What potential risks could the fully collateralized, semi-centralized stablecoin USDe bring?

TechFlow Selected TechFlow Selected

What potential risks could the fully collateralized, semi-centralized stablecoin USDe bring?

USDe's collateral consists of a synthetic asset formed by combining crypto assets with corresponding short futures positions.

Authors: BeWater Giga-Brain, 0xLoki

I. Defining USDe: A Fully Collateralized Semi-Centralized Stablecoin

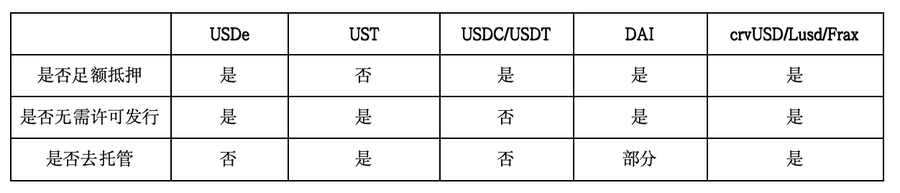

There are many ways to categorize stablecoins, for example:

(1) Fully collateralized vs. under-collateralized;

(2) Centralized custody vs. decentralized custody;

(3) On-chain issuance vs. issuance by centralized entities;

(4) Permissioned vs. permissionless.

Some overlaps and variations exist. For instance, previously we considered AMPL, UST, and similar algorithmic stablecoins—whose supply and circulation are fully regulated by algorithms—as falling under the category of under-collateralized stablecoins. By this definition, most stablecoins are under-collateralized, though exceptions exist. Take Lumiterra’s LUAUSD: although its minting and burning prices are algorithmically adjusted, the protocol treasury provides collateral (USDT & USDC) valued no less than the anchored value of LUAUSD. Thus, LUAUSD possesses dual characteristics of both an algorithmic stablecoin and a fully collateralized stablecoin.

Another example is DAI. When DAI's collateral consists entirely of on-chain assets, it qualifies as a decentralized custodied stablecoin. However, with the introduction of real-world assets (RWA), part of the collateral is effectively controlled by real-world entities, transforming DAI into a hybrid stablecoin combining centralized and decentralized custody.

Given these nuances, rather than getting bogged down in overly complex classifications, we can distill the core attributes into three key metrics: full collateralization, permissionless issuance, and de-custodization. Comparatively, USDe differs from other common stablecoins across these dimensions. If we define “decentralization” as requiring both permissionless issuance and de-custodization, then USDe does not meet this standard. Therefore, classifying USDe as a "fully collateralized semi-centralized stablecoin" is appropriate.

II. Analysis of Collateral Value

The first question is whether USDe has sufficient collateral—and the answer is clearly yes. As stated in the project documentation, USDe’s collateral consists of a synthetic asset formed by crypto holdings combined with short futures positions.

l Synthetic asset value = spot value + short futures position value

l Initially, spot value = X, futures position value = 0, assume basis = Y

l Collateral value = X + 0

l Assume after some time, spot price increases by $a, while the futures position gains $b (a, b can be negative). Position value = X + a - b = X + (a - b), basis becomes Y + ΔY, where ΔY = (a - b)

It follows that if ΔY remains unchanged, the intrinsic value of the position stays constant. If ΔY is positive, the intrinsic value increases; otherwise, it decreases. For delivery contracts, the basis is typically negative at inception and converges to zero by expiry (ignoring trading frictions), meaning ΔY will necessarily be positive. Hence, if the synthetic position was created with a basis of Y, its value at expiry will exceed its initial value.

The combination of holding spot and shorting futures is known as "basis arbitrage." This arbitrage structure itself is risk-free (though external risks remain). Based on current data, constructing such a portfolio yields approximately 18% annualized low-risk returns.

Returning to Ethena, I couldn't find a definitive statement on the official website regarding whether delivery or perpetual contracts are used (given liquidity considerations, perpetuals seem more likely), but the on-chain addresses of collateral and their distribution across CEXs have been disclosed.

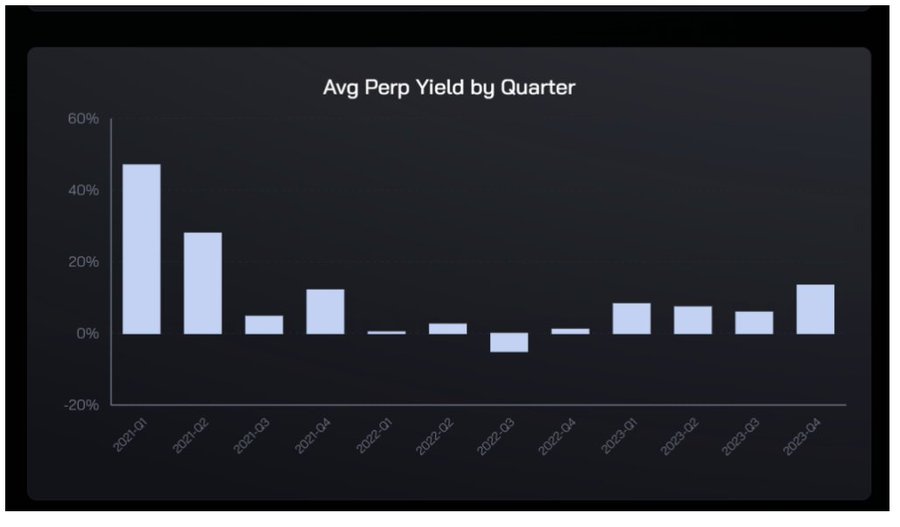

In the short term, there are differences between the two approaches. Delivery contracts offer a more "stable and predictable" yield, with non-negative returns at expiry. Perpetual contracts, however, deliver variable daily rates, which could turn negative under certain conditions. Empirically, historical returns from perpetual arbitrage slightly outperform those from delivery contracts, and both remain positive:

1) Delta-neutral futures shorts are essentially fund lending. Lending funds cannot sustainably maintain zero or negative interest rates, especially given the added risks of USDT exposure and centralized exchange counterparty risk. Therefore, required yield > USD risk-free rate.

2) Perpetual contracts carry variable funding rates, necessitating additional risk premiums.

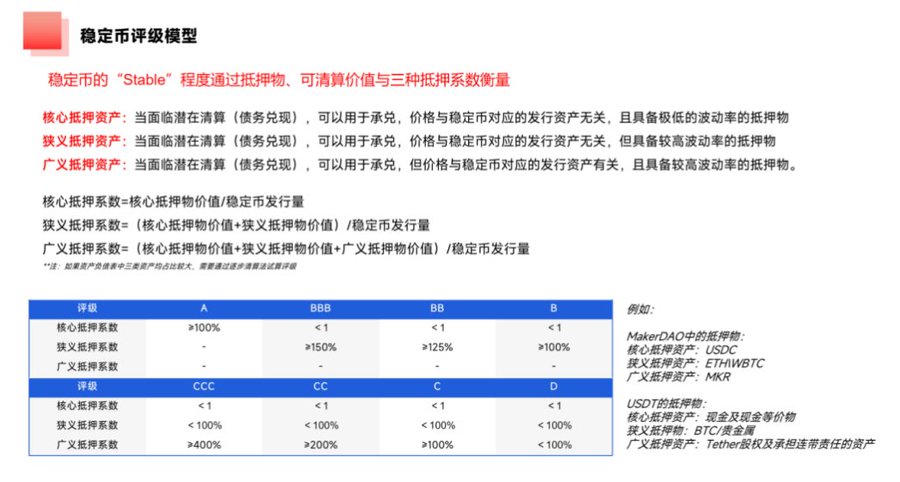

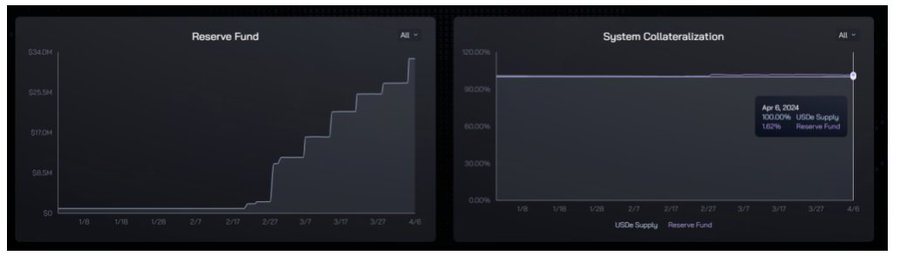

Thus, concerns about USDe being insolvent or comparisons to UST are entirely misplaced. Using the collateral risk assessment framework introduced earlier, USDe currently has a core/narrow collateral ratio of 101.62%. Including ENA’s $1.57 billion circulating market cap, the broad collateral ratio reaches approximately 178%.

The concern that ["potential negative funding rates could shrink USDe's collateral"] is also minor. According to the law of large numbers, given sufficient time, frequency converges to probability. Over the long run, USDe's collateral will grow at a rate converging toward the average funding rate.

Put simply: imagine drawing cards repeatedly from a deck—drawing a joker costs you $1, but drawing any of the other 52 cards earns you $1. With a starting capital of $100, would you worry about going bankrupt due to drawing too many jokers? Looking directly at the data: over the past six months, the average contract funding rate dipped below 0% only twice. The historical win rate of basis arbitrage far exceeds that of random card draws.

III. Where Are the Real Risks?

1. Market Capacity Risk

We've now established that collateral risk is not a major concern. That said, other risks do exist. The most significant is the potential constraint imposed by derivative market capacity on Ethena.

The first such risk is liquidity risk.

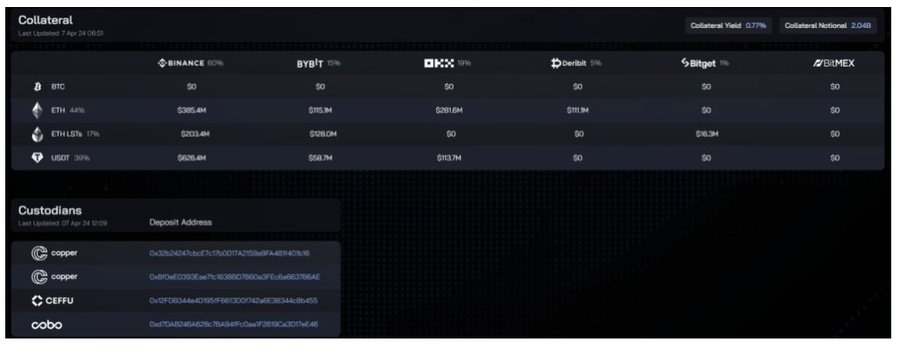

Currently, USDe’s issuance stands at around $2.04 billion, with ETH and LST accounting for approximately $1.24 billion. This implies that, under full hedging, a short position of $1.24 billion must be opened—an amount proportional to the scale of USDe issued.

Binance’s current ETH perpetual contract open interest is about $3 billion. 78% of Ethena’s USDT reserves are held on Binance. Assuming uniform capital utilization, Ethena would need to establish a short position worth 2.04 billion × 61% × 78% = $970 million in notional value on Binance—already representing 32.3% of total open interest.

If Ethena’s position size constitutes too high a proportion on Binance or other derivatives exchanges, several negative consequences may arise:

1) Increased trading friction;

2) Inability to handle large-scale redemptions over short periods;

3) USDe-driven increases in short-side supply could depress funding rates, reducing yields.

Although mechanisms like time-based minting/burning caps and dynamic fees (as adopted by LUNA) might mitigate these risks, a better approach is simply avoiding such precarious positions altogether.

Based on these figures, the market capacity offered by the Binance + ETH pairing is already nearing its limit for Ethena. However, this ceiling can be expanded by incorporating multiple currencies and exchanges. According to Tokeninsight, Binance holds 50.1% of the derivatives market share. Coinglass data shows that, excluding ETH, the top 10 coins’ combined open interest on Binance is roughly three times that of ETH. Using these figures:

USDe theoretical market capacity ceiling = 20.4 × (628/800) × 60% / 4 / 50.1% = $12.8 billion

The bad news: USDe has a capacity ceiling. The good news: it still has room for ~5x growth before hitting that limit.

Based on these limits, we can divide USDe’s scale expansion into three phases:

(1) $0–2 billion: Achieved via the ETH market on Binance;

(2) $2–12.8 billion: Requires expanding collateral to major coins with deep markets and fully leveraging other exchanges’ capacities;

(3) Beyond $12.8 billion: Depends on overall crypto market growth and introducing additional collateral management methods (e.g., RWA, lending market positions).

Note: For USDe to truly displace centralized stablecoins, it must at least surpass USDC to become the second-largest stablecoin. USDC’s current supply is ~$34.6 billion—2.7 times the potential upper bound of USDe’s Phase 2. This presents a significant challenge.

2. Custody Risk

Another controversial aspect of Ethena is that protocol funds are custodied by third-party institutions. This is a compromise based on current market realities. Coinglass data shows dydx’s BTC contract open interest is $119 million—only 1.48% of Binance’s and 2.4% of Bybit’s. Hence, managing positions through centralized exchanges is unavoidable for Ethena.

However, it should be noted that Ethena employs an "Off-Exchange Settlement" custody model. Simply put, funds managed this way never actually enter the exchange. Instead, they are transferred to a dedicated address managed jointly by three parties: the principal (Ethena), the custodian (third-party institution), and the exchange. The exchange then creates corresponding trading limits internally based on the size of custodied funds—these funds can only be used for trading, not withdrawal. Settlement occurs later based on profit/loss outcomes.

The greatest advantage of this mechanism is precisely that it **eliminates the single point of failure posed by centralized exchanges**, since the exchange never truly controls the funds. At least two out of the three parties must sign to move funds. Provided the custodian is trustworthy, this setup effectively prevents exchange rug pulls (like FTX) and project-side fraud. Besides Copper, Ceffu, and Cobo listed by Ethena, Sinohope and Fireblocks also offer similar services.

Of course, custodians theoretically retain potential for malfeasance. But given that CEXs still dominate the landscape and on-chain security incidents remain frequent, this semi-centralized model represents a local optimum—not a final solution. After all, APY isn’t free; the key question is whether the improved returns and efficiency justify assuming these risks.

3. Yield Sustainability Risk

USDe requires staking to earn yield. Since staking rates won’t reach 100%, sUSDe’s yield will exceed the underlying derivative funding rate. Currently, about $470 million worth of USDe is staked—just ~23% of total supply. The 37.1% nominal APY for sUSDe corresponds to an underlying asset APY of ~8.5%.

Current ETH staking yield is ~3%, while the average ETH funding rate over the past three years has been ~6–7%. An 8.5% underlying APY is thus fully sustainable. Whether the 37.1% sUSDe APY can persist depends on whether enough applications emerge to support USDe adoption, lower staking ratios, and thereby generate even higher yields.

4. Other Risks

Including contract risk, liquidation and ADL risk, operational risk, exchange risk, etc. Ethena and Chaos Labs provide more detailed explanations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News