Understanding the Hottest Keywords from Consensus 2025 in One Article

TechFlow Selected TechFlow Selected

Understanding the Hottest Keywords from Consensus 2025 in One Article

Under the spotlight of Consensus 2025, Hong Kong has proven itself not only a policy innovator but also an ecosystem builder.

Author: OKG Research

The global Web3 spotlight is now on Hong Kong. Consensus, the premier industry event for Web3, has landed in Hong Kong for the first time this week, drawing over ten thousand professionals to the Convention and Exhibition Center, reigniting a wave of crypto enthusiasm across the city. The Hong Kong Consensus conference serves not only as a showcase for global Web3 innovation but also as a milestone assessment of Hong Kong's Web3 strategy—since the release of the "Policy Statement on the Development of Virtual Assets in Hong Kong" in October 2022, Hong Kong has accelerated the construction of a bridge connecting traditional finance with the crypto world through its "regulation-first, ecosystem development in parallel" approach, becoming an indispensable part of the global Web3 landscape.

As an industry observer, OKG Research has been tracking the evolution of Hong Kong’s Web3 policies since 2022, focusing on ecosystem growth and technological innovation. We have published more than 30 in-depth articles on key topics such as VASP, stablecoins, and RWA tokenization, and established column collaborations with mainstream Hong Kong media outlets including Sing Tao Group and Ta Kung Wen Wei Media Group, consistently delivering industry insights. Leveraging the momentum of the Consensus conference, we present a systematic review of the core developments within Hong Kong's Web3 ecosystem and launch our new专题 series «HK Web3 Frontline», aiming to help more people gain a comprehensive understanding of how Hong Kong’s Web3 ecosystem continues to evolve.

1. Regulation First: Exploring the Compliance Frontier of Web3

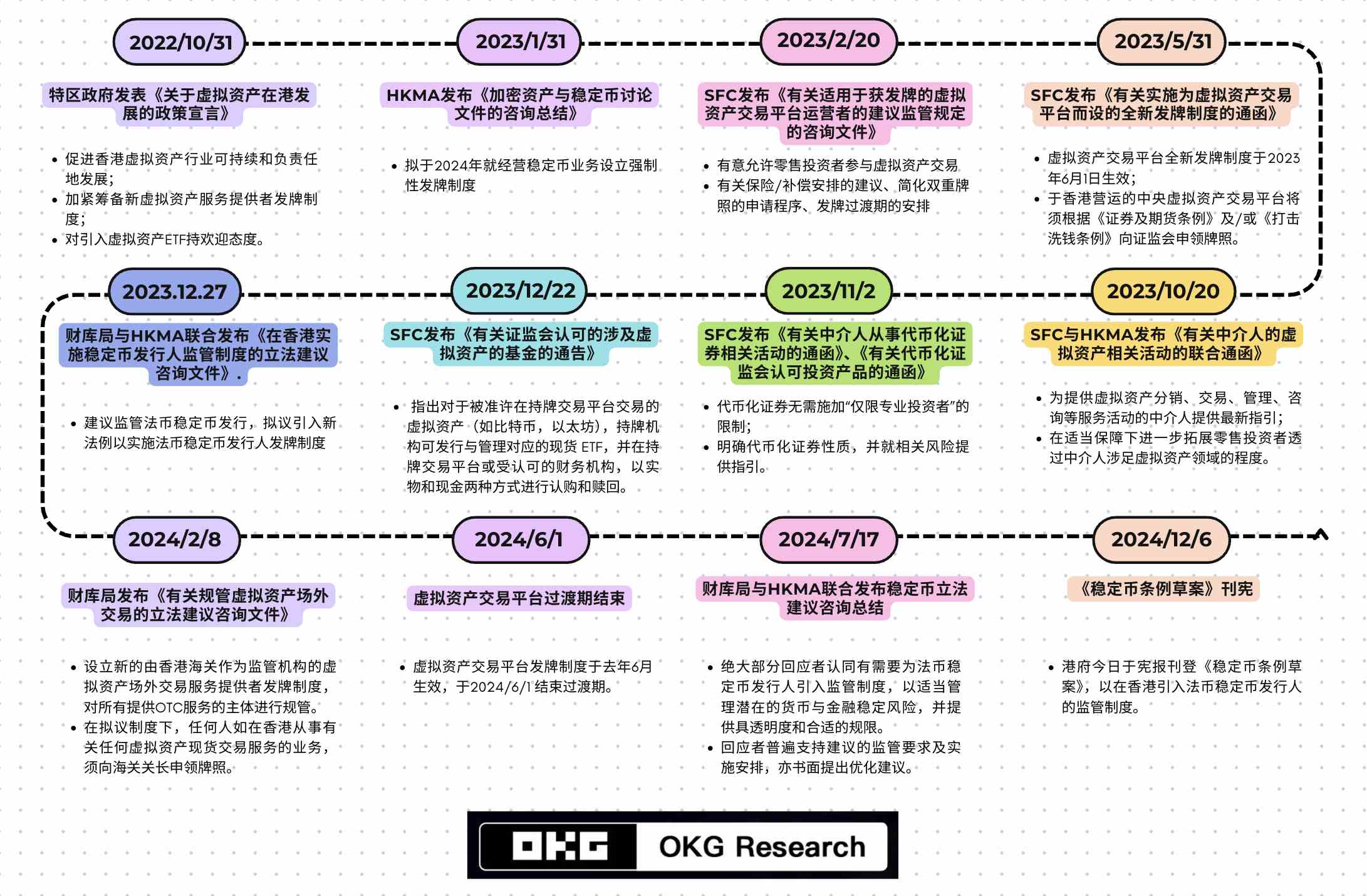

Compliance remains the central theme of Hong Kong's Web3 development. Since the release of the policy statement, Hong Kong has continuously explored compliance boundaries for Web3, rolling out a series of regulatory frameworks that lay the foundation for the development of virtual assets and the broader Web3 industry, while providing clear guidance for market participants.

Starting with the Virtual Asset Service Provider (VASP) licensing regime, Hong Kong is gradually building a compliant development framework for its virtual asset market. Building on this foundation, regulations are being extended to areas such as stablecoin issuers, custodians, and OTC services to ensure market safety and transparency. These measures have enhanced the credibility of Hong Kong’s virtual asset market and continue to attract capital and businesses. By the end of 2024, Cyberport alone had gathered nearly 300 Web3 companies, raising over HK$400 million in total funding.

Yet during her opening remarks at the Consensus conference, Julia Leung, CEO of the Securities and Futures Commission (SFC), repeatedly emphasized the “balance between regulation and innovation.” How can industry players maintain their innovative drive within Hong Kong’s current regulatory environment? And compared to the United States, can Hong Kong’s regulatory approach effectively promote market growth?

2. Hong Kong Dollar Stablecoins: Hong Kong’s Financial Ambition

Stablecoins were a hot topic at this year’s Consensus conference and have been a major focus of Hong Kong’s strategic efforts over the past two years. Recent reports indicate that Standard Chartered Hong Kong, ANI Group, and Hong Kong Telecom plan to form a joint venture to apply for a license from the Hong Kong Monetary Authority (HKMA) under the new regulatory framework to issue a stablecoin pegged to the Hong Kong dollar. Circle, the issuer of USDC, previously announced cooperation with Hong Kong’s three note-issuing banks to launch HKDCoin, a stablecoin fully backed 1:1 by Hong Kong dollars.

While it remains uncertain how much market share a Hong Kong dollar-backed stablecoin can capture in a landscape currently dominated by the U.S. dollar, developing such stablecoins is a necessary step for Hong Kong to seize initiative in Web3 and secure a leading position in future financial systems. Channels linking cryptocurrencies with fiat currencies represent today’s most valuable and promising use cases in the crypto ecosystem, and stablecoins are essential infrastructure for building these bridges. Moreover, the next phase of Web3.0 development globally—and particularly in Hong Kong—centers on breaking down barriers between the digital and physical worlds. Stablecoins serve as the core link between traditional finance and the crypto economy and may emerge as widely accepted payment instruments.

If Hong Kong dollar stablecoins achieve broad adoption within the Web3 ecosystem, they could significantly enhance Hong Kong’s and the Hong Kong dollar’s competitiveness in international financial markets. But how should these stablecoins be developed? What is their relationship with the proposed digital Hong Kong dollar? And do the upcoming regulatory measures align with current market realities?

3. RWA Tokenization: From Concept to a Multi-Billion-Dollar Market

RWA was undoubtedly the hottest concept at this year’s Consensus. “Real World Asset (RWA) tokenization is not just a trend—it is inevitable,” declared John Cahill, Head of Digital Assets at Morgan Stanley, during the Institutional Investment Summit, highlighting the strategic shift among traditional financial giants.

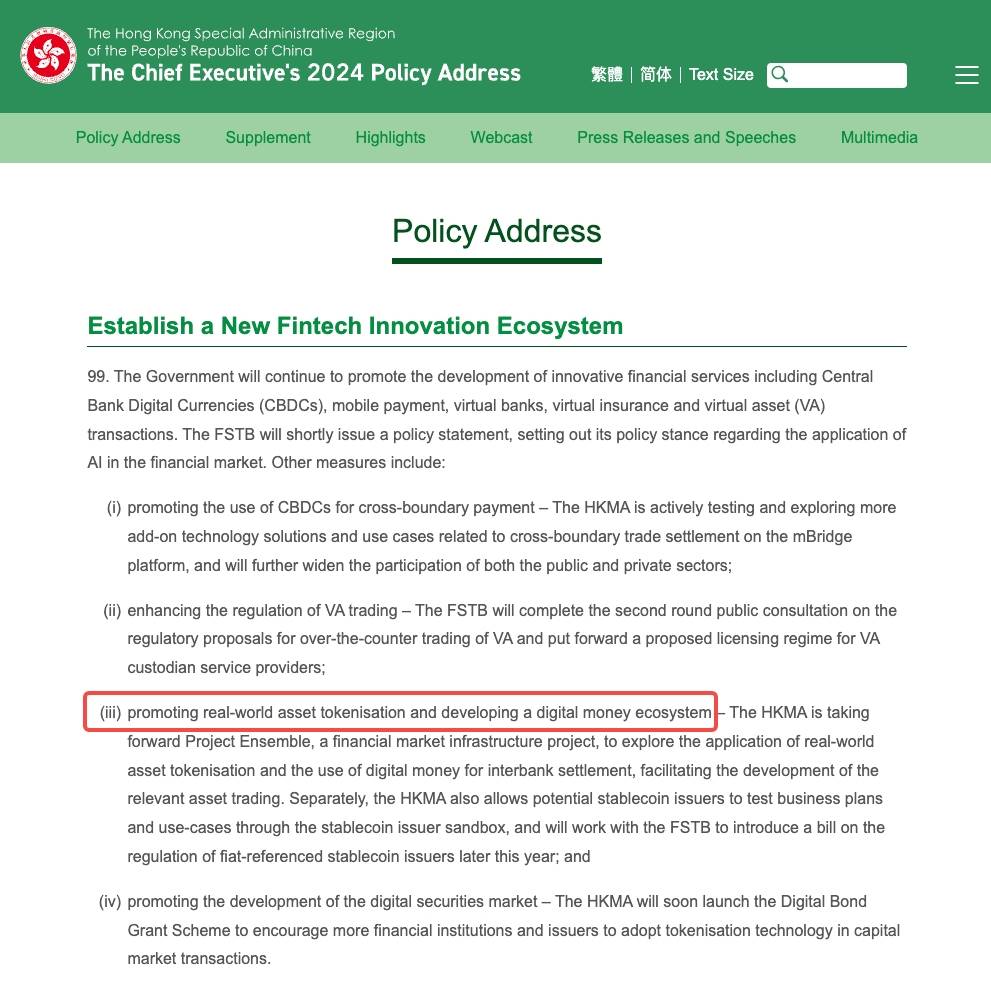

As a global financial hub, Hong Kong is actively embracing the RWA tokenization wave. The 2024 Policy Address called for advancing RWA tokenization and digital currency ecosystem development. The HKMA launched its “Digital Bond Grant Scheme” to encourage capital markets to adopt tokenization technologies. The HKMA-led “Project Ensemble” has already attracted over 30 institutions, including HSBC and Bank of China, covering diverse asset classes such as bonds, funds, and carbon credits.

At the Consensus conference, Christopher Hui, Secretary for Financial Services and the Treasury of the Hong Kong Special Administrative Region, stated that the government is considering promoting gold tokenization—linking physical gold with blockchain technology—to offer investors greater flexibility and enhanced security, aiming to drive financial innovation through tokenization. But why is Hong Kong well-suited for RWA development? Which sectors should be prioritized for tokenization at this stage? And does Hong Kong hold competitive advantages over the U.S. in the field of asset tokenization?

4. ETFs and OTC: The "Light and Shadow" of Funding Channels

One of the key developments in Hong Kong’s Web3 landscape in 2024 was the launch of spot virtual asset ETFs. From the SFC announcing acceptance of applications at the end of 2023, to six spot virtual asset ETFs receiving formal approval and listing on the Hong Kong Stock Exchange by late April—this process took fewer than 100 days, demonstrating the speed and efficiency of Hong Kong’s regulators. The introduction of spot virtual asset ETFs has opened another investment channel into the crypto market for retail and institutional investors alike. By the end of 2024, the total AUM of Hong Kong’s Bitcoin spot ETFs exceeded HK$3 billion, accounting for 0.66% of the overall Hong Kong ETF market.

Besides ETFs, Hong Kong has also developed a three-tiered funding network comprising “licensed exchanges – compliant OTC platforms – banks.” Notably, OTC trading volume in Hong Kong has surged since 2023. According to incomplete data from OKG Research, Hong Kong’s OTC market handles nearly $10 billion in annual transaction volume. The region-specific phenomenon of crypto exchange shops has not only attracted young global investors but also resonates strongly with middle-aged and older participants. In recent years, Hong Kong’s OTC market has drawn increasing attention from users and institutions in international trade and cross-border payments, emerging as another vital conduit for global capital inflows into Hong Kong.

Under the spotlight of Consensus 2025, Hong Kong has proven itself not only a pioneer in policy innovation but also a builder of ecosystems. Regulations can be designed, technologies iterated—but only deep respect for market dynamics can serve as the ultimate weapon to endure market cycles. OKG Research will continue to track the development of Hong Kong’s Web3 industry, offering observations and insights to a broader audience and market participants, jointly contributing to a more vibrant Hong Kong Web3 ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News