EigenDA officially launches mainnet—what new developments have emerged?

TechFlow Selected TechFlow Selected

EigenDA officially launches mainnet—what new developments have emerged?

A new "one fish, two dishes" opportunity.

Author: Azuma, Odaily Planet Daily

In the early hours of April 10, EigenLayer—the Ethereum restaking protocol widely regarded as the most anticipated project in the market (perhaps without needing the qualifier "among others")—officially launched its mainnet and introduced EigenDA, its first "Active Validation Service" (AVS) for data availability validation.

At this point, some readers might be confused. Didn’t EigenLayer already launch on mainnet back in June 2023? Its total value locked (TVL) is already over $13 billion—why are we saying it’s launching again?

The key clarification here is that during its testnet phase, EigenLayer outlined a three-stage rollout plan to gradually onboard different ecosystem participants and activate new functionalities step by step.

In June 2023, EigenLayer only launched Stage One—"Stakers"—which allowed users to perform restaking via the protocol. Today's launch marks Stage Two—"Operators"—enabling validators to register and accept delegations from restakers. This stage also sees the debut of the first AVS, EigenDA. Looking ahead, EigenLayer plans to roll out additional AVS offerings beyond EigenDA (over ten AVSs are currently being tested on Holesky).

Odaily Note: The “three-phase” roadmap was initially proposed by EigenLayer when it first launched its testnet. While later announcements have mentioned it less explicitly, the actual development progress continues to follow this trajectory.

What is an AVS? What is EigenDA?

The above explanation may still leave some confusion for those unfamiliar with EigenLayer’s core concepts, especially regarding AVS and EigenDA.

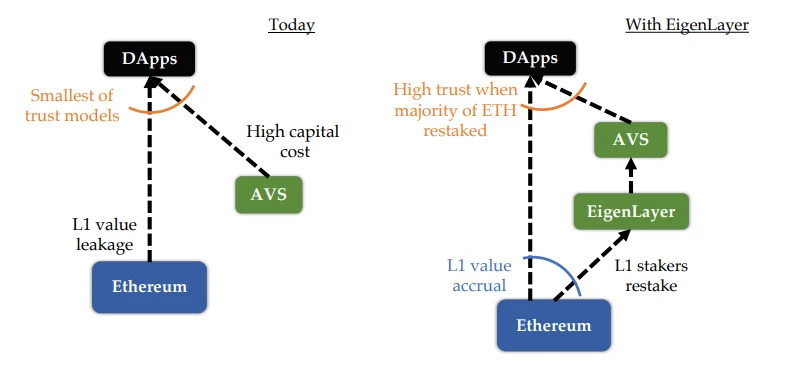

To understand these terms, let’s start with EigenLayer’s business model. In simple terms, EigenLayer’s operations can be broken down into three components:

First, restakers can re-stake their ETH and derivative LSTs on EigenLayer and delegate their tokens to EigenLayer validators;

Second, EigenLayer validators can choose to join various AVSs and use delegated stake to provide validation services;

Third, clients (such as oracles, cross-chain bridges, Rollups, etc.) can pay (currently not yet activated) to rent these AVS validation services.

Let’s walk through a few steps to further unpack this cycle.

First, as countless users restake their ETH, EigenLayer accumulates massive economic value;

Next, validators leverage this accumulated value to build more secure validation systems (Odaily Note: under PoS logic, larger economic stakes lead to stronger consensus). These validation systems are known as AVSs, which serve downstream applications like oracles, bridges, and Rollups by offering enhanced security for their operations;

From the client side, instead of having to painstakingly build their own fragile validation networks (Odaily Note: e.g., many current bridges secure billions in TVL but rely on low-market-cap native tokens for validation), projects can now conveniently and efficiently utilize EigenLayer’s AVS to access a far more robust security layer;

Conversely, both restakers and validators earn ongoing rewards from fees paid by clients using the AVS services.

This outlines EigenLayer’s core business logic. In short, AVS refers to the various validation services offered by EigenLayer, and EigenDA—the first AVS—is now officially live on mainnet.

EigenDA focuses on providing data availability solutions for Rollups. You can think of it simply as Celestia nested within the EigenLayer protocol, inherently secured by EigenLayer’s multi-billion-dollar consensus safety net.

What Can You Do Now?

For ordinary users, rather than dissecting EigenLayer’s business logic frame-by-frame, the more pressing question is likely: “How can I meaningfully interact with the protocol to potentially qualify for future airdrops?”

With EigenLayer entering a new phase and officially activating EigenDA, there are indeed new opportunities for interaction. As previously noted, the “Operators” stage enables validator registration and delegation acceptance—so our task now is to delegate our restaked tokens to a validator.

Users who have already restaked on EigenLayer can follow the steps below. Those who haven't deposited yet should first refer to the guide titled “EigenLayer Officially Launches Mainnet—How to Interact.”

Odaily Note: If you didn’t deposit directly through the EigenLayer frontend but used indirect restaking protocols such as Renzo, Puffer, or Ether.fi, no action is needed—you’re covered, as these protocols will automatically delegate on your behalf.

First, visit EigenLayer’s official website. Regular users may notice a new “Delegate Your Stake” button on the right-hand side of the interface. Clicking it will begin the delegation process.

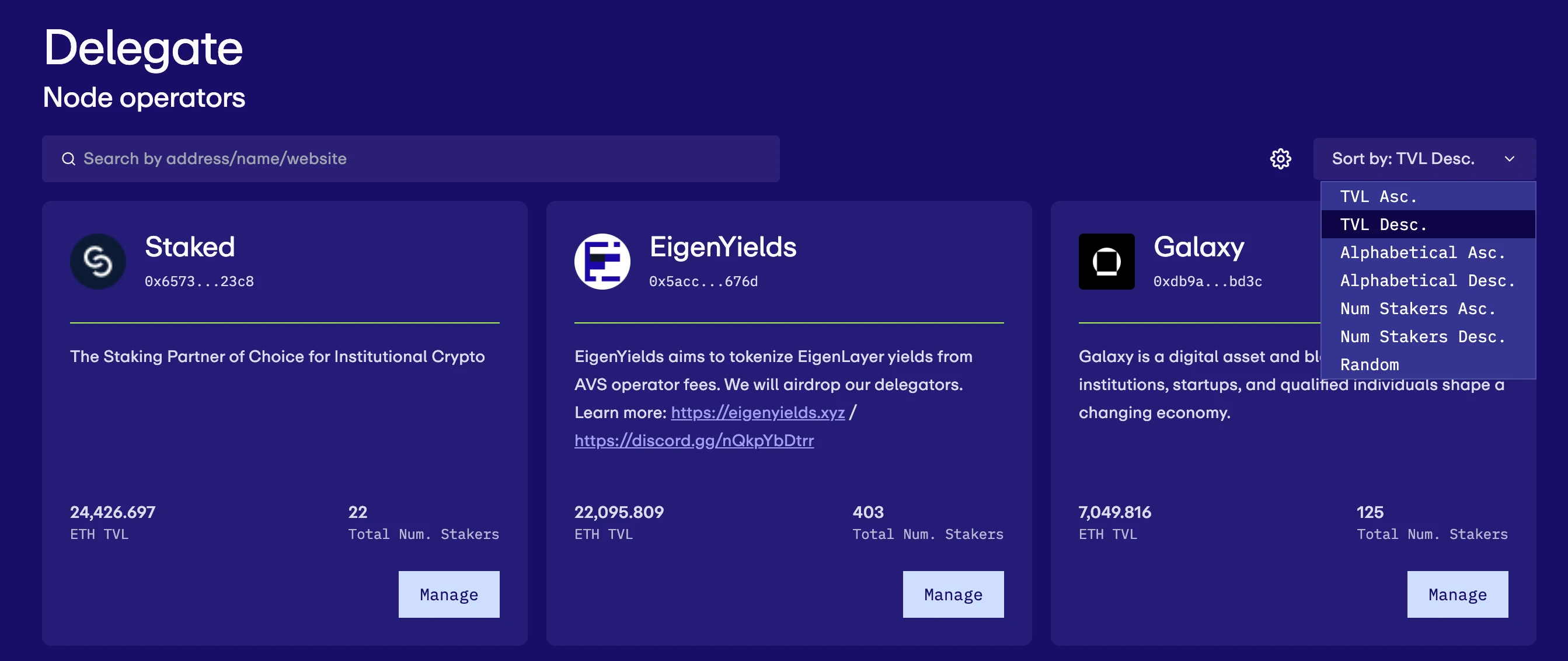

You’ll then enter the validator delegation interface, which currently lists over a hundred available nodes. For operational stability, it’s advisable to prioritize validators with higher delegated amounts (Odaily Note: similar to other PoS systems, validators cannot steal funds, but may face penalties for misbehavior). You can sort them by clicking “TVL Desc.” on the right.

I personally chose EigenYields, currently ranked second in total delegated amount. Clicking “delegate” completes the process. As shown in the image below, EigenYields has already registered and joined EigenDA under the “AVS Registration” section (many other nodes have not yet done so).

Beyond its large delegation size and fast execution, another reason I chose EigenYields is that the project made its first public appearance on social media only after EigenLayer’s official announcement this morning, yet quickly amassed over 20,000 ETH in a short time (raising curiosity about the team behind it…). Additionally, the project has announced it will reveal its tokenomics and governance details this quarter, offering a potential opportunity for a “two-for-one” reward play.

Finally, two important points to emphasize:

First, EigenLayer currently does **not** support partial delegation. Once you select a validator, all your staked amount will be fully delegated to that single node.

Second, many users are concerned about slashing risks—if a validator operates improperly, could their funds be penalized? EigenLayer has clarified that, for stability reasons, the slashing mechanism will not be activated until later this year. So for now, users don’t need to worry too much. However, while immediate slashing risks are absent, EigenLayer has warned that validators exhibiting persistent poor behavior will eventually face consequences. Therefore, exercise caution when choosing a delegation target—EigenYields, after all, is a new project with relatively higher risk. Don’t blindly follow my choice; do your own research (DYOR).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News