The listing of spot Ethereum ETFs in the U.S. holds greater long-term significance than short-term impact

TechFlow Selected TechFlow Selected

The listing of spot Ethereum ETFs in the U.S. holds greater long-term significance than short-term impact

This article will analyze the impact of the Ethereum spot ETF listing on the balance between short-term buyers and sellers of Ethereum tokens, as well as its long-term effects on the crypto ecosystem.

Author: SoSoValue Research

On July 23, 2024, U.S.-listed spot Ethereum ETFs officially began trading—exactly ten years after Ethereum's initial coin offering (ICO) on July 22, 2014. Whether this date was intentionally chosen or merely coincidental, the launch of Ethereum ETFs holds epic significance for the sustainable development of the broader crypto ecosystem. It marks a critical step for Proof-of-Stake (PoS) blockchains entering mainstream finance, attracting more builders across dimensions and scale to the Ethereum ecosystem, and paving the way for other foundational crypto infrastructures like Solana to enter the traditional financial world. This event carries substantial weight in advancing blockchain adoption among the general public.

On the other hand, since current U.S. regulations do not allow staking for Ethereum ETFs, investors holding ETFs will forgo 3%-5% in staking yield—the risk-free rate within the Ethereum ecosystem—compared to directly holding ETH tokens. Additionally, retail investors generally find Ethereum more complex to understand than Bitcoin. As a result, the short-term impact of U.S. spot Ethereum ETFs on ETH’s price may be less pronounced than the effect seen when Bitcoin spot ETFs were approved. Instead, the primary near-term impact is likely to be increased relative price stability and reduced volatility for Ethereum.

The following analysis examines the short-term impact of spot Ethereum ETFs on the supply and demand dynamics of ETH, as well as their long-term implications for the broader crypto ecosystem.

I. Short-Term Outlook: Weaker Buyer and Seller Forces Than Bitcoin ETFs; Ethereum ETF Impact Likely Smaller

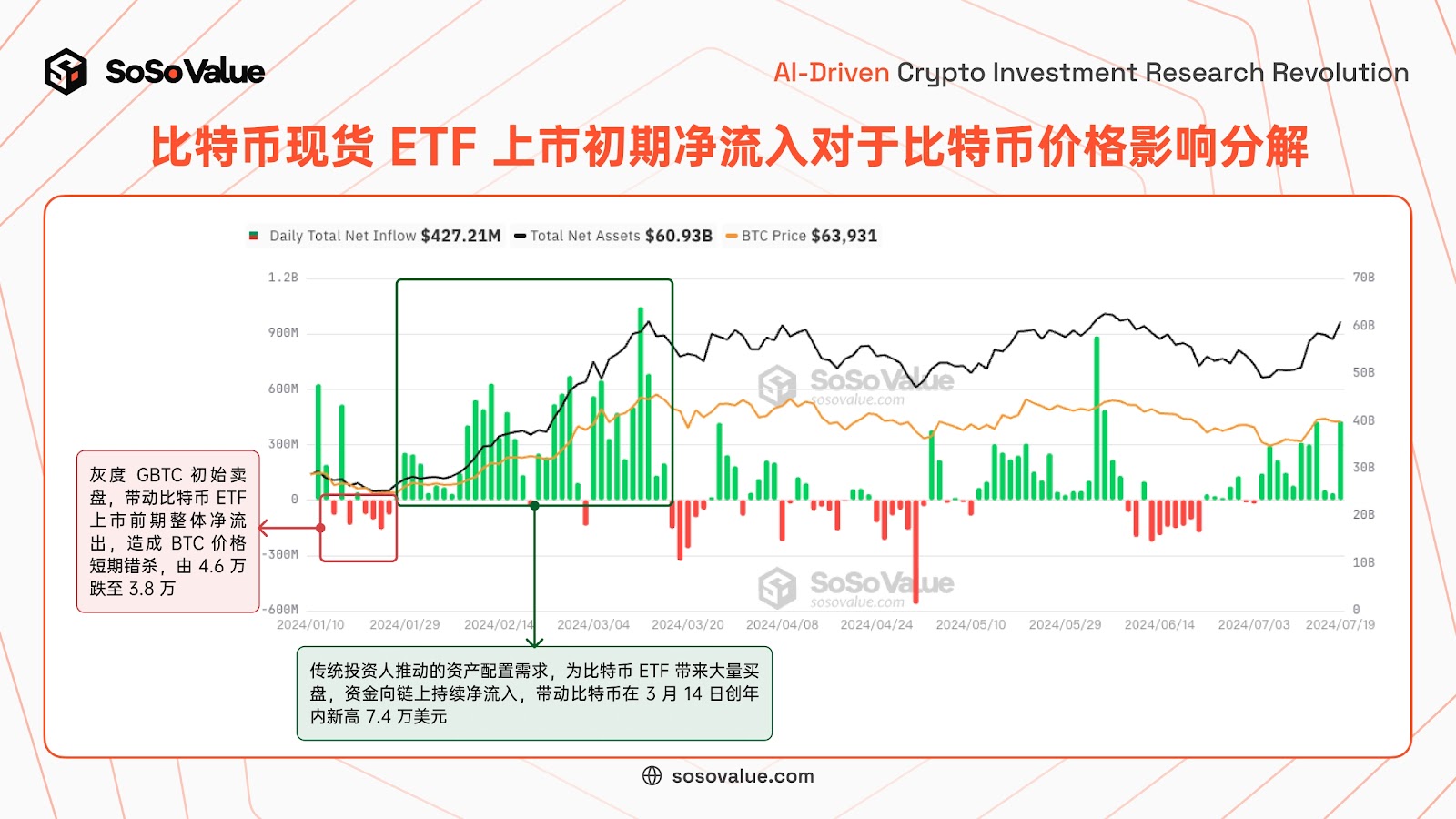

Based on SoSoValue’s ongoing tracking of Bitcoin spot ETFs, the most significant factor influencing cryptocurrency prices is daily net inflows—the actual new buy/sell pressure introduced into the crypto market through cash creations and redemptions of ETF shares (see Figure 1), which affects supply-demand balance and thus price. According to S-1 filings, U.S. spot Ethereum ETFs operate under the same cash-only creation/redemption mechanism as Bitcoin spot ETFs, making daily net inflows the key metric to watch. However, two main differences exist:

-

Sell side: The "migration effect" from Grayscale Ethereum Trust (ticker: ETHE), driven by its over 10x higher management fee compared to competitors, continues to generate selling pressure. Markets are also prepared for potential outflows from Grayscale ETHE, having already experienced the negative spillover from GBTC redemptions impacting Bitcoin. Unlike Bitcoin, however, during the conversion of Grayscale’s Ethereum Trust into an ETF, 10% of its net assets were spun off into a lower-fee Grayscale Ethereum Mini Trust (ticker: ETH). This structural change may slightly reduce overall sell-side pressure.

-

Buy side: Because Ethereum ETFs are not permitted to participate in staking under current regulations, investors earn 3%-5% less yield compared to holding ETH directly—the so-called risk-free return in Ethereum’s economy. Moreover, retail investors’ understanding of Ethereum lags behind Bitcoin. When allocating to crypto, most investors still prefer Bitcoin ETFs due to Bitcoin’s clear scarcity model capped at 21 million coins.

Figure 1: Decomposition of early net outflows from spot Ethereum ETF listing on Bitcoin price (Data source: SoSoValue)

1. Sell Side: $9.2B Grayscale ETHE Faces 10x Fee Gap, Leading to Early Migration Selling, But Less Severe Than GBTC Outflows

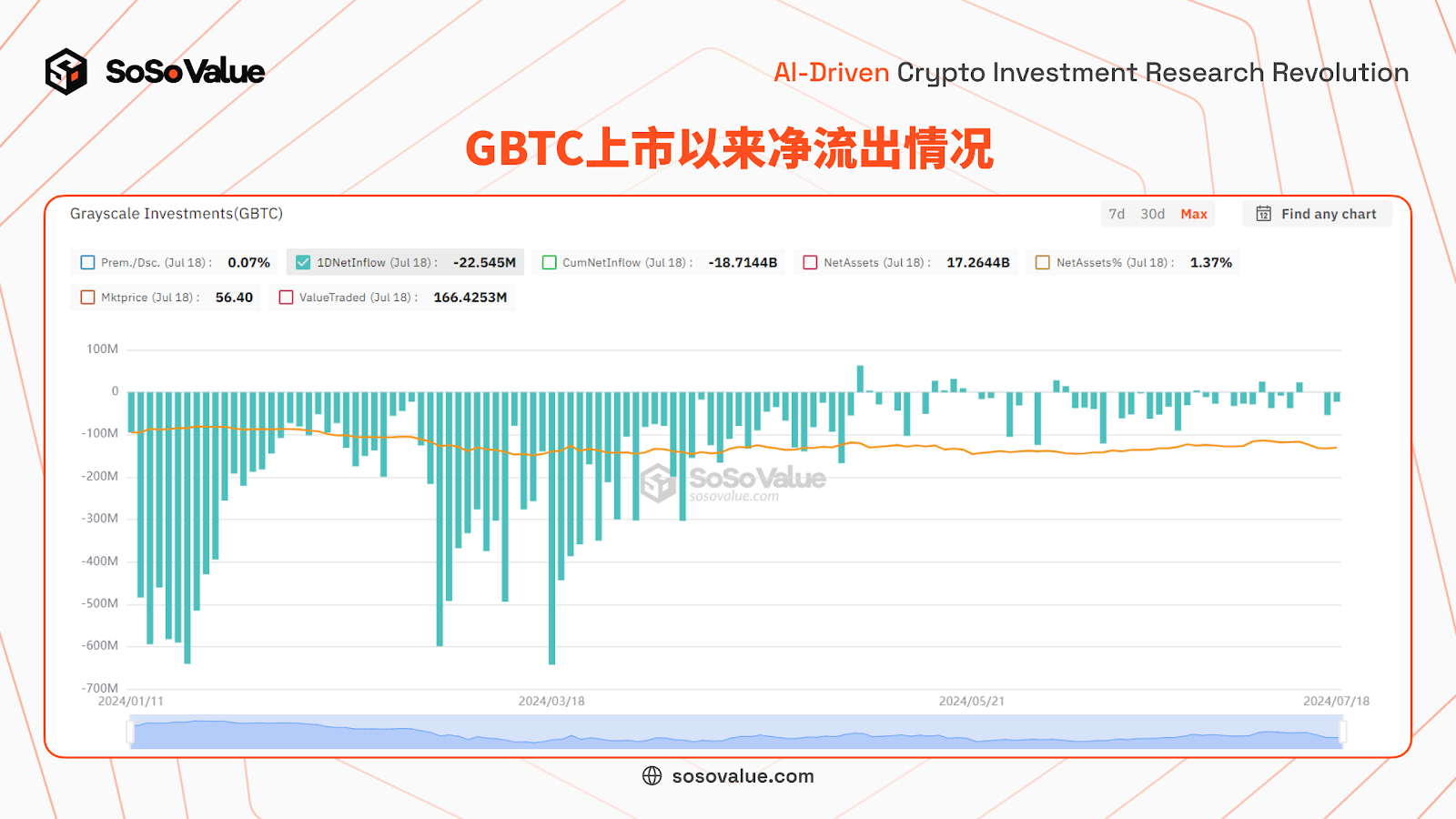

Looking back at the initial large-scale outflows from Grayscale Bitcoin Trust (GBTC), two key reasons emerge: first, its significantly higher management fee incentivized a “migration effect,” where investors redeemed shares from the 1.5% fee GBTC and moved into competing ETFs charging around 0.2%; second, arbitrageurs who had previously bought GBTC at a discount sold their positions for profit once the ETF launched and the discount narrowed. At the beginning of the year, GBTC (with $28.4 billion in AUM) experienced sustained massive outflows immediately after transitioning to an ETF. Two core factors drove this: one, GBTC’s 1.5% management fee was about six times that of competitors, prompting long-term BTC holders to move their holdings elsewhere; two, prior to conversion, GBTC traded at a persistent ~20% discount, encouraging traders to buy discounted GBTC shares and hedge by shorting BTC externally to capture the spread. Once the ETF launched and the discount disappeared, these arbitrageurs exited their positions, adding further downward pressure. According to SoSoValue data, GBTC saw continuous outflows from January 11 to May 2, after which the pace slowed, with its BTC holdings dropping by 53% during that period.

Figure 2: GBTC Net Outflow Since Launch (Data source: SoSoValue)

Unlike GBTC’s direct conversion, Grayscale simultaneously split off 10% of its Ethereum Trust’s net assets into a low-fee Ethereum Mini ETF (ticker: ETH) during the ETF transition process. Thus, Grayscale now offers two Ethereum ETFs with fees of 2.5% and 0.15%, respectively, somewhat alleviating the outflow pressure caused by high fees. According to S-1 filings, Grayscale Ethereum Trust (ETHE) transferred approximately 10% of its ETH holdings to the new Grayscale Ethereum Mini Trust (ETH) as seed capital. Afterward, both ETFs operate independently. For existing ETHE shareholders, each share held on July 23 automatically received one share of the mini-trust ETH, while the NAV of ETHE was adjusted to 90% of its previous value. Given that ETHE charges a 2.5% management fee while the mini-trust ETH charges only 0.15% (with a promotional waiver for the first $2B in assets for six months), 10% of existing investors’ exposure is now in a lower-cost vehicle. Considering that roughly 50% of GBTC’s assets eventually migrated out, the spin-off of the low-fee ETH mini-trust and its early-bird fee incentives are expected to moderate short-term capital outflows from ETHE.

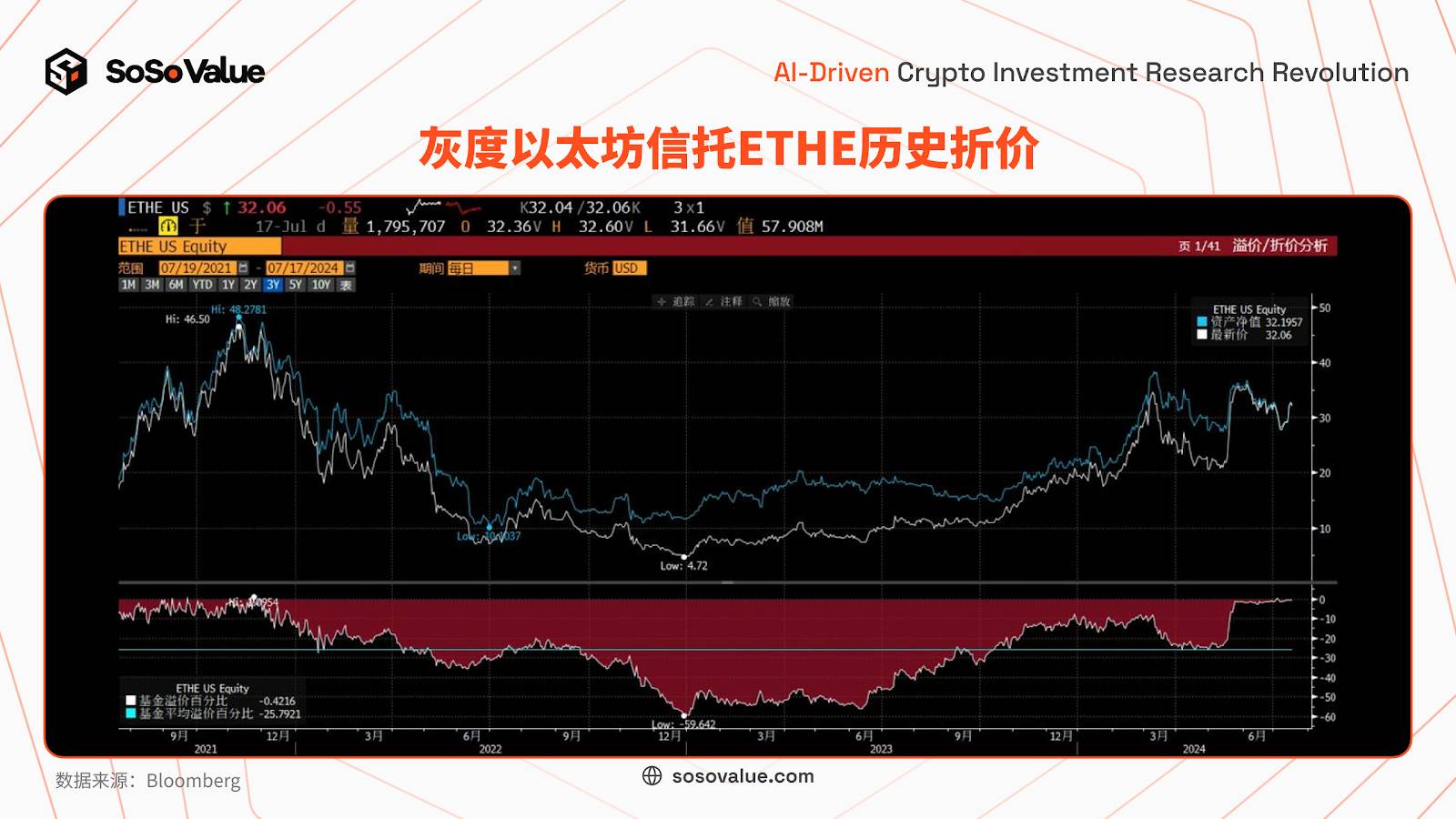

Additionally, because ETHE’s discount converged earlier, the unwind of discount arbitrage positions is expected to exert less selling pressure than seen with GBTC. ETHE had previously traded at steep discounts—up to 60% at the end of 2022 and above 20% in April–May 2024—but began narrowing in late May, reaching 1%-2% by June and below 1% by July. In contrast, GBTC still traded at a 6.5% discount just two days before its ETF conversion (January 9). Therefore, the incentive for arbitrageurs to exit ETHE positions is significantly lower.

Figure 3: Comparison of Ethereum Spot ETF Fees (Data source: S-1 Filings)

Figure 4: Historical Discount of Grayscale Ethereum Trust (ETHE) (Data source: Bloomberg)

2. Buy Side From Public Markets: Retail Consensus on Ethereum Is Much Weaker Than Bitcoin; Asset Allocation Demand Lower Than BTC ETF

For retail investors, Bitcoin’s narrative is simple and widely accepted: digital gold with clear scarcity—only 21 million coins ever. This fits neatly into traditional investment frameworks. In contrast, Ethereum, as the leading Layer 1 blockchain, has a more complex mining mechanism and its development depends on multiple ecosystem forces. Most importantly, its token supply is harder to grasp: it involves dynamic inflation and deflation mechanisms influenced by staking rewards (inflationary) and transaction fee burning (deflationary), creating a complex, evolving supply model. Currently, ETH supply stands at around 120 million, with a recent annualized inflation rate between 0.6% and 0.8%. Furthermore, from a fundamental standpoint, Ethereum faces strong competition from other Layer 1 chains, and there is no clear consensus among retail investors about a winner-takes-all outcome. While alternative ecosystems like Solana and Ton are known to the public, assessing their competitive edge remains highly technical and inaccessible to average investors. Therefore, if investors want exposure to crypto, they are more likely to start with Bitcoin ETFs, which offer clear scarcity and minimal perceived competition.

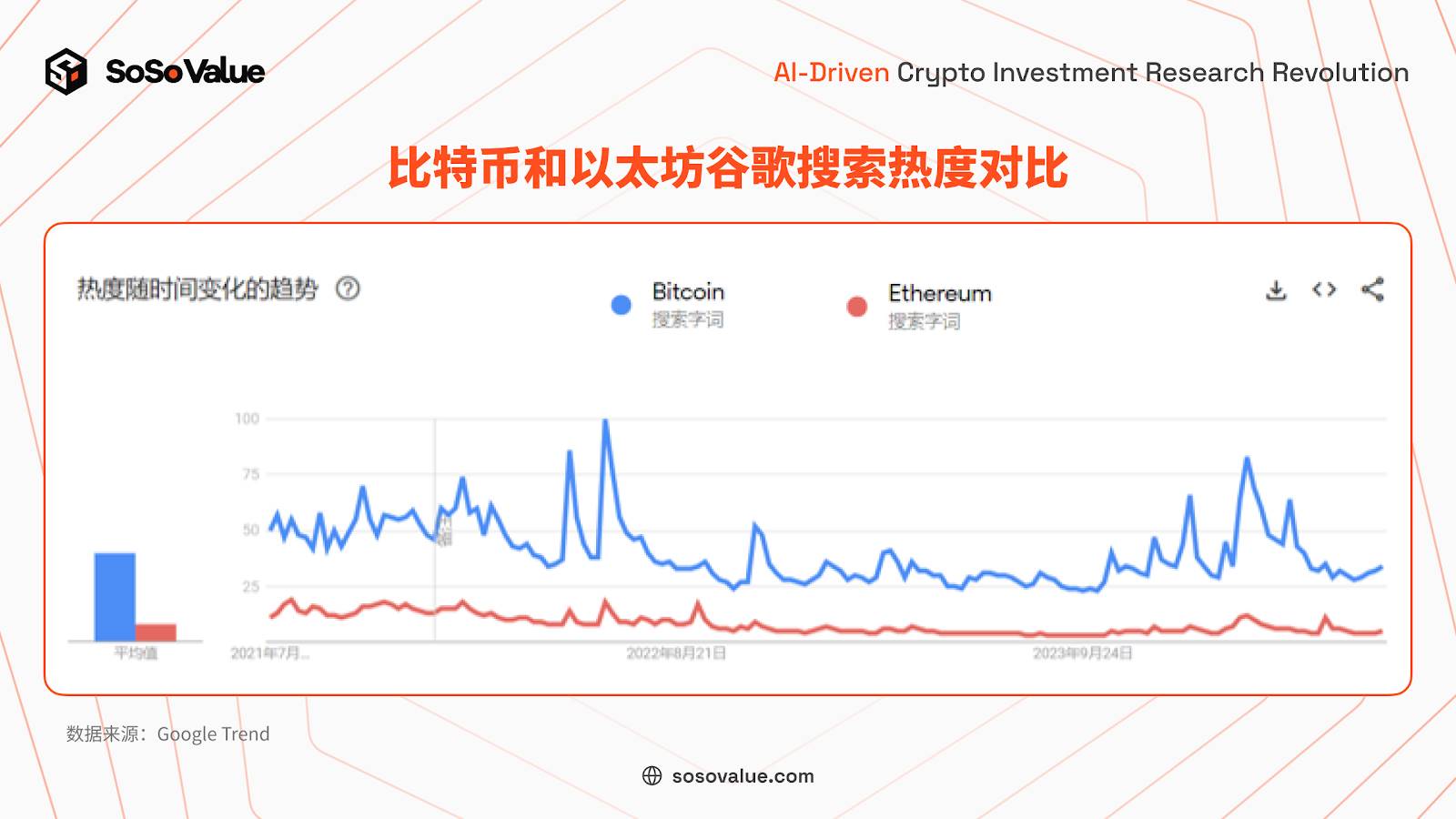

Public data also reflects a stark difference in interest between Ethereum and Bitcoin ETFs. Google search trends show Ethereum interest is only about 1/5 that of Bitcoin (see Figure 5). Looking at seed funding for the ETF launches (typically provided by fund managers or underwriters), Fidelity allocated only 1/4 of the seed capital to its Ethereum ETF (FETH) compared to its Bitcoin ETF (FBTC). Other issuers like VanEck and Invesco also showed significant disparities (see Figure 6).

Figure 5: Google Search Interest Comparison Between Bitcoin and Ethereum (Data source: Google Trends)

Figure 6: Seed Funding Size Comparison Between Ethereum and Bitcoin ETFs From Same Issuers (Data source: S-1 Filings)

3. Buy Side From Crypto Natives: Lack of 3%-5% On-Chain Staking Yield Makes Demand Essentially Nonexistent

Crypto-native investors contributed partially to Bitcoin ETF demand, primarily for real-world asset verification purposes. Holding a Bitcoin ETF allows crypto investors to prove asset ownership in traditional finance with only a 0.2%-0.25% annual fee, facilitating integration into conventional economic life—balancing portfolios, accessing leverage, borrowing against holdings, or building structured products. This is particularly attractive to high-net-worth individuals in the crypto space. Since Bitcoin uses Proof-of-Work (PoW), there is no staking yield, and given typical fiat-crypto on/off-ramp costs (~0.2%-2%), the cost of holding a Bitcoin ETF versus holding BTC directly is relatively small.

However, for Ethereum spot ETFs, regulatory restrictions prevent access to staking yields. For crypto investors, holding an ETF means forgoing 3%-5% in annual risk-free returns. Ethereum operates on a Proof-of-Stake (PoS) model, where validators stake ETH to secure the network and earn block rewards—commonly referred to as PoS staking yield. This yield, derived from protocol-level incentives, is considered the foundational risk-free rate in the Ethereum ecosystem. Recent staking yields have remained above 3%. Therefore, using an ETF to gain ETH exposure results in at least a 3% lower annual return compared to holding ETH directly. Consequently, demand from high-net-worth crypto investors for spot Ethereum ETFs can be effectively ignored.

Figure 7: Ethereum Staking Yield Since Transition to PoS (Data source: The Staking Explorer)

Figure 7: Ethereum Staking Yield Since Transition to PoS (Data source: The Staking Explorer)

II. Long-Term Outlook: Ethereum ETF Paves the Way for Other Crypto Assets to Enter the Mainstream

As the largest blockchain by ecosystem size, the approval of a spot Ethereum ETF represents a major milestone in integrating public blockchains into mainstream finance. Reviewing SEC criteria for approving crypto ETFs, Ethereum meets key standards in anti-manipulation safeguards, liquidity, and pricing transparency. This sets a precedent for additional qualified crypto assets to gradually gain ETF approval and enter the radar of mainstream investors.

-

Anti-manipulation: First, Ethereum’s node distribution is sufficiently decentralized, with over 4,000 nodes globally, preventing any single entity from controlling the network. Additionally, spot Ethereum ETFs do not participate in staking, reducing risks of centralization via staking concentration. Second, Ethereum’s financial infrastructure is mature, especially with CME Group offering liquid futures contracts, providing investors with hedging tools and enhancing price predictability, thereby lowering manipulation risks.

-

Liquidity & Pricing Transparency: Ethereum has a market cap of ~$420 billion—ranking within the top 20 U.S. equities by market cap—and sees ~$18 billion in daily trading volume across nearly 200 exchanges, ensuring deep liquidity and fair, transparent pricing.

By comparison, other Layer 1 blockchains like Solana also meet many of these criteria to some extent (see Figure 8). VanEck and 21Shares have already filed applications for Solana spot ETFs. As traditional financial instruments such as crypto futures continue to expand, more crypto asset ETFs are expected to gain approval, further embedding digital assets into traditional investor portfolios and accelerating institutional adoption.

Figure 8: Core Metrics Comparison of Representative Layer 1 Blockchains (Data source: Public Data Compilation)

Figure 8: Core Metrics Comparison of Representative Layer 1 Blockchains (Data source: Public Data Compilation)

In summary, given weaker buyer and seller dynamics for Ethereum ETFs compared to Bitcoin ETFs, market preparedness for ETHE outflows following the GBTC experience, and the fact that six months have passed since Bitcoin ETFs launched—allowing time for the Ethereum ETF approval news to be priced in—the short-term impact on ETH’s price is likely to be smaller than that of Bitcoin ETFs, with potentially lower volatility. If initial outflows from Grayscale lead to another mispricing event, it could present a favorable entry opportunity.

Investors can monitor developments via SoSoValue’s dedicated U.S. Ethereum Spot ETF Dashboard.

In the long term, the crypto ecosystem and traditional finance are moving from parallel development toward convergence—a process that will involve a prolonged period of mutual understanding. The gap in perception between traditional and crypto-native participants may become the core driver of crypto price fluctuations and investment opportunities over the next 1–2 years. Historically, the integration of emerging assets into mainstream finance has always involved divergent views generating trades, significant volatility, and recurring investment opportunities—making this transition highly promising.

The approval of Ethereum ETFs further opens the door for crypto-native applications to be included in mainstream asset allocations. It is foreseeable that other user-rich, ecosystem-strong infrastructures like Solana will gradually follow into the mainstream. Simultaneously, as the crypto world enters traditional finance, the reverse flow—mainstream assets entering crypto—is also quietly progressing. Traditional financial assets, such as U.S. Treasuries, are increasingly being tokenized via RWA (Real World Assets) and brought on-chain, enabling more efficient global capital flows.

If Bitcoin ETFs opened the door to a new era of fusion between crypto and traditional finance, Ethereum ETFs represent the first step through that doorway.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News