MT Capital Research Report: A Comprehensive Analysis of Parallel EVM, Project Overview, and Future Outlook

TechFlow Selected TechFlow Selected

MT Capital Research Report: A Comprehensive Analysis of Parallel EVM, Project Overview, and Future Outlook

Parallel EVM demonstrates significant potential in enhancing blockchain scalability and efficiency, marking a major shift in blockchain technology.

Author: Xinwei, MT Capital

TL;DR

-

The necessity of parallel EVM lies in its ability to address the inefficiency of traditional EVM's sequential transaction processing. By enabling multiple operations to execute simultaneously, it significantly improves network throughput and performance.

-

Implementation methods for parallel EVM include schedule-based concurrency, multi-threaded EVM instances, and system-level sharding, while facing technical challenges such as unreliable timestamps, blockchain determinism, and validator incentives.

-

Monad Labs aims to significantly enhance blockchain scalability and transaction speed through its Layer 1 project Monad, featuring up to 10,000 transactions per second, a 1-second block time, parallel execution capability, and the MonadBFT consensus mechanism.

-

Sei V2 is a major upgrade to the Sei network, aiming to become the first fully parallelized EVM with backward compatibility for EVM smart contracts, optimistic parallelization, a new SeiDB data structure, and interoperability with existing chains, significantly boosting transaction processing speed and network scalability.

-

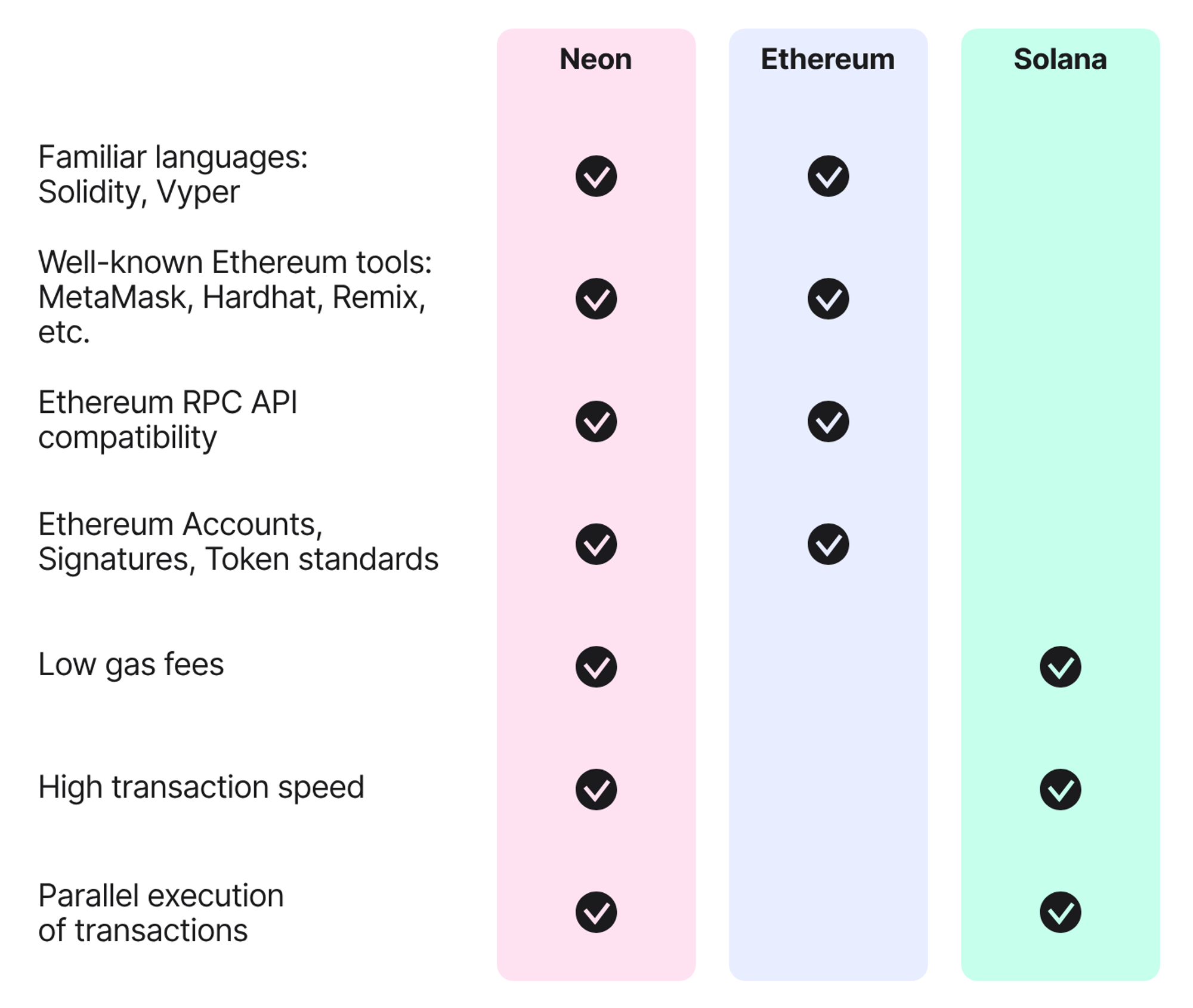

Neon EVM is a platform on Solana that provides an efficient, secure, and decentralized environment for Ethereum dApps, allowing developers to easily deploy and run dApps while leveraging Solana’s high throughput and low-cost advantages.

-

Lumio is a Layer 2 solution developed by Pontem Network that innovatively addresses Ethereum’s scalability challenges by supporting both EVM and Aptos’ Move VM, elevating the Web3 experience close to Web2 levels.

-

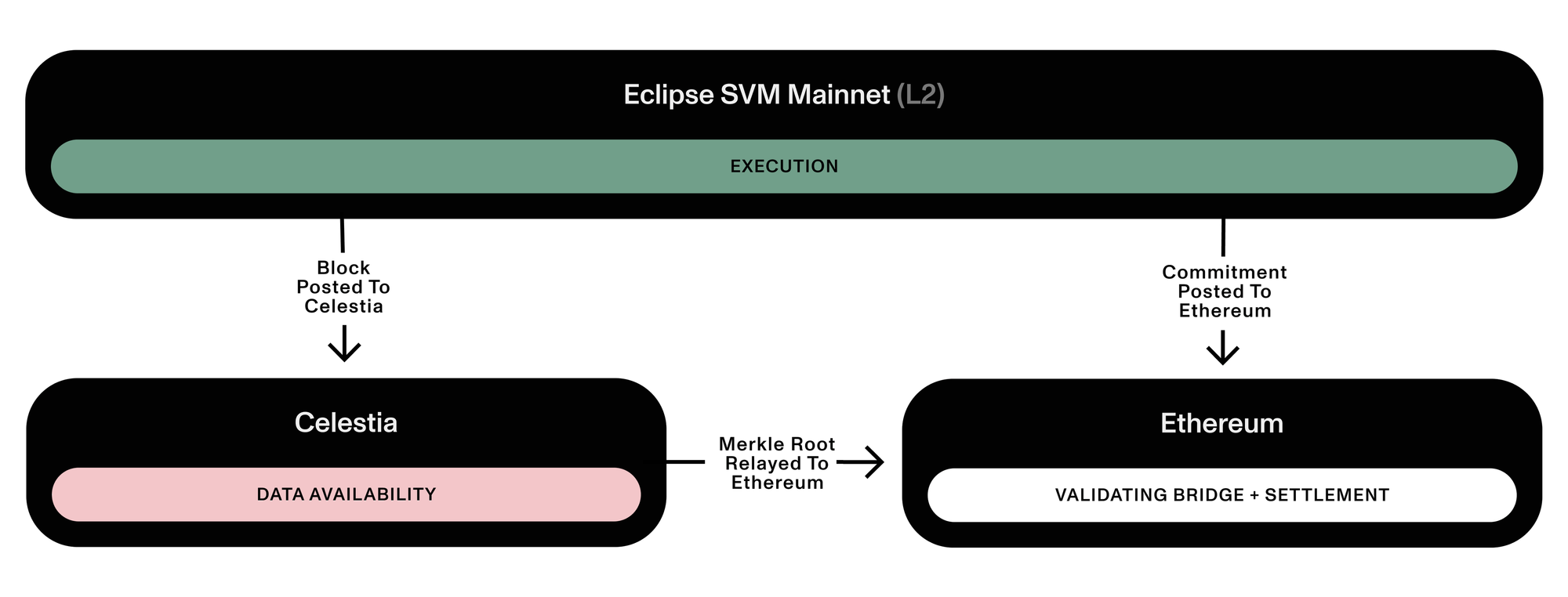

Eclipse is an Ethereum Layer 2 solution using SVM to accelerate transaction processing, adopting a modular rollup architecture integrating Ethereum settlement, SVM smart contracts, Celestia data availability, and RISC Zero fraud proofs.

-

Solana leverages its Sealevel technology for parallel smart contract processing, Sui enhances throughput via Narwhal and Bullshark components, Fuel enables parallel transaction execution through a UTXO model, and Aptos uses the Block-STM engine to boost transaction processing—each showcasing different implementations and advantages of parallel technologies in blockchain.

-

Main challenges in adopting parallelization include resolving data races and read-write conflicts, ensuring compatibility with existing standards, adapting to new ecosystem interaction patterns, and managing increased system complexity, especially in security and resource allocation.

-

Parallel EVM demonstrates immense potential in enhancing blockchain scalability and efficiency, marking a significant shift in blockchain technology by increasing transaction capacity through simultaneous execution across multiple processors, breaking the limitations of traditional sequential processing. While offering great promise, successful implementation of parallel EVM requires overcoming complex technical hurdles and achieving broad ecosystem adoption.

Basics of Parallel EVM

Introduction to EVM

The Ethereum Virtual Machine (EVM) is the core component of the Ethereum blockchain, serving as its computational engine. It is a quasi-Turing-complete machine that provides a runtime environment for executing smart contracts on the Ethereum network, which is crucial for maintaining trust and consistency throughout the entire Ethereum ecosystem.

The EVM executes smart contracts by processing bytecode—a lower-level form compiled from high-level programming languages like Solidity. This bytecode consists of a series of opcodes used to perform various functions, including arithmetic operations and data storage/retrieval. The EVM operates as a stack machine, processing instructions in a last-in-first-out manner, with each operation carrying an associated gas cost. This gas system measures the computational work required to execute operations, ensuring fair resource allocation and preventing network abuse.

In Ethereum, transactions play a critical role within the EVM framework. There are two types of transactions: those resulting in message calls and those leading to contract creation. Contract creation results in a new contract account containing compiled smart contract bytecode, which gets executed when another account makes a message call to it.

The EVM architecture includes components such as bytecode, stack, memory, and storage. It has dedicated memory space for temporary data storage during execution and persistent storage on-chain for indefinite data retention. The design of the EVM ensures a secure execution environment for smart contracts by isolating them to prevent reentrancy attacks and implementing various security measures such as gas limits and stack depth restrictions.

Furthermore, the influence of the EVM extends beyond Ethereum itself through EVM-compatible chains. These chains, though distinct, maintain compatibility with Ethereum-based applications, enabling seamless interaction with core Ethereum applications. They play key roles in diverse fields such as enterprise solutions, GameFi, and DeFi.

Necessity of Parallel EVM

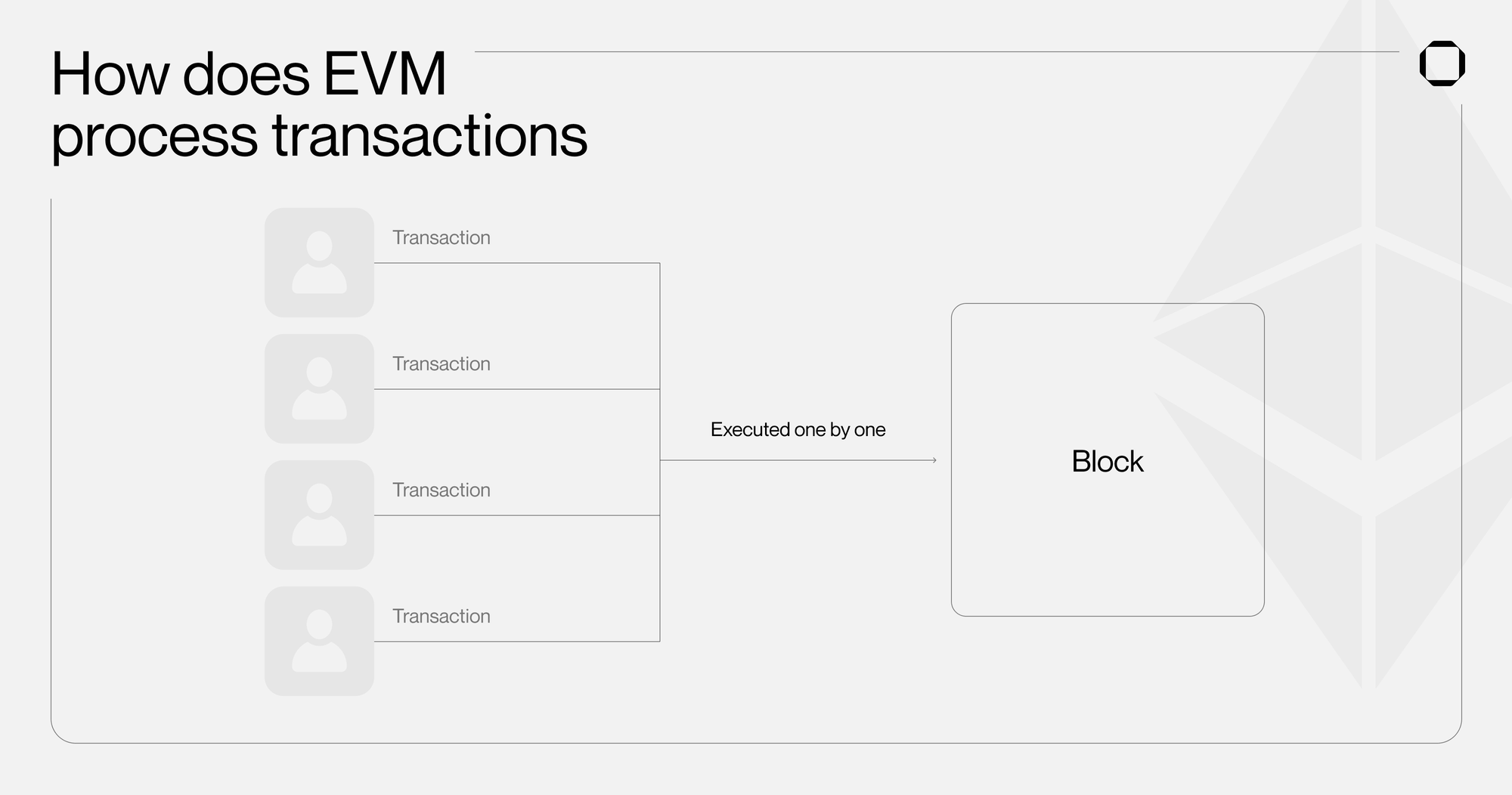

The necessity of parallel EVM stems from its ability to significantly improve the performance and efficiency of blockchain networks. Traditional EVM processes transactions sequentially, which is not only energy-intensive but also places a heavy burden on network validators. This approach often leads to high transaction costs and inefficiencies, considered a major barrier to widespread blockchain adoption.

Parallel EVM revolutionizes the consensus process by allowing multiple operations to be executed simultaneously. This capability for parallel execution greatly increases network throughput, thereby enhancing overall blockchain performance and scalability. With parallel EVM, blockchain networks can handle more transactions in less time, effectively addressing common issues of congestion and slow processing times seen in traditional blockchain systems.

Parallel EVM has significant impacts across various aspects of blockchain technology:

-

It offers a more energy-efficient and sustainable method of transaction processing. By reducing the workload on validators and the entire network, parallel EVM contributes to building a more sustainable blockchain ecosystem.

-

Improved scalability and increased throughput directly lead to lower transaction fees. Users benefit from a more economical experience, making blockchain platforms more attractive to a broader audience.

-

Processing multiple transactions simultaneously rather than sequentially means dApps can run more smoothly even during periods of high network demand.

Implementation Methods of Parallel EVM

In the current EVM architecture, the finest-grained read/write operations are sload and sstore, which respectively read from and write to the state trie. Therefore, ensuring no conflict between different threads on these two operations is a simple entry point for implementing parallel/concurrent EVM. In fact, Ethereum has a special transaction type that includes a special structure called "access list," allowing transactions to carry addresses of storage locations they intend to read or modify. Thus, this provides a good starting point for implementing a scheduling-based concurrent approach.

From a system implementation perspective, there are three common forms of parallel/concurrent EVM:

-

Multi-threading within a single EVM instance.

-

Multi-threading across multiple EVM instances on one node.

-

Multi-threading across multiple EVM instances on multiple nodes (essentially system-level sharding).

The difference between parallelism/concurrency in blockchain and in database systems lies in the following:

-

Unreliable timestamps make timestamp-based concurrency methods difficult to deploy in the blockchain world.

-

Absolute determinism in blockchain systems ensures that re-executed transactions yield identical results across different validators.

-

Validators' ultimate goal is higher revenue, not faster transaction execution.

So what do we need?

-

System-wide consensus where faster execution leads to higher rewards.

-

A multivariate scheduling algorithm considering block constraints, capable of capturing more revenue while completing execution faster.

-

Finer-grained data operations, including opcode-level data locking, memory caching layers, etc.

Main Projects and Their Technologies

Monad Labs

Monad is an EVM Layer 1 designed to significantly increase blockchain scalability and transaction speed through its unique technical features. Monad's key advantage is its ability to handle up to 10,000 transactions per second with a 1-second block time. This is enabled by its MonadBFT consensus mechanism and EVM compatibility, allowing highly efficient and rapid transaction processing.

One of Monad's most notable features is its parallel execution capability, allowing it to process multiple transactions simultaneously—greatly improving network efficiency and throughput compared to the sequential processing used in traditional blockchain systems.

Monad is developed by Monad Labs, co-founded by Keone Hon, Eunice Giarta, and James Hunsaker. The project has successfully raised $19 million in seed funding and plans to launch its testnet in mid-Q1 2024, followed by the mainnet.

Monad is optimized in four main areas, making it a high-performance blockchain:

-

MonadBFT:

MonadBFT is the high-performance consensus mechanism of the Monad blockchain, designed to achieve agreement on transaction ordering under partial synchrony conditions despite Byzantine actors. Based on HotStuff, it uses a two-phase BFT algorithm with optimistic responsiveness, linear communication overhead under normal conditions, and quadratic overhead during timeouts. In MonadBFT, the leader sends a new block along with the previous round’s QC (Quorum Certificate) or TC (Timeout Certificate) to validators. Validators audit the block and, if agreed, send signed “yes” votes to the next round’s leader. Threshold signatures aggregate **

2f+1** validator votes into a QC. Under normal communication, the leader broadcasts the block, and validators directly send votes to the next leader. MonadBFT also adopts pairing-based BLS signatures to solve scalability issues, aggregating incremental signatures into one, so verifying a single aggregated signature proves all associated stakes have signed. For performance, MonadBFT uses a hybrid scheme where BLS is only used for aggregatable messages (votes and timeouts), while ECDSA ensures integrity and authenticity. These features enable efficient and robust blockchain consensus. -

Late Execution:

This is a key innovation that decouples execution from the consensus process. In this architecture, consensus involves nodes agreeing on the official transaction order, while execution refers to actually running these transactions and updating the state. Here, the leader proposes a transaction order without knowing the final state root at proposal time; validators vote on block validity without knowing whether all transactions will succeed.

This design allows Monad to achieve significant speed improvements, enabling a single-shard blockchain to scale to millions of users. Each node independently executes transactions in block N while reaching consensus on block N+1. This approach allows larger gas budgets since execution only needs to keep pace with consensus. Moreover, because execution only needs to average out over time, it tolerates variations in computation duration.

To further ensure state machine replication, Monad includes a Merkle root delayed by D blocks in its block proposals. This delayed Merkle root ensures consistency across the network even if some nodes execute incorrectly or maliciously.

In MonadBFT, finality is single-slot (1 second), and execution results typically lag behind full nodes by less than 1 second. This single-slot finality means users see the official transaction order after just one block. Unless a supermajority behaves maliciously, reordering is impossible. Users needing fast confirmation (e.g., high-frequency traders) can run full nodes to minimize latency.

-

Parallel Execution:

This enables Monad to execute multiple transactions simultaneously. At first glance, this may seem inconsistent with Ethereum’s execution semantics, but it is not. Monad blocks are linearly ordered sets of transactions, just like Ethereum. The results of executing these transactions are identical between Monad and Ethereum.

During parallel execution, Monad uses optimistic execution—starting later transactions before earlier ones finish. This sometimes causes incorrect results. To fix this, Monad tracks inputs used during transaction execution and compares them with outputs from prior transactions. If discrepancies exist, the affected transaction is re-executed with correct data.

Additionally, Monad employs a static code analyzer during execution to predict dependencies between transactions and avoid invalid parallel execution. In best cases, it predicts many dependencies early; in worst cases, it falls back to simple sequential execution.

Monad’s parallel execution technology not only boosts network efficiency and throughput but also reduces transaction failures due to parallelization through optimized execution strategies.

-

MonadDb:

MonadDb optimizes data storage and processing. As part of Monad’s optimization strategy, it aims to improve overall network performance, particularly in handling state and transaction data. This component is designed to enhance data storage efficiency and scalability, increasing the blockchain’s capacity to process large volumes of data. It includes improved indexing mechanisms, more efficient storage structures, and optimized data access paths. These optimizations help reduce data access times, increase transaction processing speed, and thus improve overall blockchain performance.

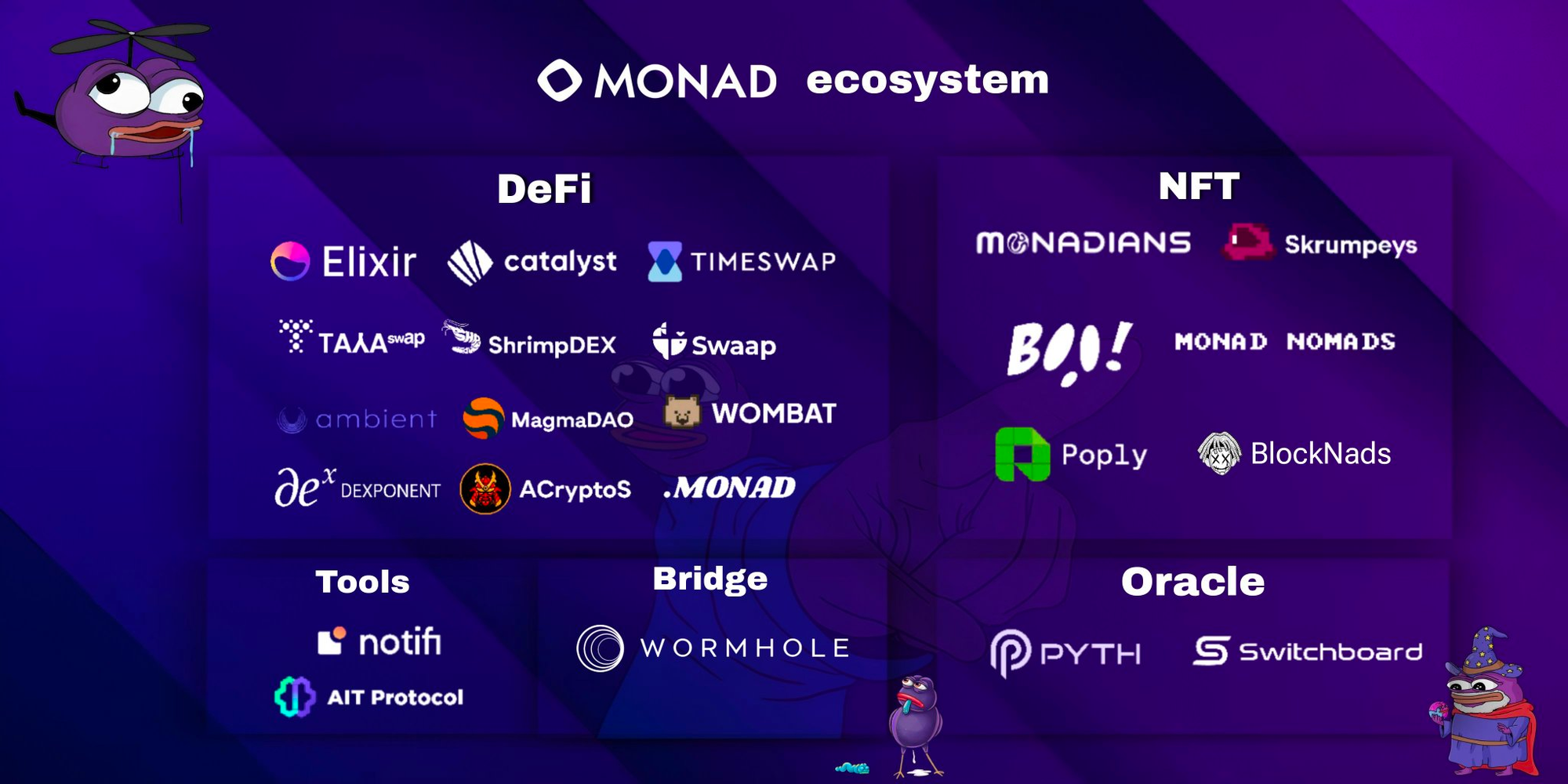

Ecosystem Projects

Tayaswap

TayaSwap is an AMM DEX built on Monad, powered by SubLabs, enabling asset trading without traditional order books or intermediaries. AMMs use mathematical formulas and smart contracts to facilitate token swaps, determine prices, and enable peer-to-peer trading.

Ambient Finance

Ambient (formerly CrocSwap) is a decentralized exchange protocol allowing bilateral AMMs combining concentrated and constant-product liquidity across any pair of blockchain assets. Ambient runs the entire DEX within a single smart contract, where individual AMM pools are lightweight data structures rather than separate contracts.

Shrimp Protocol

Shrimp is a (3,3) DEX with flywheel-style tokenomics, supporting real-world assets, soon launching on Monad.

Catalyst

Catalyst is a permissionless liquidity solution across modular blockchains, built to connect all chains, enabling access to any asset anywhere. Catalyst allows developers to automatically connect to all chains, gaining access to users in a unified ecosystem, while its simple, decentralized, self-custodial design ensures projects can securely and seamlessly access liquidity.

Swaap

Swaap is a market-neutral automated market maker (AMM). It combines oracles and dynamic spreads to provide sustainable returns for liquidity providers and cheaper prices for traders. The protocol significantly reduces impermanent loss and supports multi-asset pools.

Elixir

Elixir is a decentralized market-making protocol that interacts with centralized exchanges via API calls using market-making algorithms, bringing liquidity to long-tail crypto assets.

Timeswap

Timeswap is an oracle-free, liquidator-free decentralized money market protocol based on AMM. Unlike Uniswap, which enables real-time asset trading, borrowing on Timeswap involves swapping tokens until repayment is complete. Lenders provide asset A as collateral while “insuring” a certain amount of borrower’s asset B. Users can adjust their risk profiles, accepting lower collateral ratios for higher interest rates, or vice versa.

Poply

Poply is a community-driven NFT marketplace focused on the Monad chain, showcasing and empowering NFT collections created specifically for this chain. Using AI-generated art and a user-friendly interface, Poply attracts individuals interested in unique NFTs to trade ERC-721 tokens here.

Switchboard

Switchboard is a permissionless, customizable, multi-chain oracle protocol for general-purpose data feeds and verifiable randomness. By allowing anyone to push any form of data regardless of type, it offers a one-stop service and helps drive the development of next-generation decentralized applications.

Pyth Network

Pyth Network is Douro Labs’ next-generation price oracle solution, aiming to deliver valuable financial market data on-chain—including cryptocurrency, stocks, forex, and commodities—to projects, protocols, and the public via blockchain technology. The network aggregates first-party price data from over 70 trusted data providers and publishes it for use by smart contracts and other on- or off-chain applications.

AIT Protocol

AIT Protocol is an AI data infrastructure providing Web3 AI solutions. Its decentralized marketplace gives millions of cryptocurrency users a special and broad opportunity to participate in “train-to-earn” tasks, rewarding them while actively contributing to AI model development.

Notifi

Notifi provides a universal communication layer for all Web3 projects, planning to embed notification and messaging features into decentralized applications for digital and on-chain user engagement. The Notifi API allows developers to unlock complex communication infrastructure via simple APIs, delivering native user experiences to all apps worldwide; Notifi Center gives users a customizable notification experience, letting them view and manage all Web3 messages from mobile and web; Notifi Push enables marketers to create cohesive multi-channel engagement, driving business growth and user retention.

ACryptoS

ACryptoS is an advanced crypto strategy platform—an omnichain yield aggregation optimizer and DEX—offering a range of unique products including auto-compounding single-token vaults, dual-token LP vaults, unique liquidity vaults, Balancer-V2 fork DEX, and stablecoin swaps. Initially launched on BNB Chain in November 2020, ACryptoS has now expanded to 11 chains with over 100 vaults deployed, aiming to support DeFi users and protocols.

MagmaDAO

MagmaDAO is a DAO-controlled liquid staking protocol aiming for fair token distribution through ecosystem competition airdrops. It is the first distributed validator outside Ethereum, built on Monad—the fastest, cheapest, and most censorship-resistant EVM L1.

Wombat Exchange

Wombat Exchange is a multi-chain stablecoin exchange featuring open liquidity pools, low slippage, and single-sided staking.

Wormhole

Wormhole is a decentralized general-purpose messaging protocol enabling developers and users of cross-chain applications to leverage the strengths of multiple ecosystems.

DeMask Finance

DeMask Finance is an on-chain AMM protocol for trading between NFTs and ERC20 tokens. It supports creating NFT collections and NFT launchpads paired with ETH and other tokens; NFT decentralized exchanges supporting ERC-1155 NFTs or other tokens paired with ETH and ERC-20 tokens. The DeMask protocol aims to add liquidity to NFT markets, providing an interface for seamless swaps between ERC20/native tokens and NFT collections. DeMask is an interconnected system of smart contracts where all users can create and own liquidity pools and trade fully automatically. Each pool holds a pair of assets—one token and one NFT—providing fixed pricing for instant trades. It also allows other contracts to estimate the average price of the two assets over time. Users owning liquidity pools earn rewards when asset pairs are swapped.

Sei V2

Sei V2 is a major upgrade to the Sei network, aiming to become the first fully parallelized EVM. This upgrade will equip Sei with the following capabilities:

-

Backward Compatibility with EVM Smart Contracts:

This means developers can deploy audited, EVM-compatible smart contracts on Sei without modifying code. This is extremely important for developers, simplifying the migration of existing smart contracts from Ethereum and other blockchains to Sei.

Technically, Sei nodes will automatically import Geth—the Go implementation of the Ethereum Virtual Machine. Geth will handle Ethereum transactions, and any resulting updates (including state changes or calls to non-EVM-related contracts) will go through a special interface created by Sei for EVM.

-

Optimistic Parallelization:

This allows the blockchain to support parallelization without requiring developers to define any dependencies. All transactions can run in parallel; when conflicts occur (e.g., transactions touching the same state), the chain tracks which storage parts each transaction accesses and re-runs conflicting transactions sequentially. This process recurses until all unresolved conflicts are resolved. Because transactions are ordered within the block, this process is deterministic, simplifying developer workflows while maintaining chain-level parallelism.

-

SeiDB:

It introduces a new data structure called SeiDB to optimize the platform’s storage layer. SeiDB’s primary goal is to prevent state bloat—where the network becomes overloaded with data—while simplifying state synchronization for new nodes. This design aims to improve Sei blockchain’s overall performance and scalability.

Sei V2 achieves this by transforming the traditional IAVL tree into a two-component system—state storage and state commitment. This change significantly reduces latency and disk usage, and Sei V2 also plans to switch to PebbleDB to improve read/write performance for multi-threaded access.

-

Interoperability with Existing Chains:

Sei V2 allows seamless composition between EVM and any other execution environments supported by Sei, giving developers a smoother experience with easy access to native tokens and other chain features like staking. It will also create a new component to support EVM smart contracts. These EVM smart contracts will benefit from all changes made to consensus and parallelization and will also be able to interact with existing Cosmwasm smart contracts.

From a performance standpoint, Sei V2 will offer a throughput of 28,300 batch transactions per second, with a block time and finality of 390 milliseconds. This enables Sei to support more users, provide better interactive experiences, and offer cheaper per-transaction costs compared to existing blockchains.

The main upgrade progress for Sei V2 is nearing code completion. After audits, this upgrade will be released on the public testnet in Q1 2024 and deployed on mainnet in the first half of 2024.

Neon

Neon EVM leverages Solana blockchain capabilities to provide an efficient environment for Ethereum dApps. It runs as a smart contract within Solana, allowing developers to deploy Ethereum dApps with minimal or no code changes and benefit from Solana’s advanced features. Neon EVM’s architecture and operation focus on security, decentralization, and sustainability, offering Ethereum developers a seamless transition to the Solana environment. Leveraging Solana’s low fees and high transaction speeds, Neon EVM enables parallel transaction execution, high throughput, and cost reduction. Key components of the Neon EVM ecosystem include:

-

Neon EVM Program:

It is an EVM compiled into Berkeley Packet Filter bytecode, running on Solana. It handles Ethereum-like transactions (Neon transactions) on Solana, following Ethereum rules. Neon EVM is configured via a decentralized multi-sig EVM account, where participants can update Neon EVM code and settings.

The process of Neon EVM handling transactions involves several key steps. First, users initiate Ethereum-like transactions (N-tx) through Ethereum-compatible wallets. These transactions are encapsulated into Solana transactions (S-tx) via Neon Proxy and passed to the Neon EVM program hosted on Solana. The Neon EVM program unpacks the transaction, verifies user signatures, loads EVM state (including account data and smart contract code), executes the transaction within Solana’s BPF (Berkeley Packet Filter) environment, and updates Solana’s state to reflect the new Neon EVM state.

-

Neon Proxy: It enables Ethereum dApps to be ported to Neon with minimal reconfiguration. Neon Proxy packages EVM transactions into Solana transactions, provided as a containerized solution for ease of use. Operators running Neon Proxy servers facilitate the execution of Ethereum-like transactions on Solana, accepting NEON tokens as gas fees and other payments within the Solana ecosystem.

-

Neon DAO: The DAO provides custodial services for the Neon Foundation and guides future research and development. It operates as a series of contracts on Solana, offering a governance layer controlling Neon EVM functionalities. NEON token holders can participate in DAO activities, including proposing and voting on proposals.

-

NEON Token: This utility token serves two main purposes—paying gas fees and participating in governance via the DAO.

-

Integrations and Tools: Neon EVM supports various integrations and tools for development and analytics. These include block explorers (like NeonScan), ERC-20 SPL wrappers for token transfers, NeonPass for transferring ERC-20 tokens between Solana and Neon EVM, NeonFaucet for test tokens, and compatibility with EVM-compatible wallets like MetaMask.

Eclipse

Eclipse is a Layer 2 solution for Ethereum that dramatically accelerates transaction processing by leveraging the Solana Virtual Machine (SVM). Designed for speed and scalability, Eclipse adopts a modular rollup architecture integrating key technologies such as Ethereum settlement, SVM smart contracts, Celestia data availability, and RISC Zero security.

Specifically, Eclipse Mainnet combines the best components of the modular stack:

-

Settlement Layer – Ethereum: Eclipse uses Ethereum as its settlement layer. Transactions are finalized and secured at this layer. Using Ethereum means leveraging its strong security and liquidity, and using ETH as the gas token for transaction fees. This setup allows Eclipse to inherit Ethereum’s robust security.

-

Execution Layer – SVM: For smart contract execution, Eclipse adopts SVM. Unlike EVM’s sequential transaction processing, SVM enables parallel transaction processing. Its Sealevel runtime can process transactions involving non-overlapping states in parallel, allowing Eclipse to scale horizontally and increase throughput.

-

Data Availability – Celestia: To ensure timely availability and verifiability of data, Eclipse uses Celestia. Celestia provides a scalable and secure platform for data publication, playing a vital role in Eclipse’s high throughput.

-

Fraud Proofs – RISC Zero: Eclipse integrates RISC Zero for zero-knowledge fraud proofs, eliminating the need for intermediate state serialization, thus improving system efficiency and security.

Eclipse’s design goal is to provide Ethereum with a truly mass-scale, general-purpose Layer 2 solution. It aims to solve the limitations and resulting fragmentation and complexity caused by app-specific rollups, which could degrade user and developer experiences. Through its modular rollup system and integrated technology stack, Eclipse offers an attractive option for building scalable and high-performance dApps on Ethereum.

Lumio

Lumio is a Layer 2 solution developed by Pontem Network aimed at solving Ethereum’s scalability challenges and bringing a Web2-like experience to Web3. It stands out as a unique rollup in the blockchain space by supporting both EVM and Aptos’ Move VM. This dual compatibility allows Lumio to process transactions on Aptos while settling on Ethereum, offering a versatile and efficient solution for dApp developers and users. Key features include:

-

Dual VM Compatibility: Lumio uniquely supports both EVM and Aptos’ Move VM. This dual compatibility enables seamless integration of Ethereum and Aptos functionalities, enhancing flexibility and efficiency in dApp development and execution.

-

High Throughput and Low Latency: By leveraging high-performance chains like Aptos for transaction ordering, Lumio significantly boosts transaction bandwidth. This integration ensures Lumio can efficiently handle large transaction volumes while preserving Ethereum’s security and liquidity characteristics.

-

Optimistic Rollup Technology: Lumio uses the open-source OP Stack with optimistic rollup technology. Optimistic rollups are known for efficient transaction processing and lower costs, ideal for scaling Ethereum-based applications.

-

Flexible Gas Fee Economics: Lumio introduces an application-centric gas fee model. This model allows app developers to directly benefit from network usage, potentially encouraging more innovation and user-friendly dApp development.

-

Interoperability and Integration: Lumio processes transactions on Aptos and settles on Ethereum, demonstrating high interoperability between different blockchain ecosystems. This feature enables developers to fully leverage the strengths of both Ethereum and Aptos in their applications.

-

Balancing Security and Scalability: Combining Ethereum’s strong security with Aptos’ scalability offers developers an attractive solution for building high-performance, secure dApps. Lumio’s architecture is designed to effectively balance these two critical aspects.

Lumio is currently in closed testing, with plans to gradually roll out to selected users. This approach allows thorough testing and platform refinement based on user feedback, ensuring a robust and user-friendly platform upon wider release.

Other Parallel Projects in the Industry

Solana

Solana’s Sealevel technology is a key component of its blockchain architecture, designed to enhance smart contract performance through parallel processing. This approach differs significantly from single-threaded processing in other blockchain platforms like EVM and EOS’s WASM-based runtime, which process one contract at a time and modify blockchain state sequentially.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News