Funding Weekly: 20 deals raised approximately $214 million, infrastructure attracted the most attention

TechFlow Selected TechFlow Selected

Funding Weekly: 20 deals raised approximately $214 million, infrastructure attracted the most attention

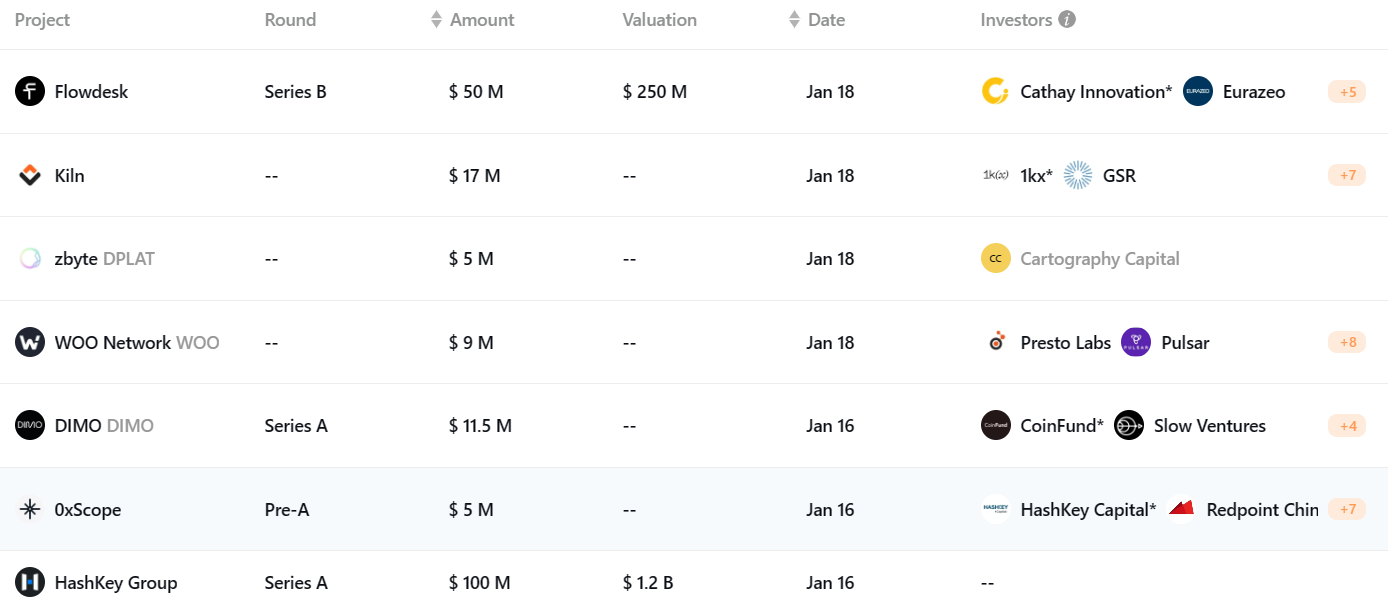

Between January 15 and January 21, seven blockchain companies raised over $5 million each.

Written by: TechFlow

According to RootData, between January 15 and January 21, 20 blockchain startups announced fundraising totaling approximately $214 million.

Projects that raised over $5 million include:

French cryptocurrency market maker Flowdesk completed a $50 million Series B round;

Institutional staking platform Kiln announced it raised $17 million;

Web3 infrastructure platform zbyte secured $5 million in funding;

Cryptocurrency exchange WOO X raised $9 million in its latest funding round;

DePIN project DIMO's developer, Digital Infrastructure, closed an $11.5 million Series A round;

Web3 knowledge graph protocol 0xScope completed a $5 million Pre-Series A round;

HashKey Group raised nearly $100 million in its Series A round at a pre-money valuation exceeding $1.2 billion.

Featured Projects

DIMO

Overview: DIMO is a decentralized software and hardware Internet of Things (IoT) platform that allows users to create verified vehicle data streams for private sharing with applications, enabling better service negotiations such as auto financing and insurance.

Investors: Digital Infrastructure, the developer behind the decentralized physical infrastructure network DIMO, raised $11.5 million in a Series A round led by CoinFund, with participation from Slow Ventures, ConsenSys Mesh, Borderless Capital, Table Management (Bill Ackman), and former General Motors CEO G. Rick Wagoner Jr.

Features:

1. DIMO tokenizes driving data by connecting vehicles and drivers, entering the global supply chain of data production from 250 million connected cars;

2. In 2023, DIMO grew by 900%, increasing its connected vehicles from 3,000 to many more;

3. Users can earn DIMO tokens in two ways:

-

Drivers collect and view their own car data and receive DIMO token incentives;

-

Users receive additional DIMO tokens when transacting with authorized DIMO applications.

Renzo

Overview: Renzo is a liquid restaking token (LRT) and strategy manager for EigenLayer. It serves as the interface to the EigenLayer ecosystem, securing active validation services (AVS) and offering higher yields than ETH staking. The protocol abstracts all complexity for end-users and enables seamless collaboration between users and EigenLayer node operators.

Investors: Restaking protocol Renzo announced a $3 million seed round led by Maven11, with participation from SevenX Ventures, Figment Capital, OKX Ventures, and IOSG.

Features:

1. Users can deposit Ethereum or LSTs into Renzo to mint ezETH, which can then be used across other DeFi protocols to generate compounded returns.

2. Renzo's TVL has exceeded $122 million;

3. Renzo passes 100% of all EigenLayer restaking points directly to users.

AOFverse

Overview: AOFverse is a mobile gaming metaverse offering an expanding suite of games and experiences designed to engage and reward players. Its first game, "Army of Tactics," is an auto-battler (auto-chess) game where players build and lead their own armies in tactical PvP battles against others.

Investors: Mobile gaming studio AOFverse closed a $3 million private placement round led by Animoca Ventures, with participation from Liquid X Ventures, Chainridge VC, Ticker Capital, Flying Falcon, and BSCN Gaming Ventures.

Features:

1. Army of Fortune Metaverse (AOFverse) is led by former developers from Finnish mobile gaming company Supercell, known for hit titles like Clash of Clans, Clash Royale, and Brawl Stars;

2. AOFverse employs a dual-token economic system: AFC is the in-game currency earned through gameplay, used to upgrade heroes and islands; AFG is the governance token obtainable by burning $AFC, completing missions, and participating in events.

3. Plans to launch the AFG token generation event and NFT marketplace in Q1.

Detailed funding information by sector:

Social Protocols

Web3 chat solution Beoble announced a strategic investment from DWF Labs, with the amount undisclosed.

All-in-one social platform DeBox announced funding from DWF Ventures, with the amount undisclosed.

Restaking

Restaking protocol Renzo announced a $3 million seed round led by Maven11, with participation from SevenX Ventures, Figment Capital, OKX Ventures, and IOSG. Users can deposit Ethereum or LSTs into Renzo to mint ezETH, which can then be used across other DeFi protocols to generate compounded returns.

GameFi

Mobile gaming studio AOFverse raised $3 million in a private placement round led by Animoca Ventures, with participation from Liquid X Ventures, Chainridge VC, Ticker Capital, Flying Falcon, and BSCN Gaming Ventures. The funds will support AOFverse’s roadmap, including launching its flagship game “Army Of Fortune” this year.

DePIN

Digital Infrastructure, the developer behind the decentralized physical infrastructure network DIMO, raised $11.5 million in a Series A round led by CoinFund, with participation from Slow Ventures, ConsenSys Mesh, Borderless Capital, Table Management (Bill Ackman), and former General Motors CEO G. Rick Wagoner Jr. Digital Infrastructure is building the DIMO Network, a decentralized car data protocol allowing drivers to collect and view their vehicle data while earning DIMO token rewards.

Infrastructure

Portal Ventures announced it led the pre-seed round for Solana shared sequencer Rome Protocol. Rome Protocol leverages Solana directly for performance and security, enabling liquidity bridging between Solana and Ethereum.

Farcaster ecosystem project Wield raised over $1 million in a pre-seed round led by Lemniscap, with participation from Farcaster co-founder Dan Romero, Colin Armstrong, Rueben Brama, Perry Randall, and Henry Shi. Its product far.quest previously received about 15,000 OP tokens in RetroPGF grants.

Web3 knowledge graph protocol 0xScope completed a $5 million Pre-Series A round led by HashKey Capital, with participation from Redpoint China, OKX Ventures, GSR Markets, Amber Group, Antalpha, DHVC, and existing investors Mask Network, Hash Global, and XIN Family. 0xScope also launched 0xScope V2, aimed at enhancing AI’s understanding of Web3.

Web3 payment platform Fetcch announced a $1.5 million pre-seed round led by Hashkey Capital and AppWorks Venture, with participation from LD Capital, Compute Ventures, M6, and GravityX Capital. Fetcch provides seamless infrastructure for digital payments and reward platforms, focusing on cross-chain Web3 ecosystems. It has already integrated cross-chain solutions including LayerZero, Axelar, Wormhole, Circle’s CCTP, and Chainlink’s CCIP.

Cryptocurrency exchange WOO X raised $9 million in its latest funding round. WOO stated it received new capital from designated market makers, including Wintermute, Selini Capital, Time Research, Presto Labs, Pulsar, AlphaLab Capital, Efficient Frontier, Amber, and Riverside Hedge.

Web3 infrastructure platform zbyte secured $5 million in investment, announcing the launch of its mainnet backed by $4 million in funding and an additional $1 million in investor commitments.

Institutional staking platform Kiln announced $17 million in funding led by 1kx, with participation from IOSG Ventures, Crypto.com, Wintermute Ventures, KXVC, LBank, and existing investors. The new funds will support Kiln’s global expansion, including establishing an APAC headquarters in Singapore in Q1 2024 and further developing its platform to incorporate various reward mechanisms within DeFi.

Web3 analytics platform Safary announced a $2.4 million pre-seed round led by Lemniscap, with participation from Arca, SevenX, Big Brain Holdings, Saison Capital, Diaspora Ventures, and 20 Web3 angel investors—14 of whom are Safary community members. The funds will expand the Safary team and accelerate development of its marketing analytics platform. Safary aims to become a Web3 alternative to Google Analytics, replacing traditional tracking systems without relying on cookies, allowing users to track visitors, wallets, and more via intuitive no-code dashboards.

Digital identity protocol Root Protocol, enabling access to Web3 platforms, has raised $10 million across two seed rounds at a $100 million valuation. The round was led by Animoca Brands, with participation from Signum Capital, Ankr Network, CMS Holdings, DFG, and angel investors Tekin Salimi and Meltem Demirors.

Others

Digital asset financial services group HashKey Group announced it raised nearly $100 million in a Series A round at a pre-money valuation exceeding $1.2 billion. In addition to strong support from existing shareholders, new investors include major institutional investors, leading Web3 firms, and strategic partners.

Blockchain finance company Canza Finance announced a $2.3 million strategic round led by Polychain, with participation from Protocol Labs, Ava Labs, 99 Capital, Bitscale Capital, Stratified Capital, Contango Digital Assets, Kairon Labs, and Mapleblock Capital. Canza Finance will use the funds to further develop its tools and services, aiming to reduce business operation costs across Africa.

South Korean Web3 research firm Four Pillars raised $500,000 with participation from Kakao Ventures, Hashed, and Bass Investment. The funds will support talent acquisition and accelerate product development. Four Pillars helps blockchain startups launch and streamlines enterprise entry into blockchain through customized solutions.

NAVI Protocol, the top Defi protocol by TVL in the Sui ecosystem, announced the acquisition of Volo, a liquid staking protocol built on Sui. This strategic move strengthens NAVI Protocol’s goal of becoming a one-stop liquidity hub on Sui and solidifies voloSui’s position within the Sui ecosystem.

Web3 advertising platform Linkko completed a strategic round led by Web3 Media (W3M) Ventures, with the amount undisclosed. The new funds will enhance product features, expand partnerships, and grow the user base. Founded in 2023 and headquartered in Singapore, Linkko uses on-chain analytics to provide advertisers with precise targeting, enabling users to watch ads and earn rewards ranging from a few cents to several dollars.

French cryptocurrency market maker Flowdesk completed a $50 million Series B round led by Cathay Innovation, with participation from Cathay Ledger Fund, Eurazeo, ISAI, Speedinvest, Ripple, and Bpifrance (France’s state-owned investment bank).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News