AC Returns to Shill, Claims to Surpass "Parallel EVM"—What Exactly Is Fantom Sonic?

TechFlow Selected TechFlow Selected

AC Returns to Shill, Claims to Surpass "Parallel EVM"—What Exactly Is Fantom Sonic?

The core of Fantom Sonic can be simply understood as "faster and stronger."

By TechFlow

Fantom appears to be rising against the tide.

Amid a broad crypto market correction over the past week, FTM's price has spiraled upward, hitting a new one-year high.

Andre Cronje (AC), Fantom’s iconic figure and star of the previous DeFi Summer, has made a comeback, actively promoting on X and even coining a new "MEME" phrase:

The meme features “Fantom Sonic,” playfully suggesting it could outperform so-called “parallel EVM” chains with superior performance.

AC bluntly stated:

“Among the gains from our technical improvements, parallelization doesn’t even rank in the top three.”

On one side, high-performance new L1s like Monad and Sei are gaining traction with their “parallel EVM” narratives; on the other, established L1s like Solana and Avalanche are staging strong comebacks.

In this L1 battleground, Fantom feels more like a hidden gem—off the mainstream radar, yet still very much in the race.

As the mainnet launch of Fantom Sonic approaches this spring, could this become the key catalyst that sends FTM into overdrive?

Faster Than Parallel EVM?

What is Fantom Sonic?

In short, Fantom Sonic is the next-generation Fantom network, set to replace the existing Fantom Opera—an upgrade akin to Fantom 2.0.

Fantom Sonic includes a new client, validator setup, virtual machine (FVM), Carmen database, and an optimized Lachesis consensus mechanism, all designed to significantly boost execution efficiency on the original Fantom chain.

Existing smart contracts on Fantom Opera remain fully compatible with Fantom Sonic, as the FVM maintains full compatibility with the EVM and its programming languages (Solidity, Vyper).

In fact, Fantom Sonic didn’t appear out of nowhere recently.

Back in late October last year, the Fantom Foundation officially announced the testnet launch of Sonic, with plans for a mainnet release this spring. With March already underway, market speculation is heating up.

No matter how L1 narratives are framed, they all boil down to one core message: our chain performs better.

Based on publicly available testnet data and materials, Fantom Sonic’s selling point is clear: it promises significantly faster speeds and stronger performance than any current EVM-based chain.

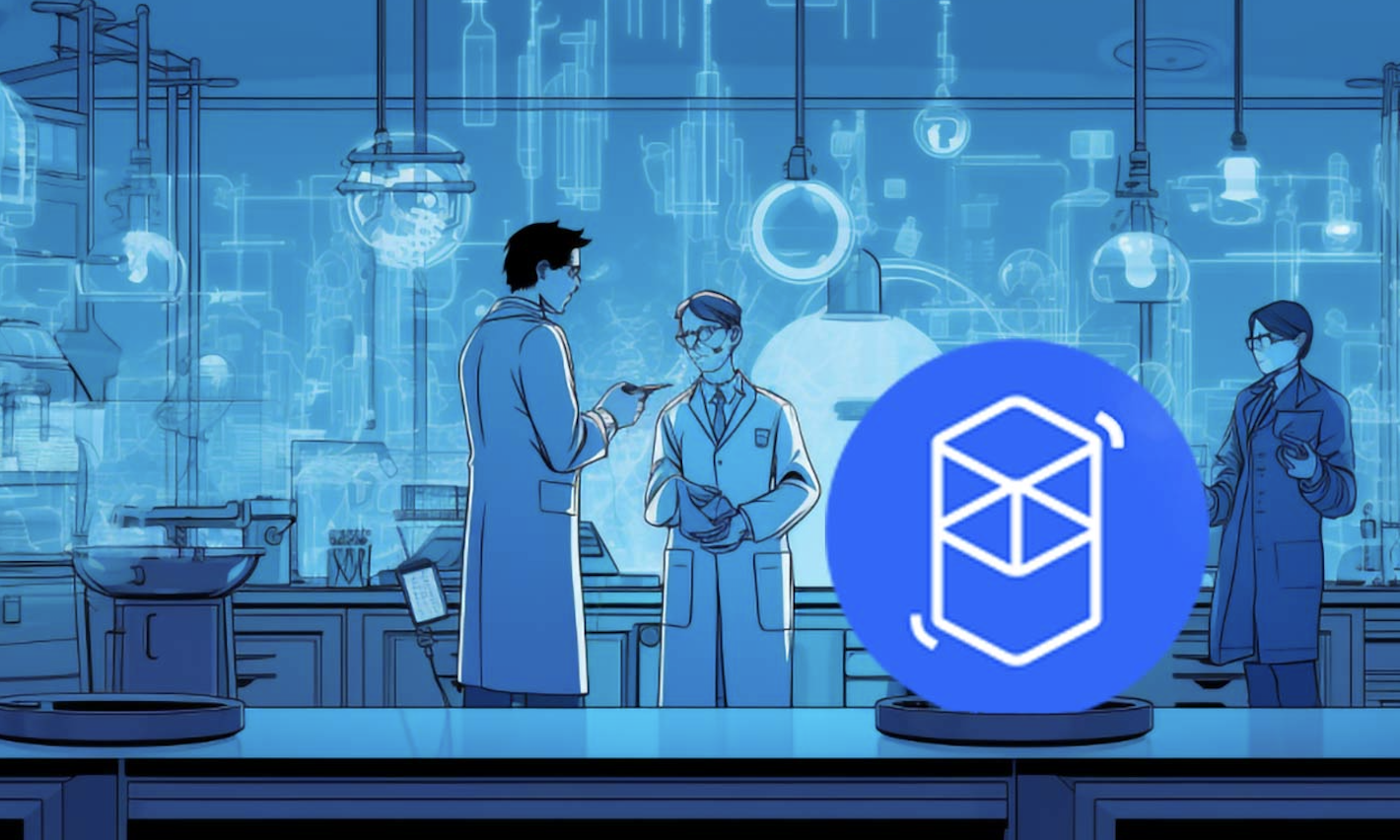

AC shared these figures on social media:

Current EVM-based chains have a theoretical limit of about 200 transactions per second (TPS). Adding “optimistic parallelization” might boost that by 40 TPS, reaching a maximum of around 240 TPS.

But with the new FVM, the theoretical limit jumps to approximately 30,000 TPS. Even adding parallelization on top would only increase throughput by another 4,500 TPS.

In other words, Fantom Sonic’s base performance is already so strong that adding parallelization offers minimal gains.

It’s forging its own path in performance optimization, unconcerned with parallelization. How is this achieved?

To improve an L1’s performance, there are typically three key areas to optimize: transaction execution environment, data storage, and consensus mechanisms.

Here’s how Sonic addresses each:

-

FVM: Maintains EVM compatibility while providing a faster environment for executing smart contracts, boosting execution efficiency.

-

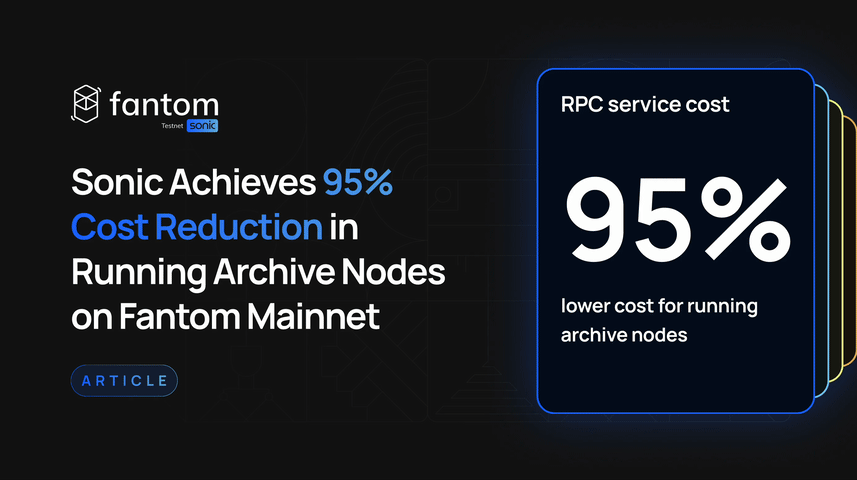

Storage: Introduces the Carmen database solution—a smart indexing system for data storage that drastically improves read/write efficiency, reduces required storage space by 90%, and enables RPC providers to cut costs by 95% through multiple archive nodes (cost efficiency improved 20x).

-

Consensus: Fantom originally adopted Lachesis, a leaderless asynchronous Byzantine Fault Tolerant (aBFT) consensus mechanism known for high efficiency. In the Sonic upgrade, Lachesis has been further optimized to reduce network message redundancy and improve decision-making speed, accelerating transaction finality and increasing overall throughput.

We may not fully grasp every technical detail, but in the crypto world—where narrative and attention often outweigh pure technology—the essence of Fantom Sonic can be simply summarized as: “faster and stronger.”

And some public data supports this claim of dramatically enhanced performance.

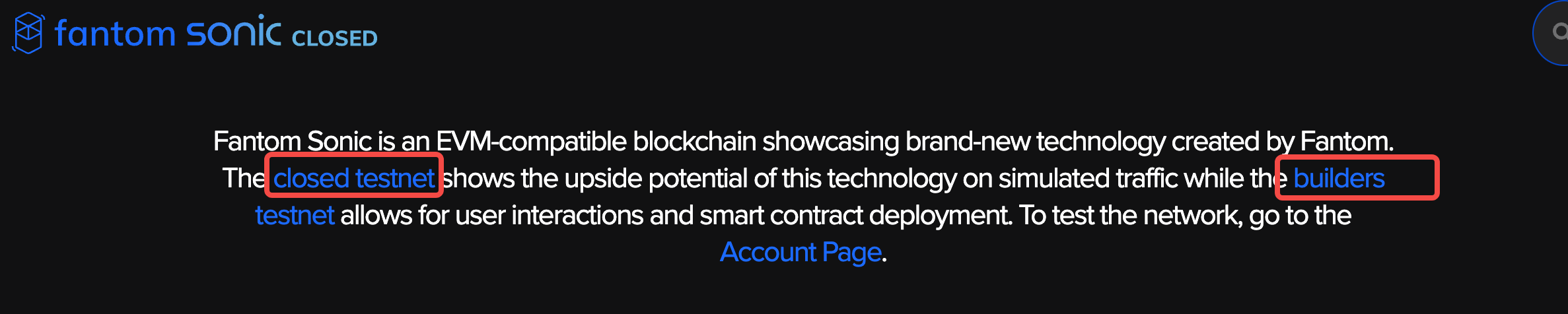

Sonic’s current design includes two types of testnets. One is a closed testnet used to showcase peak performance under ideal conditions; the other is a public testnet simulating real-world usage and interaction.

From late October last year to January this year, the Fantom team conducted multiple rounds of testing on the closed testnet, simulating real user traffic to evaluate Sonic’s performance under pressure—measuring TPS, transaction confirmation times, token swaps, transfers, and other common functions.

Results showed that under simulated real-traffic conditions performing various actions, Sonic can sustainably support 2,000 TPS with finality of around 1 second (the time from transaction submission to irreversible confirmation).

While this is just theoretical data from a closed test, for comparison: Ethereum’s finality takes roughly 1.5–3 minutes, and while Solana achieves sub-second finality, its supported TPS falls short of Sonic’s test results.

For swap-only transactions, Sonic achieves 4,000 TPS with ~1.3 seconds finality; for pure transfers, it reaches up to 10,000 TPS with ~1.6 seconds finality—impressive figures.

Pure benchmark numbers aren't very meaningful on their own—they’re more about showcasing capability. Real user experience matters more.

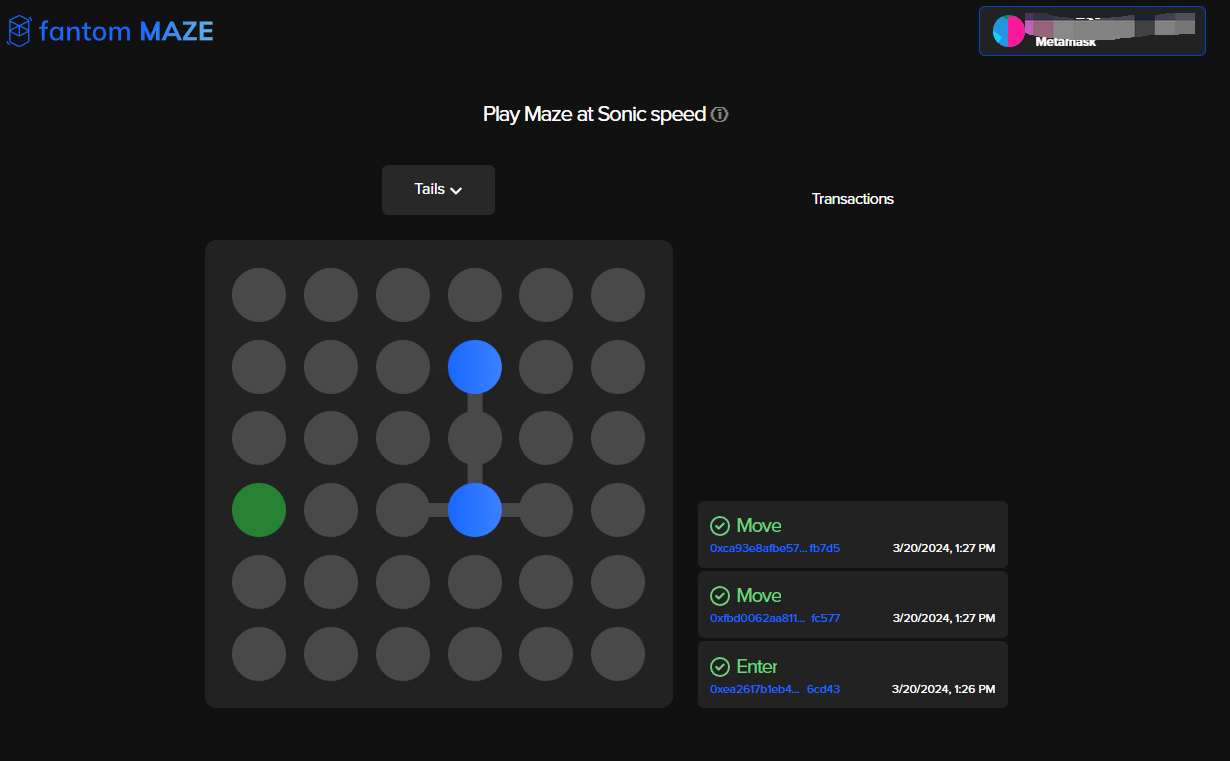

On the public Sonic testnet, you can try a fully on-chain maze game called Maze, where you control a green dot navigating a board to win.

Each move requires an on-chain transaction. During my experience, every step triggered a wallet signature prompt.

Notably, from claiming test tokens to making repeated moves, each transaction confirmed in about 1–2 seconds. If the mainnet delivers similar responsiveness, it opens exciting possibilities for fully on-chain games and other high-frequency DApps.

Sonic Labs Launched, AC Personally Mentors Ecosystem Projects

No matter how fast Sonic is, it ultimately needs strong dApps running on it.

To support technological and performance upgrades, the Fantom Foundation launched Sonic Labs at the end of December last year—an incubator aimed at helping developers build innovative dApps ahead of the Sonic mainnet launch.

The top five winning projects will split 100,000 FTM tokens and receive personal mentorship from Andre Cronje. Additionally, winners will gain technical, compliance, salary, and corporate structure guidance from partners like Pyth, Request Finance, and the Fantom Foundation, along with potential fundraising opportunities from VC partners.

This marks the foundation’s direct involvement in funding and nurturing ecosystem growth.

In February this year, Fantom announced the five winners—projects that now form part of the most anticipated new additions to the Sonic ecosystem:

-

Lynx Protocol

A perpetual DEX allowing any token as collateral with up to 100x leverage.

Twitter: @Lynx_Protocol

Website: lynx.finance

A SocialFi project enabling users to interact with communities via tradable social tokens (tickets).

Twitter: @ThunderDomeSoFi

Website: thunderdome.so

-

Debita

A P2P lending platform letting users choose preferred collateral and interest rates when borrowing.

Twitter: @DebitaFinance

Website: debita.fi

-

KiricCoin

A green tech startup tracking and rewarding individuals for sustainable behaviors to combat climate change.

Twitter: @KiriCoin

Website: kiritechnologies.com

-

Froqorion

A team-based RPG set in the ancient frog civilization of Froqorion.

Twitter: @Froqorion

Website: http://froqorion.com

Not Paying for "Speed," Paying for "Action"

Is Fantom Sonic’s demonstrated speed and performance alone enough reason for the market to price in FTM?

Technical storytelling remains a constant theme, but the L1 race long surpassed the era of “just selling TPS.” Raw performance isn’t enough to capture attention in today’s fierce competition—especially since Fantom isn’t a fresh face like Monad.

On social media, some Fantom ecosystem projects subtly mock L2s for boasting low gas fees, pointing out that Fantom has maintained similarly low fees for the past four years.

And that highlights the crux: if the market truly valued Fantom’s performance, why hasn’t it stayed in the spotlight?

Clearly, technology provides narrative confidence—but whether the market buys in depends heavily on action and momentum.

Here, AC—the soul of Fantom—is renowned for creating buzz. While Fantom Sonic’s performance is impressive, the market’s pricing of FTM likely reflects greater anticipation around AC and his team’s upcoming moves. Can they nurture more innovative dApps? Can they drive effective marketing and community engagement? These are the added expectations surrounding Fantom Sonic.

It’s not just about paying for performance—it’s about paying for action. That’s the unspoken consensus among both old and new participants in crypto’s attention economy.

Whether FTM sustains its breakout momentum, and whether Fantom Sonic emerges as a new winner in the L1 wars, remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News