Solana Under the TradFi Logic: How High-Performance Blockchains Impact the Traditional Financial System?

TechFlow Selected TechFlow Selected

Solana Under the TradFi Logic: How High-Performance Blockchains Impact the Traditional Financial System?

High-performance blockchains represented by Solana may completely revolutionize traditional financial markets.

By OSL

Is blockchain a disruptor of the traditional financial system, or a catalyst helping TradFi leap forward?

The answer may not be binary. On one hand, blockchain technology has indeed brought significant disruption to traditional finance—potentially eliminating cumbersome intermediaries, reducing transaction costs, and improving efficiency through smart contracts, thereby minimizing human error and fraud risks. In this sense, it holds transformative potential.

On the other hand, blockchain can also empower traditional finance by enabling more efficient and secure solutions. For example, in areas such as cross-border payments, securities trading, and supply chain finance, blockchain supports digital transformation, enhances service quality, and strengthens competitiveness—acting as an enabler for TradFi’s evolution.

However, this requires robust blockchain infrastructure capable of supporting killer applications. At the recent Solana Breakpoint conference, Jump Crypto officially launched Firedancer—their new Solana validator client—on mainnet (non-voting mode). During internal testing, it achieved up to 1 million TPS, far surpassing Solana's current theoretical limit of tens of thousands of TPS. This breakthrough appears sufficient to meet the demands of all high-frequency trading applications, providing stronger technical support for blockchain adoption in traditional finance.

Great winds rise from still waters. In the long term, Solana, as a representative of high-performance public blockchains, could solve the "last mile" problem in integrating traditional finance with blockchain, opening up entirely new possibilities for TradFi.

A New Web3 Trend in Traditional Finance

Before proceeding, consider this question: What has been the most successful crypto financial product globally over the past five years?

The answer is not hard to guess. It’s neither Uniswap nor other DeFi innovations that sparked the DeFi Summer, nor NFTs like CryptoPunks that ignited the digital art craze. Instead, it’s something we’ve come to take for granted: stablecoins.

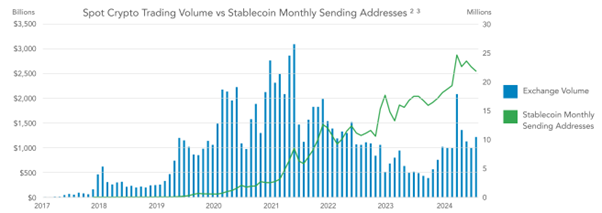

Indeed, beyond niche applications like DeFi and NFTs, stablecoins have become one of the most widely adopted use cases for both crypto and non-crypto users alike—TRC20-based accounts alone exceed 40 million. Stablecoins have transformed blockchain and crypto economies from being exclusive playgrounds into accessible tools for the masses, dramatically expanding and deepening user adoption.

According to the report "Stablecoins: The Emerging Market Story", stablecoin usage now extends well beyond serving just crypto traders. In the first half of 2024 alone, approximately $2.62 trillion was settled via stablecoins, annualizing to $5.28 trillion, covering broader financial needs including currency exchange, goods payments, remittances, and salary disbursements.

The reason is simple: stablecoins offer a powerful entry point for users who need better cross-border transactions and payment solutions within traditional finance. Blockchain-based payments drastically reduce transaction costs and improve overall efficiency in cross-border transfers—reducing delays and overcoming the complexity and high fees associated with legacy systems—making international payments easier, faster, and more reliable for individuals and businesses alike.

Put simply, crypto-based global payment services like USDT have become essential—“unnoticed when present, painfully missed when gone.” This reflects the current reality of how traditional finance is merging with Web3:

Despite decades of development and a relatively mature architecture, traditional finance shows clear limitations when confronting globalization and emerging technologies—high cross-border transaction fees, slow settlement times, and complex regulatory hurdles hinder efficient economic flow.

Web3, with its decentralized, fast, and user-friendly ethos, offers fresh ideas and directions for transforming traditional finance.

Solana Is Accelerating Into TradFi

As a high-performance blockchain platform, Solana’s characteristics—high throughput, low latency, and scalability—give it a major edge in processing financial transactions, meeting traditional institutions’ demands for speed, security, and reliability.

Data-wise, Solana’s first growth wave came after the 2023 Solana Foundation Breakpoint annual event. Prior to October 2023, daily paying users—a key metric of ecosystem activity—hovered between 80,000 and 100,000.

The Breakpoint conference in late October to November 2023 triggered the first surge. Subsequent events like the JTO airdrop and Coinbase listing BONK further boosted growth, pushing the number up more than fivefold—to around 500,000.

Since 2024, Solana has continued accelerating into TradFi amid rapid fintech innovation, bringing transformative opportunities to the financial sector.

The Underlying Logic of PayFi on Solana

PayFi is a prime example—essentially building diverse financial applications (Fi) centered around the act of “payment” (Pay).

Lily Liu, Chair of the Solana Foundation, put it clearly: "PayFi aims to fulfill Bitcoin’s original vision of peer-to-peer payments. It’s not DeFi—it creates new financial primitives centered on the time value of money."

Currently, PayFi on Solana remains largely unexplored—a blue ocean. Lily Liu highlighted several potential use cases:

- Buy Now Pay Never (BNPN): Unlike installment plans, BNPN works by depositing funds into a DeFi lending protocol to earn yield, using the interest to cover purchase costs—effectively sacrificing liquidity. For example, a user buys a $1,000 TV but deposits $10,000 into a DeFi lending product. Over time, the accrued interest reaches $1,000, at which point the system automatically pays for the TV and returns the remaining principal;

- Creator Monetization: Suppose an artist creates a painting expected to sell for $5,000 in two months. Using PayFi, they can discount and receive $4,500 immediately, allowing them to access working capital for materials or living expenses without waiting;

- Accounts Receivable Financing: A small business delivers goods worth $20,000 but faces a long customer payment cycle, straining cash flow. By pledging the receivable to a financing firm, they receive $18,000 upfront, ensuring smooth operations regardless of client delays.

Imagine, too, a world where salaries are paid daily—or even hourly based on work output—or where you pay per minute while watching videos or listening to music. What would that look like?

In short, leveraging smart contract programmability, Solana’s high performance and low transaction costs enable micro, frequent, streaming payments—scenarios impossible under traditional settlement systems. Previous attempts at streaming payments stalled due to Ethereum’s high gas fees and performance bottlenecks.

Comprehensive Optimization of Traditional Financial Trading Systems

Beyond payments, traditional financial markets demand high volume and speed. Solana’s high throughput makes it ideal for moving large-scale trading onto the blockchain for faster, more decentralized processing.

Securities markets are a direct fit. Millions of stock and bond trades occur daily, and legacy systems often face congestion during peak hours, causing delays. Solana can process millions or even tens of millions of transactions in seconds, ensuring timely execution.

Once Firedancer rolls out fully, Solana’s peak throughput could reach hundreds of thousands of transactions per second—far exceeding traditional financial systems’ capabilities, offering institutions a more efficient alternative that reduces wait times and boosts market liquidity.

In finance, time is money. Low latency is critical for rapid decision-making and trade execution. Solana’s near-instant confirmation—within milliseconds—delivers real-time trading experiences.

Take forex trading: exchange rates fluctuate constantly. Traders must react instantly. Solana’s low latency ensures trades execute in the shortest possible time, avoiding missed opportunities. It also reduces market risk and improves transaction safety.

Scalability Meets Growing Financial Demand

As financial markets grow, traditional institutions face increasing pressure on their systems. Solana’s scalability allows seamless adaptation to rising transaction volumes and expanding business needs.

With the rise of digital currencies, more traditional institutions are entering the space. Solana provides a stable, reliable blockchain infrastructure for trading, storing, and managing digital assets. It can also integrate with legacy systems, enabling cross-chain transactions and asset transfers—unlocking new innovation opportunities.

Projects like PYUSD on Solana are already delivering new business models and revenue streams for traditional finance, offering customers higher-yield savings and convenient lending services: Since PYUSD launched on Solana, its supply has grown 271%, with 88% of total PYUSD now on Solana.

From this perspective, integration with Solana’s DeFi ecosystem helps traditional institutions boost competitiveness and meet growing demand for diversified financial services.

Supply Chain Finance and Asset Tokenization

Solana’s blockchain enables transparent, traceable records for supply chain finance, reducing credit risk. In international trade, for instance, Solana can track shipping, warehousing, and transaction data, giving all parties real-time visibility into goods and fund flows. This increases supply chain efficiency, lowers financing costs, and opens better funding avenues for SMEs.

Moreover, according to BCG, the tokenized asset market could reach $16 trillion by 2030—equivalent to 10% of global GDP. Solana can tokenize traditional assets like real estate and artwork, digitizing them to enhance liquidity, lower investment barriers, and increase value.

Cross-Border Settlement

As discussed previously in "Re-examining Crypto Transactions: A New Take on Liquidity Revolution in Traditional Finance", traditional cross-border payment systems suffer from several inherent flaws:

- First, involving multiple correspondent banks leads to lengthy, multi-step processes, resulting in settlement times of several days (T+N). In an era where real-time transactions are standard, this inefficiency is glaring;

- Second, each intermediary charges fees, significantly increasing the total cost for senders. These costs and delays are particularly burdensome for businesses managing cash flow and individuals sending money to family abroad;

- Third, complex and varying regulations across jurisdictions create additional challenges. Over extended periods, unpredictable exchange rate fluctuations further compound these issues.

In short, the current interbank payment system is broken. There’s urgent demand for innovative solutions that offer faster, cheaper, and more reliable cross-border payments to keep pace with global trade—and blockchain-based settlement is inherently better positioned to deliver.

Among blockchain options, Solana stands out—not merely by speeding up bank transfers, but through its combination of low latency, high throughput, and programmable smart contracts, fundamentally transforming how money moves. It enables diverse transaction forms between individuals, merchants, supply chains, and financial institutions—precisely quantifying every economic activity as streaming payments, enabling instant, automated settlements—a uniquely Web3 financial paradigm.

Conclusion

In summary, Solana is rapidly penetrating traditional finance with its high throughput, low latency, and scalability, driving innovation and creating new opportunities. As technology advances and adoption grows, Solana is poised to become a key driver in the digital transformation of traditional financial institutions.

Recently, OSL officially launched Solana (SOL) trading for professional investors, aiming to provide valuable investment opportunities.

As the Web3 industry continues evolving, we will undoubtedly see Solana deliver more and better solutions to traditional finance and the world at large—and it may very well emerge as a central narrative in the next bull market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News