Interview with Plume Founder and CEO: Building the TradFi ⇋ DeFi Bridge with RWAfi, Mainnet and Token TGE Approaching

TechFlow Selected TechFlow Selected

Interview with Plume Founder and CEO: Building the TradFi ⇋ DeFi Bridge with RWAfi, Mainnet and Token TGE Approaching

Follow Chris's insights to explore Plume's more practical and feasible approach to RWAfi.

Author: TechFlow

Looking at this market cycle, the crypto space appears to have split into two distinct directions:

One led by MEMEs—ignoring real-world utility, heavily speculating on narratives, and creating a frenzied boom;

The other represented by the RWA sector, treating mass adoption as doctrine and seeking tighter integration between the real world and the crypto ecosystem.

Indeed, RWA is one of the fastest-growing niche sectors this year. According to Binance Research's September report titled "RWA: A Safe Haven for On-Chain Yields?":

The total value of on-chain RWAs has reached $12 billion, not including the $175 billion stablecoin market. Meanwhile, institutions and traditional financial players are increasingly participating in RWA.

We know that RWA aims to bring real-world assets onto blockchains. But why tokenize them? The answer is clear: to leverage decentralization for more efficient, transparent transactions and more attractive yields. It is precisely for this reason that the concept of RWAfi has emerged.

Although the demand for RWAfi is very clear, implementation remains challenging due to technical barriers, regulatory hurdles, and issues around broad applicability. How can we support a wider variety of assets being tokenized? How do we increase the utility of tokenized assets? And how can we achieve deeper integration of RWA assets with DeFi use cases?

To address these questions, we had an in-depth conversation with Chris Yin, Founder and CEO of Plume Network.

As the first modular blockchain specifically designed for RWA, Plume aims to simplify the complex deployment process for RWA projects by embedding compliance and asset tokenization directly into the protocol layer. By leveraging its thriving ecosystem of DeFi applications, Plume enables composable RWAfi solutions and provides investors with a platform for interaction.

When asked about "why RWAfi needs a dedicated blockchain," Chris stated:

Our value lies in bridging the traditional finance (TradFi) world with the decentralized finance (DeFi) ecosystem, providing RWAfi tools that are both user-friendly and meet institutional standards.

Regarding Plume’s remarkable achievement of attracting over 3.26 million users and generating 129 million interactions within just one month of launching its testnet, Chris shared further plans:

We are about to launch our mainnet, followed closely by our Token Generation Event (TGE). The mainnet will support institutional-grade tokenization, RWAfi applications, and cross-chain integration, serving as a comprehensive solution for RWAfi.

In this article, let’s explore Plume’s practical and feasible approach to realizing RWAfi through Chris’s insights.

Built for RWAfi: The Necessity and Customization of Plume’s Dedicated Chain

Plume Network ushers in a new era for blockchain technology in the realm of real-world assets (RWA).

TechFlow: It’s great to have this opportunity for an in-depth discussion. Could you briefly introduce yourself and share your motivation behind founding Plume Network?

Chris:

Hello everyone, I’m Chris Yin, Founder and CEO of Plume Network. I’m excited to have this chance to engage deeply with you all.

I’ve always been fascinated by the intersection of technology and finance—a builder and investor alike. Throughout my career, I’ve experienced the ups and downs of startups. After working at Beluga and investing in multiple early-stage companies, I realized that real-world assets (RWAs) hold tremendous potential but lack the infrastructure to integrate with decentralized finance (DeFi). That’s why Plume is the first RWAfi blockchain designed to bridge RWA and DeFi.

Fortunately, this vision aligned perfectly with our Co-Founder and CBO Teddy. With his experience at Coinbase and BNB Chain, he brought valuable industry connections and expertise. Combined with my background building products at companies like Rainforest QA and Coupa, we founded Plume Network.

Our goal is to build a modular blockchain that allows institutions to tokenize assets while ensuring compliance and scalability—filling a critical gap in the market.

TechFlow: Plume is a blockchain network specifically designed to advance RWA development. Why does RWAfi need a dedicated blockchain? What value does Plume bring to the market?

Chris:

RWA requires a unique approach to developing its RWAfi ecosystem because RWA assets must comply with real-world legal and regulatory frameworks. Drawing from my experience in enterprise software, I understand how to handle institutional-grade data and assets—hence, RWA needs a dedicated blockchain.

Plume provides institutions with a secure and compliant infrastructure, while also meeting the needs of crypto-native users. Our value lies in bridging the traditional finance (TradFi) world with the decentralized finance (DeFi) ecosystem, offering RWAfi tools that are both easy to use and meet institutional standards.

TechFlow: How does Plume’s customization around RWA help participants enter the market?

Chris:

Plume’s mission is to simplify and revolutionize the way RWAs are introduced on-chain.

We’ve integrated compliance, custody, and tokenization services, lowering entry barriers so both institutional investors and individual users can easily participate in the RWA ecosystem.

For institutions, this means they can seamlessly bring assets like real estate and bonds onto the blockchain without worrying about complex regulations. For retail users, Plume enables these tokenized assets to be used within DeFi apps, enhancing liquidity and transaction ease for RWA assets.

TechFlow: Can you outline Plume’s ecosystem and future focus areas?

Chris:

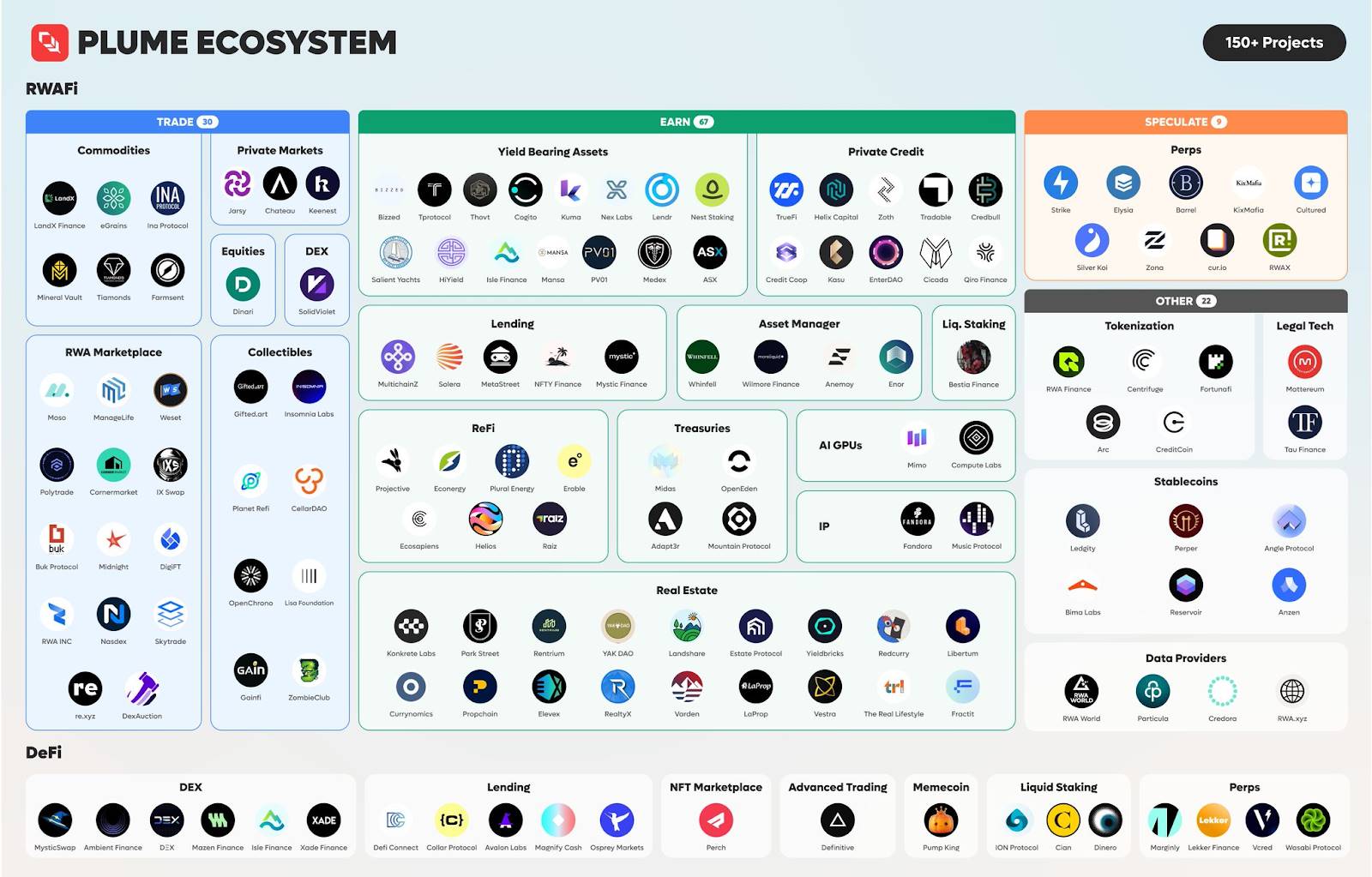

We’ve expanded the concept of RWA to include collectibles and alternative assets, opening up new opportunities for investors. Currently, Plume supports over 170 projects spanning tokenized bonds, real estate, and collectibles across various use cases.

Our future focus will be deepening integration within the RWAfi space and expanding our Data Highway network to bring real-world data on-chain.

Focusing on RWAfi: Enabling Efficient RWA Mobility

Plume’s core focus is RWAfi: bringing real-world assets into the crypto space.

TechFlow: Recently, Plume successfully joined the Tokenized Asset Coalition (TAC). What is the Tokenized Asset Coalition (TAC), and what are Plume’s goals in joining?

Chris:

TAC brings together forward-thinking companies committed to advancing innovation in RWA tokenization.

Through TAC, we can collaborate with industry leaders such as a16z, Coinbase, Circle, and BlackRock to accelerate RWAfi adoption and deepen the integration between real-world assets and the RWAfi ecosystem.

TechFlow: How can ordinary users participate in RWA, and what makes Plume appealing to them?

Chris:

Through RWAfi, ordinary users can access stable real-world yields and diversify their investment portfolios. Plume not only tokenizes these assets but also enables composability within the RWAfi ecosystem, allowing users to easily trade and lend these assets.

Our goal is to enable seamless participation in the RWA ecosystem for all users.

TechFlow: With RWAfi as Plume’s core philosophy, what challenges has Plume faced during RWAfi implementation, and how have you turned them into advantages?

Chris:

One of the biggest challenges in implementing RWAfi is the complexity of compliance and regulation.

By embedding compliance and custody features directly into the Plume network, we meet strict institutional requirements while maintaining flexibility for RWAfi applications. This dual-mode approach differentiates us in the market.

TechFlow: Could you provide a specific example from the ecosystem to help readers better understand the concrete advantages of RWAfi in attracting user participation on Plume?

Chris:

A typical example is our work in real estate asset tokenization.

By fractionalizing real estate assets into tokens, we allow more investors to enter the real estate market with smaller capital. These tokenized assets can also serve as collateral in RWAfi lending protocols, providing users with enhanced liquidity and flexibility.

With Rate Cuts Approaching: Plume’s RWA Strategy

How does Plume strategically position itself amid changing economic cycles?

TechFlow: How do you view the upcoming rate cut cycle and market trends, and how will Plume respond?

Chris:

Rate cuts typically increase market liquidity, which benefits RWA—especially in environments where investors seek stable returns.

Plume will capitalize on this trend by offering tokenized assets that generate real-world yields, positioning RWA as a viable alternative to traditional bonds or savings accounts.

TechFlow: Does Plume have customized strategies or expansion plans for the Asian and Chinese-speaking markets?

Chris:

Asia, especially China, is one of our key growth markets. We’ve established teams in the region and built partnerships with local traditional financial institutions and government bodies.

We’ll focus on delivering localized RWA solutions that meet regional regulatory requirements and user preferences.

Testnet Success Paves Way for Mainnet and TGE

Plume Network has achieved significant success on testnet and is now preparing for its next major milestone.

TechFlow: What factors contributed to the success of Plume’s testnet?

Chris:

Key factors behind the testnet’s success include our modular technical design, strong community engagement, and deep integration with other DeFi protocols within the RWAfi ecosystem.

TechFlow: Can you share more details about the mainnet launch and TGE?

Chris:

We are about to launch our mainnet, followed closely by our TGE. The mainnet will support institutional-grade tokenization, RWAfi applications, and cross-chain integration, serving as a comprehensive solution for RWAfi.

TechFlow: How can regular users and developers better engage with Plume Network?

Chris:

For users, the best way to get involved with Plume right now is by exploring the RWAfi ecosystem projects deployed on our testnet. Once the mainnet launches, we’ll roll out staking rewards, trading events, collectible campaigns, and more for users.

For developers, we offer comprehensive SDKs and APIs that enable them to build RWAfi solutions on Plume’s modular architecture or integrate with existing DeFi protocols. Stay tuned for our official mainnet launch date.

TechFlow: What are Plume’s primary goals and roadmap for next year?

Chris:

Over the next year, Plume will focus on expanding our ecosystem, deepening integration with DeFi protocols, and advancing our Data Highway to enhance the interaction between real-world data and blockchains.

We’ll also launch platform-specific products, such as Mini Apps on Telegram. Additionally, we plan to introduce more tokenized assets with a particular focus on alternative assets and collectibles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News