Understanding Morpheus: Intelligent Agents Leading the Future

TechFlow Selected TechFlow Selected

Understanding Morpheus: Intelligent Agents Leading the Future

Morpheus goes beyond traditional smart contracts—which are reactive—by leveraging AI agents for proactive, real-time decision-making.

Author: 0xGreythorn

Source: Morpheus

Project Name: Morpheus

Project Type: Smart Agent AI

Token Symbol: $MOR

Crypto Rank: N/A

Market Cap: N/A

Full Diluted Valuation (FDV): N/A

Circulating Supply: N/A

Maximum Supply: 42 million

Introduction

Greythorn recently analyzed several AI projects, highlighting the transformative impact of artificial intelligence in the coming years. Notably, Greythorn observed a growing market demand for open-source large language models (LLMs). However, these LLMs often lack essential features such as user-friendly interfaces and effective user data management. To address these shortcomings, smart agent protocols have been introduced. These protocols facilitate the management of local LLMs through Web3 wallets, significantly enhancing user experience and control.

As the AI market prepares for significant growth, many key players predict that AI will play a pivotal role in mainstream crypto adoption. Morpheus, with its innovative AI agent network and fair launch strategy, challenges centralized AI paradigms and positions itself as a critical player in the future AI landscape.

Project Overview

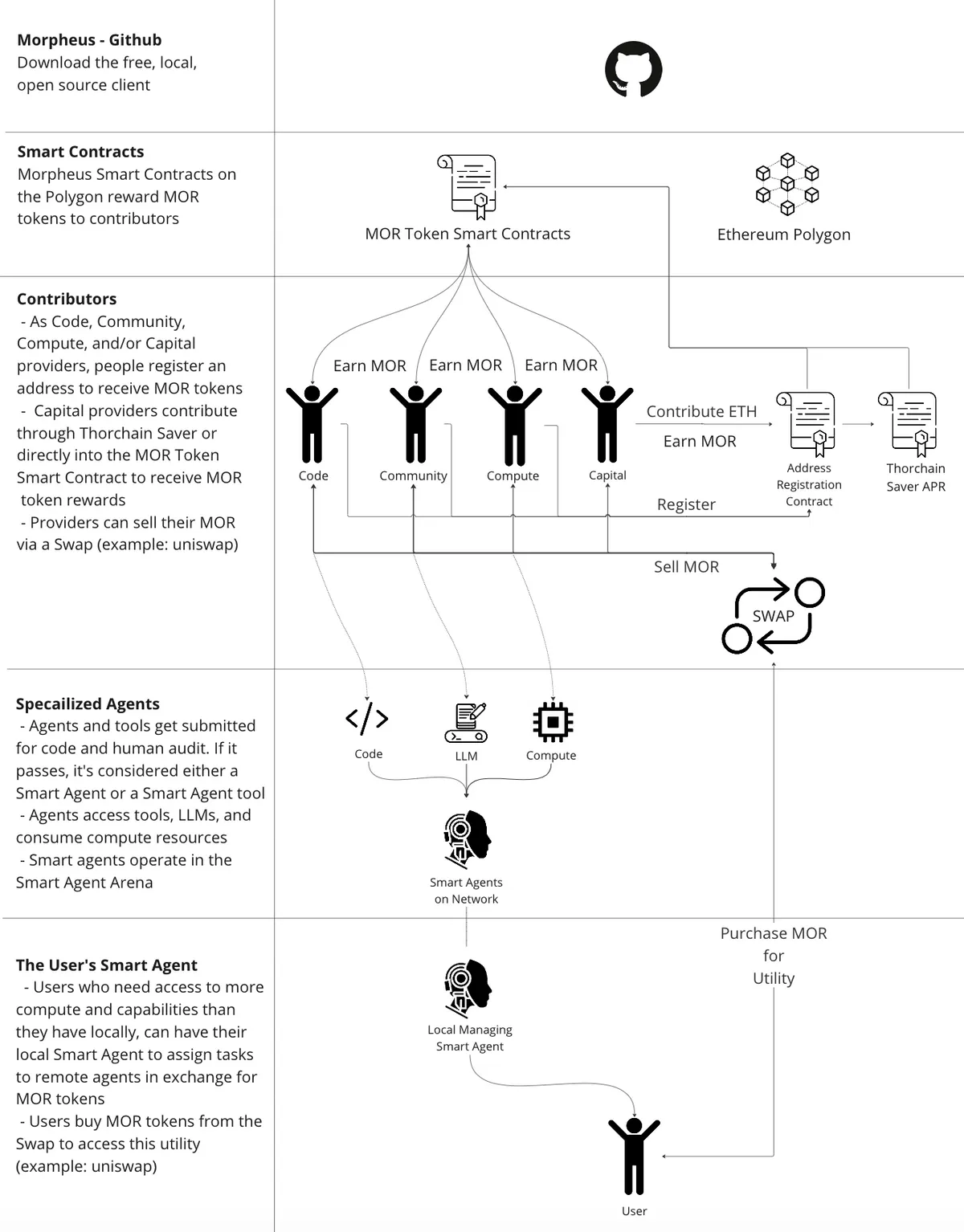

MorpheusAI represents a significant advancement in integrating AI with blockchain, particularly for Web3. It goes beyond traditional smart contracts—which are reactive—by leveraging AI Agents to enable proactive, real-time decision-making. This shift from basic automation to complex, autonomous task management is powered by advances in large language models (LLMs), combining AI's analytical power with blockchain’s efficiency and security.

MorpheusAI not only enables sophisticated AI-driven tasks, enhancing sectors like service markets and crypto gaming, but also seamlessly integrates with Web3 technologies. By offering APIs, decentralized cloud services, and easy integration with crypto tools and DApps, it aims to make personal AI agents—or smart agents—widely accessible. These intelligent agents can interact with users’ wallets, DApps, and smart contracts, bridging the gap between traditional tech and blockchain.

By enabling natural language communication with smart agents and introducing a token-backed network to incentivize development and usage, MorpheusAI offers a user-friendly and innovative approach to AI in blockchain. It stands out as an open-source alternative in a space dominated by closed-source models, providing a secure and efficient solution that enhances both developer and user experiences within the blockchain ecosystem.

Key Features of Morpheus

● Web3 Integration: Morpheus is natively Web3-integrated, enabling users to conduct cryptocurrency transactions, use smart contracts, and access DApps and DeFi services—capabilities beyond current LLMs that lack direct Web3 connectivity.

● Decentralization and Cost Efficiency: By operating on decentralized public infrastructure, Morpheus avoids the regulatory and cost barriers faced by centralized entities, offering a more affordable and flexible solution for AI deployment and usage.

● Developer-Friendly Platform: Morpheus provides developers with a Linux-like alternative, enabling rapid creation of new agents or LLMs at no cost while ensuring data ownership and security.

● Innovative Reward System: The platform incentivizes contributions from various roles—including capital providers, coders, compute providers, and community builders—rewarding participation and contributions to the Morpheus ecosystem via a token-based system.

Morpheus Pathways

● Proof of Capital and Rewards

Capital providers support the network by depositing stETH, generating yield and contributing to protocol-owned liquidity (PoL). This mechanism ensures ecosystem liquidity and rewards capital providers with $MOR tokens proportional to their contribution.

● Proof of Code, Registration, and Rewards

Developers contribute code to the Morpheus network and receive rewards based on the value of their contributions. This system encourages the development of specialized agents and tools, enhancing platform capabilities and user experience.

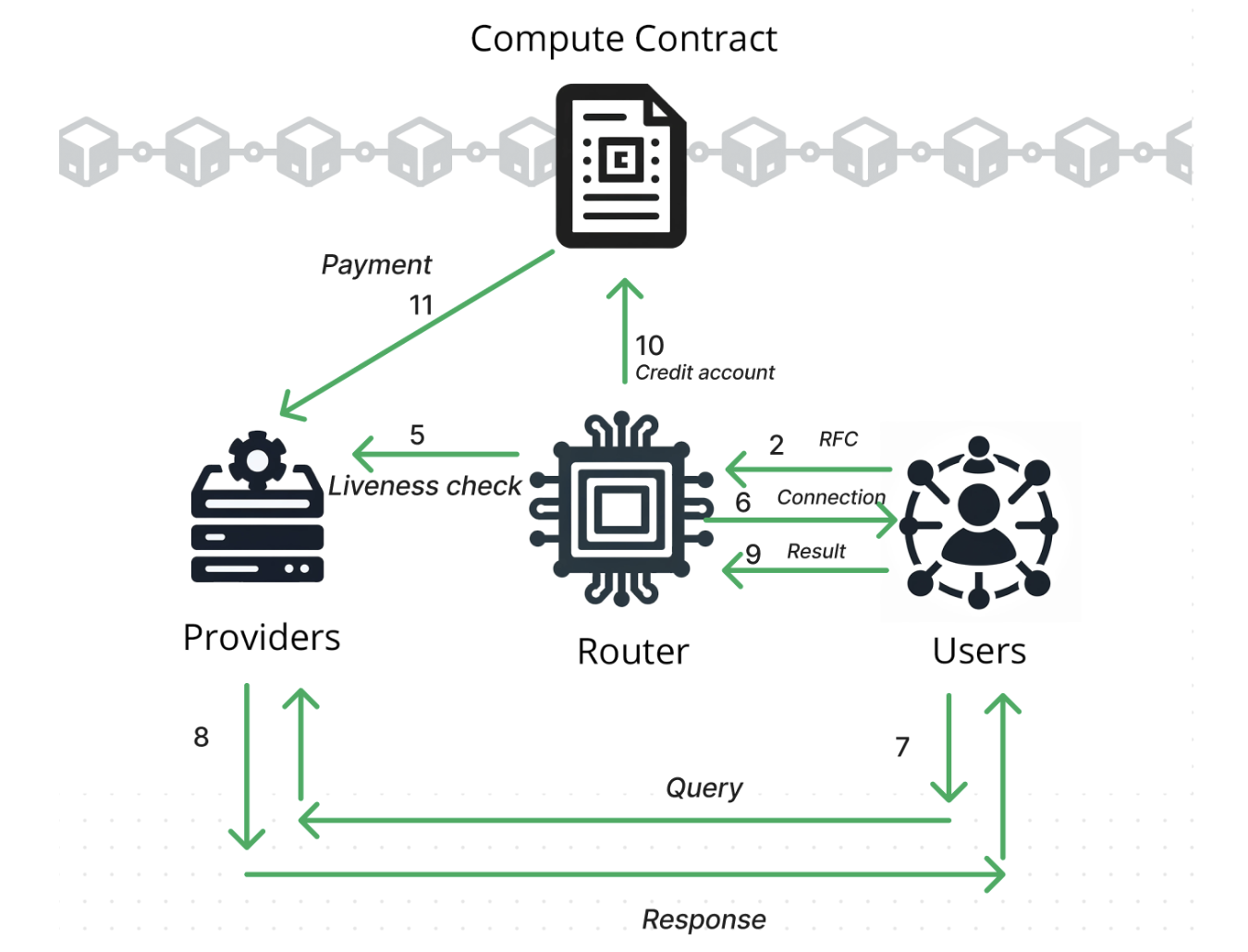

● Proof of Compute and Rewards

Compute providers supply resources required for AI models and are compensated based on demand. This approach ensures efficient resource utilization and rewards contributors for meeting the network’s computational needs.

Source: Morpheus

● Proof of Community Building, Registration, and Rewards

Community builders develop and provide user interfaces and developer tools that facilitate interaction with the Morpheus API. They are rewarded based on fees generated from their contributions, fostering a vibrant and supportive ecosystem.

Source: Morpheus

Morpheus Technology

● Tech Stack and Smart Contract Development: Morpheus leverages the Ethereum blockchain and its ERC20 standard for the MOR token, with plans to expand to other Ethereum Layer 2 solutions and compatible blockchains for broader adoption and functionality. User Data Security: Prioritizing data security, Morpheus plans to implement Fully Homomorphic Encryption (FHE) to enhance user data protection for LLMs, ensuring security within peer-to-peer networks.

● Bootstrapping and Network Growth: The bootstrapping phase will facilitate the initial distribution of MOR tokens, ensuring a balanced and fair start for the network. This stage is crucial for establishing a stable foundation for Morpheus' growth and utility.

Tokenomics

Distribution and Rewards

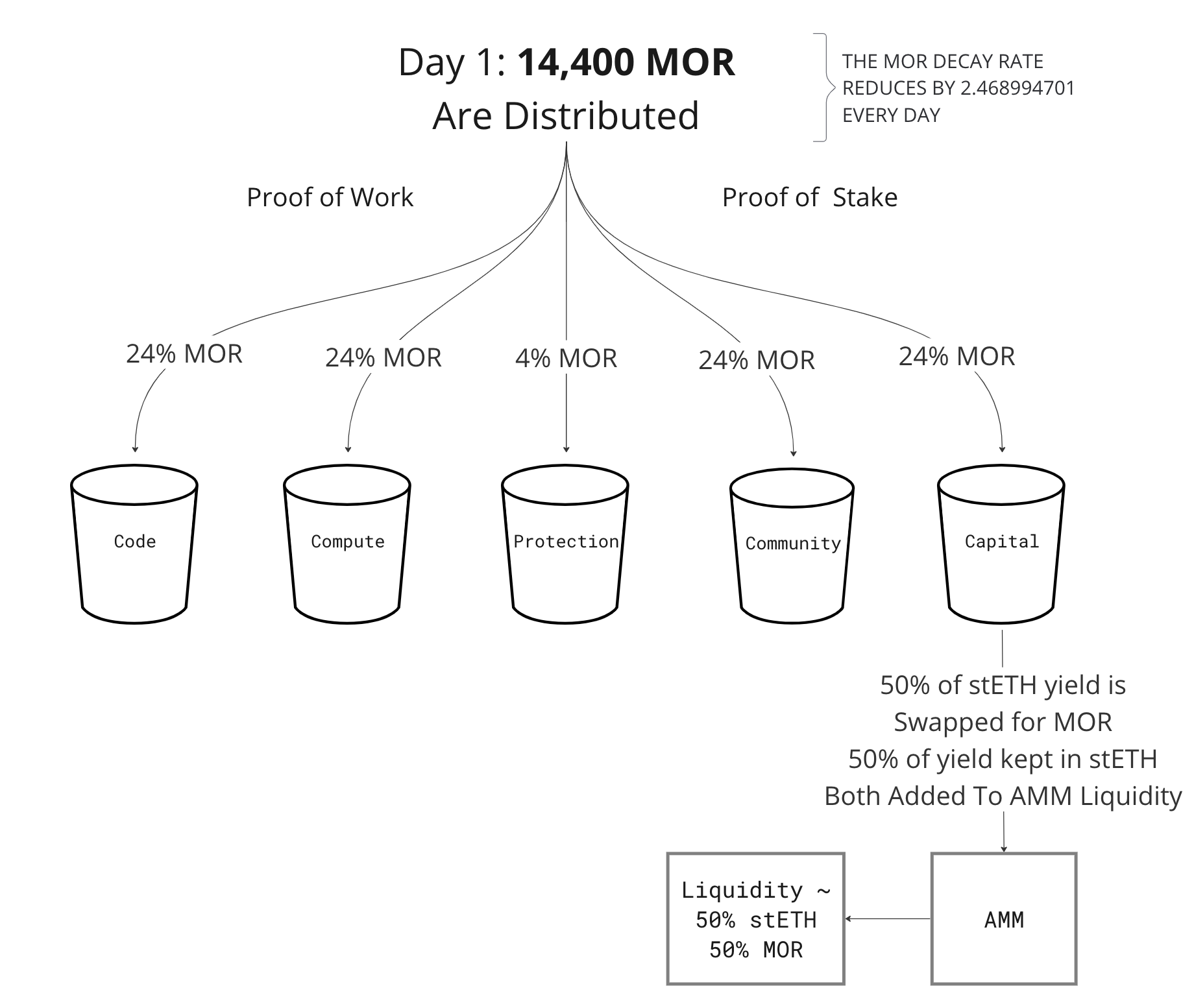

● Daily Distribution: $MOR tokens are distributed daily, with 24% allocated to the community (builders and creators who drive user engagement and growth through tools and frontends), 24% each to capital providers, compute resource providers, and coders, and an additional 4% reserved as a protection fund.

● Total Supply: The $MOR token cap is set at 42 million, with no pre-mine or early token sale, ensuring a fair launch that occurred on February 8.

● Block Rewards: Starting at 14,400 $MOR per day, rewards decrease daily until reaching zero on day 5833, transitioning the incentive model from block rewards to transaction fees.

Source: Morpheus

Utility of MOR Token

$MOR serves as an on-chain mechanism facilitating transactions within the Morpheus network, including:

● Developers paying compute providers for API calls. Transactions specific to agents created by developers. Rewarding users who contribute training data for new LLMs/agents.

Token Distribution Phases

Early Stage: Launch Phase

● Capital Providers: Receive $MOR based on their stETH contributions.

● Compute Providers: Compensated in $MOR for processing user prompts.

● Coders: Rewarded in $MOR for contributions to Morpheus software.

● Community Builders: Receive $MOR for involvement in frontends, tools, and value-added services.

Mid-Term: Broader Circulation

● Block rewards and transaction fees become balanced across all roles.

Long-Term: Deep Liquidity

● Transaction fees become the primary incentive mechanism within the ecosystem.

Tail Emission Strategy

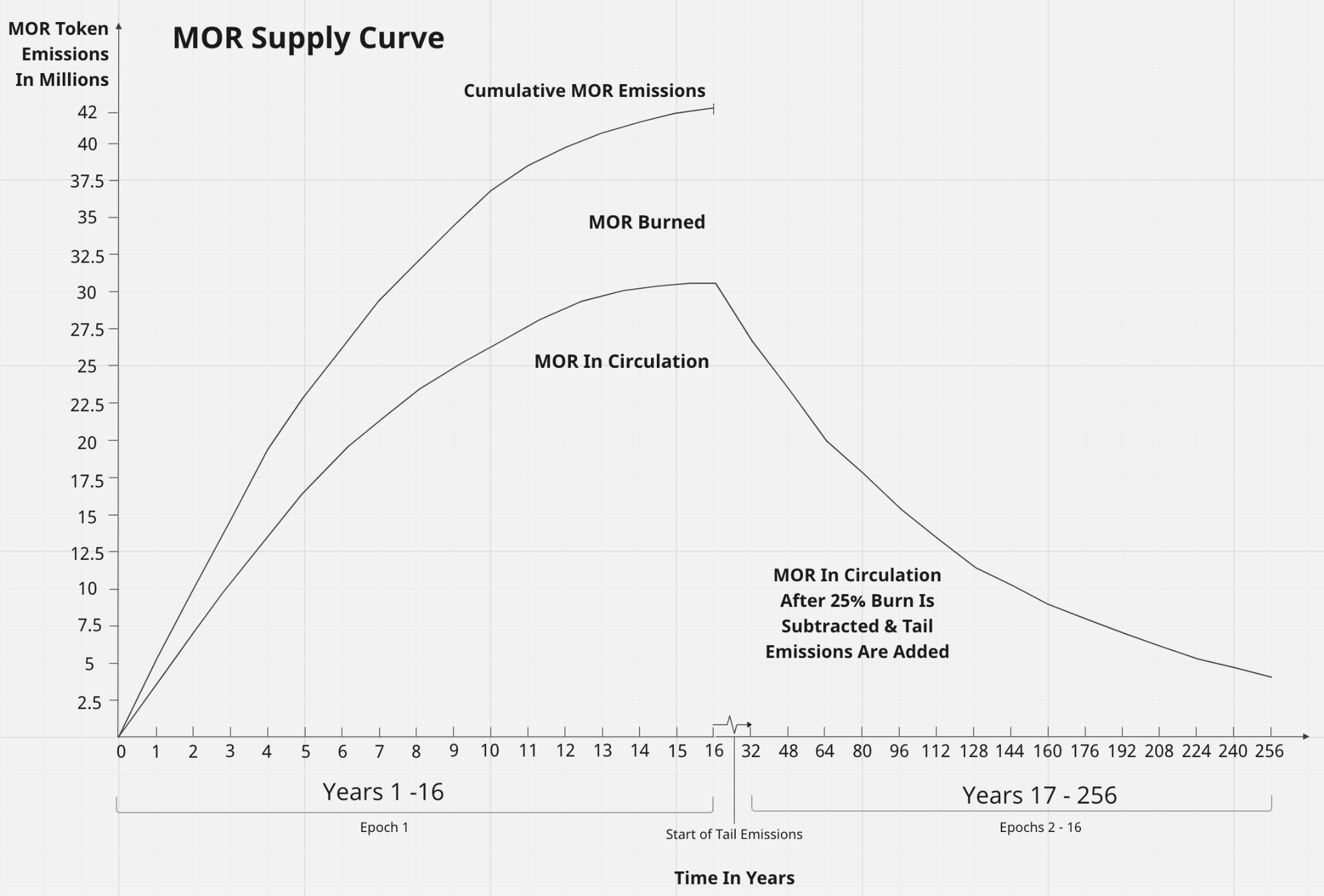

To ensure long-term sustainability and sustained incentive alignment, Morpheus adopts a "tail emission" strategy:

● Post-Block Rewards: After the initial distribution period, a tail emission of 50% of burned $MOR tokens ensures ongoing rewards. This $MOR tail emission begins after the final $MOR token is issued on day 5833 (approximately 16 years) of the distribution schedule.

● Circulating Cap: Tail emissions are capped at 16% of circulating tokens, preserving $MOR scarcity and value.

By ensuring that tail emissions only replace a portion of destroyed tokens, the total circulating supply of $MOR will never exceed the hard cap of 42 million. In practice, because some tokens are burned and only partially replaced, the total supply of MOR may become increasingly scarce over time. This approach allows the Morpheus ecosystem to balance participant incentives with the preservation of $MOR token scarcity.

The chart below shows the number of available $MOR tokens over time starting from year 17 through year 256, assuming an average of 25% of $MOR tokens are destroyed or "burned" during this period.

Source: Morpheus

Competitive Analysis

Olas (formerly Autonolas) is a leading project in the AI smart agent space and is considered one of Morpheus’s main competitors. We’ve previously discussed Autonolas in detail, comparing it with Morpheus and Fetch.ai, so here we offer only a brief overview. Autonolas stands out due to its operation across multiple blockchain platforms, increasing its adaptability and potential for wider adoption. It focuses on creating and deploying autonomous agents for developers, dApps, and users, emphasizing shared governance and ownership.

In contrast, Morpheus focuses on making AI and computing power as widely accessible as personal computers and smartphones. It emphasizes empowering individuals to own and utilize AI agents and computing resources, extending beyond AI to encompass a broader range of computational capabilities.

While both projects compete for market share, they actually have complementary goals. Autonolas focuses on governance of autonomous agents across different blockchains, whereas Morpheus focuses on giving individuals direct access to AI and computing resources. This difference in focus suggests potential for mutual benefit and collaboration between the two.

Overall, Autonolas provides a blockchain-agnostic platform for governance and co-ownership of autonomous agents, while Morpheus aims to directly place AI and computing power into users' hands.

Bullish Fundamentals

● Since its launch, 1% of Lido’s stETH has been staked in the Morpheus Capital Provider Smart Contract, reaching 99,717 stETH within just 20 days.

● MorpheusAI introduces a novel reward mechanism that actively rewards various contributors with $MOR tokens, fostering a collaborative and incentivized ecosystem.

● Rapid advancements in AI technology are leading to AI agents increasingly replacing human labor across various domains. The CEO of Animoca Brands predicts that 70–80% of transactions will soon be conducted via autonomous AI agents, signaling a transformative shift in transaction methods.

● The DeAI sector gained particular popularity following the launch of ChatGPT, ranking first in sector-based search traffic on CoinGecko’s 2023 report, despite representing a small fraction of the overall crypto market cap, indicating growing interest.

● As founder of MorpheusAI, David Johnston has been at the forefront of decentralized technology, introducing “Dapps” in 2013 and later “Smart Agents” in 2023.

● MorpheusAI actively participates in major events such as the 2023 Decentralized AI Summit, demonstrating its commitment to leading and shaping discussions in the decentralized AI space.

● MorpheusAI stands out with unique features such as the Techno Capital Machine (TCM) and its commitment to a fair launch, positioning it to make a significant impact in the agent space.

● Considering valuations of similar agent projects such as OLAS ($3.5 billion FDV) and FET ($1.5 billion FDV), MorpheusAI demonstrates substantial growth potential backed by a large total addressable market (TAM).

Bearish Fundamentals

● Like any project leveraging blockchain and AI, Morpheus is vulnerable to security risks, including smart contract vulnerabilities and potential manipulation of AI models. Any major security breach could severely impact trust and user adoption.

● Morpheus’s success also depends on its ability to deliver a user-friendly experience. The technical complexity of managing AI agents and blockchain operations may deter non-technical users, limiting adoption.

● Bear market conditions or declining investor confidence in crypto assets could indirectly affect the project’s performance.

● Morpheus’s economic model, including its tokenomics and incentive structure, must prove sustainable over the long term. Any design flaws could lead to issues with liquidity, token value stability, and overall project sustainability.

● Convincing users to transition from traditional AI platforms and services to decentralized models may be challenging.

● Practical implementation of its vision faces significant technical hurdles, including scalability, interoperability across different blockchains, and ensuring the effectiveness and security of AI models.

Conclusion

As always, we invite you to connect with us on LinkedIn, explore further insights on our website, and follow us on X for the latest updates. Additionally, you can discover more of our research through our Medium page.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News