Kairos Research Report: EigenDA, Revolutionizing Rollup Economics

TechFlow Selected TechFlow Selected

Kairos Research Report: EigenDA, Revolutionizing Rollup Economics

This article will delve into EigenDA, exploring its unique mechanisms in design while analyzing the competitive landscape.

Author: Kairos Research

Translation: TechFlow

Introduction

Currently, EigenDA is the largest AVS in terms of restaked capital and number of unique operators, with over 3.64 million ETH and 70 million EIGEN restaked—totaling approximately $9.1 billion in restaked capital—from 245 operators and 127,000 unique staking wallets. As more alternative data availability platforms emerge, distinguishing their differences, unique value propositions, and how protocol value accumulates has become increasingly difficult. In this article, we will dive into EigenDA, explore its unique design mechanisms, analyze the competitive landscape, and examine where this market segment might be headed.

What is Data Availability?

Before diving into EigenDA, we first need to understand the concept of data availability (DA) and its importance. Data availability refers to ensuring that all participants (nodes) in a network can access the data required to validate transactions and maintain the blockchain. DA is a fundamental component of the classic monolithic architecture—essentially, execution, consensus, and settlement all rely on DA. Without DA, the integrity of the blockchain would be compromised.

Because all other system components depend on DA, it creates a scalability bottleneck—this is why we've seen the emergence of Layer 2 solutions. Since the introduction of Optimistic Rollups in 2019, the future of L2s began to take shape. L2s move execution off-chain but still rely on Ethereum's data availability layer for security. With this paradigm shift, many realized that further advantages could be gained by building dedicated blockchains or services focused specifically on overcoming the limitations of the monolithic architecture’s DA layer.

While the emergence of specialized data availability (DA) layers offers opportunities for fee reduction through competition and enables further experimentation, Ethereum mainnet is addressing the DA issue through a process called “Dank Sharding.” The first phase of Dank Sharding was implemented via EIP-4844, which introduced transactions capable of carrying additional data blobs, up to 125 KB in size. These blobs are committed using KZG (a cryptographic commitment), ensuring data integrity and compatibility with future data availability sampling. Prior to EIP-4844, rollups published transaction data to Ethereum using calldata.

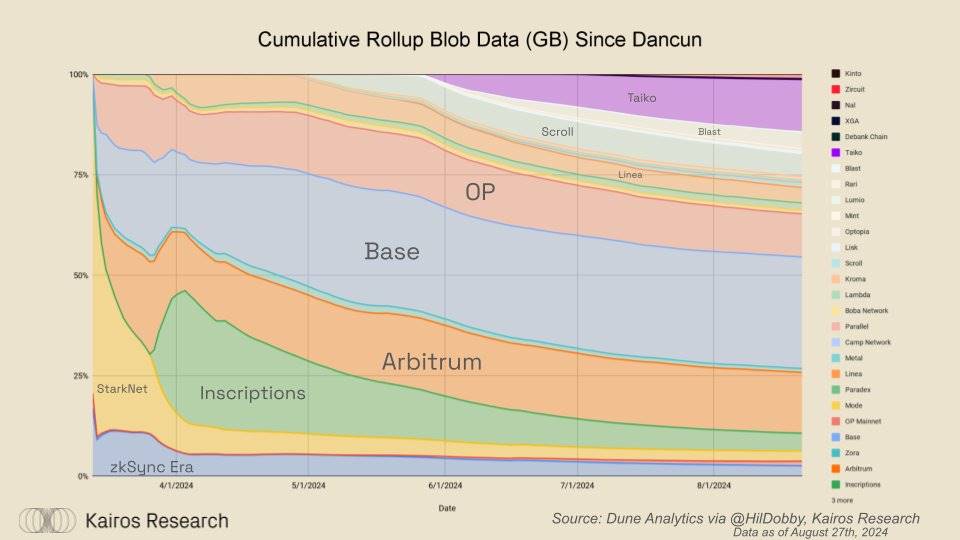

Since the Dencun upgrade in mid-March introduced the initial form of Dank Sharding, 2.4 million blobs have been generated, totaling 294 GB of data and costing over 1,700 ETH in fees paid to L1. It's important to note that these blobs are not visible to the Ethereum Virtual Machine (EVM) and are automatically pruned after approximately two months. Currently, each block is limited to 6 blobs, totaling 750 KB in capacity. For non-technical readers: if three consecutive blocks are fully utilized, the total data volume equals the storage capacity of a GameCube memory card.

This limit has been hit multiple times per day, indicating strong demand for blob space on Ethereum. Although the current base fee for blob space on Ethereum is around $5, it's crucial to recognize that this fee correlates closely with ETH price movements—and so does most DeFi activity. Therefore, when ETH prices rise significantly, activity increases, leading to greater demand for blob space. To accommodate potential increases in DeFi speculation or support new use cases, the cost of data availability must decrease further. There remains strong incentive to reduce these costs to sustain ongoing user engagement.

How Does EigenDA Work?

EigenDA operates on a simple principle: Data availability does not require an independent consensus mechanism to be solved. As a result, EigenDA’s architecture can scale linearly, since operator responsibilities are primarily limited to data storage. Specifically, the EigenDA architecture consists of three main components:

-

Operators

-

Data Dispensers

-

Data Retrievers

The operators in EigenDA are entities responsible for running the EigenDA node software, registered within EigenLayer and delegated stake. Think of them as node operators in traditional proof-of-stake networks. However, instead of achieving consensus, their role is to store data blobs associated with valid storage requests. A valid storage request here means one that has paid the required fee and whose provided blob has passed KZG commitment and proof verification.

In simple terms, a KZG commitment allows you to associate a piece of data with a unique code (commitment), and later verify using a special key (proof) whether the retrieved data matches the original. This ensures the data hasn’t been altered or tampered with, preserving blob integrity.

The Data Dispenser is described in EigenDA documentation as a “trustless” service hosted by EigenLabs. Its primary role is to act as an interface between EigenDA clients, operators, and smart contracts. EigenDA clients send data distribution requests to the dispenser, which performs Reed-Solomon erasure coding on the data (aiding recovery), computes KZG commitments for the encoded shards, and generates KZG proofs for each shard. The dispenser then sends the shards, KZG commitments, and KZG proofs to EigenDA operators, who return signed attestations. The final step for the dispenser is aggregating these signatures and uploading them as calldata to the EigenDA contract on Ethereum. Notably, this step is essential for enabling slashing of misbehaving operators.

The final core component of EigenDA, the Data Retriever, is a service responsible for querying EigenDA operators to fetch blobs, verifying their accuracy, and reconstructing the original data for users. While EigenDA provides a default retriever service, client rollups can also host their own retriever as an extension of their sequencer.

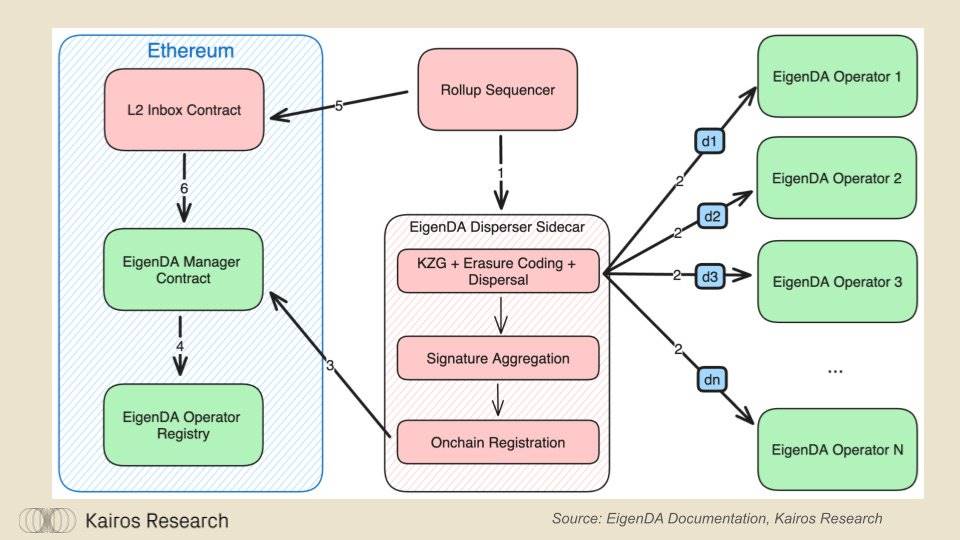

Here is the sequence of events in EigenDA’s operation:

-

A rollup sequencer sends a batch of transactions as a data blob to EigenDA’s dispenser module.

-

The dispenser performs erasure coding on the blob, splitting it into smaller shards, generates KZG commitments and multi-reveal proofs for each shard, distributes them to EigenDA operators, and receives signed storage attestations in return.

-

After aggregating the received signatures, the dispenser registers the blob on-chain by sending a transaction containing the aggregated signature and blob metadata to the EigenDA manager contract.

-

The EigenDA manager contract verifies the aggregated signature with the help of the EigenDA registry contract and stores the result on-chain.

-

Once the blob is stored off-chain and registered on-chain, the sequencer publishes the EigenDA blob ID to its inbox contract as a transaction. The blob ID is no more than 100 bytes in length.

-

Before accepting the blob ID into the rollup’s inbox, the inbox contract queries the EigenDA manager contract to confirm whether the blob has been attested as available. If yes, the blob ID is accepted; if not, it is discarded.

In short: the sequencer sends data to EigenDA, EigenDA slices, stores, and checks its validity. If everything checks out, the data gets a green light and proceeds. If not, it's discarded.

Competitive Landscape

In the competitive landscape of data availability (DA) services, EigenDA holds a clear advantage in throughput. As more operators join the network, its potential for scalable throughput increases. Moreover, when considering which alternative DA service offers better compatibility with Ethereum, EigenDA is clearly the frontrunner.

Although Celestia brought groundbreaking innovation with data availability sampling (DAS), it's difficult to consider it fully compatible with Ethereum. While this isn't mandatory, it does influence customer (e.g., rollup) decision-making. Celestia employs an interesting strategy with its light node architecture, potentially allowing larger blocks and thus more data per packet—but subject to certain constraints.

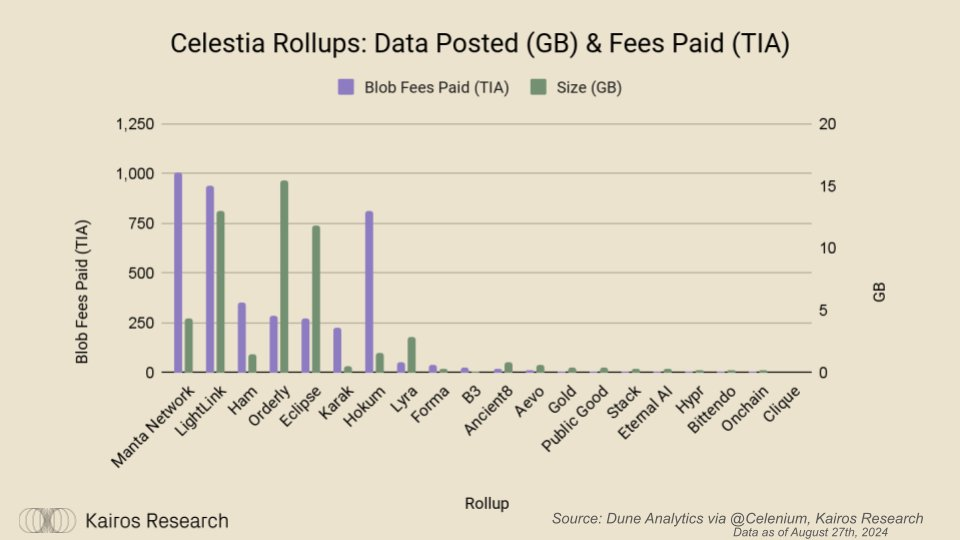

Celestia has been highly successful in reducing rollup costs, benefiting end users. However, despite this significant and far-reaching innovation, they have made little tangible progress in fee revenue, even with a fully diluted valuation reaching several billion dollars—approximately $5.5 billion at the time of writing. Celestia launched last Halloween, and since then, 20 unique rollups have integrated their DA service. These 20 rollups have collectively published 54.94 GB of data space, generating 4,091 TIA for the protocol—worth about $21,000 at current prices. That said, it's fair to note that collected fees go to stakers and validators, and TIA’s price has fluctuated over time, having reached a high of $19.87. Thus, the actual USD amount may vary. Based on secondary data, we estimate total fees are more likely around $35,000 in USD terms.

Current Rollup Landscape and EigenDA's Positioning

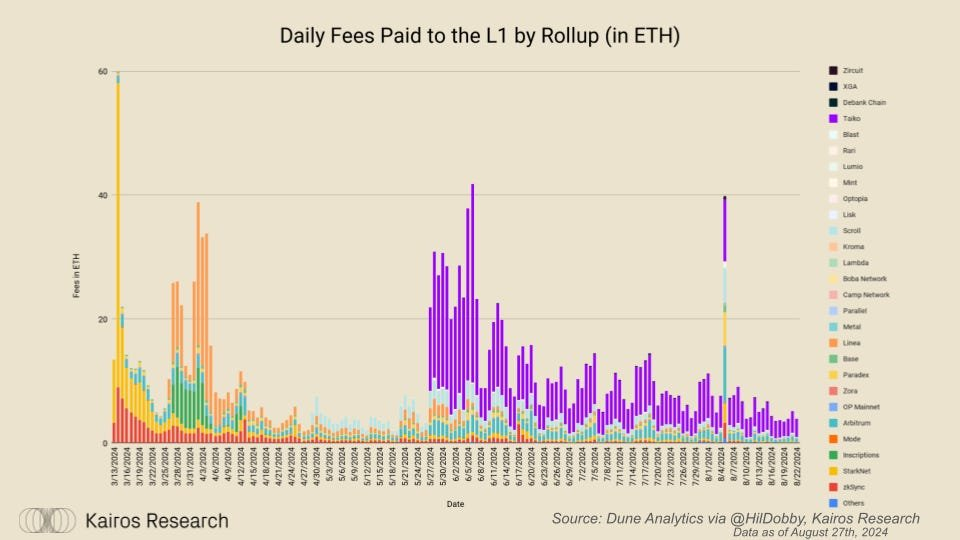

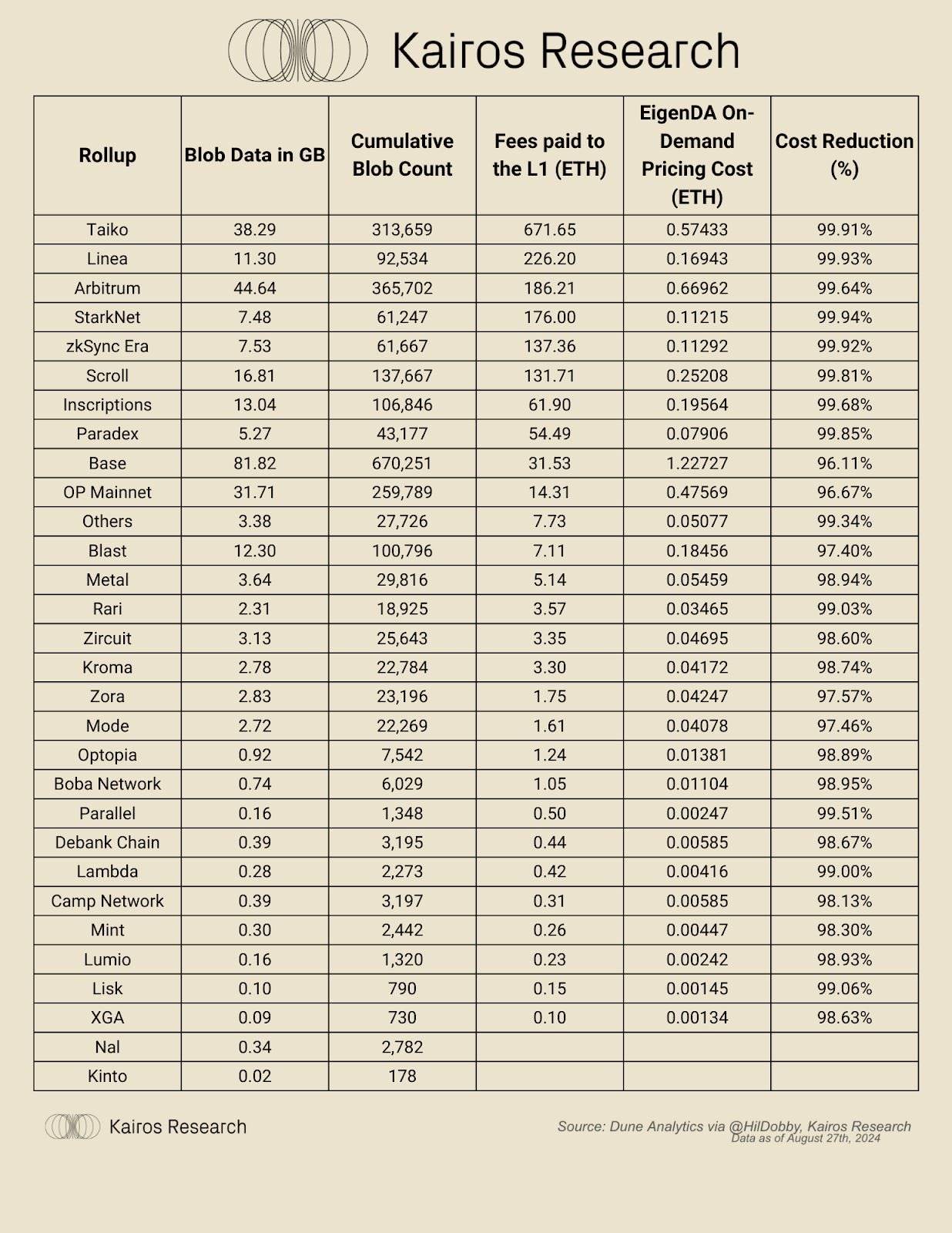

EigenDA recently announced its pricing model, including a “pay-as-you-go” option and three fixed tiers. The pay-as-you-go option offers variable throughput at 0.015 ETH/GB, while Tier 1 offers 256 KiB/s for 70 ETH. By examining the current data availability landscape on Ethereum mainnet, we can make assumptions about EigenDA’s potential demand and estimate possible revenue for restakers.

Currently, around 27 rollups upload blobs to Ethereum L1, using data from queries. Each blob uploaded post-EIP-4844 contains 128 KB of data. Across these 27 rollups, approximately 2.4 million blobs have been uploaded, totaling 295 GB. Therefore, if all these rollups adopted the 0.015 ETH/GB rate, total fees would amount to 4.425 ETH.

At first glance, this appears problematic. However, it's important to recognize that rollups differ significantly in their unique services and architectures. Due to differences in design and user base, their individual characteristics lead to vast disparities in blob count and L1 fees paid.

For example, in the rollups analyzed in this research, here is how much data (in count + GB) and fees each has used:

From this analysis alone, six rollups have already exceeded the fee threshold of EigenDA’s Tier 1 pricing. Yet, from a data throughput perspective, Tier 1 may not be cost-effective for them. In reality, using EigenDA’s pay-as-you-go pricing could reduce costs by an average of ~98.91%.

This places restakers and other ecosystem stakeholders in a dilemma. The cost reductions offered by EigenDA benefit both L2s and users by increasing L2 profitability and revenue, but they do not necessarily strengthen restaker confidence—the group hoping for EigenDA to lead in restaking rewards among AVSs.

Alternatively, one could argue that EigenDA’s cost reductions stimulate innovation. Historically, cost reductions have often served as key catalysts for growth. For instance, the “Bessemer Process” was an innovative steel production technique that drastically reduced the cost and time of steel manufacturing, enabling mass production of stronger, higher-quality steel—cutting costs by up to 82%. A similar principle applies to data availability (DA) services. The emergence of multiple DA providers has not only significantly lowered costs but also, through competition, inherently driven innovation in high-throughput rollup designs, expanding previously unexplored architectural boundaries.

For example, Eclipse—a SVM-based rollup that began publishing blobs just 28 days ago—already accounts for 86% of total blob share on Celestia. Their mainnet hasn’t even launched publicly yet. While much of this usage may be for testing technological robustness, it demonstrates the potential of high-throughput rollups and suggests they will consume far more data availability resources than most rollups today.

Summary and Conclusion

So where do we stand now? To reach the EigenDA monthly revenue target of $160,000 set by the team in their blog post, assuming the Tier 1 pricing of 70 ETH per year and an average ETH price of around $2,500, you would need 11 rollups as paying customers. According to our analysis, since EIP-4844 went live in early March, about six rollups have already spent more than 70 ETH on L1. As discussed, pay-as-you-go pricing would reduce costs for these rollups by approximately 99%, but the ultimate deciding factor for adoption will be their required throughput.

Moreover, lower costs may drive increased demand by enabling multiple high-throughput rollup solutions (like MegaETH). In the future, such high-performance rollups may be deployed via Rollup-as-a-Service (RaaS) providers like AltLayer and Conduit. However, in the short term, reaching the $160,000 monthly revenue goal—assuming only 400 operators supporting EigenDA—will require some validation work, which will mark the break-even point. Overall, EigenDA opens new design possibilities with significant value-add potential, but it remains unclear how much of that value will be captured by EigenDA and returned to restakers. Nevertheless, we believe EigenDA, as a provider, is well-positioned to capture a major share of the data availability (DA) market and look forward to continuing to follow this one of the most notable AVSs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News