Pump.fun Protocol Insights: From Bonding Curve Calculations to Profit Strategy Construction

TechFlow Selected TechFlow Selected

Pump.fun Protocol Insights: From Bonding Curve Calculations to Profit Strategy Construction

Pump.fun, the Memecoin issuance platform on Solana, surpassed Uniswap Labs in monthly revenue, becoming the fourth-largest protocol across all blockchain networks.

Author: @malloyberac3

Introduction

Bitcoin established the value foundation of cryptocurrencies through its non-inflationary supply; Ethereum triggered the ICO boom via smart contracts; inscriptions and memecoins attracted massive capital due to fair distribution. The continuous emergence of new technologies has expanded the audience for crypto applications, while differences in emerging token issuance mechanisms further reflect shifts in investor values.

Unlike legacy memecoins such as $DOGE, $SHIB, and $FLOKI that attempt to integrate practical use cases, since early this year the memecoin market—led by $BOME and $SLERF—has exhibited a new landscape. From issuance to trading, numerous innovative applications have emerged across the upstream, midstream, and downstream of the memecoin ecosystem.

PUMP.FUN is a decentralized memecoin launchpad that enables users to instantly launch their own memecoin at extremely low cost (0.02 SOL) simply by providing creativity. Users can also participate in tokens launched by others, witnessing the journey of a memecoin from inception to widespread popularity.

As a breakout application in this sector, PUMP.FUN holds significant research value and warrants ongoing discussion. The PUMP.FUN Dune dashboard offers insights into behavioral patterns, user activity, growth trends, and other aspects of this evolving ecosystem, making it worthy of long-term tracking.

1. Introduction to PUMP.FUN

1.1 A Comparison

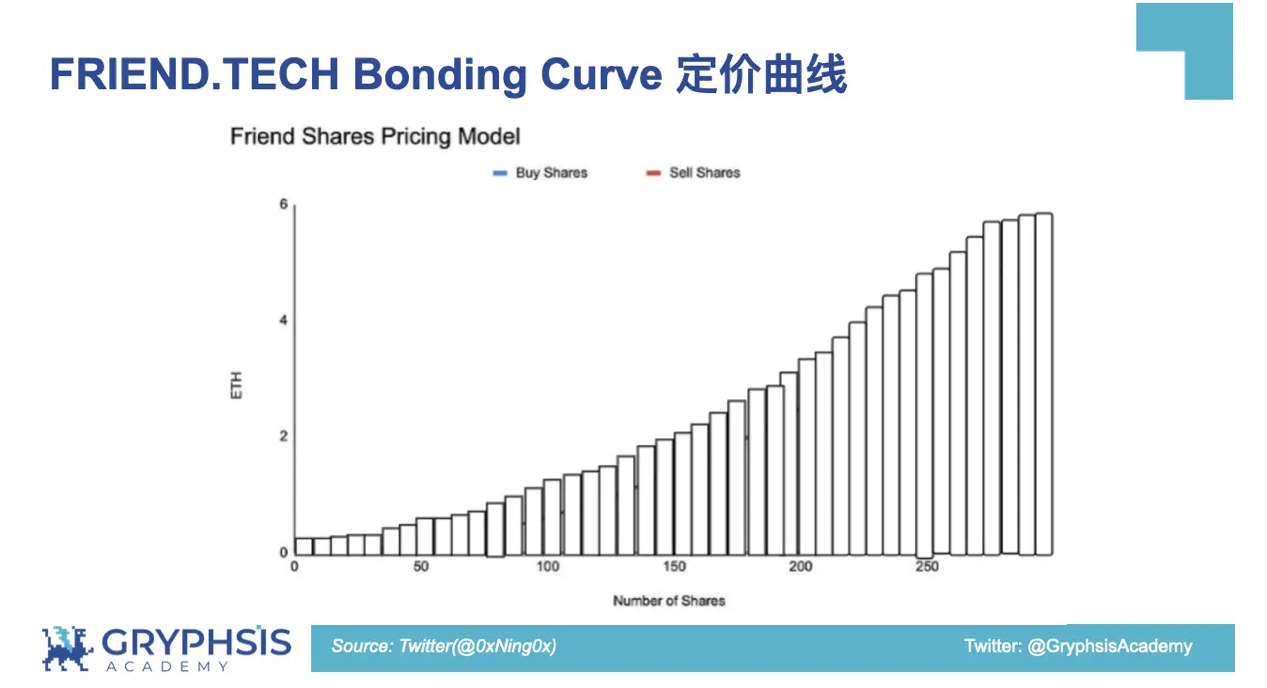

Let’s begin with a comparison. In the author’s view, PUMP.FUN resembles FRIEND.TECH, which launched last year, in terms of market performance: both initially gained traction within niche on-chain degens circles before going mainstream, after which platform and sector data spiraled upward. Both quickly captured dominant market share as industry pioneers, experiencing daily increases in real users and protocol revenue, while FUD common in the crypto world had almost no impact on their ecosystem standing.

From a product design perspective, the two platforms are similar yet differ in key ways. Both utilize the PAMM (Primary Automated Market Makers) mechanism to facilitate user convenience, but differ in asset types and specific pricing curves. Taking PUMP.FUN as an example (similarly applicable to FRIEND.TECH), PAMM consists of two mechanisms: Fund-to-Mint and Burn-to-Withdraw. The former allows users to deposit $SOL into the PAMM smart contract pool, which then mints an appropriate amount of memecoin based on the current bonding curve price and sends it to the user. The latter allows users to exit by selling their memecoins back to the PAMM smart contract. Unlike the memecoins on PUMP.FUN, FRIEND.TECH tokens have integer minting and theoretically “infinite supply” characteristics (tied to social relationship building). Moreover, FRIEND.TECH assets represent tokens tied to user social accounts, whereas PUMP.FUN hosts user-issued memecoins.

The two projects adopted very different market entry and follow-up strategies. FRIEND.TECH was backed by top-tier crypto firm Paradigm, whose portfolio includes NFT marketplace Blur and Ethereum Layer 2 network Blast—both of which used Pointsfi incentive models later replicated to help FRIEND.TECH retain users. The launch of FRIEND.TECH V2, complete with token airdrops and Club Key mechanics, sparked renewed market speculation. In contrast, PUMP.FUN adheres strictly to the ethos of democratized, fairly launched memecoins. Its funding background is obscure, and despite earning hundreds of thousands of dollars daily, it has not announced any plans for a native token, quietly expanding platform functionality instead. For deeper analysis of FRIEND.TECH, see the previous session: Friend Tech — Gryphsis Academy Session

1.2 PUMP.FUN Bonding Curve and Product

Since the project's smart contracts are not open-sourced, PUMP.FUN has only disclosed gameplay and fees, remaining silent on technical details and underlying mechanisms. This necessitates constructing a product model and validating it against data. Below is an analysis of the PUMP.FUN bonding curve:

(1) Product Model Construction

Compared to other sector tokens, memecoins are designed around community consensus and collective trading sentiment. They typically feature large total supplies and full circulation, enabling diverse promotional strategies. Initial prices are kept low, with steep early price curves causing sharp volatility to attract capital inflows.

PUMP.FUN product flow:

-

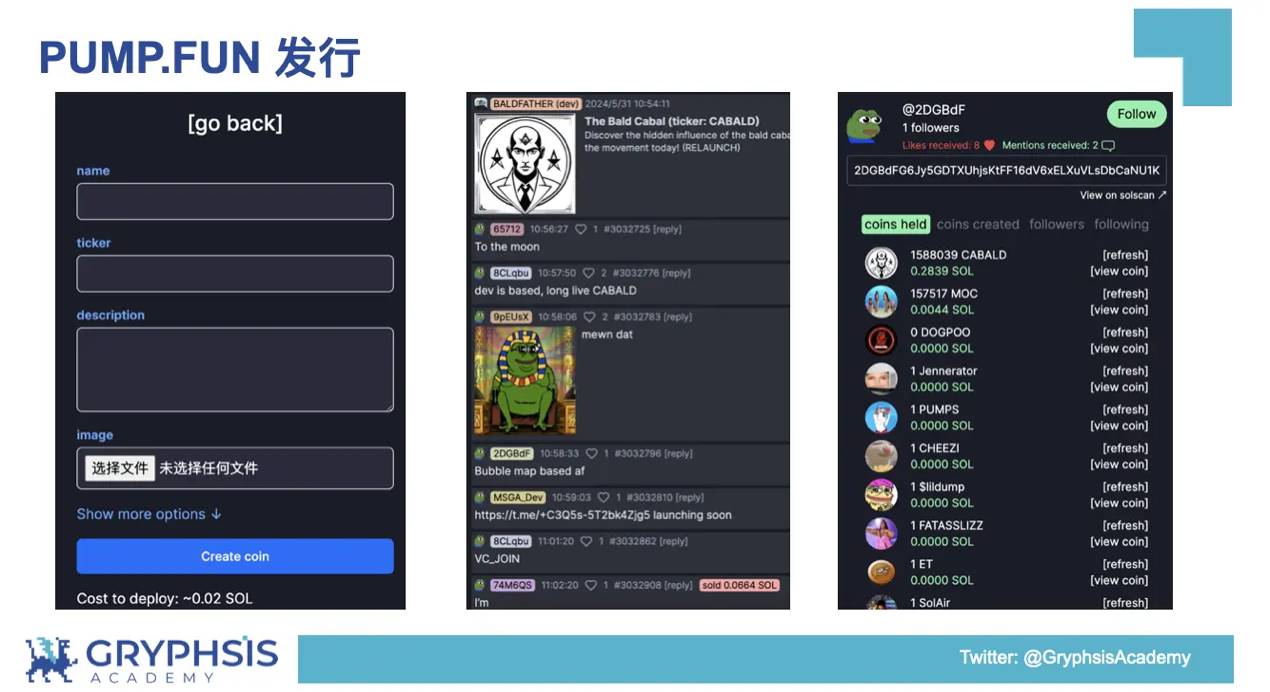

A user comes up with a creative idea and selects a ticker on PUMP.FUN to instantly launch a new memecoin.

-

Other users continuously buy and sell the memecoin along the pricing curve.

-

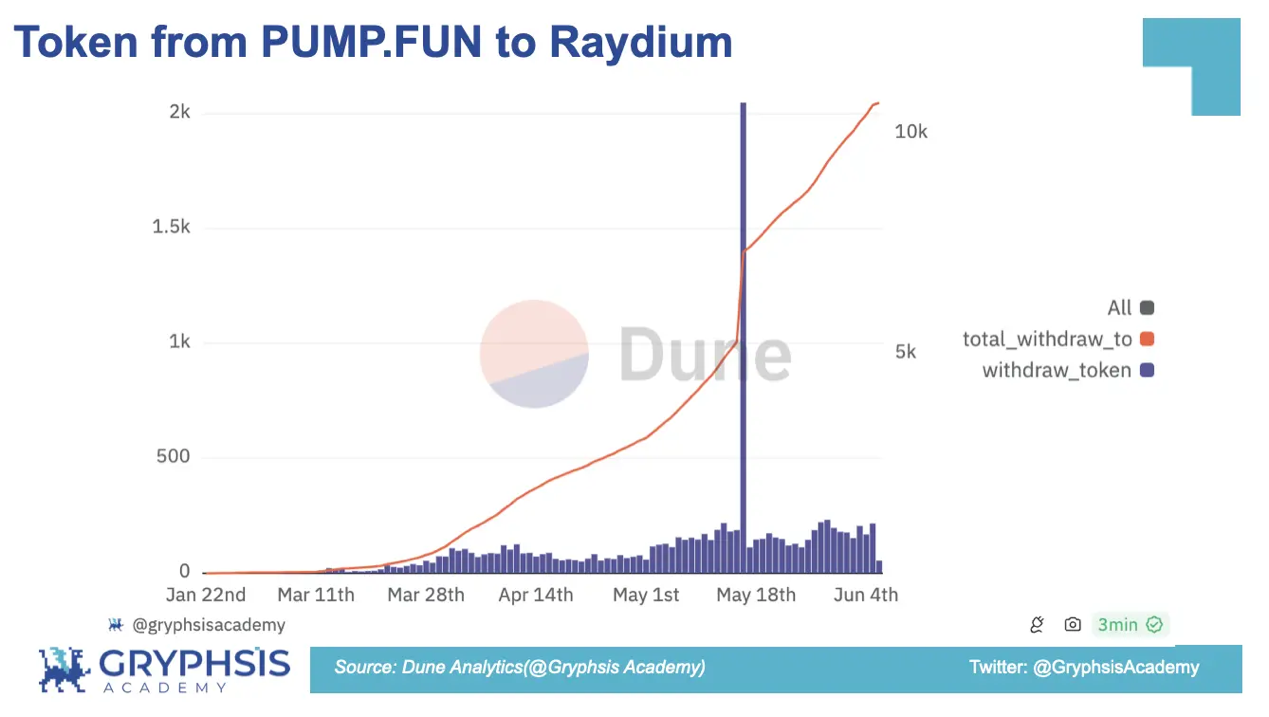

Once funding goals are met, PUMP.FUN transfers the newly created memecoin to Raydium.

-

The memecoin gains broader attention, allowing users to trade a brand-new token—created by one user, funded by others on PUMP.FUN, with a total supply of 1 billion and an initial market cap of $69k (410 $SOL)—on Raydium.

Users need only decide on a ticker, upload an image, write a short description, and pay a small fee to easily create a memecoin. Others can comment underneath—the built-in message board function facilitates community building. Clicking on a user’s address shows their held/created tokens and whom they follow.

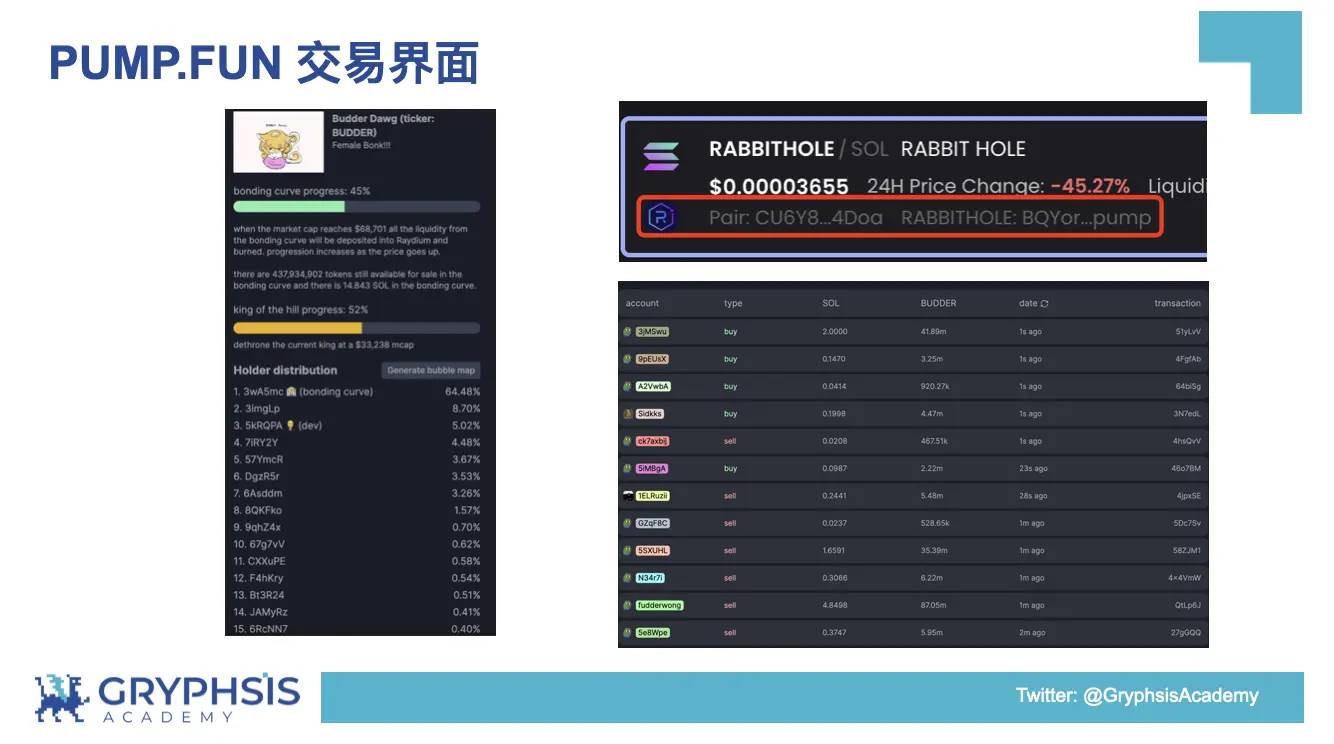

Other users can trade these tokens, and once fundraising targets are reached, the token is sent to Raydium.

(2) Pricing Curve

Unlike FRIEND.TECH’s system—which accepts only integer inputs and outputs—PUMP.FUN uses a smooth pricing curve. Also unlike FRIEND.TECH’s theoretically infinite supply, all memecoins on PUMP.FUN share the same economic model with fixed total supply. Users mint part of the supply at reasonable prices via the bonding curve, while the remainder combines with raised funds to form the LP pool.

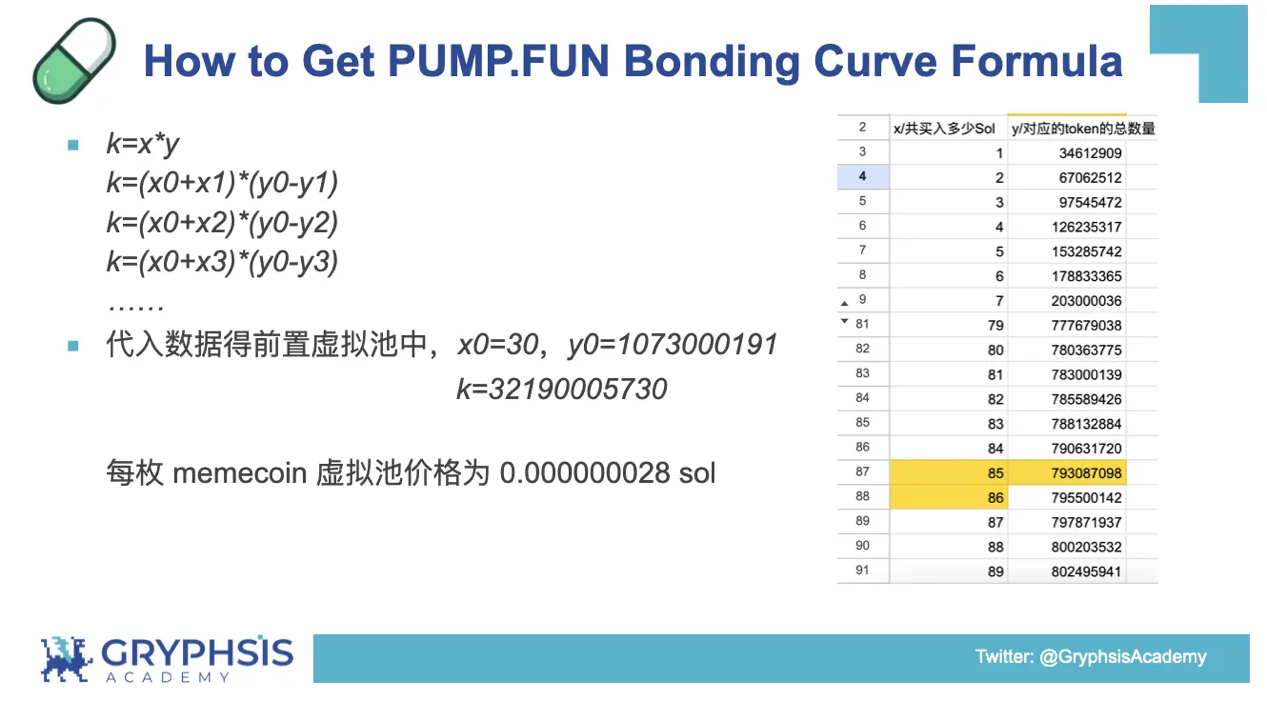

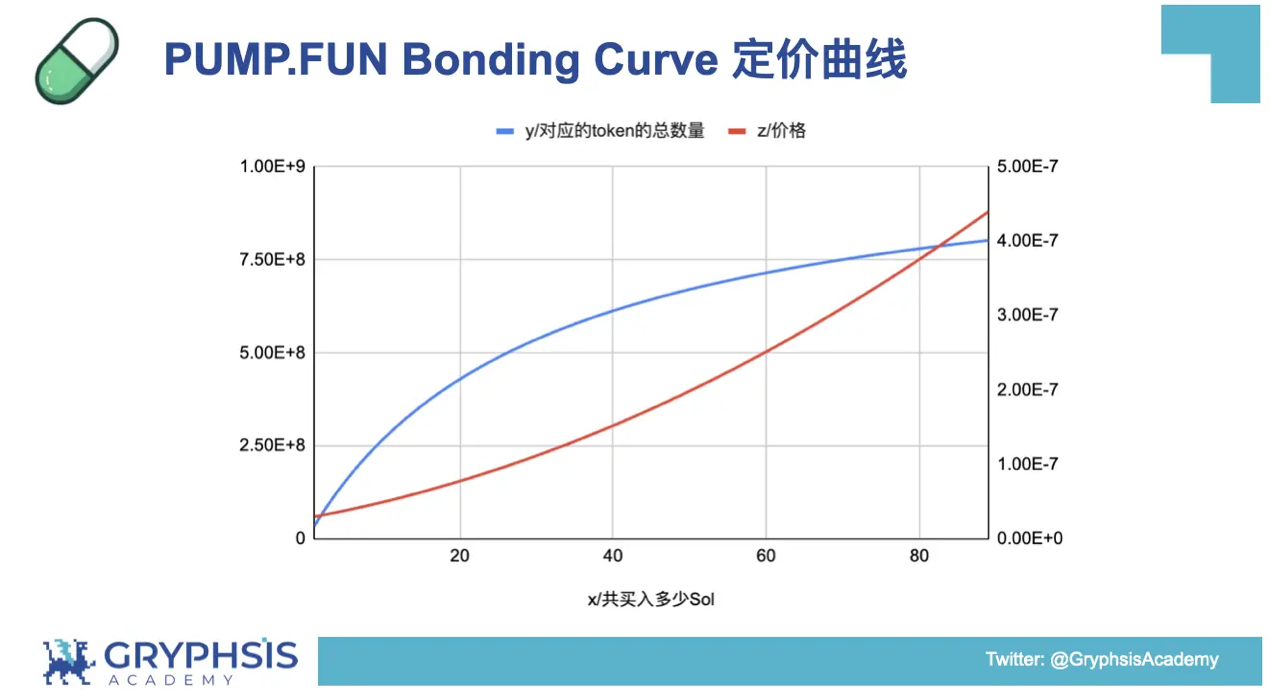

Through frontend code analysis, we identified a function call named virtualSolReserves, revealing that PUMP.FUN employs a pre-funded virtual pool containing x₀ $SOL and y₀ tokens. By collecting data on users’ $SOL purchases and corresponding token receipts, and fitting them to the formula x*y=k, we determined the virtual pool consists of 30 $SOL and 1,073,000,191 tokens, with an initial k-value of 32,190,005,730. Thus, each token starts at 0.000000028 $SOL.

Below is the calculation process:

The combined pricing function is y = 1,073,000,191 - 32,190,005,730 / (30 + x), where x is the amount of $SOL purchased and y is the number of tokens received. Differentiating gives the per-token price. The graph below shows the curve: blue represents the pricing curve, red the price curve. As expected, it reflects the steep initial phase typical of newly issued memecoins.

(3) Case Validation Analysis

-

A user buys and sells until raising 85 $SOL, receiving 800 million tokens—consistent with actuals.

-

The raised 79 $SOL (after deducting 6 $SOL listing fee) and additional 200 million tokens are added as initial liquidity to a pool sent to Raydium. Final total supply: 1 billion tokens—matches reality.

-

Upon Raydium listing, the token price equals the final funding price: 0.00000041 $SOL per token—14.64x the initial virtual pool price—aligning with observed data.

To summarize, PUMP.FUN’s product mechanics are now clear: users spend 0.02 $SOL to instantly launch a memecoin with a virtual initial market cap of 30 $SOL. Other users raise 85 $SOL to acquire 800 million tokens. PUMP.FUN then mints another 200 million tokens, combining them with funds to create a trading pair listed on Raydium. The result is a fully decentralized memecoin with a final market cap of 410 $SOL and a total supply of 1 billion tokens. Throughout this process, PUMP.FUN collects 1% of pre-Raydium trading fees plus a 6 $SOL “listing fee.”

2. Why Pay Attention to PUMP.FUN?

2.1 Why Focus on Memes?

To outsiders, Bitcoin serves no practical purpose—its soaring price merely reflects successful meme propagation through pure speculation. Even within Ethereum’s smart contract ecosystem, $UNI had no utility before governance voting, sharing the same investment logic as Dogecoin: rooted solely in recognition of first-mover advantage and shared crypto ethos. After experiencing the Meme Season, Inscription Summer, and the pre-sale mania of on-chain investments, crypto natives now possess a unique understanding of utility-free memecoins. Amid narrative vacuums and temporal misalignment of capital flows, the pursuit of fair launches among memecoin investors continues to strengthen the market’s reflexivity. For more thoughts on memes, read: Deconstructing Memes: Why MEMEs Excelled This Cycle?

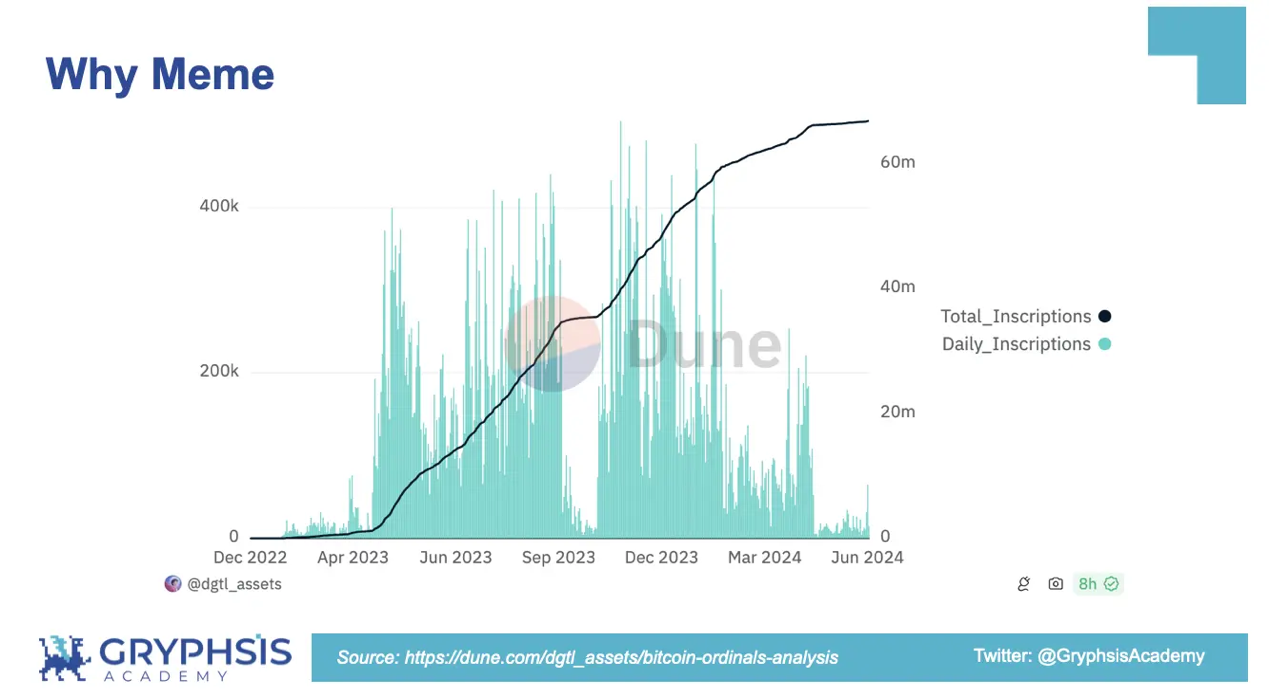

Last November, $ORDI’s listing on major exchanges kicked off “Inscription Summer,” injecting fresh narratives into the market amid shifting cycles. To date, Bitcoin inscriptions exceed 66 million, generating over $470 million in cumulative fees.

Memecoin $GME last caught market attention three months ago. Recently, renewed social media activity by the central figure brought both stocks and related cryptos back into public view. On Solana, $GME surged 30x, sparking a wave of copycat projects on PUMP.FUN and explosive growth in热度.

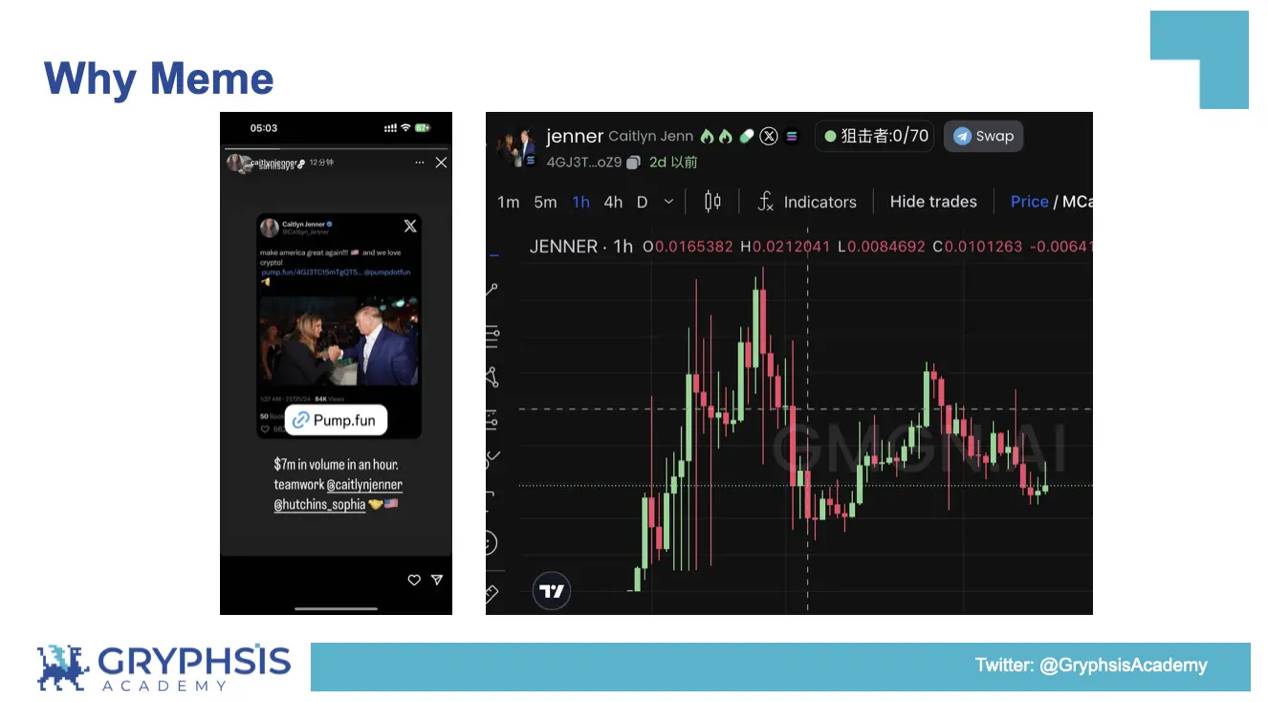

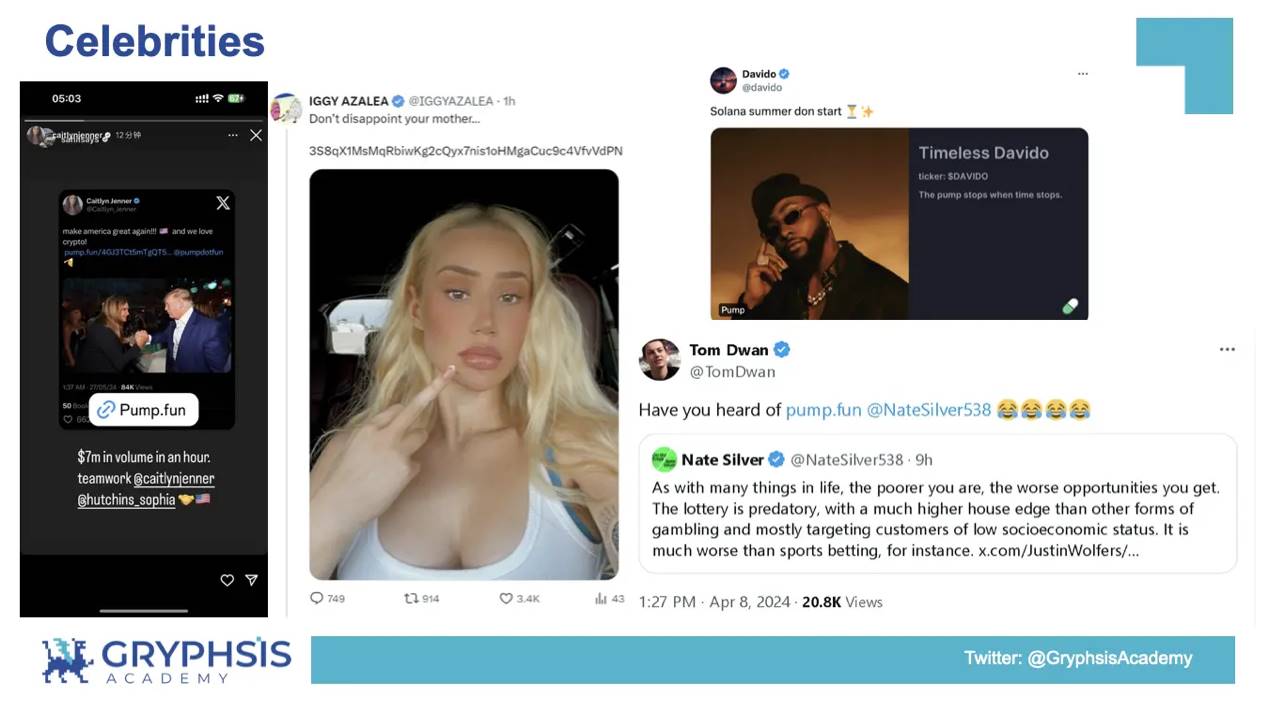

Celebrities launching tokens on PUMP.FUN and collaborating with crypto insiders drive further crossover. Caitlyn Jenner of the Kardashian family launched $JENNER, bringing drama into crypto and achieving a 160x surge overnight, peaking at a $30 million market cap.

Why focus on memes? Borrowing from the earlier article: “A meme spreads through imitation; any information that can be copied via imitation qualifies as a meme.” As inherently mimicking beings, humans propagating memes is both phenomenon and outcome—an evolving genetic ensemble seeking order amidst chaos. Beyond the wealth-generation effect of the memecoin sector, many crypto assets themselves possess meme-like qualities, whether it’s Bitcoin forming the foundational value of the crypto world, decentralized tokens powered by smart contracts, or simple-logic-driven inscription-based memecoins and celebrity tokens.

2.2 PUMP.FUN Operational Data

Memecoins launched and traded on PUMP.FUN undergo market validation, leading to imitation effects that amplify trading volume. All token information is labeled on PUMP.FUN, and repeated mentions of trending events generate substantial profits for the platform. Validated and modeled Dune dashboards suggest that amplified data can explain most phenomena in the new memecoin ecosystem pioneered by PUMP.FUN. These dashboards track platform users, revenue, token creation status, and high-frequency trading activities, enabling behavioral, engagement, and growth trend analysis across platform, user, and product dimensions. Dune Dashboard: PUMP.FUN by Gryphsis Academy

(1) Platform Revenue

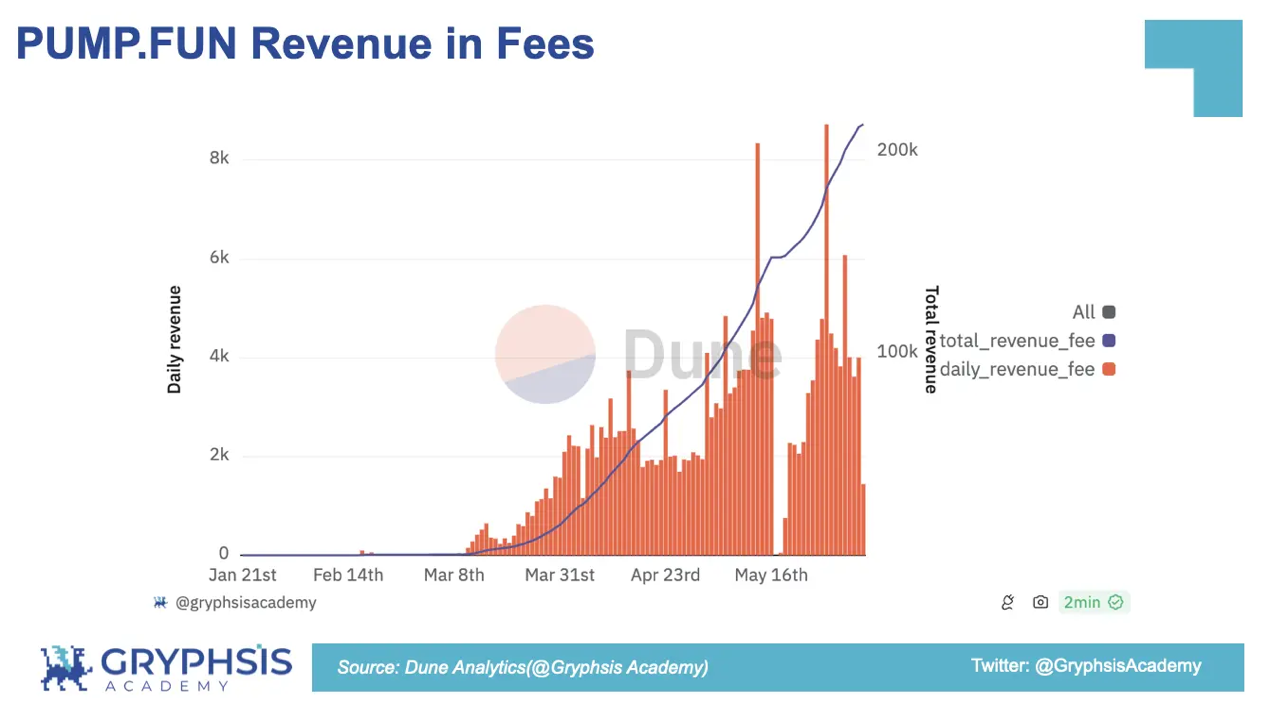

According to the Dune dashboard, PUMP.FUN saw its first surge in mid-March. Though not the earliest player in the space, it gradually gained user acceptance during this period. Several memecoins filtered by the platform generated notable wealth stories—for instance, $SC, launched on March 26, reached a market cap of over $100 million within days. Other user-created memecoins in early stages also delivered varying degrees of returns. Platform daily revenue hit 1,000 $SOL and continued rising.

April to early May marked PUMP.FUN’s breakout phase. $MICHI, launched on April 8, surpassed a $200 million market cap, igniting market sentiment. Memecoin narratives shifted rapidly, with countless clones emerging—from national coins inspired by the summer Olympics to religious tokens and Trump-themed coins—thousands of new memecoins created and traded daily. Average daily revenue exceeded 2,000 $SOL.

Mid to late May: On May 13, coinciding with GME stock’s surge, related memecoins on PUMP.FUN set a revenue record of $1.2 million. Despite a brief dip following a former employee attack, PUMP.FUN experienced renewed crossover appeal, with celebrity-launched memecoins pushing revenue back to $1 million. Post-crossover, average daily revenue stabilized at $700,000, with total platform revenue nearing $37 million.

On May 16, a former employee stole access to PUMP.FUN’s wallet responsible for creating trading pairs, preventing numerous memecoins from being listed on Raydium post-fundraising, resulting in ~$2 million in user losses. PUMP.FUN responded by waiving platform fees to compensate users.

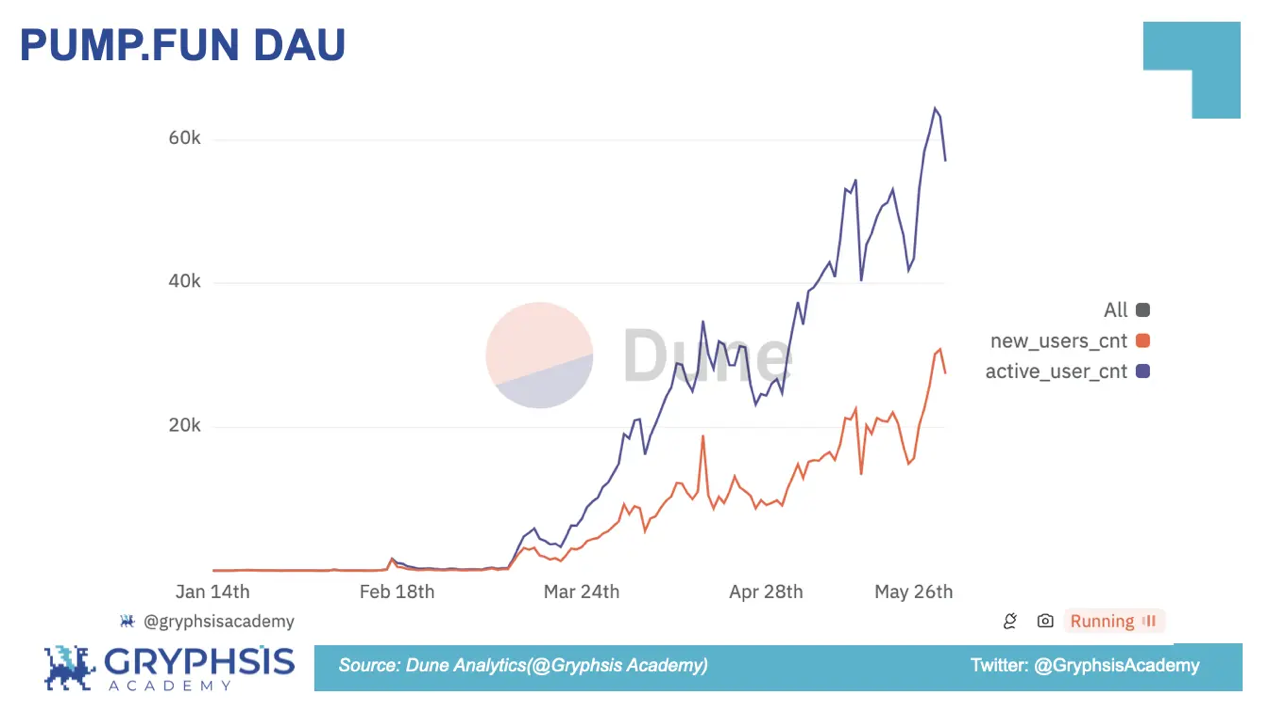

(2) User Growth

Per Dune data, PUMP.FUN’s user base remains in an upward trajectory, with temporary setbacks but sustained热度generation. Before April 16, new users surged daily, amassing nearly 35,000 active users within a month—user habits cultivated by the product laying groundwork for retention. From late April to May, daily new user growth slowed. Celebrity-driven crossover propelled active users to a peak of 64,378 on May 30. Subsequently, daily additions decelerated, suggesting the platform may be approaching its first user growth bottleneck.

(3) Memecoin Products

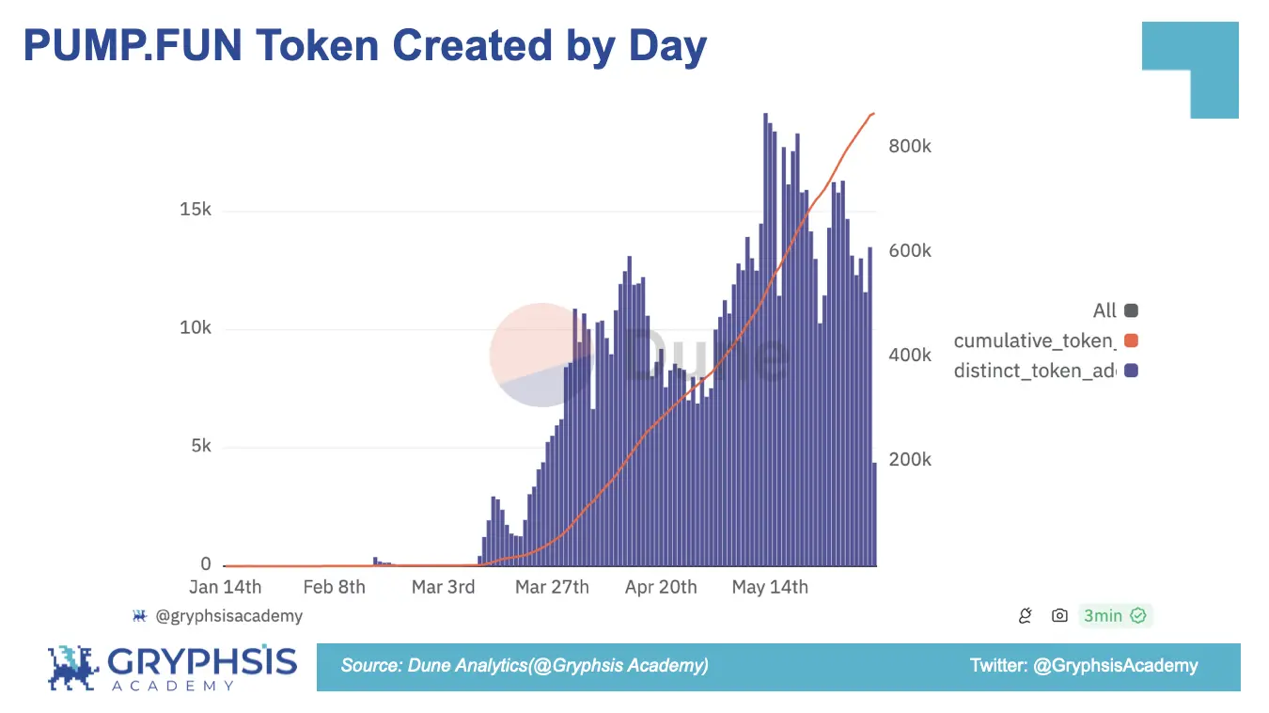

Treating each memecoin created and traded by users on PUMP.FUN as a product, analyzing product data reveals user behavior and informs improvements.

The number of memecoins created on PUMP.FUN correlates with active user count. Since launch, 862,988 memecoins have been created, averaging ~15,000 new ones per day since May.

Only 10,707 successfully launched to Raydium for broader trading, indicating platform revenue relies primarily on trading fees, with token creation and listing fees playing minor roles.

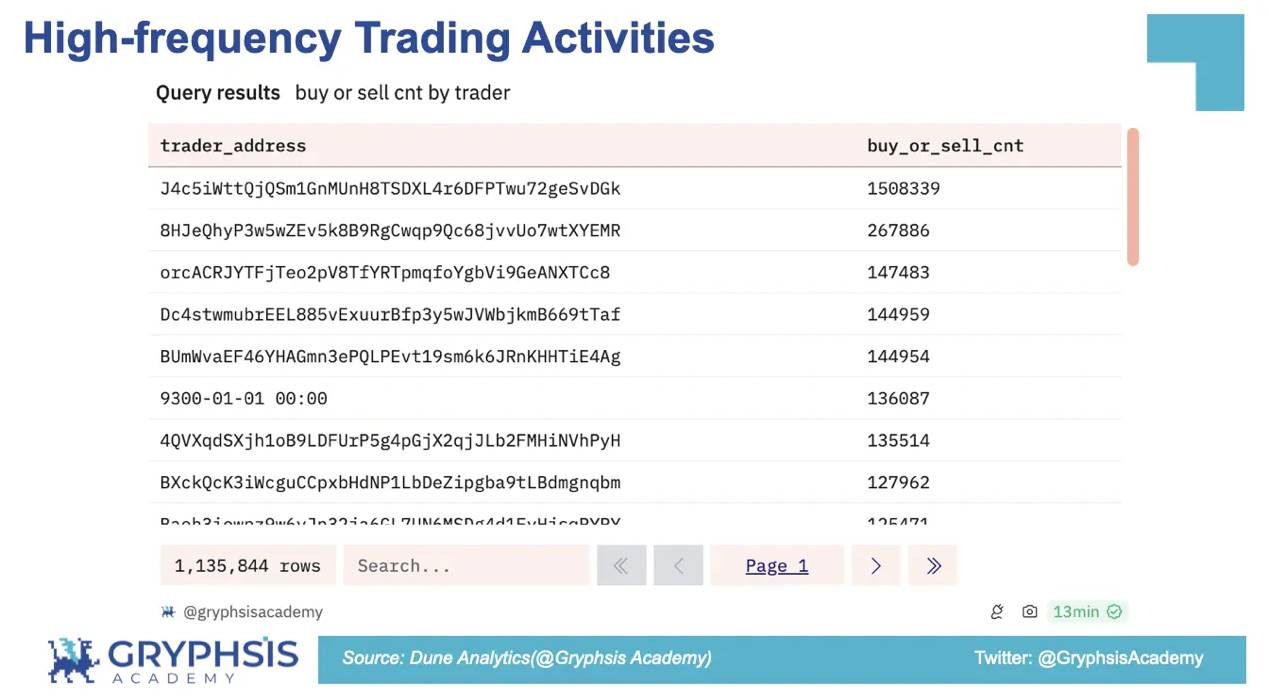

PUMP.FUN has not disclosed funding details and remains in growth mode. Dune data shows many high-frequency trading addresses, leaving room for potential volume manipulation.

The platform has now added live streaming, showcasing new memecoin launches and operations via livestreams and videos—a suitable format for driving traffic and capital crossover.

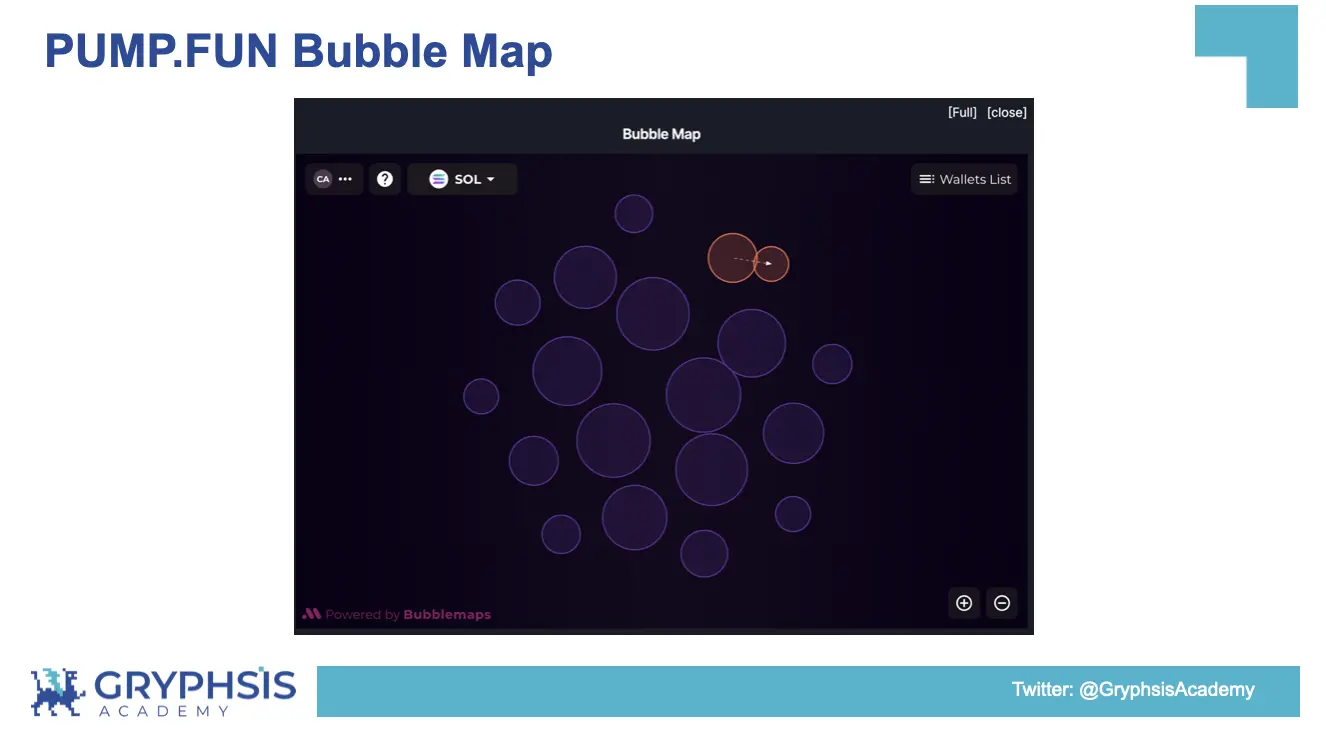

PUMP.FUN has partnered with @bubblemaps to visualize trader connections, enabling visibility into token holder wallet relationships and potential sniper attacks from dev wallets, reducing rug pull risks. The effectiveness of these new features requires further data validation, but the rapid iteration of memecoin narratives and new functionalities demonstrates the team’s agility.

Overall, PUMP.FUN ignited the market upon launch. Without institutional backing, it satisfied user needs through its bonding curve mechanism, leveraging the wealth effect generated by user-launched memecoins for organic promotion. Despite rapid narrative shifts and intense user PVP dynamics, structural data growth remained unaffected—and even accelerated during key events. Future competition may bring growth headwinds, but for a dominant ecosystem player like PUMP.FUN, strategic options remain abundant.

2.3 Competitor Comparison

Compared to other memecoin launchpads, PUMP.FUN better embodies the foundational value of memecoins—community consensus and collective trading sentiment. Its launched memecoins dominate market performance. As of June 6, when this article was finalized, PUMP.FUN hosted 16 tokens exceeding $3 million market cap, with $SC reaching a peak of $300 million.

PUMP.FUN’s strong performance versus weaker competitors stems from product design and ecosystem positioning.

(1) Unlike competitors offering calm, static interfaces, visiting PUMP.FUN immediately strikes users with flashing numbers and dynamic visuals. High-saturation design stimulates the senses, evoking the frenzied, surreal atmosphere of memecoin trading. Gameplay instructions are just five simple sentences—perfect for the fast-paced nature of memecoin traders—while detailed token information on other pages helps newcomers quickly form consensus. The platform’s logo—a green pill—seems medicinal but addictive, symbolizing how users become hooked.

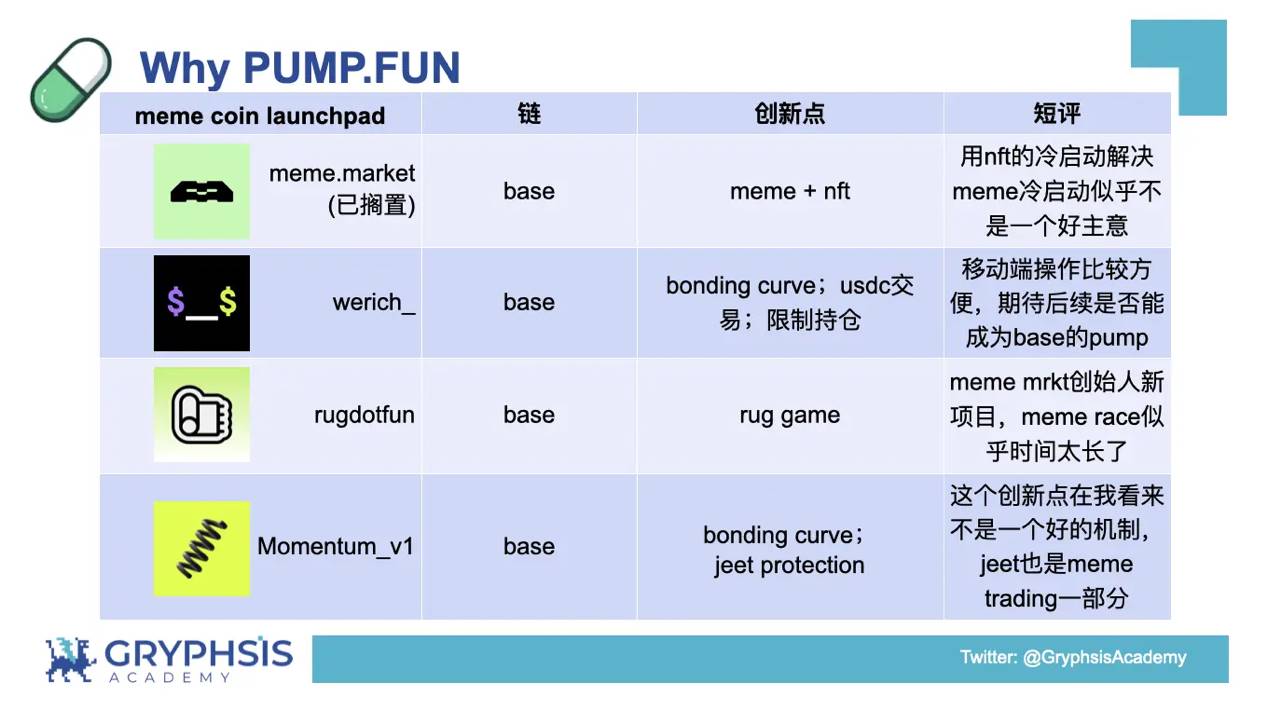

(2) While PUMP.FUN leverages the Solana ecosystem, meme.market / werich_ / rugdotfun / Momentum_v1 chose Base chain. However, Base’s capital and attention have been captured by FRIEND.TECH and Farcaster. With SocialFi platforms solving cold-start issues, and large-cap tokens like $DEGEN and $FRIEND offering spillover potential, the memecoin launchpad scene on Base already operates within entrenched echo chambers—capital and traffic largely pre-allocated.

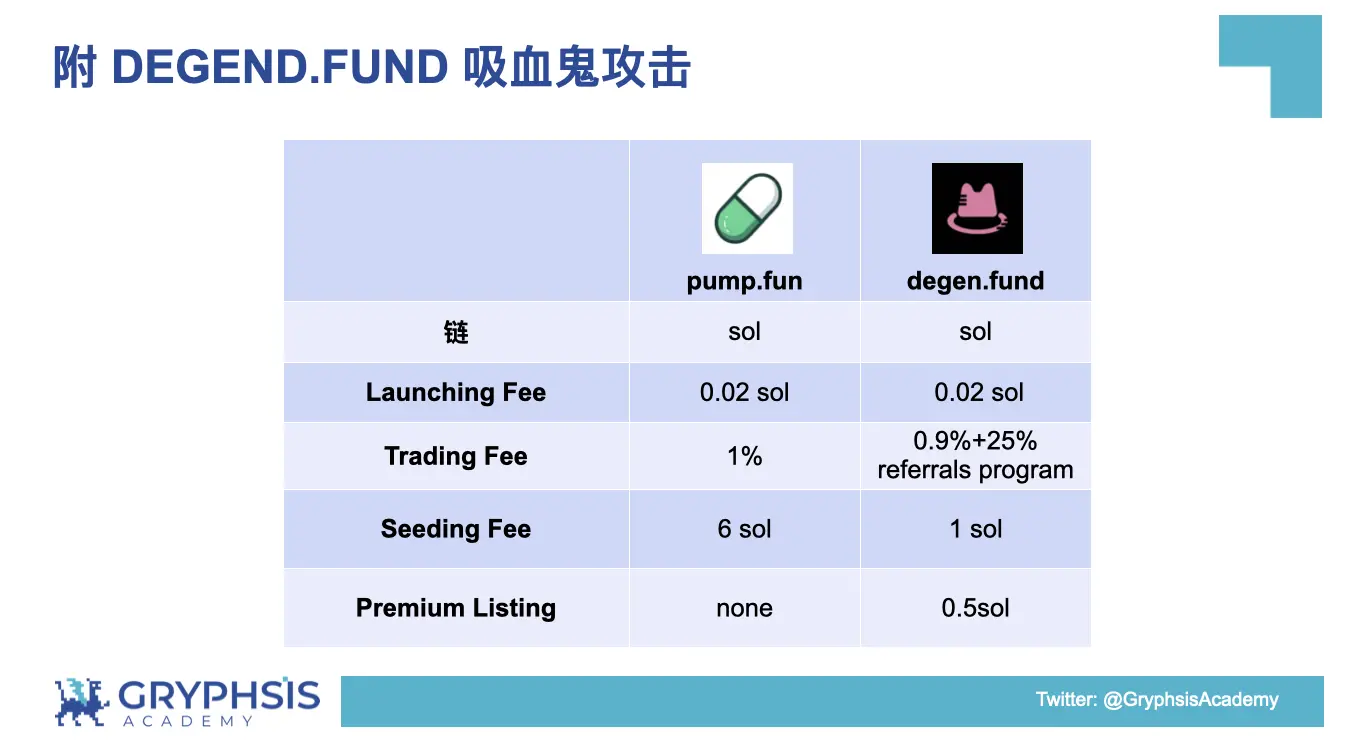

(3) During PUMP.FUN’s attack period, DEGEN.FUND launched on Solana, offering a similar bonding curve and cheaper fees—but failed to sustain market interest or scale meaningfully. Its flagship炒作token $IYKYK briefly spiked before fading into obscurity.

3. How to Participate in PUMP.FUN

For this emerging niche—memecoin launchpads—PUMP.FUN should be a focal point for research and deep participation. We categorize platform users into three roles: Memecoin Creator, Memecoin Trader, and Memecoin Opportunist. These roles are fluid—users switching between them encounter different opportunities with the same memecoin.

3.1 Memecoin Creator

A Memecoin Creator could be a crypto artist, an early evangelist of a memecoin narrative, a project team using the platform for marketing, or now—even celebrities from various fields. As someone needing to launch or discover tradable memecoins, creators must understand basic principles of virality and wield some influence. A skilled memecoin dev can leverage social media to filter out strong tickers. Even less market-savvy devs benefit from reduced trial-and-error costs on PUMP.FUN. If you’re someone like Caitlyn Jenner or Iggy Azalea with inherent clout, the decentralized platform eliminates intermediaries, rapidly delivering capital and traffic to your token.

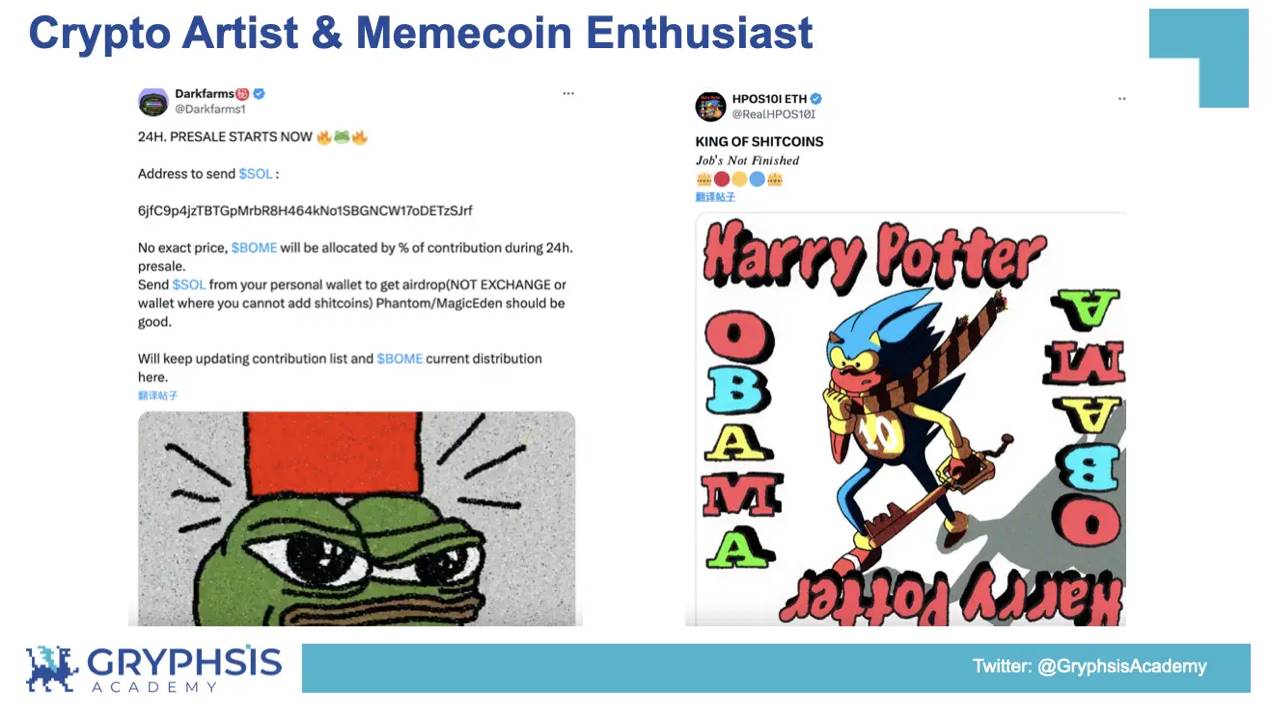

Crypto-native artists and memecoin enthusiasts can significantly reduce issuance costs via PUMP.FUN once they’ve identified a compelling ticker.

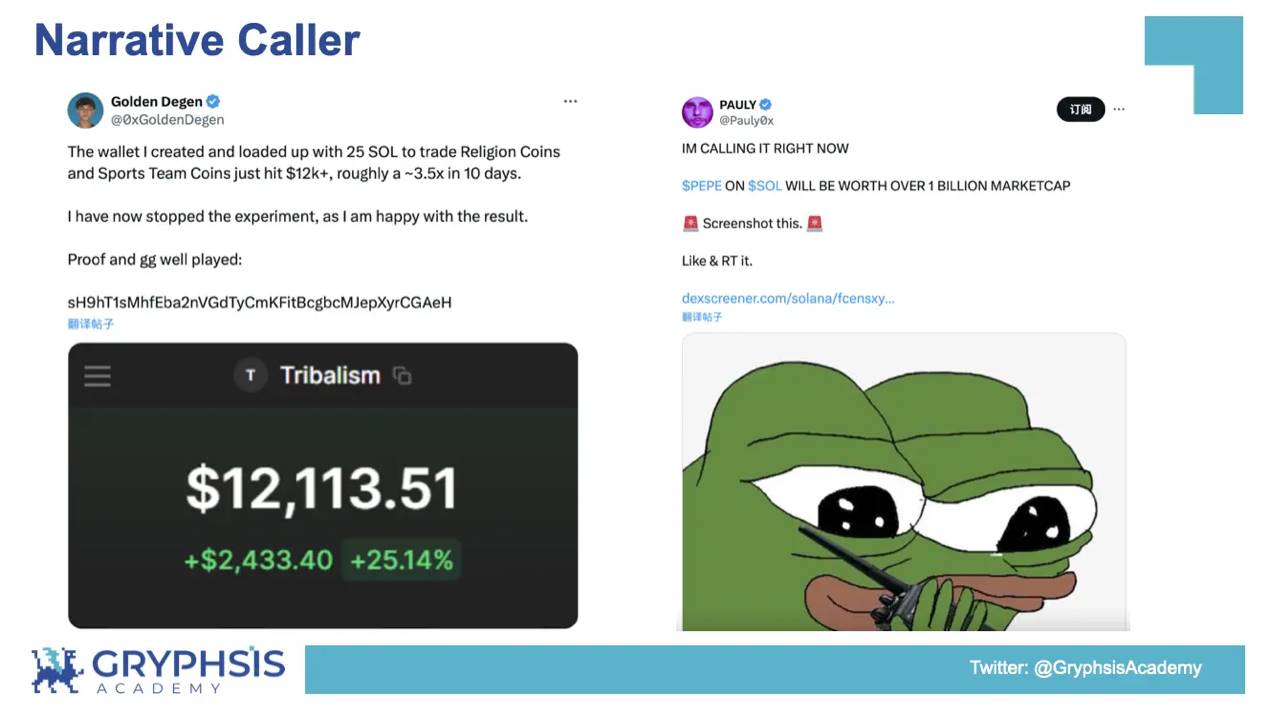

Early adopters leverage cognitive edge and influence to endorse specific memecoins, forming new narratives capable of crossing over into broader communities.

Celebrities launching tokens on PUMP.FUN join crypto users in the memecoin frenzy—something not seen since NFTs crossed over. Compared to FRIEND.TECH, celebrity tokens and NFTs serve as IP extensions. Tokenizing social relationships lacks appeal for influential figures—they already have abundant public connections, and private interactions fulfill personal needs.

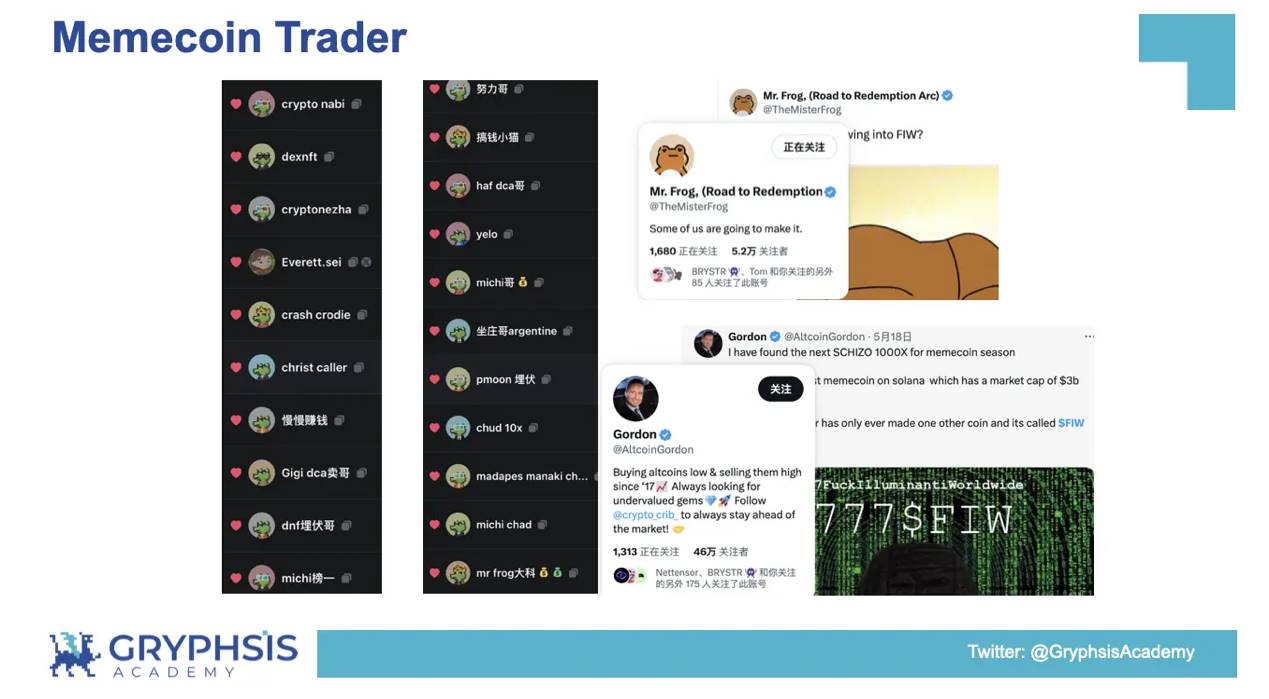

3.2 Memecoin Trader

Memecoin Traders are among the most active on-chain participants recently. To profit in this high-risk, high-reward game, they must track wallets, use tools, monitor social media, and build robust trading strategies. Compared to other risky assets, profitability in memecoins is less stable, win rates are generally low, and the platform’s fast pace increasingly favors losses.

The author’s experience as a PUMP.FUN trader revealed that beyond refining trading systems, team collaboration is crucial. Even faced with huge opportunities, on-chain players benefit from community cooperation, and the camaraderie formed through trading ultimately reinforces consensus in the traded assets. Below is @0xSunNFT and community members reviewing the process of celebrity Iggy Azalea launching $MOTHER.

3.3 Memecoin Opportunist

Whether arbitrage-seeking “on-chain scientists” or high-frequency bots hunting alpha, compared to the prior two roles, the Memecoin Opportunist deserves special attention from sophisticated wallets. Figuring out optimal strategies on PUMP.FUN is worth deep reflection. Using poker as analogy: when the table is hot, enter the pot—opt for liquidity-rich sniping bots at launch to boost participation and amplify returns. When the table cools—during market bottoms or stability—adopt counter-snipe strategies to generate returns while maintaining market sensitivity.

(1) Memecoin Opportunist Sniping Strategy

Each time PUMP.FUN lists a new memecoin, snipe bots complete initial trades within seconds after filtering metrics. Given sufficiently low entry points, steep early curves, and sustained overall market热度, this strategy has captured several high-growth tokens over recent months.

From left to right: $DONALDCAT (peak $15M), $JAPAN ($5M), $NIGI ($12M).

Sniping bots require acute market sensitivity. Unlike general Solana sniper bots, PUMP.FUN snipers don’t target contracts but rather the act of token creation—requiring clear monitoring of Solana user-platform interactions and filtering out rugs from malicious devs. Post-snipe, timely stop-loss/take-profit parameters and capital allocation adjustments based on backtesting are essential.

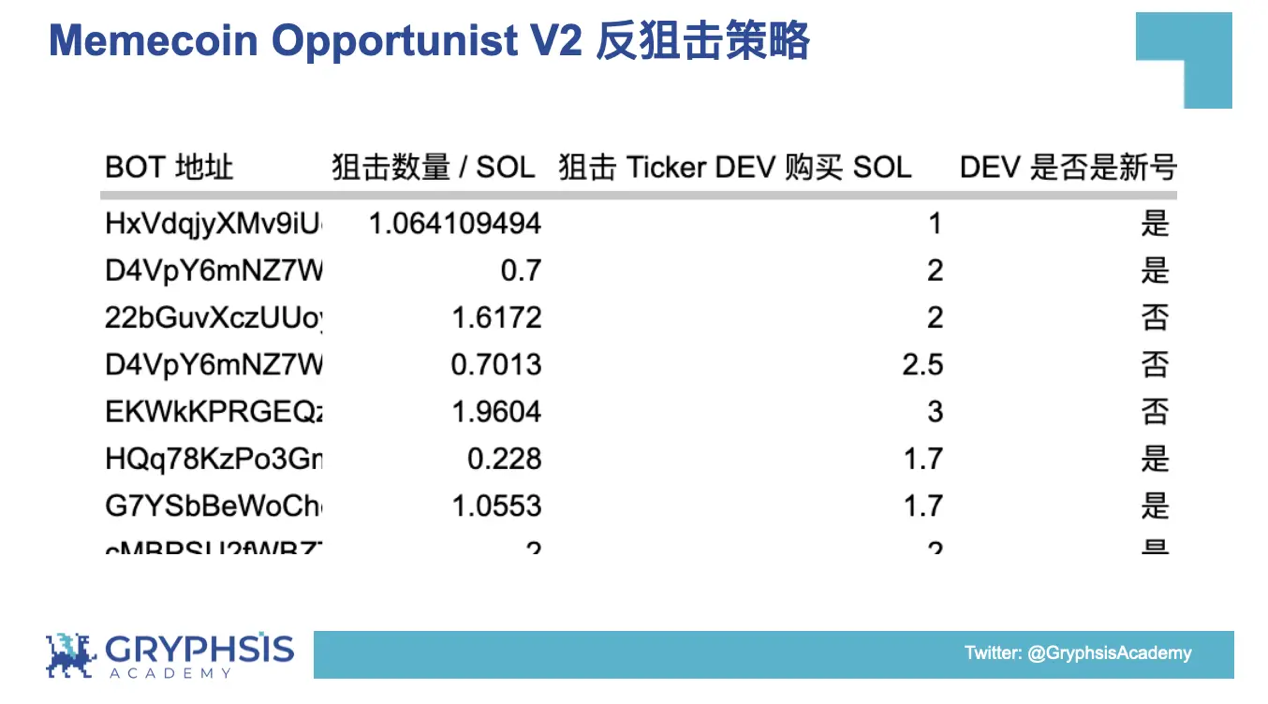

(2) Memecoin Opportunist Counter-Snipe Strategy

Sniping strategies heavily depend on overall market conditions. Broad-net approaches demand capital and face growing competition, compressing margins. Fewer breakout memecoins emerge from such battles. The counter-snipe strategy arises to adapt to this shift. Implementation steps:

-

Regularly summarize market trends and build a token-launch content library

-

Test snipe bot behaviors, document their strategies (ticker, amount, timing…)

-

Automate the minting process to construct a counter-snipe workflow

-

Optimize parameters to improve capital efficiency

Counter-sniping exploits PUMP.FUN’s low-cost minting. Properly tuned, this strategy can yield single-session returns of 2%–20% within seconds.

Parameter tuning requires analyzing snipe bot address behavior. Short-term trend clones continuously trigger strategy signals. Automating the entire counter-snipe process is key to improving capital efficiency and scaling returns. This strategy enables low-risk arbitrage, efficiently screens strong memecoin narratives, and positions participants for potential future airdrops.

BSC attracted traffic via its Meme-Innovation-Program; Base, under founder leadership, launched Base Onchain Summer, ensuring memecoin sectors receive preferential流量. Blockchains organize campaigns to seed memecoin ecosystems, yet PUMP.FUN—the sector’s unicorn—currently runs only on Solana. While believing in PUMP.FUN’s team and product, strategic participation must consider cyclical trends. The author believes institutional entry paths are now clear—whether aggressive acquisition at lows or participation in development—sector leaders will return to fair value across primary and secondary markets. Hence, adopting the Memecoin Opportunist counter-snipe strategy via PUMP.FUN represents the optimal path to preemptively position within the entire sector.

4. Conclusion

From Ethereum to Solana, from Shiba Inu to frog tokens, from crypto enthusiasts to celebrity-driven crossover effects—the pursuit of viral热点never ceases. From the sloth burning down the pool to innovations in issuing and trading on PUMP.FUN, people continue exploring decentralization and fairness in memecoins. As the leader in this emerging sector, PUMP.FUN’s ultra-low-cost issuance model has transformed the memecoin ecosystem, fulfilling user demands and establishing itself as a crypto unicorn. Yet, this most crypto-native narrative application hasn’t even launched its own token. What kind of economic flywheel it will ultimately form remains to be explored by pioneers.

According to Defillama, PUMP.FUN, as a memecoin launchpad on Solana, generates monthly revenue exceeding Uniswap Labs, ranking as the fourth-largest protocol across all blockchain networks. Facing this opaque unicorn, we must ask: what truly is it? Some see a giant casino; others view it as yet another PVP arena amid crypto liquidity drought. The author believes beyond these traits, it is revolutionary—a product embodying decentralization at near-zero cost. Just as Bitcoin rewarded early miners and evangelists, why shouldn't memecoins—built on community consensus and trading sentiment—reward those who discover their value through gameplay? Is the only difference that Bitcoin consumes electricity, while PUMP.FUN consumes mental and physical effort?

“Before learning to construct, don’t treat deconstruction as the final answer.” Faced with the surging wave of memecoin revolution in the crypto MATRIX, the author will calmly swallow PUMP.FUN’s green pill.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News