Token ZKL officially launches as zkLink aims to "build bridges" in the multi-chain aggregated DeFi space

TechFlow Selected TechFlow Selected

Token ZKL officially launches as zkLink aims to "build bridges" in the multi-chain aggregated DeFi space

After ZKL's launch, the price briefly surged past $1, and its circulating market cap temporarily reached $130 million.

Author: Frank, PANews

If there were a tangible scenario for the Web3 world, it would be people building skyscrapers and cities—much like what Ethereum, Solana, and other Layer 2 sidechains are doing: constructing better infrastructure to attract more users. Others focus on building bridges and roads, connecting assets and data across these cities. zkLink clearly follows this latter approach.

To address issues such as asset fragmentation and complex multi-chain DApp development, zkLink leverages zero-knowledge proof technology to build an application-specific scaling engine and a unified Layer 3 Rollup network called zkLink Nova, aiming to break down liquidity silos across existing blockchains. According to L2BEAT data, zkLink Nova is currently the largest Layer 3 (L3) network by TVL.

On July 22, zkLink, a highly anticipated player in the multi-chain aggregated DeFi space, completed its Token Generation Event (TGE). Its native token, ZKL, launched on major exchanges including Bybit, HASHKEY, Bitget, CoinList, Kucoin, Bitmart, and Mexc, briefly surpassing $1 in price with a circulating market cap peaking at $130 million.

Tokenomics: 1 Billion Total Supply, Initial Release ~13.63%

ZKL is the native governance and utility token of the zkLink protocol, issued on the Ethereum mainnet. The total supply of ZKL is capped at 1 billion tokens, with no inflationary mechanism.

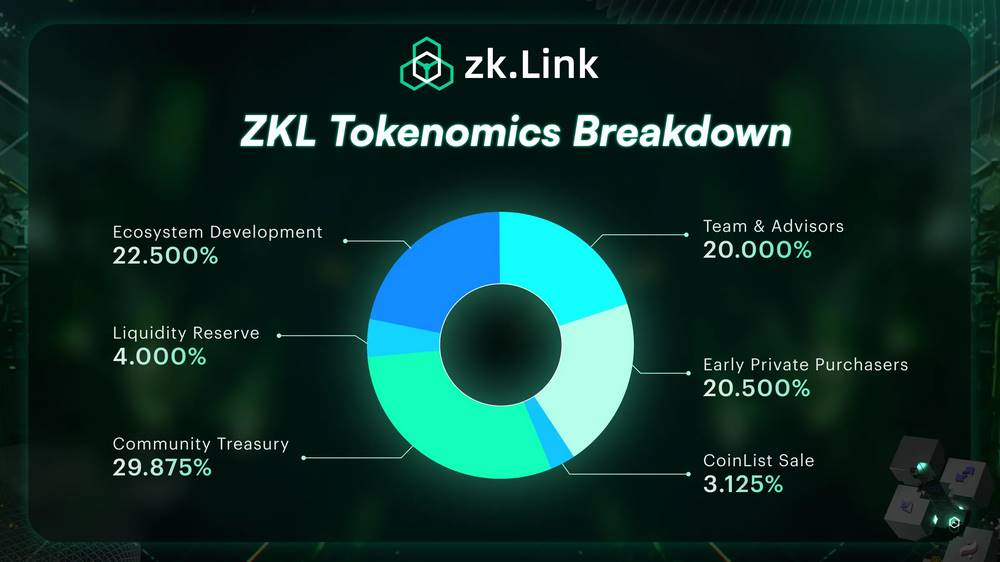

The token distribution is allocated as follows: Community Treasury (29.875%), Liquidity Reserves (4%), Ecosystem Development (22.5%), Founding Team & Advisors (20%), Early Private Investors (20.5%), and CoinList Sale (3.125%).

Of this, the initial TGE unlocked the following portions: 5% for community rewards, 1.2% for community development incentives and bug bounties, 2% for CEX and DEX liquidity provision from the liquidity reserve, 4.5% for ecosystem development funds, and 0.9375% from the CoinList sale—totaling an initial unlock of 13.6375%. The team and early investors will have their tokens unlocked over several months.

On July 22, ZKL trading went live on multiple exchanges including Bybit, HASHKEY, Bitget, CoinList, Kucoin, Bitmart, and Mexc.

Governance and Utility Functions

According to zkLink’s official documentation, users holding ZKL tokens on the zkLink Nova network are considered stakers. ZKL stakers gain the right to participate in the governance of the zkLink protocol.

ZKL serves two primary functions: governance and utility. Governance functionality primarily involves voting. However, to prevent Sybil attacks during the early stages, only designated roles such as administrators, moderators, and authors can initially create proposals. After the token launch, three governance proposals will be initiated: 1) setting the minimum ZKL requirement to submit governance proposals; 2) establishing the zkLink Ecosystem Fund; and 3) determining the next chain to integrate into the aggregated rollup network, zkLink Nova.

On the utility front, while ETH serves as the native gas token on zkLink Nova, ZKL can be used to pay transaction fees at a discount. Official documents also indicate that in the future, ZKL holders will be able to participate in Nova's decentralized sequencing network. Additionally, ZKL is the payment token for zero-knowledge proof generation services provided by verifiers, who can bid in zkLink’s proof auction market and earn ZKL tokens upon completing proof tasks.

Moreover, ZKL can also be used by developers to access App Rollup infrastructure services via zkLink X.

Airdrop Worth ~$21.5M; 30 Million More Tokens to Be Distributed

In June, zkLink announced the details of its ZKL airdrop campaign—NovaDrop Phase I: Genesis. Three categories of users qualified for this airdrop: holders of NovaPoints, owners of Nova Lynks NFTs, and those with zkLink Loyalty Points.

Based on the amount unlocked during TGE, 50 million tokens were allocated for airdrops. At a price of approximately $0.43, this portion of the airdrop is valued at around $21.5 million. The current circulating market cap stands at about $58 million, with a fully diluted valuation of roughly $430 million.

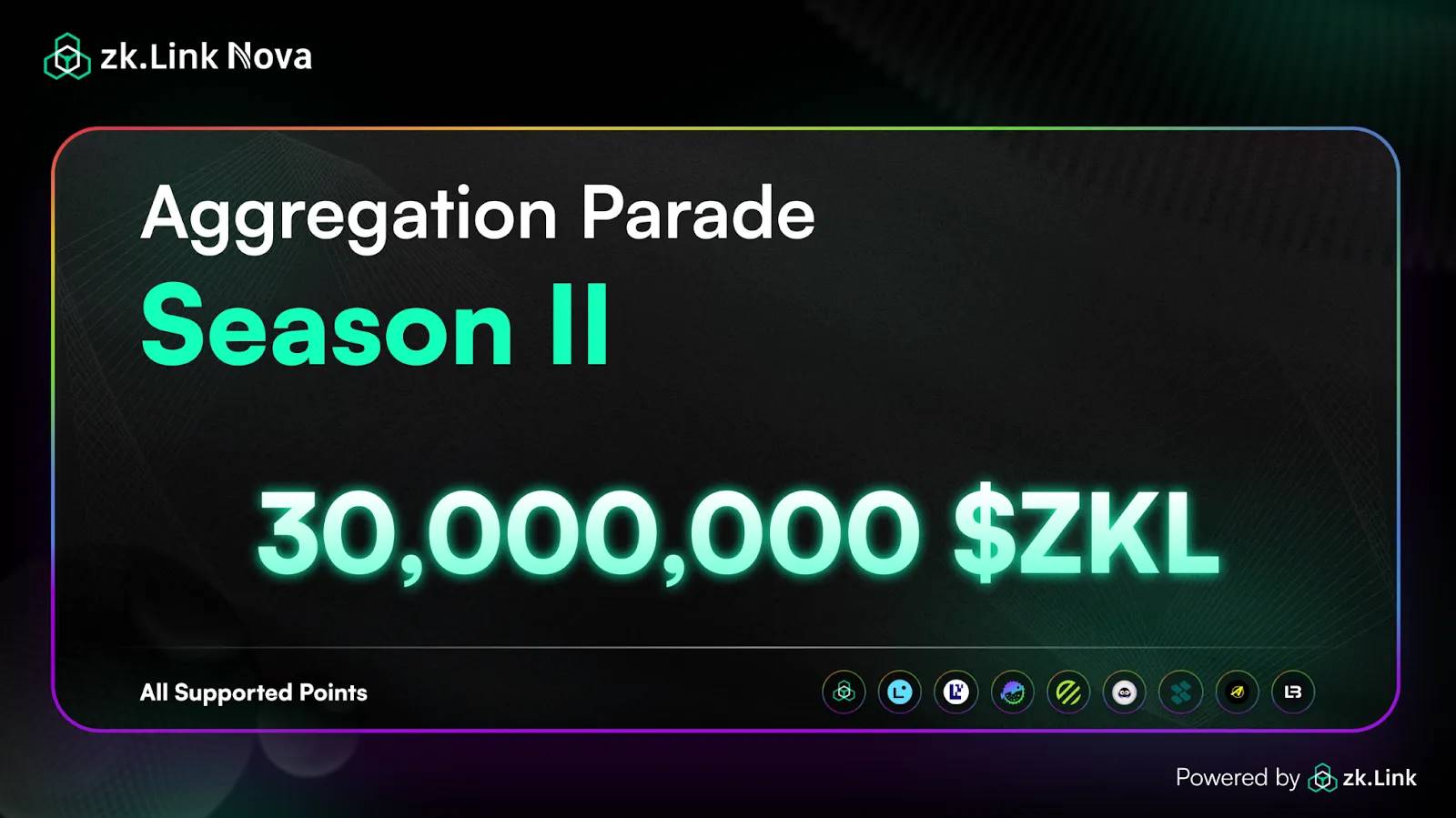

On May 12, zkLink launched the Aggregation Parade Season II campaign, offering a total reward pool of 30 million ZKL tokens. Starting from May 31, 2024, the event spans at least three cycles, each lasting six weeks. Users can earn NovaPoints by interacting with the zkLink Nova ecosystem through activities such as asset holding (including token merging, wheel spins, and referrals), spot and perpetual decentralized exchange trading, lending, and GameFi. At the end of each cycle, accumulated NovaPoints can be converted into ZKL tokens and claimed.

Notably, the official participation threshold for this campaign is set at 0.1 ETH or equivalent value—users failing to meet this minimum will not qualify.

New Investment from OKX Ventures

Previously, zkLink raised $4.68 million through a CoinList community sale and secured $18.5 million in two prior funding rounds from investors including Coinbase Ventures, Solana Ventures, SIG DTI, and Arrington Capital, bringing the total fundraising to $23.18 million.

On July 18, zkLink announced a new strategic investment from OKX Ventures. Commenting on the rationale behind the investment, Dora Yue, founder of OKX Ventures, stated: "With the Ethereum 2.0 upgrade, ZK Rollups and Optimistic Rollups have become dominant scalability solutions—Arbitrum One, for example, leads in TVL with $16 billion, accounting for 41%. However, the proliferation of Layer 2 networks has introduced challenges related to liquidity fragmentation and interoperability. zkLink’s multi-chain aggregation layer solution enhances capital efficiency and utilization. Since launching zkLink Nova in March, it has enabled innovative DeFi products such as one-stop aggregated lending markets, aggregated AMMs, cross-chain derivatives, and NFT trading platforms. We are excited to see zkLink Nova rapidly grow into the largest Layer 3 network within the Ethereum ecosystem, already collaborating with eight Layer 2 chains and liquidity hubs. OKX Ventures remains bullish on zkLink’s liquidity aggregation layer protocol, which continues to strengthen Web3 infrastructure and prepare for mass adoption at scale."

Furthermore, zkLink has demonstrated strong performance across key metrics. As of July 21, the number of unique addresses on zkLink has surpassed one million. In June, its TVL peaked above $1 billion, with zkLink Nova’s TVL reaching $750 million. Additionally, ecosystem vitality plays a crucial role in project growth—zkLink now has over 100 ecosystem partners.

In today’s fast-evolving blockchain landscape, cross-chain interoperability has emerged as a critical frontier. As various public chains and sidechains continue to proliferate, the challenge of enabling seamless asset and data flow between them becomes increasingly urgent. As a key player in this space, zkLink has clearly taken its seat at the table. Whether its token performance and upcoming initiatives can sustainably fuel ecosystem growth remains to be seen—but the outlook is promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News