Binance Megadrop's First Project BounceBit: Can It Become the Ethena of the BTC Ecosystem?

TechFlow Selected TechFlow Selected

Binance Megadrop's First Project BounceBit: Can It Become the Ethena of the BTC Ecosystem?

Bouncebit Mechanism Analysis and Extended Reflections

Written by: @Jane @Gimmy

Edited by: @Lexi @createpjf

Introduction

BounceBit is a restaking infrastructure layer built on the Bitcoin ecosystem. Designed in deep collaboration with Binance, it features high-yield CeDeFi components and has independently developed the BounceBit Chain to provide concrete use cases for restaking, forming an intriguing integrated system. BounceBit’s native token BB is scheduled to launch on Binance on May 13. According to official data at the time of writing, its Total Value Locked (TVL) has exceeded $1 billion.

On the investment front, BounceBit raised $6 million in a seed round in February this year, led by Blockchain Capital and Breyer Capital. In March and April, OKX Ventures and Binance Labs respectively provided strategic investments.

In terms of core philosophy, BounceBit’s design differs significantly from current Bitcoin Layer 2 solutions. It does not introduce new asset types nor attempt to modify any part of Bitcoin’s base protocol. Instead, it clearly recognizes that the heart of the Bitcoin ecosystem lies precisely in BTC itself—possessing massive market capitalization and optimal decentralization—and BounceBit simply leverages BTC directly. This seemingly lazy shortcut, upon closer examination and reflection, appears to be a fundamentally insightful approach.

Below, we will detail its mechanisms and discuss several key design aspects.

Overview of BounceBit Mechanism

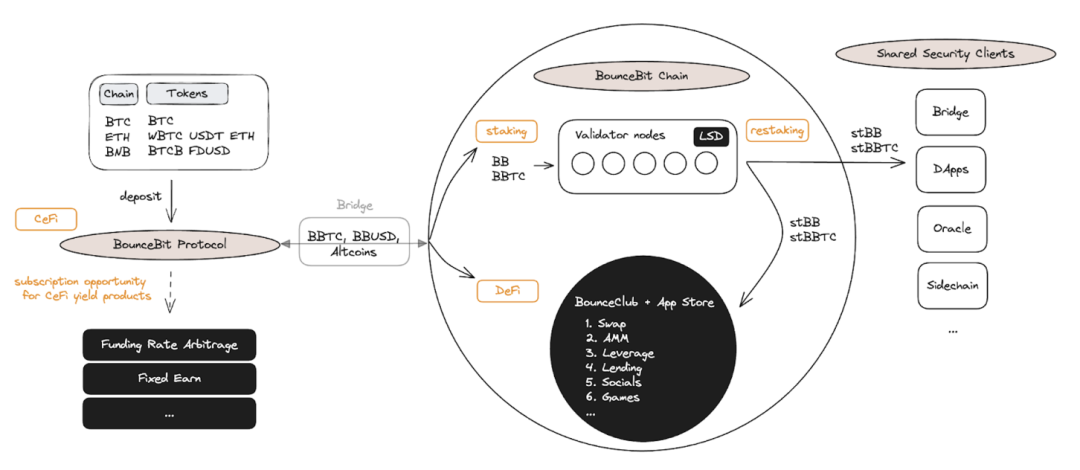

Referring to the architecture diagram above, BounceBit primarily consists of three components:

-

BounceBit Protocol: the CeFi component;

-

BounceBit Chain: the staking and LSD (Liquid Staking Derivatives) component;

-

Share Security Client: the restaking component.

BounceBit Protocol

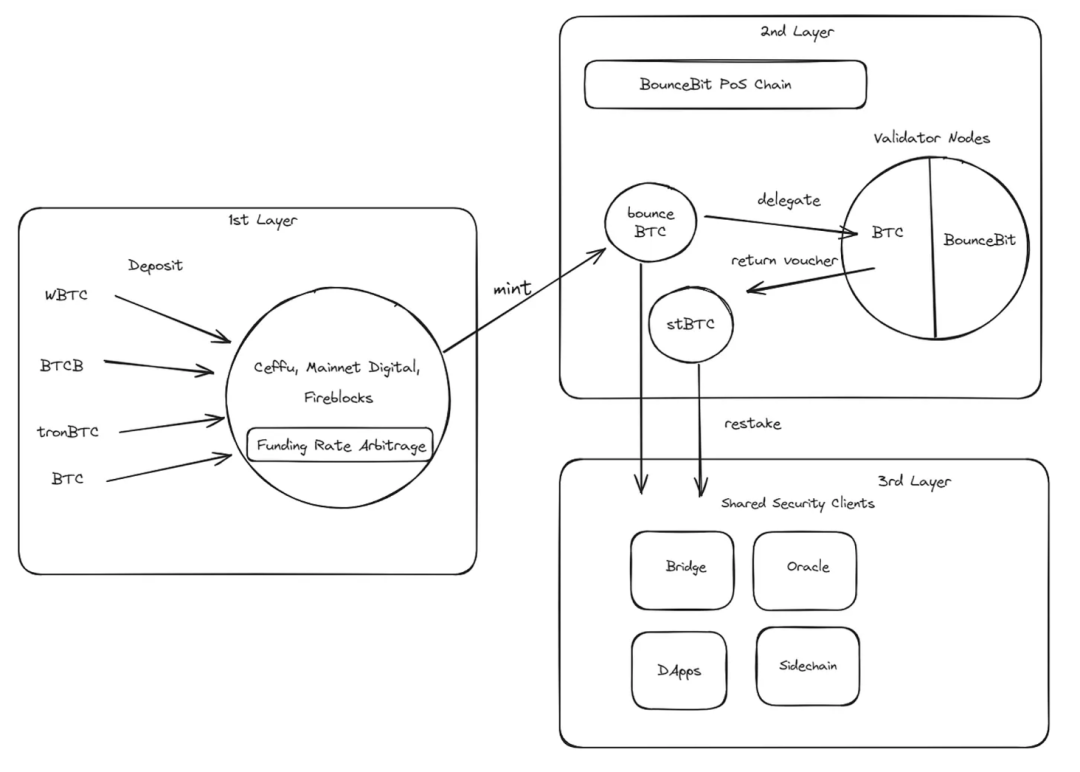

Details of the BounceBit Protocol can be illustrated as follows: users deposit BTC into the BounceBit Protocol and receive a Liquid Custody Token (LCT) at a 1:1 ratio as proof of deposit. For example, depositing BTC yields BounceBTC (BBTC), while depositing USDT yields BounceBit USD (BBUSD). According to official documentation, supported assets currently include BTC on Bitcoin, WBTC and USDT on Ethereum, and BTCB and FDUSD on Binance Smart Chain.

The BounceBit Protocol then holds all user-deposited assets within a Multi-Party Computation (MPC)-secured custody account (without moving them out). These assets are mirrored into Binance and entrusted to asset management firms, which generate profits through strategies such as funding rate arbitrage, returning those profits to users.

A T+1 off-exchange settlement (OES) mechanism ensures secure isolation between Binance and the custody account.

The custodial service providers involved are Ceffu and MainNet Digital. Ceffu was formerly known as Binance Custody and had long been Binance’s sole custody partner (recently expanded to include several crypto-friendly Swiss banks). MainNet Digital is a Singapore-based firm originating from MainNet Capital.

BounceBit Chain

BounceBit Chain is an independent EVM-compatible Layer 1 blockchain utilizing a Delegated-Proof-of-Service (DPoS) consensus mechanism.

At the core of PoS is the idea that many nodes become stakeholders in the blockchain by staking funds. By validating transactions, they contribute to network security and earn corresponding rewards. (As vividly described by Hsu Ming-en, this is a reward for digital labor.)

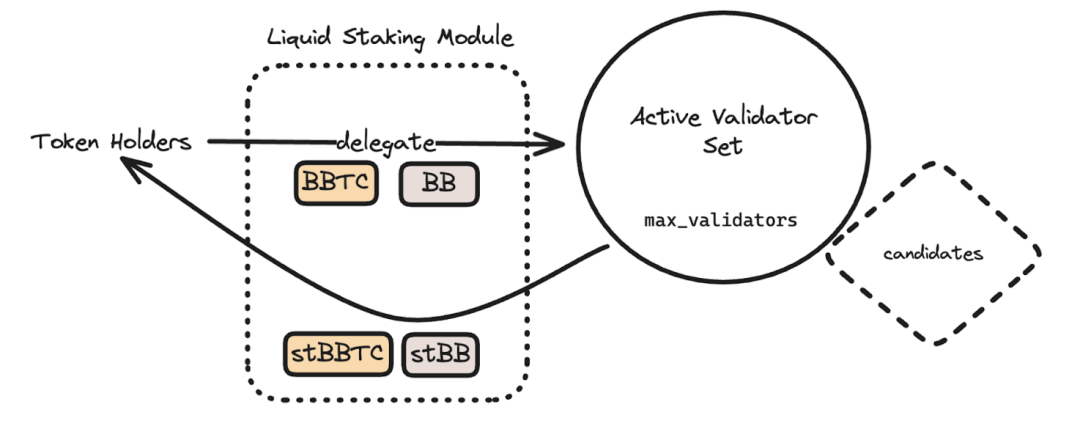

Within the BounceBit Chain design, users can freely choose to delegate their BBTC and/or BB tokens to any validator node within the Active Validator Set (AVS) to earn rewards.

Validator nodes can set commission fees competitively. Currently, each epoch lasts 24 hours, during which the AVS includes 50 active validators—25 accepting BTC staking and 25 accepting BB staking. The number 50 is governed via community decisions, while validator selection into the AVS is re-evaluated every epoch based on performance.

This entire staking process is executed via the Liquid Staking Module, issuing stBBTC and stBB tokens to users as proof of stake—these are Liquid Staking Derivatives (LSDs).

These LSDs serve two main purposes:

-

Used within dApps on BounceBit Chain—for instance, as collateral in CDP stablecoin protocols, lending platforms, or providing liquidity on DEXs (earning LP rewards);

-

Available for rent by Share Security Clients (SSCs) to leverage BounceBit Chain’s security—for bridges, oracles, sidechains, etc.—this constitutes the restaking component. The logic mirrors EigenLayer. However, no actual client implementations have emerged yet. Early incentives are expected to come in the form of points, fueling airdrop expectations. Whether this turns into a classic "carrot-and-donkey" scenario remains to be seen over time.

Overall, the complete architecture and interrelationships among components are shown below:

Tokenomics

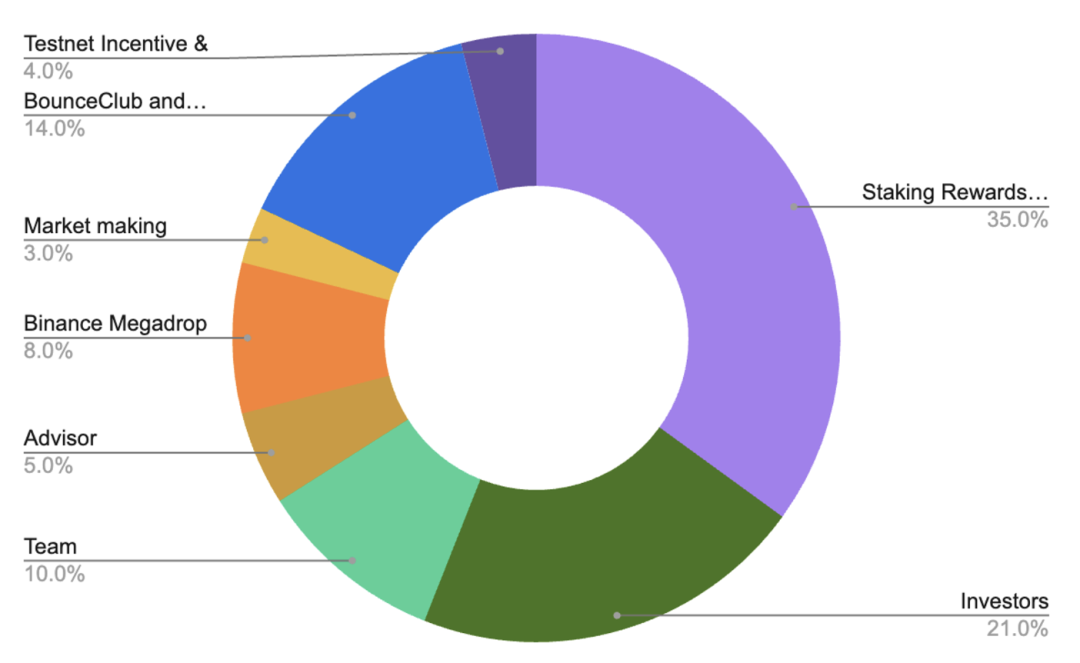

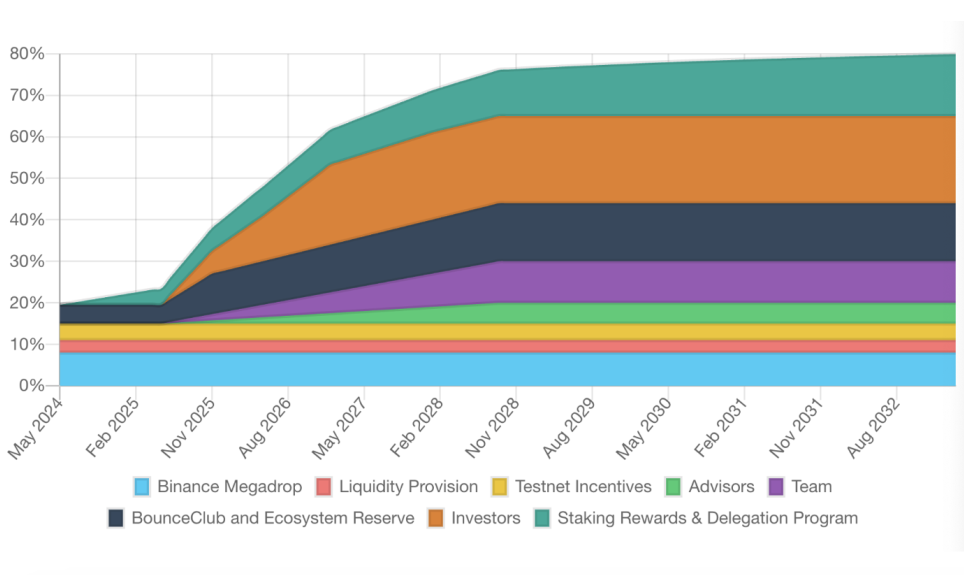

As the native token of BounceBit Chain, BB has a total supply of 2,100,000,000 tokens. The detailed allocation and vesting schedule are as follows:

The Token Generation Event (TGE) for BB is expected in May 2024. At launch, the circulating supply will be 409,500,000 tokens, representing 19.50% of the total supply.

Two aspects stand out:

-

Investor allocation accounts for 20%, slightly higher than the typical Web3 range of 10%–15%;

-

Binance Megadrop receives 8% of tokens, fully unlocked at TGE.

Considering 1) BounceBit is the first project featured in Binance Megadrop, and 2) early support for BNB-formatted Bitcoin (BTCB), it's evident that BounceBit maintains a strong relationship with Binance. Such substantial airdrops are likely to attract significant users and TVL from Binance initially. However, sustained growth post-airdrop will depend on whether BB offers real yield-generating use cases capable of delivering competitive APYs.

Marketing Strategy

In terms of marketing, BounceBit previously ran the "Water Margin" campaign on testnet to incentivize TVL, launched the "Journey to the West" program encouraging participation in BounceClub, and most recently partnered with Binance on the "Megadrop" event.

-

"Water Margin" was a TVL incentive campaign similar to Blast’s model, rewarding users with points for deposits, referrals, leaderboard rankings, and introducing gamified elements like acceleration cards, bonus multiplier cards, team events, and raffles.

-

"Journey to the West" allows users to create their own clubs (Clubs), serving as a customizable toolkit integrating various dApps.

-

Megadrop is a deeply integrated initiative with Binance, driving traffic to BounceBit while simultaneously creating utility and lock-up incentives for BNB. Specific rules can be found here—it represents a relatively novel and intuitive engagement model.

Overall, as marketing is an indispensable element of any Web3 product, the BounceBit team appears highly adept at user engagement—xD

Ecosystem Progress

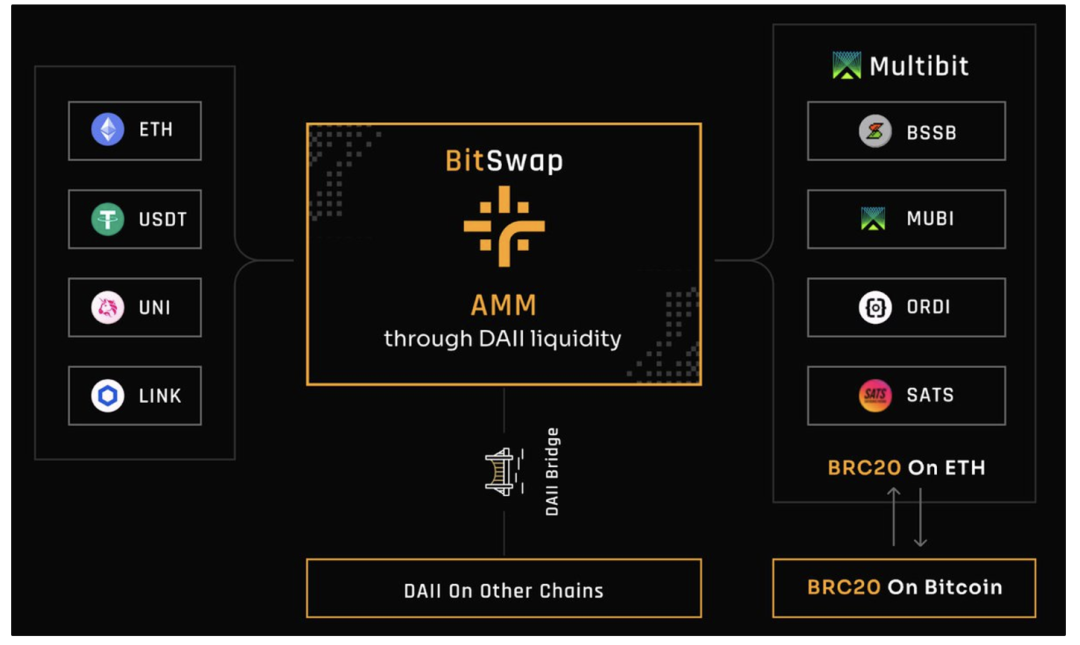

Several DeFi projects are already active within the BounceBit ecosystem, including BitSwap (DEX), MultiBit (BTC-EVM bidirectional bridge), and BitStable (stablecoin).

Take BitSwap as an example—the first DEX built on BounceBit—which aims to simplify cross-chain trading and become a liquidity hub for BRC-20 assets through partnerships with MultiBit and DAII. Users can swap any ERC20 token (ETH/USDT/etc.) for DAII on BitSwap, where DAII is paired with bridged BRC-20 assets. Furthermore, by integrating MultiBit’s CCIP, users can seamlessly transfer bridged BRC-20 tokens back to the Bitcoin network.

ERC20 <–> DAII <–> bridged BRC-20 <–> BRC-20

https://twitter.com/BitSwap_xyz/status/1750015734216864145

Further Reflections on BounceBit

After understanding BounceBit’s foundational design, several interesting points warrant deeper discussion:

1. CeDeFi Has Valid Use Cases

Even when entering a relatively decentralized environment like BounceBit Chain, users may still face CeFi-related risks associated with BBTC or BB due to its CeDeFi nature. However, centralized exchanges (CEXs) or centralized components should not be viewed as inherently dangerous. For example, most dApps today use upgradable contracts controlled by project teams (which is why users hold tokens, not equity). Similarly, many L2s currently rely on centralized sequencers. Yet, this doesn’t stop people from using them.

Decentralization exists on a spectrum. Centralized exchanges like Binance can actually offer safer and more rational experiences for novice users compared to self-custody and DeFi trading. For large holders, CeDeFi provides a balanced option—enhancing yield through centralized services while maintaining relative asset security.

2. Revenue Sources and Sustainability

Revenue sources and their sustainability are central to evaluating any Web3 product. For BounceBit, revenue streams can be broadly categorized into three types:

a. Asset Management Revenue via Binance Integration in BounceBit Protocol

Currently, Binance’s asset management revenue mainly comes from funding rate arbitrage (Funding Rate Arb). When properly executed, this strategy is nearly delta-neutral, making it a low-risk and controllable trading approach.

b. Staking Rewards on BounceBit Chain

Staking rewards on BounceBit Chain derive from transaction fees and newly minted BB tokens via PoS issuance.

c. DeFi Ecosystem Yield

DeFi yield depends on the level of activity within BounceBit’s DeFi ecosystem.

Moreover, given that the Bouncebit ecosystem is still in its early stages, the future development of SSCs and the broader restaking ecosystem will be critical indicators of BounceBit’s long-term momentum. We expect the team to launch initiatives such as hackathons to stimulate application development, helping maintain attractive restaking rewards.

3. Value Contribution to BTC L1

During the recent surge in Bitcoin ecosystem innovation, inspired by Mezo’s design philosophy, we apply a first-principles framework to evaluate new projects: what value does this chain/protocol bring to BTC L1?

If the essence of PoS/DPoS is to use distributed capital to secure blockchain networks, then strengthening security can happen in two ways: increasing total capital and improving capital distribution. While the latter is harder to prove, the former benefits greatly if PoW-based assets like BTC can be incorporated. In this regard, BounceBit’s approach—focused solely on creating new utility for BTC at the asset level—is simple, direct, and stands in stark contrast to many other Bitcoin-layer projects.

Initially, we perceived this method as lazy—neither building native EVM capabilities nor leveraging native UTXO architecture. However, after research and reflection, we see it instead as a direct and honest approach: clearly telling users this is a product with centralized elements, designed purely to bring BTC onto-chain for usage. Ultimately, the key is enabling BTC holders to trustfully utilize their assets and expand use cases—the specific methods can remain flexible.

Conclusion

Effectively unlocking BTC’s utility remains a central focus in the Bitcoin ecosystem, and different teams have offered varied approaches to this challenge. BounceBit’s solution is simple and direct, tightly focused on generating yield from BTC to create value. Having achieved the status of Binance’s inaugural Megadrop project in under six months, the team’s operational and integration capabilities are evident. Nonetheless, its long-term success hinges critically on whether its SSC ecosystem develops robustly—only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News