundle on-chain, such initiators route their users’ bundles to all leading Ethereum builders.

For example, suppose you and I are Ethereum builders receiving the same 10 ETH bundle from a TG bot, including a 5 ETH “tip” to incentivize priority placement in the block. I build a potential block, and so do you. I bid 1 ETH; you see that and bid 1.1 ETH, and so on, until the full 5 ETH is exhausted. In this case, the 5 ETH ultimately goes to the proposer, not pocketed by any single builder.

Note: This example assumes no other transactions are sent to the builders

Logically, when a TG bot sends its bundles to multiple builders, it maximizes the chance of inclusion in the winning block and on-chain confirmation, as builders compete to have their block accepted by validators. Conversely, sending exclusive order flow (EOF) to a single builder means that builder must successfully get the order flow (and bribe) on-chain. Any delay undermines the advantage—the bundle ceases to be a snipe. Thus, initiators like Banana ideally should route order flow to builders with the highest on-chain inclusion rates. Based on SMG’s research at Banana’s launch, clearly builders like BeaverBuild and other well-funded HFT-backed builders would be ideal EOF recipients for Banana. But as we’ll see next, the Banana team chose a different path.

PBS market as of June 2023. Source: SMG

An indirect consequence of routing Banana’s order flow exclusively to one builder might unfold as follows.

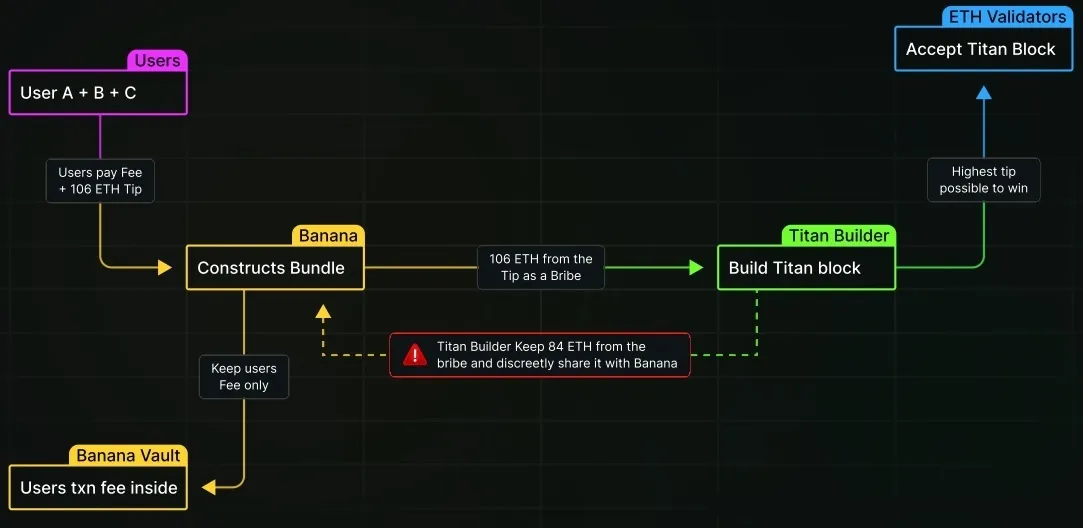

When high-bribe bundles are sent exclusively to one builder, other builders cannot access the bundle or its bribe. The chosen builder’s rational strategy is to incrementally increase their bid just enough to secure inclusion in the next block, minimizing payment to the proposer and pocketing the remainder as pure profit. So, if a block 0 bundle with a 5 ETH bribe is routed via EOF, and the highest competing bid from other builders is 1 ETH, the exclusive builder can bid “just enough” (e.g., 1.1 ETH) to win, retaining 3.9 ETH as profit.

What does the Banana team gain from providing EOF to a single builder? The answer lies in potential kickbacks from the builder’s profits. Such an EOF agreement allows the builder to return a portion of the bribe to Banana (as payment for the EOF), meaning Banana now profits not only from transaction fees but also from the high-bribe culture generated among its users. This isn’t a novel business model—Robinhood Markets in the U.S. received hundreds of millions from Citadel for “payment for order flow.”

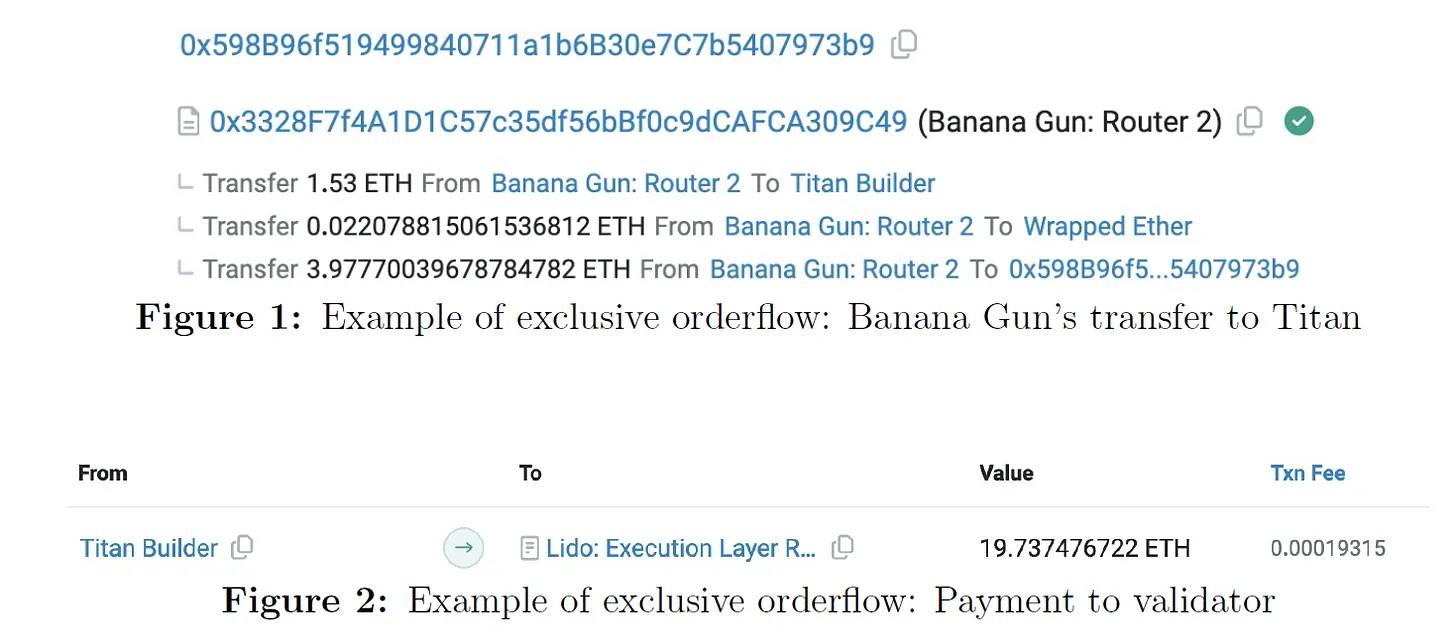

Source: Ethereum Block 19238546

Q: Has the Banana team publicly disclosed such an EOF agreement?

A: No.

Q: As issuer of the $BANANA token and custodian of the project treasury, has the Banana team redistributed excessive bribes to its users or $BANANA holders?

A: Absolutely not.

Q: More importantly, in 2023, did the Banana team execute an EOF agreement with the Ethereum builder holding the largest market share in block construction, ensuring users had the best possible chance under good faith to get their bribed block 0 bundles on-chain?

A: Strangely, no.

'Backroom Deals in the Dark Forest'

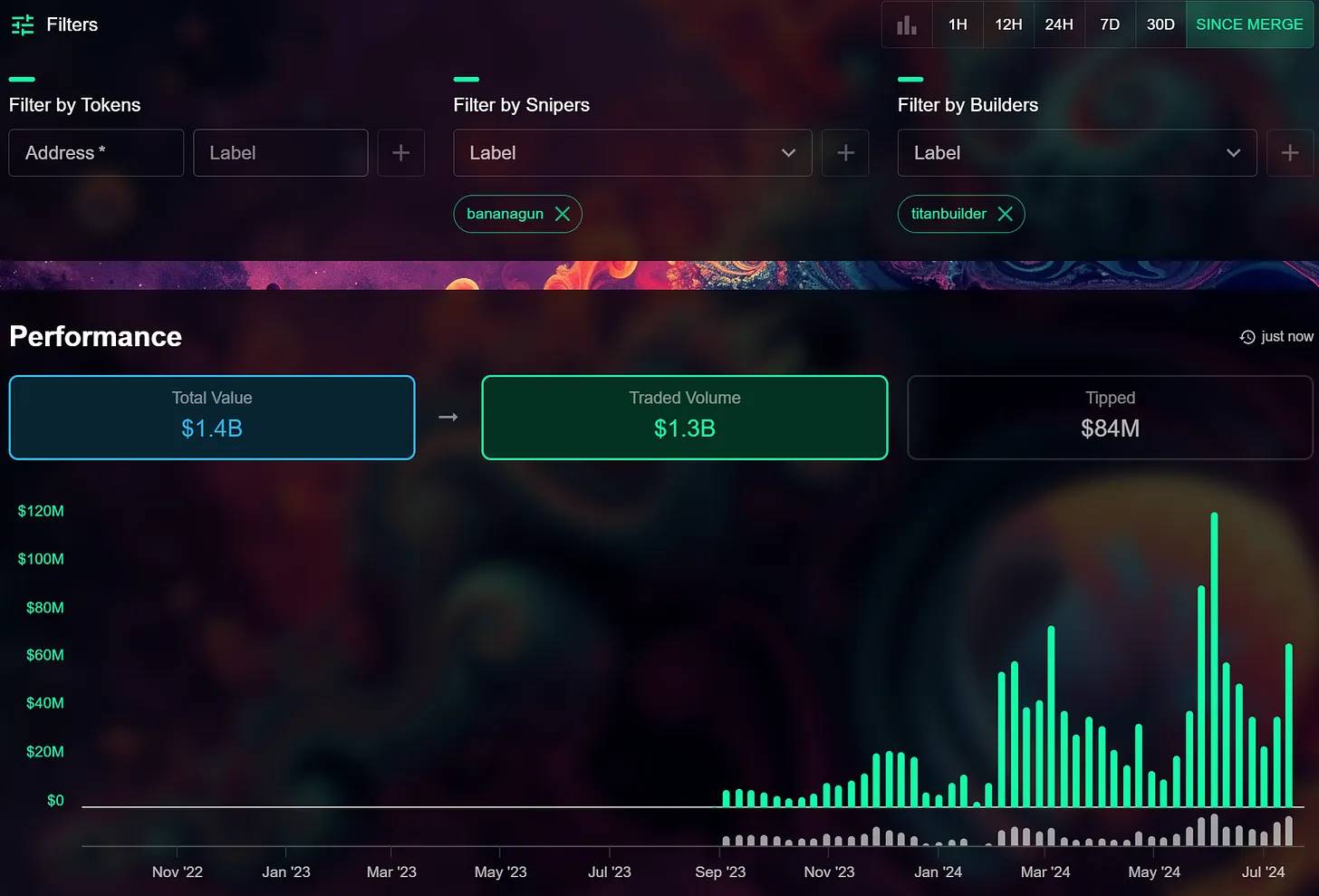

Analysis of transactions through the Banana Gun router shows that the Banana team has, for most of the time, exclusively routed its snipe bundles through Titan Builder.

In April 2023, Titan held only a 1% share of the PBS block-building market. When the Banana team began directing exclusive order flow (EOF) to Titan, Titan significantly lagged behind other builders in PBS performance. Notably, in the seven days prior to this article’s publication, Titan contributed nearly 40% of all Ethereum blocks.

In short, in less than a year, Titan has become:

-

Ethereum’s second-largest block builder, and

-

The most profitable builder in Ethereum’s PBS ecosystem—largely thanks to Banana Gun team’s EOF support.

Source: libMEV

A closer look at the data in the graph above from libMEV reveals the true scale of Titan’s success.

Beaverbuild is the leading block builder on post-PBS Ethereum. Since the merge, it has built over 1.2 million blocks, generating 146,241 ETH for Ethereum validators and 14,520 ETH in profit for itself.

Take the Flashbots builder, for example—it delivered over 552,800 blocks, earned 16.7 ETH in profit, and transferred 58,349 ETH to the Ethereum ecosystem via validator payments. In contrast, Titan has delivered 615,200 blocks since May 2023, earned 13,151 ETH in profit, and transferred 60,912 ETH to the Ethereum ecosystem.

By doing so, Titan has earned nearly 787 times the profit of the Flashbots builder, despite delivering slightly more blocks. Likewise, while Beaverbuild retained approximately 9% of the ETH users paid for block construction, Titan has already captured 17.75% of ETH as profit—despite building fewer than half as many blocks as Beaverbuild!

A recent excellent paper by Markovich (May 2024) dives deep into this arrangement. She uses block 19728051 (referred to as block 8930981 in the paper) as an example, where the total block value was 76.38 ETH, total priority fee was 4.54 ETH, and total bribe paid to Titan was 72 ETH.

Source: "Decentralized Monopoly Power in DeFi", Sarit Markovich

Sarit points out that in block 19728051, the proposer Lido earned only 19.75 ETH, while Titan made a pure profit of 56.6 ETH through its EOF agreement with the Banana Gun team.

Sarit analyzed 181,651 blocks between April 6 and May 5, 2024. She studied both Banana and Maestro, though the latter is irrelevant here as it lacks a token and makes no profit-sharing promises to ecosystem participants. Sarit reported that in her dataset, total block value was 21,406 ETH, yet only 17,127 ETH was transferred to the Ethereum ecosystem via proposers. Thus, proposers lost 4,279 ETH in that short period. Specifically, Lido alone missed out on 1,666 ETH in payments that month.

This paper supports my initial calculations reviewing over 3,500 Ethereum blocks between December 2023 and March 2024, where Banana block 0 bundles were almost exclusively routed through Titan Builder. This indicates that of the total 4,466.89 ETH paid by Banana users to get their snipe trades on-chain, only 2,915.65 ETH was transferred to Ethereum proposers, while 2,271.26 ETH was captured solely by Titan Builder. Even assuming a 50-50 split of the private EOF between Banana and Titan, it can be inferred that 1,135.63 ETH was funneled back to the Banana Gun team’s private accounts during this period. These would be undeclared profits amounting to millions of dollars, extracted from innocent users steered into a high-bribe culture by the Banana Gun team.

Source: libMEV

Conclusion

-

An unidentified team with suspicious background,

-

Allegedly monitoring user trades for frontrunning (using them as exit liquidity for themselves),

-

Now extracting millions from an apparent exclusive order flow arrangement, rather than paying it to Ethereum validators or distributing it to $BANANA holders,

-

Meanwhile creating a troubling centralization effect that strains the entire operation of Ethereum’s PBS system,

-

Worse still, the $BANANA token is listed on Binance, granting their brand immense legitimacy in the public eye.

Thus, the monkey business continues.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News