Detailed Explanation of SolvBTC: The First BTC That Allows Self-Bringing Yields – Staking to Earn Points Has Begun

TechFlow Selected TechFlow Selected

Detailed Explanation of SolvBTC: The First BTC That Allows Self-Bringing Yields – Staking to Earn Points Has Begun

SolvBTC is the first yield-bearing BTC in history that generates yield while maintaining spot exposure.

Author: Ash

Translation: TechFlow

Starting from BRC-20 and Ordinals, I've consistently supported Bitcoin's latest advancements in enhancing utility beyond just being a store of value. Given the scale of this asset class and the nascent state of on-chain DeFi/NFT ecosystems, pushing the frontier of BTC development makes perfect sense. Solv Protocol aligns with my overall bullish narrative in this space, and their recent launch of SolvBTC marks the world's first yield-generating BTC.

Key Highlights:

-

Most Bitcoin remains idle, as holders have limited incentives to transfer or utilize the value of their Bitcoin.

-

SolvBTC is the world’s first yield-bearing BTC that generates returns while maintaining spot exposure.

-

Yields are generated through three strategies: staking, restaking, and trading strategy returns.

-

SolvBTC will be integrated across various chains and dApps, with the Solv Protocol acting as a unified liquidity gateway.

Yield Generation Strategies

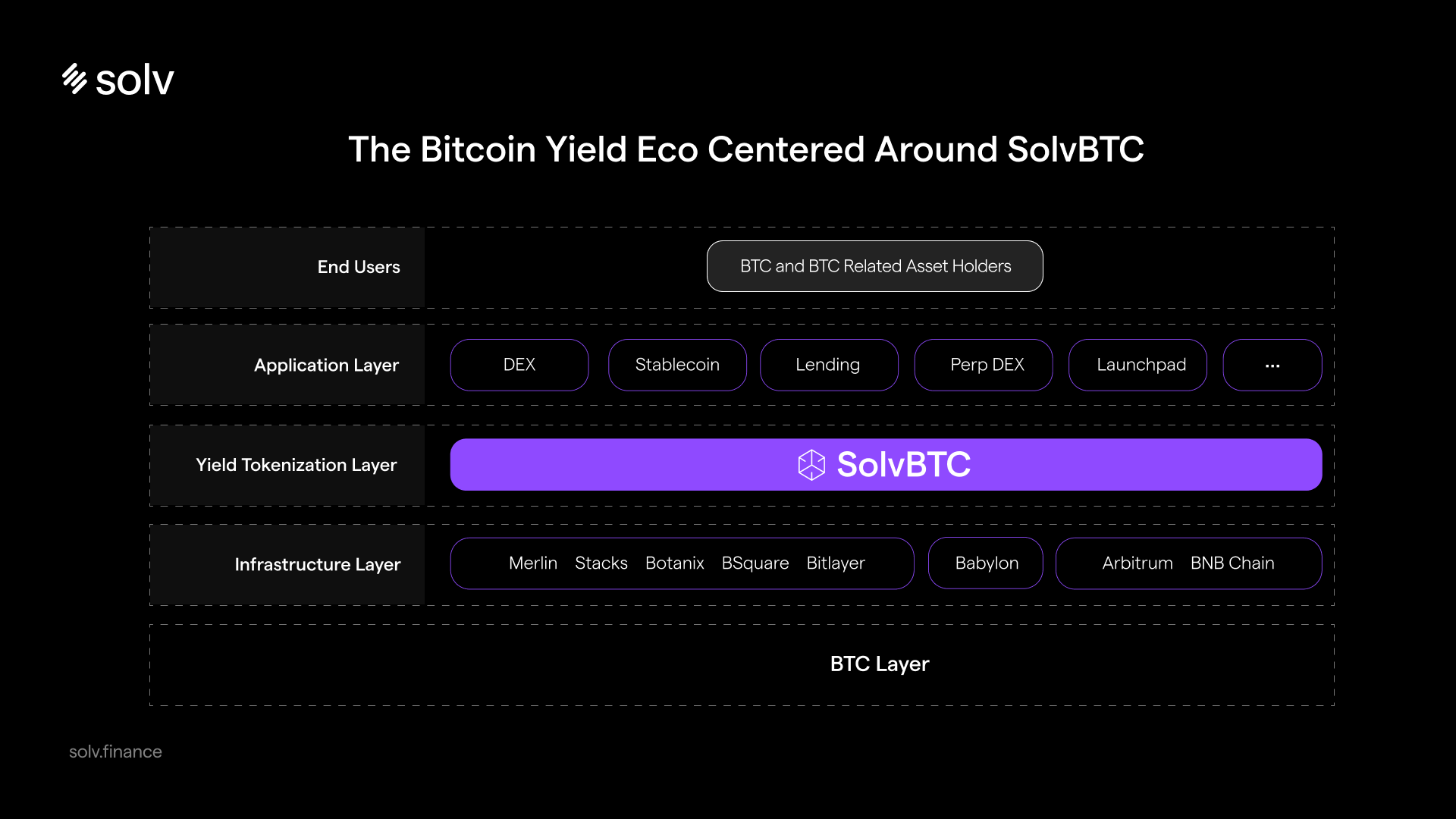

SolvBTC captures yield from staking on BTC Layer 2s, restaking networks, and DeFi activities on ETH Layer 2s, seamlessly integrating with various application-layer protocols to offer Bitcoin holders abundant earning opportunities.

SolvBTC yields will be generated via three strategies:

1. Staking yields from BTC Layer 2s such as Merlin Chain, Stacks, Botanix, Bsquare, and Bitlayer;

2. Restaking yields from networks like Babylon;

3. Trading strategy yields from Layer 2 networks such as Arbitrum and BNB Chain;

I particularly appreciate the diversified approach across multiple strategies to ensure risk dispersion and optimal returns for users.

An advisory committee—comprising both internal members and key external partners—will also serve as a check-and-balance mechanism, offering guidance to ensure transparency and trustworthiness of these strategies.

Next Steps

Market Launch and Expansion of the BTCFi Ecosystem

SolvBTC has already launched on Arbitrum and Merlin Chain. The Solv platform currently manages over 2,700 BTC in Bitcoin assets under management (AUM), with total platform TVL exceeding $260 million.

To date, other SolvBTC vaults have generated over $7 million in yield, and I'm excited to see what this means for the future of SolvBTC. Furthermore, given that SolvBTC shares the same properties as ERC-20 tokens, it can be integrated into various dApps and blockchains, enhancing liquidity and serving as a modular building block for cross-chain BTCFi.

Points Program

The Solv team announced that its points system will go live on April 5, potentially rewarding early adopters of SolvBTC (hint: the token has not yet been launched).

Funding Overview

The team has raised substantial funding from investors including Binance Labs and Laser Digital, completing four rounds of financing totaling up to $11 million, including a strategic round from Binance Labs whose amount was undisclosed.

Getting Started

For those interested, click here to start earning BTC yield.

Links

Twitter: https://twitter.com/SolvProtocol

Website: https://app.solv.finance/points/FCN884

Documentation: https://docs.solv.finance/solv-documentation/getting-started/overview

DeFi Llama: https://defillama.com/protocol/solv-protocol

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News