Deep Dive into Banana Gun: When Newbies Use Tokens to Snipe Bots, On-Chain IPO Competition Has Already Intensified

TechFlow Selected TechFlow Selected

Deep Dive into Banana Gun: When Newbies Use Tokens to Snipe Bots, On-Chain IPO Competition Has Already Intensified

Banana Gun's sustained growth during the bear market demonstrates the product's utility and demand.

Written by: GABE TRAMBLE

Translated by: TechFlow

Imitation perfectly captures the speculative atmosphere of GambleFi in crypto, where traders are driven by daily 100x returns, rugs, and liquidity grabs. In this space, meme coins hold a unique appeal—especially when traders follow market trends and promoters pushing these tokens on Twitter. Platforms like Banana Gun have emerged to provide users with essential tools for high-speed trading.

Years ago, Maestro led the charge in this domain, initially gaining attention under its original name Catchy. Maestro became a must-have platform for traders chasing short-term market volatility. Then came Unibot, which improved upon the model by shifting focus away from sniping toward addressing the usability challenges posed by Uniswap's less user-friendly interface. They strategically prioritized referral fees to drive rapid growth—a strategy similar to what we’ve seen on platforms like Rollbit and Stake.

More recently, Banana entered the arena, offering a product that competes directly with Maestro on sniping capabilities while also providing better fee structures. Banana appears poised to win over the hearts of "Degen" traders—those willing to take extreme risks for potentially massive rewards.

This fluid landscape highlights the continuous evolution of platforms and strategies within the underground world of crypto GambleFi, each striving to meet the shifting needs and risk preferences of their user base.

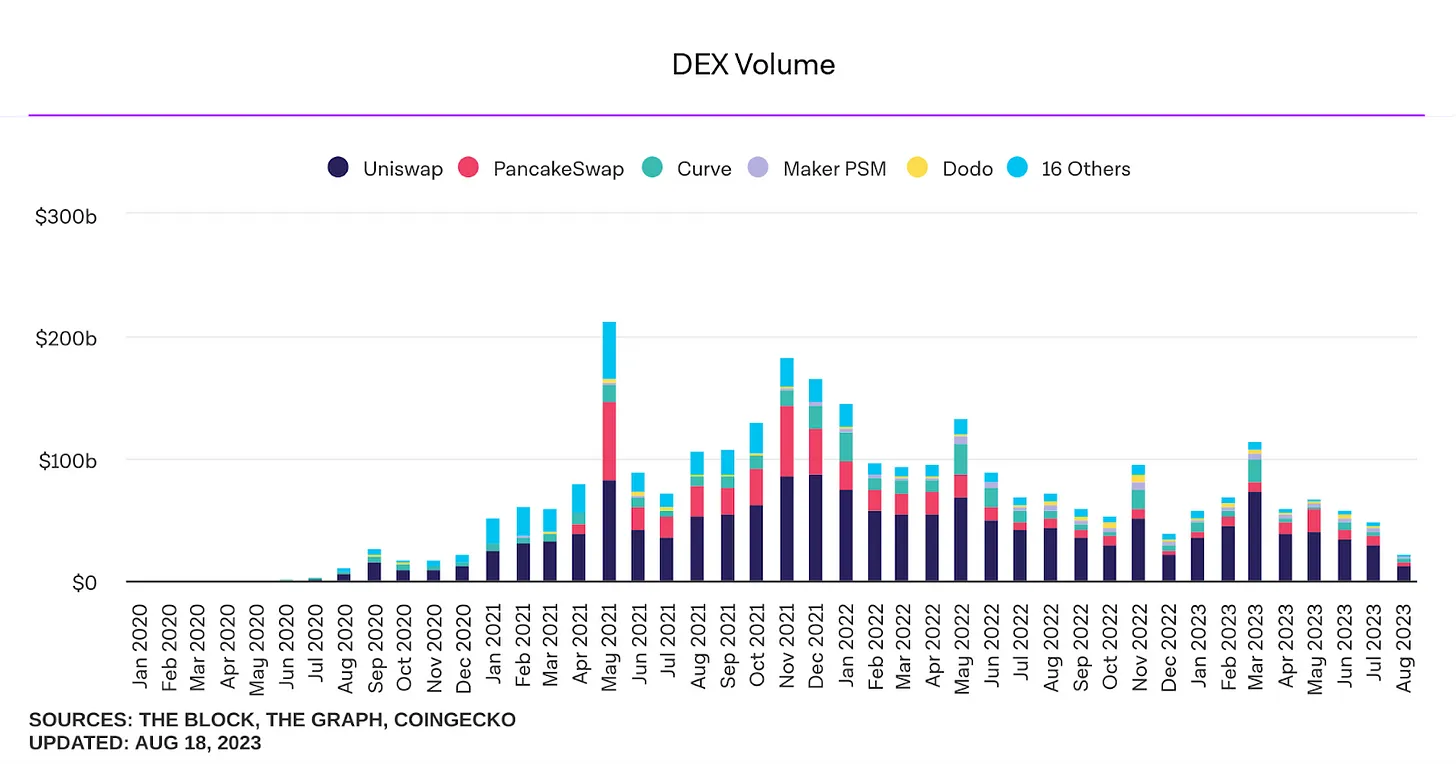

Even during bear markets and at historic lows for DEX trading volume since 2020, hundreds of new ERC-20 tokens are deployed every day. For some traders, tracking meme coin markets is a full-time job. A single project pumping 100x can cover losses and yield solid profits. Traders can participate in multiple ways, including presales, sniping (front-running), and spot purchases.

-

Presale: Allocating funds before a token launch.

-

Sniping: Using bots to automatically buy tokens at launch.

-

Spot: Buying tokens directly on exchanges like Uniswap or Coinbase.

Traders tend to assess their strengths and focus on a few categories. In this analysis, we’ll concentrate primarily on the sniping phase—let’s dive in.

Token Snipers

Before Telegram sniping bots existed, success relied entirely on expertise. Top token snipers and bot operators would carefully analyze meme coin contracts to identify key functions triggering token releases, maximum trade sizes, and any developer-imposed restrictions blocking early buyers. This approach has largely been replaced by the emergence of Telegram-based bots like Banana Gun and Maestro.

In short, token snipers are automated trading bots that allow users to execute rapid buy and sell orders on newly launched tokens across decentralized exchanges like Uniswap. Many of these bots operate via Telegram. Developers favor Telegram because it's where trading ideas thrive and is a crypto-native messaging app. The product-market fit for token snipers is clear, as adoption accelerates rapidly. These sniping bots can also purchase already-listed tokens with similar speed and efficiency, which constitutes a large portion of their transaction volume.

Top-tier sniping bots today can simulate entire contract functions, allowing users to bypass the interfaces of platforms like Uniswap and simply decide how much ETH to deploy. This shift has made sniping more accessible—but also far more competitive.

For example, with Maestro, users still need to input maximum trade sizes and require knowledge of contract methods unless using advanced mode. This is where Banana differentiates itself—no such expertise is needed, and the process is even simpler and more straightforward.

In contrast, platforms like Uniswap have recently removed their expert mode. While this change may benefit retail traders by adding security layers for high-impact trades, it forces skilled traders to manually adjust their strategies—an inconvenience they now face. The removal of expert mode impacts experienced traders, who often build custom frontends to improve usability. This explains why Telegram-based sniping bots like Banana Gun, designed for more sophisticated users, gain traction in the fiercely competitive ERC-20 trading environment. By using these bots, traders not only optimize their strategies but also bypass limitations imposed by retail-focused DEX interfaces.

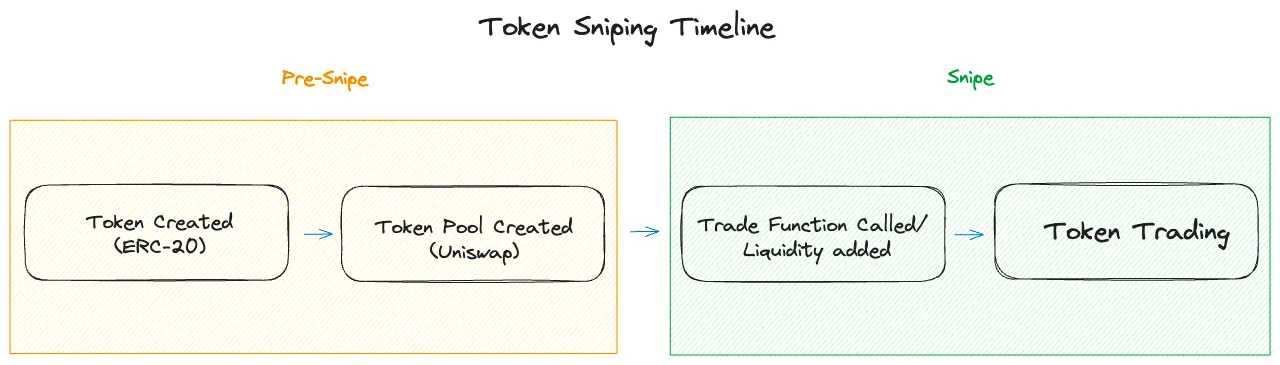

How Do These Sniping Bots Work?

Imagine a trader watching the upcoming launch of $TOKEN in a few days. All they need to do is open the Telegram app and feed the smart contract into the sniping bot. After specifying how much ETH they're willing to risk, it's time to wait. Once the token enters the DEX pool, the Telegram sniper activates, executing predefined trading parameters. If everything goes according to plan, the trader enters at a $10k market cap (hypothetical) and within seconds sees it surge to $200k—a 20x return. But today, it’s no longer that simple. The effectiveness of these sniping bots has led to an influx of traders using identical strategies, often deploying 10 or more wallets to outcompete others.

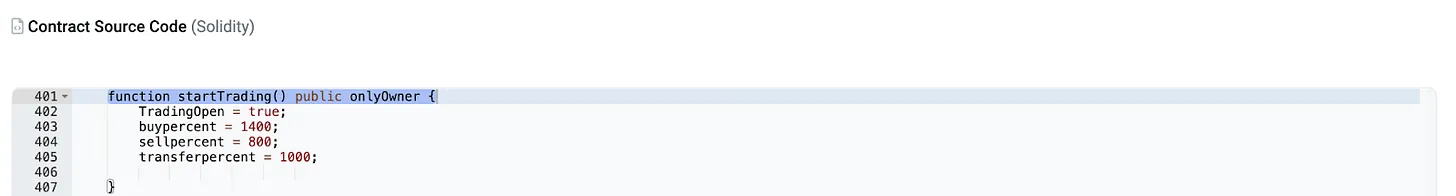

That’s why merely owning a sniping bot isn’t enough anymore—timing is critical. Enter Banana Gun. Unlike platforms requiring manual inputs or constant monitoring, Banana Gun optimizes the entire process. Once a contract is added to the bot before trading begins, Banana’s sniper automatically detects smart contract triggers like “EnableTrading,” buying/sniping instantly upon token release.

The sniper can also monitor “liquidity addition” transactions, enabling trading once liquidity is available.

Banana Gun

Banana Gun has democratized the sniping landscape in crypto. Previously, sniping was an exclusive activity reserved for individuals with advanced technical skills capable of reading and configuring smart contracts. Banana Gun opens the door for everyone by automating most of the sniping process. Their platform is designed for ease of use: you paste a contract, and the bot handles complex tasks like identifying method IDs, tax rates, and maximum trade sizes. This feature sets them apart from competitors like Maestro, where users must manually read contract addresses and configure settings.

The cornerstone of Banana Gun’s unique value proposition lies in its focus on automation and user-centric protection against most rug scams. Beyond automation, every transaction is privately executed using Ethereum bribes set by the user. This clever mechanism adds an extra layer of security. In an environment where someone might attempt a costly gas war rug pull, Banana Gun allows you to front-run at favorable prices. The private transaction feature also ensures you’re never sandwiched or front-runned. Sandwich attacks occur when traders (or bots) exploit transaction ordering by placing trades before and after a user’s transaction. In practice, Banana Gun takes additional steps—if a transaction is detected to be at risk of being sandwiched, it will cancel your trade—even if it was privately executed. Even competitors like Maestro lack this nuanced functionality.

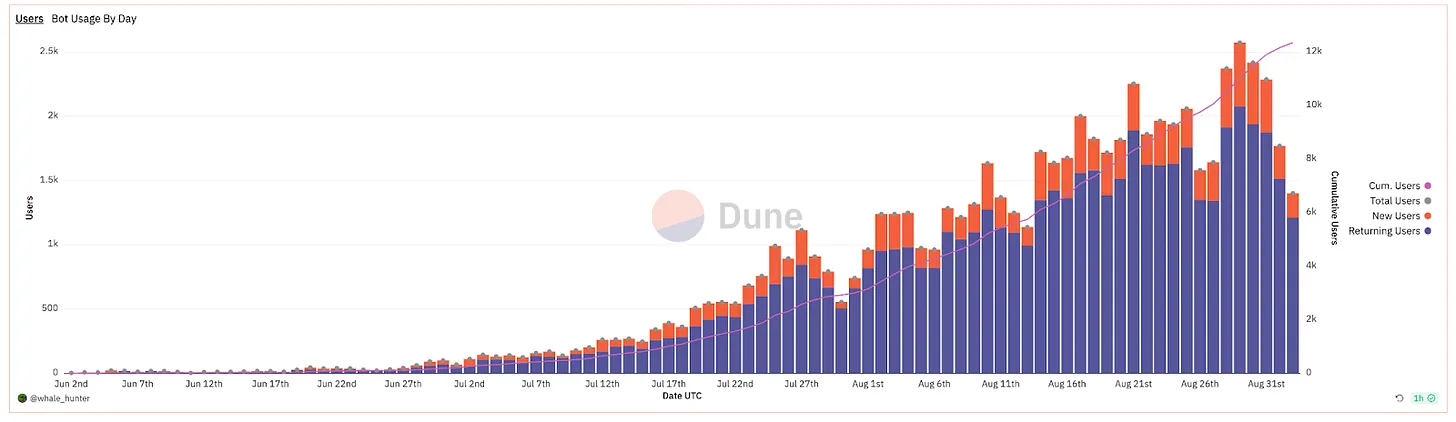

Speed is crucial, and Banana Gun is currently one of the fastest retail sniping bots on the market. Launched in early June, it has already attracted around 700 daily active users and over 12,000 cumulative users.

When users buy, the interface shifts to a sell channel, allowing them to focus solely on selling mechanisms. Typically, other sniping bots combine buying and selling within a single interface.

Core Features

Block Zero Bribes

Bribes are a key feature of Banana Gun, though it should be noted that Maestro originally pioneered the concept of collective bribing. Maestro’s system makes it extremely difficult for individual bot users or snipers to outperform a group’s combined bribe, effectively democratizing the process.

However, Banana Gun advances this approach from a fresh angle. While Maestro may have introduced collective bribing, Banana Gun refines it by attracting a smaller yet more sophisticated and experienced user base. These users deeply understand sniping mechanics and know how to outmaneuver even a collective group.

Banana Gun uses a custom RPC—a dedicated node that communicates directly with the blockchain—enabling faster data transmission than standard providers like Infura or Alchemy. In this high-speed environment, pending transactions from Banana Gun’s elite snipers are bundled into a single transaction package. This package is then forwarded to block builders—the Ethereum network validators responsible for grouping transactions.

When the package reaches the block builder, the battle intensifies. Banana Gun’s snipers engage in blind bidding, where each participant submits a hidden bribe, also known as a “tip,” to secure faster transaction confirmation. Take User A, for example, who buys Token X for 0.20 ETH and includes a 0.10 ETH bribe. This bribe directly incentivizes the block builder to confirm User A’s transaction faster. If the token involves trading taxes, User A might initially incur a loss until the token appreciates.

The blindness of these bribes adds a layer of strategy and unpredictability to the process. Since you can’t see others’ bids and they can’t see yours, your experience and shrewdness become your greatest assets. This explains why Banana Gun consistently stays ahead in the race for block zero despite having a smaller community. The combination of fast custom RPCs, transaction bundling, and blind bribing gives Banana Gun a unique competitive edge, establishing it as a powerhouse in the token sniping arena. This distinctive trio streamlines the trading process, creating an environment where skill, strategy, and speed converge—setting Banana Gun apart from its rivals.

Max Spend

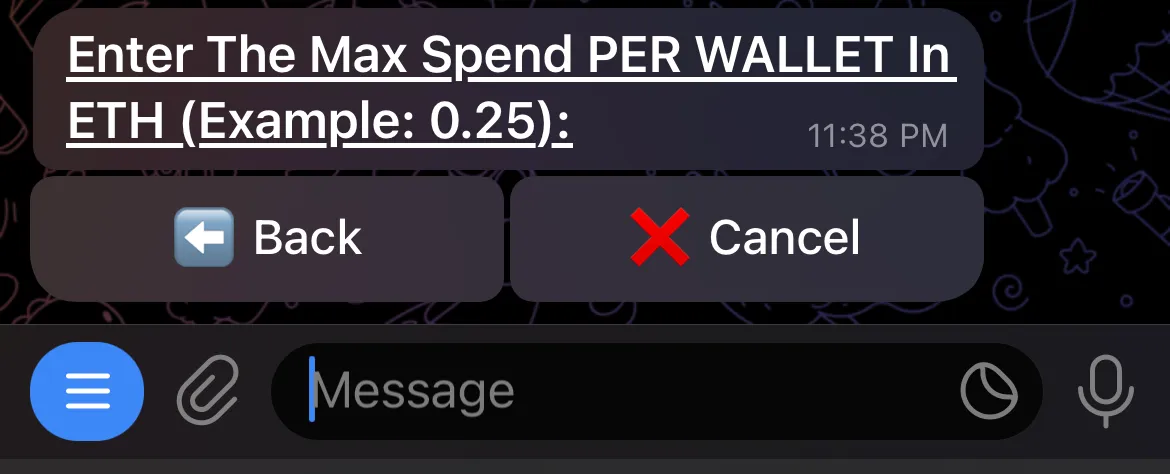

Banana Gun made a critical update to address one of its initial flaws: users had no control over sniping limits. In early versions, the bot would automatically purchase whatever amount the user set. However, this left some traders vulnerable to sandwich attacks.

To fix this, Banana Gun added slippage controls and limit orders within its transaction bundles. Now, users can define a “Max Spend” limit in ETH, capping both the number of tokens and gas they’re willing to spend. This is particularly beneficial when dealing with tokens that have maximum trade sizes—meaning the contract code restricts the maximum amount that can be bought in a single transaction. For instance, if a user sets a spending cap of “0.25 ETH,” the bot keeps total expenditure (including gas) below that threshold. Any remaining ETH is refunded to the user if the maximum allowed trade size is reached.

An important new feature, added based on user feedback, ensures that if a transaction cannot fulfill the maximum allowed purchase amount, it will be automatically canceled. This safeguard is crucial to prevent situations where users receive only a small number of tokens due to higher competing bribes but still pay high fees. This update adds a layer of risk mitigation, making the sniping game more strategic.

These improvements level the playing field, giving Banana Gun users greater confidence as they navigate increasingly cutthroat and cooperative trading scenarios.

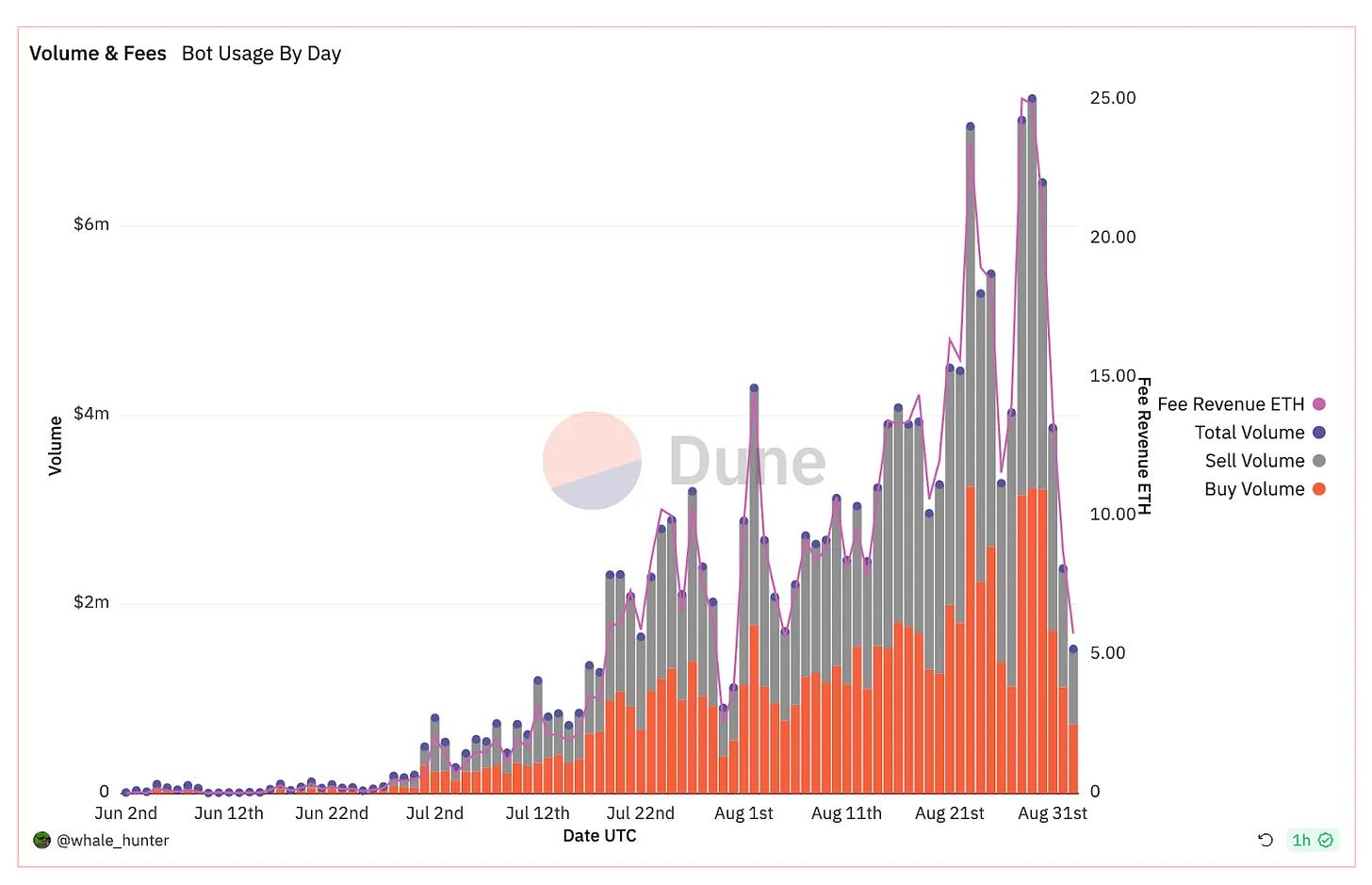

Trading Revenue

Traders use the product, but you might still wonder whether building trading infrastructure like Banana Gun is worth the effort. Ultimately, Banana Gun generates 10–25+ ETH in daily revenue from transaction fees alone—without any token revenue (as of September 15). For Unibot, token revenue adds an extra layer of transaction fees on top of trading volume.

Competitive Landscape

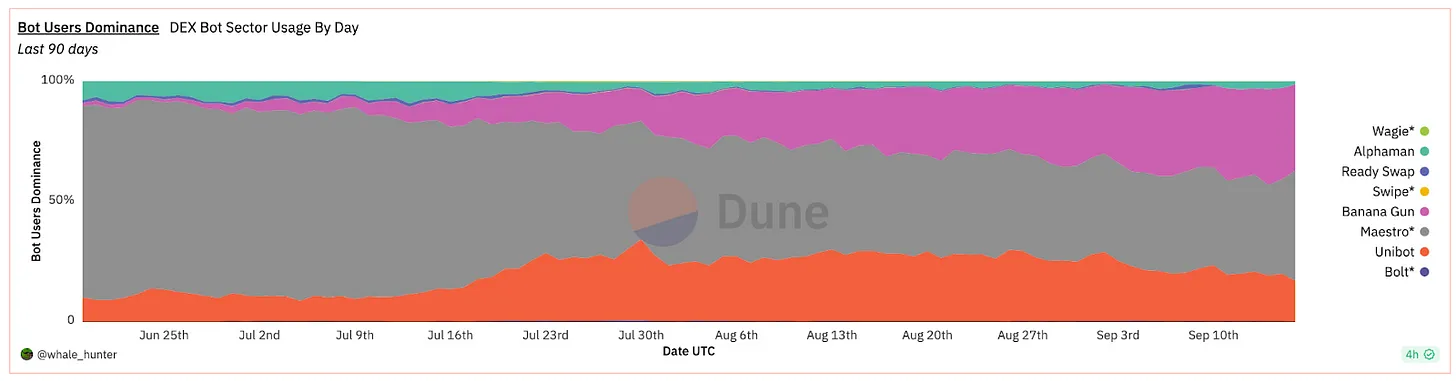

Several bots compete with Banana Gun in the sniping space, including Maestro and Unibot, the two largest players. Overall, Maestro holds the largest user base. However, in recent days, Banana Gun has surpassed Maestro in daily bot usage.

Market Structure

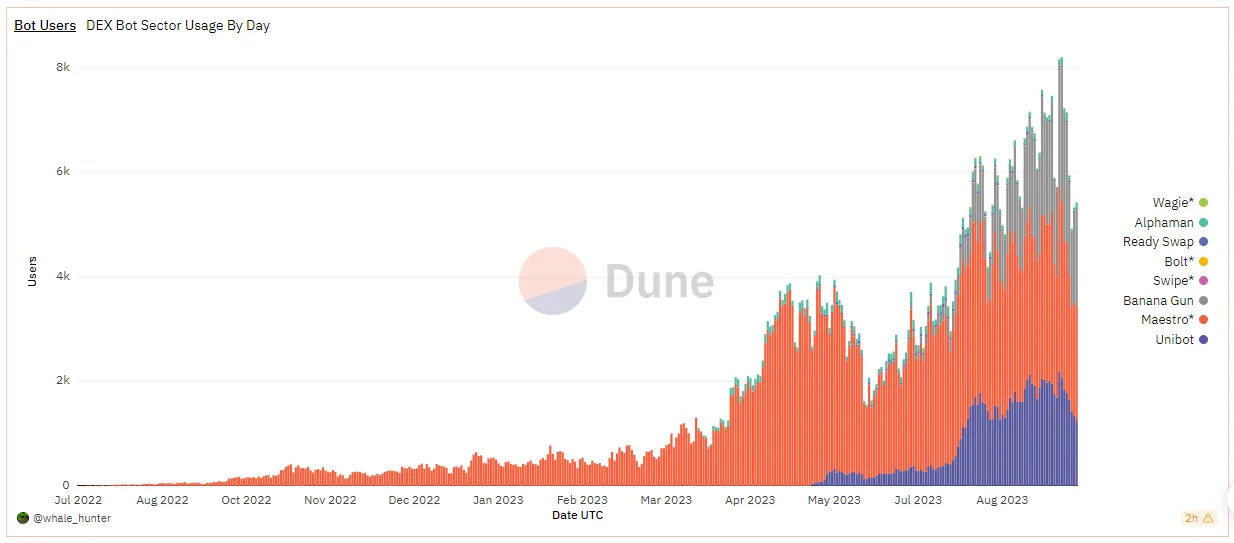

Currently, the total bot user base exceeds 100,000, with daily active users consistently surpassing 4,000 since August. A few leading products account for over 90% of total users—specifically Maestro, Banana Gun, and Unibot.

Revenue and Fee Structure

As of September 15, 2023, Banana Gun reported 756 ETH in transaction fee revenue—over $1.2 million. Banana Gun adopts a low-fee model, charging only 0.5% total fees on buys and sells, which appeals to its smaller but more sophisticated user base.

Understanding the fee structure is key to explaining why Banana Gun’s average daily fee revenue is lower despite advantages in speed and strategy. In contrast, Maestro charges 1% on total buys and sells and even offers a $200 monthly premium membership for additional features. Another competitor, Unibot, operates under a completely different model—its revenue comes from taxes as part of its fee structure.

The word “total” here is crucial. If you make a 10 ETH trade and break even (buy 10 ETH/sell 10 ETH), you still pay fees based on total volume. On Maestro, you pay 0.1 ETH on the buy and another 0.1 ETH on the sell—0.2 ETH total. With Banana Gun, you pay 0.005 ETH on both buy and sell—just 0.01 ETH total. This clear difference in fee structure partly explains Banana Gun’s lower daily transaction fee revenue but also represents a competitive advantage for cost-conscious users.

By breaking down these fee differences, it becomes evident that despite fewer daily active users, Banana Gun offers an attractive alternative for experienced traders seeking to maximize strategy while minimizing costs.

Outlook: Intent-Based Swaps

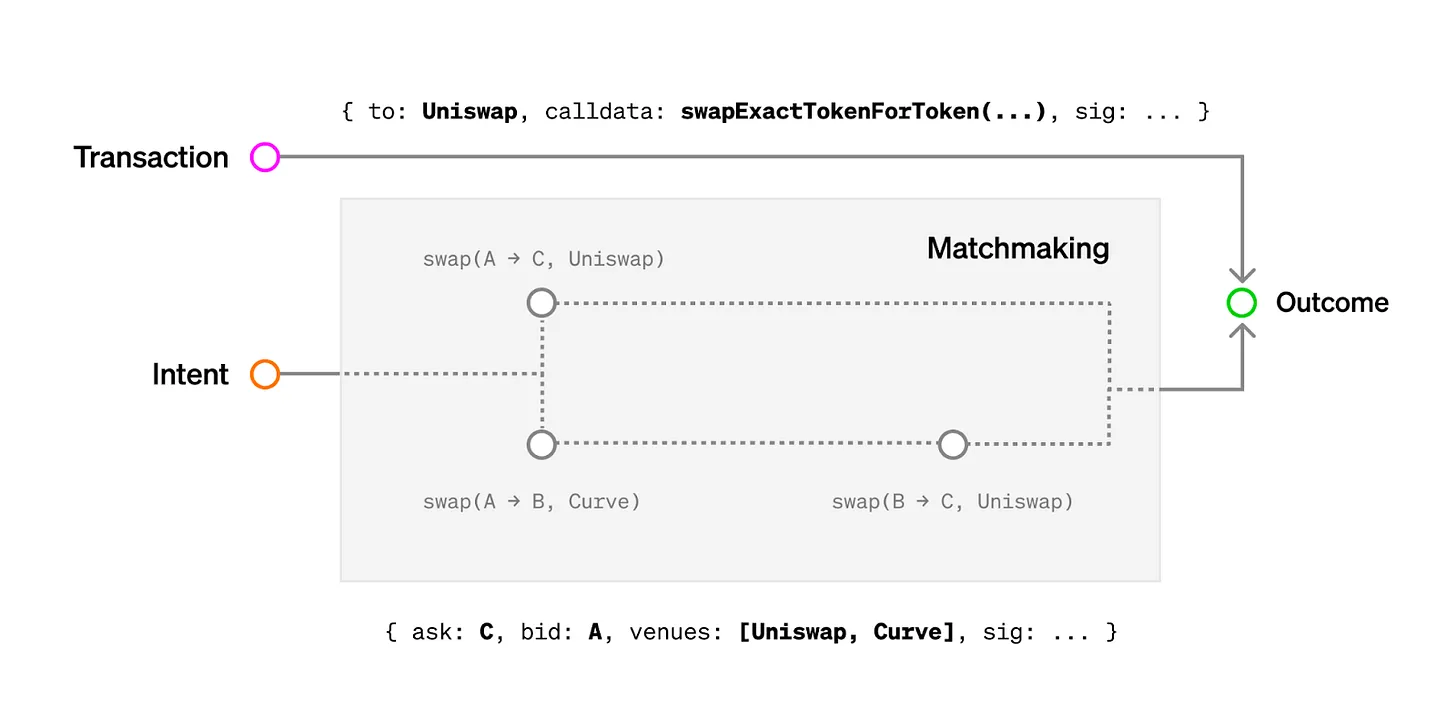

We anticipate that Telegram-based bot tools will evolve toward “intent-based trading,” essentially acting as automated executors of users’ specific trading intentions—whether to swap x, execute y, or z.

An intent is a signed instruction to execute a trade based on defined criteria, rather than a single transaction (TXN) or a fixed path to the same outcome. By using intents, users gain greater flexibility in controlling the results of their trades.

If a transaction says “first do A, then do B, pay C to get X return,” an intent says “I want X, I’m willing to pay up to C.”

—Paradigm

Since BananaGun does not route swaps to third parties for execution, it is typically not considered intent-based swapping. However, we may see tools like Banana Gun auctions or order fulfillment services representing users, or RFQ (request-for-quote) models allowing users to submit off-chain orders for execution. Banana Gun already interacts with block builders to accelerate transaction processing and initiate snipes. In the future, snipers may shift toward off-chain solutions to fulfill early snipes or general swaps. Theoretically, a user could sign a transaction stating their willingness to spend X, and Banana Gun could either execute it on their behalf or forward it to a high-tier participant for an additional fee.

Risks

Like most protocols, Banana Gun is not without risks. Risks in DeFi are generally similar across protocols and include economic exploits or smart contract vulnerabilities. Economic exploits involve manipulating the monetary system within a protocol’s mechanism, while smart contract exploits may exist in unaudited code. Both risks can apply to sniping bots.

Security Risks

With Banana Gun, security risks extend beyond smart contract bugs. The bot has access to users’ private keys, meaning the project team technically has control over user funds. To mitigate this risk, most traders keep only enough funds in their Telegram wallet to execute trades, storing the rest in more secure wallets.

There’s always a risk that something unexpected could expose private key data. That said, both Banana Gun and Maestro immediately delete private keys from the Telegram user interface once provided or generated within the app. For Banana Gun, if you forget or lose your private key, the platform cannot retrieve it for you. Private keys are stored on a separate encrypted server accessible only to the bot, protected by multiple security layers including marshaling, hashing, and transformation. Marshaling packages data for secure storage, hashing converts it into one-way irreversible strings, and transformation further obfuscates the data into unreadable formats—collectively ensuring the highest level of private key protection.

Bribes (Tips)

Being the fastest comes at a cost. Just as cheetahs can sprint incredibly fast but then need to rest, using Banana Gun may lead users to over-bribe tokens based purely on hype and speculation, eroding profits. If “Sniper A” bribes 0.1 ETH and competitor “Sniper B” bribes 0.2 ETH, “Sniper A” ends up with a worse entry price. In some cases, irrational bribes are added, leading to losses for many participants. Tips are non-refundable and sent entirely to block builders.

Conclusion

Banana Gun stands out with its speed, low cost, and strong stability, focusing heavily on execution timing. Many successful trades can be attributed to Banana Gun’s efficiency and transaction bundling architecture.

Banana Gun’s sustained growth throughout the bear market underscores the product’s utility and demand. Despite the complexities of sniping, Banana Gun maintains a strong user base—surpassing 700 daily users within months and recently generating over 10 ETH in daily revenue.

However, the user base for token sniping bots is ruthless and brand-loyal-free, so the Banana Gun team must continue iterating to ensure they maintain a competitive product.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News