Confirming the airdrop: Why is BounceBit, the first Bitcoin restaking chain, so attractive?

TechFlow Selected TechFlow Selected

Confirming the airdrop: Why is BounceBit, the first Bitcoin restaking chain, so attractive?

Includes BounceBit interaction tutorial.

Author: Meteor, ChainCatcher

In 2024, the restaking market has seen explosive growth. So far, Ethereum remains the central hub for the restaking narrative, primarily because EigenLayer—the pioneer of the "restaking" concept—is built on Ethereum. According to DeFiLlama data, as of this writing, the TVL in Ethereum's liquid restaking protocols exceeds $6.5 billion. However, the cryptocurrency industry constantly cycles through and imitates narratives. With Ethereum’s restaking gaining such momentum and offering users additional returns, Bitcoin naturally needs its own restaking infrastructure to improve asset utilization for BTC holders, unlock greater potential from BTC, and increase profitability. Today we’ll introduce BounceBit, the first native restaking chain in the BTC ecosystem.

Unlocking Maximum BTC Yield Potential: What BounceBit Does

In 2024, Bitcoin L2s are undoubtedly a key narrative, with many projects striving toward BTC scaling solutions. A variety of innovative frameworks have emerged within the Bitcoin L2 space. Rather than follow the trend and position itself as a Bitcoin L2, BounceBit introduces a paradigm shift—from L2 to L1—positioning itself as an asset-driven PoS L1.

BounceBit was designed to solve the problem of insufficient yield for BTC holders. It provides three mechanisms enabling BTC holders to earn BTC-based returns:

Staking

DeFi Ecosystem (BounceClub)

Arbitrage BTC Strategies

Staking Nodes

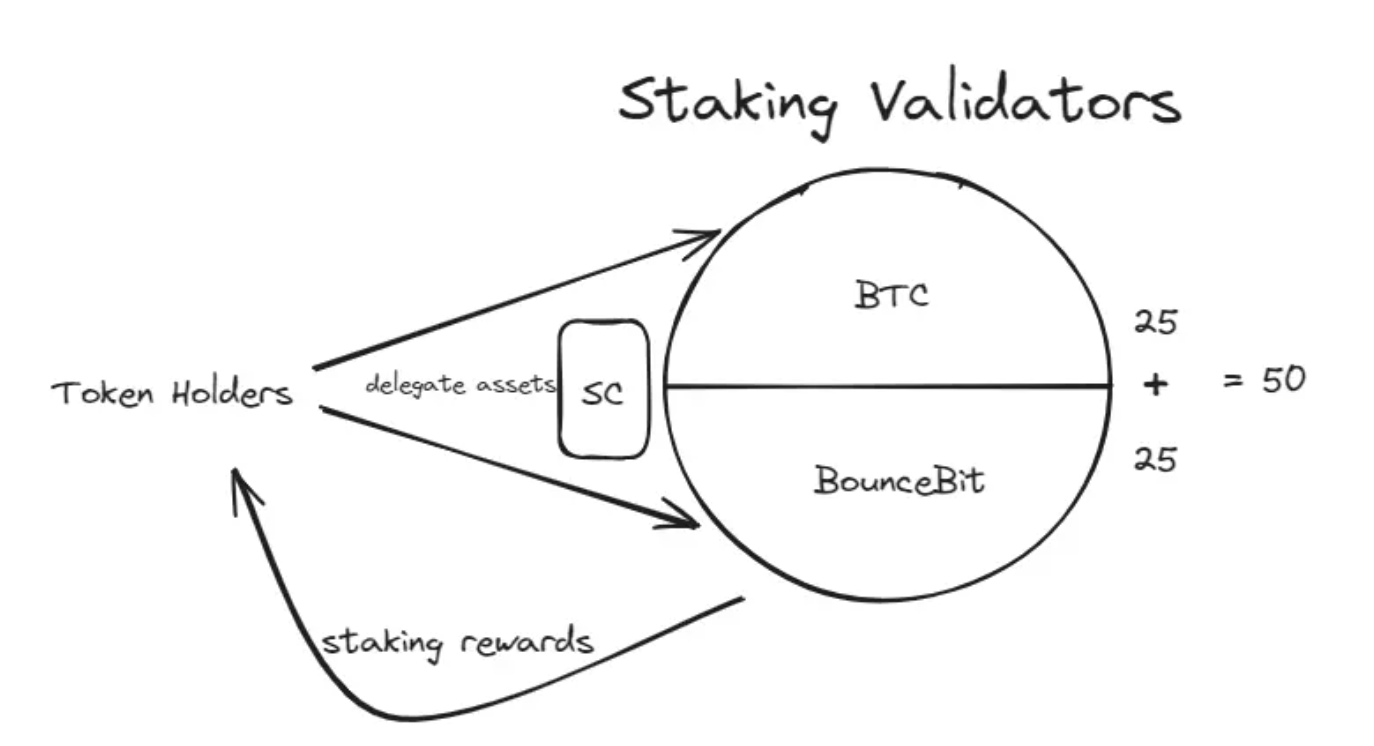

BounceBit secures its network by staking BTC and its native token BB, with audited custody support provided by CEFFU (formerly Binance Custody) and Mainnet Digital. The system's PoS mechanism leverages native BTC security and full EVM compatibility to introduce a dual-token staking system. BounceBit’s PoS algorithm selects 25 staking validators from each of the two token categories—BTC or BounceBit tokens. Token holders can delegate their assets to validators to earn staking rewards and help secure the network.

BounceClub

BounceClub is BounceBit’s on-chain DeFi ecosystem, inspired by the technological and user experience integration of Apple’s App Store. Jack Bounce, founder of BounceBit, once stated: “Traditional blockchains are boring. Steve Jobs’ Apple Store business model set the standard for Web2. BounceBit is adopting a similar, Apple-inspired model to set standards for Web3.”

BounceClub serves as a central hub where users can design, launch, and experience dApps within the BTC ecosystem. Users can customize their Web3 projects via the BounceBit App Store by selecting various tools and components based on their needs. They can actively participate in the BounceBit ecosystem through activities like LP provision, liquidity mining, Launchpad participation, or governance, earning rewards in the form of trading fees, governance tokens, or other incentives designed to encourage ecosystem engagement.

Currently, the BounceClub App Store includes projects such as Bitstaking (staking application), Bitswap (AMM DEX), Bitstable (lending protocol), and Bitleverage (derivatives). Users can create their own BounceClub or join existing ones to interact and boost activity.

CeFi + DeFi Yield Integration

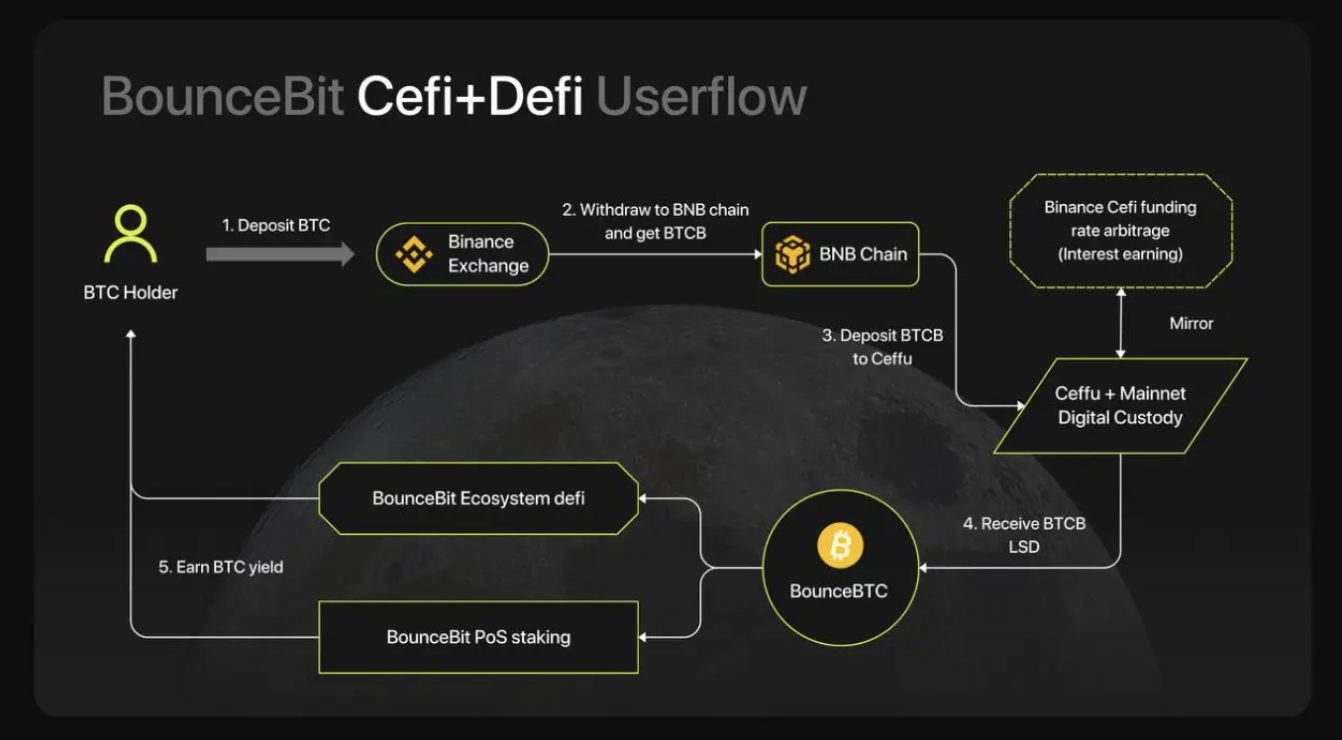

One of the most important aspects positioning BounceBit at the forefront of the staking race is its ability to generate both CeFi and DeFi yields simultaneously. Users can earn original CeFi returns while also engaging in LSD-based BTC staking and on-chain mining—a process known as “restaking.”

The ecosystem offers Bitcoin holders three types of yield: base CeFi returns, node operator rewards from staking BTC on the BounceBit chain, and opportunity yields from participating in on-chain applications and the Bounce Launchpad.

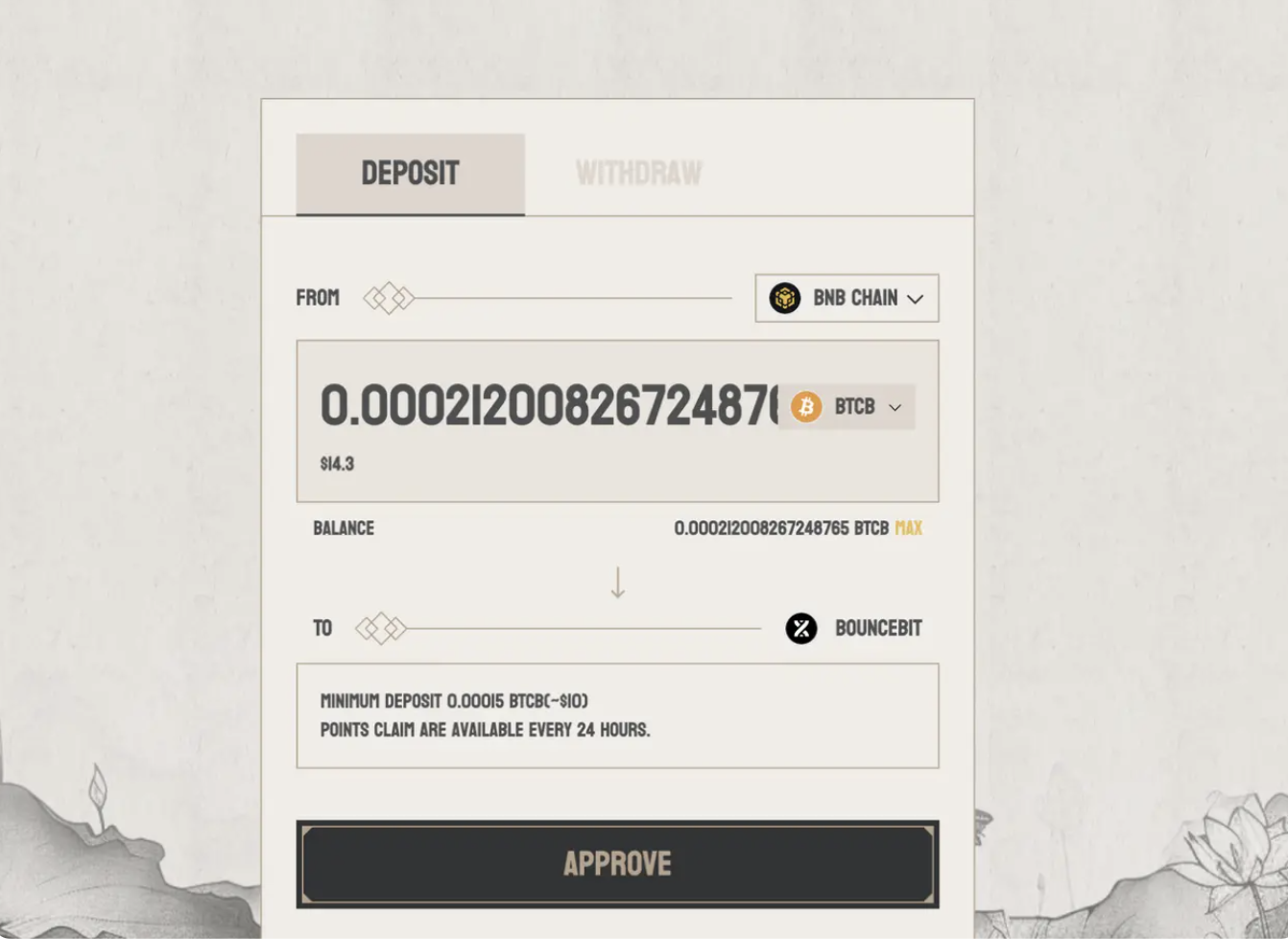

Taking BNB Chain as an example, the general flow is: deposit BTC (BTCB) from BNB Chain into BounceBit; the deposited BTCB is then transferred to custody via Ceffu + Mainnet Digital (integrated CeFi framework, generating CeFi yield and funding rate arbitrage). After participation, users receive BTCB and LSD tokens as rewards; these LSD tokens can be bridged into the BounceBit chain and used within the BounceBit DeFi ecosystem for mining, LP, staking, and other activities.

Note: User-deposited TVL is securely managed by Mainnet Digital’s regulated custodial services, ensuring compliance and safety. These assets are then mirrored via Ceffu’s MirrorX service to maintain transparency.

BounceBit Investors

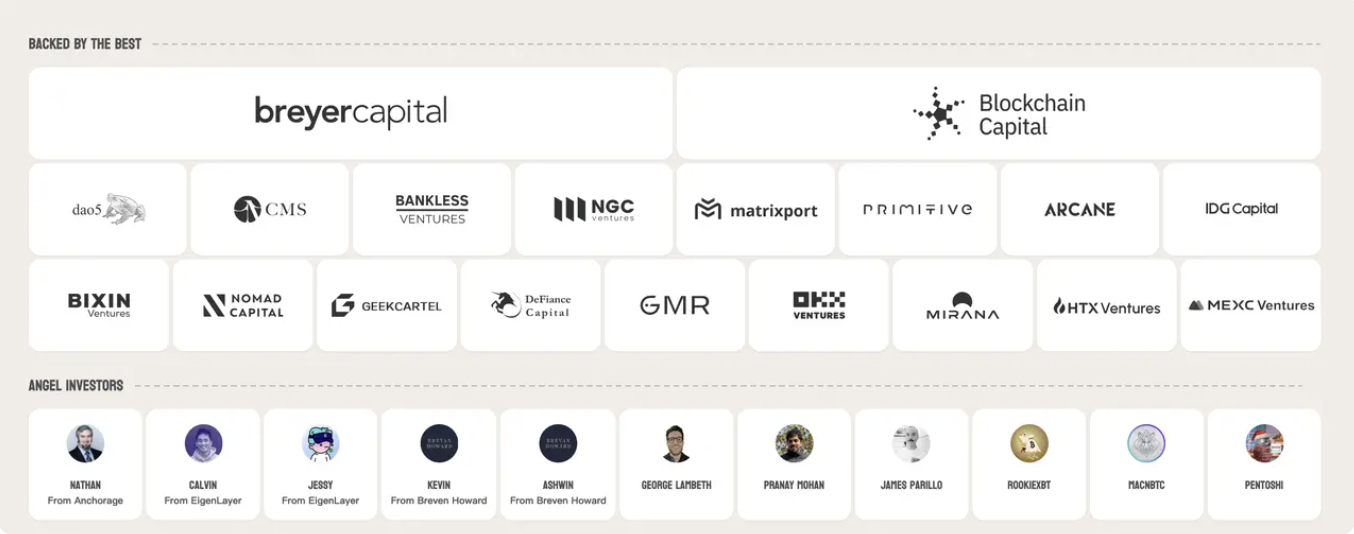

At the end of February, BounceBit announced it had completed a $6 million seed round. Investors include Blockchain Capital, Breyer Capital, CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, DeFiance Capital, OKX Ventures, Bixin Ventures, and HTX Ventures. Notable individual investors include Calvin Liu, Chief Strategy Officer of EigenLayer, and Nathan McCauley, Co-Founder & CEO of Anchorage Digital.

BounceBit Tokenomics and Roadmap

BounceBit’s PoS introduces a dual-token system consisting of the native token BB and BBTC.

BB

The native token of BounceBit is called BB. The total supply cap is 2.1 billion tokens, mirroring Bitcoin’s total supply of 21 million. A portion of the total supply will become liquid upon mainnet launch, while the remainder will be allocated as future staking rewards or unlocked over the coming years.

Uses of BB include:

- Participating in BounceBit’s PoS staking mechanism;

- Being distributed as staking rewards to validators securing the network;

- Serving as gas required for transactions and smart contract execution on BounceBit;

- Acting as a liquidity and utility token on the BounceBit platform;

- Used across various applications and infrastructure as a medium of exchange or store of value;

- Enabling composability, interoperability, and cross-chain compatibility;

- Participating in on-chain governance, such as voting on protocol upgrades.

The total supply of BB remains fixed at 2.1 billion. As more users join the network, token distribution may be adjusted based on on-platform crypto-economic activity. Future token burn mechanisms may be introduced through platform governance.

BBTC

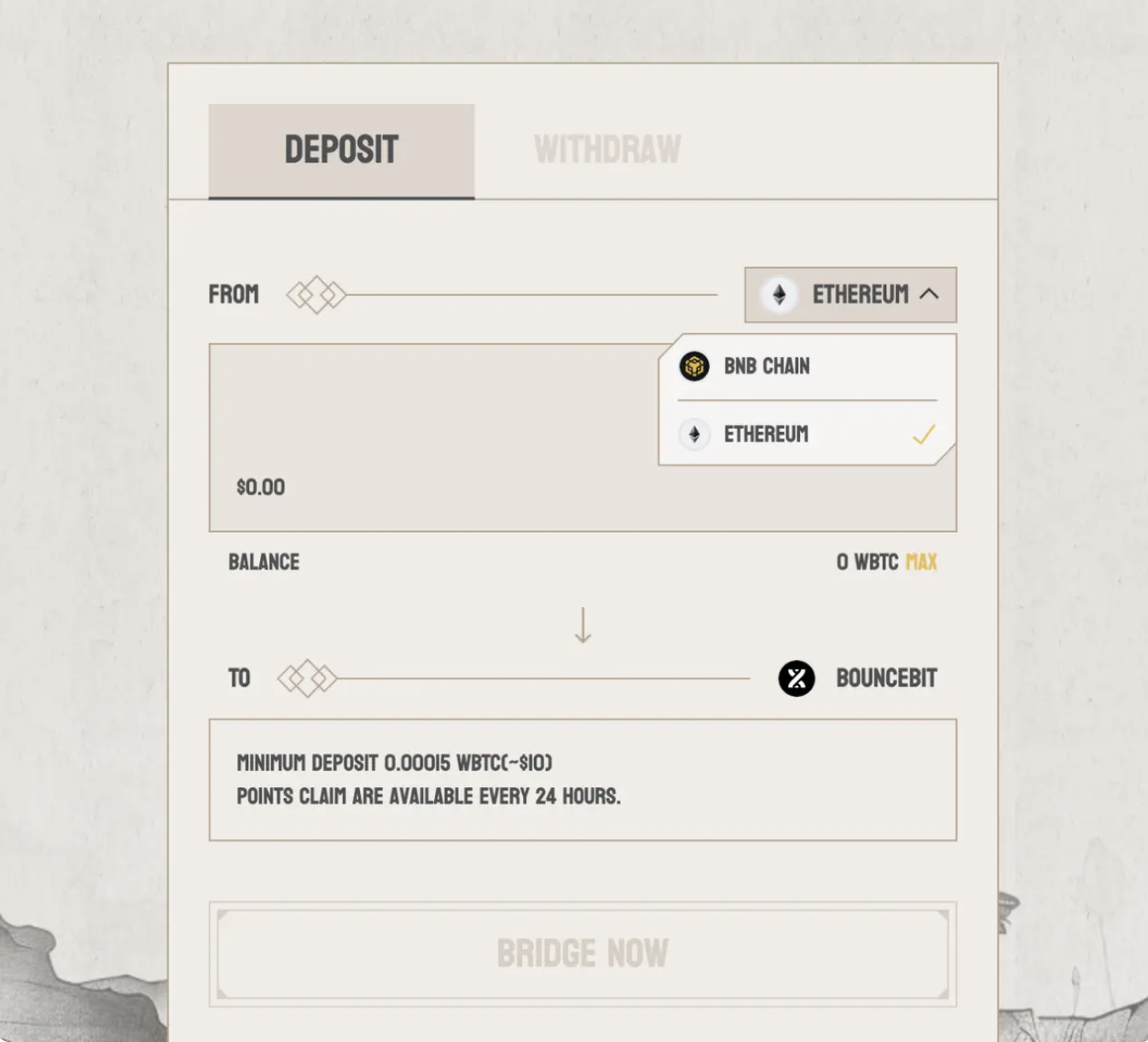

BBTC is the wrapped version of BTC on BounceBit. Users can bridge native Bitcoin and BTC from various EVM-compatible chains into the BounceBit ecosystem via the BTC Bridge. Bridged tokens are referred to as BBTC on BounceBit. This includes support for BTCB on Binance Smart Chain (BEP20) and WBTC on Ethereum, all of which can be bridged to BounceBit.

BounceBit plans to support all BTC asset types in the future.

BounceBit supports liquid staking of BBTC. BBTC holders can stake their funds with node operators and receive liquid staking derivatives (LSD) as proof, which can then be reinjected into infrastructure such as BTC Bridge, oracles, and data availability layers.

When performing liquid staking on BounceBit, staking BTC and BB is preferred to ensure network security. Upon staking, users receive corresponding LSDs. Current staking options provide:

- stBB, the LSD for BB tokens;

- stBBTC, the LSD for BBTC.

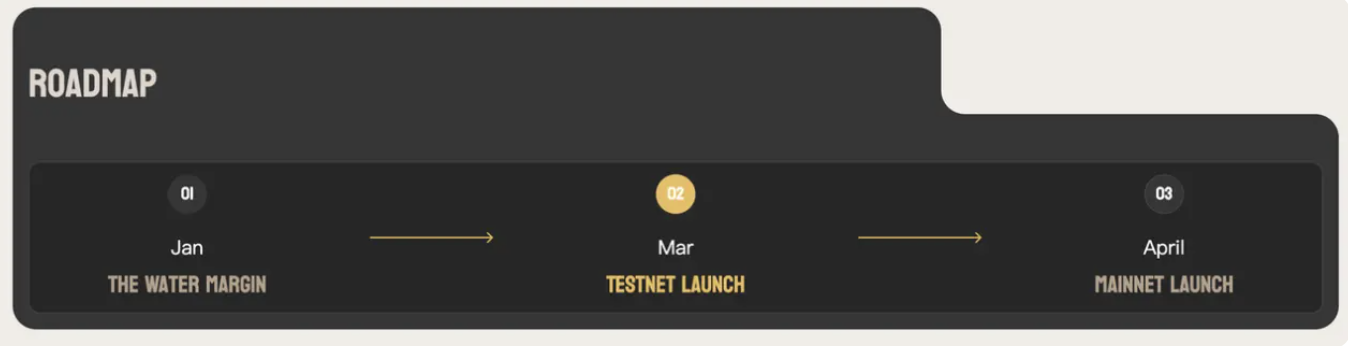

According to BounceBit’s roadmap, the project is currently in testnet phase and plans to launch its mainnet in April.

How to Interact with BounceBit

Current interactions with BounceBit fall into two categories: depositing via bridge (Early Access) to earn points, and interacting with the BounceBit testnet (Join BounceClub).

BNB Chain and Ethereum Bridge

Visit the BounceBit official website and select either Ethereum or BNB Chain. Deposit a minimum of 0.00015 BTC worth of assets (approximately $10), click Approve to authorize the BTCB transaction, and confirm.

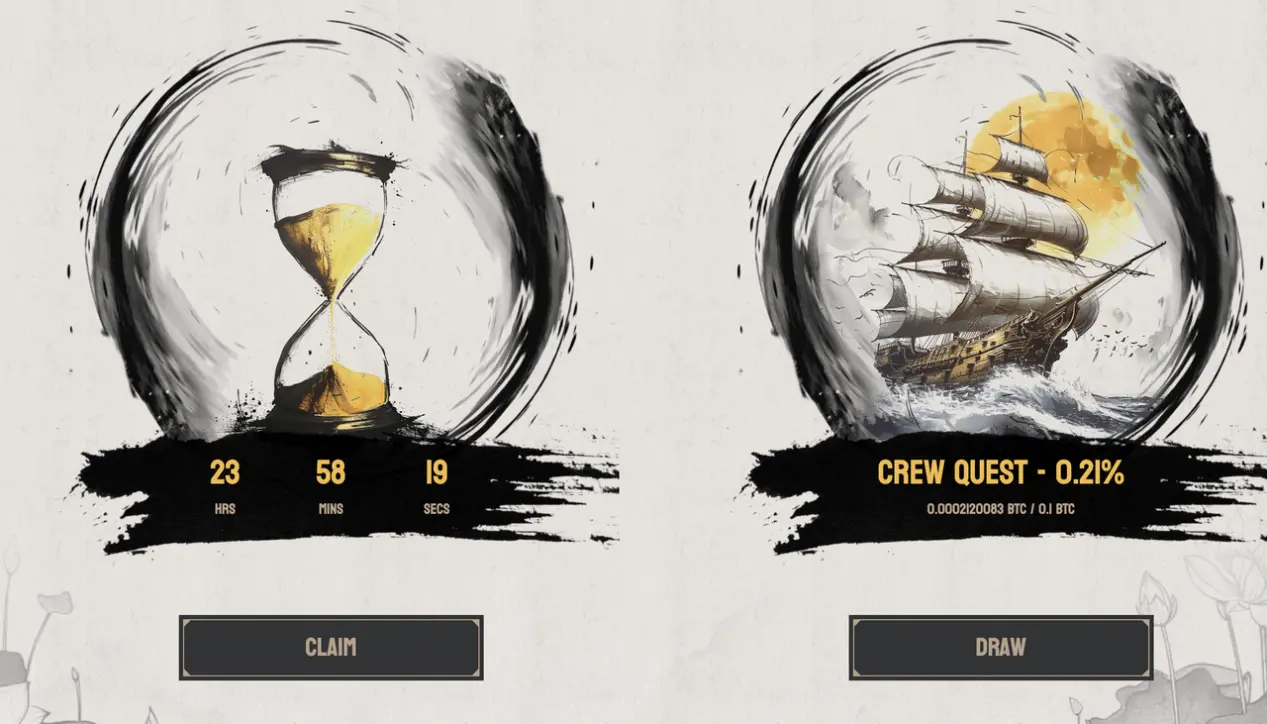

After depositing, users can click Hallway Claim to collect platform points (points are claimable via an hourglass timer, typically once every 24 hours). Points are likely tied to potential airdrop eligibility.

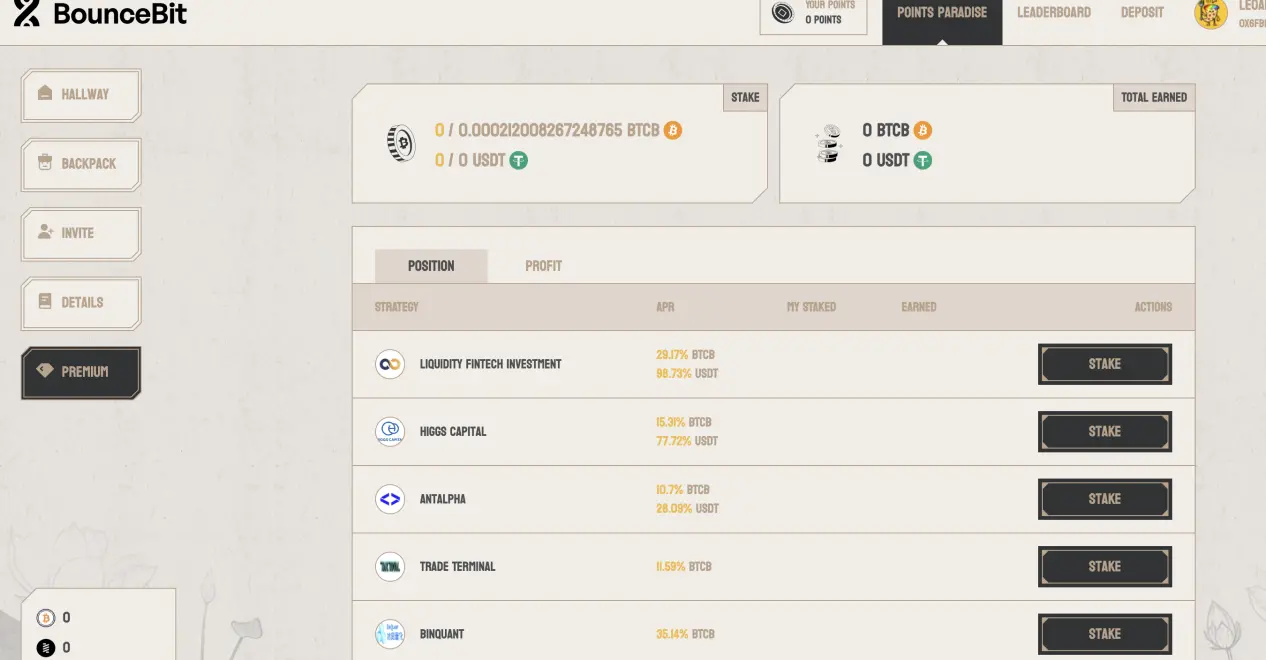

In addition to the minimum $10 deposit, BounceBit offers premium features. Click Premium to access higher-yield staking projects currently available on the platform. The premium tier requires a deposit of at least 0.1 BTC or 1,000 USDT.

Author’s BounceBit referral codes (feel free to use):

https://bouncebit.io?code=3MWRD

https://bouncebit.io?code=8RZOT

https://bouncebit.io?code=3MLUF

https://bouncebit.io?code=XT7CE

https://bouncebit.io?code=F1OKF

https://bouncebit.io?code=Z2RIL

BounceBit Testnet Interaction

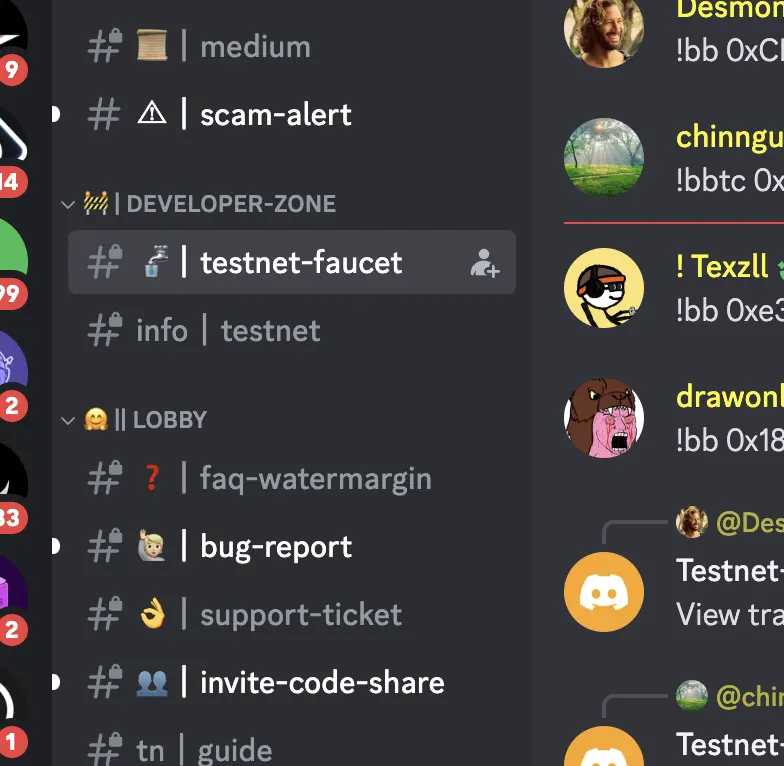

Join BounceBit’s official Discord, complete verification, then click on testnet-faucet in the left sidebar and enter your wallet address to receive test BB or BBTC tokens (1 BB or BBTC);

After receiving test tokens, visit the (BounceClub) App website. You can choose to create your own Club (editing club details; creation requires BB as gas) or join an existing one.

Users can then add dApp applications from the BounceBit App Store to their BounceClub and interact with them. Currently, the App Store includes AMM DEX, lending, staking, and other apps.

Take Bitswap as an example: after adding the app, users can customize trading pairs (requiring sufficient quantity and variety of test tokens in the wallet to create pools), then perform test transactions to increase testnet activity.

Finally, users can stake test tokens by visiting BBScan website, connecting their wallet, and staking BB or BBTC.

Conclusion

BounceBit has been live for less than seven weeks. The site currently shows a TVL exceeding $670 million and over 57,000 users.

As the first Bitcoin restaking chain; backed by renowned institutions such as Blockchain Capital, Bankless Ventures, and OKX Ventures; supported by industry leaders including the CEO of EigenLayer; unlocking triple yield for BTC holders; and with strong airdrop expectations—BounceBit combines compelling attributes that make it worthwhile for early adopters to engage with its ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News