Kernel Ventures: A Panoramic View of the Application Layer Amid the BTC Ecosystem Development Boom

TechFlow Selected TechFlow Selected

Kernel Ventures: A Panoramic View of the Application Layer Amid the BTC Ecosystem Development Boom

The Bitcoin ecosystem will be a key narrative in this bull market.

Author: Kernel Ventures Jerry Luo

1. With the surge in the inscription sector, Bitcoin's existing mainnet application layer can no longer meet market demands for inscriptions—this has become a key focus of current Bitcoin network development.

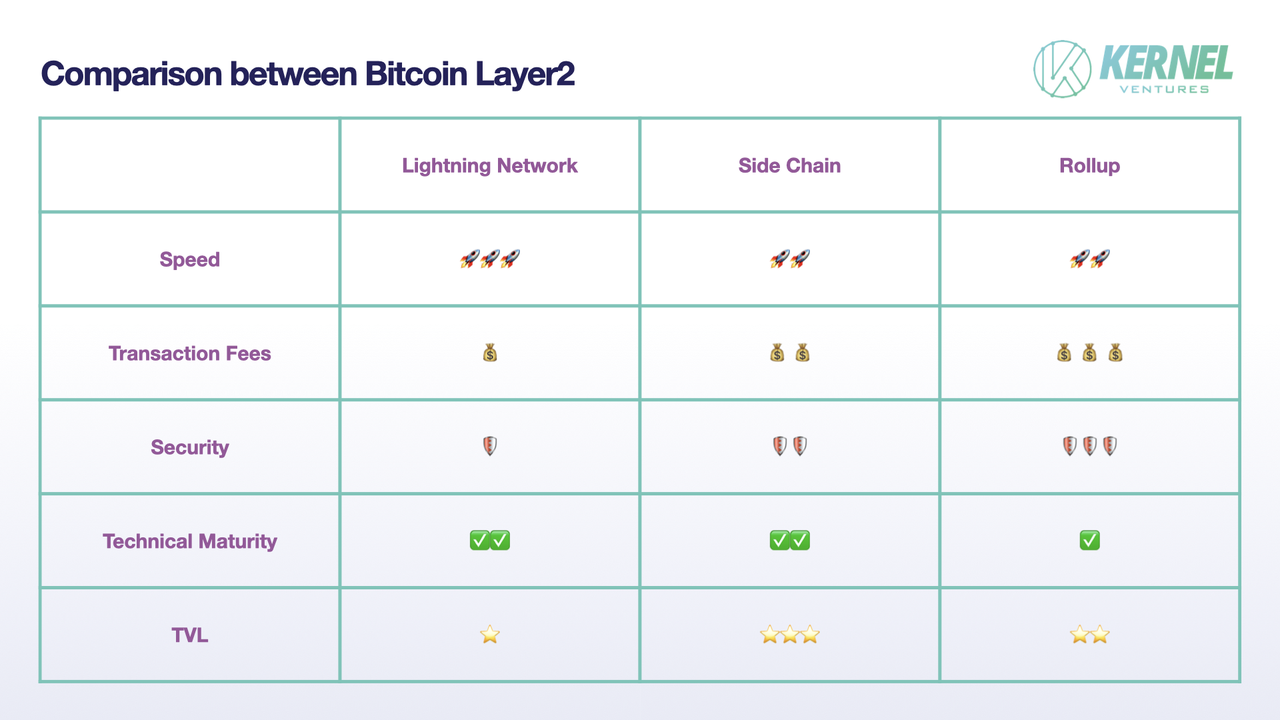

2. Currently, there are three mainstream Layer2 solutions on Bitcoin: Lightning Network, sidechains, and Rollups:

-

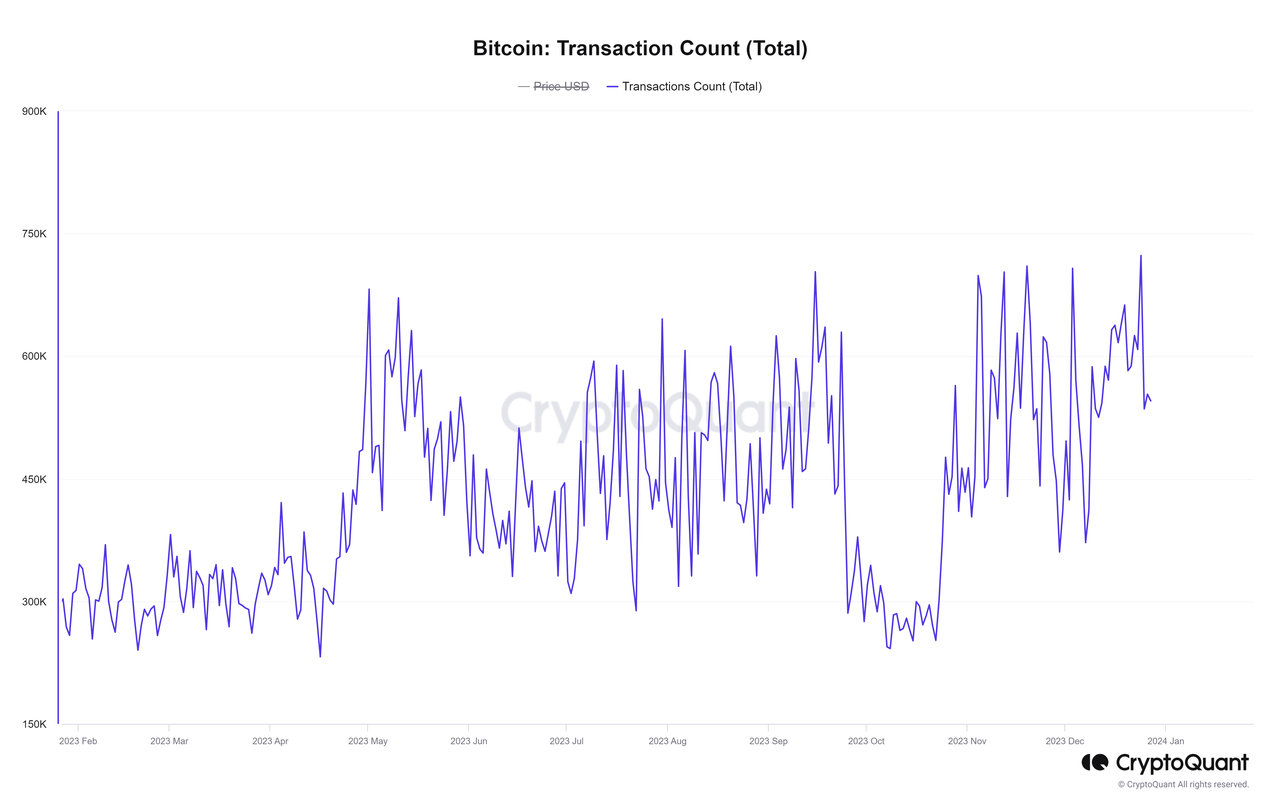

The Lightning Network enables peer-to-peer payments through off-chain payment channels, settling final balances on the mainnet when channels close;

-

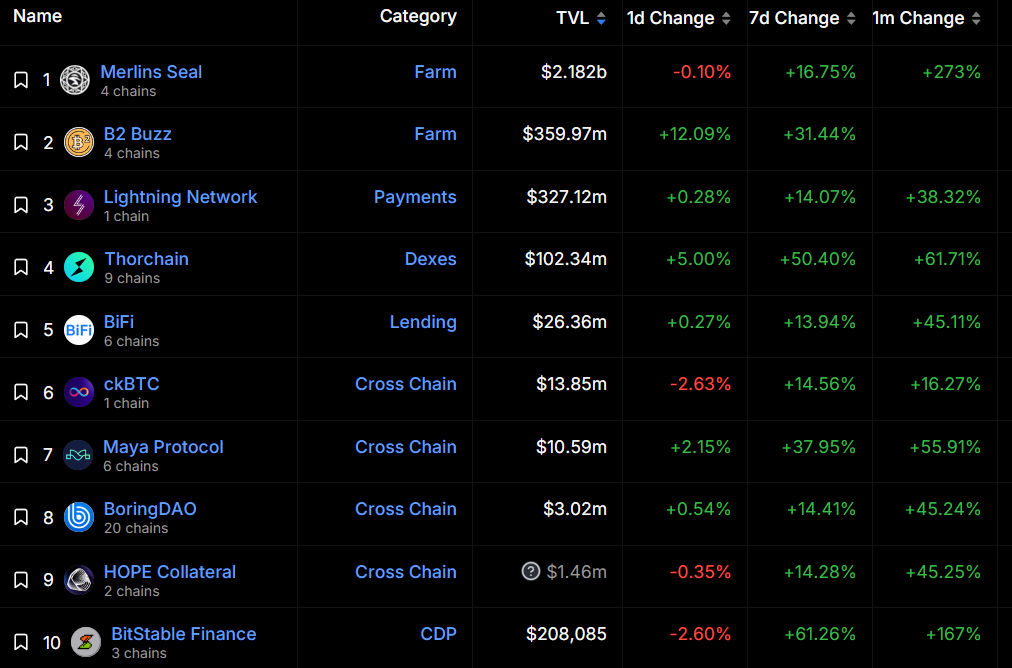

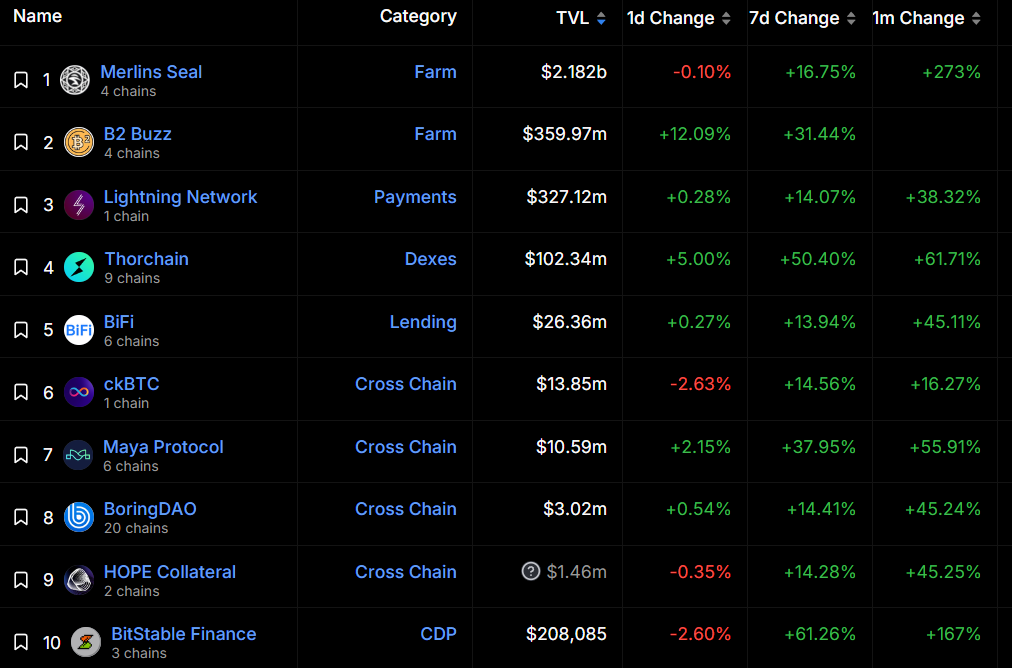

Sidechains lock BTC assets on the mainnet via specific or multi-sig addresses and mint equivalent BTC assets on the sidechain. Merlin Chain supports cross-chain transfers for multiple inscription asset types and maintains close ties with the BRC420 asset community, currently achieving a TVL exceeding $3 billion;

-

Current BTC Rollups simulate smart contracts on-chain using Taproot circuits while performing transaction bundling and computation off the Bitcoin mainnet. B2 Network leads implementation progress, with its on-chain TVL surpassing $200 million.

3. There are few bridges specifically designed for Bitcoin; most current solutions integrate multi-chain or omnichain bridges from major public blockchains. Meson.Fi has established partnerships with numerous Bitcoin Layer2 projects.

4. Bitcoin stablecoin protocols mostly use over-collateralization models, supplemented by other DeFi protocols built atop them to provide users with additional yield opportunities.

5. DeFi projects within the Bitcoin ecosystem vary significantly—some migrated from other chains, some were built directly on the Bitcoin mainnet during this development boom, and others originated from the previous bull market and operate on Bitcoin sidechains. Overall, Alex offers the most comprehensive range of trading functions and superior user experience, while Orders Exchange holds greater growth potential.

6. The Bitcoin ecosystem is poised to be a central narrative in this bull market cycle. Investors should monitor developments among leading projects across various Bitcoin sub-sectors.

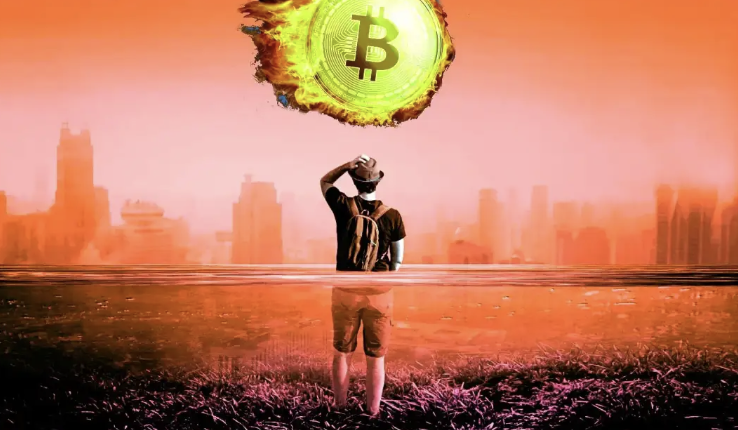

1. Background

The Ordinals protocol has triggered an overflow of inscription assets, bringing a wave of data-on-chain activity to the Bitcoin network—a network previously limited by the absence of smart contracts, reliance on script-based development, and weak infrastructure and scalability (for background, see Kernel’s prior research report: Can RGB Replicate the Ordinals Hype?). Similar to Ethereum’s earlier boom, text, images, and even videos are being inscribed into 4MB Tapscript spaces that will never execute. While this trend has stimulated ecosystem growth and infrastructure development, it has also caused a sharp rise in transaction volume and immense storage pressure on the Bitcoin network. Moreover, simple transfers no longer meet users’ trading needs for diverse inscriptions—they now expect the rich derivative services available on Ethereum to be brought to Bitcoin. Therefore, developing the Bitcoin mainnet’s application layer has become an urgent market need.

2. Bitcoin Layer2

Unlike Ethereum’s relatively consistent Layer2 approaches, Bitcoin cannot natively support smart contracts through its scripting language. Smart contract deployment on Bitcoin must rely on third-party protocols. Bitcoin Rollup-style Layer2 solutions cannot achieve the same level of security proximity to the mainnet as Ethereum’s Rollups do. Currently, several Layer2 solutions exist on Bitcoin, including the Lightning Network, sidechains, and TapScript-based Rollups.

2.1 Lightning Network

The Lightning Network is Bitcoin’s earliest Layer2 solution. Gregory Maxwell first proposed its protocol stack—BOLT—in December 2015. Lightning Labs launched the alpha version in January 2017 and has continuously upgraded it since. By establishing peer-to-peer off-chain payment channels, users can conduct unlimited transactions without fees until one party closes the channel, at which point only a single settlement fee is paid. Due to its off-chain nature, Lightning Network can theoretically achieve TPS in the millions. However, off-chain channels carry centralization risks, require pre-established connections (or routing through intermediaries), and mandate both parties remain online during transactions for security.

2.2 Sidechains

Bitcoin sidechain solutions resemble those on Ethereum—essentially launching new chains with 1:1 pegged tokens to Bitcoin. These new chains bypass Bitcoin’s transaction speed and development constraints, enabling faster and cheaper transfers of pegged Bitcoin assets. While sidechains inherit Bitcoin’s asset value, they do not inherit its security—the settlement occurs entirely on the sidechain.

2.2.1 Stacks

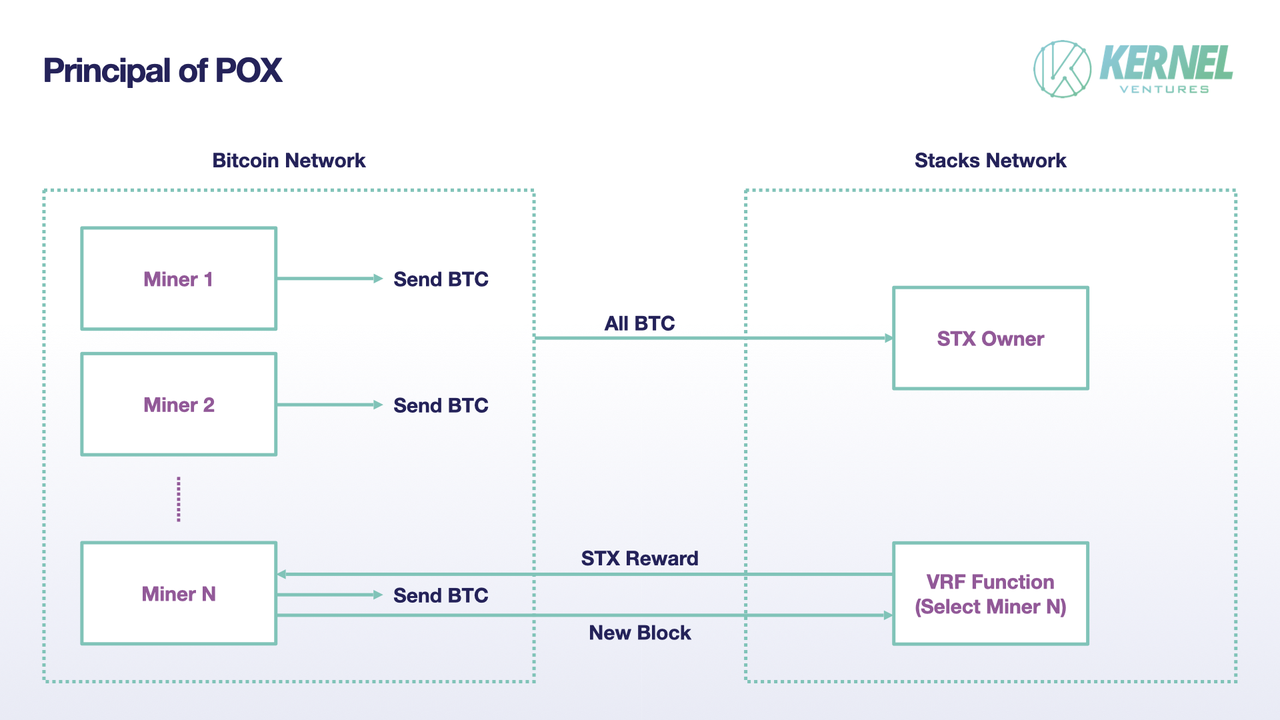

The current Stacks project is the 2.0 version launched in 2021. Users lock BTC on the Bitcoin mainnet and receive an equivalent amount of SBTC on Stacks. Transactions on the Stacks sidechain require STX, the native token, as gas. Since Bitcoin lacks smart contract addresses to manage locked BTC, these funds are sent to specific multi-signature addresses on the Bitcoin mainnet. Thanks to Clarity, a smart contract language supported on Stacks, redemption is straightforward: users simply submit a request to the Burn-Unlock contract on Stacks to destroy SBTC and return the locked BTC to their original Bitcoin address. Stacks uses the POX consensus mechanism, where Bitcoin miners bid BTC for block production rights—the higher the bid, the greater the weight. A verifiable random function selects the winner who then produces blocks on the Stacks chain and earns STX rewards. Meanwhile, the BTC used in bidding is distributed as SBTC to STX holders as staking rewards.

2.2.3 BEVM

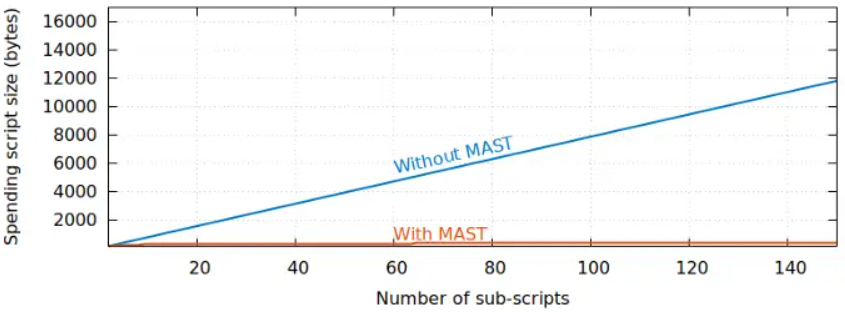

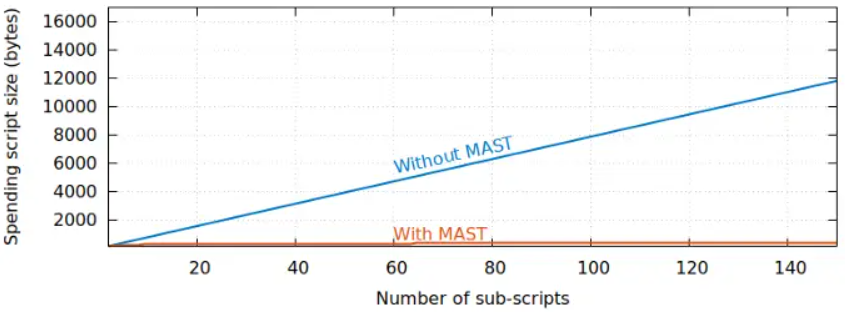

BEVM is a POS sidechain compatible with EVM at the base layer and has not yet issued its own native token. On the Bitcoin mainnet, it uses Schnorr’s multi-signature algorithm to store incoming assets in a multi-sig script address controlled jointly by 1000 addresses—corresponding to 1000 POS validators on BEVM. Additionally, writing MAST (Merkelized Abstract Syntax Tree) scripts within the TapScript area enables automated asset control. MAST breaks down programs into many independent small segments, each representing part of the logic. Instead of storing full code logic on-chain, only hash results of each segment are stored, greatly reducing contract code size on the blockchain. When users deposit BTC to BEVM, the funds are locked by the script program and can only be unlocked with signatures from more than 2⁄3 of the validators before being returned to the corresponding address. BEVM’s EVM compatibility allows zero-cost migration of Ethereum dApps, supports trading of pegged BTC assets, and uses these pegged assets as gas.

2.2.4 Merlin Chain

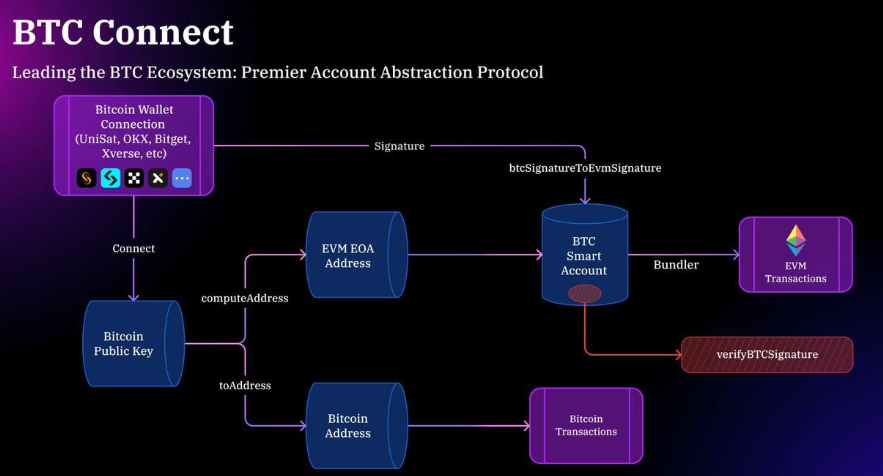

Merlin Chain is an EVM-compatible Bitcoin sidechain supporting direct network access via Bitcoin addresses through Particle Network, generating a unique Ethereum address for each. It also allows direct connection via Ethereum accounts through RPC nodes. Currently, Merlin Chain supports cross-chain migration of BTC, Bitmap, BRC-420, and BRC-20 assets. The BRC-420 protocol, like Merlin Chain itself, was developed by the Bitmap asset community based on recursive inscriptions. The broader community has also proposed initiatives such as the RCSV recursive inscription matrix and the Bitmap Game metaverse platform.

Merlin Chain launched its mainnet on February 5, followed by an IDO and staking rewards distributing 21% of its governance token MERL. Direct and large-scale airdrops attracted massive participation. Merlin Chain’s TVL now exceeds $3 billion, surpassing Polygon in Bitcoin-layer TVL and ranking sixth among all public blockchains.

2.2 Sidechains

Bitcoin sidechain solutions resemble those on Ethereum—essentially launching new chains with 1:1 pegged tokens to Bitcoin. These new chains bypass Bitcoin’s transaction speed and development constraints, enabling faster and cheaper transfers of pegged Bitcoin assets. While sidechains inherit Bitcoin’s asset value, they do not inherit its security—the settlement occurs entirely on the sidechain.

2.2.1 Stacks

The current Stacks project is the 2.0 version launched in 2021. Users lock BTC on the Bitcoin mainnet and receive an equivalent amount of SBTC on Stacks. Transactions on the Stacks sidechain require STX, the native token, as gas. Since Bitcoin lacks smart contract addresses to manage locked BTC, these funds are sent to specific multi-signature addresses on the Bitcoin mainnet. Thanks to Clarity, a smart contract language supported on Stacks, redemption is straightforward: users simply submit a request to the Burn-Unlock contract on Stacks to destroy SBTC and return the locked BTC to their original Bitcoin address. Stacks uses the POX consensus mechanism, where Bitcoin miners bid BTC for block production rights—the higher the bid, the greater the weight. A verifiable random function selects the winner who then produces blocks on the Stacks chain and earns STX rewards. Meanwhile, the BTC used in bidding is distributed as SBTC to STX holders as staking rewards.

Additionally, Stacks plans a "Satoshi Upgrade" in April, including optimizations to its Clarity programming language to lower developer barriers. It will also enhance network security, enabling direct confirmation of mainnet block transactions with 100% resistance to Bitcoin reorganizations. All Stacks transaction confirmations will occur on the mainnet, upgrading its security from a sidechain to a true Layer2 equivalent to Bitcoin. Finally, Stacks will drastically improve block times—achieving five seconds per block in testing (currently 10–30 minutes). If successfully implemented, Stacks will perform comparably to many Ethereum Layer2s, likely attracting significant capital inflows and boosting ecosystem development.

2.2.2 RSK

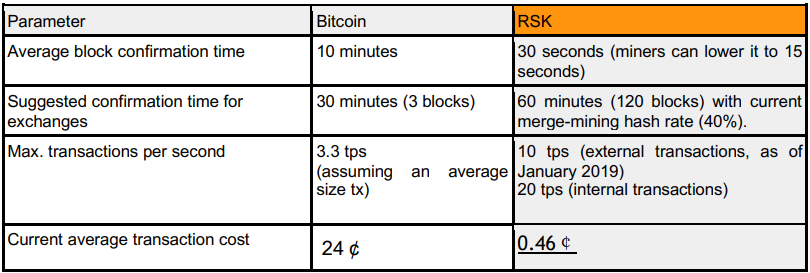

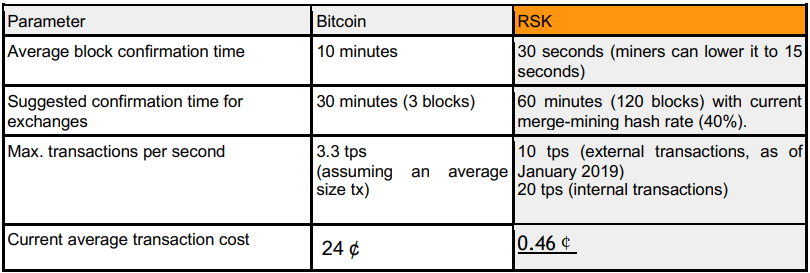

RSK (RootStock) is a Bitcoin sidechain without a native token—current transaction fees are paid in Bitcoin. Users can use RSK’s built-in PowPeg two-way pegging protocol to exchange mainnet BTC for RBTC on RSK at a 1:1 ratio. RSK is also a POW public chain but introduces merged mining: Bitcoin miners can reuse their existing mining infrastructure and configurations for RSK mining, lowering entry costs. Currently, RSK achieves triple the transaction speed of the mainnet and one-twentieth the transaction cost.

2.2.3 BEVM

BEVM is a POS sidechain compatible with EVM at the base layer and has not yet issued its own native token. On the Bitcoin mainnet, it uses Schnorr’s multi-signature algorithm to store incoming assets in a multi-sig script address controlled jointly by 1000 addresses—corresponding to 1000 POS validators on BEVM. Additionally, writing MAST (Merkelized Abstract Syntax Tree) scripts within the TapScript area enables automated asset control. MAST breaks down programs into many independent small segments, each representing part of the logic. Instead of storing full code logic on-chain, only hash results of each segment are stored, greatly reducing contract code size on the blockchain. When users deposit BTC to BEVM, the funds are locked by the script program and can only be unlocked with signatures from more than 2⁄3 of the validators before being returned to the corresponding address. BEVM’s EVM compatibility allows zero-cost migration of Ethereum dApps, supports trading of pegged BTC assets, and uses these pegged assets as gas.

2.2.4 Merlin Chain

Merlin Chain is an EVM-compatible Bitcoin sidechain supporting direct network access via Bitcoin addresses through Particle Network, generating a unique Ethereum address for each. It also allows direct connection via Ethereum accounts through RPC nodes. Currently, Merlin Chain supports cross-chain migration of BTC, Bitmap, BRC-420, and BRC-20 assets. The BRC-420 protocol, like Merlin Chain itself, was developed by the Bitmap asset community based on recursive inscriptions. The broader community has also proposed initiatives such as the RCSV recursive inscription matrix and the Bitmap Game metaverse platform.

Merlin Chain launched its mainnet on February 5, followed by an IDO and staking rewards distributing 21% of its governance token MERL. Direct and large-scale airdrops attracted massive participation. Merlin Chain’s TVL now exceeds $3 billion, surpassing Polygon in Bitcoin-layer TVL and ranking sixth among all public blockchains.

During the People’s Launchpad IDO, users earned points toward MERL purchase eligibility by staking Ally or more than 0.00025 BTC, with a maximum eligible BTC stake of 0.02, entitling them to 460 MERL tokens. This round allocated only 1% of total tokens. Despite the small allocation, based on the current OTC price of $2.90 per MERL, returns exceeded 100%. In the second staking incentive campaign, Merlin distributed 20% of its total token supply. Users could stake BTC, Bitmap, USDT, USDC, and select BRC-20 and BRC-420 assets on Merlin Chain via Merlin’s Seal. Hourly snapshots of users’ assets were taken and priced in USD, with daily averages multiplied by 10,000 to determine points earned. The second staking event adopted a team-based model similar to Blast, allowing users to choose between captain and member roles. Captains received invitation codes, while members needed to input a captain’s code to join a team.

Among current Bitcoin Layer2 implementations, Merlin stands out technologically, unlocking liquidity for Layer1 assets and enabling low-cost movement of Bitcoin on its chain. Backed by the extensive Bitmap ecosystem and mature technology, Merlin shows strong long-term potential. Current staking yields on Merlin are extremely high—not only due to anticipated MERL rewards but also chances to earn project airdrops of meme or other tokens. For example, the official Voya token airdrop grants 90 VOYA tokens to any single wallet staking over 0.01 BTC. Since launch, VOYA’s price has steadily risen, peaking at 514% above its initial price, now trading at $5.89. Assuming a BTC price of $50,000 during staking, the effective return reaches 106%.

2.3 Rollup

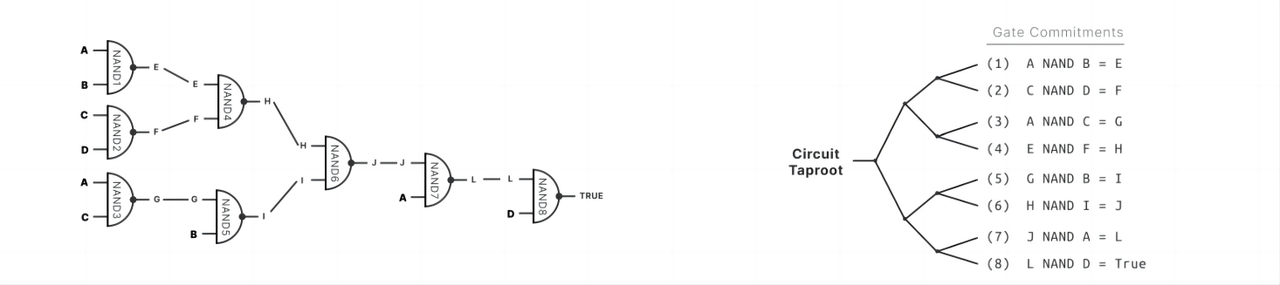

2.3.1 BitVM

BitVM is a Bitcoin Layer2 based on Optimistic Rollup. Similar to Ethereum’s Optimistic Rollup, users first send transaction data to Layer2 on the Bitcoin mainnet, then execute computations and bundle transactions off-chain. Results are submitted to a smart contract on Layer1 for verification, with a challenge period allowing verifiers to dispute the prover’s claims. However, Bitcoin lacks native smart contracts, making implementation far more complex than Ethereum’s Optimistic Rollup—requiring processes like Bit Value Commitment, Logic Gate Commitment, and Binary Circuit Commitment, abbreviated below as BVC, LGC, and BCC.

-

BVC (Bit Value Commitment): BVC is essentially a binary signal with only two states—0 or 1—similar to a Boolean variable in other programming languages. Since Bitcoin’s stack-based scripting language doesn’t support such types, BitVM simulates them using bytecode combinations.

<Input Preimage of HASH> OP_IF OP_HASH160 //Hash the input of user <HASH1> OP_EQUALVERIFY //Output 1 if Hash(input)== HASH1 <1> OP_ELSE OP_HASH160 //Hash the input of user <HASH2> OP_EQUALVERIFY //Output 0 if Hash(input)== HASH2 <0>

-

In BVC, users must first submit an input, which is hashed on the Bitcoin mainnet. The script unlocks only if the hash matches HASH1 or HASH0—outputting 1 for HASH1 and 0 for HASH2. For brevity, we’ll refer to this entire code segment as an OP_BITCOMMITMENT opcode moving forward.

-

LGC (Logic Gate Commitment): All computer functions can ultimately be reduced to combinations of Boolean logic gates. Any gate can be simplified into combinations of NAND gates. Thus, if we can simulate NAND gates on the Bitcoin mainnet using bytecode, we can effectively replicate any function. While Bitcoin lacks a direct NAND opcode, it does have OP_BOOLAND (AND) and OP_NOT (NOT). Combining these two opcodes replicates NAND functionality. Using outputs from OP_BITCOMMITMENT, we can construct a NAND output circuit via OP_BOOLAND and OP_NOT.

-

BCC (Binary Circuit Commitment): Building on LGC circuits, we can establish specific gate relationships between inputs and outputs. In BCC, inputs come from hash preimages within the TapScript, with different Taproot addresses corresponding to individual gates called TapLeafs. Multiple TapLeafs form a Taptree, serving as input to the BCC circuit.

Ideally, BitVM’s prover compiles and computes the circuit off-chain, then submits the result back to the Bitcoin mainnet. However, since off-chain execution isn't automatically enforced by smart contracts, to prevent malicious provers, BitVM requires challengers on the mainnet. During challenges, verifiers first reproduce the output of a specific TapLeaf gate, then combine it with the prover’s provided results from other TapLeafs as inputs to drive the circuit. If the output is False, the challenge succeeds—indicating the prover lied. Otherwise, the challenge fails. Completing this process requires pre-shared knowledge of the Taproot circuit between challenger and verifier, and currently only supports one-on-one interaction between a single prover and verifier.

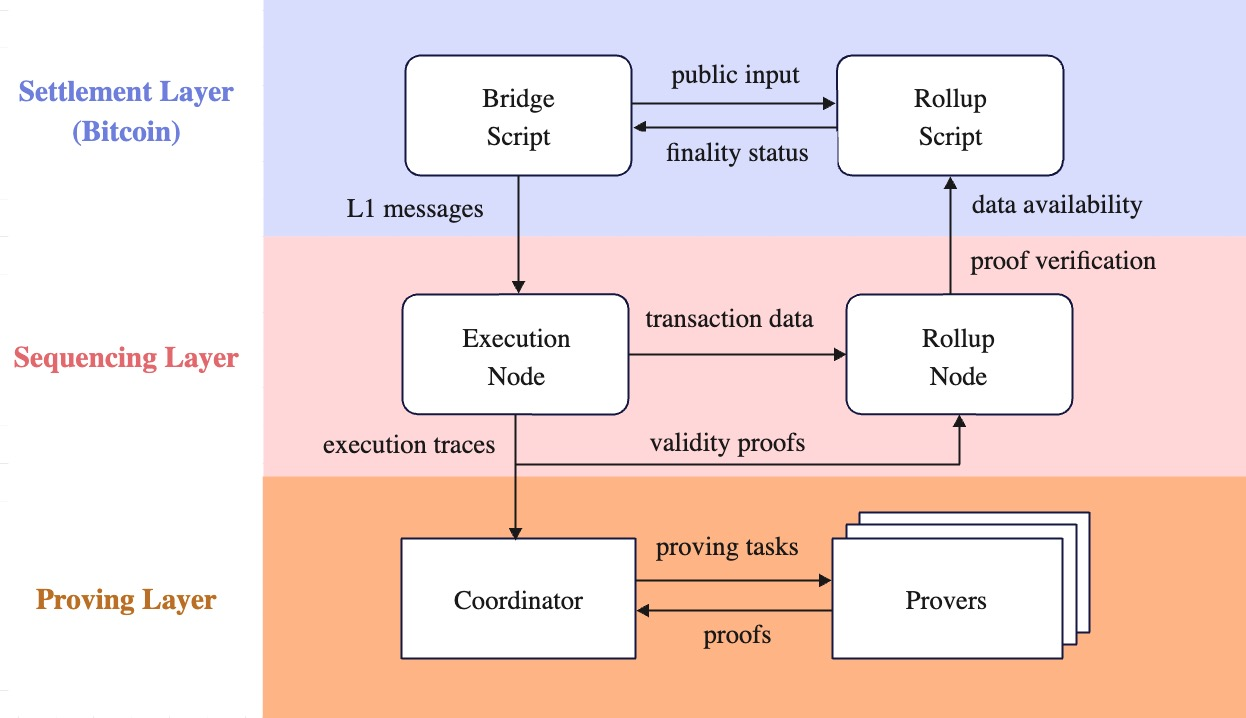

2.3.2 SatoshiVM

SatoshiVM is an EVM-compatible Zk Rollup-style Bitcoin Layer2. Its smart contract implementation mirrors BitVM—using Taproot circuits to simulate complex functions—and thus won’t be repeated here. SatoshiVM consists of three layers: Settlement Layer, Sequencing Layer, and Proving Layer. The Settlement Layer—i.e., the Bitcoin mainnet—provides the DA layer, stores transaction Merkle roots and zero-knowledge proofs, and verifies the correctness of Layer2 transaction bundles via Taproot circuits for final settlement. The Sequencing Layer handles transaction bundling and processing, returning computation results and ZK proofs to the mainnet. The Proving Layer generates ZK proofs for tasks from the Sequencing Layer and sends them back.

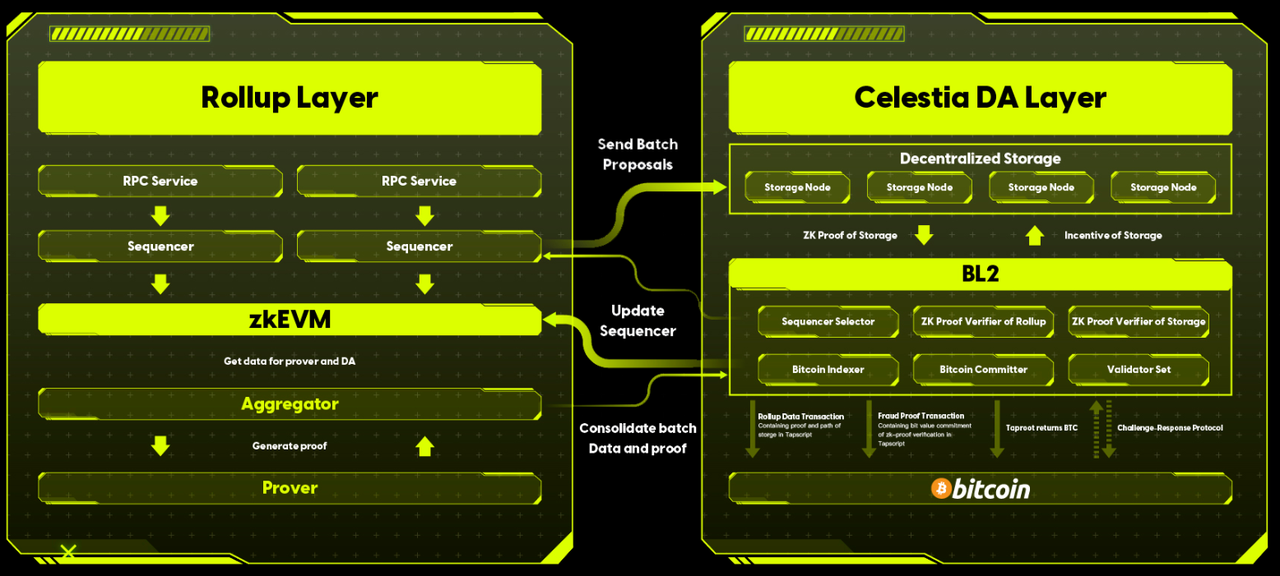

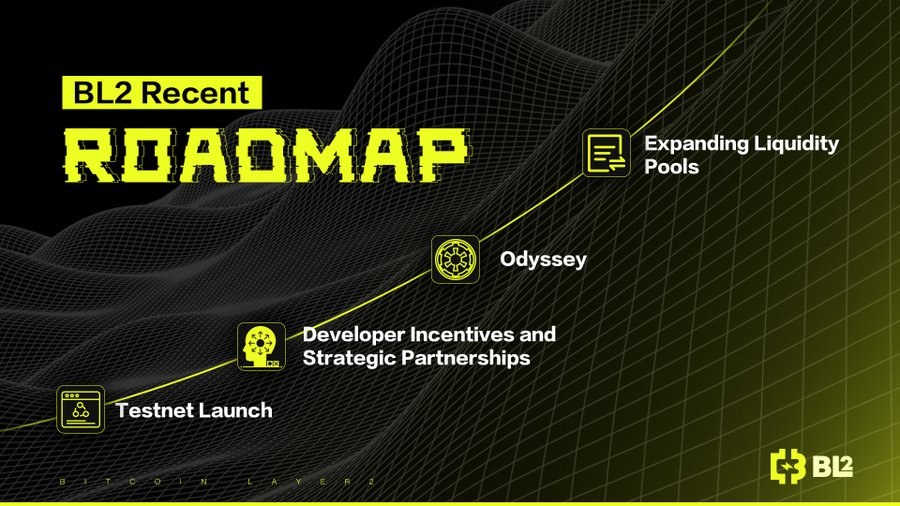

2.3.3 BL2

BL2 is a Zk Rollup-type Bitcoin Layer2 built on a universal VM protocol (officially designed to support all major virtual machines). Like other Zk Rollup Layer2s, its Rollup Layer primarily uses zkEVM to bundle transactions and generate corresponding zero-knowledge proofs. BL2’s DA layer leverages Celestia to store bulk transaction data, while BL2’s own network stores only ZK proofs. Finally, ZK proof verification and minimal validation data like BVC are returned to the mainnet for settlement.

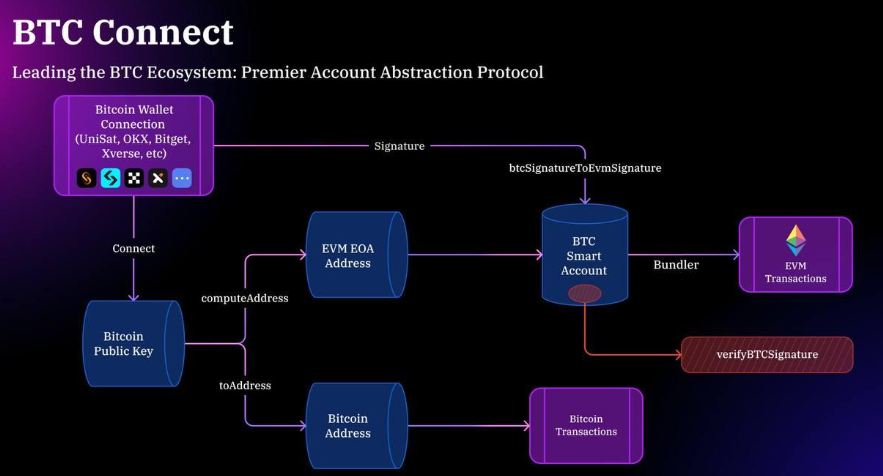

BL2’s X account updates frequently, nearly daily, openly sharing development roadmaps and tokenomics—allocating 20% of tokens to OG Mining and hinting at an imminent testnet launch. Currently, the project remains niche compared to other Bitcoin Layer2s, still in early stages. It incorporates trending concepts like Celestia and Bitcoin Layer2, giving it conceptual momentum. However, its website lacks functional features—only showing mockups—and has no whitepaper. Its goals are highly ambitious—like account abstraction on Bitcoin and a VM protocol compatible with all major virtual machines—posing significant technical hurdles. Whether the team can deliver remains uncertain, making accurate assessment premature.

2.3.4 B2 Network

B2 Network is a zkRollup-style Layer2 using Bitcoin as its settlement and DA layer. Structurally, it consists of two main layers: Rollup Layer and DA Layer. User transactions are first submitted and processed on the Rollup Layer, which uses zkEVM to execute transactions, generate proofs, and store user state. Bundled transactions and generated ZK proofs are then forwarded to the DA Layer for storage and verification. The DA Layer further divides into decentralized storage nodes, B2 Nodes, and the Bitcoin mainnet. Decentralized storage nodes receive Rollup data, periodically generate time-and-space ZK proofs based on that data, and send the resulting storage proofs to B2 Nodes. B2 Nodes verify the data off-chain, then record transaction data and corresponding ZK proofs onto the Bitcoin mainnet via TapScript. The Bitcoin mainnet validates the authenticity of the ZK proofs and performs final settlement.

B2 Network enjoys strong visibility among Bitcoin Layer2 projects, with 300K followers on X—surpassing BEVM’s 140K and SatoshiVM’s 166K. It has secured seed funding from OKX and HashKey, drawing significant attention. Its current on-chain TVL exceeds $600 million.

B2 Network has launched its mainnet “B2 Buzz,” requiring an invitation link to participate—direct access is not allowed. Drawing inspiration from Blast’s viral model, B2 creates strong mutual incentives between new and existing users, motivating early adopters to promote the project. After completing simple tasks like following official social media, users enter the staking interface. Currently, staking supports assets from four major chains: BTC, Ethereum, BSC, and Polygon. On the Bitcoin mainnet, in addition to BTC, inscription assets ORDI and SATS are also eligible. Staking BTC involves direct transfer, while staking inscription assets requires inscription and transfer steps. Notably, since Bitcoin lacks native smart contracts, BTC assets in current Layer2 cross-chain transfers are effectively locked in specific multi-sig BTC addresses. Assets staked on B2 Network won’t be redeemable until at least April, but earned points can be used to redeem virtual mining components—BASIC miners require just 10 components, while ADVANCED miners need over 80.

The team has disclosed partial tokenomics: 5% of total supply allocated to virtual mining rewards and another 5% to ecosystem project airdrops. In today’s competitive landscape emphasizing fairness, allocating only 10% of tokens may fail to ignite strong community enthusiasm. Additional staking incentives or a LaunchPad program are likely in later stages.

2.4 Comparative Overview

Among the three Bitcoin Layer2 models, the Lightning Network offers the fastest transaction speeds and lowest costs, making it ideal for real-time Bitcoin payments and offline purchases. However, for building application ecosystems—such as DeFi or cross-chain protocols—the Lightning Network falls short in stability and security. Thus, competition in the application layer mainly unfolds between sidechains and Rollup-type solutions. Sidechains currently lead in TVL due to not requiring mainnet transaction confirmation and having more mature, easier-to-implement architectures. However, because Bitcoin lacks native smart contracts, methods for verifying Rollup-submitted data are still evolving, meaning practical deployment may take more time.

3. Bitcoin Cross-Chain Bridges

3.1 Multibit

Multibit is a cross-chain bridge specifically designed for BRC20 assets on Bitcoin, currently supporting BRC20 transfers to Ethereum, BSC, Solana, and Polygon. During the process, users first send assets to a designated Multibit BRC20 address. Once Multibit confirms the transfer on the mainnet, users gain the right to mint equivalent assets on the target chain, though they must still pay gas to complete minting. Among bridges offering BRC20 cross-chain services, Multibit provides the best UX and supports the largest number of BRC20 assets—over a dozen, including ORDI. Additionally, Multibit actively expands beyond BRC20, now supporting farming and cross-chain for Bitstable’s governance token and stablecoin—native BTC stablecoin protocol assets. Among bridges serving BTC-derived assets, Multibit stands at the forefront of the sector.

3.2 Sobit

Sobit is a cross-chain protocol connecting Solana and the Bitcoin mainnet. Current cross-chain assets mainly include BRC20 tokens and Sobit’s native token. Users deposit BRC20 assets to a designated Sobit address on Bitcoin. After verification by Sobit’s validator network, users can mint mapped assets on a designated Solana address. The core of Sobit’s validator network relies on a framework requiring multiple trusted validators to approve cross-chain transactions—adding an extra security layer against unauthorized transfers, significantly enhancing system security and robustness. Sobit’s native token is Sobb, used to pay bridge fees, with a total supply of 1 billion. 74% of Sobb was fairly launched. Unlike many other Bitcoin DeFi and cross-chain tokens that surged post-launch, Sobb briefly rose before entering a downtrend with over 90% decline—and recently showed no clear rebound despite rising BTC prices. This may stem from Sobit’s niche focus. Sobit and Multibit target overlapping audiences, but Sobit currently only supports cross-chain to Solana and supports just three BRC20 assets. Compared to Multibit’s broader asset and ecosystem support, Sobit struggles to compete.

3.3 Meson Fi

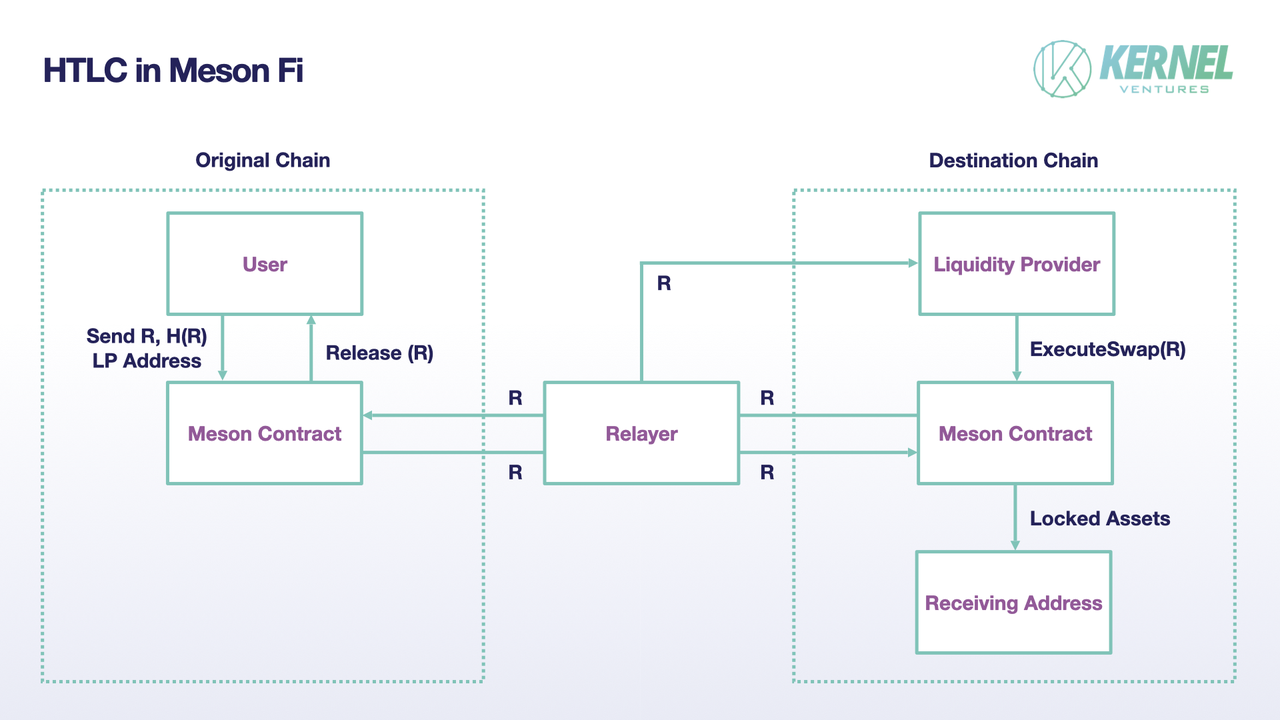

Meson Fi is a cross-chain bridge based on HTLC (Hash Time-Locked Contract) principles, currently enabling interoperability across 17 major public chains including BTC, ETH, and SOL. During cross-chain transfers, users sign transaction data off-chain and submit it to the Meson Contract for confirmation, locking assets on the source chain. After confirmation, Meson Contract broadcasts the message to the target chain via Relayers. Relayers come in three forms: P2P nodes (higher security), centralized nodes (higher efficiency and availability), and nodeless (requires users to hold assets on both chains). Users can choose based on needs. LPs on the target chain verify transaction validity via Meson Contract’s postSwap method, then lock equivalent assets via the Lock function on Meson Contract, exposing the address to Meson Fi. Next follows standard HTLC flow: users create a hash lock pointing to the LP address on the source chain, withdraw assets on the target chain by revealing the preimage, and LPs then use the preimage to unlock user assets on the source chain.

Meson Fi is not a bridge exclusively for Bitcoin assets—it’s more akin to an omnichain bridge like LayerZero. However, major BTC Layer2s such as B2 Network, Merlin Chain, and BEVM have partnered with Meson Fi, recommending its use for cross-chain asset transfers during staking. According to official data, during a three-day staking event on Merlin Chain, Meson Fi processed over 200,000 transactions and approximately 2,000 BTC in cross-chain staking—handling nearly all major-chain-to-Bitcoin flows. As new BTC Layer2s continue launching with staking incentives, Meson Fi is well-positioned to capture substantial cross-chain volume, driving ecosystem growth and increasing cross-chain revenue.

3.4 Comparative Overview

Overall, Meson Fi differs fundamentally from the other two bridges. Meson Fi is an omnichain bridge that happens to partner with many Bitcoin Layer2s to facilitate inbound asset bridging. In contrast, Sobit and Multibit are bridges specifically designed for Bitcoin-native assets, serving BRC20 and other DeFi/stablecoin assets on Bitcoin. Multibit supports far more BRC20 assets—dozens including ORDI and SATS—while Sobit supports only three. Moreover, Multibit partners with select Bitcoin stablecoin protocols, offering related cross-chain services and staking yield programs, delivering broader service coverage. Finally, Multibit offers superior cross-chain liquidity, supporting five major chains including Ethereum, Solana, and Polygon.

4. Bitcoin Stablecoins

4.1 BitSmiley

BitSmiley is a suite of protocols built on Bitcoin’s mainnet using the Fintegra framework, encompassing stablecoin, lending, and derivatives protocols. Users can over-collateralize BTC via its stablecoin protocol to mint bitUSD. To reclaim collateralized BTC, users must send bitUSD back to the Vault Wallet for burning and pay a fee. When collateral value drops below a threshold, BitSmiley triggers automatic liquidation. The liquidation price formula is:

\(Liquidation Price = \frac{bitUSDDGenerated \times LiquidationRatio}{Quantity of Collateral}\)

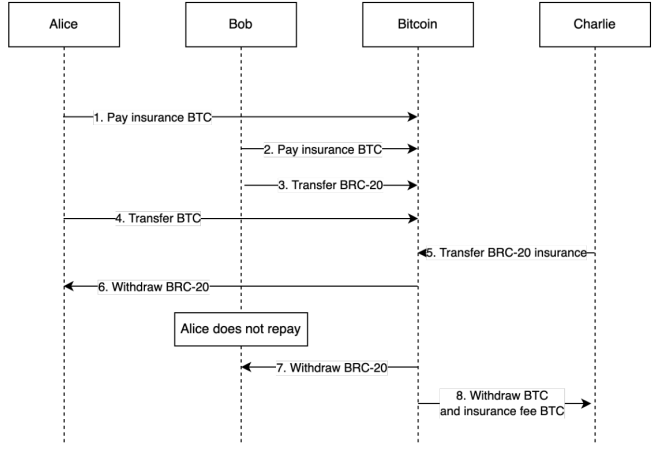

As shown, the exact liquidation price depends on the real-time value of the user’s collateral and the amount of bitUSD minted, with Liquidation Ratio being a fixed constant. To protect liquidated users from price volatility losses, BitSmiley includes a Liquidation Penalty—the longer the liquidation takes, the higher the compensation. Liquidations use Dutch auctions to clear assets as quickly as possible. Protocol surpluses are stored in a designated account and periodically auctioned via BTC-bid English auctions—maximizing surplus value extraction. Of these surplus assets, 90% subsidizes on-chain stakers, while the remaining 10% goes to the BitSmiley team for operational costs. BitSmiley’s lending protocol also introduces settlement innovations tailored to Bitcoin. Given Bitcoin’s 10-minute block time, integrating oracles for real-time price monitoring—as done on Ethereum—is impractical. Hence, BitSmiley introduces a third-party insurance mechanism to mitigate counterparty risk: either party can pre-pay BTC as insurance (both sides required); if one party fails to fulfill obligations, the guarantor compensates the other.

BitSmiley offers rich DeFi and stablecoin functionality, with innovative liquidation mechanisms better protecting users and improving Bitcoin compatibility. From both settlement and collateral design perspectives, BitSmiley represents a strong stablecoin and DeFi model. Given the Bitcoin ecosystem’s early stage, BitSmiley is well-positioned to capture a significant share of the stablecoin market.

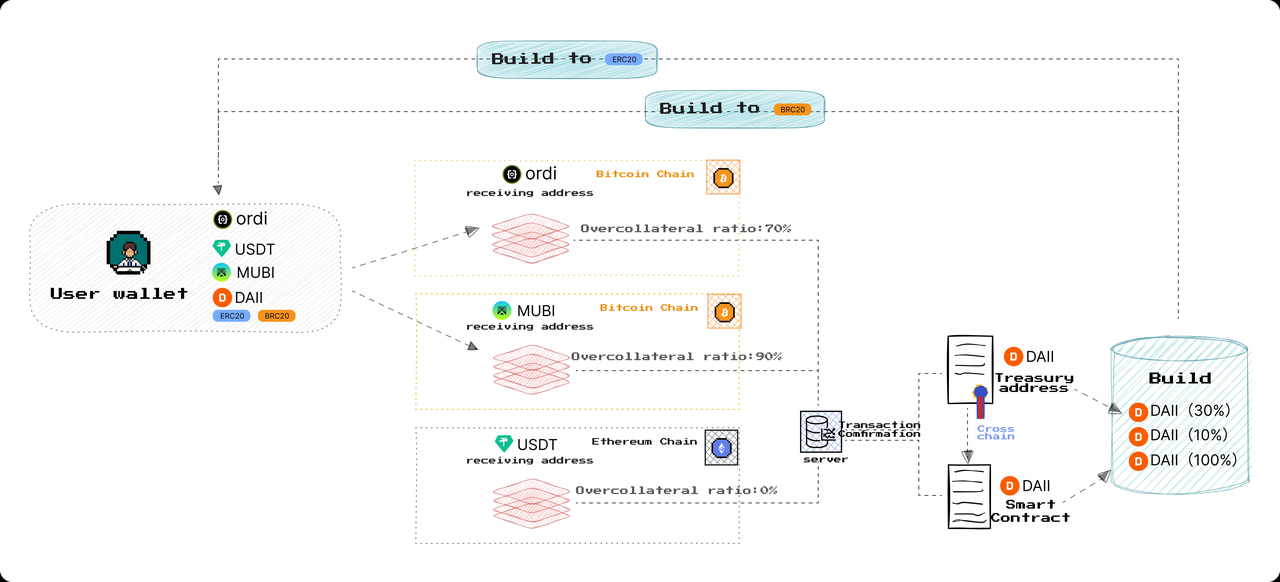

4.2 BitStable

BitStable is another over-collateralized Bitcoin stablecoin protocol, currently accepting Ordi and Mubi from the Bitcoin mainnet and USDT from Ethereum as collateral. Based on each asset’s volatility, BitStable sets different over-collateralization ratios: 0% for USDT, 70% for Ordi, and 90% for Mubi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News