Decoding ReFi: The Intersection Narrative of Finance, Energy, and DePIN—Which Projects Are Worth Watching?

TechFlow Selected TechFlow Selected

Decoding ReFi: The Intersection Narrative of Finance, Energy, and DePIN—Which Projects Are Worth Watching?

ReFi, a sector that combines the crypto world with energy, environmental protection, and physical devices.

Author: TechFlow

“To be or not to be, that's a question”.

This famous quote from *Hamlet* could be rephrased in crypto terms as: “Buy or not buy — that is the question.”

One of the daily routines for Web3 participants is jumping back and forth between trending narratives.

When evaluating a project, users often consider whether it aligns with current hot narratives before deciding to invest. When comparing multiple projects, they frequently rotate their investments based on shifting narrative trends.

What are the current market narratives?

Beyond Bitcoin ETF developments, DePIN is emerging, new L1s are advancing rapidly, and RWA has repeatedly appeared on institutional outlook lists... With so many narratives competing, funds in one’s wallet always seem insufficient.

Ideally, a single project would hit multiple of these narratives at once, which intuitively increases its perceived chance of success—placing multiple bets while only spending once. Moreover, if such a project also delivers positive social impact, it gains an extra layer of legitimacy.

So, what projects meet these criteria?

Beyond recent market focus, there’s an under-the-radar sector quietly growing but rarely discussed: ReFi.

Note: This "Re" prefix does not refer to “re-staking finance,” but rather to "Regenerative Finance"—a sector combining the crypto world with energy, environmental protection, and physical devices.

For example, Rowan, a leading ReFi project, has seen its token surge an astonishing 200x over the past year—yet many readers may have never heard of it.

So what makes ReFi so compelling, and which other projects deserve attention?

ReFi: Riding Multiple Narratives, Aiming at Environmental Protection

ReFi isn’t a new narrative. Searching for “ReFi” in last year’s crypto articles reveals numerous introductions and analyses.

However, for Web3, the popularity of narratives and projects often correlates with broader capital market trends.

According to BloombergNEF data from August last year, global investment in new renewable energy capacity surged to $358 billion in the first half of 2023, up 22% year-on-year and setting a six-month record high.

During the same period, related capital markets also experienced rapid growth. Venture capital and private equity commitments to renewable energy companies reached $10.4 billion, up 25% compared to the first half of 2022.

As environmental protection and sustainable development attract increasing attention, the Web3 space—known for linking real-world trends—is naturally showing signs of development.

A general approach within ReFi is leveraging blockchain’s transparency to bring natural assets on-chain and introduce incentive mechanisms that reward green contributions, thereby promoting sustainability.

More specifically, today’s ReFi projects can leverage the following components:

-

Decentralized Ledger / L1: Enables distributed consensus, recording environmentally beneficial actions onto public chains, making eco-friendly behaviors visible and traceable, providing a basis for regulation and rewards;

-

NFTs: Serve as containers for regenerative project data, tracking social, environmental, and economic metrics across specific ecological zones;

-

Tokens & Contracts: Natural capital, productive/manufacturing capital, social capital, and human capital—all beneficial to the environment—can be tokenized and traded or regulated via smart contracts. A concrete example is tokenizing regional carbon emission allowances.

-

DAOs: Enable new organizational models for governing environmental and renewable resources, potentially including previously marginalized stakeholders (e.g., environmental NGOs).

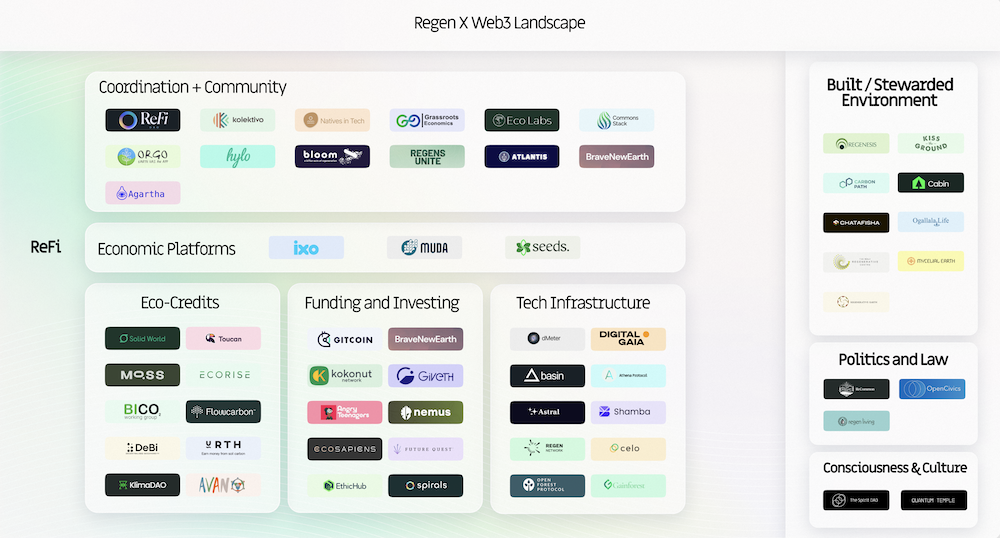

A Gitcoin blog post last year categorized the ReFi ecosystem into community, economic/technical platforms, credit scoring, and financing tools. However, this categorization remains too broad. Let’s get more concrete:

First, collecting environmentally beneficial data requires physical devices—this inherently involves DePIN. Additionally, managing real-world natural capital through trading or incentives brings a flavor of RWA. Furthermore, recording environmental and renewable-related data may require a dedicated chain, linking it to L1 and infrastructure...

By straddling multiple narratives and targeting environmental protection, ReFi connects with various existing sectors. More importantly, it offers a form of legitimacy—grounded in tangible real-world impact—that purely financial crypto projects lack: moving from virtual speculation to real-world utility.

Combining synergy with multiple narratives and delivering positive social value, these dual advantages have given rise to several noteworthy projects.

Dione Protocol ($DIONE): Connecting Power Suppliers, an L1 and Marketplace Dedicated to Renewable Energy Trading

Dione Protocol aims to reduce barriers to entry in the renewable energy industry, enabling consumers to establish their own “green energy” businesses.

To achieve this, the project developed a blockchain-based platform designed to incentivize all participants to use green energy, making energy production processes and supply chains more efficient and transparent for end-users, utilities, investors, and regulators.

Architecturally, Dione is a PoS-based L1 compatible with EVM, built for renewable energy trading. Its core architecture leverages Avalanche, giving Dione over 5,000 TPS, support for scaling additional nodes, and the ability to store private data under strict access controls, ensuring data privacy and security.

Based on this architecture, the project has built Nebra, an energy trading marketplace.

Nebra operates on a peer-to-peer (P2P) model connecting energy producers and consumers. This allows producers to bypass traditional grids and sell surplus energy directly to consumers, resulting in significant cost savings for both parties.

When an energy unit is generated and ready for consumption by a supplier, the transaction occurs via Nebra. However, the actual movement of that unit from supplier to consumer device still flows through the conventional grid.

Additionally, users can install solar panels (sold through Dione’s collaboration with grid operators) to receive clean energy transmitted by suppliers.

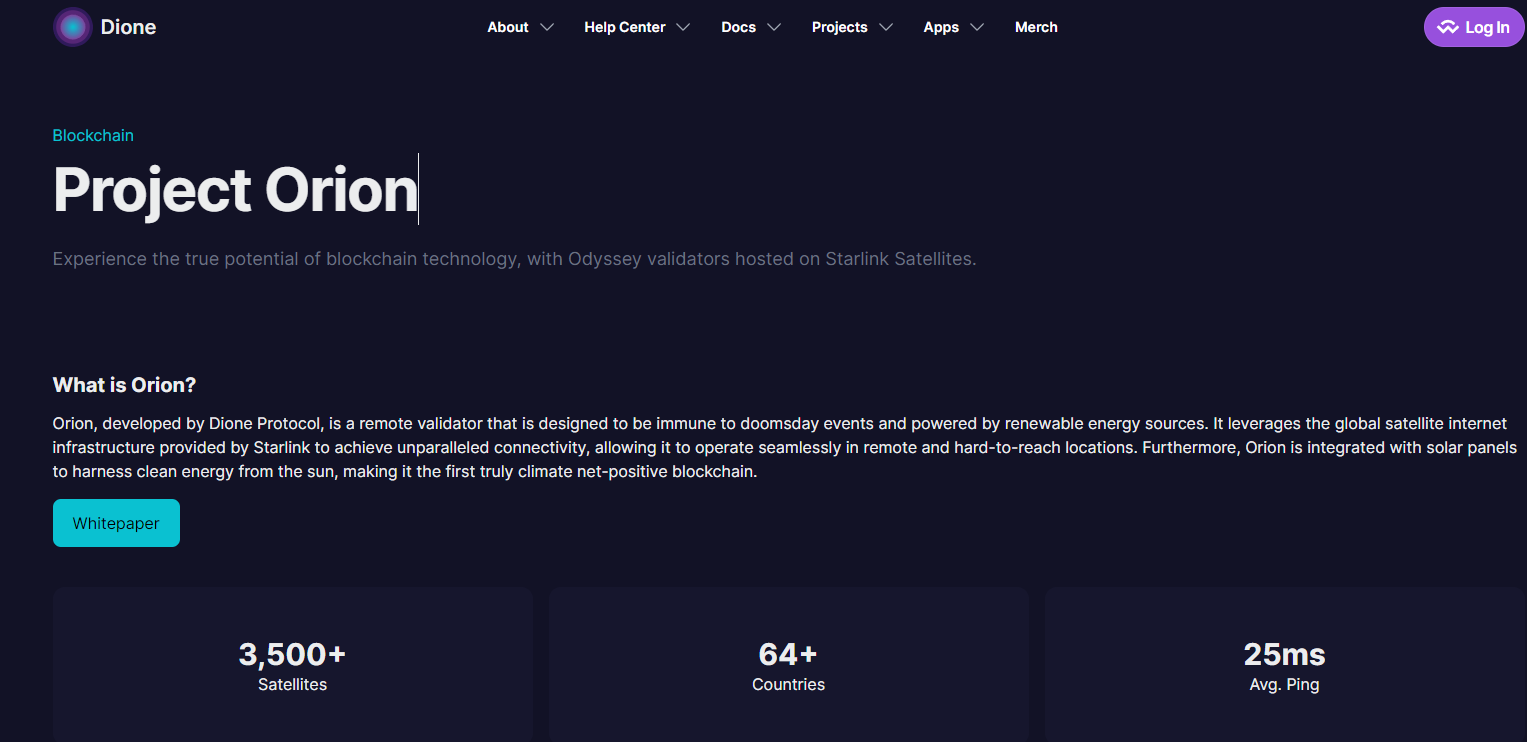

Interestingly, Dione’s validator node design uses Starlink satellites provided by Elon Musk’s SpaceX for connectivity, powered entirely by solar energy. This enables seamless operation in remote and hard-to-reach locations, achieving true physical-level “eco-friendliness” and “decentralization” for the blockchain.

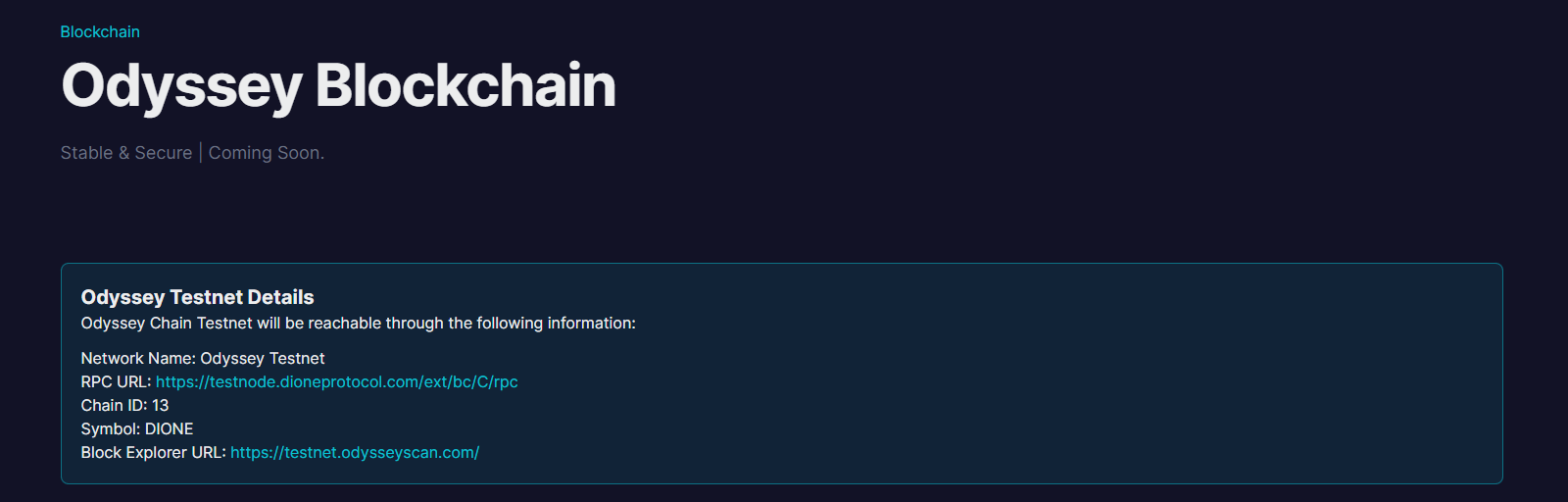

Dione’s native blockchain, named Odyssey, is currently in testnet phase but will officially migrate to mainnet around January 15.

However, as a two-year-old project, this mainnet launch timeline isn’t particularly fast. Performance and market response post-launch warrant close observation.

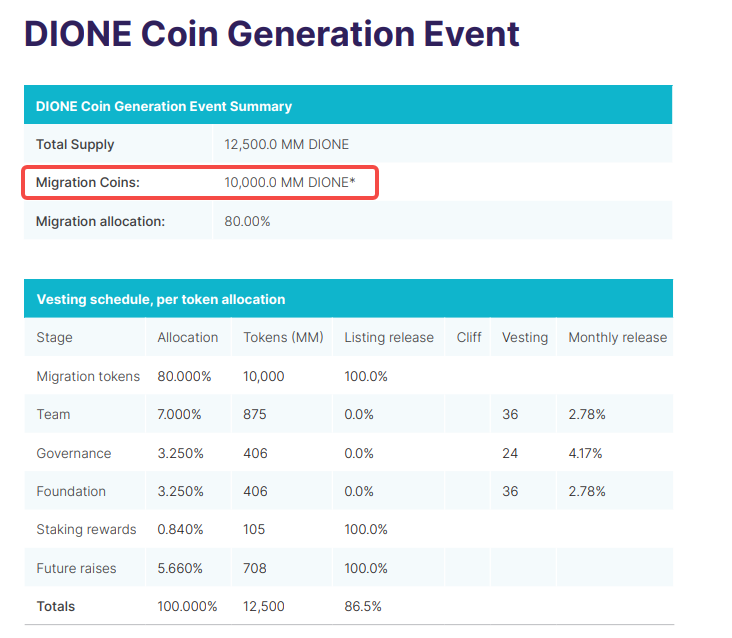

Although its L1 hasn’t launched yet, Dione’s native token $DIONE was initially deployed on Ethereum and will later migrate to the mainnet—a move affecting DIONE’s tokenomics.

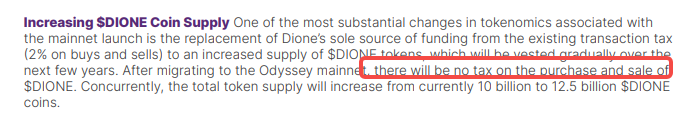

According to the tokenomics whitepaper (see here), total $DIONE supply will increase from 10,000M to 124,000M after mainnet launch. In return, buying and selling $DIONE will no longer incur transaction taxes.

The author speculates that around January 15, the token price may fluctuate due to supply changes—not directly because of increased supply (due to linear vesting), but possibly driven by market炒作.

Additionally, users can stake $DIONE to secure network safety, earning 1% every 30 days, with a maximum yield of 8% during the staking period.

On secondary markets, $DIONE doubled in price over the past month. Over the past year, it surged 200x. Yet, despite this performance, the current market cap stands at just $36 million. With mainnet launch and growing environmental awareness, $DIONE may experience further speculation.

Rowan Energy ($RWN): Residential Solar Mining, Combining Environmental and Economic Benefits

If Dione focuses on the energy supply side, Rowan targets the consumer side.

Rowan Energy is a renewable energy company with its own L1.

Rowan Energy uses blockchain technology to track solar power generation from residential rooftops. This provides accurate monitoring and data verification, solving issues like untraceable electricity and opaque transactions in traditional energy markets.

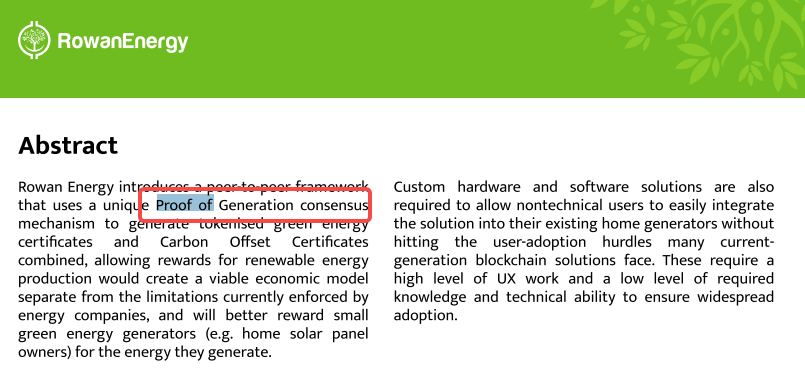

The project employs a consensus mechanism called “Proof of Generation,” allowing users connected to the network to participate in blockchain maintenance by proving their solar energy output. Unlike traditional Proof of Work, this method is far more eco-friendly and energy-efficient.

The L1 records data, but hardware is needed to generate and transmit it.

Their hardware solution is called SmartMiner—a device integrating a smart meter with cryptocurrency mining capabilities.

Together, this resembles a DEPIN model where solar-powered physical hardware mines tokens, with the shared goal of promoting renewable energy usage and environmental protection.

Physically, SmartMiner is a box the size of a standard smart meter, installed between the user’s solar panels and home Wi-Fi. While measuring power consumption, it generates crypto rewards. According to official documentation, Rowan Energy pays $RWN worth 10 pence for every kWh of solar energy produced. These rewards can be cashed out via PayPal or sent to a compatible Rowan wallet on the user’s phone.

Each time a SmartMiner is sold or fees are incurred on its L1, Rowan Energy repurchases a portion of $RWN, creating value support for the token and encouraging long-term use of clean energy (solar).

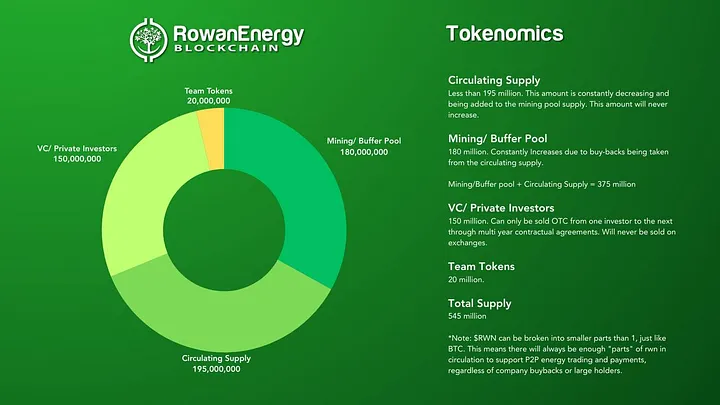

Regarding token design, $RWN has a total supply of 545M, with 150M allocated to VC and private rounds. Notably, the project stipulates that VC-round $RWN tokens can only be redeemed via OTC, never listed on exchanges.

Currently, 195M $RWN are in circulation, with the remaining 180M reserved for DePIN mining rewards.

In market terms, $RWN rose 200% in the past month and an impressive 20x over the past year. Its $33 million market cap is comparable to DIONE mentioned earlier.

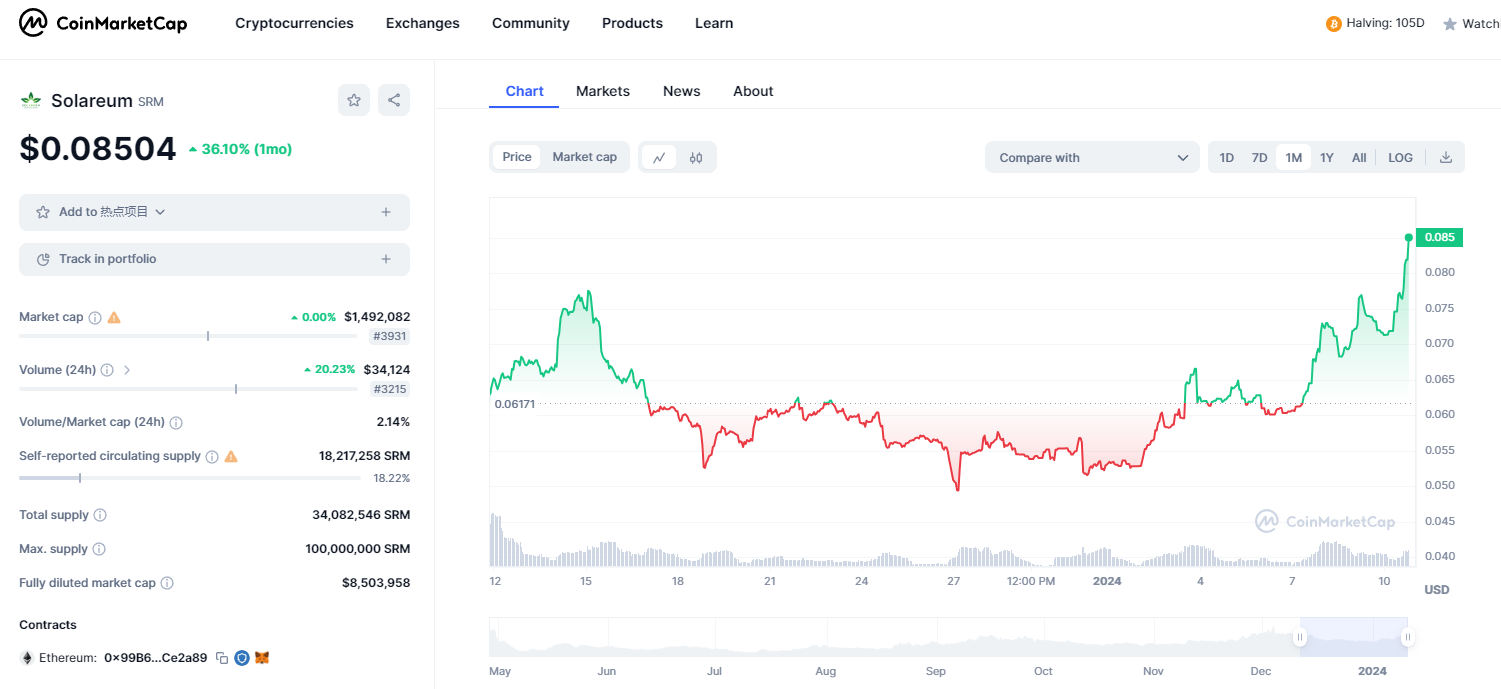

Solareum ($SRM): A “Green L1” Where Renewable Energy Providers Act as Validators

SolareumChain leverages blockchain technology to incentivize greater adoption of green energy through token rewards, addressing the energy crisis. This L1 uses two innovative consensus mechanisms: Proof of Generation (PoG) and Proof of Holding (PoH).

PoG—Proof of Green Generation—is SolareumChain’s core. Unlike Bitcoin, which consumes massive electricity and computing power, miners in Solareum earn rewards not by consuming power, but by producing renewable energy.

SolareumChain opens the door for renewable energy producers—including solar farms, wind farms, tidal plants, geothermal installations, and even individual rooftop solar panels—to act as validators. These producers continue generating green energy while simultaneously enhancing the security of the Solareum L1.

PoG technology ensures that generated renewable energy is verified as legitimate. It also prevents any single entity from gaining excessive control, forming a truly decentralized solution. This approach makes SolareumChain not only more environmentally friendly but also more secure.

PoH, meanwhile, rewards those who hold Solareum tokens ($SRM) and meet certain criteria. This unique mechanism allows anyone to easily become a validator and contribute to network security and integrity.

The more $SRM held, the higher the earnings, with opportunities to participate in energy generation and become an integral part of the SolareumChain ecosystem. $SRM also serves as the currency for buying and selling energy on Solareum’s public energy market. Since this market runs on blockchain, every transaction and validation process is publicly verifiable, ensuring network integrity.

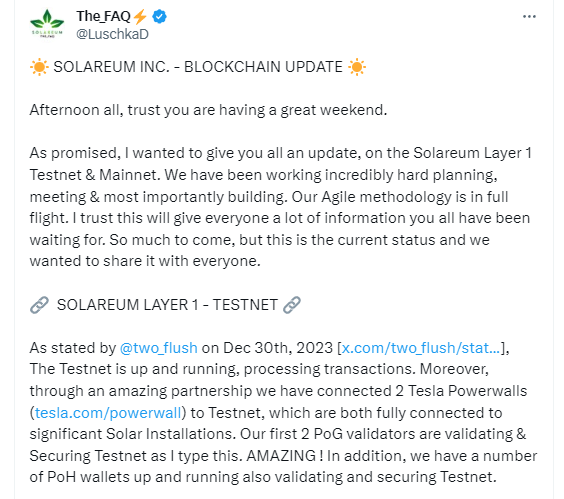

Currently, SolareumChain remains in testnet phase.

According to official Twitter updates, the testnet is already built and processing transactions. They’ve partnered to connect two Tesla Powerwalls to the testnet, each linked to major solar installations.

Solareum plans to soon announce a developer program, inviting developers to build dApps on the testnet in preparation for public mainnet launch. The official launch date will be announced closer to the time.

In terms of token performance, $SRM has risen about 35% in the past month. Over the past year, its price hasn’t shown dramatic movements, and its market cap is under $1.5 million—smaller than some well-known meme coins.

However, based on the project’s documentation, Twitter engagement, and other information, $SRM discloses fewer details than the previous two projects. The whitepaper emphasizes values and mathematical formulas more than substantive progress, highlighting the coexistence of high risk and high potential:

Lack of detail could mean the project hasn’t fully activated yet—or suggest limited substance. Future performance remains to be seen.

Arkreen Network ($AKRE): A Zero-Energy-Consumption Network for Carbon Reduction Data

Arkreen combines Ark and (g)reen, symbolizing an ark gathering green energy data and carrying the future.

Arkreen Network is a Web3-based carbon reduction infrastructure for globally distributed renewable energy resources, enabling connection and monetization of carbon reduction applications.

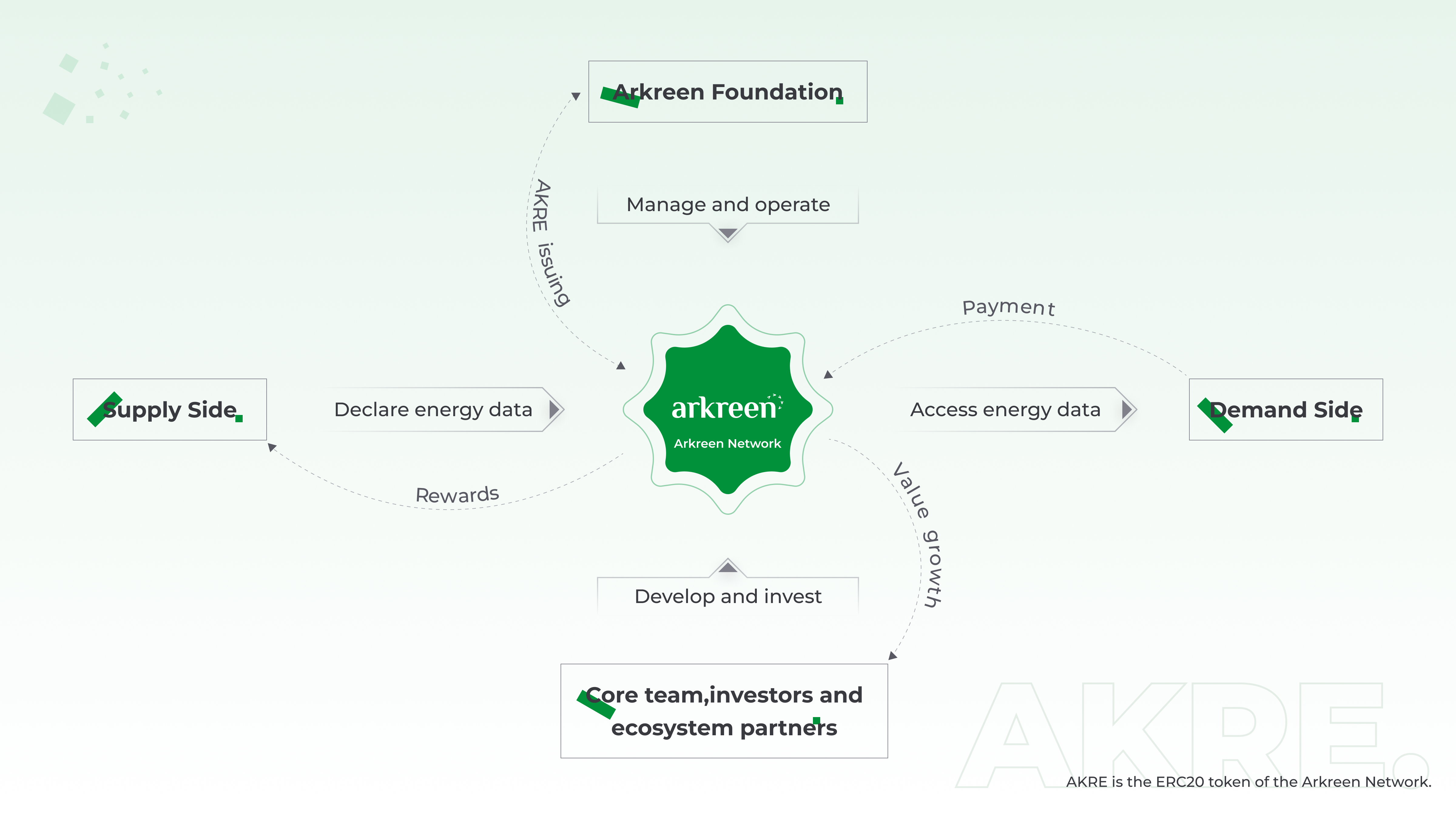

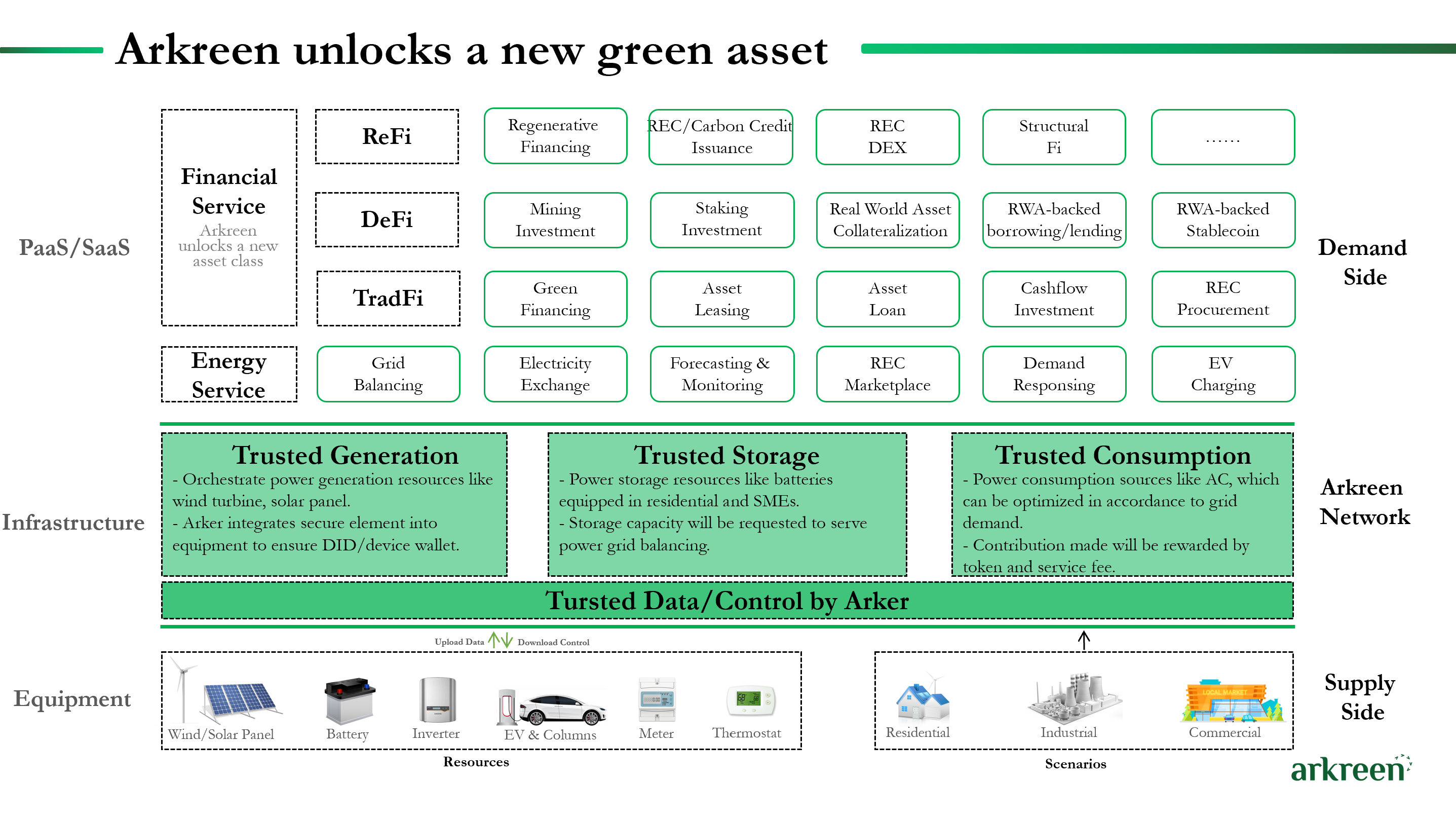

Specifically, it connects energy producers and consumers.

Suppliers use Arkreen Network to report quantities of renewable electricity they produce, store, or consume. The network rewards participating suppliers. Owners of solar PV systems and households practicing demand-side energy saving are examples of suppliers.

Demand-side users access power data via Arkreen Network to build applications and services (e.g., REC issuance and VPPs).

For instance, you can check on the project’s blockchain how much generation capacity a clean energy provider has used and issue a certificate like the one below to recognize their contribution.

To achieve these functions, Arkreen Network relies on IoT, AI, blockchain (DLT), and token economics. By digitizing energy facility parameters and states, it creates digital twins reflecting physical infrastructure.

Ultimately, the project aims to:

-

Encourage generators to produce more renewable electricity, reducing overall fossil fuel dependence.

-

Enable storage providers to absorb excess energy when generation is high and release it during shortages, reducing waste and improving efficiency.

-

Reduce total consumption by end-users.

-

Shift some consumer energy usage from peak shortage periods to times of surplus.

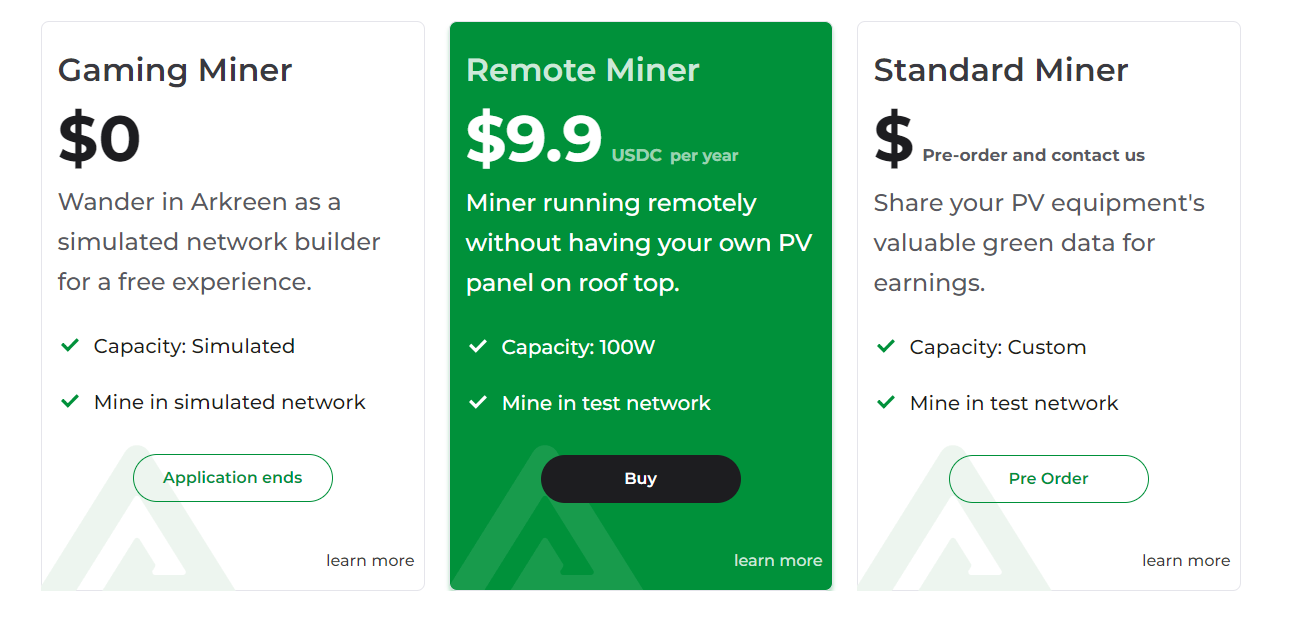

Currently, Arkreen supports several types of “miners” that participate in $AKRE mining while also contributing to renewable energy generation:

-

Remote Miner: Operated remotely without installing local energy equipment (e.g., solar panels) or data collectors. Provides a lightweight way into the Arkreen ecosystem for users unable to install hardware. Each Remote Miner purchase mints a corresponding NFT.

-

Standard Miner: Requires purchasing monitoring hardware and data collectors. Though more complex and costly than Remote Miners, owners earn higher rewards.

-

API Miner: Rewards are based on third-party platform data. For example, users link existing energy facilities to energy management platforms. Qualified third-party platforms can submit facility data to Arkreen Network, which then issues rewards. Each API Miner receives an NFT upon data validation.

Beyond energy generation, Arkreen introduces energy-consuming products—Smart Plugs. These measure appliance energy usage and enable remote power scheduling. Users can power appliances (e.g., air conditioners) via Smart Plugs to join green initiatives. Each Smart Plug also mints a corresponding NFT.

Regarding tokens, $AKRE can be distributed as rewards to contributors building and maintaining the Arkreen network, used to pay transaction fees on the network, or paid to external entities using Arkreen’s green energy data services.

$AKRE has a maximum supply of 10,000,000,000 (10 billion). All $AKRE tokens will be gradually released to stakeholders based on network development progress, with 30% allocated to mining and the remainder distributed among team, advisors, investors, and ecosystem roles—all subject to lock-up and linear release schedules.

The author found no public indication that $AKRE has undergone TGE, suggesting the project is still in the build phase. Unlike previous projects, Arkreen focuses more on energy-related data and credentials. The full role of its token awaits further official updates.

Summary

Reviewing the above projects and the overall sector, several characteristics emerge:

First, these projects span multiple narratives—L1, DePIN, and even RWA.

Second, their market caps are relatively low.

Third, participation requires certain barriers—such as owning solar panels, purchasing small devices, or integrating into the broader renewable energy industry.

That third point may precisely limit their current scale. Clean energy generation involves entrenched traditional interests, complex policies, and multiple stakeholders. While blockchain and IoT can improve efficiency, they cannot yet disrupt the traditional energy industry’s operating model.

Yet these projects tackle tough challenges—upgrading equipment, convincing residents, and partnering with energy suppliers—all requiring extensive technical, relational, and resource investments, with long timelines and slow results.

Conversely, precisely because these efforts are difficult, they carry greater social value—perhaps the foundational reason why the ReFi narrative deserves attention.

Still, in a lively and often speculative crypto market, it remains questionable whether capital and attention will patiently await the realization of these “legitimate” projects. Nevertheless, positioning trades on low-market-cap projects at the intersection of overlapping narratives may offer a strategic way to engage with emerging trends.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News