Exploring the Value of Memes: Financial Nihilism as a New Form of Social Security

TechFlow Selected TechFlow Selected

Exploring the Value of Memes: Financial Nihilism as a New Form of Social Security

Meme coins need time to win people's trust.

Author: yuga.eth

Translation: TechFlow

I believe meme coins are beneficial to society. Even within the cryptocurrency space, this is a controversial stance. Many argue that meme coins distract attention from core technological innovations in crypto, and some claim they are inherently worthless.

Overall, I believe meme coins are good because they reflect society’s commitment to upholding digital property rights through free and open markets. Meme coins represent one of the purest expressions of citizens exercising financial freedom—people should not need to justify legitimate buying and selling; their preferences should be the arbiters of economic decisions, highlighting principles of individual autonomy and market liberty. Conversely, in most markets (perhaps excepting those with overwhelming national interest), regulators or legislators shouldn’t decide what can or should be bought and sold. Restricting meme coin markets based on personal disapproval opposes broader free-market principles. Limiting meme coin markets due to subjective taste contradicts support for free markets more generally.

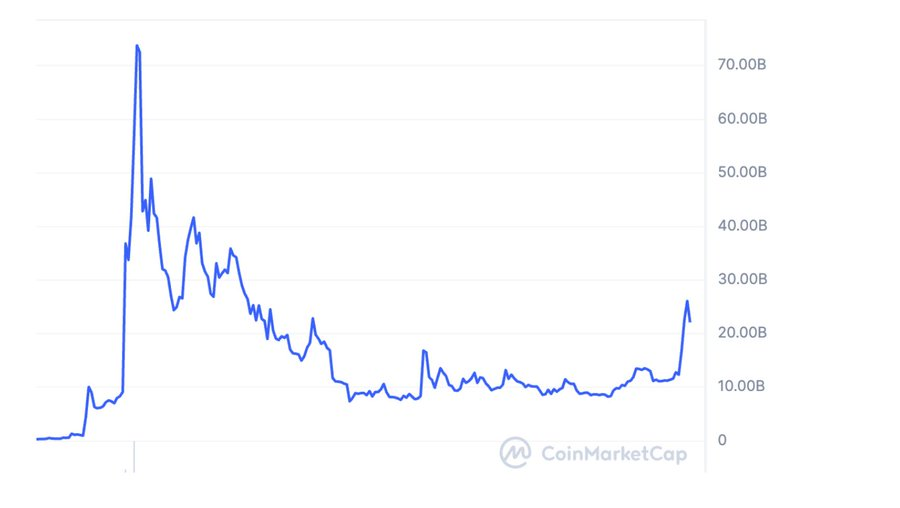

The above argument holds regardless of whether meme coins possess intrinsic value—but the assumption that they are fundamentally valueless is increasingly untenable. An intuitive indicator is market price. For example, Dogecoin reached a bear market low market cap of $7.7 billion in 2022.

DOGE from 2020 to present

This would place DOGE’s market cap at a level comparable to News Corporation (the parent company of FOX News and a member of the S&P 500) during the same period, which had a market cap of $9.1 billion. Even amid crypto downturns and high interest rates, the market continues to reflect significant value attributed to DOGE.

There are many explanations for this, ranging from skepticism to ideology. Skeptics might argue that large DOGE holders have an incentive to prevent prices from falling below certain levels and thus support the price through further purchases. Crypto-ideologues might contend that all money—including the U.S. dollar—is essentially a meme coin, since its value stems from social convention, a kind of imitation or meme. (As economist Paul Krugman once said, fiat currency is backed by “men with guns,” making meme coins appear more benign than their alternatives.)

I believe both explanations hold varying degrees of truth, but there’s a third explanation: meme coins are primarily cultural phenomena rather than financial ones. They serve as channels for people to use new technology to express collective humor, dissent, or camaraderie. Through meme coins, communities form around shared jokes, cultural moments, or sociopolitical sentiments, enabling participation in a form of digital expression that transcends traditional financial mechanisms. Meme coins become symbols of shared identity or cause, deriving value not only from market dynamics but also from the popularity of the values they represent.

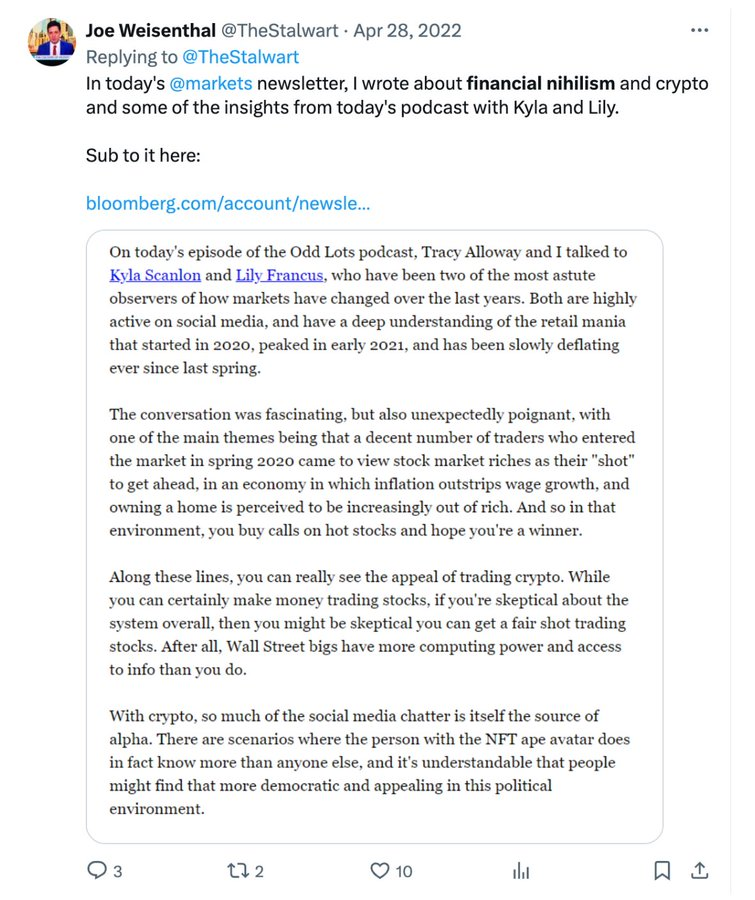

It's easy to dismiss such activity as "financial nihilism": as Joe Weisenthal wrote in the image below, it reflects extreme distrust in the existing system and seeks to undermine it by exposing its absurdity:

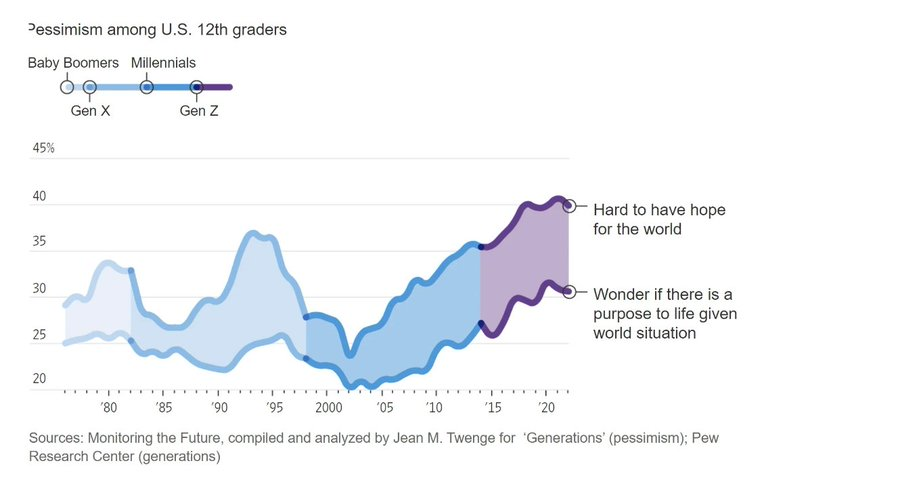

Indeed, part of the motivation behind meme coin activity may well be driven by financial nihilism. This sentiment reflects broader trends of pessimism fueled by inflation, uncompetitive wages, unaffordable housing, unsustainable sovereign debt, and political polarization.

However, things become interesting when people attempt to censor or invalidate financial nihilism as a philosophical viewpoint. So-called financial “laws” are neither inviolable nor inherently moral—and indeed, they aren't even consistently observed. It wasn't until the 1950s that investment banks began using discounted cash flow models for company valuation, based on academic research by Fisher, Modigliani, and Miller. Similarly, the concept of a “risk-free rate” emerged from the Capital Asset Pricing Model developed by Treynor and others in 1962—less than 70 years ago. These relatively recent constructs are difficult to elevate into moral doctrines; they are simply theories with varying degrees of predictive validity. Then why is questioning the traditional system often framed as a moral failing, rather than a critical inquiry into its effectiveness?

One answer is that those with vested interests in the current system—particularly individuals working in traditional finance and the regulatory bodies surrounding it—want to preserve it. To do so, they must delegitimize any systems challenging it, including cryptocurrencies and meme coins. A wholesale rejection of financial nihilism reveals a bias toward maintaining the current financial order while disregarding the possibility of alternatives.

Another answer is that meme coins are perceived as rife with fraud and scams—and yes, there is some truth to this. Meme coin advocates should demand honesty and transparency from their communities just as vigorously as they advocate for price increases. I suspect many of the loudest critics of meme coins are those who have lost money through scams, and I empathize with them. Those who commit fraudulent acts should be held accountable by either the community or the state.

Some scams are meme coins, but not all meme coins are scams. At this point, I’ll disclose the meme coins I hold. This is absolutely not financial advice—any of these meme coins could go to zero. Rather, this is an expression of my personal cultural sentiment and my commitment to transparency:

-

MOCHI: The cutest cat on-chain. I believe cuteness is a universal value that transcends culture and brings people together—and besides, I like cats.

-

TOSHI: Currently the highest-valued cat on-chain.

-

JENSEN: A community modeled after the CEO of NVIDIA.

Recently, I tweeted: “Structurally, meme coins aren’t that different from Social Security.” That may sound facetious, but there are unexpected similarities:

-

Community-based value: Both meme coins and Social Security rely on collective belief. The value of meme coins arises from community consensus, much like the effectiveness of Social Security is rooted in societal commitment.

-

Wealth redistribution mechanism: Both meme coins and Social Security redistribute wealth. Meme coins redistribute wealth among investors, while Social Security transfers income from the current workforce to retirees.

-

Reliance on new participants: The sustainability of meme coins depends on attracting new investors, similar to how Social Security requires continuous contributions from the working population to pay benefits to retirees. The difference is, Social Security faces insolvency risks.

As a form of cultural expression, meme coins require time to earn trust—especially in an industry entrenched in decades-old dogmas about what value means. But even without that, meme coins hold social value because they serve as a crucial litmus test for financial freedom. Fraud must be eradicated, but people should retain the right to transact using any medium—including meme coins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News