Exploring Berachain: One Hand Grasps Liquidity, the Other Security

TechFlow Selected TechFlow Selected

Exploring Berachain: One Hand Grasps Liquidity, the Other Security

Berachain's consensus mechanism, tokenomics model, and key changes in its unique ecosystem.

1. Introduction

Proof of Stake (PoS) is a network consensus mechanism where security increases with the amount of native tokens staked on the network, and has recently become the most widely adopted mechanism.

However, native tokens in PoS networks can be used not only for staking but also to pay Gas fees and serve as the foundational currency within the ecosystem. This design creates a self-contradictory situation: as more tokens are staked on a PoS network, liquidity and activity within the DeFi ecosystem decrease.

This lack of liquidity negatively impacts the entire ecosystem—for example, causing high slippage on decentralized exchanges (DEXs) and hindering the development of protocols that rely on token deposits. As a result, many ecosystems have been forced to conduct excessive token airdrops or build their own L2s or app-chains to maintain sufficient liquidity, fragmenting liquidity across the blockchain ecosystem and degrading user experience.

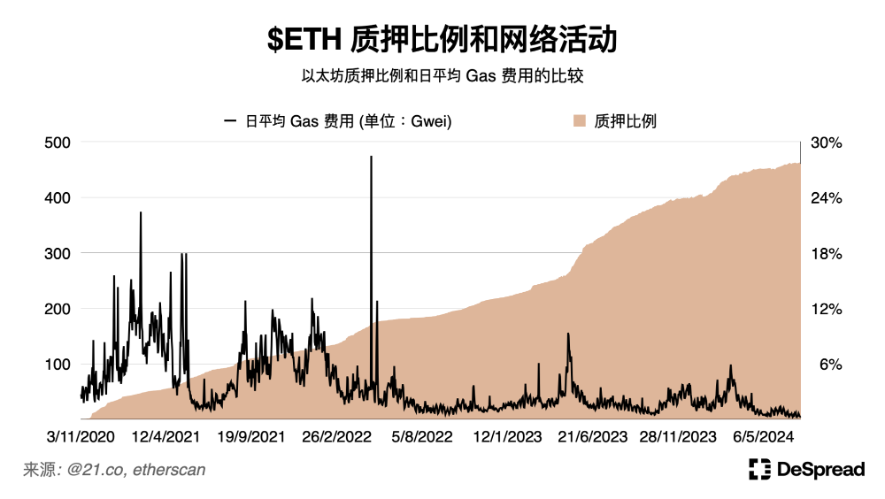

On Ethereum's mainnet, restaking protocols have gained attention, driving ETH staking to an all-time high of approximately 28%. However, we observe a clear decline in Ethereum’s network traffic, with average daily Gas fees dropping to around 5 Gwei.

This structure of PoS presents a problem: users cannot simultaneously stake tokens both in liquidity protocols and in the network itself, leading to conflicting incentives between validators and protocols.

Of course, many foundations have recognized this issue and attempt to align interests by providing funding, technical mentorship, and marketing support to ecosystem-contributing protocols. However, such approaches still struggle to reflect the views of ecosystem participants like users and validators, and may even lead to centralization of power due to overreliance on foundations.

If one of blockchain's core principles is creating an environment that “can’t be evil” rather than merely “don’t be evil,” then a new systemic solution is needed to resolve PoS’s inability to simultaneously ensure ecosystem liquidity and network security. Berachain aims to solve these issues inherent in PoS networks by designing a token economy based on game theory that simultaneously enhances both ecosystem liquidity and network security.

In this article, we will explore Berachain’s consensus mechanism and token economics model, the key changes introduced in its Testnet v2 released in June 2024, and the unique ecosystem being built upon it.

2. Berachain: Balancing Network Security and Ecosystem Liquidity

Berachain is built using BeaconKit, a framework that leverages Cosmos SDK to create customizable EVM execution environments, making it an EVM-compatible Layer 1 network.

Typical blockchain projects usually begin by publishing a whitepaper outlining their technical vision, followed by various campaigns to recruit potential users and build a community. In contrast, Berachain started forming its community through an NFT project called "Bong Bears".

Launched in 2021 during the NFT market boom, Bong Bears received strong support from the community of the then-popular DeFi project Olympus DAO. Since then, holders of Bong Bears have successively received airdrops of derivative NFTs such as The Bond Bears, The Boo Bears, and The Baby Bears, continuously expanding the community.

During this time, "Berachain" was initially just a meme within the Bong Bears community, but developer Dev Bear began actively developing Berachain, which has now entered the testnet phase.

Many recent blockchain projects, despite investing significant time and capital into building loyal communities, often lose users after token airdrops. Berachain’s distinct community-building approach has naturally attracted considerable attention from cryptocurrency users.

Another key factor that makes Berachain a highly anticipated L1 is its innovative "Proof of Liquidity (PoL)"—a consensus protocol designed using game-theoretic tokenomics to resolve the misaligned incentives among participants in traditional PoS networks.

2.1 Proof of Liquidity (PoL)

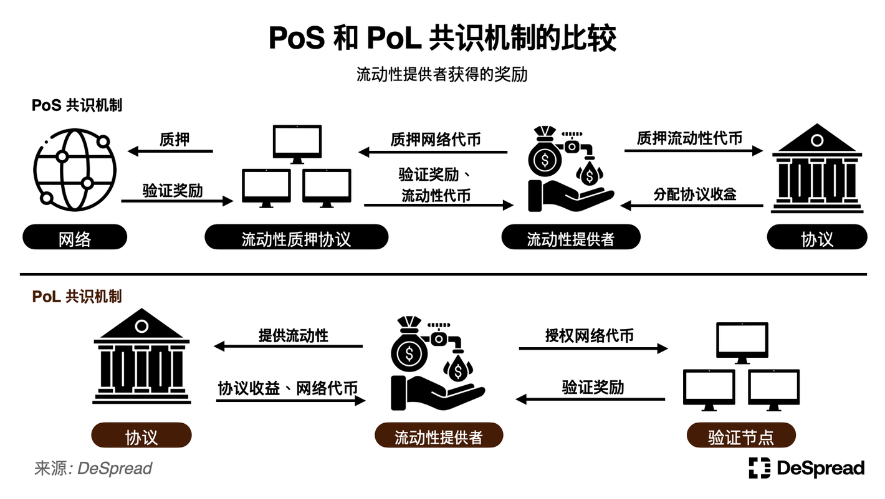

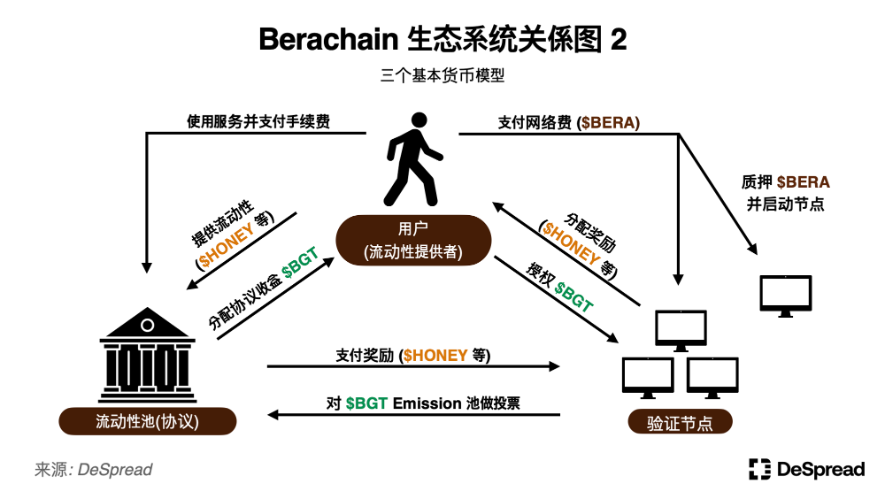

Participants in Berachain’s PoL consensus mechanism include the following roles and relationships:

- Validators: Operate Berachain nodes and participate in network validation.

- Liquidity Providers: Supply liquidity to protocols within the ecosystem.

- Protocols: Provide specific services to users on the Berachain network and require liquidity.

In Berachain’s PoL mechanism, liquidity providers who supply liquidity to designated protocol pools receive rewards in the form of Berachain’s native tokens, issued at every block. These tokens can then be delegated by liquidity providers to validators, allowing them to indirectly participate in network validation. Through this process, liquidity providers earn interest from their deposited assets and also receive income via validator rewards.

At first glance, this structure appears similar to PoS—apart from the sequence of staking assets into liquidity protocols on PoS chains and then depositing the resulting liquidity tokens into another protocol to earn yield.

However, in PoS, competing liquidity protocols lead to token diversification and fragmented liquidity. Berachain, by integrating this functionality directly into the chain, prevents liquidity fragmentation at the base layer.

Moreover, validators on Berachain have voting rights over which liquidity pools receive block rewards. This means validators can directly boost rewards for specific pools—an enhancement that enables tighter integration between liquidity providers, protocols, and the PoL consensus mechanism compared to traditional PoS.

2.1.1. The Ecosystem Flywheel

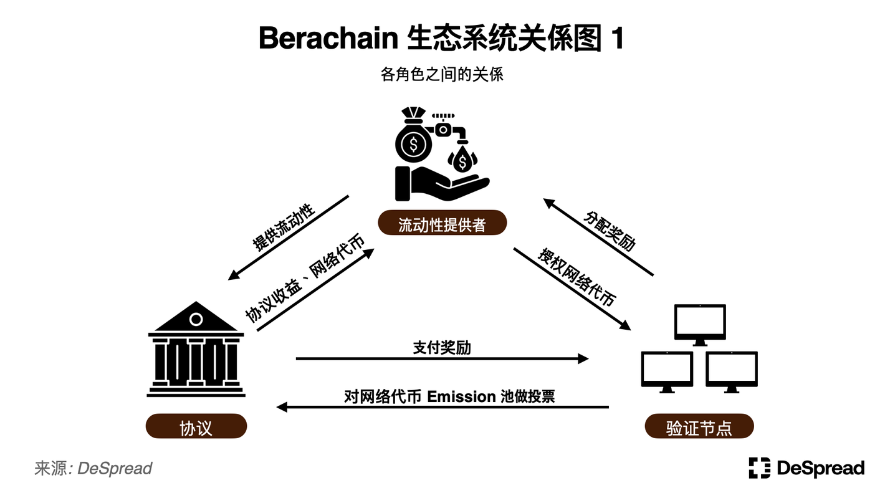

We can anticipate that protocols launching on Berachain will use investment funds, their own issued tokens, and protocol fees to incentivize validators, securing their votes and ensuring early-stage growth.

This, in turn, incentivizes validators to distribute earned rewards to delegators to gain more voting power. Distributing rewards back to liquidity providers encourages them to supply further liquidity, creating a virtuous cycle that strengthens network security.

Through this mechanism, Berachain’s PoL treats projects and liquidity providers as primary participants, resolving the issue in traditional PoS systems where they do not directly engage in network consensus. These three entities are tightly interconnected, exchanging liquidity and incentives to form an ecosystem flywheel: value flows from liquidity providers to protocols, from protocols to validators, and back to liquidity providers.

2.2. Tri-Token Model

To better leverage the flywheel effect of PoL, Berachain adopts a tri-token model, utilizing three types of network tokens:

- $BERA: Used to pay network transaction fees (Gas), which are burned. Validators must stake 69,420 $BERA to activate a node.

- $BGT: Inflationary reward tokens allocated to liquidity pools via validator voting. $BGT is non-transferable and account-bound. After providing liquidity, liquidity providers receive $BGT and can take the following actions:

- Destroy $BGT at a 1:1 ratio to obtain $BERA

- Delegate $BGT to validators

- $HONEY: A stablecoin pegged to 1 USD, serving as the reserve currency within the Berachain ecosystem. Currently issued on the testnet as wrapped USDC, it may transition to an over-collateralized model in the future. A 0.5% issuance fee is charged, distributed to $BGT holders.

Applying this tri-token model to Berachain’s participant relationship diagram, we can summarize the following points.

Since $BGT, which determines inflation reward allocation, is non-tradable and can only be obtained by providing liquidity, Berachain’s structure prevents whales from quickly acquiring large amounts of $BGT to influence governance. This design compels protocols seeking $BGT-driven liquidity in the Berachain ecosystem to convince influential validators through incentive distribution.

This socially-consensual behavior among ecosystem participants increases both network security and liquidity, helping attract more users to the Berachain ecosystem.

As more users join, network usage rises, increasing the amount of $BERA burned as Gas fees. Additionally, growing demand for collateral and trading assets within ecosystem protocols boosts demand for $HONEY, generating profits for $BGT holders.

3. bArtio Testnet

With its loyal community and unique PoL mechanism, Berachain has garnered widespread attention and achieved impressive results. It launched its first testnet, “Artio Testnet,” in January 2024, reaching 1 million active wallets within just eight days.

However, since Berachain uses CometBFT—a Cosmos-based consensus engine—to run EVM, compatibility and scalability issues with EVM were discovered during the testnet phase. In June 2024, Berachain launched its second testnet, “bArtio Testnet,” resolving the challenges faced by the first testnet and improving other deficiencies related to the PoL mechanism.

3.1. Full EVM Compatibility

During development, the Berachain team created an EVM-compatible framework called "Polaris" to connect the Cosmos-based CometBFT consensus engine with the EVM execution environment. The Artio testnet was built using this framework.

Polaris achieves compatibility between CometBFT and EVM through precompile technology that translates and stores operations across two different execution environments.

However, testing revealed the following limitations of Polaris:

- The Cosmos SDK consensus engine waits for EVM transaction processing to complete before creating blocks, creating bottlenecks under high transaction volume.

- Polaris fails when executing computations not supported by precompiles, causing EVM compatibility issues.

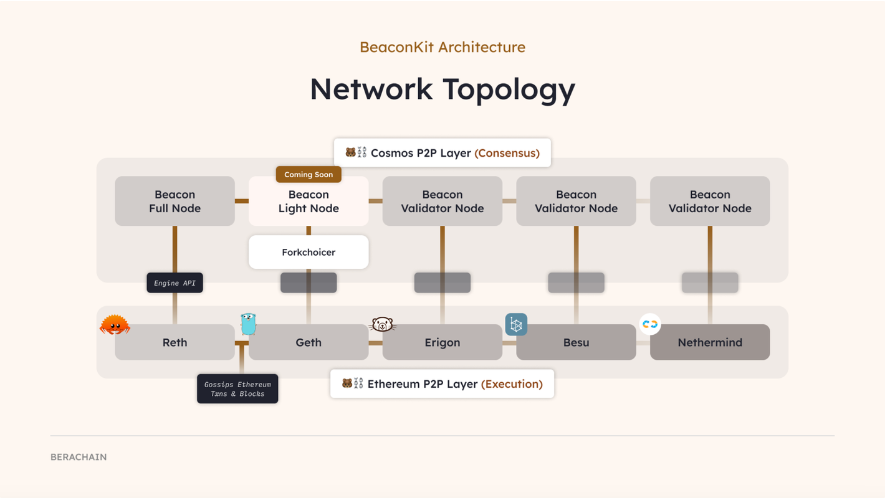

To overcome these issues, the bArtio testnet introduced BeaconKit, an EVM-compatible framework derived from Ethereum’s 2.0 Beacon Chain.

3.1.1. BeaconKit

Unlike Polaris, BeaconKit clearly separates the execution layer (EVM) and consensus layer (CometBFT), connecting them via EngineAPI while maintaining compatibility. This architecture allows BeaconKit to work seamlessly with standard Ethereum execution clients (Geth, Erigon, Nethermind, etc.).

BeaconKit Architecture, Source: Berachain Blog

Since the bArtio testnet uses the same execution clients as Ethereum, it provides an EVM execution environment identical to Ethereum. When Ethereum’s execution environment updates, Berachain simply installs and runs the updated client provided by Ethereum, replicating all improvements without requiring special modifications on the Berachain network.

Additionally, unlike Polaris, BeaconKit allows independent operation of the execution and consensus layers, preventing bottlenecks in one layer from affecting the other. Furthermore, when a validator creates a block, it broadcasts the final state after executing all transactions to other validators. This “immediate execution” mechanism significantly improves transaction processing speed, solving Polaris’s scalability issues.

3.2. Enhanced PoL Mechanism

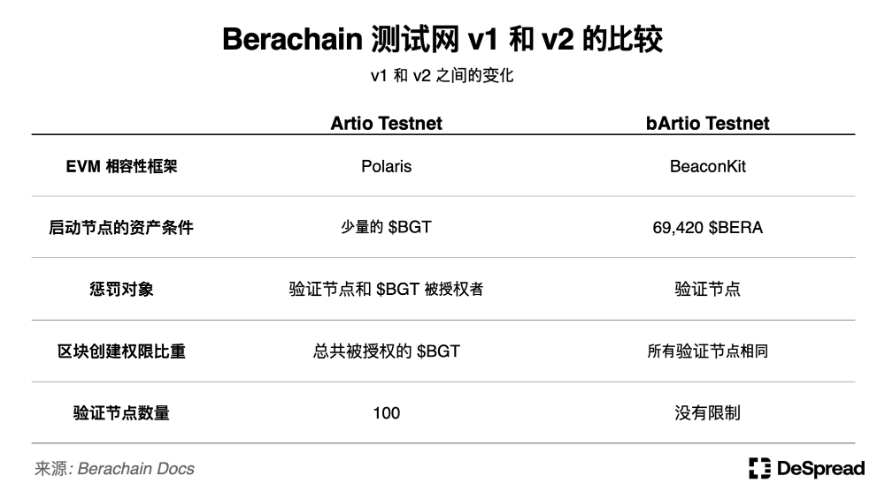

In addition to switching to the BeaconKit framework for EVM compatibility, Berachain made several improvements to strengthen the PoL mechanism in the bArtio testnet.

Validator Participation Requirements: In v1, activating a validator node required only a small amount of $BGT staking. In bArtio testnet, this requirement changed to 69,420 $BERA, increasing staking volume and network security.

Penalty Conditions: In v1, validator misconduct affected both the validator and liquidity providers who delegated $BGT to them, resulting in slashing of their $BGT. In v2, penalties now only reduce the validator’s staked $BERA, separating the roles of $BGT and $BERA in the PoL ecosystem and strengthening validator accountability.

Block Creation Rights Criteria: In v1, a validator’s chance to create new blocks depended on the amount of $BGT delegated to them. In v2, delegation amount no longer affects block creation chances—each validator has equal opportunity. However, block rewards still scale with the amount of $BGT delegated.

Increased Validator Cap: To enhance decentralization and security, Berachain removed the previous limit of 100 validators. As of July 16, 150 validators are actively participating in network validation.

The table below summarizes changes from the Artio testnet to the bArtio testnet (note: conditions may change before mainnet launch).

Following tests of the PoL mechanism on the Artio testnet, the bArtio testnet is currently fine-tuning PoL details and parameters in preparation for mainnet launch.

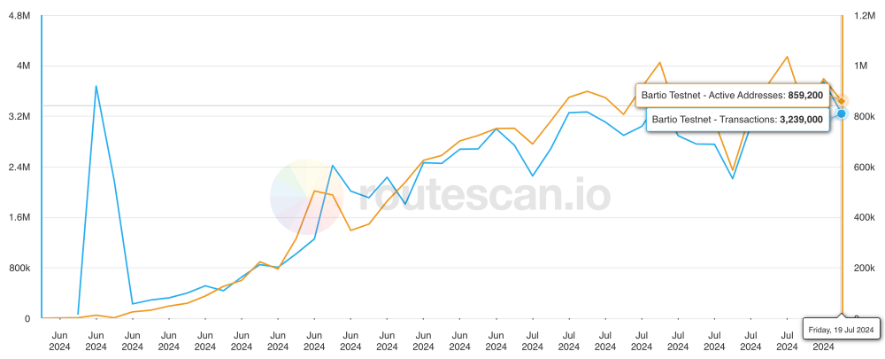

Since its launch, the bArtio testnet has seen gradually increasing daily transaction volume, currently averaging around 3.2 million transactions and 860,000 active wallets. Over 150 projects are preparing to build new protocols on Berachain, aiming to leverage its EVM compatibility, scalability, and PoL mechanism.

Berachain Daily Active Wallets and Transaction Volume, Source: Beratrails

4. Exploring the Berachain Ecosystem

In typical L1 networks, foundations typically issue tokens and allocate portions to the ecosystem for development grants, hackathons, and other initiatives to foster ecosystem growth.

The Berachain team does operate a program called “Build-a-Bera,” but it only provides seed investments and mentorship using Berachain’s internal funds—without distributing Berachain tokens through grants or hackathons.

Berachain co-founder Smokey The Bera has even publicly criticized the grant systems of other networks. The reason Berachain can take this stance is that its PoL consensus mechanism inherently supports ecosystem projects by distributing $BGT to users who contribute liquidity to pools.

Compared to traditional ecosystem incubation programs, Berachain doesn't directly provide assets to protocol teams. Instead, the network participants’ “consensus” guides liquidity toward protocols—a healthier model for ecosystem growth.

Due to the incentive structure of the PoL system, communication and alignment among validators, protocols, and liquidity providers are crucial for ecosystem growth. Even though Berachain is still in testnet phase, this has already led to numerous collaborations, with some protocols attempting to play multiple roles—including running their own validator nodes.

Next, let’s explore some protocols within the Berachain ecosystem.

4.1. Native dApps

Berachain’s native dApps are developed by the core team to serve as foundational infrastructure for essential ecosystem functions. Currently, three native dApps are live on the testnet: BEX, Bend, and Berps.

- BEX: A decentralized exchange enabling users to trade peer-to-peer or create custom trading pools.

- Bend: A decentralized lending protocol allowing users to borrow $HONEY using various assets as collateral or earn interest by supplying $HONEY liquidity.

- Berps: A decentralized perpetual futures exchange allowing users to open leveraged positions using $HONEY as collateral or earn trading fees by depositing $HONEY to provide liquidity for position payouts.

Before third-party protocols launch, these native dApps will provide essential DeFi functionality to users in the nascent Berachain ecosystem. They also act as channels for distributing $BGT to liquidity providers entering the ecosystem. On the current bArtio testnet, eligible $BGT-rewarded pools are exclusively those operated by native dApps.

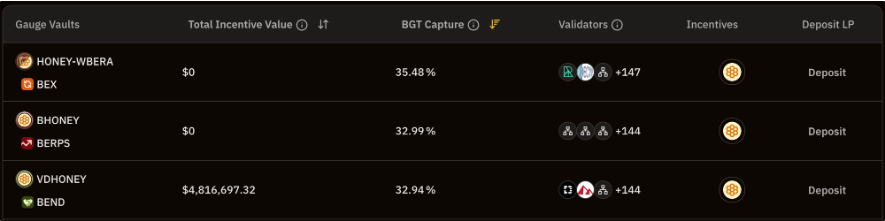

Berachain Treasury Gauge, Source: BGT Station

By using $HONEY as the primary collateral asset, native dApps further strengthen Berachain’s tri-token economic model, expand its utility, and distribute protocol-generated revenue to $BGT holders.

Additionally, this economic model acts as a catalyst for ecosystem diversification, encouraging developers on Berachain to creatively leverage the PoL mechanism beyond basic infrastructure.

4.2. How DeFi Protocols Leverage PoL

DeFi protocols on other networks typically attract liquidity by offering additional rewards to liquidity providers, then use that liquidity to drive user traffic and generate protocol revenue.

However, DeFi protocols on Berachain focus not on rewarding liquidity providers directly, but on incentivizing validators to create the following flywheel:

- Protocols distribute rewards to validators who vote for their pools, encouraging users to delegate $BGT to those validators.

- Users continue delegating $BGT to rewarded validators to maximize earnings. As total $BGT delegation increases, validators gain more voting power, boosting $BGT rewards for their supported liquidity pools.

- To earn these increased $BGT rewards, users bring in more external liquidity, increasing protocol traffic and revenue.

- Repeat steps 1–3.

Within this flywheel, we observe protocols enhancing user convenience and added value through negotiations involving protocol revenues and future benefits. Some protocols aggregate fragmented liquidity to strengthen their position and increase returns.

4.2.1. Kodiak

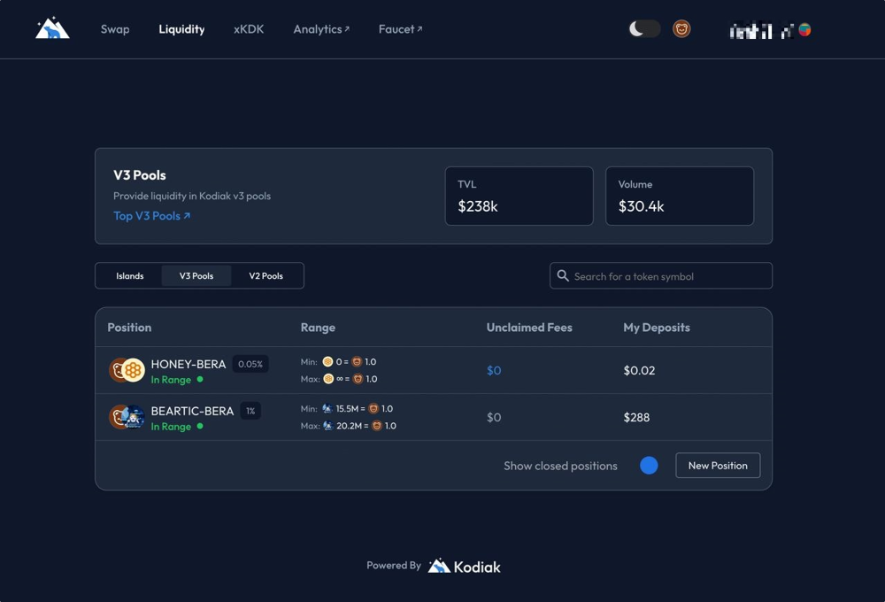

Kodiak is a DEX offering concentrated liquidity (Concentrated Liquidity AMM, CLAMM) for pools like Uniswap v3, allowing users to concentrate their liquidity in specific price ranges for more efficient $BGT farming compared to BEX.

Kodiak V3, Source: Kodiak

Kodiak has two tokens: $KDK and $xKDK, exchangeable within the protocol:

- $KDK: Reward token distributed to liquidity providers and traders.

- $xKDK: Kodiak’s governance and non-transferable token. Holders receive protocol revenue, including trading fees and rewards submitted by other protocols.

While concentrated liquidity enables higher capital efficiency in $BGT farming, if prices move outside the specified range, liquidity becomes inactive and earns neither $BGT nor trading fees. Sustained rewards thus require constant range management.

To address this, Kodiak introduced the Kodiak Islands vault feature, which automatically adjusts liquidity ranges based on market conditions. This solves the burden of manual range management and prevents idle liquidity caused by range deviation, ensuring robust trading liquidity on Berachain. During automatic adjustments, Kodiak integrates with BEX, establishing a complementary relationship with native dApps.

Currently, Kodiak operates a validator node on the bArtio testnet, suggesting potential future integration with the validation mechanism. Its future evolution will be worth watching.

4.2.2. Infrared

Infrared is a liquid staking protocol in the Berachain ecosystem. It operates vaults to provide liquidity on behalf of users, and delegates the $BGT generated from user-deposited liquidity to its own validator node. Users receive $iBGT, a liquid version of $BGT, and governance token $IRED.

- $iBGT: A liquid token representing $BGT. Users can deploy $iBGT in other DeFi protocols to earn additional yields.

- $IRED: Infrared’s governance token, granting control over the validator’s $BGT voting power and entitlement to protocol revenue.

Infrared ensures $BGT retains both key utilities—conversion to $BERA and voting power—to attract substantial $BGT accumulation. The more $BGT Infrared gathers, the more influential $IRED becomes in determining $BGT voting outcomes. This sets the stage for future protocols to treat $IRED as a proxy for $BGT.

Kodiak exemplifies this trend and is currently collaborating with Infrared, planning to launch a Kodiak vault on Infrared, allowing Kodiak’s liquidity providers to earn $IRED.

Infrared X Kodiak Flywheel, Source: Kodiak Blog

Other DeFi protocols such as Gummi and BeraBorrow will accept $iBGT as collateral, indicating the emergence of a sub-ecosystem centered around Infrared.

Beyond $BGT liquid staking, Infrared recently introduced liquid staking for $BERA, positioning itself as a comprehensive liquid staking solution within the Berachain ecosystem.

4.3. Community Approaches to Leveraging PoL

DeFi protocols on Berachain are attempting to resolve internal liquidity wars through quantifiable incentives, offering users improved convenience and capital efficiency.

We also observe participants in the PoL ecosystem first building communities through NFTs and memes, gaining visibility and reputation before monetizing their influence.

While this qualitative approach may be less efficient than DeFi protocols' methods in terms of direct incentives, such community-driven strategies may increasingly be needed to counteract complexity and entry barriers created by proliferating derivative protocols, especially for new users.

Moreover, considering Berachain’s origins in an NFT project and its deeply devoted community, this strategy may be particularly “Berachain” in spirit.

4.3.1. The Honey Jar

The Honey Jar is a community that emerged in 2022 around the Honeycomb NFT, built on the principle of creating a community-driven flywheel to connect real-world activities and generate hard-to-displace “sticky liquidity.”

Similar to Berachain’s own development path, the Honey Jar community has expanded by issuing and airdropping a series of derivative NFTs to holders. Through continued growth, Honey Jar has begun partnering with various projects on Berachain to offer exclusive benefits to NFT holders.

In recent years, Honey Jar has produced educational content about Berachain and offers services such as testnet faucets for new users. It has also incubated community-based initiatives like S&P (Standard & Paws), a community ratings service, and Bera Infinity, which values and rewards contributions within the Berachain ecosystem—proving Honey Jar is more than just a community, but a full-fledged Berachain ecosystem startup studio.

Honey Jar also operates a validator node within the Berachain ecosystem. Due to its extensive activities and services, Honey Jar became the validator with the highest amount of $BGT delegated by July 2023.

Validator $BGT Delegation Rankings, Source: BGT Station

Recently, Honey Jar has been preparing for post-mainnet liquidity battles, negotiating rewards and liquidity partnerships with upcoming Berachain protocols. It has also established a DAO to distribute earned rewards to Honeycomb NFT holders.

5. Conclusion

Starting from an NFT project, Berachain has cultivated a loyal community and, through its PoL consensus mechanism, tightly aligned the interests of validators, liquidity providers, and protocols.

We also see numerous DeFi protocols building novel models atop Berachain’s consensus, while community-driven projects carve out their space in the ecosystem.

Although Berachain’s PoL mechanism aims to establish a sustainable ecosystem flywheel, this flywheel could potentially spiral into a negative feedback loop. Ensuring Berachain’s long-term sustainability faces several challenges:

$BGT Inflation: With continuous $BGT inflation, external inflows of liquidity may only sustain limited demand for $BGT. Long-term, $BERA burn rates must increase—but given PoL’s focus on liquidity, actual network usage might remain low.

Risk of Centralization: As the ecosystem matures, powerful cartels may form around dominant validators, protocols, and liquidity whales. If the ecosystem revolves solely around these groups, new protocols may struggle to enter, discouraging innovation and new user participation.

To overcome these challenges, protocols that attract new users and drive active trading must emerge, and ecosystem participants must collectively ensure positive-impact protocols receive adequate liquidity support.

Berachain’s attempt to integrate liquidity and security into its incentive design could have profound implications for the broader blockchain industry. As it remains in the testnet phase, how it navigates these challenges will be a fascinating journey to follow.

Disclaimer: The content of this report reflects the views of the respective authors, is for informational purposes only, and does not constitute advice to buy or sell tokens or use any protocol. Nothing in this report constitutes financial advice, nor should it be interpreted as such.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News