Deep Dive into zkLink: ZK-Rollup + Oracle Network, Building a New Solution for Seamless Cross-Chain Liquidity

TechFlow Selected TechFlow Selected

Deep Dive into zkLink: ZK-Rollup + Oracle Network, Building a New Solution for Seamless Cross-Chain Liquidity

As a stable and reliable multi-chain trading platform infrastructure, zkLink has laid a solid foundation for future comprehensive applications including finance.

Author: JUMPENG, Senior Researcher at Shilian Investment Research

zkLink is a transaction-centric, ZK-Rollup-based multichain middleware that achieves multi-chain functionality and extends classic ZK-Rollups through its "ZK-Rollup + Oracle Network" mechanism. Its key feature lies in connecting multiple L1s and L2s, aggregating liquidity across different ecosystems, and enabling dApps built on the zkLink network to leverage seamless multichain liquidity for rapid deployment of decentralized, non-custodial order books, AMMs, derivatives, and NFT marketplaces.

1. Research Highlights

1.1 Core Investment Thesis

As a trustless, permissionless, and non-custodial interoperability protocol, zkLink aims to connect disparate chains, eliminate token fragmentation, and resolve the issue of isolated liquidity silos formed on isolated blockchains. Its core investment thesis manifests in several aspects:

As a pioneer in multichain decentralized trading, zkLink faces vast market prospects. It enjoys unique first-mover advantages by leveraging multichain aggregation to fully cover the public chain sector, demonstrating strong vitality. Meanwhile, it effectively addresses user experience pain points using ZK technology, attracting more participants into industry development. zkLink not only focuses on meeting the rapidly growing demand for decentralized trading but also places greater emphasis on the infinite potential of long-term industry evolution. The inherent programmability and customizability of zkLink's technology enable it to adapt to various future blockchain business models, satisfy diverse transaction and interaction needs, and unlock extensive commercial possibilities, potentially becoming a critical cornerstone supporting sustained industry prosperity. Moreover, with its open and universal technical roadmap, zkLink can propel the entire decentralized sector forward by consolidating resources from various chains and fostering collaborative growth among application ecosystems.

Innovative and practical technical solutions: zkLink’s technical approach directly addresses major current blockchain pain points—technological breakthroughs are key drivers of industry progress. With its strong capabilities in this domain, zkLink continuously pioneers new heights in multichain swaps and DeFi interactions. By integrating emerging technologies like ZK-Rollups, it creates highly efficient and practical cross-chain interaction mechanisms. For example, customized ZK proofs allow rapid integration of different DApps, greatly improving ecosystem integration efficiency. This ensures rich multichain resource interactions and supports sustainable expansion and optimization of projects. Simultaneously, zkLink continues optimizing details such as trade matching and liquidity management, refining every aspect of the trading experience. Overall, adhering to the philosophy of driving industrial development through technological innovation, zkLink consistently incorporates cutting-edge achievements to support holistic industry advancement while ensuring long-term robustness of its product architecture. These rich technical highlights will be crucial for zkLink to stand out amid homogenized competition and secure its core competitive advantage.

Fund security is the lifeline of any project—and one of zkLink’s most important competitive strengths. zkLink adopts the principle of minimal security assumptions in its design, fully leveraging the security mechanisms of multiple mainstream public chains to achieve security levels equivalent to those of mainnets. Additionally, zkLink implements an on-chain witnessing mechanism where multiple mainchain nodes can track and verify zkLink states, forming multi-party supervision that effectively prevents single-point attacks and operational errors. More importantly, zkLink passed the “Dunkirk” test, which assessed its resilience under system attack scenarios. This exceptional recovery capability further strengthens user confidence, elevates zkLink’s security standards to a new level, and lays a solid foundation for its commercial operations. In summary, zkLink leads the industry in fund protection mechanisms, helping it gain broader user trust amid surging demands for multichain finance.

1.2 Valuation

To date, zkLink has completed two funding rounds totaling $18.5 million. However, since full details of both rounds remain undisclosed, we cannot determine zkLink’s exact valuation. Furthermore, its economic model and token distribution specifics have yet to be announced, increasing the difficulty of valuation. Despite this, given the massive market space zkLink operates within and its technological edge in multichain trading, its future valuation potential remains promising. If zkLink achieves new milestones in developer ecosystem growth and commercial applications, gradually building a healthy ecosystem, its valuation could rapidly scale alongside actual business expansion.

1.3 Project Risks

zkLink’s project risks mainly stem from technical complexity, early-stage ecosystem development challenges, multichain environment complexities, and competitive pressures—details are covered in section 5.2 SWOT analysis.

2. Project Overview

2.1 Project Introduction

zkLink is a multichain ZK-Rollup infrastructure that aggregates assets and enables transactions across different chains using zero-knowledge proof technology, offering users efficient, secure, low-cost, and privacy-preserving decentralized trading experiences. zkLink’s vision is to become the bridge connecting all blockchain networks, allowing users to freely trade any asset on any chain without switching networks or wallets—building a truly decentralized, frictionless, and borderless crypto world.

2.2 Team Background

2.2.1 General Overview

According to Crunchbase, the team currently consists of 11–50 members headquartered in Singapore. Aside from the founders, team member information has not been publicly disclosed. However, according to blog posts on the official website, zkLink’s global engineering and expert team spans the globe, with members having studied at institutions such as Paris ENSPM, Imperial College London, Harbin Institute of Technology, Duke University, Peking University, and Tsinghua University, possessing research and work experience in cybersecurity, cloud computing, cryptography, and zero-knowledge proofs.

2.2.2 Key Members

Vince Yang: Co-founder and CEO of zkLink, primarily responsible for overall strategic planning and day-to-day operations. Vince has extensive internet entrepreneurship experience, having participated in founding several well-known internet companies. He maintains a low profile and rarely appears publicly; detailed information about him is currently unavailable. In recent promotional activities, he used alternate avatars, possibly due to anonymity or personal privacy considerations.

2.3 Funding History

● On October 22, 2021, zkLink completed an $8.5 million seed round led by Republic Crypto, with participation from Arrington Capital, DeFi Alliance, Huobi Ventures, Ascensive Assets, Morningstar Ventures, GSR, and Marshland Capital. The funds will be used to expand the team and support additional platform features.

● On May 4, 2023, zkLink announced a $10 million fundraising round with participation from Coinbase Ventures, Ascensive Assets, SIG DTI, BigBrain Holdings, and Efficient Frontier. This funding will help drive zkLink toward launching its mainnet in Q3.

2.4 Project Partnerships

2.5 Development History and Roadmap

2.5.1 Historical Development

2.5.2 Development Plan and Roadmap

2.6 Social Media Metrics

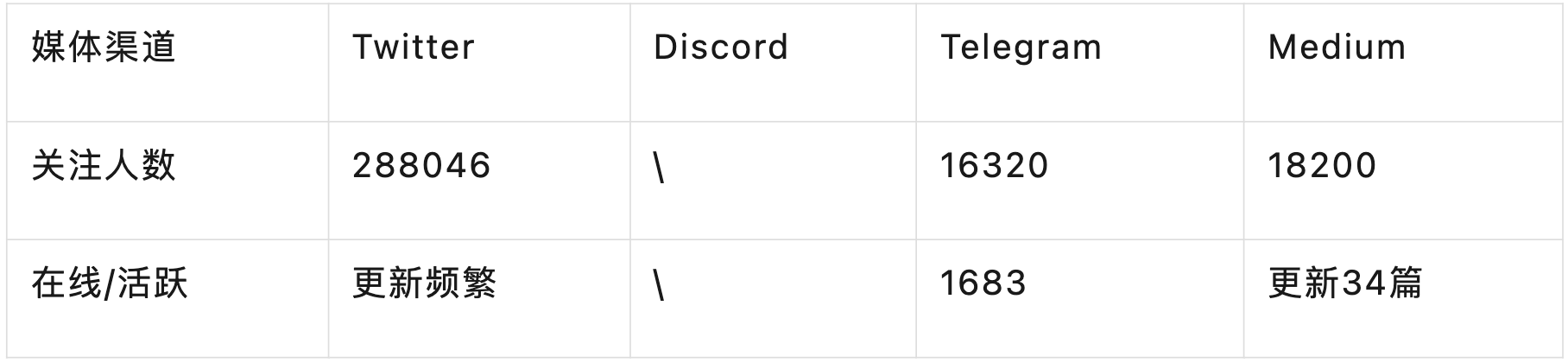

As of September 30, 2023, zkLink demonstrates strong performance across social media platforms, indicating high project热度 (heat). Currently active channels include Twitter, Discord (server invite expired), Telegram, and Medium. Notably, zkLink’s Twitter account has attracted nearly 290,000 followers, with frequent updates and engagement, making it one of the most popular channels. Below are specific metrics per platform:

3. Project Analysis

3.1 Project Background

With the rapid development of blockchain technology, numerous public chains, sidechains, and Layer 2 solutions have emerged, resulting in a multichain coexistence landscape. While this offers users and developers more choices, it also leads to significant liquidity fragmentation. Specifically, in this multichain world, assets and liquidity on different chains are isolated within their respective systems, hindering effective cross-chain interoperability. This creates substantial inconvenience for users managing asset allocations and executing trades—they must perform multiple transfers between chains, pay various fees, and endure cumbersome processes. It also imposes liquidity bottlenecks on trading projects, limiting their ability to attract sufficient user scale and transaction volume. Meanwhile, frequent cross-chain operations carry inherent security risks: during cross-chain transfers, assets require validation and movement by third parties, demanding trust and authorization from users. Any operational error or abuse of power could result in asset loss.

Driven by the original ideals of decentralization and self-managed assets, people are seeking new solutions to these pain points. zkLink was born to address this need—its goal is to build a multichain interconnected trading infrastructure enabling true free flow of cross-chain assets. By aggregating liquidity from different chains, reducing transaction costs, and leveraging zero-knowledge proofs for transaction security, zkLink aims to solve liquidity fragmentation and insufficient interoperability in the multichain world, thereby advancing decentralized trading.

3.2 Project Mechanics

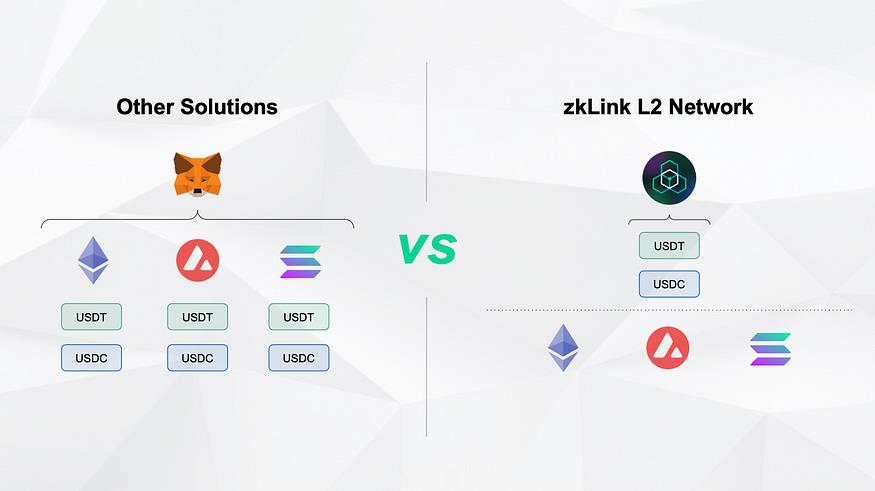

zkLink is neither an independent public chain nor a sidechain, but rather a Layer 2 infrastructure built atop multiple public chains and Layer 2 networks—it functions more like a Layer 2.5 network, leveraging the decentralized consensus and security of base chains. zkLink works by deploying smart contracts on multiple base chains, allowing users to deposit and withdraw tokens directly via these contracts, completing cross-chain transfers without requiring bridge operations. This simplifies the cross-chain usage process and makes it safer and cheaper. Additionally, zkLink enables real liquidity aggregation across chains—unlike bridges that merely move liquidity, zkLink significantly improves liquidity utilization efficiency through methods like stablecoin consolidation, similar to centralized exchanges’ liquidity pooling functions.

In short, zkLink builds a Layer 2 infrastructure for cross-chain trading via a bridgeless multichain mechanism and liquidity aggregation technology. It combines the reliability and security of public chains with the network effects of centralized exchange liquidity, greatly enhancing user experience and promoting the prosperity of multichain ecosystems.

3.2.1 zkLink Network Architecture

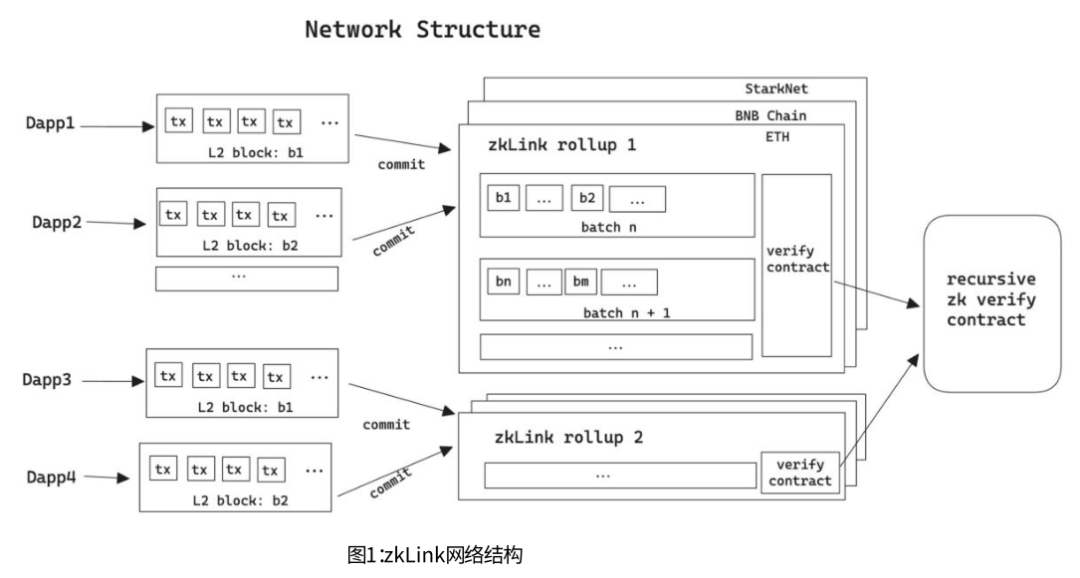

After gaining a general understanding of zkLink’s mechanics, let’s conceptualize its network architecture in three layers for clarity:

① The bottom layer comprises multiple L1 chains and L2 networks such as ETH, BSC, Arbitrum, and Optimism;

② The middle layer is the zkLink Protocol Layer—a ZK-Rollup-based middleware layer capable of connecting different L1s and L2s and aggregating and verifying cross-chain transactions;

③ The top layer is the zkLink DApp Layer—an open platform supporting various decentralized trading products including DEXs, lending platforms, NFT markets, and RWA trading.

Additionally, according to the project whitepaper, zkLink uses multiple Rollup states to enhance network performance (Rollup is a method for scaling blockchain performance, enabling many off-chain transactions to occupy minimal on-chain space, thus improving efficiency and lowering costs; a Rollup state is an off-chain data storage space). This manifests in several ways:

● A single Rollup state can support multiple upper-layer DApps running simultaneously, enabling cooperation and resource sharing among DApps. However, if there are too many or overly complex DApps, performance and security may suffer—therefore, the number of supported DApps is limited and depends on specific conditions and performance factors.

● zkLink deploys multiple Rollup states, but these do not directly share the same liquidity pool.

● When operating on zkLink, DApps also act as sequencers responsible for managing transaction order, which improves efficiency and fairness. However, risks exist—for instance, some DApps might exploit their position for MEV gains or disrupt other DApps’ normal operations. To prevent this, DApps must establish rules and protective measures.

● Multiple Rollup states can collaboratively optimize via zkLink’s recursive zk verification mechanism, e.g., sharing computational workloads to accelerate individual Rollup processes and improve overall network efficiency. Recursive zk verification uses zero-knowledge proofs (ZKP) to verify other ZKPs, allowing one ZKP to contain another’s information, reducing data size and verification time. This enhances collaboration and communication between different Rollup states, boosting overall network efficiency and security (explained in detail later).

In short, zkLink uses multiple Rollup states to increase throughput, but the number of DApps supported per Rollup state and liquidity pool configurations must be carefully designed based on actual circumstances to balance performance and security. Additionally, DApps acting as sequencers must guard against MEV-related risks, and zkLink supports collaborative optimization of computational costs across Rollup states.

Source: zkLink Whitepaper

3.2.2 zkLink Network Operation Principles

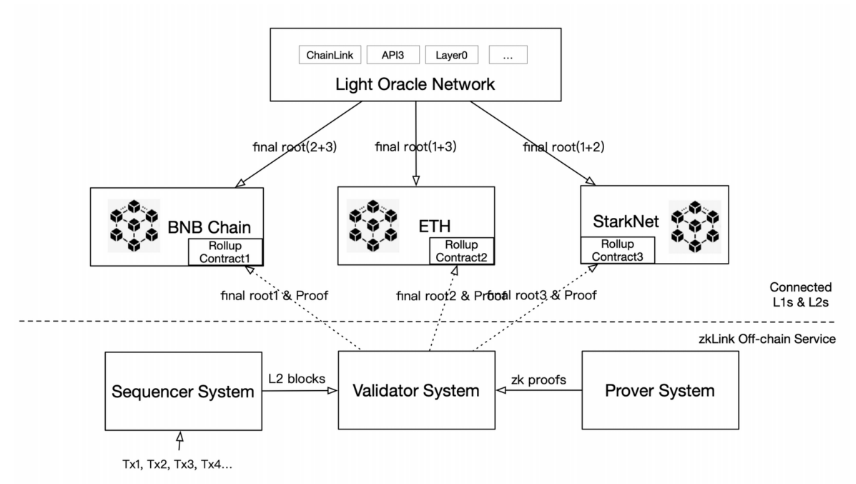

Based on zkLink’s network structure, we see that the project relies on two core technologies to fulfill its role as a cross-chain trading infrastructure:

1) ZK-Rollup

The ZK-Rollup technique batches multiple on-chain transactions together, generates a verifiable proof, and submits it to Layer 1. This mechanism significantly reduces the mainchain’s verification load and storage requirements. The working principles of ZK-Rollup are as follows:

● ZK-Rollup consists of two types of participants: Provers and Validators. The Prover packages multiple transactions into a batch and generates a zero-knowledge proof attesting to their validity. The Validator verifies the zero-knowledge proof provided by the Prover and updates the batch’s transaction state on the mainchain.

● By compressing multiple transactions into a single zero-knowledge proof, ZK-Rollup reduces on-chain data storage and computation demands, thereby increasing transaction throughput and lowering fees. At the same time, ZK-Rollup uses zero-knowledge proof technology to protect user transaction privacy and security, preventing data leaks or tampering.

● By inheriting the security and decentralization of the mainchain, ZK-Rollup ensures user asset safety and recoverability. Users can always withdraw their assets from the ZK-Rollup network back to the mainchain without relying on any third party or trust assumptions.

Source: zkLink Whitepaper

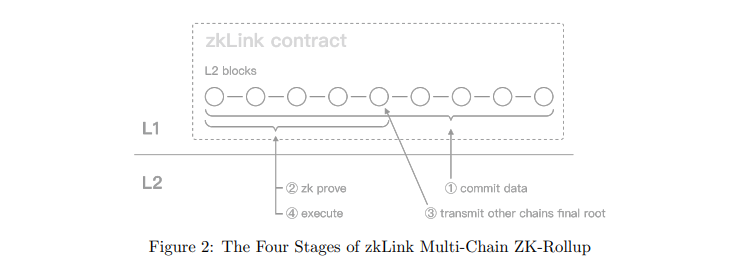

Standard ZK-Rollups operate in three sequential phases: submission, proving, and execution. zkLink adds a synchronization phase between the proving and execution stages. zkLink’s ZK-Rollup process is as follows:

① Submission Phase: Users initiate transaction requests on different chains via smart contracts. DApps act as sequencers, taking responsibility for ordering transactions and sending the ordered transaction list to the Prover.

② Proving Phase: The Prover packages the received transaction list into a batch and generates a zero-knowledge proof attesting to its validity. The Prover then submits both the batch and the proof to the mainchain. (In zkLink’s design, the Prover functions more as an auxiliary entity to the Validator system and does not directly interact with the zkLink protocol.)

③ Synchronization Phase: Since zkLink unifies multiple chains, this phase synchronizes states across different chains. It involves the oracle network processing final root exchanges between chains and comparing whether the final roots are consistent.

④ Execution Phase: The Validator verifies the zero-knowledge proof provided by the Prover and updates the transaction state across the respective chains.

Source: zkLink Whitepaper

From this process, we observe that zkLink leverages ZK-Rollup technology to aggregate transaction data from different chains into a single ZK-Rollup, forming a cross-chain transaction state layer.

2) zkSNARKs

zkSNARKs can prove transaction validity without revealing transaction details. zkLink uses zkSNARKs to ensure correctness of off-chain states and transaction validity, verifying finite off-chain states via zero-knowledge proofs and introducing lightweight oracle networks to meet specific network requirements, ensuring transaction validity. The zkSNARKs process in zkLink is as follows:

① Generation Phase: The Prover generates a proof based on the transaction list and a random number, proving knowledge of how to correctly execute the transactions without disclosing any details.

② Verification Phase: The Validator verifies the Prover’s knowledge based on the proof and a public parameter, without needing to know the transaction list or random number.

③ Update Phase: The Validator updates the on-chain state based on the verification result, completing transaction execution.

Through the synergy of these two technologies, zkLink constructs an efficient and secure multichain interconnected infrastructure. It connects different blockchain networks, supports seamless cross-chain transactions and liquidity aggregation, providing superior user experience and higher security compared to single-chain or simple cross-chain bridges/atomic swaps. This lays the foundation for building a borderless multichain DeFi trading network.

3.3 Project Workflow

Having understood zkLink’s project mechanics, let’s briefly introduce its operational workflow to deepen our understanding. The workflow can be divided into the following steps:

1) User Registration

Users register an account on zkLink and map their assets from different L1 or L2 networks to the zkLink protocol layer. This requires users to “deposit” tokens into zkLink’s smart contract on the L1/L2 network, generating a corresponding account and balance on the zkLink protocol layer. Users can manage multiple accounts and assets on the zkLink network without switching chains or wallets.

2) Initiate Transaction

Users initiate cross-chain transactions on the zkLink application layer, such as swapping, borrowing/lending, or buying NFTs across different DEXs. They enjoy fast, low-cost, high-speed, and private transactions on zkLink without worrying about compatibility or liquidity issues between chains.

3) Transaction Sequencing

The Sequencer collects users’ cross-chain transactions and batches them into a proof—this role is fulfilled by DApps. The Sequencer gathers cross-chain transactions on the zkLink protocol layer, orders them according to predefined rules, packages them into a batch, and calls the Prover service to convert the batch into a zero-knowledge proof, paying a fee.

4) Proof Construction

The Prover uses zero-knowledge proof technology to compress large volumes of off-chain transactions into a small proof and submits it to the L1 chain. Upon receiving the request from the Sequencer, the Prover uses cryptographic algorithms and tools to compress all transaction data and state changes in the batch into a compact proof and returns it to the Sequencer. The Sequencer then submits the proof to the zkLink smart contract on the L1 chain, paying a gas fee.

5) Proof Verification

After the lightweight oracle network synchronizes the final root state, the Validator executes the zkLink smart contract on the L1 chain to verify the proof submitted by the Prover and update users’ asset balances across chains based on the verification result. The Validator pays a fee on the L1 chain to complete proof verification and state updates. If the proof is invalid or incorrect, the Validator rejects it and reports anomalies to zkLink.

6) Asset Withdrawal

Users can withdraw their assets from the zkLink protocol layer back to the original L1 or L2 network at any time. This requires users to “withdraw” tokens via zkLink’s smart contract on the L1/L2 network, destroying the corresponding account and balance on the zkLink protocol layer. Users can freely transfer assets between chains without waiting for confirmations or paying high fees.

3.4 Wallet Integration and User Fund Simplification

zkLink supports integration with advanced Account Abstraction (AA) wallets, offering users more flexible and convenient asset management. AA wallets use smart contracts to control accounts, allowing users to set access permissions, transaction limits, and improved recovery options—making them very user-friendly for non-technical users, unlike rigid traditional private-key wallets. To integrate with zkLink, AA wallets must support specific signature formats and key generation standards, with the key requirement being that account security does not depend on zkLink—even if zkLink services go down, users can still retrieve their assets.

● For deposits, users can directly call zkLink’s deposit function or use intermediary transfer contracts to accommodate different use cases.

● For withdrawals, zkLink supports fast withdrawals. Users receive real-time quotes from multiple chain brokers and choose the best offer for withdrawal execution, eliminating the need to wait for on-chain confirmation and significantly speeding up withdrawal times.

In short, through AA wallet integration and optimized deposit/withdrawal flows, zkLink delivers a simple, secure, and smooth Layer 2 asset management experience for ordinary users, dramatically lowering the barrier to entry for public chain usage and facilitating wider adoption of zkLink.

3.5 Project Security

zkLink is committed to maximizing application security through technical means. Specifically, it employs multiple security mechanisms:

① zkLink’s security is primarily guaranteed by the underlying linked ecosystems plus SNARK proof technology. Only transactions verified via zero-knowledge proofs can be executed by Layer-1 contracts, extending the classic ZK-Rollup model with multichain functionality.

② To meet varying security and ecosystem needs of different DApps, zkLink offers customizable deployment options. When DApps link only to Ethereum and its Rollup VMs (e.g., zkSync, Scroll), they inherit Ethereum mainnet security.

③ When DApps choose to connect Ethereum with other L1s, zkLink uses a minimal trust assumption model, introducing a “witness” role. Witnesses have a simple task: read state roots received on different chains and compare them against a unified state. The unified state records all incoming asset information and user account changes across chains. If states match, off-chain information is fully consistent, mathematically eliminating risks like “False Prove” or “Rug Pull.” The security assumption is that zkLink won’t collude with all components of the oracle network. This mechanism allows zkLink to support additional Ethereum Rollups and multichain ecosystems while ensuring fund security.

④ Conducted the “Dunkirk” security test, simulating mass emergency withdrawals under extreme conditions: zkLink performed a “Dunkirk” test to simulate large-scale emergency withdrawals when user funds are at risk. During the test, zkLink shut down servers—simulating real-world scenarios where protocol operators disappear or servers crash—and invited reputable third parties to run recovery programs. Users successfully retrieved tokens from zkLink via recovery procedures, proving fund security and recoverability. This test also educated users on protecting their funds during crises, boosting confidence in decentralized trading security.

Through these multiple compatible mechanisms, zkLink enhances application support scope while safeguarding fund security, paving the way for users to select optimal paths. This solution achieves hybrid enhancement of security and universality.

3.6 Technical Features

1) Native Asset Aggregation Capability

Supports listing and delisting of cross-chain tokens, enabling users to operate FTs, NFTs, and RWAs from multiple public chains via a single interface—without any bridging required, avoiding cross-chain risks and costly bridge fees. Additionally, zkLink supports cross-chain portfolio management, allowing users to manage portfolios of the same token from multiple public chains using a single wallet address, eliminating the need to switch between chains or wait.

2) Liquidity Aggregation

zkLink achieves token merging and stablecoin unification, eliminating differences between identical assets across chains. For example, USDT issued on different chains is consolidated into a single USDT within the zkLink network. Additionally, zkLink introduces USD as a unified pricing currency for USDC, USDT, and BUSD, eliminating price spreads among fiat-pegged stablecoins. USD can be freely transferred within the zkLink system and serve as the primary currency for any trading pair. For example, an order-book DEX can list pairs like ETH/USD, BTC/USD, BNB/USD for spot or derivatives trading. An NFT marketplace can list NFTs priced in USD, reducing friction and lowering user entry barriers.

3) Better Capital Utilization

Users and organizations benefit from higher capital efficiency. Token consolidation promotes circulation, thereby improving utilization. Instead of holding long lists of mostly idle tokens on each chain, users need only a few token types to participate in multichain protocols. Additionally, deeper liquidity enables extra yield strategies like LP reinvestment.

4) Application-Specific Zero-Knowledge Proofs

For developers, zkLink’s zero-knowledge system is customizable, supporting industry-leading performance (1000+ TPS) for order-book trading, bridging the gap between high-frequency traders’ needs and on-chain products. Currently, developing zero-knowledge circuits remains complex, expensive, and time-consuming. zkLink’s infrastructure achieves several core advantages through application-specific circuit design:

● Customizable design supporting high-performance proof systems for specific applications like order books.

● High API usability and low development cost.

● Application-specific circuits are much smaller than general-purpose ZK circuits, offering higher efficiency and lower transaction costs.

● Continuous optimization of transaction performance, reducing per-transaction cost.

3.7 Project Use Cases

As a cross-chain trading infrastructure, zkLink theoretically supports any decentralized application scenario. However, prioritizing security and performance, it currently serves as a chain-agnostic, application-specific protocol offering a series of plug-and-play APIs designed specifically for this purpose. Below are some API use cases:

1) Order-Book DEX Trading

A decentralized exchange supporting cross-chain asset trading, combining CEX-like advantages with DEX-level security. Key features include:

● Users can access CEX-like features—limit orders, market orders, combined margin—on a single platform to trade assets from different chains such as ETH, BTC, SOL.

● Users retain custody of their assets without trusting third parties. The protocol uses a centralized matching engine for fast order matching but relies on zero-knowledge proofs (ZK) to ensure on-chain security and correctness.

● The protocol improves capital efficiency, supporting simultaneous spot and perpetual contract trading with leverage and margin management.

2) Multichain AMM

A decentralized protocol supporting cross-chain liquidity provision and swapping, using different types of automated market makers (AMMs) to suit market demands. Key features include:

● Users can create or join liquidity pools composed of native assets from different chains, such as ETH-SOL, UNI-CAKE, and receive corresponding LP tokens.

● Users can swap any cross-chain assets using different AMMs on the protocol—Constant Product (UNI V2), optimized stablecoins (Curve.fi), concentrated liquidity (UNI V3)—improving efficiency, reducing slippage, and deepening liquidity.

● The protocol enables seamless cross-chain asset transfers without requiring additional user actions or fees.

3) Omnichain Fungible Tokens (OFT)

A decentralized protocol supporting issuance and bridging of fungible tokens (OFT) across multiple chains, using a unified standard to define and manage cross-chain assets. Key features include:

● Users can issue their own OFTs and bridge them to other supported chains like ETH, BSC, SOL, or bridge existing OFTs from other chains into the protocol and transfer them across chains.

● The protocol ensures constant total supply of cross-chain assets, preventing double-spending or replay attacks. Users can query and verify their OFT balances and status anytime.

4) Multichain NFT Minting and Trading

Supports minting and trading NFTs across multiple chains, using a unified pricing unit to evaluate and compare NFTs across chains. Key features include:

● Users can create their own NFTs and mint them on other supported chains, or mint existing NFTs from other chains onto the protocol and transfer them across chains.

● Provides a unified NFT marketplace where users can browse and buy NFTs from different chains on a single platform.

5) Real-World Assets (RWA)

Enables users to access and trade real-world assets (RWA) from a single account, ensuring user autonomy and on-chain security.

● Users can use on-chain assets to buy/sell real-world assets (e.g., fixed income, stocks) and arbitrage or hedge across markets.

● Users maintain self-custody, preserving local autonomy and on-chain security.

3.8 Project Ecosystem

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News