In-Depth Analysis of Ethena's Success Factors and Death Spiral Risks

TechFlow Selected TechFlow Selected

In-Depth Analysis of Ethena's Success Factors and Death Spiral Risks

The reason for Ethena's success as a CeFi product lies in its provision of short-side liquidity to centralized exchange perpetual futures markets, but risks of a death spiral inherent in its mechanism design should be carefully monitored.

Author: @Web3Mario

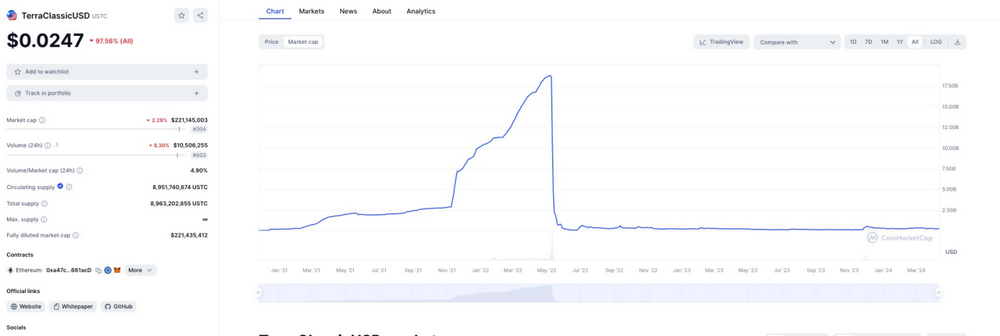

In recent days, the market has been ignited by Ethena, a stablecoin protocol offering annualized yields exceeding 30%. Numerous articles have already explained Ethena's core mechanics, so I won't repeat them here. In short, Ethena.fi tokenizes delta-neutral arbitrage trades on ETH by issuing a stablecoin (USDe) that represents the value of delta-neutral positions. Their stablecoin USDe captures arbitrage profits—thus they claim it to be an "internet-native bond" delivering native yield for the internet. However, this scenario inevitably reminds us of UST, the algorithmic stablecoin from Terra that triggered the last crypto bull-to-bear transition. UST rapidly attracted deposits through Anchor Protocol’s 20% APY subsidy but collapsed swiftly after a bank run. Given this precedent, USDe—the stablecoin issued by Ethena—has sparked widespread discussion in the crypto community, particularly following skepticism voiced by DeFi thought leader Andre Cronje. Therefore, I aim to explore more deeply both the reasons behind Ethena’s surge and the risks embedded within its mechanism.

Why Ethena Succeeds as a CeFi Product: Savior of Centralized Exchange Perpetual Markets

To understand why Ethena succeeded, I believe the key lies in its potential to become a savior for perpetual futures markets on centralized cryptocurrency exchanges. Let's first analyze the problems currently faced by major centralized crypto exchanges in their perpetual contract markets—specifically, the lack of short-side liquidity. We know that futures serve two primary purposes: speculation and hedging. Given the extremely bullish sentiment prevailing among most speculators today, far more traders are taking long positions than short ones. This imbalance leads to high funding rates for longs, increasing the cost of holding long positions and dampening overall market activity. For centralized exchanges, perpetual contracts are among the most actively traded products, with trading fees constituting a core revenue stream. High funding costs suppress trading volume and thus reduce exchange revenues. Hence, attracting short-side liquidity during bull markets becomes crucial for exchanges seeking greater competitiveness and higher income.

Here, it may help to review some basics about perpetual contracts and how funding rates work. A perpetual contract is a special type of futures contract. Unlike traditional futures, which have fixed settlement dates involving asset transfers and clearing processes that increase operational costs for exchanges, perpetuals have no expiry or settlement. Traders can hold positions indefinitely. The challenge, however, is maintaining price alignment between the perpetual contract and the underlying asset. In conventional futures, convergence occurs at delivery because the contract mandates physical (or cash) settlement at a predetermined price. But since perpetuals do not settle, an additional mechanism—funding rates—is introduced to tether the contract price to the spot price.

We know prices are driven by supply and demand. When more people go long than short, the perpetual contract price tends to rise above the spot price. This difference is known as the basis. When the basis widens significantly, a corrective mechanism is needed—this is where funding rates come in. During positive basis conditions (when the contract trades above spot), longs pay shorts a periodic fee proportional to the basis spread (ignoring fixed components). The larger the deviation, the higher the cost for longs, discouraging further buying and helping restore equilibrium. Conversely, when shorts dominate, they pay longs. This mechanism ensures price correlation between perpetuals and spot markets.

Returning to our earlier point: under current extreme market optimism, long funding rates are very high, suppressing long-side participation and reducing market vitality—and thereby lowering exchange revenues. To mitigate this, centralized exchanges typically bring in third-party market makers or act as counterparties themselves (a common practice revealed post-FTX collapse). While effective, this introduces additional risk and cost. Market makers hedge their short exposure in perpetual markets by going long in the spot market—a strategy identical to Ethena’s core mechanism. However, given today’s massive market scale, individual market makers often lack sufficient capital, creating significant single-point risk. Exchanges need innovative solutions to crowdsource capital, distribute risk, and absorb basis spreads to keep funding rates competitive. Enter Ethena—at precisely the right moment.

At its heart, Ethena accepts crypto assets like BTC, ETH, and stETH as collateral, then opens short positions on corresponding perpetual contracts via centralized exchanges, achieving delta neutrality while earning yield from staked assets and funding rate payments. Its stablecoin USDe essentially functions like a share in an open-ended market-making fund focused on delta-neutral crypto basis arbitrage. Holding USDe grants entitlement to the fund’s returns. Users gain easy access to a high-barrier, high-yield strategy, while centralized exchanges benefit from broader short-side liquidity, lower funding rates, and enhanced competitiveness.

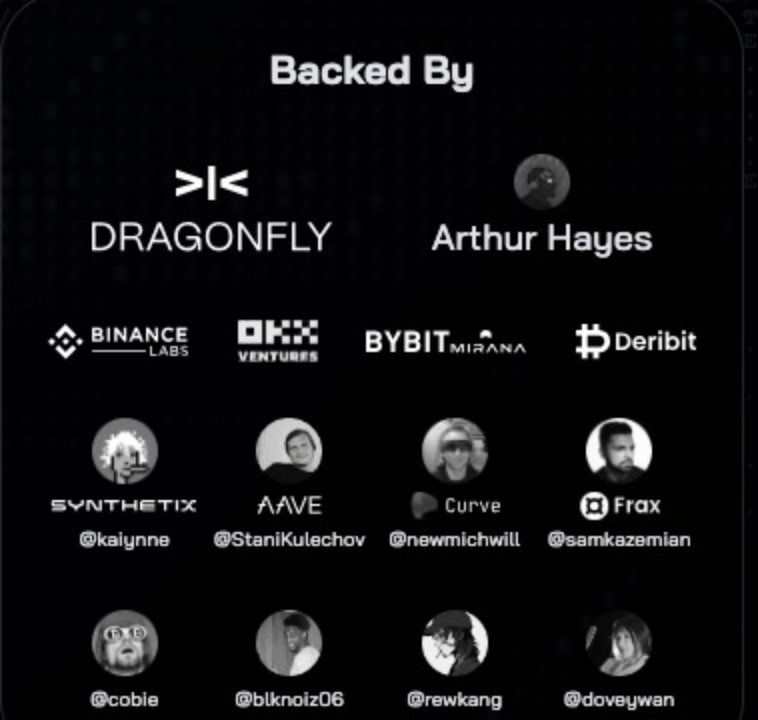

Two observations support this view. First, Ethena isn’t unique in using this model—UXD in the Solana ecosystem employed a similar mechanism. Yet UXD failed before integrating with centralized exchange liquidity, due partly to unfavorable low-rate environments across cycles and severely impacted by FTX’s collapse. Second, examining Ethena’s investor base reveals heavy involvement from centralized exchanges, underscoring their strong interest in this model. Nevertheless, amid the excitement, we must not overlook the inherent risks!

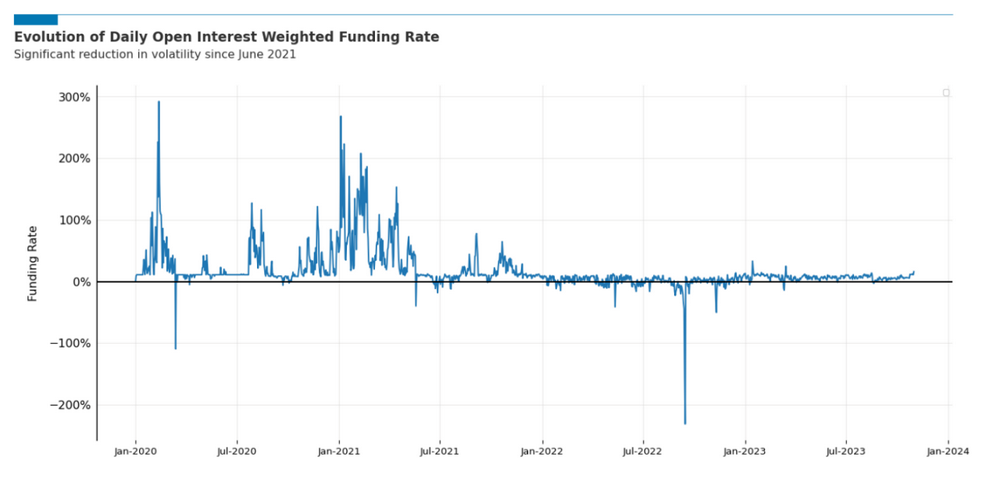

Negative Funding Rates Are Just One Trigger—Basis Is the Key to the Death Spiral

For any stablecoin protocol, resilience against bank runs is critical. Much of the discourse around Ethena focuses on how negative funding rate environments in crypto futures markets could erode USDe’s collateral value. However, such events are typically brief. Cross-cycle backtesting shows negative funding periods are rare and short-lived—a conclusion well-supported in Chaos Labs’ economic model audit report published by Ethena. Moreover, the damage from negative rates is gradual, as funding is settled every eight hours. Backtests show that even under an extreme -100% annualized rate, maximum loss per 8-hour period would be just 0.091%. Over the past three years, negative funding occurred only three times, averaging 3–5 weeks in duration: ~3 weeks in April 2022 (-3.3%), ~3 weeks in June 2022 (-4.8%), and a five-week episode ending September 15 (-17.9%). With positive funding prevailing otherwise, Ethena has ample opportunity to build reserves during favorable periods to buffer against downturns and prevent collateral ratios from falling below 100%. Thus, I argue the risk from negative funding is manageable—or at least significantly mitigable—and represents merely one possible trigger for a run. Of course, questioning statistical validity falls outside the scope of this article.

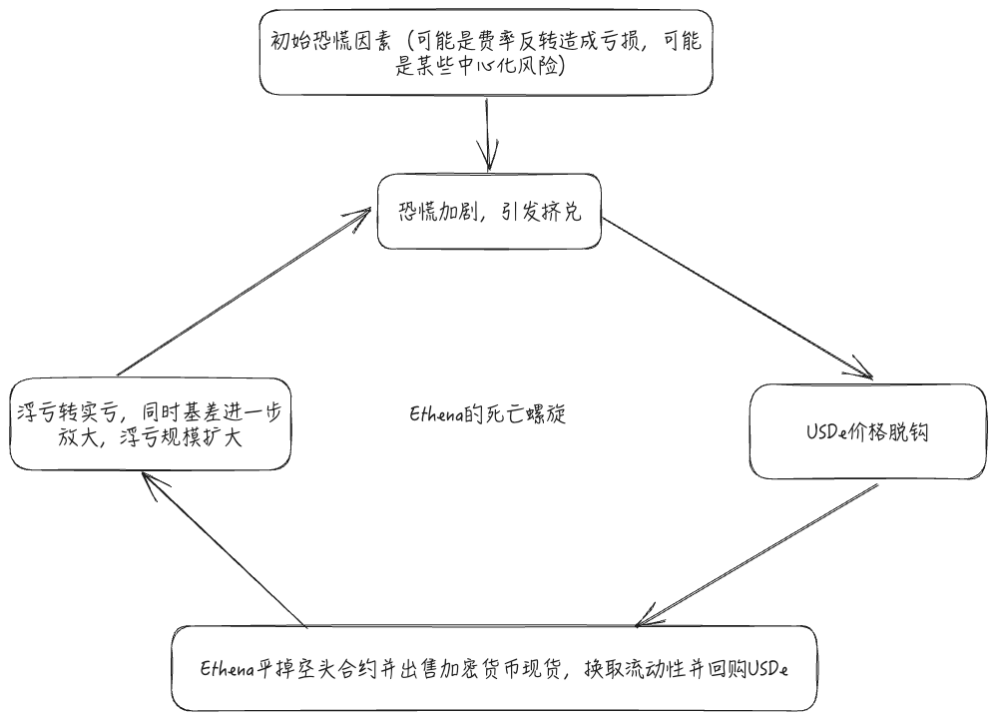

That said, Ethena is far from immune to systemic shocks. After reviewing official and third-party analyses, I believe a fatal factor has been overlooked: the basis. This is precisely where Ethena becomes most vulnerable during a bank run—or rather, the epicenter of its potential death spiral. Revisiting two iconic stablecoin runs—UST’s collapse and USDC’s March 2023 depeg following Silicon Valley Bank’s failure—we see that in today’s digital age, panic spreads rapidly, triggering massive redemptions within hours or days. This demands robust tolerance from stablecoin mechanisms. Most protocols therefore use highly liquid, low-volatility assets as collateral (e.g., short-dated Treasuries) to quickly sell and meet redemption demands. However, Ethena’s collateral consists of volatile crypto assets paired with futures contracts, placing immense strain on liquidity across both spot and derivatives markets. When USDe issuance reaches scale, can markets provide enough liquidity to unwind these basis arbitrage positions fast enough during a mass redemption? That remains its greatest risk.

While all stablecoins face collateral liquidity challenges, Ethena’s design introduces an additional negative feedback loop, making it more susceptible to death spirals. A death spiral occurs when a triggering event amplifies fear, leading to escalating redemptions. The crux lies in the basis. Recall that Ethena’s collateral strategy is fundamentally a short-basis trade: holding spot assets while shorting equivalent perpetuals. When the basis expands positively—i.e., perpetual prices rise faster than spot, or fall slower—the portfolio incurs unrealized losses. During a bank run, users dump large amounts of USDe, causing clear depegging in secondary markets. To correct this, arbitrageurs must close outstanding short futures and sell spot collateral to buy back USDe and reduce circulating supply. But closing shorts converts unrealized losses into realized ones, permanently impairing collateral value and potentially pushing USDe below full backing. Worse still, unwinding positions exacerbates the basis: covering shorts pushes up perpetual prices, while selling spot depresses spot prices—widening the basis further. This increases Ethena’s unrealized losses, fueling more panic and triggering even broader redemptions, potentially cascading into irreversible collapse.

This death spiral is no exaggeration. While historical data suggests basis tends toward mean reversion over time, this offers little comfort in a crisis context. Stablecoin users have extremely low tolerance for price volatility. While investors might accept drawdowns in pure arbitrage strategies, users expect stability from instruments designed for store-of-value and medium-of-exchange functions. Even yield-focused interest-bearing stablecoins inevitably attract users who don’t fully grasp complex mechanisms but participate based on surface-level appeal (a central accusation against UST founder Do Kwon: misleading marketing). These users form the core group likely to initiate runs—and suffer the heaviest losses. The risk is real and substantial.

Of course, sufficient liquidity on both the short-futures and long-spot sides could mitigate this negative feedback. But considering Ethena’s current issuance scale and its powerful deposit-gathering ability fueled by high subsidies, we must remain vigilant. Remember, after Anchor offered 20% yields, UST surged from $2.8 billion to $18 billion in just five months—a growth trajectory unlikely matched by proportional expansion in crypto futures market depth. It’s reasonable to expect Ethena’s open interest to balloon disproportionately. Imagine a scenario where over 50% of all short positions in the market belong to Ethena. Unwinding such a position would incur enormous friction costs, as no counterparty could absorb that volume in the short term. The resulting basis widening would be severe, accelerating the death spiral dramatically.

I hope this analysis helps clarify the risks associated with Ethena. Let us maintain healthy respect for risk and avoid being blinded by high yields.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News