Two-Minute Guide to Eigenpie: How the Points System and Token Model Work

TechFlow Selected TechFlow Selected

Two-Minute Guide to Eigenpie: How the Points System and Token Model Work

Within 24 hours of opening pre-deposits, Eigenpie's TVL surpassed $50 million.

Compiled & Written by: Karen, Foresight News

The nested re-staking ecosystem continues to gain traction in the market, offering not only maximized returns and optimized capital efficiency but also potential airdrop opportunities, drawing significant investor interest and participation.

On January 28, Eigenpie, an isolated liquidity restaking solution, opened its LST pre-deposit window. Within 24 hours, Eigenpie's TVL approached $50 million. But what exactly is Eigenpie? How do its points system and tokenomics work?

What is Eigenpie?

Eigenpie is a SubDAO created by Magpie, focused on re-staking ETH LSTs (Liquid Staked ETH) via EigenLayer, enabling users to earn passive income from both Ethereum staking rewards and EigenLayer earnings—without lock-up periods.

Currently, Eigenpie allows users to re-stake their stETH (Lido), rETH (Rocket Pool), mETH (Mantle), sfrxETH (Frax), and wBETH (Binance). Support for additional LSTs accepted by EigenLayer will be added in the future.

Magpie, the team behind Eigenpie, is a multi-chain DeFi platform offering yield optimization and veTokenomics enhancement services, and has launched several SubDAOs. In addition to Eigenpie, these include Penpie (enhancing Pendle), Radpie (enhancing Radiant Capital), Campie (enhancing Camelot), and Cakepie (enhancing PancakeSwap). The combined TVL of these four SubDAOs has exceeded $200 million.

Eigenpie’s isolated liquidity restaking solution enables holders of LSTs from various protocols to seamlessly re-stake their ETH LSTs through EigenLayer, receiving isolated liquidity restaked ETH tokens (denoted with an "m" prefix), while maximizing their rewards—including Eigenpie’s own points (linked to upcoming airdrops and IDO opportunities) and EigenLayer points. This means users can add an extra layer of yield on top of their existing ETH positions while continuing to earn base yields from their original LSTs.

Eigenpie will also launch its governance and revenue-sharing token, EGP (ERC-20 standard). The total supply of EGP is capped at 10 million tokens: 40% allocated to IDO, 35% to community incentives, 15% to the Magpie treasury, and 10% airdropped to early supporters.

Notably, Eigenpie emphasizes fairness—aside from the IDO, there will be no VC rounds or private sales. Additionally, the Eigenpie team has officially waived its token allocation, redirecting those tokens to the treasury instead.

How Does the Eigenpie Points System Work?

The Eigenpie pre-deposit window will remain open for 15 days, closing on February 10 at 03:00 Beijing time. During this period, early contributors will receive double points as a reward. After EigenLayer deposits go live (starting February 6 at 04:00 UTC), depositors on Eigenpie will begin accumulating EigenLayer points.

Eigenpie points will give users the chance to claim 10% of the total EGP supply via airdrop and secure allocations in the upcoming EGP token IDO (60% of the IDO pool) at a fully diluted valuation (FDV) of $3 million, with allocation sizes proportional to the total points accumulated on the platform.

Regarding point accumulation: for every 1 ETH worth of LST deposited, users earn 1 point per hour. The more LST ETH a user deposits and holds on Eigenpie, the higher their potential EGP airdrop and IDO allocation. Users can also earn points by referring others—referrers receive 0.1 points for every point accumulated by their referred user, credited at the end of each hour.

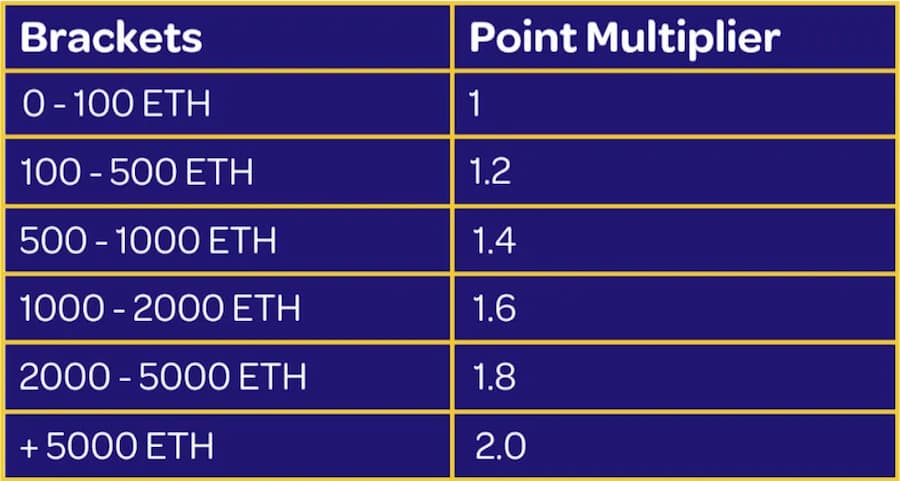

Additionally, first-level and second-level referrals can form a team. If a team’s total LST ETH deposits exceed certain thresholds, a points multiplier will be activated for all team members based on their deposit tier. Details are shown below:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News