East HashKey Chain, West Base: The TradFi Battle Under the Trend of Compliance

TechFlow Selected TechFlow Selected

East HashKey Chain, West Base: The TradFi Battle Under the Trend of Compliance

Under the overarching trend, a battle for话语权 over on-chain finance has already begun.

Author: TechFlow

In January 2025, Coinbase and EY-Parthenon surveyed 352 institutional decision-makers, revealing that 83% of respondents plan to expand their cryptocurrency allocations this year, while 59% intend to allocate more than 5% of their asset management规模 to crypto assets in 2025.

A clear signal has been sent: as the regulatory environment becomes increasingly transparent and broader use cases emerge, institutional confidence in crypto assets is growing. With unprecedented institutional participation, 2025 will be a pivotal turning point for on-chain financial explosion.

As a critical infrastructure for on-chain finance, how can blockchain better support its development—accommodating more capital, users, and complex financial applications?

This is an arena where technical strength is paramount, and leading crypto players are already gearing up.

In this landscape, U.S. government pro-crypto policies, combined with active presidential engagement driving attention and momentum, have placed American-concept crypto enterprises at the center of public discourse. As the most representative U.S. crypto company, Coinbase not only attended the White House Digital Assets Summit but is also rapidly advancing the prosperity of its on-chain financial ecosystem through Base—a high-performance Layer 2 platform leveraging the compliant stablecoin USDC.

Meanwhile, in the East, where financial innovation is equally prioritized, a transformative movement centered on tokenizing financial products is beginning to take shape:

As Asia’s leading digital asset financial services group, HashKey has officially launched the mainnet of HashKey Chain—the preferred public chain for finance and RWA—aiming to build a secure, compliant, and efficient blockchain ecosystem, and drive deeper integration between DeFi and traditional finance through financial product tokenization.

Against these macro trends, the battle for influence over on-chain finance has already begun. In this evolving competition, who will lead the future of on-chain finance?

This report explores the catalysts behind the 2025 on-chain financial surge, how blockchain platforms can effectively onboard value, and the key factors required to become essential infrastructure for on-chain finance.

2025: The Eve of Full-Scale On-Chain Financial Explosion

The history of human finance mirrors the progress of human civilization. Whether it was Renaissance-era Italy giving birth to modern banking or post-WWII Wall Street operating under the gold standard, every major leap in finance has pursued more efficient capital flow and resource allocation.

Blockchain technology, with its advantages of decentralization, permissionless access, transparency, and higher capital efficiency through faster settlement, has emerged as a transformative force capable of overcoming deep-rooted inefficiencies in traditional finance. On-chain finance is poised to become the core engine for capital movement and resource allocation, pushing society toward a more efficient, fair, and sustainable financial future.

As 2025 unfolds, on-chain finance is approaching a breakout moment, fueled by clearer regulations and increasing institutional interest.

As early as 2024, several milestones laid a solid foundation for the growth of on-chain finance.

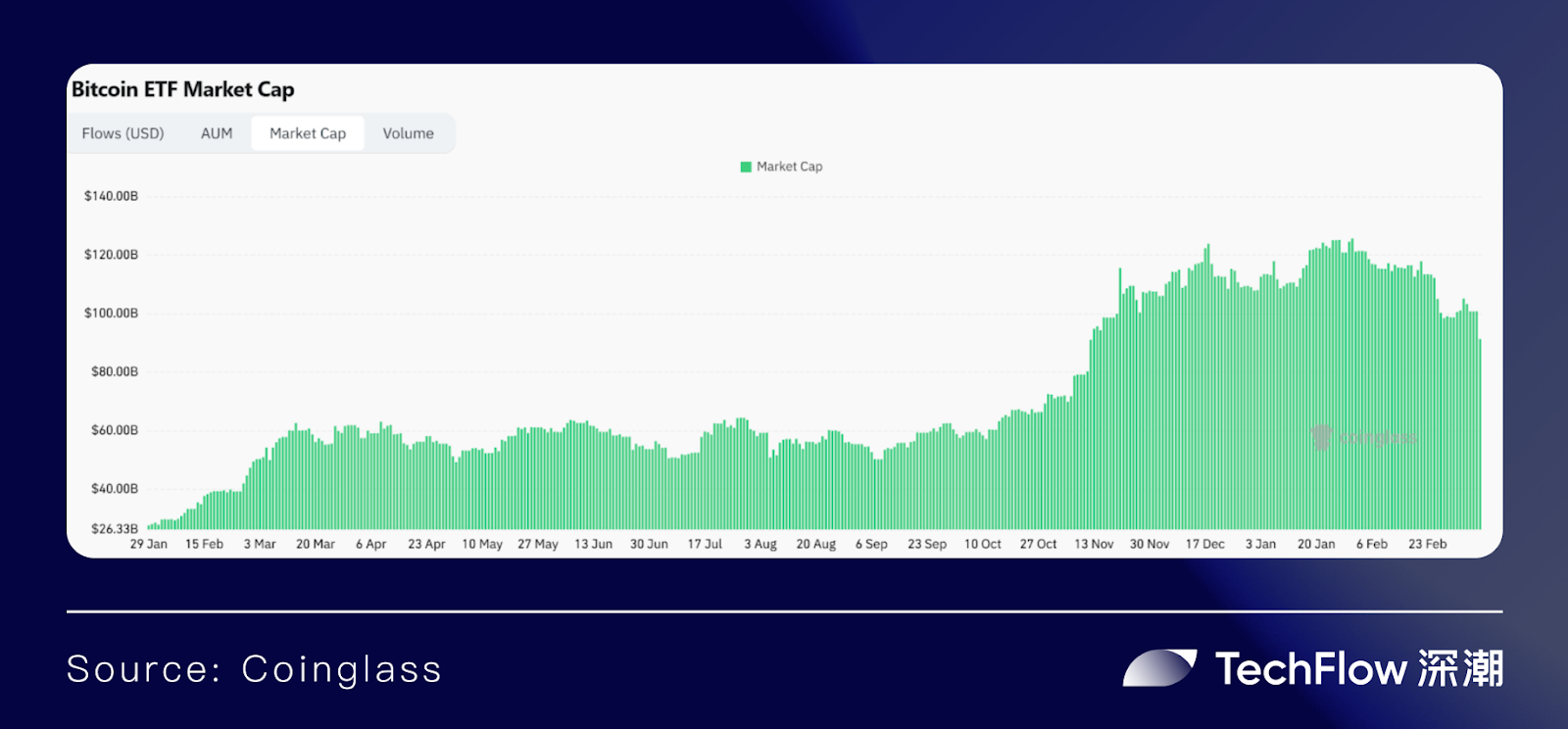

In January 2024, we witnessed the approval of Bitcoin ETFs, a historic event that eliminated the complexity and technical barriers associated with directly purchasing, storing, and managing Bitcoin, opening the door to mainstream adoption and attracting massive institutional inflows:

According to Coinglass data, the total net assets of spot Bitcoin ETFs now stand at approximately $100 billion, with IBIT (BlackRock) holding around $46.3 billion, FBTC (Fidelity) about $16.2 billion, and GBTC (Grayscale) approximately $15.8 billion.

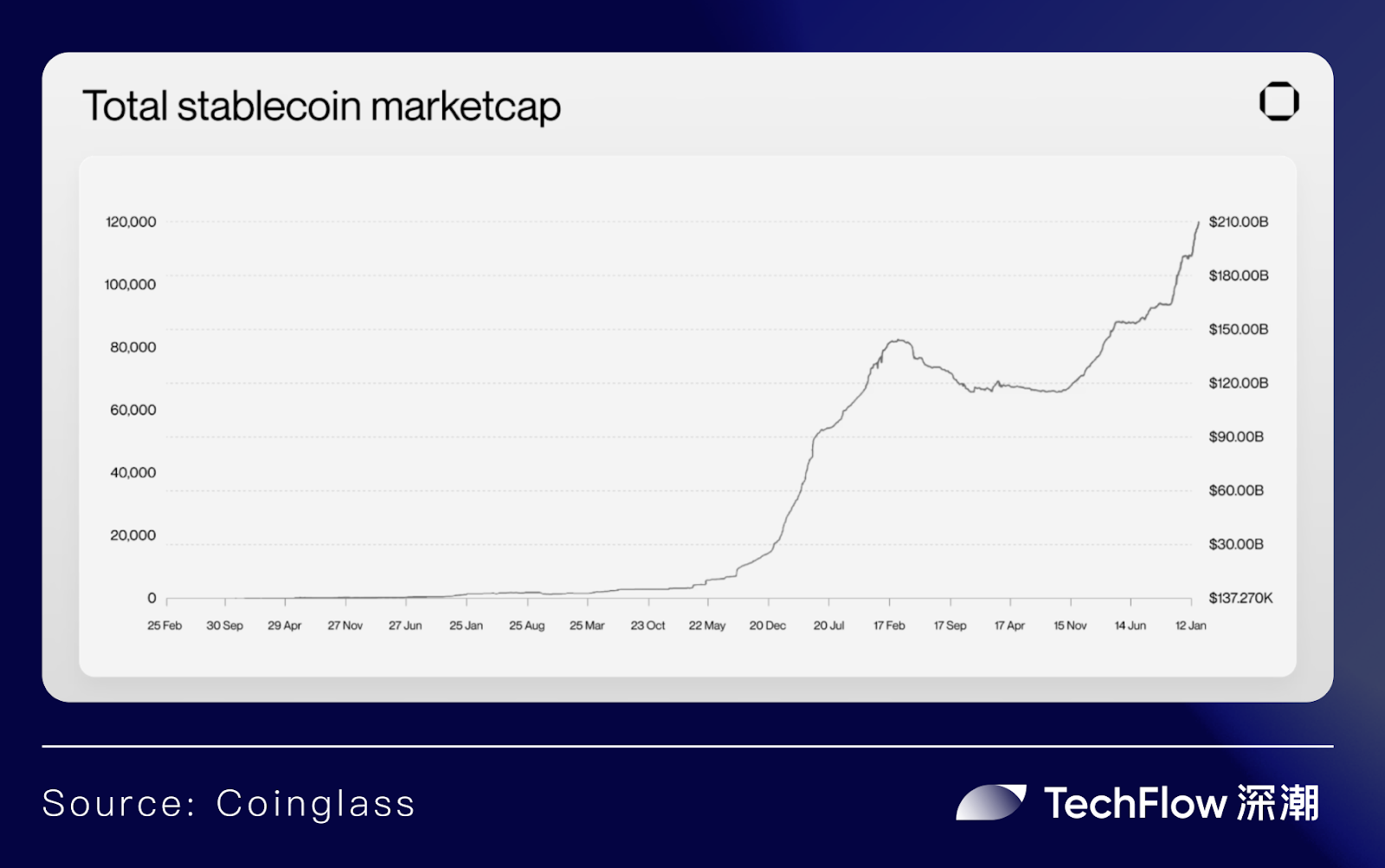

Beyond ETFs, sectors closely tied to on-chain finance—such as RWA and stablecoins—experienced explosive growth, forming crucial bridges between traditional and on-chain finance.

RWA saw explosive growth in 2024, surpassing $19 billion in total value (excluding stablecoins), representing over 85% annual growth. Tokenized credit, tokenized treasuries, and tokenized real estate were the primary drivers. Additionally, according to Coinglass, stablecoin transaction volume exceeded $8.3 trillion in 2024, with total market cap surpassing $210 billion. Traditional giants including Stripe, PayPal, and SpaceX have all entered the stablecoin space.

Moreover, in November 2024, Donald Trump’s U.S. election victory brought heightened optimism for the on-chain financial boom.

Prior to taking office, from speaking at the Bitcoin 2024 conference to the sudden emergence of the $TRUMP meme coin, the unpredictable president consistently demonstrated strong pro-crypto sentiment.

Within just two months of assuming office, he signed over a dozen crypto-related executive actions, including an executive order titled "Strengthening American Leadership in Digital Financial Technology," overturning the IRS’s DeFi broker rule, and announcing five strategic crypto reserves—BTC, ETH, XRP, SOL, and ADA. Simultaneously, the SEC established a Crypto Task Force and dropped lawsuits against multiple crypto firms.

Under the slogan “Make America Great Again,” crypto has clearly become a key tool for the U.S. to reinforce its status as the “global financial heart.”

Notably, the impact of this pro-crypto shift in the U.S. extends far beyond its borders.

As on-chain finance gains traction globally and nations increasingly recognize the need for crypto regulation, the U.S. regulatory framework serves as a model, prompting other jurisdictions to follow suit and推动 the establishment of clearer global crypto regulations. In Europe, the Markets in Crypto-Assets Regulation (MiCA), now formally in effect, provides European countries with a solid legal foundation for crypto development.

Compared to the West led by the U.S., regions in the East are engaged in an even fiercer race to clarify regulations and capture leadership in on-chain finance. Countries and regions including Hong Kong, South Korea, Japan, Singapore, Thailand, India, and Dubai have all introduced regulatory measures to govern crypto development—with Hong Kong standing out: recently, the Hong Kong Securities and Futures Commission (SFC) released a 12-point “A-S-P-I-Re” roadmap for the virtual asset market, specifically aiming to boost institutional investor participation.

If the efficient capital flows enabled by on-chain finance serve as the original driver attracting traditional finance to go on-chain, then clearer, open, and inclusive regulations further eliminate concerns, encouraging institutions to adopt more proactive on-chain strategies.

This trend is already evident: Western institutions such as JPMorgan Chase, Goldman Sachs, BlackRock, and MicroStrategy, and Eastern counterparts like Sony, Samsung, and HSBC, have all taken concrete steps.

Another clear phenomenon is the surge in ETF applications: multiple firms have submitted ETF proposals to the SEC, covering Ripple (XRP), Solana (SOL), Litecoin (LTC), Cardano (ADA), Hedera (HBAR), Polkadot (DOT), and Dogecoin (DOGE).

With institutions bringing more capital and users into the ecosystem, 2025 will mark a pivotal turning point for on-chain finance. Facing this trend, how can one become a leading player? A dual focus on internal and external strengths is key:

Externally embrace compliance: Regulatory compliance will be the core criterion for institutional participation. Proactively aligning with regulators will further alleviate institutional concerns and foster a healthy, stable environment for on-chain finance.

Internally strengthen capabilities: Continuously optimize transaction speed, cost, user experience, and security to enhance blockchain's role as foundational infrastructure, enabling it to handle large-scale capital and user demands.

How have the main contenders performed along these two paths?

East and West Compliance Leaders: The White House Insider and Hong Kong’s Regulatory Pioneer

Coinbase in the West, HashKey in the East.

This widely circulated analogy stems not only from both companies’ extensive crypto empires but also from their shared determination and similar approaches to compliance.

As the first U.S.-listed cryptocurrency company, Coinbase has obtained money transmission licenses across U.S. states and secured regulatory approvals to operate in the UK, EU, Singapore, Japan, and other jurisdictions.

Although Coinbase’s compliance journey faced obstacles due to SEC intervention, it has gradually overcome them following the rise of a pro-crypto administration under Trump and the SEC’s withdrawal of litigation against Coinbase.

As a guest at the inaugural White House Digital Assets Summit, Coinbase CEO Brian Armstrong sat third from Trump’s left and publicly stated his willingness to serve as a government custodian for national crypto reserves. Coinbase is already collaborating with multiple government departments on crypto custody and trading. Additionally, Coinbase has indicated it will actively lobby Congress to accelerate stablecoin legislation and market structure reforms.

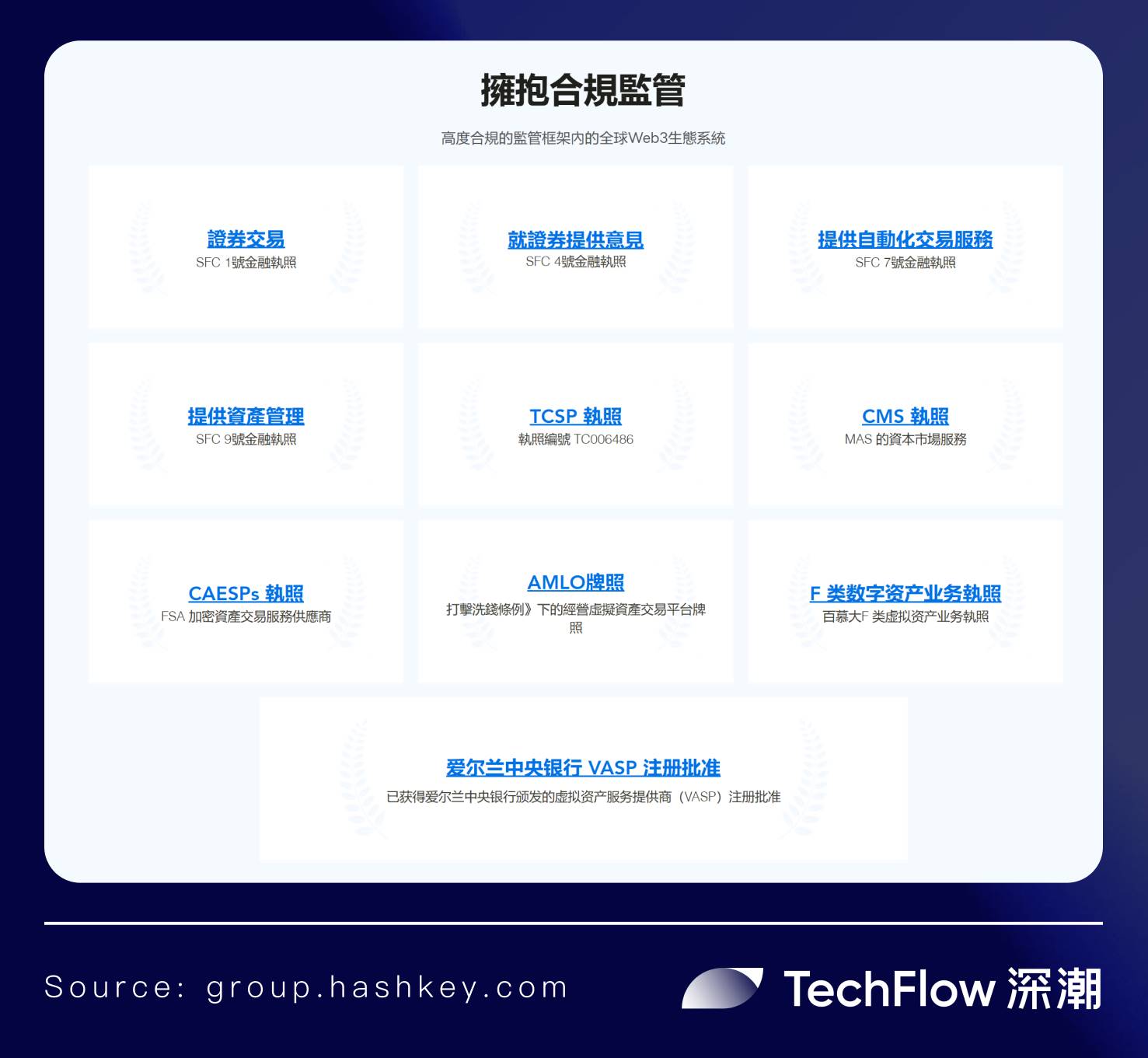

On the Eastern front, Hong Kong-based HashKey is widely regarded by the community as the undisputed pioneer in compliance:

Hong Kong, once known as one of Asia’s Four Asian Tigers, boasts a unique geographical advantage, linking mainland China, Japan, South Korea, and Southeast Asia as a key financial hub in the Asia-Pacific region. Its robust financial infrastructure, vibrant culture of financial innovation, and deep pool of professional talent in finance, technology, and law are unmatched by other cities.

Hong Kong’s fertile financial ecosystem previously nurtured industry leaders such as FTX, Amber Group, Crypto.com, and BitMEX. According to the Hong Kong Investment Promotion Agency’s “Hong Kong FinTech Ecosystem Report,” the city hosts over 1,100 fintech companies, including 175 focused on blockchain applications or software and 111 in digital assets and cryptocurrencies.

In 2023, Hong Kong reaffirmed its commitment to developing blockchain as a priority sector and officially launched its Virtual Asset Service Provider (VASP) licensing regime. With progressive policies such as opening ETFs and virtual asset funds to retail investors, Hong Kong is gaining global recognition as a “Center for On-Chain Financial Innovation.”

As one of the first crypto firms to apply for a Hong Kong license and a leading advocate for blockchain economic development, HashKey has officially obtained Class 1, Class 4, and Class 9 licenses from the Hong Kong Securities and Futures Commission (SFC), significantly expanding its regulated business scope and capabilities.

Building from Hong Kong, HashKey has rapidly advanced its global compliance efforts over the past year, securing a Major Payment Institution license from Singapore’s Monetary Authority (MAS), a crypto exchange license in Japan, a Class F license from the Bermuda Monetary Authority (BMA), and in-principle approval (IPA) from Dubai’s Virtual Asset Regulatory Authority (VARA) for its VASP license.

HashKey Group has also announced plans to continue building a global licensing matrix over the next five years, expanding into markets including the Middle East and Europe, thereby extending its on-chain financial services worldwide.

As HashKey’s dedicated chain for on-chain finance and RWA, HashKey Chain inherits this compliance edge, aiming to build a compliance-driven on-chain financial infrastructure and deliver full-stack solutions bridging Web2 and Web3.

The momentum from compliance is already reflected in tangible business growth, particularly in institutional partnerships:

In 2024, HashKey successfully launched the Boshi HashKey BTC ETF and Boshi HashKey ETH ETF and established deep collaborations with well-known institutions such as Futu Securities, Tiger Brokers, Cinda International Asset Management, and ZhongAn Bank.

Meanwhile, HashKey surpassed 250,000 users, attracted over HK$4.5 billion in on-chain deposits, and achieved cumulative trading volume exceeding HK$500 billion.

Beyond shared compliance strategies, blockchain serves as the foundational infrastructure for on-chain finance. As both Coinbase and HashKey have launched their own L2s, attention naturally turns to Base and HashKey Chain.

On-Chain Financial Foundations: The Battle Between Compliant Stablecoins and Financial Product Tokenization

Base and HashKey Chain share many similarities.

As next-generation on-chain financial infrastructures, both have heavily invested in performance optimization to better support large-scale capital and user activity.

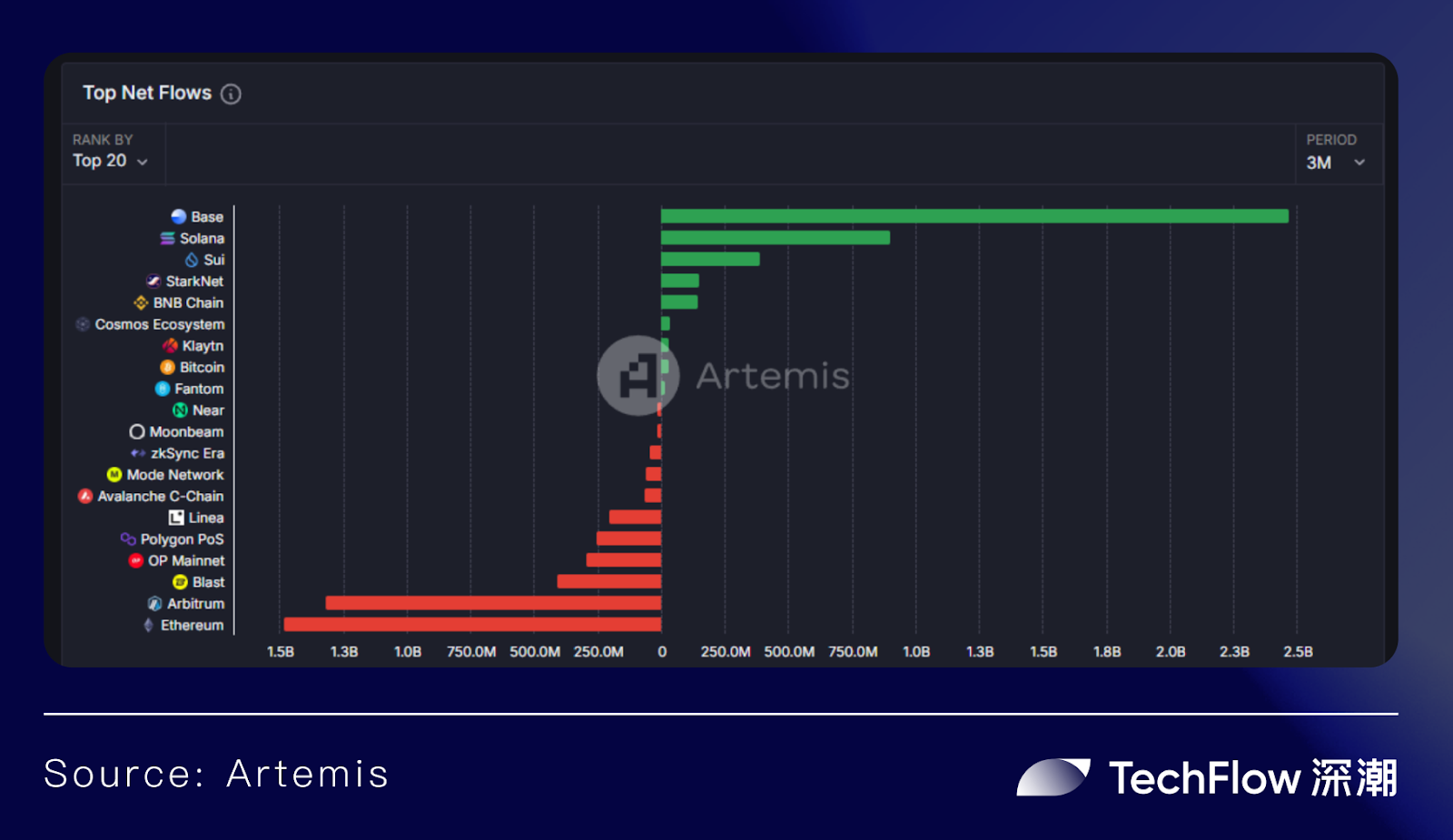

Base mainnet launched in 2023 and within less than two years became one of the most popular L2s. According to Artemis data, Base recorded over $2.5 billion in net capital inflow in Q4 2024, with daily transactions averaging around 11.1 million. During the 2024 AI agent and meme coin booms, Base demonstrated strong capital attraction and the ability to handle frequent, large-scale on-chain interactions.

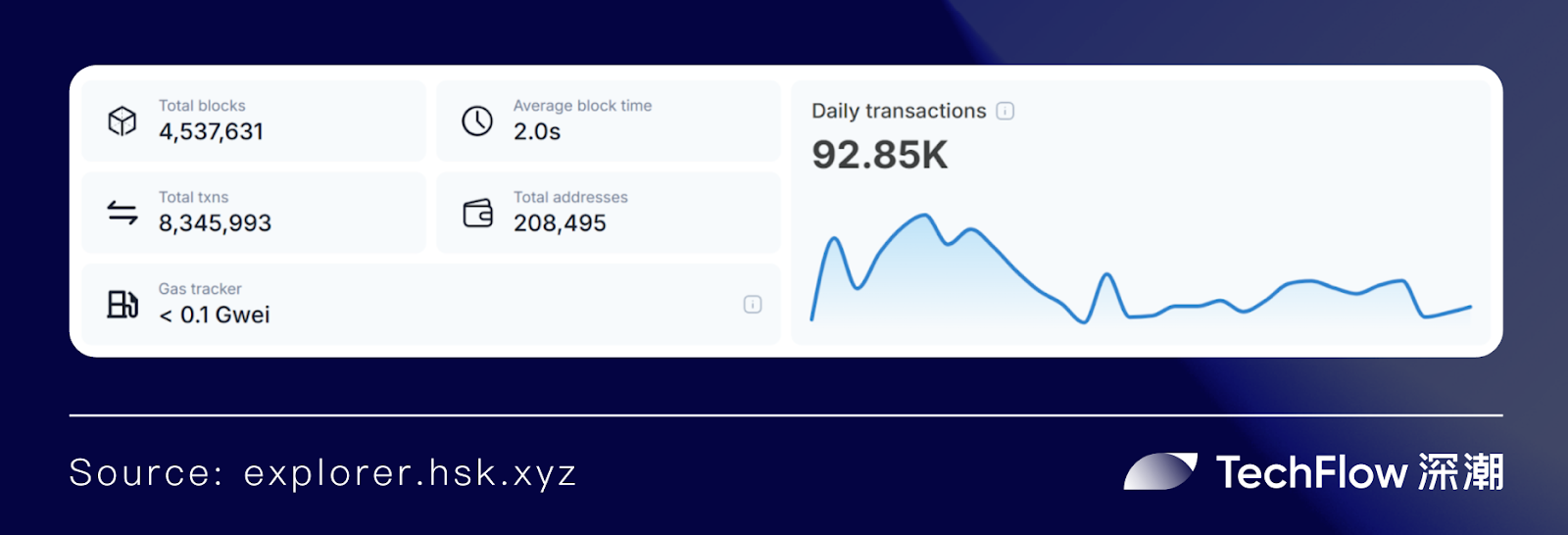

In contrast, HashKey Chain has only been live for a little over two months, yet its rapidly growing on-chain metrics and features designed specifically for institutional adoption reveal HashKey Chain’s ambition to become the preferred blockchain for finance and RWA.

Built on OP Stack as an Ethereum Layer 2, HashKey Chain offers EVM compatibility, high throughput, and scalability. Public data shows that HashKey Chain achieves an average block time of 2 seconds, gas fees as low as 0.1 Gwei, and TPS up to 400, delivering superior on-chain financial user experiences.

During testnet, HashKey Chain processed 25.816 million transactions, registered over 870,000 wallet addresses, and engaged 300,000 community members. According to hashkey.blockscout, within two months of mainnet launch, HashKey Chain surpassed 8.34 million total transactions and 208,000 total addresses.

For institutions managing large capital pools, security is paramount—and HashKey Chain is well-prepared:

HashKey Chain’s Smart Exit Vault periodically synchronizes state Merkle trees to Layer 1 at fixed block intervals, ensuring final asset security.

Additionally, multi-tiered DAO governance enables a Security Council DAO to respond quickly to potential threats, while a Technical Audit DAO focuses on deep analysis and validation, further enhancing system security.

Through its partnership with Chainlink, Chainlink CCIP serves as HashKey Chain’s standard cross-chain infrastructure, effectively preventing common risks such as double-spending and cross-chain reentrancy attacks, ensuring reliable and secure cross-chain services. Chainlink Data Streams acts as the official data solution, providing low-latency, real-time, tamper-proof market data, unlocking innovation in high-frequency trading and derivatives.

Of course, in the public chain infrastructure arms race, beyond raw performance, ecosystem strength is equally critical.

While both Base and HashKey Chain aim to seize the 2025 on-chain finance opportunity, they differ in their ecosystem entry strategies.

Base’s primary lever is the compliant stablecoin USDC:

The relationship between Base and compliant stablecoins dates back to 2018, when Circle and Coinbase jointly launched USDC—the first stablecoin backed by a centralized exchange. USDC’s key advantage is compliance: Circle holds full U.S. licenses and payment licenses in the UK and EU, received MiCA-compliant authorization in July last year to issue USDC and EURC, and recently filed an S-1 with the SEC for an IPO.

Compliant stablecoins provide a stable medium of exchange, enabling fast conversion and efficient liquidity between crypto assets, while offering a regulated path for traditional finance to go on-chain. Through USDC, Base not only enhances user experience but also drives innovation and penetration in payments, RWA, and other financial applications within its ecosystem—already home to native stablecoin payment apps like Peanut and LlamaPay.

HashKey, leveraging its institutional partnership strengths, positions HashKey Chain as the go-to blockchain for tokenizing financial products, targeting finance and RWA:

Institutions manage vast capital and user bases. Their participation signifies maturity and scale in on-chain finance, driving significant capital deployment and user growth. HashKey Chain aims to remove barriers for institutional adoption by offering efficient and compliant financial product tokenization solutions.

The successful deployment of CPIC Estable MMF—a tokenized USD money market fund initiated and managed by Taiping Investment Management Co., Ltd. (Hong Kong)—on HashKey Chain exemplifies HashKey Chain’s strategy of using financial product tokenization to become the preferred platform for finance and RWA.

For institutions, HashKey Chain significantly lowers technical and operational barriers to going on-chain by offering a compliant, secure, high-performance, low-cost environment enriched with a comprehensive DeFi ecosystem—enhancing asset liquidity and use cases. As a result, CPIC Estable MMF serves as an effective digital asset allocation tool, enabling transparent, efficient, and granular fund management on the blockchain.

For DeFi users, by equipping institutions with powerful tokenization tools, on-chain finance gains access to more high-quality, yield-generating assets, diversifying income sources.

For on-chain finance overall, as more institutional-grade assets undergo digital transformation on HashKey Chain, the integration between on-chain and traditional finance accelerates, elevating its role within the global financial system.

According to HashKey data, CPIC Estable MMF attracted over $100 million in subscriptions on its first day, highlighting strong market demand for institutional financial product tokenization. As HashKey Chain continues deepening collaborations with multiple institutions, it will emerge as the ideal platform for tokenizing bonds, funds, stablecoins, and other financial products, accelerating the leapfrog development of on-chain finance and RWA.

Both strategies have their merits, each driven by a grand vision to catalyze on-chain finance and achieving breakthroughs in their respective domains. However, given that on-chain finance remains in its early stages, both Base and HashKey Chain may still require more real-world, deeply integrated on-chain/off-chain scenarios to prove long-term viability. A longer-term perspective is essential.

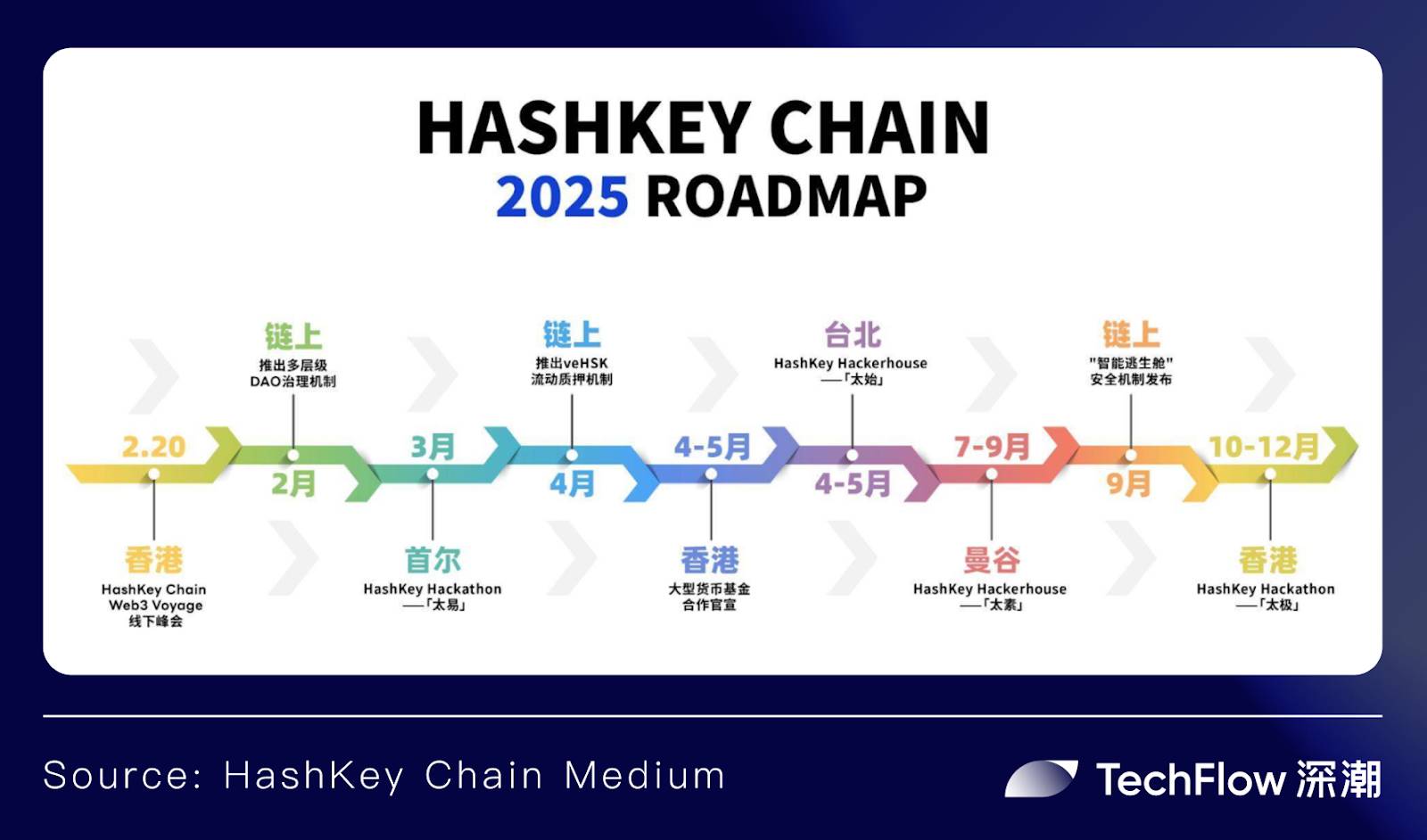

To anticipate the future, perhaps their 2025 roadmaps offer more insight.

Multipronged Strategies: Welcoming the Golden Age of On-Chain Finance

Base’s 2025 roadmap reveals a clear dual-track approach focusing on technology and ecosystem:

On the technical side, Base will prioritize OnchainKit, Paymaster, and L3 to improve user experience.

On the ecosystem front, Base aims to establish over 25 fiat on/off ramps, onboard 25 million users and 25,000 developers, and achieve $100 billion in on-chain assets by year-end.

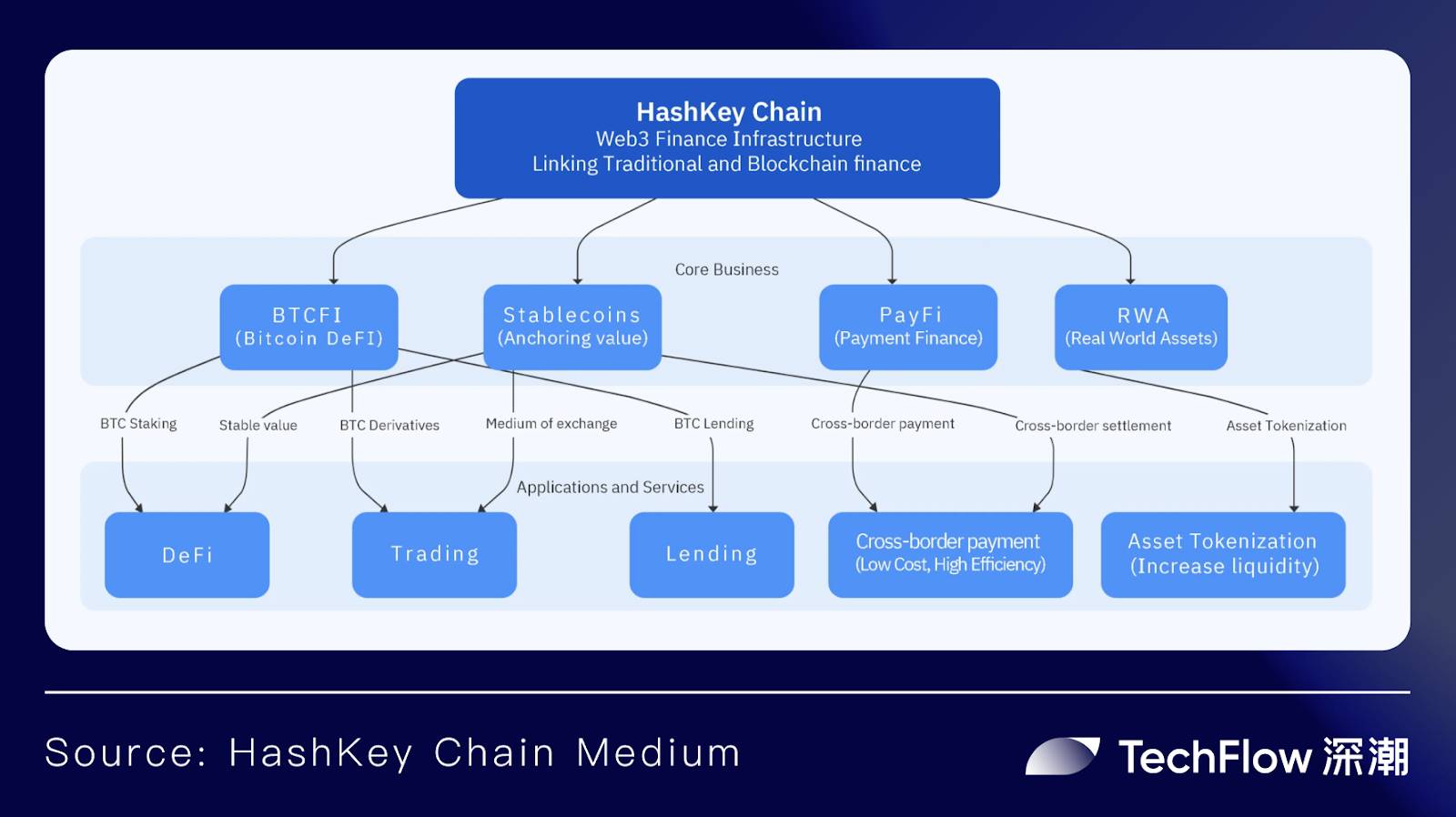

Compared to Base’s ambitious numerical targets, HashKey Chain’s 2025 roadmap centers on specific verticals—BTCFi, PayFi, RWA, and stablecoins—detailing concrete initiatives to advance on-chain finance, grow developer communities, attract institutional capital, and build a compliance-first financial infrastructure.

First, HashKey BTC (HBTC), the Wrapped BTC asset issued by HashKey Chain, is即将 launched:

This product targets the trillion-dollar BTCFi market, offering users compliant and attractive on-chain yields—including lending returns, liquidity mining, restaking rewards, and HashKey Points.

Second, with the vision of becoming the “first blockchain for finance and RWA,” HashKey Chain will continue focusing on RWA, continuously improving institutional-grade financial product tokenization services:

Previously, HashKey Group partnered with Cinda International Asset Management to launch STBL—the first security token offered by a Hong Kong financial institution. Backed by an AAA-rated money market fund (MMF) portfolio, each STBL is valued at $1, transferable 24/7, and distributes accrued interest automatically in new tokens to qualified investor wallets on a monthly basis. STBL issuance will soon expand onto HashKey Chain.

Meanwhile, HashKey Chain will promote tokenization in real estate, commodities, and art, enhancing asset liquidity and market transparency.

More importantly, based on deep partnerships with multiple institutions, a Hong Kong dollar stablecoin on HashKey Chain is in development:

HashKey Exchange has partnered with Wanbi Technology and Allinpay International to prepare for the launch of a HKD-pegged stablecoin on HashKey Chain. This stablecoin ecosystem will further drive the growth of cross-border payments and decentralized financial solutions on HashKey Chain, accelerating the global transition to on-chain finance.

On the developer front, multiple incentive programs highlight HashKey Chain’s commitment to building on-chain finance:

At mainnet launch, HashKey Chain introduced the Atlas Grant program with a total prize pool of $50 million, aimed at identifying and empowering top Web3 projects to fuel exponential growth in applications and users. Phase I concluded on January 20, 2025, with Phases II through V launching progressively in Q2, Q3, and Q4 of 2025.

In addition, a series of HashKey Hacker Houses and hackathons will be held in cities across South Korea, Taiwan, Japan, and Thailand, offering developers opportunities to engage directly with HashKey Chain’s core team and receive support.

From embracing compliance to building a secure, efficient, and institution-friendly on-chain financial ecosystem via BTCFi, RWA, and stablecoins, HashKey is emerging as a key force driving deeper integration between on-chain and traditional finance.

Whether it’s Coinbase and its high-performance Layer 2 Base in the West, or HashKey and its finance- and RWA-focused public chain HashKey Chain in the East, both are advancing the prosperity of on-chain finance in their own ways. This parallel evolution between East and West not only reflects diverse pathways but also reveals profound shifts in the global financial system.

As the community often says:

Coinbase in the West, HashKey in the East

Base in the West, HashKey Chain in the East

Given the near-inevitable trend of clearer regulations and increasing institutional adoption, rather than framing this as pure competition, it may be more accurate to view it as collaboration.

With San Francisco—home to Coinbase—and Hong Kong—home to HashKey—as two central hubs, and Base’s compliant stablecoins and HashKey Chain’s institutional financial product tokenization as dual engines, facing the golden age of on-chain finance, we can look forward to both Base and HashKey Chain adopting a cooperative stance—jointly shaping Eastern and Western on-chain financial orders and accelerating the arrival of a global on-chain financial transformation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News