From the crypto market to the broader financial market: Exchanges are no longer just selling cryptocurrencies—could TradFi become the next growth curve?

TechFlow Selected TechFlow Selected

From the crypto market to the broader financial market: Exchanges are no longer just selling cryptocurrencies—could TradFi become the next growth curve?

This article will systematically analyze the background of TradFi’s emergence, the definition and mechanisms of TradFi, and its differences from perpetual contracts.

Introduction

Over the past year, with the rise of Real World Assets (RWA) and tokenized stocks, leading crypto exchanges have increasingly brought traditional financial assets “on-platform”: gold, foreign exchange, stock indices, and commodities are now appearing within crypto account systems. Against the dual backdrop of a shifting crypto cycle and strengthening macroeconomic conditions, TradFi products have become a key weapon for exchanges to compete for trading volume, user retention, and capital retention. This represents an inevitable evolution—from a single-asset crypto trading venue to a multi-asset trading terminal.

This article systematically analyzes the background behind the emergence of TradFi, its definition and mechanics, how it differs from perpetual contracts, and focuses on dissecting two mainstream product approaches: first, the MT5/CFD brokerization path represented by Bybit, Bitget, and Gate; second, the TradFi Perps perpetualization path championed by Binance. Further, we examine the opportunities and challenges facing TradFi—including fragmented regulation, pricing risks during market closures, and risk management model limitations—and outline the future trend of exchanges evolving into “financial supermarkets”: the ultimate endgame for TradFi may not simply be listing more underlying assets, but rather the consolidation of stablecoin liquidity, cross-market capital circulation, and the reconstruction of multi-asset risk management frameworks.

I. Background Behind the Rise of TradFi

The fundamental logic underpinning this wave of TradFi expansion is straightforward: macro volatility has become a more stable trading theme; strong U.S. equities performance and major precious metals rallies have provided sustained “tradable narratives”; and the shifting crypto cycle has amplified users’ demand for “new trading content.” Meanwhile, stablecoin-based margin, unified accounts, and mature brokerage trading systems have established the infrastructure required to “distribute” traditional assets in crypto-native ways. TradFi is being treated as a new growth category—both capturing macro-driven trading demand and serving platforms’ goals of capital retention and user stickiness.

1) Macro Themes and Market Catalysts: Rising Trading Activity in Traditional Assets

Trading activity in crypto markets heavily depends on cycles and narratives, and the “shelf life” of new tokens and concepts continues to shorten. In contrast, traditional asset price movements are often driven by macro variables—offering more enduring trading rationales: interest rate expectations, inflation trajectories, geopolitical risks, and shifts in risk appetite continuously generate trends and event-driven windows for gold, FX, indices, and commodities. When U.S. equities remain strong and precious metals exhibit heightened volatility, exchanges integrating TradFi “on-platform” are effectively converting “global macro volatility” into an internal, tradable traffic funnel.

2) Evolving User Demand: Hedging and Multi-Asset Allocation Become Imperatives

As traders mature, more and more recognize that exposure solely to crypto assets binds their entire portfolio to a single risk factor—if risk sentiment reverses, all positions rapidly increase in correlation. TradFi’s appeal lies in offering lower-correlation, hedgeable asset baskets: gold absorbs safe-haven flows, FX reflects the dollar cycle, indices represent risk-asset pricing, and commodities mirror inflation and supply-demand shocks. Users want to execute these allocations on a single platform—not open multiple accounts across disparate platforms, convert margin currencies, or manually move funds between systems. Exchanges launching TradFi aren’t merely “adding another toy for users”; they’re embedding “portfolio management” as an on-platform capability—boosting user retention and extending capital dwell time.

3) Mature Infrastructure Makes TradFi “Replicable and Scalable”

Stablecoins have become de facto cross-market margin, resolving the issue of “inconsistent funding forms” in traditional asset trading; unified accounts align TradFi from “isolated systems” toward “a single pooled fund,” enhancing capital efficiency. Moreover, TradFi’s rapid rollout across multiple exchanges hinges on its replicable engineering pathways:

- The MT5/CFD route directly reuses mature brokerage infrastructure—transferring standardized rules (spreads/commissions/overnight financing, margin ratios) wholesale into the product layer, enabling fast deployment;

- The perpetualization route attempts to host traditional assets within the familiar contract framework used by exchanges, paired with stablecoin margin and unified accounts, lowering user migration costs.

4) Exchange Competition Pressure: Capturing “Global Market Volatility” and Capital Retention

As listing new spot crypto assets and launching single-contract products grow increasingly insufficient to sustain growth, exchanges must seek new sources of trading volume. TradFi’s core value lies in two dimensions:

- It brings volatility from outside crypto onto the platform—enabling exchanges to trade beyond “crypto-only narratives” and maintain tradable themes even during crypto market lulls;

- It improves capital retention efficiency—users keep USDT on-platform to trade TradFi, further fueling a trading loop between TradFi, crypto derivatives, and spot markets.

From a business logic perspective, TradFi isn’t “product embellishment”—it’s a fundamental redesign of growth architecture: transforming exchanges from single-asset venues into cross-asset, multi-category platforms competing for broader trading share.

II. Definition and Scope of TradFi

TradFi (Traditional Finance) does not allow users to “own physical stocks or gold.” Instead, exchanges package the price fluctuations of traditional assets into tradable derivatives, enabling users to trade gold, FX, indices, and commodities—macro-level assets—within unified accounts and stablecoin-margin systems. The core of this product paradigm is “trading price differentials,” not holding underlying assets or receiving associated rights.

It’s crucial to clarify that “TradFi” in the context of crypto exchanges is distinct from RWA and from tokenized stocks. Although all three point toward “traditional assets entering the crypto ecosystem,” their essential differences are stark: Exchange-based TradFi is primarily a derivative-style entry point to traditional asset price movements; RWA emphasizes on-chain ownership verification and composability of real-world assets and cash flows; while tokenized stocks involve securities rights mapping, custodial structures, and regulatory licensing—placing them in a far more sensitive compliance domain.

In terms of concrete product form, exchange-based TradFi typically covers precious metals, FX, indices, commodities, and certain equity-linked derivatives. These assets are not on-chain; instead, they enter the trading system via index-based quotation feeds—users trade price fluctuations, not physical delivery.

1. Mainstream TradFi Product Approaches

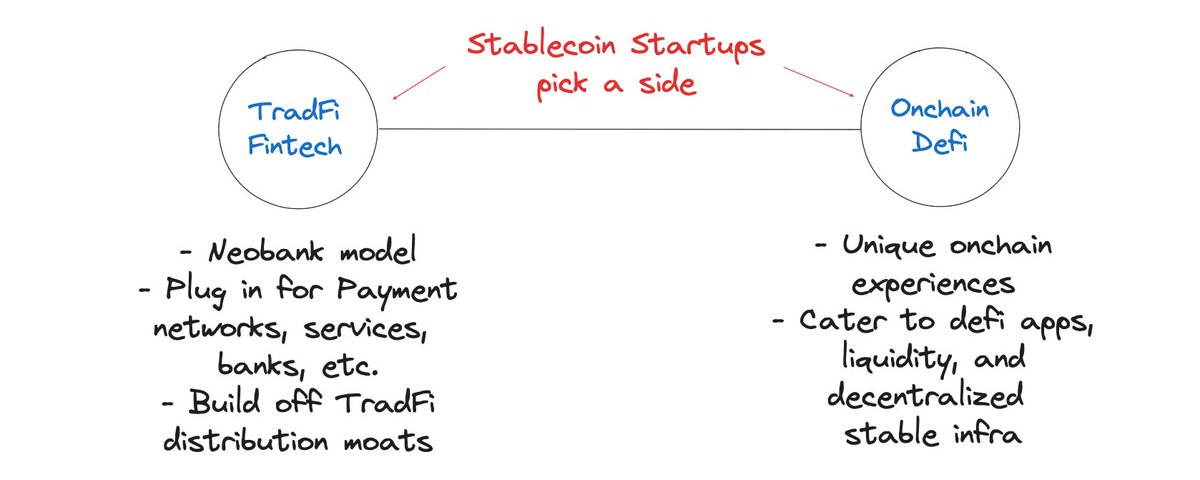

Currently, exchange-based TradFi mainly bifurcates into two paths:

(1) CFD/MT5 Path

CFDs center on “price-differential settlement”: users don’t hold the underlying asset itself but go long/short based on anticipated price rises/falls. Leverage is fixed—not manually adjustable—and cost structures generally comprise spreads, commissions, and overnight financing. They offer 24/5 trading in FX, U.S. equity CFDs, indices, and commodities. Bybit, Bitget, and Gate follow this model—the essence here is “turning the exchange into a brokerage gateway”: users activate a TradFi (MT5) sub-account to trade traditional-asset CFDs within the MT5 environment.

(2) TradFi Perpetual Contract Path

This path is more “crypto-native”: traditional assets like precious metals and equities are packaged into perpetual-like contract experiences—settled in USDT, with no expiry date—emphasizing a unified, on-exchange experience. Binance leans toward this approach, defining its TradFi perpetuals as USDT-settled contracts tracking traditional asset prices, with margin and settlement mechanisms closely mirroring existing crypto perpetuals. Key selling points include 7×24 continuous trading, USDT (and other stablecoin) margin, and adjustable leverage.

2. TradFi (MT5/CFD) Contract Mechanics

Underlying Asset: CFDs are essentially bets on price movement—no delivery involved. Profits/losses derive from price changes, not from holding equity or physical gold.

Fee Structure: Under MT5, TradFi trading fees break down into: execution costs (spread + per-lot commission) + overnight swap fees.

Trading Hours: Not 24/7. TradFi contracts operate within defined market hours and scheduled closures—introducing gap risk and overnight financing. You confront the “market closure + price gaps” rhythm of traditional markets.

Liquidation Logic: Unlike crypto perpetuals, TradFi (MT5/CFD) typically triggers liquidation based on margin ratio. A common stop-out level is 50%, after which positions may be closed progressively, prioritizing those with the largest losses.

3. TradFi (MT5/CFD) vs. Crypto Perpetual Contracts

| Dimension | TradFi (CFD/MT5 Path) | Crypto Perpetual Contracts |

| What Is Traded? | Price differentials of traditional assets (no underlying ownership, no delivery) | Crypto asset prices (perpetual derivatives, typically using mark-price mechanisms to maintain fair valuation) |

| Asset Categories | Gold/silver, FX, indices, commodities, select U.S. equities, etc. | BTC/ETH/SOL and other crypto assets, plus various altcoins |

| Trading Hours | Market hours–based (with closures/market close) | 7×24 |

| Quotation/Execution Style | Closer to “brokerage/MT5” systems (spreads, per-lot commissions, overnight fees) | Closer to “exchange order book/matching” systems (maker/taker fees, funding rates) |

| Primary Cost Structure | Spread + Per-Lot Commission + Overnight Swap Fee | Maker/Taker Fees + Funding Rate |

| Leverage Characteristics | Most instruments feature preset/fixed leverage (not freely adjustable) | Most exchanges allow manual leverage adjustment within upper limits |

| High-Risk Scenarios | Price gaps at market open + accumulated overnight fees, plus margin-ratio-triggered liquidations | Liquidations triggered by extreme market moves affecting mark price/maintenance margin; funding rates significantly impact holding costs |

| Liquidation Trigger Mechanism | Margin Level / Margin Ratio (Equity / Used Margin) | Maintenance Margin Ratio + Mark Price + Liquidation Price |

III. Comparative Analysis of Major Exchanges’ TradFi Products

As TradFi becomes a new battleground for exchange competition, top-tier platforms are exhibiting clear differentiation in product strategy and user experience. Bybit, Bitget, and Gate have opted for the MT5/CFD brokerization path, emphasizing rapid replication and strategy ecosystem development; Binance, meanwhile, pushes TradFi perpetualization—prioritizing unified access and seamless 7×24 trading. TradFi is emerging as a critical variable in exchange differentiation.

1. MT5+CFD Path

- Bybit: Leading Exchange-Based TradFi CFD Provider, Widest Range of Underlyings

On June 3, 2025, Bybit rebranded and upgraded “Gold & FX” to “Bybit TradFi,” integrating it into the Bybit App. In mid-October 2025, it launched web/desktop versions and continued expanding offerings—including equity CFDs, indices, FX, and commodities. It emphasizes allowing users to trade gold, FX, commodities, indices, and equity CFDs using USDT through one application and one wallet—eliminating currency conversion and app-switching for 24/5 diversified investment across crypto and traditional markets. Building on the MT5 ecosystem, Bybit has also developed growth levers tailored for crypto-native users—for example, TradFi Copy Trading, enabling newcomers to enter traditional finance markets via “copy-trading.”

- Bitget: Clear Categorization, Emphasis on UX

Bitget launched TradFi in December 2025, explicitly defining it as USDT-denominated CFD trading on traditional assets—covering FX, precious metals, commodities, and indices. Maximum leverage reaches 500×, though leverage is preset by asset class and non-adjustable by users. TradFi accounts are denominated in USDT; if negative-balance protection is enabled, the platform automatically resets negative balances to zero—delivering friendlier UX. Bitget disclosed that non-crypto products accounted for ~11.75% of its total January trading volume, with daily TradFi volume reaching $4 billion.

- Gate: Tiered Leverage + Perpetuals, Offering Greater Choice

Gate’s TradFi also follows the traditional-asset CFD model, with MT5 as its underlying trading system. Funds transferred from USDT are displayed internally as USDx—a platform-specific accounting unit pegged 1:1 to USDT. Its distinguishing feature is “tiered-leverage productization for precious metals”: beyond a standard 500× leverage framework, gold is offered in multiple tiers (e.g., 20×, 100×, 200×), tailoring the same underlying to diverse risk profiles. Gate reported cumulative TradFi trading volume exceeding $20 billion since launch, with peak daily volume surpassing $5 billion.

2. Perpetual Contract Path

Binance: Making TradFi “Feel Like an Exchange Perpetual”—Smoother 7×24 Trading

On January 8, 2026, Binance officially launched TradFi perpetual contracts, supporting up to 100× leverage and highlighting its pricing and risk models for 7×24 trading. Binance’s differentiation lies in “making TradFi feel like a native exchange perpetual”—emphasizing USDT settlement, unified contract access, and 7×24 continuous trading—packaging traditional assets into a format familiar to crypto users. During underlying market closures, Binance designed specialized index/mark price mechanisms and deviation constraints to support 7×24 operation: during non-trading hours, the mark price uses EWMA smoothing and enforces strict bounds on deviation from the index—reducing gap risk and abnormal liquidations.

| Dimension | Binance | Bybit | Bitget | Gate |

| Contract Form | TradFi Perpetual Contracts, USDT-settled | MT5 CFDs | MT5 CFDs | MT5 CFDs + Perpetuals |

| Asset Types | Metals, equities | Broadest coverage: metals, equities, indices, FX, commodities | Metals, indices, FX, commodities (equities listed separately—not part of TradFi) | Metals, equities, indices, FX, commodities |

| Account Requirements | No separate account needed—unified access via Binance Futures | Requires activation of TradFi/MT5 sub-account | Requires activation of TradFi/MT5 sub-account | Requires activation of TradFi/MT5 sub-account |

| Pricing Unit | USDT (TradFi asset balances included in total platform balance) | USDx (TradFi asset balances included in total platform balance) | USDT (funds transferred to TradFi account excluded from total platform balance) | USDx (funds transferred to TradFi account excluded from total platform balance) |

| Matching/Execution | Exchange futures matching; shares same margin/settlement framework as crypto perpetuals | MT5 system: STP (zero-commission, fees embedded in spread) / ECN (ultra-low spreads + per-lot commissions) account types | MT5 system, executed per CFD market rules—overnight fees, liquidation logic, etc., closely aligned with traditional CFD practices | MT5 system; executed per CFD market rules—overnight fees, liquidation logic, etc., closely aligned with traditional CFD practices |

| Trading Hours | Supports 7×24 trading, with robust pricing and risk controls during non-trading hours | 24/5 framework, aligned with underlying TradFi market hours | 24/5 framework, aligned with underlying TradFi market hours | 24/5 framework, aligned with underlying TradFi market hours |

| Fee Model | Futures trading fee model, participation via USDT | Commission per lot; additional overnight swap fee; STP/ECN account-type differentiation | Commission per lot; additional overnight swap fee | Commission per lot; additional overnight swap fee |

| Leverage Adjustment | Up to 100×, manually adjustable | Up to 500×; leverage fixed per instrument, non-adjustable | Up to 500×; leverage fixed per instrument, non-adjustable | FX/metals/indices up to 500×; gold offers tiered leverage (e.g., 20×/100×/200×), adjustable via contract interface |

IV. Challenges and Opportunities for TradFi

Macro-asset volatility presents TradFi with fresh trading themes and product narratives—and marks a pivotal opportunity window for the crypto industry’s maturation and transition toward multi-asset platformization. Yet TradFi’s expansion across exchanges is not frictionless. Regulatory fragmentation, pricing risks during market closures, technical/risk-control coupling, and user cognition shifts mean TradFi cannot simply replicate the growth patterns of crypto derivatives.

Opportunity Windows for TradFi

1. Macro-Asset Volatility as a “Trading Theme” for Crypto Users

Crypto markets’ traditional growth engine relies on “new tokens, new narratives, new cycles.” In contrast, gold, FX, indices, and commodity moves are driven by macro variables and events (interest rate expectations, inflation data, geopolitical risk, risk appetite shifts)—making them inherently more “explainable” and conducive to sustained trading rationale. This means TradFi can serve as a stabilizer against “altcoin-cycle volatility”: when crypto narratives cool, macro themes persist—and exchanges can retain users on-platform via TradFi.

2. Web3 Integration Enables New Product Narratives

The crux of Web3 integration lies in potentially rewriting TradFi’s “funding and collateral forms.” As RWAs/tokenized assets mature, TradFi need not remain permanently siloed in MT5’s “island accounts.” It could achieve stronger composability with on-chain assets: on-chain yield-bearing assets could serve as margin; on-chain risk profiling could enable layered leverage; on-chain clearing and settlement could reduce dependence on monolithic systems.

3. Transitioning TradFi from “Opportunity-Driven” to “Habit-Driven”

TradFi (especially the MT5 ecosystem) excels in mature strategy ecosystems—essentially offering professional strategy-oriented users a calculable cost framework. Once exchanges embed TradFi strategy templates, copy-trading, risk alerts, and portfolio margining as “default capabilities,” TradFi evolves beyond opportunistic speculation during market moves—and becomes users’ daily habit: trend-following, arbitrage, hedging, and event-driven trading all consolidate into persistent volume.

4. Experience Certainty May Build Stronger User Trust

A long-standing critique of crypto derivatives is volatile funding rates and unpredictable risk parameters—making cost forecasting difficult for traders. By contrast, MT5/CFD cost structures align more closely with traditional finance norms (spreads/commissions/overnight fees), offering greater transparency. If exchanges pre-visualize TradFi costs, liquidation thresholds, and closure-risk warnings before order placement, they may differentiate themselves via “experience certainty”—attracting rational, strategy-focused capital away from crypto perpetuals.

Real-World Challenges Facing TradFi

1. Regulatory Uncertainty and Regional Fragmentation

Regulatory Uncertainty: CFDs are subject to intense scrutiny across most jurisdictions globally. For instance, the EU’s ESMA CFD intervention imposes tiered retail leverage caps (30:1 down to 2:1), mandates 50% margin-based liquidation, requires negative-balance protection, restricts inducement marketing, and enforces mandatory risk disclosures. The same product’s availability, permitted leverage, permissible marketing language, and even risk-control parameters may differ across regions—creating multiple localized versions. Exchanges attempting to deploy “one global product” for growth will face friction across the full funnel—listing, promotion, conversion, and retention—either forced to reduce leverage (diminishing appeal) or constrained by compliance (shrinking addressable markets), ultimately resulting in “can do, but can’t scale.”

2. Pricing and Liquidity Gaps During Non-Trading Hours

The CFD/MT5 path adheres to traditional market hours, entailing scheduled closures and market closes: users bear overnight financing (swap/overnight fee) and “gap risk”—information accumulating during closures manifests instantly at open, risking worse-than-intended fill prices for stop-loss orders. While the perpetualization path (e.g., Binance’s TradFi Perps) ostensibly offers 7×24 continuous trading, risk doesn’t vanish—it shifts to “model risk”: when underlying markets close, how index price, mark price, funding cost, deviation constraints, and liquidation parameters are set determines whether users face abnormal liquidations, extreme slippage, or unreasonable holding costs.

3. Technical and Risk-Control Coupling Risks

MT5/CFD liquidation logic typically revolves around margin levels—users monitor Margin Level / Margin Ratio, not the crypto-perpetual-familiar “mark price / liquidation price.” This poses significant cognitive overhead for many crypto-native users: despite identical leverage trading, risk metrics are entirely different. Adding unified accounts, multi-asset margin, and cross-category hedging compounds opacity—risk exposure becomes harder to interpret, easily triggering cascading liquidations and user dissatisfaction during sharp market moves.

4. Entry Friction and Scalable Conversion Challenges

TradFi acquisition naturally relies on strong stimuli—macro hotspots, large gold price swings, index rallies—but conversion faces real-world bottlenecks: users often must complete extra onboarding steps, undergo additional risk disclosures, and pass regional compliance checks; some platforms require standalone TradFi/MT5 accounts—segregated from original crypto accounts—creating “entry friction.” This explains why Binance’s decision to integrate TradFi Perps directly into its existing futures interface—with no separate account requirement—confers a distinct growth advantage: it lowers friction cost from emotional impulse to order execution.

V. Outlook and Conclusion on TradFi Evolution

Future TradFi evolution on exchanges will extend beyond “listing more underlyings,” evolving into systemic competition across product form, regulatory stratification, and risk-control experience—driving stablecoin consolidation and cross-market circulation to forge new exchange moats.

TradFi Evolution Outlook

1. Product Forms Will Continue Diverging—Yet Cross-Pollinate

The MT5/CFD path will strengthen “low-barrier strategy enablement”: making copy-trading, strategy templates, cost calculators, margin alerts, and pre-trade risk simulations standard features—lowering learning curves for traditional rules. Simultaneously, it will expand categories (indices/commodities/equity CFDs), institutionalizing macro themes as evergreen entry points. The perpetualization path will broaden underlying coverage and refine closure-hour risk controls: Binance has already disclosed its closure-hour pricing mechanism (fixed index, EWMA-smoothed mark price, deviation constraints); next, the critical step is “productizing” these rules—letting users understand upfront what happens during closures, how costs evolve, and how liquidation thresholds dynamically adjust.

2. Compliance Shifts from “Can We Do It?” to “How Do We Stratify It?”

Regulatory direction is largely clear: region-specific product distribution, stricter risk disclosures and suitability assessments, restrictions on inducement incentives, and standardized risk warnings. For exchanges aiming to build TradFi as a sustainable business, the shift must be toward compliance zoning + risk-layering + leverage-tiering: the same user sees different tradable categories, leverage ceilings, and warning formats across regions and risk profiles—even marketing materials must be “compliance-generated.” Compliance ceases to be mere legal cost—it becomes foundational architecture for product and growth.

3. Transitioning from Volume-Driven to Asset-Consolidation-Driven

TradFi’s true value isn’t adding another category—it’s encouraging users to retain USDT on-platform, enabling cross-market circulation: macro-asset volatility provides trading motivation; crypto assets provide high-frequency, 7×24 environments; stablecoin consolidation anchors traditional-asset trading. Long-term, TradFi will deeply bind with platform-wide unified accounts, risk models, market-making depth, and user segmentation—forging stronger moats.

4. Shifting from “Single-Product Trading” to “Portfolio-Level Risk Control”

Next-stage competition likely won’t hinge on “who lists the most TradFi underlyings,” but on who best transforms TradFi into a portfolio tool—using gold/U.S. Dollar Index positions to hedge crypto risk, or using index trends to replace high-Beta altcoin exposure. This demands platforms deliver enhanced portfolio margin explanations, correlation alerts, stress testing, and position recommendations.

Conclusion

TradFi’s rise on crypto exchanges marks a pivotal shift—from “single-asset crypto narratives” toward “multi-asset financial supermarkets.” It frees exchanges from sole reliance on crypto cycles, enabling them to capture broader macro-driven trading demand. For investors, TradFi’s significance extends beyond more leveraged options—it introduces new portfolio tools and risk-management methodologies: hedging crypto positions against systemic risk using macro assets, replacing pure-narrative speculation with more interpretable market themes. The true winners of the next competitive phase may not be platforms listing the most underlyings—but those building TradFi into “sustainable, explainable, trustworthy” multi-asset risk-control systems—because what ultimately endures is never the most thrilling leverage, but the most stable experience and clearest rules.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is committed to transforming professional analysis into your practical trading edge. Through our “Weekly Insights” and “Deep Dive Reports,” we decode market dynamics; via our exclusive column “Hotcoin Select” (AI + expert dual screening), we identify promising assets—reducing trial-and-error costs. Each week, our researchers engage you live via live streams, interpreting hot topics and forecasting trends. We believe that warm, consistent companionship coupled with professional guidance empowers more investors to navigate cycles and seize Web3’s value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News