Introducing Converge: A New Chain Launched by Ethena, Providing a Settlement Layer for TradFi and Digital Dollars

TechFlow Selected TechFlow Selected

Introducing Converge: A New Chain Launched by Ethena, Providing a Settlement Layer for TradFi and Digital Dollars

Converge Network is designed specifically for TradFi, enabling its interaction on-chain with assets backed by iUSDe, USDe, and Securitize.

Author: Ethena Labs

Translation: TechFlow

We proudly introduce Converge on Chain, a settlement network for traditional finance and digital dollars, backed by @ethena_labs and @Securitize. Our mission is to deliver the first purpose-built settlement layer that deeply integrates traditional finance (TradFi) with decentralized finance (DeFi), centered around USDe and USDtb stablecoins and secured by the ENA token.

We believe blockchain has two core use cases:

-

Settlement of permissionless spot and leveraged DeFi speculation.

-

Storage and settlement of stablecoins and tokenized assets.

While speculation remains significant in crypto, we see a broader and relatively less competitive opportunity: leading the second use case over the next decade.

To achieve this, Ethena and Securitize were born.

We firmly believe the dominant theme of this cycle and the coming years will be the large-scale entry of institutional capital.

Currently, DeFi’s total value locked (TVL) stands at approximately $100 billion—still negligible compared to global capital markets.

A key barrier preventing TradFi from entering crypto is the lack of infrastructure purpose-built for large pools of capital.

Ethena and Securitize are uniquely positioned to lead in capturing this opportunity.

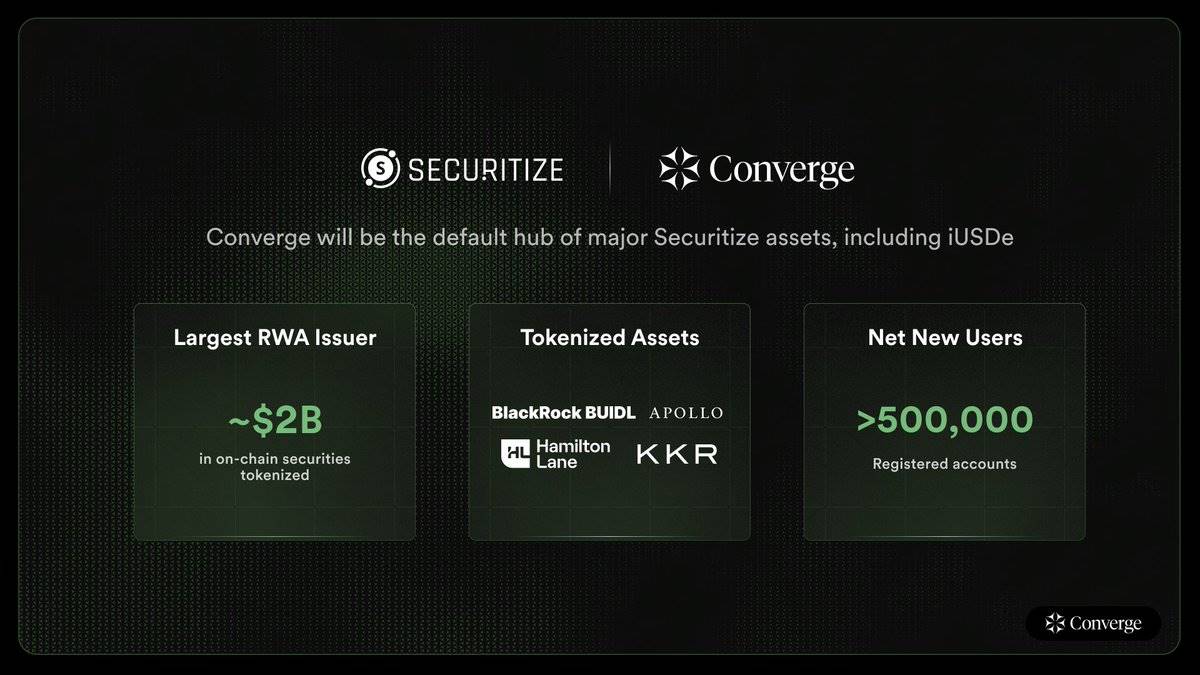

Securitize is the market leader in tokenized products, having already issued approximately $2 billion worth of securities on-chain—including the Blackrock BUIDL fund and funds from Apollo, Hamilton Lane, and KKR—with over 500,000 user accounts.

Notably, Securitize will serve as the foundational issuance layer for core future tokenized assets on the Converge network. This deployment extends beyond tokenized Treasury products and funds, encompassing securities across all asset classes.

This move further strengthens our partnership with Securitize, which is also the partner behind USDtb, the stablecoin backed by Blackrock's BUIDL.

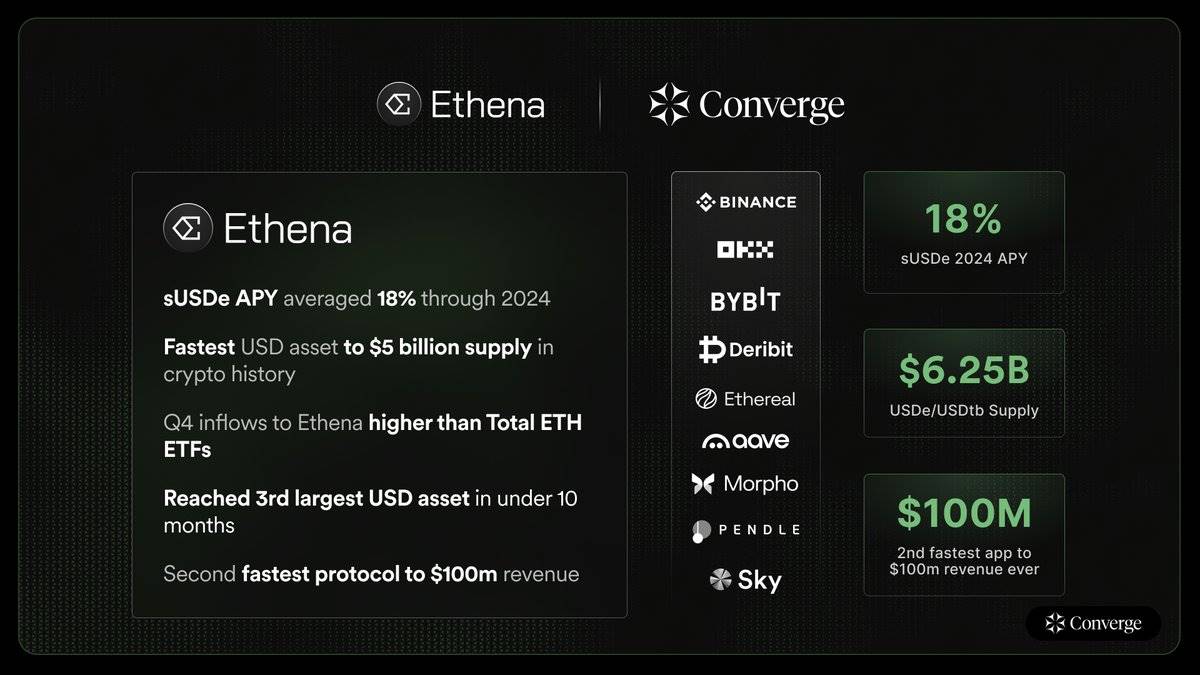

Ethena is one of the most influential on-chain protocols. Its core products—USDe, USDtb, and iUSDe—will be natively issued directly on Converge, aiming to provide interoperable crypto asset formats tailored for traditional finance.

These native crypto assets and foundational building blocks will be exported to TradFi in dedicated formats, enabling underwriting and interaction, thereby unlocking billions in new capital flows onto the chain.

As one of the most impactful on-chain protocols, Ethena has achieved deep integration with nearly all major DeFi protocols and most centralized exchanges. Despite the notable success of existing USDe-based applications, vast design space remains for creating entirely new financial primitives built on USDe.

The U.S. dollar remains the structural core of on-chain capital flows—whether for settlement, payments, or core DeFi activities such as trading, lending, derivatives, and leverage.

Every dollar-denominated DeFi protocol today can be reimagined around Ethena to achieve natural economic optimization.

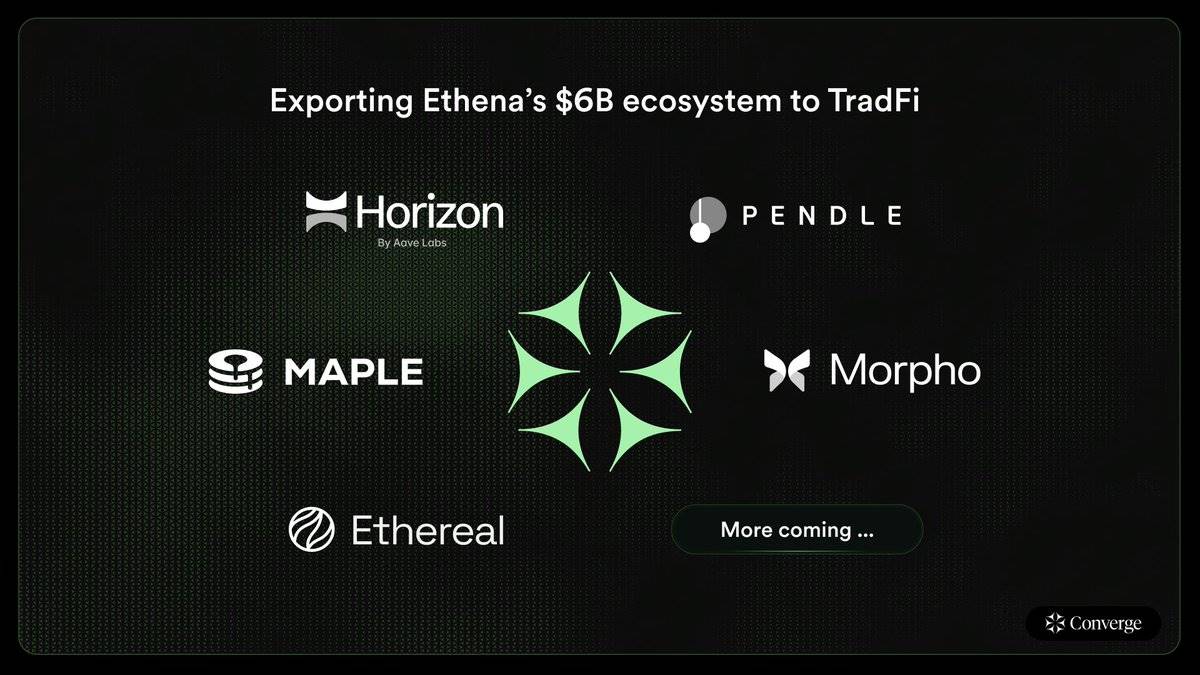

The Converge network is purpose-built for traditional finance (TradFi), enabling it to interact on-chain via iUSDe, USDe, and Securitize-backed assets. Five top-tier protocols have already committed to building and distributing institutional-grade DeFi products on Converge, driving institutional capital into the on-chain ecosystem:

-

Horizon by Aave Labs: Building a dedicated market for Securitize-tokenized assets, including Ethena’s institutional-grade iUSDe, bridging TradFi and DeFi.

-

@Pendle_fi Institutional: Providing infrastructure for rate speculation, creating scalable institutional opportunities for assets like iUSDe.

-

@MorphoLabs building modular money markets supporting Ethena and Securitize assets.

-

@maplefinance / @syrupfi: Developing verifiable on-chain institutional yield and credit products based on USDe and real-world assets (RWAs).

-

@etherealdex providing high-performance derivatives and spot trading for Ethena liquidity, using USDe as collateral.

We are excited to collaborate closely with these leading partners to build cutting-edge products that pave the way for institutional capital to enter the on-chain ecosystem.

This marks the first era where traditional finance and internet-native finance coexist within the same execution environment—coming together on-chain to usher in a new chapter of finance.

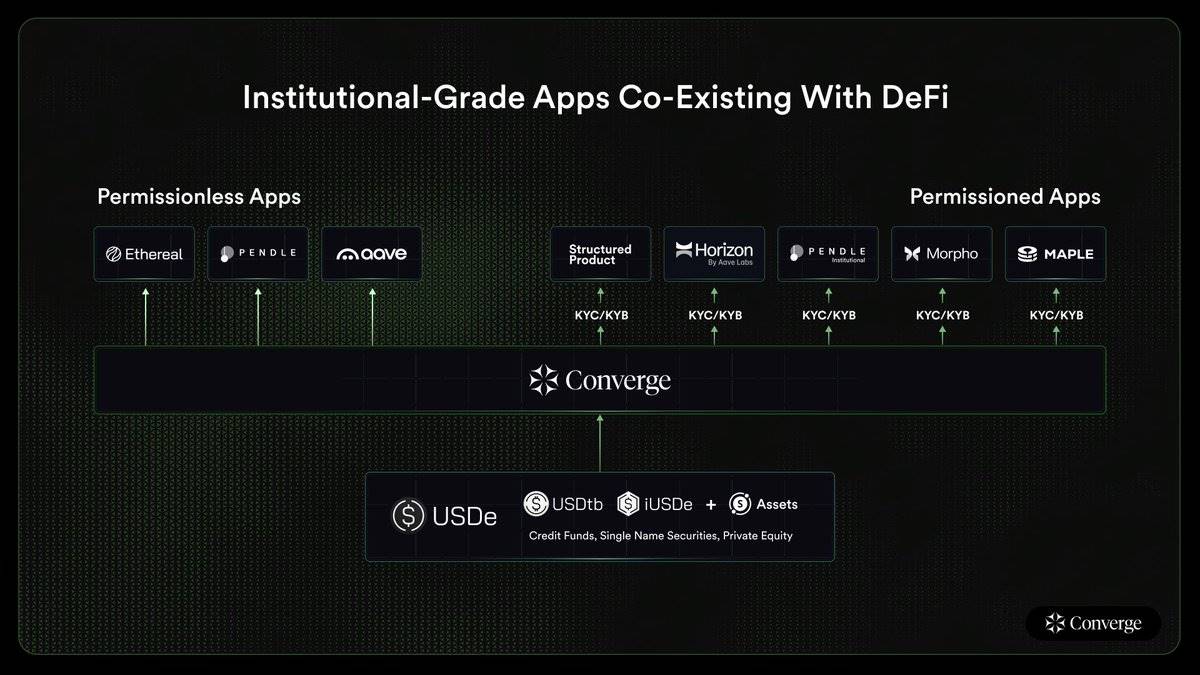

Beyond a suite of permissioned applications, Converge will also support permissionless on-chain finance within the same blockspace.

The ecosystem will operate through three distinct pillars in parallel:

-

Full permissionless user access

Users can seamlessly access the USDe-based DeFi ecosystem and applications, which have already proven market demand. Ethena also supports and accelerates innovative projects like Ethereal DEX.

-

Permissioned applications: compliant interaction for TradFi

Traditional financial institutions can interact via permissioned applications with KYC-compliant counterparties, using Ethena’s iUSDe and USDtb. These apps are designed specifically for TradFi, meeting its needs for compliance and transparency.

-

New permissioned financial applications based on Securitize tokenized assets

Enabling novel financial scenarios, including leveraged operations on credit and fixed-income assets, and spot or perpetual swap trading of individual equities and other securities. These applications will further deepen and broaden the scope of on-chain financial products.

Converge will launch a high-performance EVM network compatible with the Ethereum mainnet, offering developers a development experience on par with Ethereum.

Ethena and Securitize plan to release detailed information about the tech stack and developer documentation in the coming weeks, followed by an official developer testnet.

Mainnet is expected to go live in Q2 2025.

We invite developers to join us in building products that attract institutional capital into crypto, while exporting unique crypto primitives back to traditional finance.

From day one, Converge will integrate major infrastructure providers and development tools, including @LayerZero_Core (providing cross-chain interoperability for Ethena assets), @PythNetwork, @wormhole, and @redstone_defi. @Anchorage, @CopperHQ, @FireblocksHQ, @KomainuCustody, and @ZodiaCustody have all committed to providing institutional-grade custody and key management services for @convergeonchain.

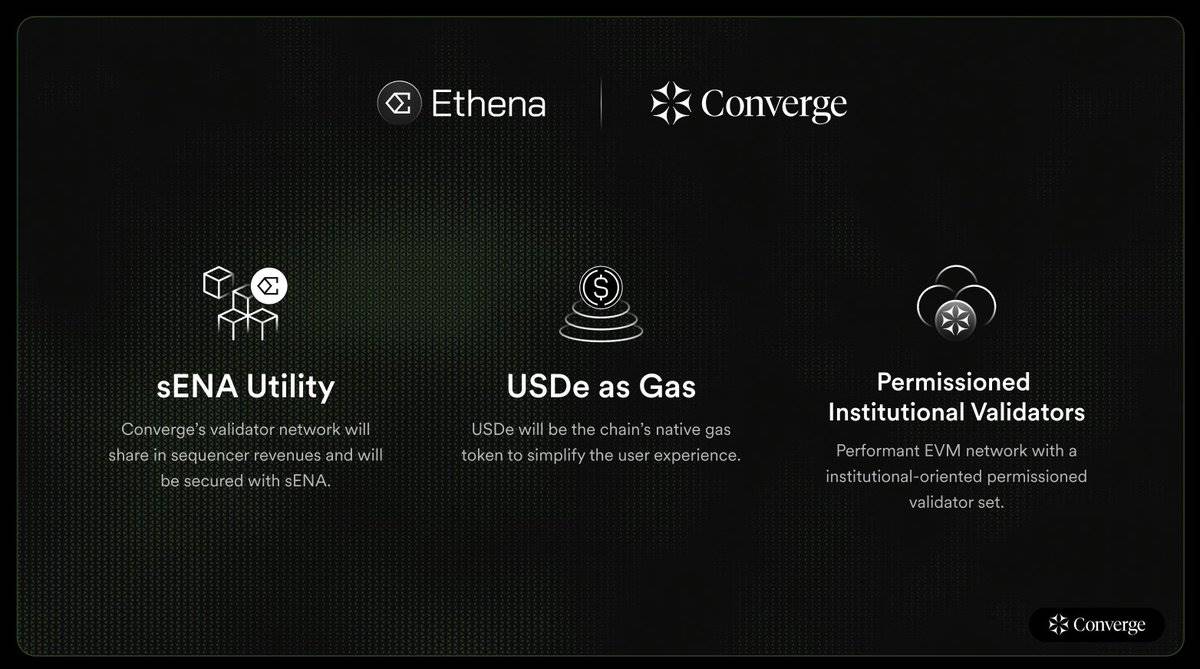

USDe, USDtb, and sENA will serve as the network’s core assets.

The Converge network will be built by a set of permissioned institutional validators who must stake ENA tokens to secure the network.

Meanwhile, USDe and USDtb will act as the network’s native gas tokens, allowing users to transact with significantly lower friction costs.

It’s time to welcome the era of convergence!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News