Consensus Live | Avenir Group, Tiger, AMINA, and CoinRoutes Discuss Institutional Capital Efficiency and Financial Infrastructure Evolution

TechFlow Selected TechFlow Selected

Consensus Live | Avenir Group, Tiger, AMINA, and CoinRoutes Discuss Institutional Capital Efficiency and Financial Infrastructure Evolution

All parties reached a core consensus: the industry must shift from an “asset-centric” infrastructure framework to a “capital-centric” framework.

At Consensus Hong Kong 2026, the narrative focus of institutional investors is undergoing a structural shift. As regulatory frameworks mature, digital assets have rapidly transitioned from exploratory allocations to core components of institutional portfolios. Yet this move toward multi-asset allocation has also surfaced a new theme: while portfolios expand across asset classes, cross-system friction is eroding capital efficiency.

Avenir Group—a global investment firm dedicated to bridging traditional finance and digital assets—observed that as institutional participation scales, infrastructure maturity increasingly determines capital efficiency. As an official partner of Consensus Hong Kong 2026, Avenir Group hosted a roundtable titled “Next-Generation Institutional Trading Infrastructure.” Industry leaders from Tiger Brokers (a leading global tech-enabled brokerage), AMINA Bank AG (“AMINA Bank”)—a Swiss crypto bank licensed by FINMA—and CoinRoutes—a leading multi-asset institutional trading platform—systematically dissected the root causes limiting institutional capital efficiency in multi-asset environments and jointly explored potential evolutionary pathways.

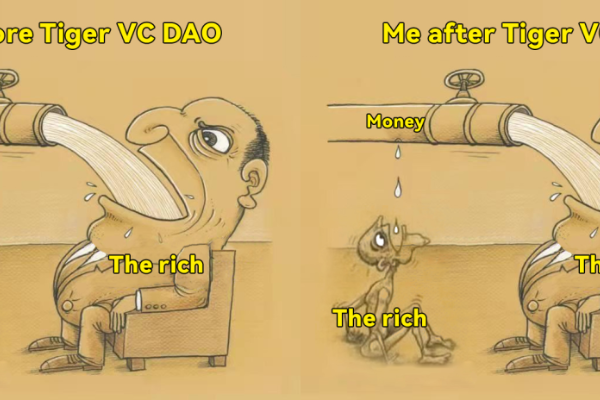

Industry Consensus: A Foundational Shift—from “Asset-Centric” to “Capital-Centric”

A core consensus emerged during the discussion: the industry must shift its infrastructure paradigm from “Asset-Centric” to “Capital-Centric.”

In the past, asset-centric models—optimized for single asset classes—sufficed. But in today’s complex, multi-asset market landscape, such models may inherently sacrifice capital efficiency. When institutions simultaneously manage traditional and digital assets, fundamental differences across dimensions—including price volatility and clearing & settlement cycles—lead to hidden capital lockup and execution friction. These are no longer mere operational inconveniences; they represent major structural constraints on overall capital efficiency.

Roundtable participants shared deep insights from different stages of the value chain:

· Integrated Capital Efficiency: Felix Huang Shuojun, Global Partner at Tiger Brokers Group, noted that traditional markets enhance capital utilization through margin interoperability—but the introduction of digital assets disrupts this synergy. Current systems are largely designed around “asset isolation,” not “holistic capital efficiency,” making it difficult for institutions to coordinate capital allocation across assets within a unified framework.

· Efficient Execution & Liquidity Integration: Ian Weisberger, CEO and Co-Founder of CoinRoutes, added that misaligned clearing rhythms leave substantial capital idle during trading gaps. Institutions urgently need unified execution capabilities across markets and multi-leg strategies—as well as flexible position and risk rotation across asset classes.

· Compliance-First Infrastructure: Myles Harrison, Chief Product Officer at AMINA Bank, emphasized that compliance is not antithetical to efficiency—it is the prerequisite for secure system operation. The pain point lies in the industry’s lack of native, scalable, and highly transparent infrastructure capable of supporting multiple asset classes and unlocking capital potential within global regulatory frameworks.

Jacob Zhong, Strategic Investment & Partnership Managing Partner at Avenir Group, stated: “Synthesizing industry insights, the direction of infrastructure evolution is now relatively clear. As institutional participation deepens in multi-asset environments, the market increasingly demands infrastructure that enables unified cross-asset capital allocation, synchronized trade execution and clearing rhythms, and natively embedded compliance capabilities—not bolt-on fixes. In this direction, more integrated, regulation-adaptive infrastructure is gradually emerging as a critical enabler of enhanced capital efficiency and scalable cross-asset operations.”

Building the Ecosystem: Advancing Financial Infrastructure Through Collaborative Action

At the conclusion of the session, Avenir Group signed a Memorandum of Understanding (MOU) with Tiger Brokers, AMINA Bank, and CoinRoutes to explore future collaboration opportunities.

The convergence of traditional finance and digital assets is not merely about integrating technologies or products—it is a gradual, systemic, and compliance-driven engineering effort. As multi-asset allocation becomes the norm, the competitive focus among institutions is shifting: success no longer hinges solely on market access, but rather on the systemic ability to centrally manage and flexibly allocate capital within compliant frameworks.

Avenir Group looks forward to collaborating with a broader network of financial institutions and technology partners. By fostering dialogue and cooperation across the entire ecosystem, Avenir Group aims to work alongside industry peers to advance more collaborative and scalable infrastructure pathways—turning the industry’s shared vision of higher capital efficiency into verifiable, real-world practice.

About Avenir Group

Avenir Group is an emerging investment group focused on accelerating the integration of traditional finance and digital assets—and building next-generation financial infrastructure. Employing an integrated “Invest–Incubate–Operate” strategy, the firm’s core investment portfolio spans digital asset management, trading and financial services platforms, payment finance (PayFi) infrastructure, and real-world asset (RWA) tokenization. It delivers institutional-grade products and services to drive financial innovation and adoption of emerging technologies. As the largest institutional holder of Bitcoin ETFs in Asia, Avenir Group operates globally—with presence in Hong Kong, Singapore, Tokyo, London, and San Francisco. Leveraging robust capital strength and professional operational expertise, the group strives to serve as a strategic bridge connecting Eastern and Western capital, enabling efficient global capital flow and collaboration. Learn more: https://avenirx.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News