CryptoAI Summit 2025 concludes successfully: High-energy clash between TradFi x Crypto ignites Wall Street

TechFlow Selected TechFlow Selected

CryptoAI Summit 2025 concludes successfully: High-energy clash between TradFi x Crypto ignites Wall Street

This is a high-density intellectual collision connecting tradition and the future, capital and technology.

On May 10, 2025, the CryptoAI Summit 2025, hosted by Bitpush and co-organized by TCFA, concluded successfully in New York.

The summit centered on "the convergence of AI and crypto," bringing together nearly 30 experts from leading institutions including Coinbase, Citigroup, Cantor Fitzgerald, MSCI, Columbia, and the Solana Foundation to discuss cutting-edge topics such as digital assets, artificial intelligence, regulatory trends, Web3 infrastructure, and investment ecosystems.

This was a high-density intellectual collision connecting tradition with the future, capital with technology—packed with insights throughout the day and energized by an electric atmosphere.

Opening Remarks

Joint opening remarks by Bitpush Managing Editor May Liu and TCFA Chairperson Joy Zhang officially kicked off the summit, emphasizing the necessity and urgency of cross-industry dialogue, urging the financial and innovation communities to “break boundaries and move toward integration.”

Keynote: Global Trading in the Digital Asset Era

Keynote speech delivered by John D’Agostino, Head of Strategy at Coinbase Institutional, moderated by Joy Zhang.

John explored how institutional capital is adapting to structural shifts in the crypto era. From macro policies, fund flows, and market structure evolution, he provided an in-depth analysis of traditional institutions’ entry logic and risk appetite amid the convergence of AI and crypto. He shared insights on the strategic shift from Wall Street to crypto-native firms, noting that clearer regulation is a prerequisite for large-scale institutional adoption.

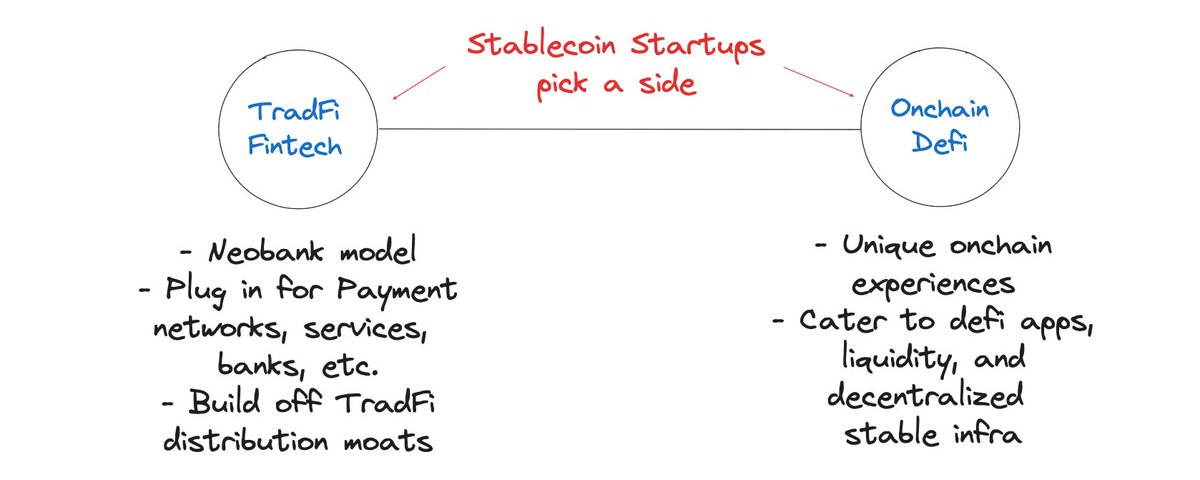

John highlighted that stablecoins, on-chain settlement, and AI-driven trading systems will be key areas of focus for capital markets in the coming years.

Panel 1: Regulation and Deregulation—Crypto Challenges in the Trump Era

Moderated by Wilfred Daye (Sylvanus CEO), with panelists Ivan Zhang, Co-founder of PennyWorks; Jue Wang, Legal Director at BitMart; Hao Wu, CEO of Clouder Power; and Winston Ma, Co-founder of Dragon AI.

The discussion covered stablecoin legislation, U.S. state-level Bitcoin reserve policies, sovereign fund investment trends, and the legalization prospects of DeFi. Panelists noted, “U.S. crypto regulation is like an onion—layered and intertwined—but the direction is clear: institutionalization.”

Fireside Chat: Reimagining the World of AI + Crypto

A remote conversation between Citigroup Managing Director and TCFA President-Elect Maggie Wang and Cantor Fitzgerald’s Global Director of Electronic Trading Kathryn Zhao.

Kathryn analyzed the bidirectional relationship between AI and crypto—from trading operations, cross-asset arbitrage, and AI agent applications—on how AI enhances user experience in crypto, while crypto reciprocally strengthens trust mechanisms in AI models. Her concept of “AI agents + blockchain identity verification” sparked widespread interest.

Panel 2: Crossing AI Boundaries—Innovation Trends and Real-World Challenges

Moderated by Maggie Wang, with panelists Columbia Professor Zhou (Jo) Yu, former Senior Director of Analytics and AI at Ally Tao Cheng, PhD, DistributedApps.ai CEO Ken Huang, and NBW CTO Dr. Jay Zou.

From perspectives such as “large model development,” “decentralized computing networks,” and “privacy-preserving data training,” panelists envisioned a democratized future for AI. Jo Yu emphasized, “The next generation of AI tools should be shaped collectively by developers and communities—not dominated by monopolies.”

Panel 3: Ethereum vs. Solana—The Web3 Performance Battle

Moderated by Coinbase AI Product Lead Lincoln Murr, with BitFi Founder Han Liu, Solayer Founding Engineer Chaz, and Solana Foundation Growth Lead Jiani Chen engaging in a technical debate.

From TPS to developer ecosystems, Solana advocates championed “performance and cost-efficiency,” while Ethereum supporters stressed “stability and security.” Panelists agreed that whoever integrates the strongest liquidity will win long-term developer loyalty. The sharp exchange became the most technically intense session of the summit.

Panel 4: Hunting the Next 100x Token—The Art of Speculation

Moderated by MetaEra CEO Jessica Y, with panelists Third Eye Co-CIO Tian Zeng, AscendEX Chairman George Cao, and OORT CTO Sichao Yang.

Panelists acknowledged, “Speculation isn’t inherently wrong—edge in cognition and information asymmetry is the real alpha.” In this narrative-driven market, institutions prefer structured products for high-volatility assets, while retail investors must focus on position management. Knowing how to “enter early,” “choose correctly,” and “hold through volatility” has become a shared challenge for both retail and institutional players.

Panel 5: Venture Capital in the Age of AI and Crypto

Moderated by renowned entrepreneur and investor Bianca Chen, with SNZ Capital Partner Keith Chen, Palm Drive Capital Founding Partner Seamon Chan, and Satoshi Lab Founder Elaine Yang sharing their investment insights.

All agreed that today’s VCs must understand AI model architectures, on-chain incentive mechanisms, and human behavior. The fusion of AI and crypto is reshaping fundraising rhythms and project evaluation frameworks. Additionally, Middle Eastern and Asian sovereign funds are re-entering the Web3 investment pipeline, particularly focusing on AI infrastructure and Layer1 protocols.

Panel 6: AI Agents + Meme Coins—The Next-Gen Market Makers?

Moderated by Abel AI Founder & CEO Stephen Wang, with panelists NYU Professor Xi Chen, SOON Network CEO Joanna Zeng, Protego Trust CIO Weiyee In, UCSD Professor and Abel.ai CTO Biwei Huang.

Meme culture × AI trading agents emerged as a new narrative focal point. Discussions spanned “Can AI serve as an on-chain assistant?”, “Can memes evolve into cultural assets?”, and “Will intelligent agents alter market microstructures?” Beyond core themes, panelists also delved into AI model security, data misuse, and mechanisms for verifying AI trustworthiness. There was consensus that transparency, verifiable behavior, regulation, and data traceability of AI agents will be critical for the future integration of AI and finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News