Reviewing 14 top projects from 0 to 1: what did they actually do right?

TechFlow Selected TechFlow Selected

Reviewing 14 top projects from 0 to 1: what did they actually do right?

The team backgrounds of the vast majority of projects are quite strong, with no grassroots teams.

Author: Zixi.eth

A week has passed. Thanks to the feedback from my Twitter followers, we've completed this summary of what 14 projects actually did during their journey from 0 to 1. Special thanks to @DGZbro and @JimsYoung_ for their help—some content was contributed by these two. We selected Avalanche, Fantom, Solana, Luna, Arbitrum, Merlin, Berachain, Celestia, Eigenlayer, Axie Infinity, Blur, Friend.Tech, BAYC, and Pudgy Penguins—covering both last cycle and this cycle’s major chains and products.

Summary

1. [Outstanding Teams]: The vast majority of these projects have strong team backgrounds—no grassroots teams here. Most are PhDs, university professors, or serial entrepreneurs. Western teams dominate.

2. [Foresight of Market Trends]: The most successful projects today or tomorrow were doing something unique at inception—something possibly unacceptable or incomprehensible to others at the time.

3. [Backing from Reputable Institutions]: Securing funding from top-tier institutions is a must for takeoff. It doesn't guarantee success, but lacking it likely caps your ceiling.

4. [Ecosystem as Mid-to-Late Stage Competitive Edge]: For infrastructure (Infra) projects, the core long-term competitiveness lies in whether one or two flagship applications emerge on the chain. Early-stage chains don’t rely on ecosystems to launch, but once the tide recedes, only those with real ecosystems survive across cycles. Infra teams must prioritize ecosystem development. Flagship apps are the true source of cross-cycle resilience. For product-focused teams, once a product scales, it can expand downward and become its own chain.

5. [Innovation]: Whether a product or a chain, it must solve a real market pain point in a unique way—not just copy others.

1. Avalanche: Strong team + unique technical approach → strong fundraising → robust ecosystem

2021 was undeniably the altcoin season, especially in H2. With Ethereum hitting over $4,000 and mainnet gas fees soaring—and no L2s available—users and capital began spilling out of Ethereum into other L1s. While Solana led the charge, market attention gradually shifted to Avalanche because:

1) Avalanche had a solid team. CEO Emin Gün Sirer: Computer scientist and associate professor at Cornell University. Sirer developed the Avalanche consensus protocol underlying the Avalanche blockchain platform and is now CEO and co-founder of Ava Labs. He was previously an associate professor of computer science at Cornell and former co-director of the Initiative for Cryptocurrencies and Contracts (IC3). He's known for contributions to peer-to-peer systems, operating systems, and computer networks;

2) Technically innovative—arguably one of the earliest "modular" designs. Using XCP three-chain architecture: X-Chain for asset creation/trading, C-Chain for smart contracts, P-Chain for validator coordination and subnets, leveraging gossip-based avalanche consensus. At the time, this was a bold and brilliant idea;

3) Because of points 1+2, fundraising capability was strong. Raised $12M private and $46M public sale in 2020; Foundation raised $230M in Sept 2021, and ecosystem accelerator raised $18.5M in Nov. Strong fundraising combined with market-making pumps helped retail investors see, understand, and trust the team’s credibility—leading to strong retail buying pressure;

4) Avalanche had a flagship project: Defi Kingdoms (DFK). A highly creative DeFi+GameFi project that used decent graphics to visualize DeFi concepts. Later, DFK evolved into an appchain on Avalanche, significantly boosting Avalanche’s reputation. Other notable projects like GMX and TraderJoe also contributed.

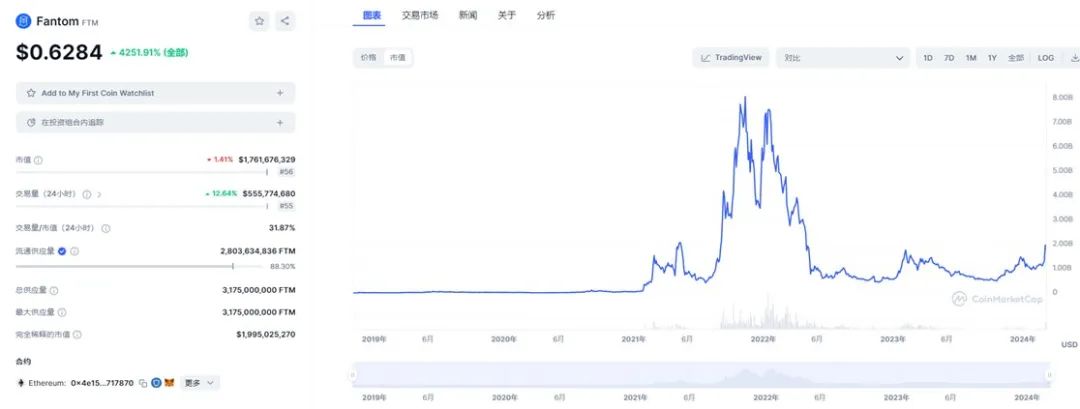

2. Fantom: A visionary leader brought the chain to peak—and then to collapse

Fantom's central figure was AC, a veteran DeFi OG and founder of Yearn Finance and Fantom. YFI created a thousand-fold return myth in the bull market, so community expectations for AC were extremely high—earning him the title “Father of DeFi.”

1) No need to elaborate—the team’s face was AC himself;

2) Fantom raised $40M in an ICO back in 2018;

During the 2021 bull run, it secured three more rounds: Alameda invested $35M, Blocktower $20M, Hyperchain $15M. After the May correction,

Fantom’s meteoric rise was due to:

1) AC kept promoting it—people trusted AC;

2) Raised massive funds, allowing Fantom to allocate 370 million tokens (~$200M) to incentivize ecosystem growth—fueling rapid DeFi expansion on-chain.

Why did FTM crash starting in 2022?

1) Fantom rose because AC was co-founder—and fell when he left. Loss of the central figure destroyed community confidence;

2) The ecosystem was unremarkable—entirely generic DeFi, all copycats. Top crypto projects are always unique—one way or another. Whether beautifully or grotesquely unique, none succeed as mere clones.

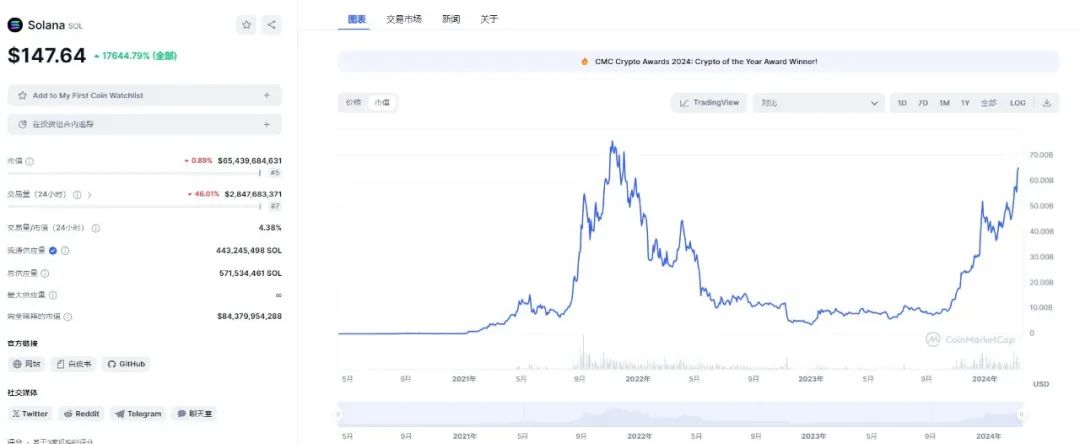

3. Solana: Rollercoaster growth, hackathons sparked miracles, survived the bear market with a unique ecosystem

Solana’s early fundraising was tough. Despite a strong team, raising funds between 2018–2019 wasn’t easy. In a market growing skeptical of high-performance L1 narratives, Solana had to compete with others and wasn’t widely recognized. However, through product persistence and pragmatism, it gradually attracted investor interest.

A key strategic divergence emerged between Multicoin and Solana’s founders. As an early investor, Multicoin insisted Solana list quickly to build brand and community consensus. Meanwhile, Solana’s founders wanted to first launch a stable, reliable mainnet. This decision proved correct—it laid the foundation for later collaboration with SBF, who was actively seeking high-performance chains.

Key reasons behind its 0-to-1 breakthrough:

1) SBF played a decisive role in Solana’s rise. Not only did he invest, but his team built Serum on Solana—greatly enhancing Solana’s visibility and legitimacy. Rumors even circulated that 70% of Solana’s TVL came from SBF’s operations alone.

2) Solana’s hackathon programs created miracles. Through hackathons and incentives, Solana cultivated an active developer community, fueling ecosystem momentum. Top projects like Magic Eden, Stepn, and Jito emerged from this environment.

3) Under SBF, price pumps created wealth effects—the best marketing tool.

4) Despite FTX’s collapse and severe price volatility, Solana maintained its developer base and community activity. Ongoing incentives and hackathons continued improving infrastructure and driving innovation—key to surviving the bear market. We’re now seeing Solana’s ecosystem diverge from Ethereum’s, especially with collective migration of DePIN projects.

Strong backing + wealth effect from price pumps + SBF’s presence attracted developers and ecosystem projects. Solana’s native performance also drew uniquely innovative apps.

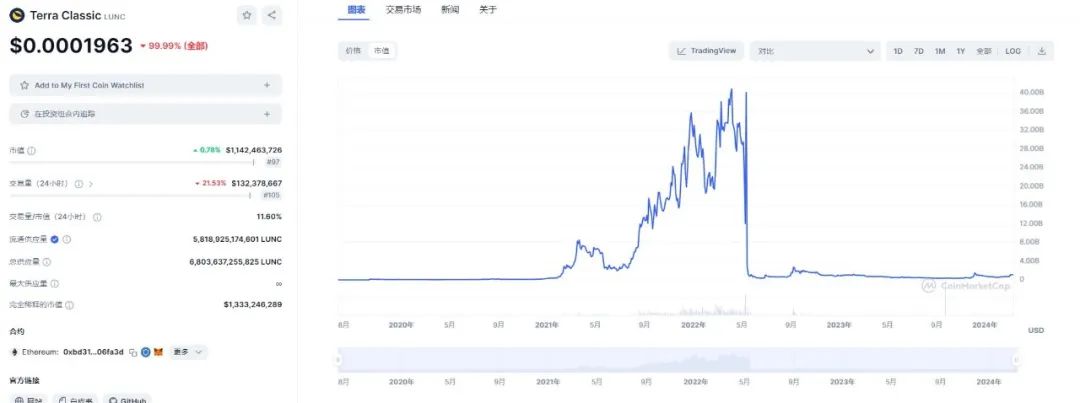

4. Terra: Rose on a dual-token spiral + high yields, died from the same spiral

Key factors behind Terra’s 0-to-1 journey:

1) Team-wise, Do Kwon graduated from Stanford—solid background. Also very active on Twitter and skilled at generating buzz.

2) Treated as Korea’s national chain—massive FOMO in Korea. Korean VCs and 3AC rode Terra to riches—and ruin. Fundraising was solid: two rounds totaling $77M.

3) On the ecosystem side, Luna+UST relied on arbitrage and supply-demand mechanisms to stabilize prices. LUNA acted as UST’s stabilizer, forming the market’s most eye-catching algorithmic stablecoin system. Their interaction created a positive feedback loop. Terra later launched Anchor, a key DeFi project offering 19%-20% APY—hailed as the “gold standard of passive crypto income”—attracting massive investment while planting seeds for collapse. Everyone kept calculating how many more days Terra could afford 20% interest. During the bull market, UST became the third-largest stablecoin, reaching $18B in market cap. LUNA peaked at $41B. Its payment app Chai also performed well, securing a $45M investment from SoftBank.

When the market turned, the positive spiral became a death spiral:

4) In 2022, amid broad crypto declines, investors moved capital into UST for high yields. This caused Anchor’s deposits to far exceed loans, creating a huge deficit. On May 8, 2022, LFG withdrew $150M in UST liquidity from the UST-3Crv pool to prepare a new 4Crv pool. Suddenly, an address dumped $84M in UST, disrupting the 3Crv pool balance. Multiple whale accounts then started selling UST on Binance, causing temporary depegging.

As reserves dwindled, confidence in UST eroded. Massive sell-offs drove UST further off peg. To defend parity, enormous amounts of LUNA were minted, crashing its price—triggering the infamous death spiral. To prevent total collapse, LFG sold BTC and other assets from the treasury, dragging down the entire market. LUNA and UST collapsed the ecosystem.

A good tokenomics design (essentially a bull-market Ponzi) + unique ecosystem built Terra. But that same tokenomics caused its downfall. Could Terra have survived if its ecosystem had kept pace?

5. Arbitrum: First-mover in OP L2 narrative + massive bull-run fundraising → strong ecosystem

Key drivers behind Arbitrum’s 0-to-1 rise:

1) Offchain Labs, the team behind Arbitrum, started working on L2 in 2018, closed angel round in 2019—among the earliest L2 teams. This gave them a significant head start. They raised two rounds totaling $140M in April and August 2021. Clear technical and first-mover advantage.

2) Among the very first to launch an OP L2 mainnet. Launched in September 2021—right in the bull market—making user and ecosystem accumulation easier, giving it early-mover ecosystem advantages.

3) Raised so much money they could fund ecosystem growth and attract developers.

4) Airdrop executed brilliantly—created massive wealth effect in early 2022 bear market. Unlike Starkware, whose DAU dropped 90% post-airdrop, Arbitrum retained most users.

5) Had a flagship app: GMX. Need I say more? GMX rose 100% in bear market with its innovative spot-Dex-for-perps model. In early days, GMX contributed heavily to Arbitrum’s user count and trading volume.

Strong team + narrative leadership → easier fundraising → launching mainnet at the “right time” → using capital to fund developers → until a flagship project emerges to carry the chain.

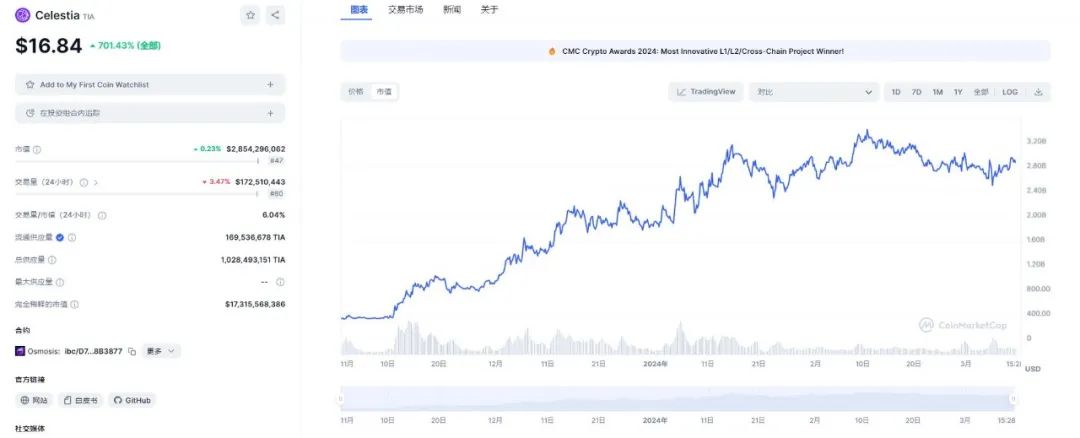

6. Celestia: Clear positioning, but weak ecosystem

Key factors behind Celestia’s 0-to-1 rise:

1) Great storytelling. As the first to propose a modular blockchain network, Celestia separates consensus from execution, offering pure Data Availability (DA) services. At inception, few projects focused on modular blockchains or DA—giving Celestia almost no direct competitors and a unique market position;

2) Launched when the market clearly demanded higher scalability and efficiency. By focusing on data availability, Celestia met growing demand for high-performance L2 solutions. It’s ideal as a DA layer for rollups—letting them offload state execution while relying on Celestia for consensus and data availability, boosting overall scalability;

3) Solid team: Mustafa is a PhD from UCL and co-founder of Chainspace, later acquired by Facebook;

4) Ecosystem building remains weak. However, joining the Cosmos ecosystem helped. Staking TIA offered generous airdrop rewards—providing some value support.

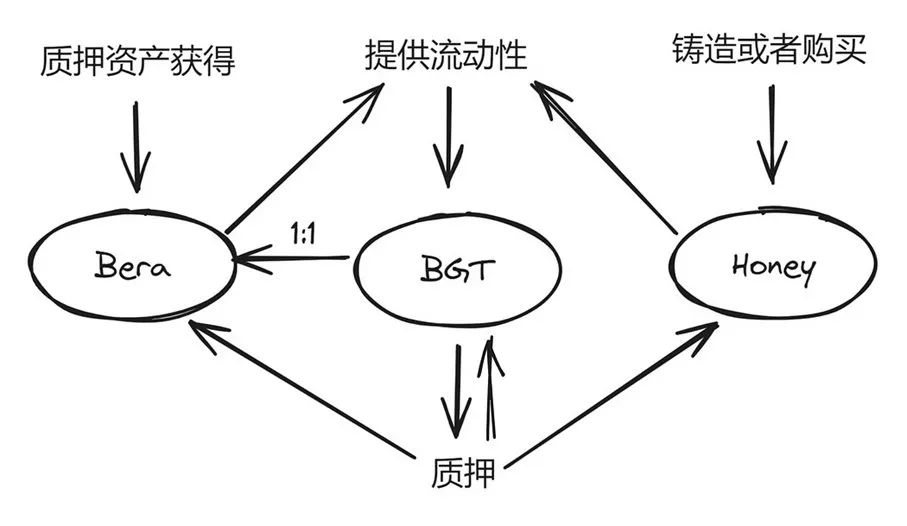

7. Berachain: Luna 2.0? Can a triple-token model recreate Luna’s bull-market miracle?

Berachain is currently drawing heavy attention (though not yet launched), so let’s briefly cover it:

1) Though anonymous, the team consists of old-school OGs from 2015. In 2021, they launched a smoking bear NFT. After experiencing DeFi Summer, they deeply understood the importance of liquidity—prompting the creation of Berachain;

2) Likely strong background enabled them to raise $42M from Polychain and HackVC in April 2023—a deep bear market;

3) The narrative still serves DeFi (“using past dynasty’s sword to cut present issues”), but token design is elegant: a three-token model (BERA/HONEY/BGT) echoing Luna/UST’s self-reinforcing mechanics. Luna/UST’s yield relied on fragile lending spreads. Learning from that failure, Berachain’s model may effectively mitigate (though not eliminate) dual-token death spirals. Given Luna’s explosive bull run, markets naturally hold high hopes for Berachain.

8. Axie: A pandemic-era anomaly—survival tool for Southeast Asian users

Key reasons behind Axie’s 0-to-1 rise:

1) During the pandemic, incomes plummeted across Southeast Asia. Axie’s P2E model transformed gaming from leisure into a viable income stream—with meaningful payouts. Bull market dynamics pulled more players in, pushing token prices up. At peak, weekly earnings reached $300–400. In economically unstable or pandemic-hit regions, this opened new income opportunities. The game didn’t just entertain—it empowered users by giving them control over productive tools, especially appealing in developing countries;

2) As the leading blockchain game in 2021, backed by guilds and institutions, Axie Infinity hit record highs in daily revenue and active users—capturing nearly 2/3 of the blockchain gaming market. AXS reached a $10B market cap at peak.

Its collapse was simple: a Ponzi scheme without positive externalities inevitably ends in zero.

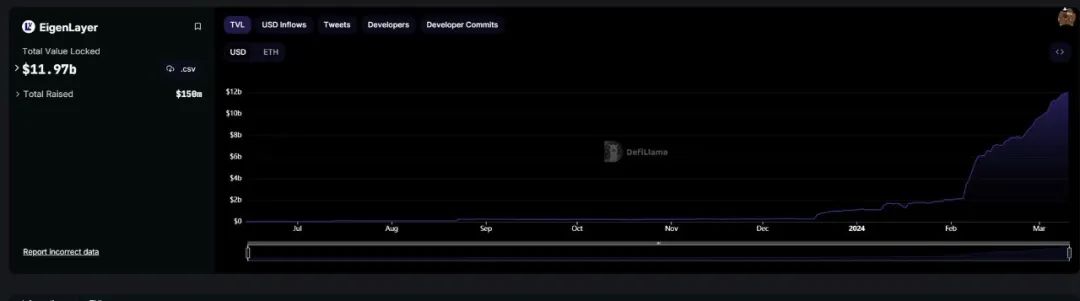

9. Eigenlayer: Aligns with user demand for leveraged capital—DA perfectly integrated with restaking

Eigenlayer’s 0-to-1 story can be summarized as:

1) A compelling narrative. As early as 2022, when ETH staking ratio was under 5%, they dared to target a niche within a niche;

2) Kannan, as a PR-savvy CEO, captured VC attention;

3) ETH staking ratio has visibly grown—from near 0% to ~30% over three years;

4) Eigenlayer’s flagship ecosystem project is EigenDA. The restaking narrative later merged seamlessly with DA—making modular blockchain DA one of restaking’s strongest use cases;

5) Due to 1+2+3+4, VCs were eager buyers. This also aligns with Ethholders’ desires—to keep leveraging capital and increasing liquidity.

10. Merlin: Key figure + wealth effect forged strong community unity; clever TVL growth strategy

Merlin has basically taken off—here’s why:

1) Founder has excellent background. In multiple offline conversations, you can sense his decade-long entrepreneurial reflections. Raised big money before, high cognitive level, deep understanding of communities—ideal for a bull market. Plus, he has personal charisma—dived into Ordinals ecosystem as early as March 2023 and was bullish early on;

2) Highly united community. BRC420/Merlin’s community is truly cohesive and faithful—but also because people made money on Blue Box. Community unity stemmed directly from the Blue Box pump creating consensus. Subsequent wealth effects from Blue Crystal and Music Box were also strong. Wealth effects enabled rapid cold start and user base formation;

3) Ecosystem support. Centered around a building in Singapore, extending several subway stops out, it gathered a cluster of ecosystem projects—all supporting each other, enabling fast ecosystem growth;

4) Extremely clever method to grow TVL. Beyond BTC staking, top inscriptions and 420 NFTs can also be staked to boost TVL—resulting in large book value;

5) Due to 1+2+3, fundraising accelerated. Founder deeply understands marketing and branding—launched at the right moment, becoming today’s largest BTC L2.

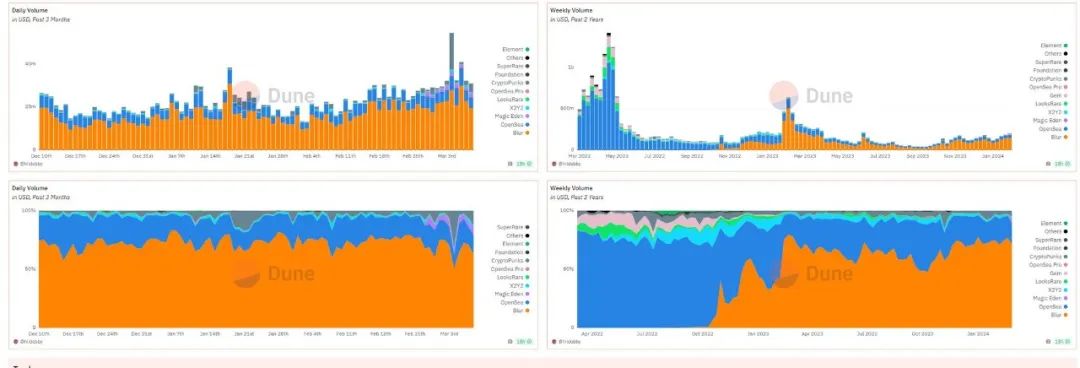

11. Blur: Fully grasped that NFT marketplace core = MM and whales, driven by continuous token incentives

To understand how Blur went from 0 to 1, remember: the only core competency of any NFT marketplace or exchange isn’t UI/UX—it’s attracting Makers. Only after you have Makers do Takers matter—and only then does UX matter.

So what did Blur do?

1) Used listing (Maker) and bidding (Maker) to attract different types of makers—and rewarded them with tokens. And only blue-chip NFTs benefit from token incentives. Makes sense: most NFT volume comes from blue chips. Non-blue-chip NFTs eventually go to zero. Blue chips are mostly held by whales and market makers—not retail. So the absolute core is serving blue-chip NFT market makers and whales. Retail doesn’t matter;

2) Token incentive model differs from X2Y2 and Looksrare. Their vampire airdrops were one-time events—limited impact. Blur’s continuous token incentives to attract whales and MMs for liquidity were among its key winning factors;

3) Everything else is minor—batch trading, aggregator features, etc.—not critical.

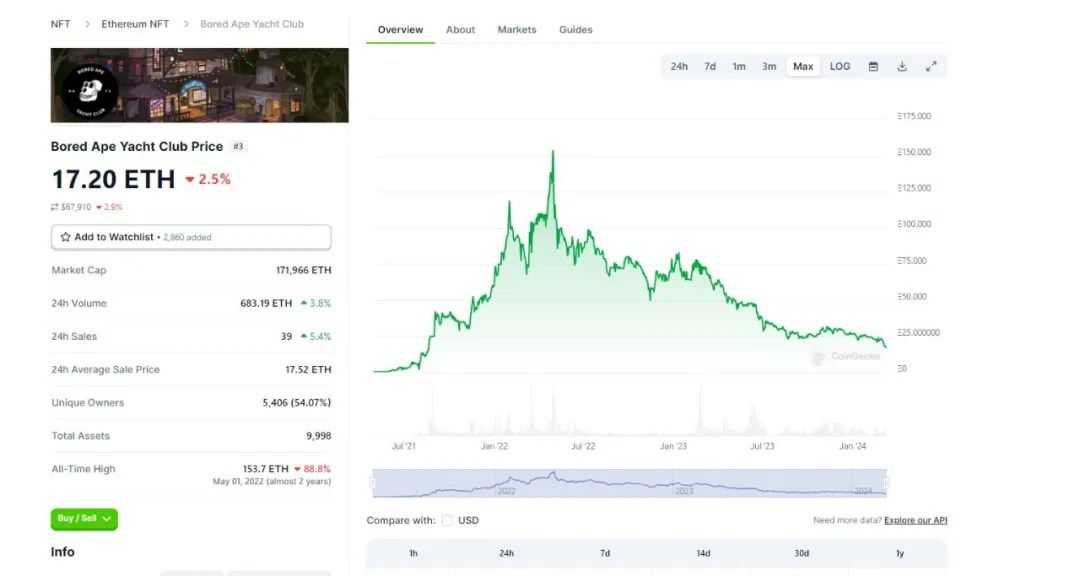

12. BAYC: Earliest NFT membership club—built consensus via celebrity effect

BAYC’s 0-to-1 rise last cycle can be explained as:

1) Owning a BAYC NFT automatically granted membership to an exclusive club. This community offered a new social experience, fostering strong belonging. Project’s strong BD attracted investors and collectors—including many celebrities—boosting exposure and appeal. In the NFT bull market, BAYC introduced a novel business model: granting IP rights to NFT holders, enabling them to create and sell merchandise based on their apes—further promoting BAYC. With unique art style and strong utility, BAYC quickly gained cultural icon status in the NFT space;

2) Launched at the peak of NFT mania, capitalizing on intense market interest in digital collectibles. Leveraged social media and celebrity endorsements to rapidly build brand awareness and community. YugaLabs expanded the BAYC universe with new NFT drops and games—Mutant Ape Yacht Club, Bored Ape Kennel Club—increasing revenue and member value. Collaborated with Adidas on Adidas x BAYC NFT. But critics argue BAYC’s model requires constant new entrants and inflows to sustain value—calling it the “ape universe scam,” reflecting broader challenges NFTs faced entering the bear market;

BAYC’s decline this cycle can be understood as:

1) Still failed to answer: what are NFTs actually useful for? During the bear market, YugaLabs provided little airdrop value to the community;

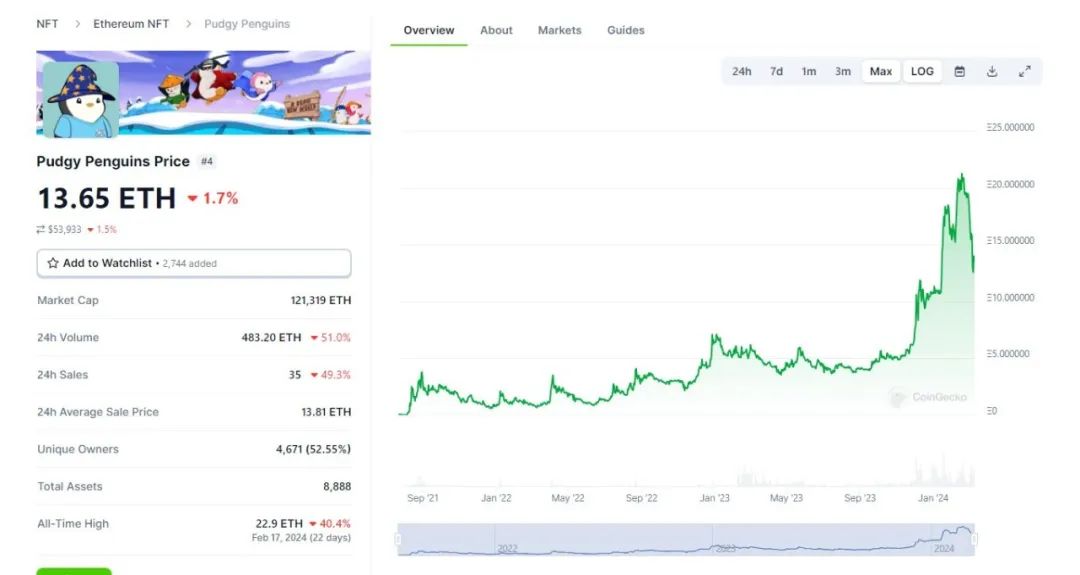

13. Pudgy Penguins: On-chain/off-chain marketing combo + price pump revived the project

Pudgy Penguins' revival this cycle can be explained as:

1) The project had already gone to zero in 2022, but Lukaz decided to acquire it due to its genuinely cute artwork;

2) At the time, NFT narratives focused on onboarding Web2 users to Web3—hoping to replicate BAYC. Investors believed Pudgy Penguins could reach outsiders through physical toy retail (off-chain) + NFT marketing/airdrops (on-chain);

3) After acquisition, Lukaz held large supply. Joined forces with market makers to easily pump price and establish consensus;

4) Outsiders discovered crypto and Pudgy Penguins through physical toys; insiders rediscovered it via price pumps/airdrops. Thus, Pudgy Penguins resurrected in late 2023—briefly overtaking BAYC.

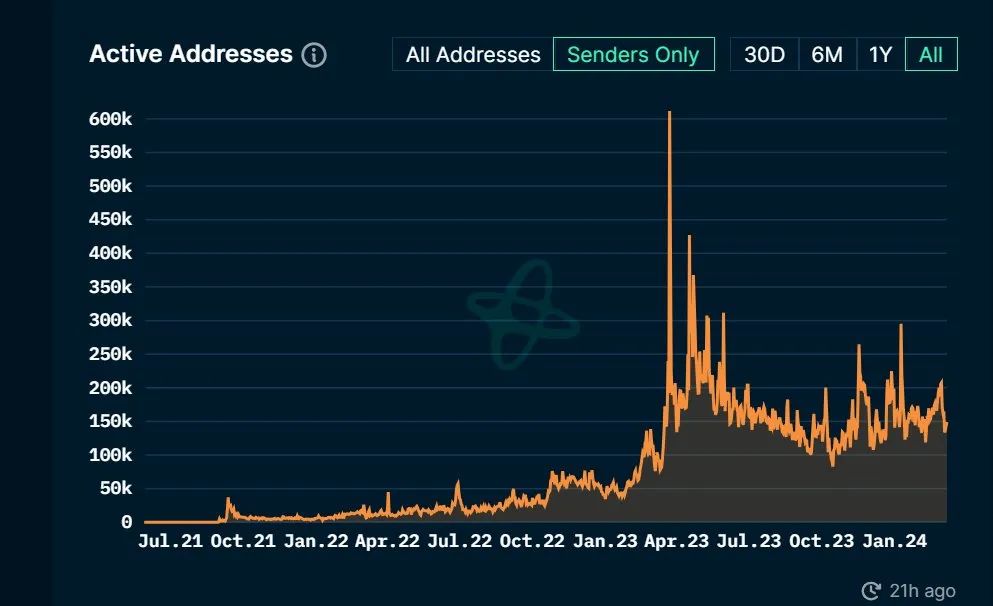

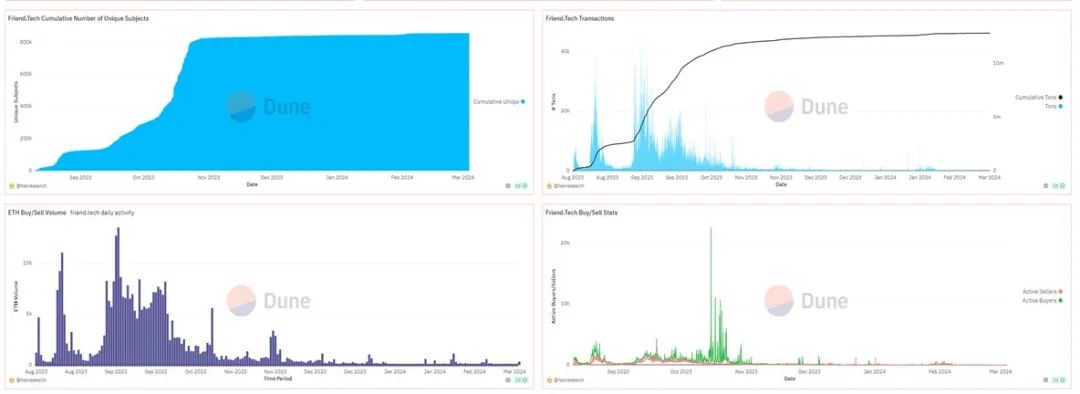

14. Friend.Tech: Tokenizes personal social value—an astonishingly original idea

Friend.Tech’s 0-to-1 growth can be briefly summarized as:

1) Did something previously impossible—quantified personal social value. In Web2, payment limitations and compliance risks (e.g., illegal gambling charges) prevented deployment of similar products. But in Crypto, the best monetization is issuing new assets. So FT elegantly solved this—anyone can issue their own key, using ETH-denominated bonding curves to quantify social value. The simplest form of ICO—how many buy/sell your key depends entirely on your personal branding. An incredibly creative concept;

2) Despite poor UX, frequent crashes, and gas costs to create accounts—all inner-circle speculation—it’s undeniable a phenomenon;

From the interaction chart below, FT has basically faded—why?

1) Model unsustainable—pure inner-circle speculation. Players pay significant fees to FT, too high a cut. STEPN at least told a positive externality story—FT couldn’t even do that;

2) No new features added later. Made money and walked away. If team had added new functions—like Web2 ad placements or real-world utility—could’ve seen renewed explosion;

3) Introduced token mechanism too late. Without token incentives, speculative trading hard to sustain;

If Blur’s continuous token incentives worked, could FT have lasted longer?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News