Understanding Vector Reserve: After Liquid Staking and Restaking, Position Staking (LPD) is Quietly on the Rise

TechFlow Selected TechFlow Selected

Understanding Vector Reserve: After Liquid Staking and Restaking, Position Staking (LPD) is Quietly on the Rise

LPD, even when creating pools, you have to nest them.

By TechFlow

New concepts in the crypto market are always evolving rapidly.

While everyone is still engaged with liquidity staking and re-staking-related concepts such as LSD, LSDFi, LST, and LRT, a new concept has quietly emerged:

LPD — Liquidity Position Derivatives.

Whenever a new concept emerges, the first project to implement it often sees strong price appreciation—for example, Restake Finance in re-staking, or Lybra Finance in earlier LSDFi narratives.

This time, the project pioneering this idea is Vector Reserve, which has launched a new ETH-based derivative called vETH—representing users' positions as liquidity providers (LPs) in DeFi.

Meanwhile, its native token VEC is currently being offered. With this opportunity, let’s explore:

What exactly is LPD? And can projects like Vector Reserve lead the next wave of Ethereum-centric narratives following re-staking?

LPD: Even Liquidity Pools Now Join the Matryoshka Game

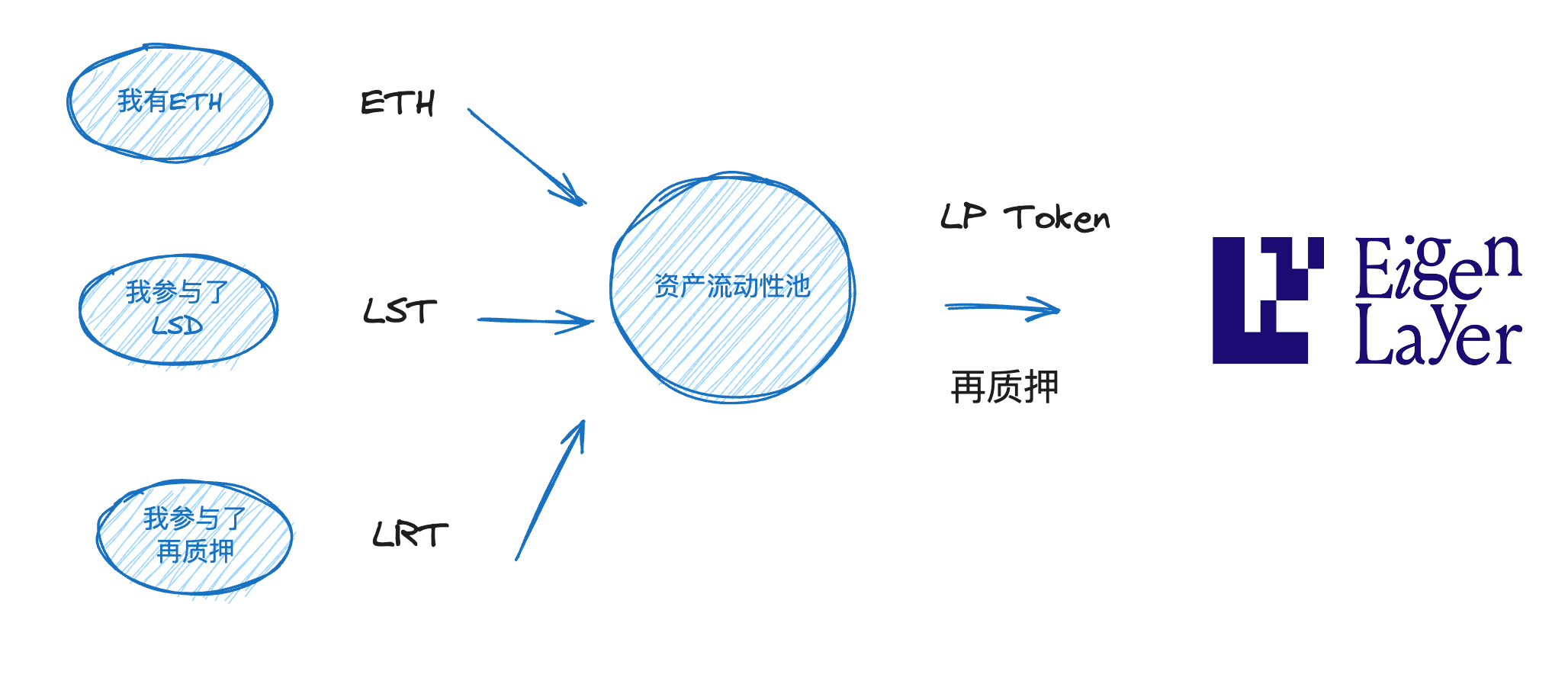

So what exactly is this new concept, LPD? To understand it, we need to start from liquid staking and re-staking.

As discussed in our previous article “Re-staking Token (LRT) Narrative Reignited: Finding High-Potential Projects Amid Endless Liquidity Matryoshkas”:

From a speculative standpoint, liquid staking and re-staking can be seen as a form of "liquidity matryoshka," justified by "securing Ethereum and its ecosystem," where assets are repeatedly staked to generate derivative tokens that earn additional yield, maximizing capital efficiency.

To briefly recap:

Stake ETH to generate liquid staking tokens (LST), then use LST for lending or staking to earn yield;

Re-stake LST on EigenLayer to generate LRT, then use LRT for borrowing, collateralization, or yield generation.

Did you notice a limitation in this nesting structure?

You might have already realized: this kind of nesting is a one-to-one mapping of a single asset—each original asset generates a derivative token used for further staking, continuously chasing the next layer of yield.

But what if the asset could be pooled with others—broadening the base—before being re-staked?

Exactly. This is the essence of LPD (Liquidity Position Derivatives): You combine ETH, LST, and LRT into a liquidity pool, take your LP token, and re-stake it on platforms like EigenLayer to earn another layer of yield—adding yet another level of returns.

Hence, LPD makes perfect sense. The "P" stands for "Position"—your liquidity position becomes a yield-generating derivative, potentially offering higher returns than holding individual assets like ETH or LST alone.

The matryoshka never sleeps—and this time, the leader is Vector Reserve. Below, we’ll walk through how LPD works in practice via the product interface.

Product Implementation at Vector Reserve

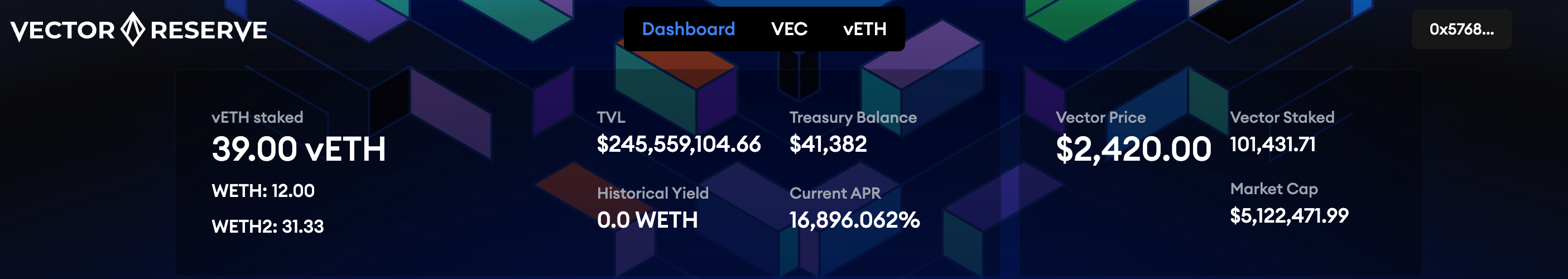

Vector Reserve has partially implemented the above LPD logic in its current product.

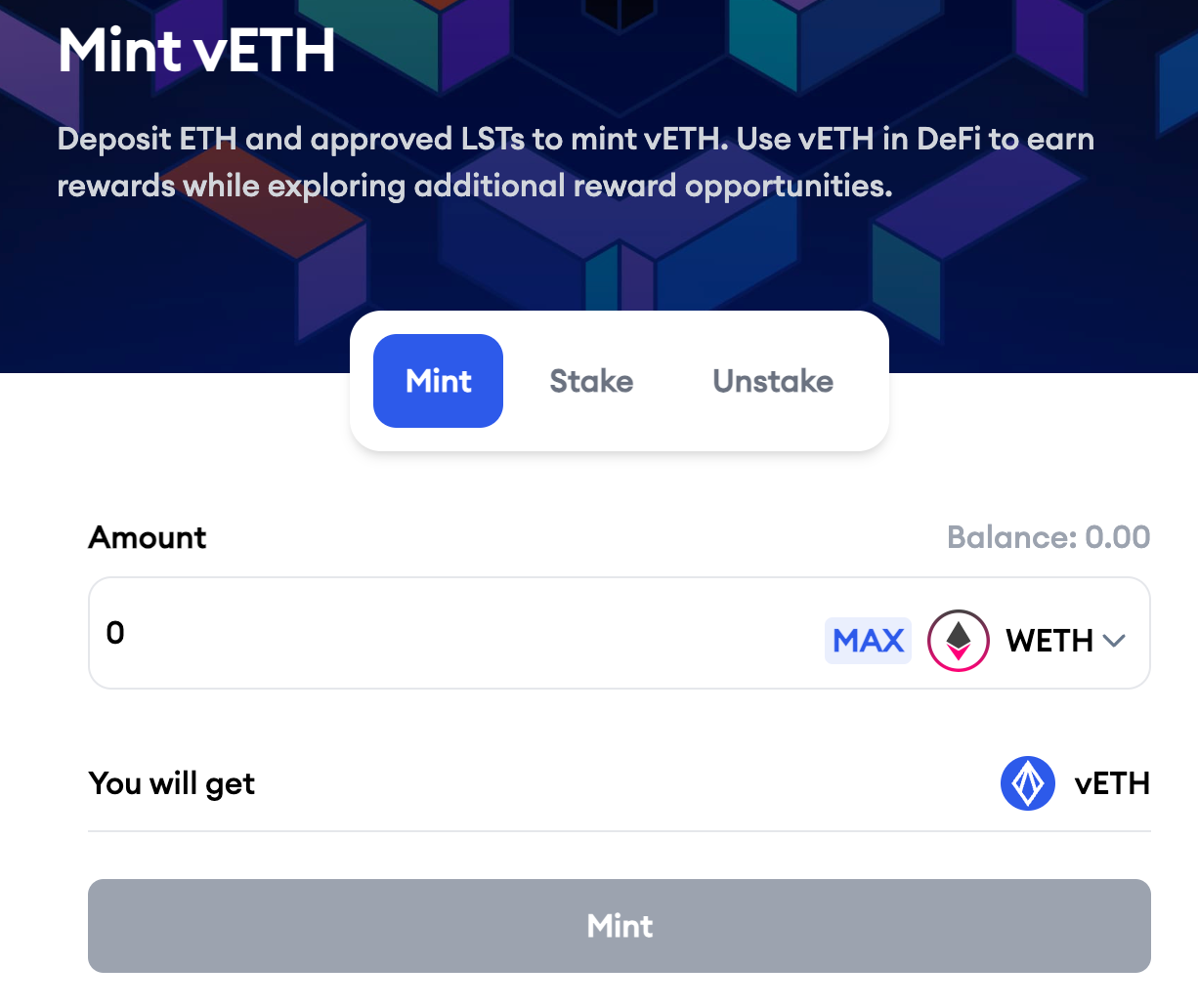

Users can deposit native ETH (or wETH) and LST-type derivative tokens into the protocol. The protocol automatically pairs these deposits into liquidity pools and mints an equivalent amount of vETH tokens, representing the user's position within those pools.

Although Vector’s documentation mentions support for LRT and LST deposits, currently only ETH and wETH are available for deposit.

Specifically, the product flow consists of the following steps:

-

Deposit Assets: Deposit native ETH, liquid staking tokens (LST), and/or re-staked liquidity tokens (LRT) into the Vector Reserve protocol.

-

Create Liquidity Positions:

-

Vector Reserve uses internal rules to pair deposited assets with other tokens, forming one or more liquidity pools (LPs). This process involves combining different token types (e.g., ETH, LST, LRT) to provide liquidity.

-

-

Receive vETH: In return for their share in these liquidity pools, users receive vETH tokens. vETH is a Liquidity Position Derivative (LPD), representing a stake in the underlying investment portfolio.

-

Re-stake for Additional Yield: Users may choose to further stake their vETH tokens—e.g., on EigenLayer. This way, vETH not only represents a liquidity pool share but also earns additional yield on external platforms.

Now, you might wonder: why can LP tokens be directly deposited into EigenLayer? This ties into another key mechanism provided by Vector: Superfluid Staking.

Superfluid Staking allows investors to use LP tokens—their proof of liquidity provision—as instruments for re-staking. This is possible because LP tokens represent ownership stakes in liquidity pools backed by real assets such as ETH and LST. By re-staking these LP tokens on platforms like EigenLayer, investors can retain their liquidity positions while simultaneously earning extra staking rewards without sacrificing liquidity.

This approach pushes the liquidity matryoshka to its extreme.

-

Yield Sources: vETH yields come from multiple streams, including liquidity pool trading fees and returns generated by specific staking strategies (such as Superfluid Staking on EigenLayer).

In summary, the LPD represented by vETH offers investors diversified income sources and risk diversification, combining traditional liquid staking and re-staking strategies into a more advanced financial product. By staking position receipts, users can earn both from liquidity pools and through re-staking vETH, achieving maximum capital utilization and yield optimization.

VEC Token Utility and Current Status

Having explored the product, let’s now examine the project’s native token, VEC.

The VEC token is the cornerstone of the Vector Reserve ecosystem, designed around sustained value growth and economic sustainability. Its goal is to build a healthy ecosystem that benefits all participants through smart strategies and innovative incentives, continuously accumulating value and expanding influence.

The VEC token plays several critical roles within Vector Reserve:

-

Reserve Currency: As the ecosystem’s reserve currency, VEC supports and stabilizes the value of vETH.

-

Incentive Mechanism: VEC encourages and rewards users for providing liquidity—a crucial component for smooth ecosystem operation.

-

Governance Rights: VEC holders have voting rights over the future direction of the ecosystem, reflecting Vector Reserve’s commitment to decentralized governance.

VEC’s value appreciation is driven by the following mechanisms:

-

Revenue Sharing: A portion of transaction fees and other revenues generated by vETH will be allocated to support VEC’s value, providing passive income to holders.

-

Treasury Management: Through prudent treasury strategies, reserve assets are managed and invested in ETH-based staking and re-staking instruments to achieve long-term stable growth.

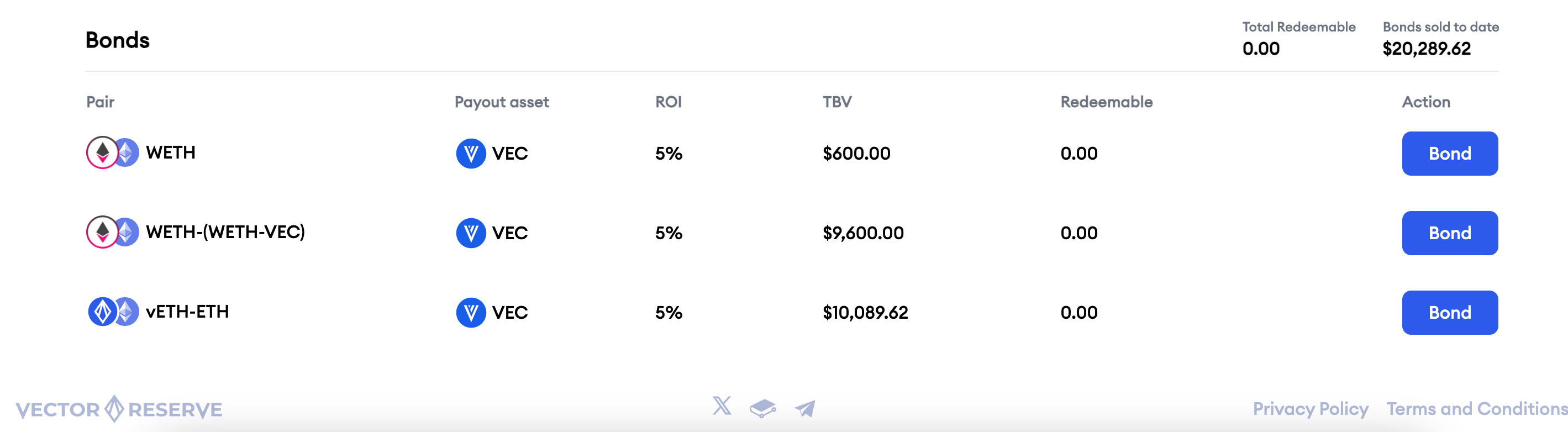

Additionally, once sufficient liquidity is achieved, Vector Reserve will introduce vote-escrowed VEC (veVEC)—representing VEC tokens staked within VEC/ETH liquidity positions (LPs). These staked tokens are locked and serve dual purposes: they contribute to VEC’s stability and liquidity, and grant holders the right to claim and allocate incentives (commonly known as “bribes”) in protocol-level liquidity governance.

Through a well-structured bribery mechanism, external protocols can incentivize veVEC holders to direct LRT liquidity in ways favorable to them. These incentives serve as a means for other DeFi protocols to attract the robust liquidity provided by Vector Reserve, thereby enhancing their own liquidity and stability.

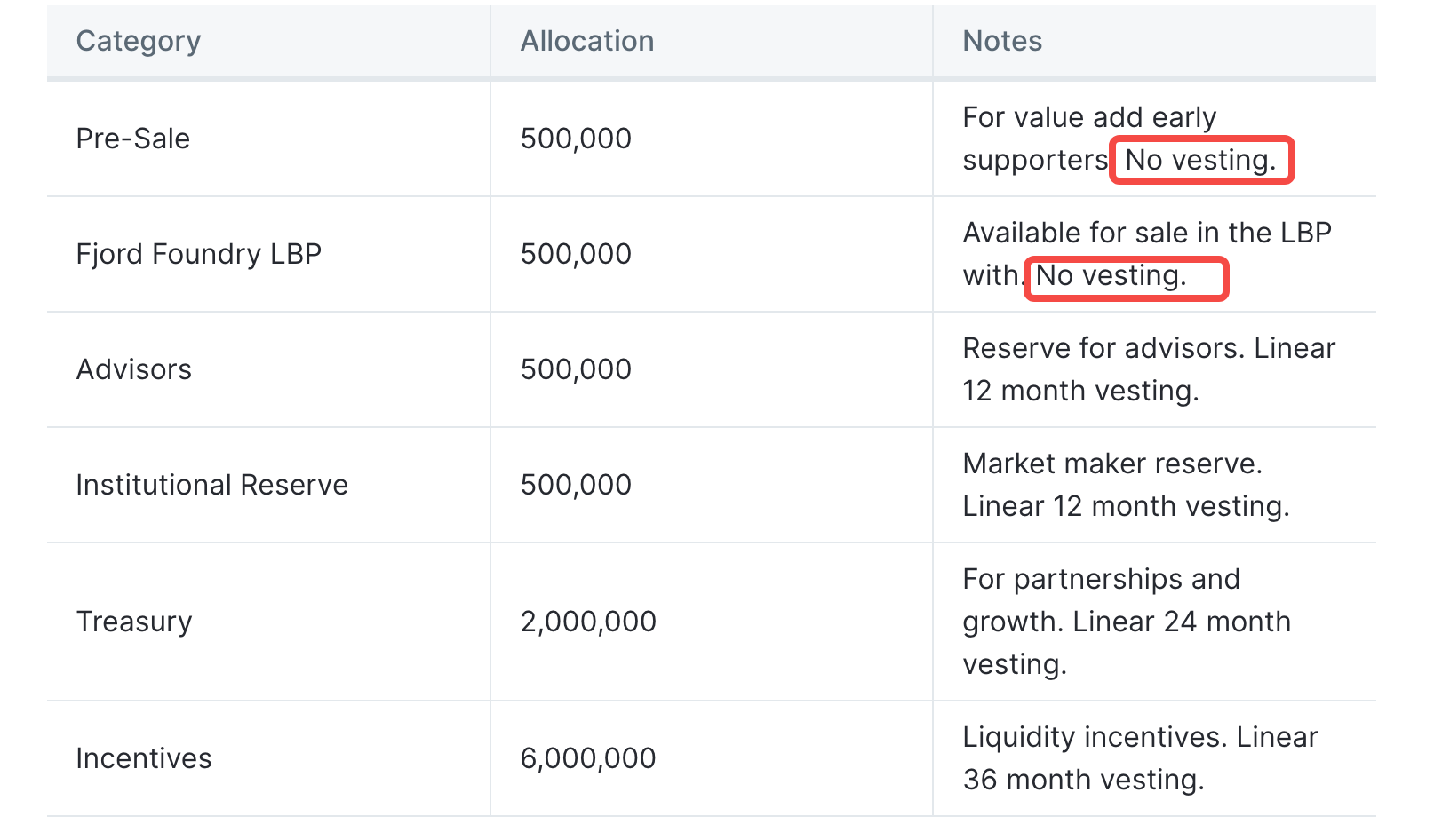

On tokenomics, the total supply of VEC is 10,000,000. However, 500,000 VEC were previously allocated for private sale—meaning early investors have already acquired VEC at a fixed price, and this portion has no linear unlock schedule, becoming fully circulating upon token generation event (TGE).

Meanwhile, allocations for advisors, treasury reserves, and incentive programs will also receive varying portions of VEC, all subject to 12–36 month linear vesting periods.

The public allocation accounts for 5%—also 500,000 tokens—dedicated to a Liquidity Bootstrapping Pool (LBP) for public trading. Compared to traditional token launches, LBP aims to roll out new tokens in a fairer, more decentralized manner while establishing initial liquidity for VEC.

LBP leverages an automated market maker (AMM) model that dynamically adjusts token prices based on trading activity. Prices are not fixed but fluctuate in real time according to buy and sell pressure.

Strong buying interest can push prices up; dominant selling activity can drive them down.

By allowing the market to determine pricing dynamically, LBP promotes fairer token distribution. Investors can purchase tokens when prices drop to levels they deem reasonable, rather than scrambling for limited supply at a fixed price.

According to current information, the liquidity pool will launch at 24:00 on January 22 (Beijing Time). Interested readers can participate here. However, the current estimated FDV is close to $180 million, which the author considers relatively high. Given ongoing market volatility and limited visibility, rushing into the pool at launch may not be optimal.

A more reasonable approach would be to observe the token’s price movement during the 4-day LBP period and selectively participate at relatively lower price points.

Finally, as we’ve previously observed, the liquidity matryoshka never sleeps—there will always be new forms chasing yield.

Focusing on the first mover in each new trend often leads to better returns. LPD is just another method focused on maximizing staking yield—it likely won’t match EigenLayer’s scale.

Yet there remains much room to innovate around staking and re-staking. LPD isn’t the first, and certainly won’t be the last.

Look to the new, not the old. Participating in new projects doesn’t guarantee profits—but at least keeps you close to where the returns are.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News