EigenPie's airdrop mechanics, mechanisms, prospects, and return expectations

TechFlow Selected TechFlow Selected

EigenPie's airdrop mechanics, mechanisms, prospects, and return expectations

Help you achieve maximum returns with complete clarity.

By: CapitalismLab

Magpie has launched a points campaign today for its subDAO focused on LRT, offering the largest share of rewards for TVL providers seen so far in the LRT space. The project stands out with unique features, and given Magpie’s previous subDAOs delivered strong returns, this opportunity holds solid strategic value.

This thread analyzes Eigenpie's airdrop mechanics, structure, outlook, and return expectations—helping you maximize gains with full clarity.

A. Airdrop Mechanics

Depositing stETH or other LSTs now yields triple benefits:

-

Eigenpie points, entitling holders to 10% of total token supply via airdrop;

-

Eigenlayer points (available after Eigenlayer opens deposits on Feb 5);

-

Access to 24% of IDO allocation, with a low $3M FDV valuation;

-

Base yield from deposited LSTs (e.g., if mETH offers 7% APR, you continue earning that);

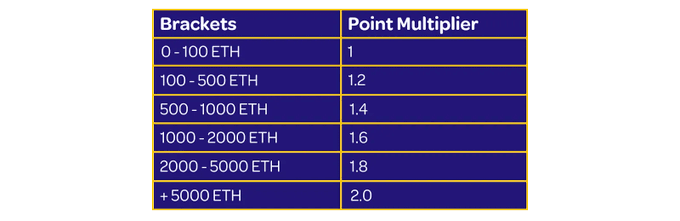

Points are boosted based on total squad size—the larger the group, the higher the multiplier, up to 2x. Pooling funds is strongly recommended.

B. Mechanism

Eigenpie introduces Isolated LRT (ILRT), issuing a dedicated token for each LST to isolate risk exposure. See table below:

With numerous LSTs already integrated into Eigenlayer, any LRT protocol accepting them collectively assumes all underlying risks. A single LST failure could be catastrophic.

Eigenpie’s ILRT model mitigates this by isolating each LST’s risk.

While isolation reduces shared liquidity, it isn’t necessarily a drawback. Compared to native staking-based LRTs, LST-supported LRTs benefit from existing LST liquidity. Dedicated pairs like mrETH/rETH and mmETH/mETH create better opportunities for collaboration with LST projects to incentivize liquidity.

C. Outlook

What advantages does this project offer? Despite launching later than some competitors, it fills a critical gap: LSTs on Eigenlayer are eager to participate in the LRT narrative, and Eigenpie currently presents the best solution. Each LST gets its own isolated LRT, eliminating concerns about subsidizing others. High-yield LSTs like mETH can fully leverage their competitive edge.

When will minted tokens like mstETH be tradable on DEXs? Will they list on Pendle?

The team clearly has both incentive and capability to push for such integrations. Success here would generate substantial bribe revenue for Magpie’s ecosystem, including subDAOs like Cakepie and Penpie.

If you're unfamiliar with Magpie’s architecture, refer to our prior thread.

D. Return Expectations

Let’s review the tokenomics:

-

IDO: 40%;

-

Airdrop: 10%;

-

Incentives: 35%;

-

Magpie Treasury: 15% (typically not sold; staking rewards distributed to vlMGP);

This resembles a Fair Launch, but unlike many "fair launches" where whitelists are pre-allocated, Eigenpie’s IDO spots are mostly transparently awarded to TVL contributors.

Benefits allocated to TVL providers include:

-

10% of total supply via airdrop;

-

60% of IDO allocation (IDO represents 40% of total supply) at a $3M FDV valuation;

In total, TVL providers receive 10% + 60% × 40% = 34% of the token supply. This accounts for ~70% of initial circulating supply (34% / 50%), with no future VC sell pressure.

The LRT narrative is currently red-hot—$RSTK, with only $7M TVL, already boasts a $35M market cap and $180M FDV. Other launched LRT projects also command high valuations.

Eigenpie’s final TVL is likely to significantly exceed RSTK’s. If valued similarly to RSTK at $180M FDV, TVL providers could realize total profits of: 10%×180 + 60%×40%×(180−3) = $60M.

Assuming a token launch in two months with average TVL of $200M, annualized returns could reach (60/2)/200×12 = 180% APR—excluding additional Eigenlayer points. Early participants in the first 15 days enjoy a 2x points boost.

Let’s examine past performance of Magpie subDAO IDOs:

-

Penpie: IDO at $3M FDV, 14x return;

-

Radpie: Average IDO FDV of $7.5M across two rounds, 1.4x return;

-

Cakepie: IDO at $20M FDV, 2.4x return;

Now entering the broader LRT赛道 with a $3M FDV IDO, offering multiple times more airdrop and IDO allocation to TVL providers than PNP did—could returns match or even surpass historical levels?

Summary

-

Maximize airdrop gains by pooling assets for higher point multipliers;

-

Core innovation is ILRT, isolating risk per LST;

-

Strong advantage lies in leveraging Magpie’s established resources with Pendle and Pancake to accelerate growth;

-

Majority of benefits are transparently allocated to TVL providers—a truly fair and open launch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News