Deep Dive into Banana Gun: An Investment Vehicle with Real Value Capture

TechFlow Selected TechFlow Selected

Deep Dive into Banana Gun: An Investment Vehicle with Real Value Capture

This article will introduce the five most important yet lesser-known features of Banana Gun.

Author: Felipe Montealegre, Theia Research

Translation: Shaofaye123, Foresight News

Great projects often emerge in the most overlooked places. When discussing successful investment cases, people tend to think of Tesla, Apple, and Amazon. But upon reflection, you’ll be surprised to find that most investors earned their first substantial returns from niche industries like insurance brokerage, auto parts, or pharmaceutical services—early-potential companies that rarely attract public attention. In such overlooked areas, outsized returns are often easier to achieve.

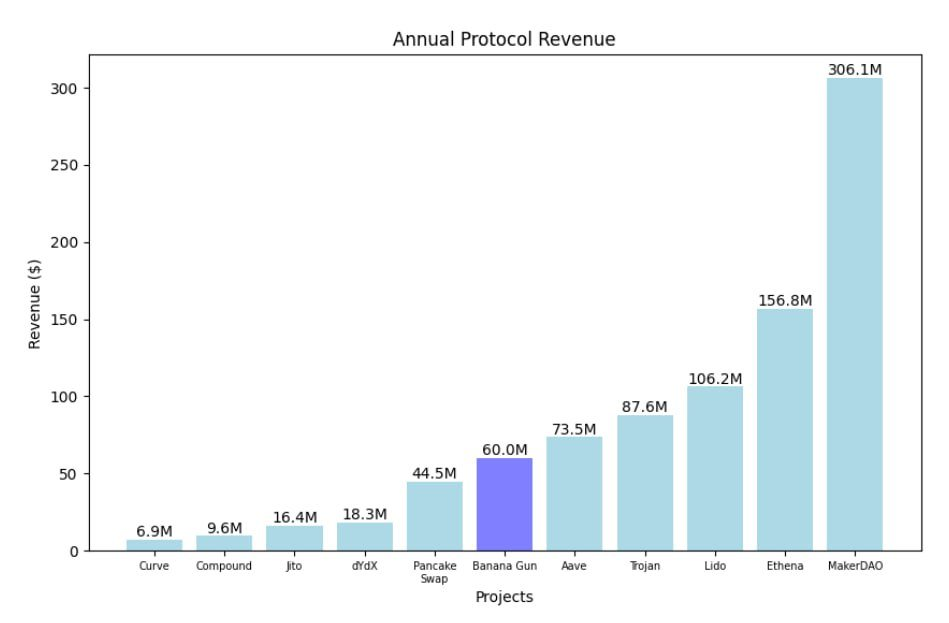

We believe the token market offers similar opportunities, particularly with Banana Gun, a Telegram bot. Banana Gun is one of the most economically robust projects across the entire on-chain ecosystem. It benefits from price-insensitive users, valuable order flow, and meaningful economies of scale. The front-end trading market is among the largest segments of the on-chain economy. Its fundamentals are frequently misunderstood, making Banana Gun’s valuation relatively cheap compared to other projects.

This article outlines five of Banana Gun’s most important yet underappreciated characteristics. Banana Gun has: (i) a high-quality user base; (ii) a deep moat built on economies of scale; (iii) potential pricing power derived from superior order flow; (iv) a significantly larger market opportunity than commonly understood; and (v) strong fundamentals.

Banana Gun Has the Most Valuable Users in the On-Chain Economy

Banana Gun is a Telegram bot enabling users to trade tokens on EVM and SVM chains. Frequent on-chain traders understand that even trading on DEXs like Uniswap or Raydium can be inconvenient—akin to trading directly through the New York Stock Exchange without using retail platforms like Robinhood or Interactive Brokers. Banana Gun provides seamless trading directly within Telegram, along with advanced features such as sniping, copy trading, and anti-RUG protection—features highly valued by its core user base.

Banana Gun’s core users are speculative traders who take on high risk in pursuit of outsized returns. They represent the most valuable users in the on-chain economy due to their high activity (large trading volume) and low price sensitivity (high revenue generation). These users actively trade volatile memecoins, aiming for 100x returns. They can make life-changing profits within weeks and are indifferent to paying fees around 75 basis points.

To illustrate the value of these users, consider a comparison between a memecoin trader and a liquid token fund. Suppose a memecoin trader manages $100,000, occasionally performs snipes, and rotates positions weekly. Over three months, they could generate $2 million in trading volume and approximately $20,000 in fees. In contrast, a liquid token fund must go through an investment committee for each trade and seeks optimal fee rates. Despite managing $30 million in capital, the same fund might generate $5 million in volume over three months but only $10,000 in fees.

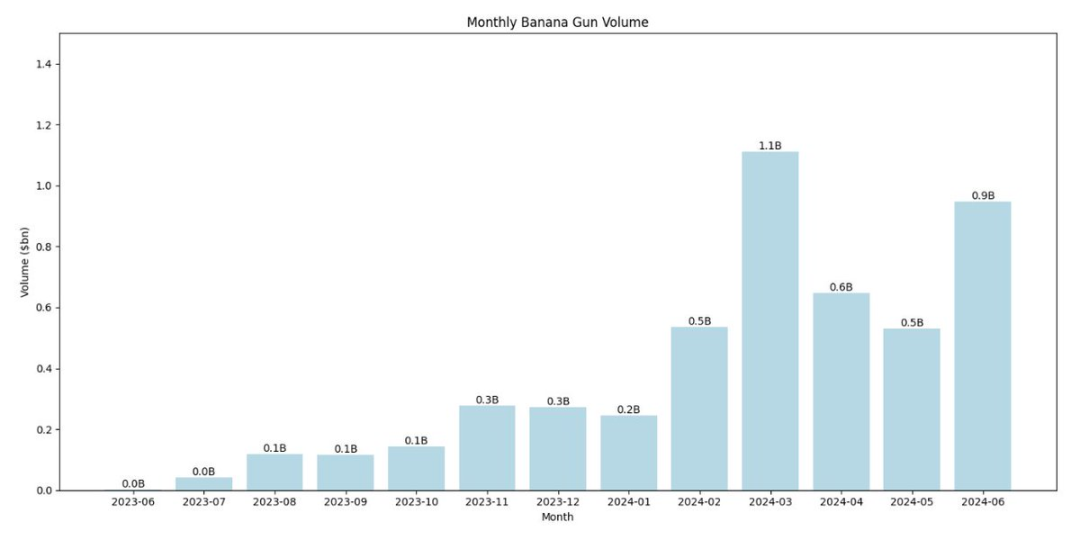

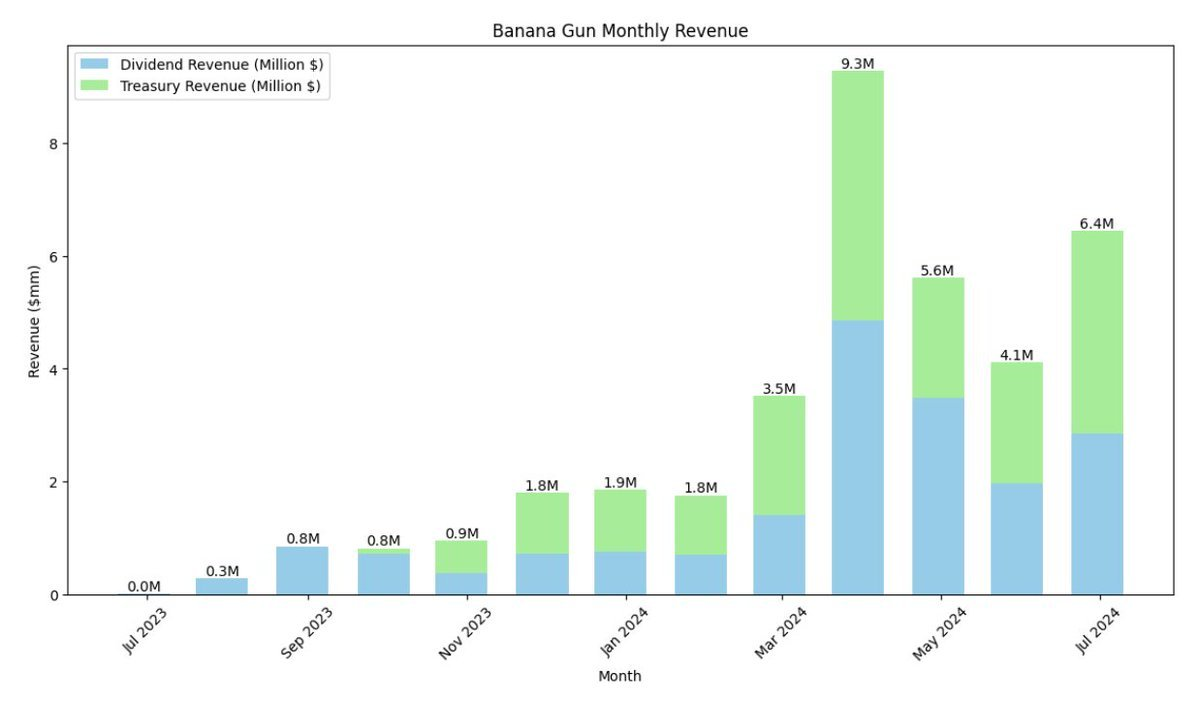

Banana Gun is projected to generate $7.8 billion in annual trading volume and $60 million in cash flow, with a cumulative user base of 151,000 and approximately 5,000 daily active users—all reflecting the quality and engagement of its user base.

Banana Gun Has a Deep Moat Based on Economies of Scale

Banana Gun users prioritize functionality, user experience, and execution quality.

Active traders do not switch easily between Telegram bots—they value convenience above all. Therefore, being multi-chain and offering all necessary features becomes critically important. This is why becoming the largest Telegram bot on EVM is easier than becoming the largest on Solana—the network effects and user demand are stronger on Ethereum-based ecosystems.

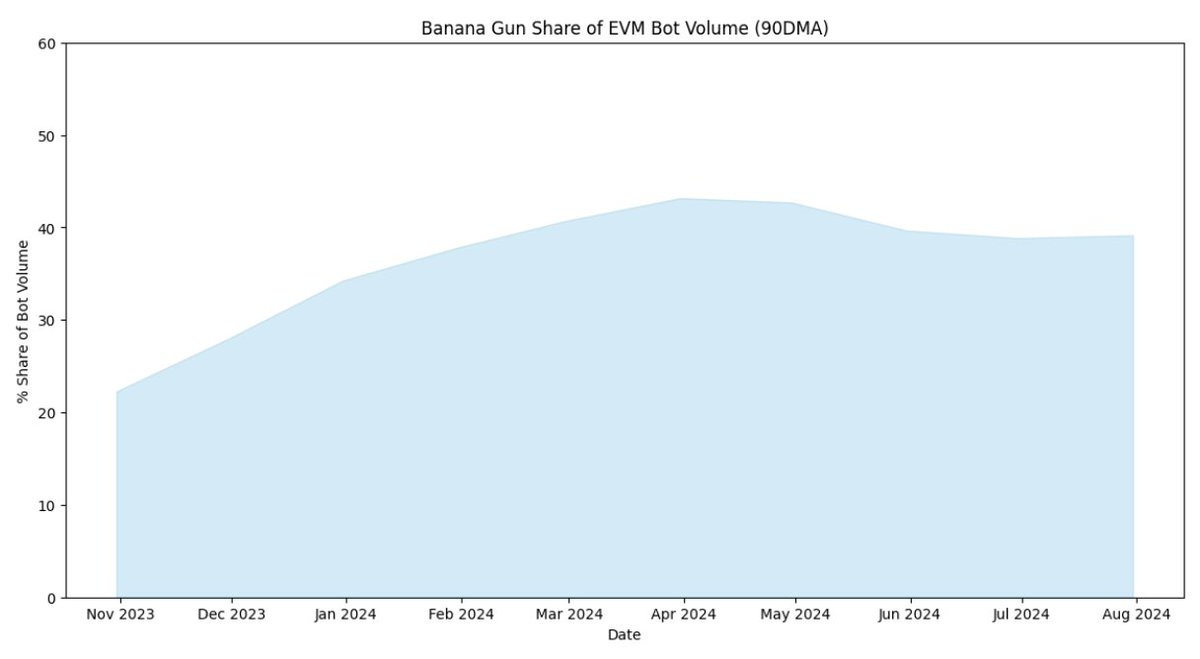

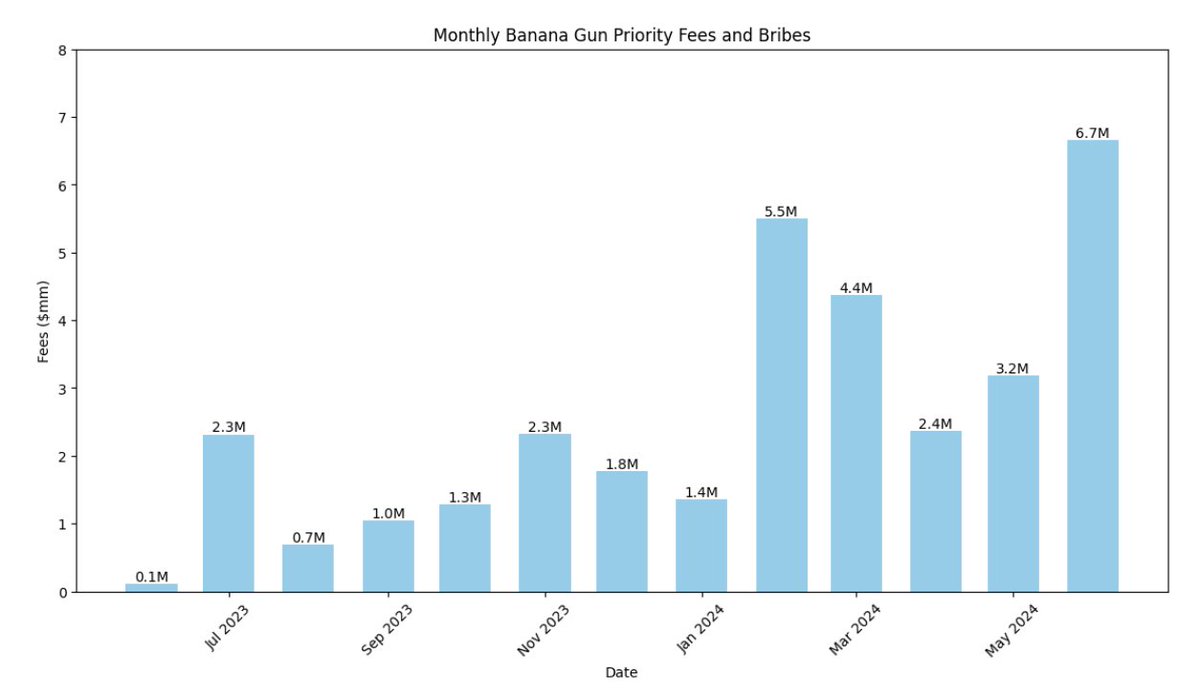

Active traders also rely heavily on advanced features such as sniping. What makes these features compelling is that many naturally lead to monopolistic outcomes. Consider the sniping process: only one Telegram bot can successfully win a snipe for its users, and it will always be the bot willing to pay the highest priority fees. This means the largest bot—or the one with the most snipers—is most likely to succeed. Market data confirms this: Banana Gun wins 88% of all snipes. Competitors have almost no chance against Banana Gun’s user base.

These capabilities require significant infrastructure investment. High-performance infrastructure is essential to ensure fast execution, as users expect low latency and high reliability. Additional systems are needed for anti-RUG features, requiring Banana Gun to monitor the mempool, detect if token creators are withdrawing liquidity, and front-run those withdrawals in the next block. Banana Gun is estimated to spend around $3.6 million annually on infrastructure. For smaller competitors, investing this amount is unsustainable, especially when market share remains limited.

All of this creates a deep moat for Banana Gun. As early investors in the Telegram bot space, we’ve seen dozens of well-funded projects launched by exceptional founders—but none have managed to take meaningful market share from Banana Gun.

Banana Gun’s Valuable Order Flow Grants It Potential Pricing Power

Banana Gun is one of the most significant players in the order flow ecosystem. It is expected to send $50 million in priority fees and bribes to miners in 2024. According to “Decentralization of Ethereum’s Builder Market” (Yang 2024), Banana Gun plays a pivotal role in about 40% of MEV Boost auctions. Per “Decentralizing Monopolistic Power in DeFi” (Markovich 2024), Banana Gun’s order flow is the primary profit driver for Titan, the second-largest miner on Ethereum.

Currently, Banana Gun does not charge for its order flow, but we believe this will change over time. Monetization could occur via direct integration into Ethereum’s protocol-level order flow auctions or through private deals with builders/miners. It’s too early to predict the exact mechanism, but we expect a significant portion of this $50 million will eventually be redistributed back to Banana Gun’s users. Banana Gun is not only a profitable project but also a systemically important protocol within the Ethereum ecosystem.

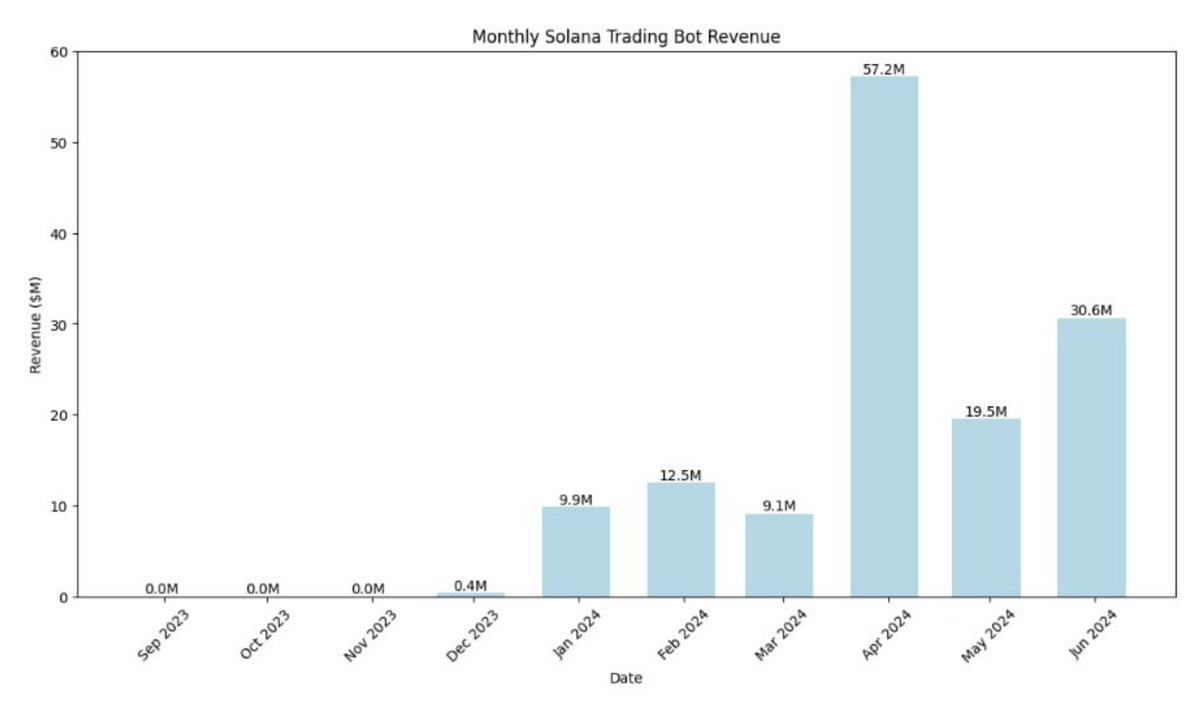

Solana + Web App = A Massive Market Opportunity

Banana Gun is launching its Solana functionality. For Telegram bots, Solana represents a higher-margin market with less mature competition. Year-to-date annualized revenue on Solana is estimated at $280 million. Trojan, a comparable established player, entered the Solana market earlier this year and is on track to generate over $100 million in revenue in 2024. While fully replicating Trojan’s success may be difficult, Banana Gun still has a clear path to capturing a meaningful share of this market.

Banana Gun is also building its own web application—a product designed to look and feel like Binance but operate entirely on-chain. Fully developing this product will take several years (as on-chain financial primitives continue evolving), but the team has already begun enabling token trading through enhanced web-based interfaces.

This represents a massive market opportunity, one that stands to benefit from all the user activity and order flow discussed so far. In traditional markets, 40% of trading volume flows through front-end platforms—we expect a similar dynamic to unfold on-chain. Ultimately, Banana Gun’s team remains focused on a single mission: capturing as much high-value order flow as possible, whether on EVM or SVM, via Telegram or WebApp.

Fundamentals

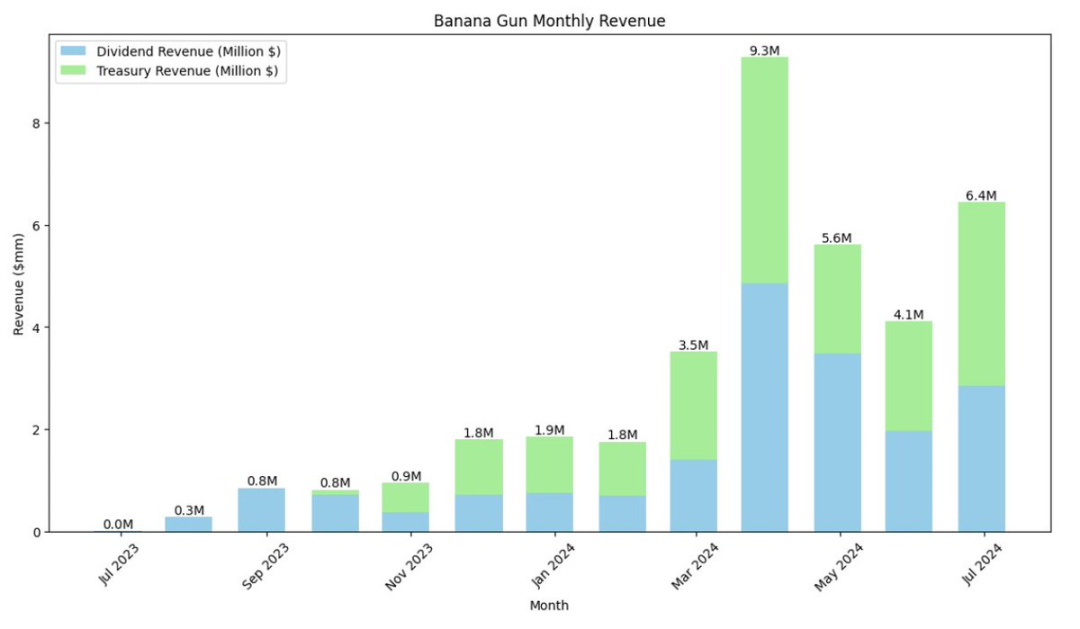

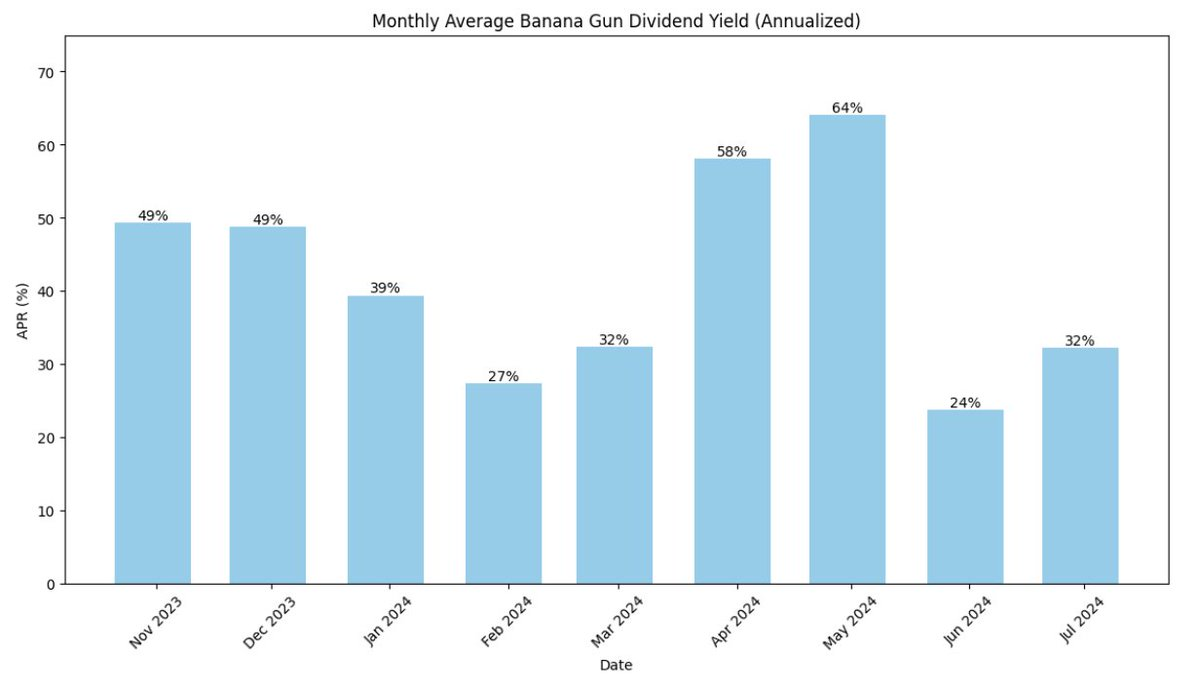

The Banana Gun team demonstrates thoughtful capital allocation. The company generates $60 million in operating revenue, returning 40% of that to token holders as dividends, while reinvesting the remaining 60% into growth initiatives and operational expenses. As the team accumulates more capital, we believe they will increase rewards distributed to users over time.

The team’s TGE (Token Generation Event) design also partially explains its long-term success. At launch in 2023, the team held 10% of the total Banana Gun token supply, with half unlocking over five years and the other half over eleven years. This structure reflects a genuine commitment to long-term development. Notably, the tokens locked over eleven years still earn yield, giving the team ongoing incentives to grow revenue and distribute more value to token holders. This forward-looking TGE design is a key foundation of Banana Gun’s valuation.

Regarding market cap, we believe analysts should evaluate circulating supply relative to unlock timelines. If a project has a $100 million circulating market cap and a $1 billion fully diluted valuation, but $900 million won’t unlock for ten years, that $900 million should effectively be disregarded. Conversely, if $900 million in VC holdings will unlock within 18 months, that must be factored in. Most cases fall somewhere in between.

Banana Gun’s fully diluted market cap is $690 million, but this includes approximately 64% of tokens allocated to the treasury. These tokens were issued early in Banana Gun’s development as a strategic reserve. Even before generating substantial revenue, the team committed to burning tokens upon unlocking and has already permanently burned around 26% of the total supply.

We can therefore adjust Banana Gun’s effective market cap from $690 million down to $250 million, since only about 35% of tokens are currently in circulation. This is a preliminary estimate. Adding a margin of safety, we assume Banana Gun will deploy roughly 30% of its remaining funds effectively. This brings the adjusted market cap to $345 million. Based on this adjusted figure, Banana Gun trades at a P/E ratio of approximately 5.75x (= $345M / $60M). This suggests significant upside potential once the project lists on Binance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News