Will RESOLV, the new stablecoin protocol with its "fee switch" activated, become the next ENA?

TechFlow Selected TechFlow Selected

Will RESOLV, the new stablecoin protocol with its "fee switch" activated, become the next ENA?

From the comparison of MC/TVL and FDV/TVL, RESOLV offers better cost performance.

Original | Odaily Planet Daily

Author|Azuma

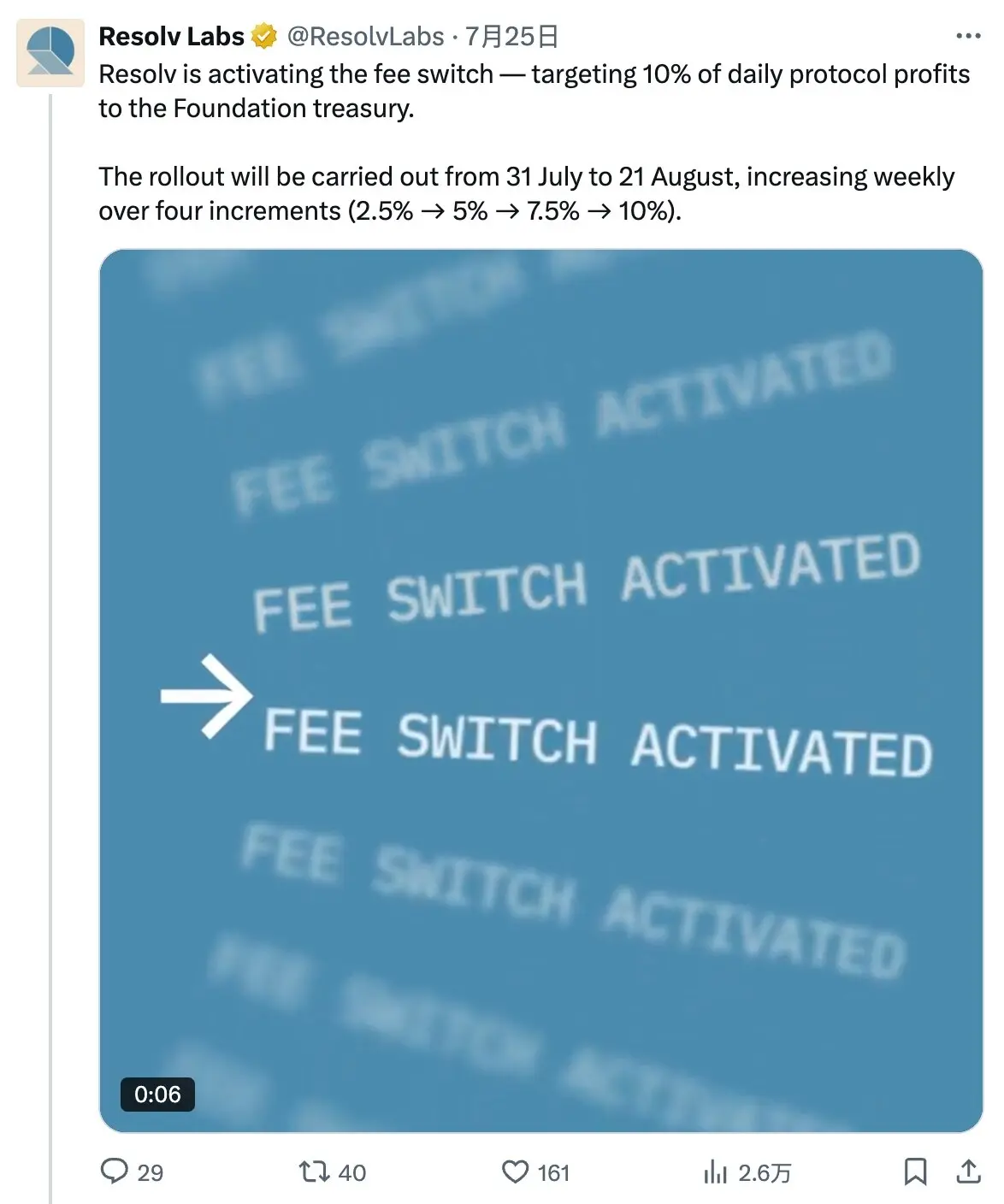

On July 25, Beijing time, yield-bearing stablecoin protocol Resolv officially announced it will gradually turn on the "fee switch," aiming to redirect up to 10% of its daily protocol revenue to the foundation treasury for long-term value creation and to incentivize RESOLV stakers. Specifically, Resolv plans to increase the revenue transfer ratio weekly over four weeks from July 31 to August 21 (2.5% → 5% → 7.5% → 10%), ultimately reaching the target of 10%.

The term "fee switch" is a common concept in DeFi protocols referring to fee distribution. In simple terms, it's an embedded contract function that determines whether protocol revenues are distributed to the native token. However, different protocols vary in their execution models. Previously, well-known projects such as Uniswap and Ethena have discussed activating their "fee switches," but refrained due to community disputes over revenue allocation and concerns about readiness.

Generally, a "fee switch" is seen as directly beneficial to the protocol’s native token, as it enhances the token's value capture ability. Conversely, since the "fee switch" often redirects part of the income previously earned by users to token holders, it may harm user interests to some extent. As a result, most protocols remain hesitant about turning on the "fee switch." For example, in Uniswap’s case, liquidity providers (LPs) originally received the full 0.3% trading fee, but once the "fee switch" is activated, part of this income must be redirected to UNI holders, thereby reducing LP returns.

Resolv's Positioning and Considerations

Returning to Resolv, similar to Ethena's USDe, the USR issued by Resolv is a yield-generating stablecoin backed equally by spot long positions and perpetual short positions. Its yield primarily comes from "staking rewards on spot holdings" and "funding rate earnings from perpetual shorts."

However, compared to Ethena, Resolv has implemented additional mechanism designs. For instance, it introduced a risk tiering mechanism via the insurance pool RLP, achieving a higher over-collateralization ratio for USR. Additionally, it integrates a larger proportion of liquid staking derivatives, resulting in higher spot staking yields. Under Resolv’s design, the protocol has achieved an annualized yield of approximately 9.5%, performing exceptionally well among emerging stablecoins.

At the end of May, Resolv officially launched its governance token RESOLV. Although Resolv attempted to empower RESOLV through measures like "offering high staking yields" and "accelerating points accumulation for Season 2 airdrops," the token’s post-launch performance has been underwhelming. Perhaps to boost the token price, Resolv has now turned its attention to the "fee switch."

In its official announcement regarding the activation of the "fee switch," Resolv stated that "the timing and architecture are now mature"—the protocol has achieved real, non-theoretical traction; it has a clear value distribution framework; and it has demonstrated resilience—thus deciding not to delay launching the "fee switch" any further.

As mentioned earlier, Resolv plans to gradually increase the revenue transfer ratio over four weeks, eventually reaching 10%. Regarding the specific use of this portion of income, Resolv states it will be used "to expand the value Resolv provides to users and stakers," including: 1) supporting new integrations between DeFi, fintech, and institutional venues; 2) funding ecosystem grants and product development; 3) driving buybacks and other token-related initiatives. Resolv also mentioned it will launch a dedicated dashboard in the future to track income usage.

Resolv provided a rough estimate of revenue distribution after the "fee switch" is turned on. With the current protocol TVL at $500 million and an average yield of 10%, it expects to generate $50 million in annual revenue. After activating the "fee switch," $45 million will still flow directly to users as product yield, while the protocol will retain $5 million for long-term value creation.

Compared to ENA, Is RESOLV More Cost-Effective?

In last week’s article, “Up Nearly 50% in a Week: Can ENA Be ETH’s Biggest Beta?”, we analyzed the logic behind ENA’s recent strong rally. Subsequently, Ethena introduced a treasury reserve mechanism for ENA akin to "micro-strategy," further boosting ENA’s price.

With ENA taking the lead, increasing attention is now shifting toward Resolv, another yield-bearing stablecoin project with a similar mechanism. So, is RESOLV currently more cost-effective than ENA?

From a static perspective, Ethena currently has a TVL of $7.781 billion, ENA’s market cap (MC) is $4.016 billion (MC/TVL ratio of 0.51), and fully diluted valuation (FDV) is $9.48 billion (FDV/TVL ratio of 1.22). Resolv currently has a TVL of $527 million, RESOLV’s market cap (MC) is $57.28 million (MC/TVL ratio of 0.108), and FDV is $205 million (FDV/TVL ratio of 0.39).

Judging solely by MC/TVL and FDV/TVL ratios, RESOLV indeed holds a clear advantage over ENA in terms of static cost-effectiveness. While ENA currently benefits from treasury-backed buying pressure, given that RESOLV will activate the "fee switch" earlier, both tokens are expected to receive some price support in the short term.

Objectively speaking, however, USR’s current application scope and network effects are far behind those of USDe. Moreover, Ethena has a second business line, USDtb, in addition to USDe, meaning Resolv still lags significantly behind Ethena in terms of protocol momentum.

Another noteworthy point is that while Resolv stated the portion of "fee switch" revenue will be used "to expand the value Resolv provides to users and stakers," it did not specify how much of the 10% revenue will go directly to RESOLV stakers. Therefore, it remains difficult to estimate the scale of new value capture for RESOLV post-"fee switch" activation.

In summary, considering RESOLV’s relatively low market cap, it could serve as a viable alternative following ENA’s surge. However, the long-term outlook for the Resolv protocol itself remains to be evaluated, and the detailed revenue distribution plan after the "fee switch" activation awaits further disclosure. Whether it’s worth building a position still requires DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News