zkLink Deep Dive: How to Find Unity in a Multi-Chain World?

TechFlow Selected TechFlow Selected

zkLink Deep Dive: How to Find Unity in a Multi-Chain World?

This article will focus on the technical principles, current status, and development roadmap of zkLink, providing a comprehensive analysis of zkLink—the multi-chain aggregation layer based on ZK-Rollup technology.

Author: Viee, Core Contributor of Biteye

Editor: Crush, Core Contributor of Biteye

* Approximately 4,500 words, estimated reading time: 8 minutes

From Layer 1 and Layer 2 to Layer 3, the blockchain island effect has become increasingly pronounced, making cross-chain interoperability more critical than ever. One gives rise to two, two to three, three to myriad things—whether there will be L4, L5, or even Ln beyond L3 remains unknown. For now, one of the most pressing challenges is how to unify fragmented liquidity across isolated chains. zkLink addresses this issue by proposing a solution for aggregating multi-chain liquidity.

This article provides a comprehensive analysis of zkLink—a multi-chain aggregation layer based on ZK-Rollup technology—focusing on its technical principles, current status, and development roadmap.

01 What is zkLink, and what problems does it aim to solve?

With the advancement of blockchain technology, we've seen the emergence of first-layer (L1) public blockchains such as Ethereum and Solana, followed by the rise of second-layer (L2) solutions like Arbitrum, Optimism, zkSync, and Starknet.

While meeting diverse user needs, these developments have also introduced issues such as liquidity fragmentation and high cross-chain transaction costs. Additionally, developers face increased complexity when deploying dApps due to differences in programming languages and tooling across various chains.

Imagine a country composed of scattered islands with poor transportation and an underdeveloped financial system, where each island (blockchain) operates its own independent currency and trading system.

You want to shop across different islands (such as Ethereum, Solana, Arbitrum), but every time you cross islands, you must exchange currencies, pay fees, and worry about losing your money.

This reflects the current困境 faced by blockchain users: fragmented liquidity, high transaction costs, and security concerns.

How can cross-chain transactions become as seamless and secure as those within a single chain? zkLink offers an answer.

(Source: zkLink official website)

By leveraging zero-knowledge proof (ZKP) technology to unify L2 and L1, zkLink achieves multi-chain state synchronization and native asset aggregation.

Tokens issued across different L1 and L2 chains by the same entity—for example, USDT on Ethereum and USDT on BSC—are consolidated into a single USDT token within zkLink Rollups.

In other words, this island nation now has a centralized trading hub that pools currencies from different islands onto one platform, eliminating the need for frequent currency exchanges, high fees, or concerns over asset security. This is zkLink’s multi-chain liquidity aggregation capability, which goes far beyond traditional “cross-chain bridges.”

Based on this foundation, zkLink has developed two main products: zkLink Nova and zkLink X.

zkLink Nova is the first aggregated L3 zkEVM Rollup network built atop Ethereum and its L2 networks. It leverages zero-knowledge Ethereum Virtual Machine (zkEVM) technology to consolidate assets from multiple Ethereum L2s, solving the problem of liquidity and asset dispersion on Ethereum.

zkLink X is a customizable Rollup infrastructure designed for multi-chain dApp development, connecting L2 and L1 layers so that developers can build applications as if they were operating on a single chain, while actually accessing liquidity across multiple chains.

Returning to our island analogy, zkLink Nova is like a universal shopping card, allowing you to freely shop (interact) across malls on different islands without repeatedly exchanging currencies.

Meanwhile, zkLink X is akin to a universal toolbox. No matter what kind of mall or store (dApp) you wish to build, you can customize it to your needs—like building blocks—and these stores accept currencies from different islands.

Thus, zkLink not only integrates liquidity scattered across different chains, reduces transaction costs and security risks, but also simplifies multi-chain dApp deployment, improves user experience, and ensures development safety.

02 What solutions does zkLink offer, and how does it stand out in the 'multi-chain race'?

Multi-chain and cross-chain topics are nothing new, but it's important to understand: zkLink is not a cross-chain bridge—it is a chain that aggregates multi-chain liquidity.

So, how does zkLink achieve multi-chain aggregation?

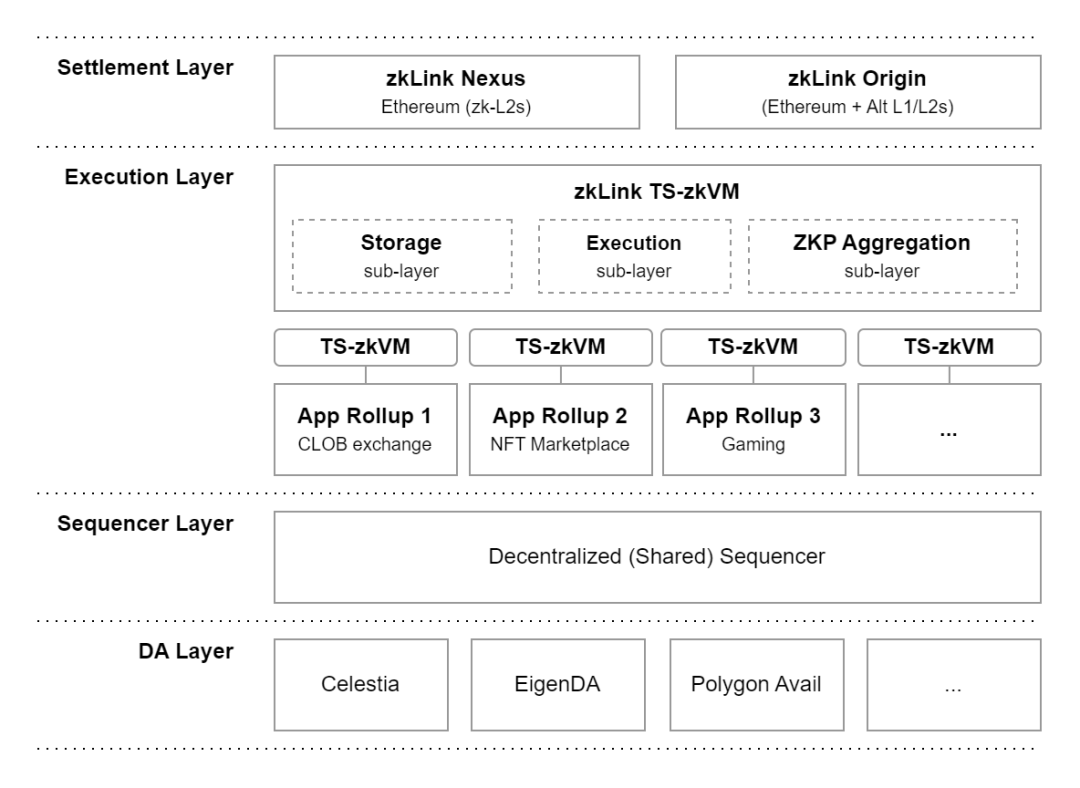

The zkLink protocol is a multi-chain ZK-Rollup infrastructure consisting of four layers: Settlement Layer, Execution Layer, Sequencer Layer, and Data Availability Layer. These layers operate independently and support customized application-specific Rollup deployments. The core value of zkLink lies primarily in the Settlement and Execution Layers.

(zkLink Protocol Architecture; Source: zkLink official website)

The settlement layer, the most critical component of zkLink, functions as a unified settlement center capable of integrating multiple chains. It uses synchronization techniques to ensure every transaction can be verified across multiple chains, preventing fraudulent activities.

Currently, there are two settlement solutions: zkLink Nexus and zkLink Origin, tailored for different network integration needs.

zkLink Nexus: Connects Ethereum and its L2 networks, inheriting Ethereum’s security.

zkLink Origin: Can connect other L1 blockchains (e.g., Solana) alongside Ethereum, enabling broader integration.

Traditional Cross-Chain vs Multi-Chain Aggregation

Transacting between different blockchains leads to higher costs and a more complex user experience. Both "traditional cross-chain" and "multi-chain aggregation" aim to solve this issue. Let's consider a simple scenario: swapping tokenA on chainA for tokenB on chainB via a DEX. What's the most basic method?

First, you need to install a wallet and purchase Gas tokens native to chainB;

Next, you must trade tokenA for a stablecoin or another intermediary token compatible with bridging to chainB;

Finally, you need to buy tokenB on a local DEX on chainB.

Compared to cross-chain transactions, this process is clearly more complex and incurs higher slippage. Hence, the emergence of cross-chain bridges improved the experience to some extent.

However, transaction costs for cross-chain tokens remain high, and users still struggle to seamlessly and affordably interact with tokens across chains.

Moreover, traditional cross-chain solutions often involve high centralization, making them vulnerable to hacker attacks, thereby increasing the risk of user fund theft.

Unlike traditional approaches, zkLink offers a more secure multi-chain settlement solution—specifically, Nexus and Origin—both powered by zero-knowledge proof technology (ZKPs).

zkLink innovatively applies zero-knowledge proofs to multi-chain interoperability, adopting a decentralized governance model that eliminates reliance on third parties for securing assets and transactions. It ensures the security and consistency of transactions and state transitions, minimizes custodial risks, and significantly enhances both security and efficiency.

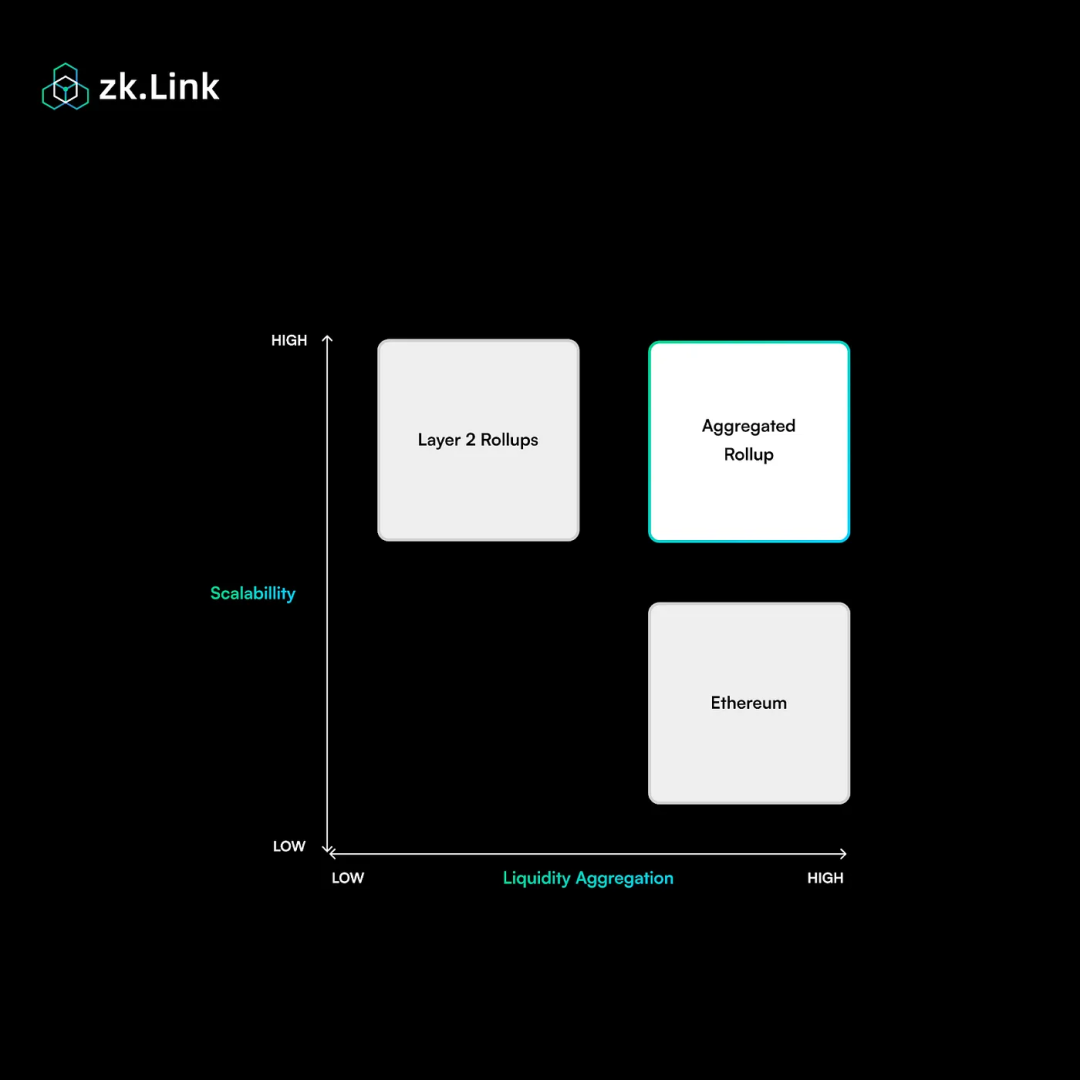

From Layer 2 to Aggregated Layer 3

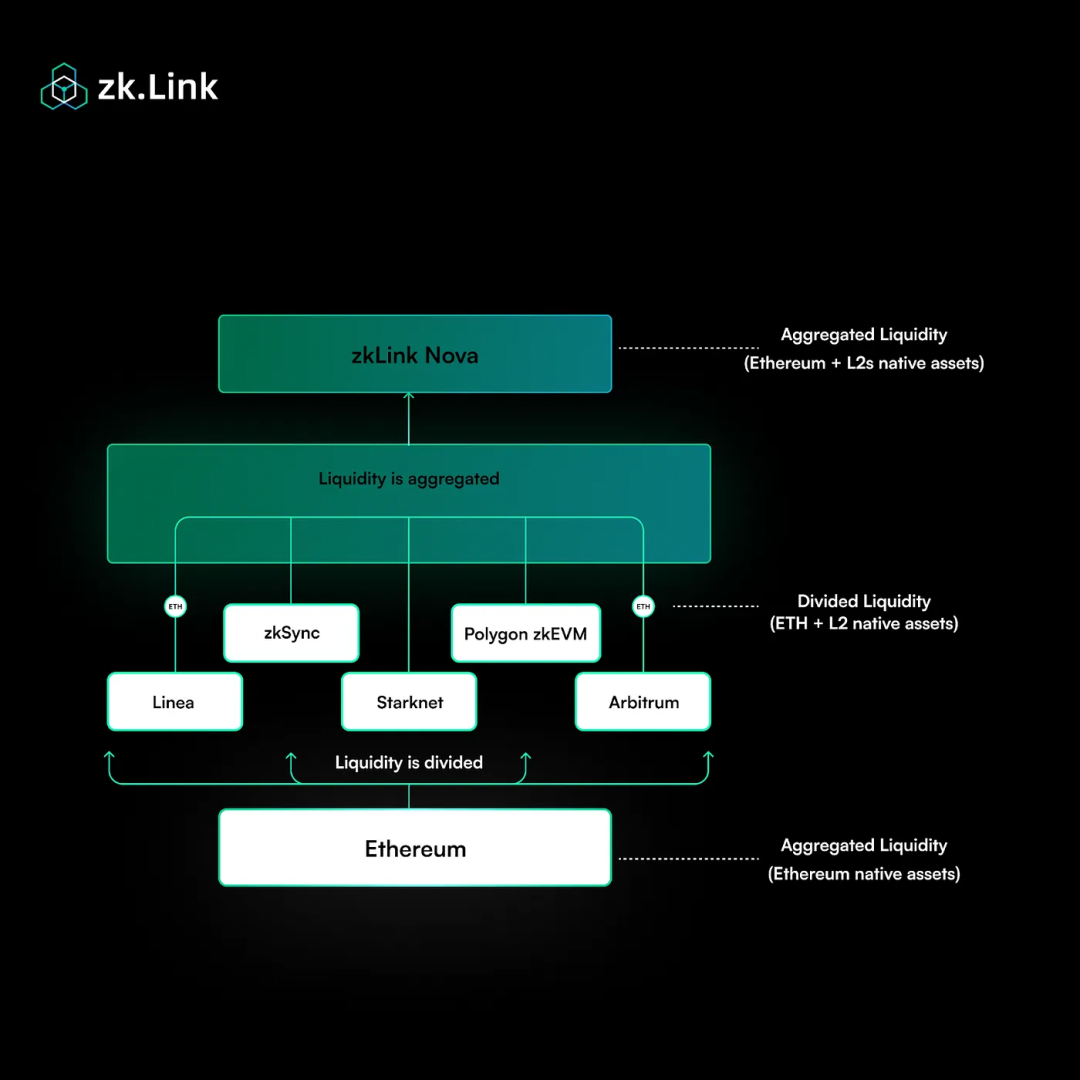

Beyond multi-chain aggregation, another highlight of zkLink is its construction of the third layer—zkLink Nova—which unites liquidity silos across Ethereum L2s.

Why build an L3 to unify liquidity across L2 ecosystems?

As we know, the rise of the L2 boom added a “highway” to Ethereum, making transactions faster and cheaper. However, it simultaneously created a non-interoperable and fragmented blockchain landscape, trapping liquidity on isolated chains.

Native assets on different Ethereum L2s (such as ARB, OP, MANTA) cannot interoperate. Transfers are often slow and expensive, and having assets scattered across multiple L2 networks results in wasted liquidity.

An increasing number of L2s, sidechains, and dApps have led to liquidity fragmentation, contradicting the goal of improving Ethereum’s usability.

This is the price of Ethereum’s L2 expansion—spreading liquidity across dozens of blockchains—necessitating more advanced solutions to improve interoperability and efficiency.

Unlike most L3s designed for specific applications and deployed on individual L2s (e.g., Starknet or Arbitrum), zkLink Nova is a general-purpose L3 aggregation network built atop Ethereum and multiple L2 networks, with Ethereum and its L2s collectively serving as the settlement layer.

Therefore, zkLink’s construction of L3 zkLink Nova isn’t just another cost-reduction layer stacked on top—it embodies the vision of “one Nova to rule them all.”

(Source: zkLink official website)

Simply put, ETH deposited from different L2s gets automatically merged into a single ETH on Nova.

Identical ERC-20 tokens bridged from different networks—such as USDC.Ethereum, USDC.Arbitrum—can be merged into a single USDC on Nova. The unified USDC then enjoys pooled liquidity on Nova, enhancing scalability and optimizing user experience.

zkLink vs Other Aggregation Solutions

Many L2s have recognized the issue of liquidity fragmentation and attempted to address it. For instance, OP’s Superchain, Polygon’s AggLayer, and zkSync’s Hyperbridge aim to unify liquidity through shared bridges or sequencers.

However, these solutions only work within their respective sub-ecosystems and specific tech stacks. In doing so, maintaining multiple distinct tech stacks may exacerbate liquidity fragmentation and cross-chain interoperability issues, further dividing the Ethereum ecosystem.

In contrast, any assets on any L2 connected to zkLink Nova can be bridged to the L3 network for fast, interoperable transactions. While sacrificing atomic composability across rollups, it offers the broadest possible liquidity aggregation across the entire Ethereum ecosystem.

(zkLink Nova Protocol Architecture; Source: zkLink official website)

03 From Present to Future: zkLink and the New Era of Cross-Chain

Current Status

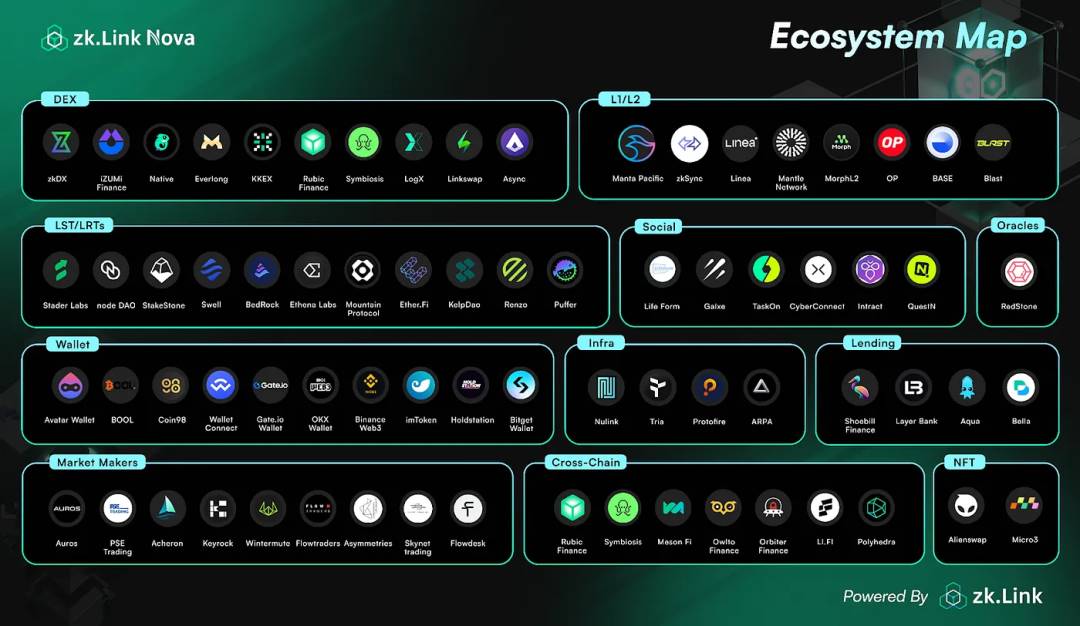

Since launching its mainnet in March 2024, the zkLink Nova ecosystem has seen significant growth. By early May, it had onboarded over 90 partner projects (data from end of March, not yet updated) spanning DeFi, tools, social, gaming, and NFTs.

On March 14, zkLink Nova launched the first season of its "Aggregation Parade" rewards campaign, lasting one month. Users could earn Nova Points by depositing assets including ETH, L2-native tokens, stablecoins, LSTs, and LRTs—encouraging deposits onto the L3 Nova mainnet.

In short, users earn Nova Points through cross-chain activity, staking, and inviting new users, which can later be redeemed for ZKL tokens.

Currently, the second season of the "Aggregation Parade" is underway, allowing users to boost their Nova Points by interacting with dApps partnered with zkLink Nova.

(zkLink Ecosystem; Source: zkLink official website)

From these initiatives, it's evident that the team is heavily investing in growing the zkLink Nova ecosystem, and the results are impressive.

The operational Alpha mainnet has processed over 2 million transactions using zkLink technology, generating 500,000 unique addresses.

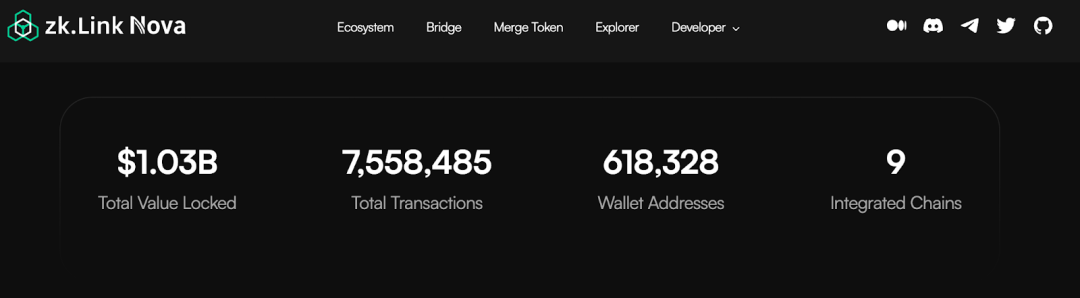

According to DefiLlama, as of May 22, zkLink Nova’s TVL surpassed $1 billion, representing a 156% increase over the past month, making it the Layer 3 network with the highest total value locked.

(zkLink Nova Total Value Locked; Source: zkLink Nova official website)

Funding

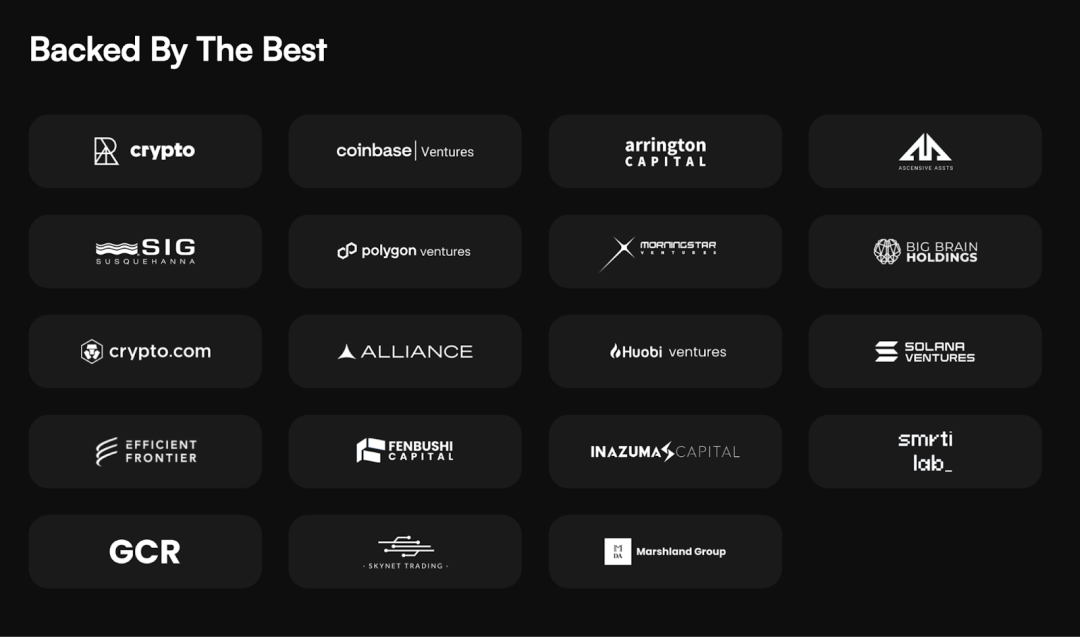

In terms of funding, zkLink raised $4.68 million through a CoinList community sale in January this year. In May last year, it completed a $10 million strategic round led by Coinbase Ventures, SIG, BigBrain Holdings, among others.

To date, zkLink has raised a total of $23.18 million, which will further fuel the development of the Nova protocol.

zkLink’s investors are more than just financiers—they act as strategic partners who provide not only capital and manpower but also extensive resources to deepen collaboration with zkLink.

(zkLink Investors; Source: zkLink official website)

Future Outlook

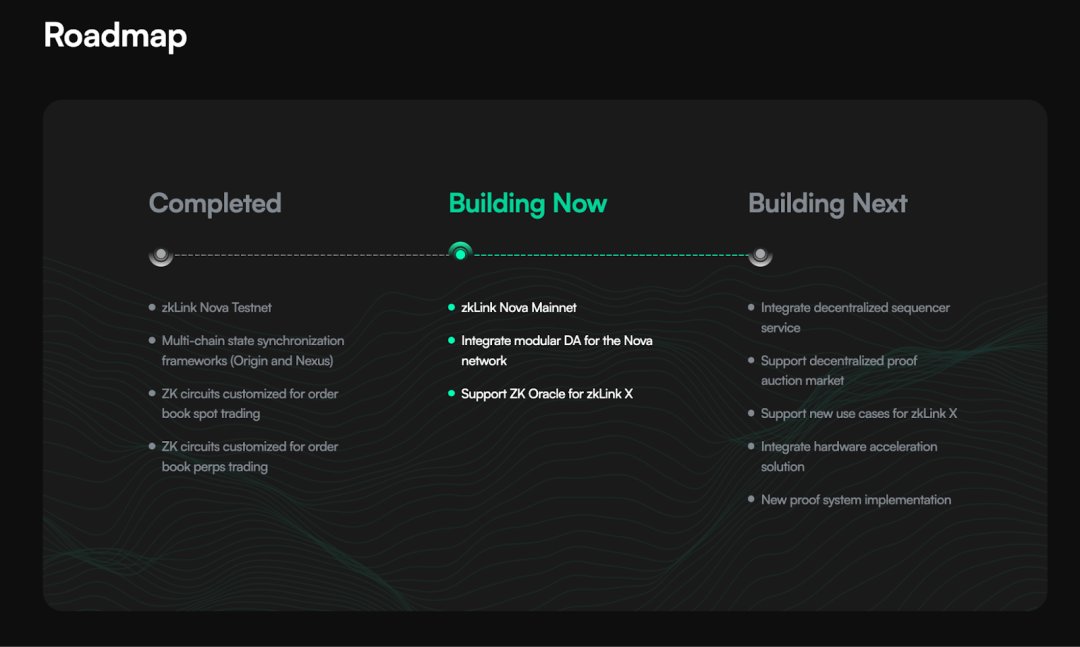

zkLink Nova’s mainnet is now live, and the team is currently upgrading ZK Oracle, a lightweight node oracle network used to verify cross-chain states, as part of improvements to the zkLink X protocol.

In the future, zkLink plans several key upgrades, including support for external data availability (DA) solutions and a decentralized proof auction market.

Currently, zkLink’s sequencing service is centrally managed, but the team plans to integrate decentralized solutions such as Espresso, Astria, and Fairblock to reduce centralization risks. Additionally, the ZKL token is即将 launched, and the team is preparing for its TGE.

It's clear that zkLink continues to evolve on its path toward unprecedented liquidity aggregation for Ethereum and its L2 networks.

If achieving “seamless on-chain interactions” once seemed like a distant dream, perhaps zkLink is turning that dream into reality.

(zkLink Roadmap; Source: zkLink official website)

04 Conclusion

Whether L1, L2, or L3 will ultimately prevail is a question only time can answer. Meanwhile, the market shows that both L1 and L2 will continue to coexist—this is not a zero-sum game.

The future will undoubtedly be a multi-chain era, and zkLink is poised to become a key hub, connecting components and systems across L1 and L2 ecosystems.

We can envision zkLink leading a new, highly interconnected multi-chain era, unlocking abundant new opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News