Environmental Financialization: Understanding Web3 Carbon Credit Markets and ReFi Regenerative Finance

TechFlow Selected TechFlow Selected

Environmental Financialization: Understanding Web3 Carbon Credit Markets and ReFi Regenerative Finance

Regenerative Finance (ReFi) is a financial movement focused on leveraging the power of blockchain and Web3 to address climate change, support conservation and biodiversity, and create a more equitable and sustainable financial system.

Author: 0x_Zoe9961, Fundamental Labs

Compiled by: TechFlow

Our relationship with Earth is driving climate change, biodiversity loss, and environmental crises. Over 130 countries and regions worldwide have set carbon neutrality targets, making green energy, low-carbon production facilities, and sustainable development international consensus. Carbon can be tracked and traded like any other commodity—by pricing carbon and discouraging polluters—to create a market for global decarbonization. As environmental pressures grow, carbon markets are becoming attractive financial systems where companies meet government regulations on carbon offsets through complex cap-and-trade systems such as those in the EU, Australia, and North America.

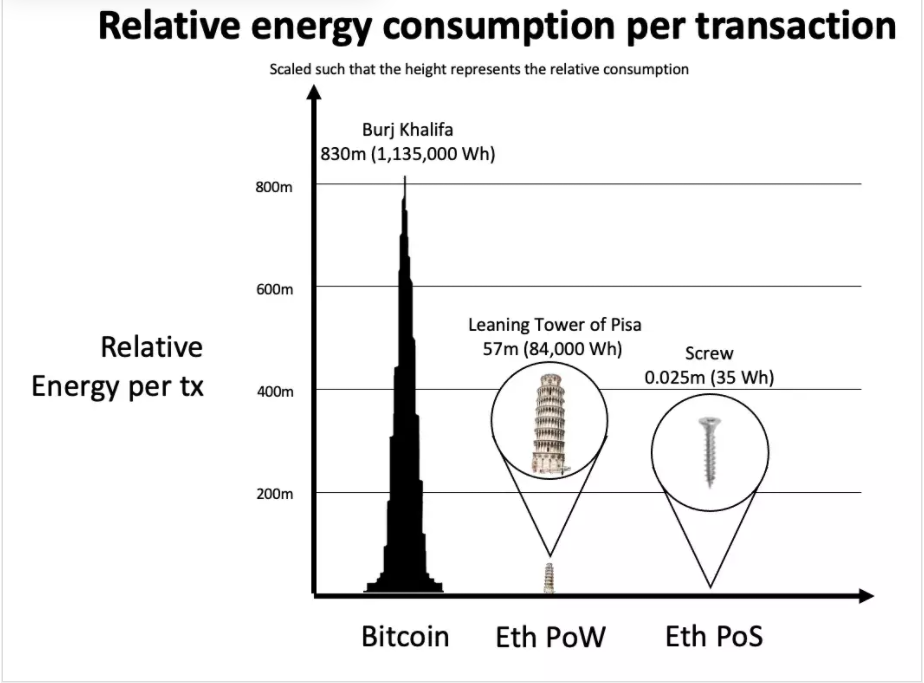

While traditional industries race to reduce emissions, Web3 faces its own energy consumption challenges. Proof-of-Work (PoW) blockchains are notoriously energy-intensive. According to Digiconomist, Bitcoin mining emits as much CO₂ as New Zealand and consumes as much electricity as Chile.

As a result, many networks are actively shifting toward greener technologies and investing in pollution-reducing initiatives. Ethereum is transitioning to Proof-of-Stake, Ripple has pledged $100 million toward carbon-neutral markets, and Polygon aims to become carbon-negative by 2022. Like traditional industries, Web3 projects are taking similar steps while also aiming to optimize carbon credit markets to support broader industrial decarbonization.

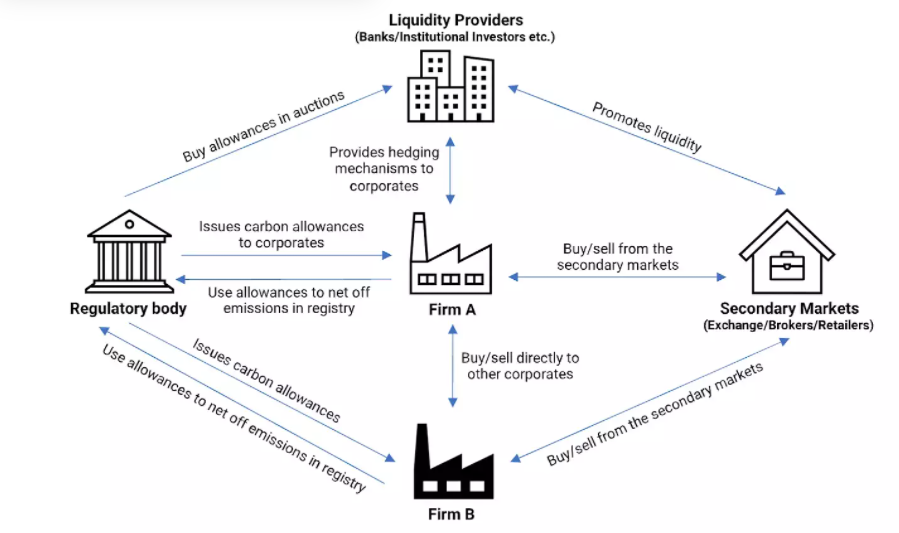

A carbon credit represents the right to emit one metric ton of carbon dioxide. These credits can be voluntarily traded in carbon markets or used within regulatory frameworks, giving rise to two types of traditional carbon markets: voluntary carbon markets (VCM) and compliance carbon markets (CCM).

Only institutions approved by regulators may participate in compliance carbon markets, which are dominated by large platforms in Europe, the UK, and North America. Consequently, there is limited room for innovation within CCMs.

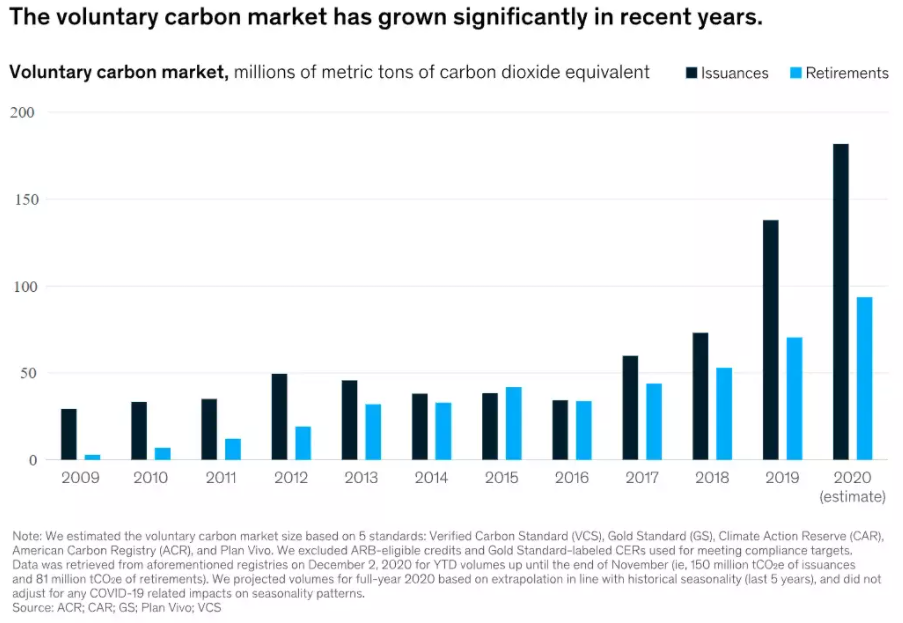

According to MSCI, the global compliance carbon market was valued at approximately $851 billion in 2021, compared to about $1 billion for the voluntary market. Due to its relatively small size, the VCM currently lacks institutional investors.

Although the VCM is only a fraction of the size of the CCM, it is a more flexible and globally accessible market. Unlike CCMs, VCMs are not bound by government regulation or standardized rules. There is no cap on the number of carbon credits that can be issued or traded. While the lack of standardization poses challenges, it hasn't stopped major corporations from energy, tech, and finance sectors from actively purchasing VCM credits to advance their net-zero agendas. Individuals can also buy credits to offset their emissions. Despite standardization issues, the VCM can serve as a coordination mechanism between supply and demand and could play a critical role in funding climate-positive projects that prove more transparent and robust over time.

In short, the idea behind the voluntary carbon market is that once carbon emissions are properly priced, regulators allow organizations to decide whether to reduce pollution or purchase credits—letting the market determine optimal resource allocation. This increases the cost of emissions, thereby incentivizing companies and individuals to reduce them.

While carbon credits quantify emissions, methodologies for measuring emissions across jurisdictions vary widely, creating significant standardization challenges. Although reducing emissions benefits the environment, there is no universally agreed-upon method to measure VCM credits from different regions. Due to inconsistent standards and concerns over actual environmental impact, buyers must spend considerable time verifying credit quality before purchase. This leads to inefficiencies in the voluntary carbon market, including scarce financing, opaque trading, and poor liquidity.

Blockchain technology holds potential to solve these problems. Many startups are experimenting with tokenizing traditional carbon credits, using blockchain to turn them into divisible, transferable, and transparent tokens—addressing the VCM’s standardization issues. This approach makes public participation in climate governance easier, and blockchain-based tokens can be integrated into DeFi projects for incentives.

What Is ReFi and Why It Matters

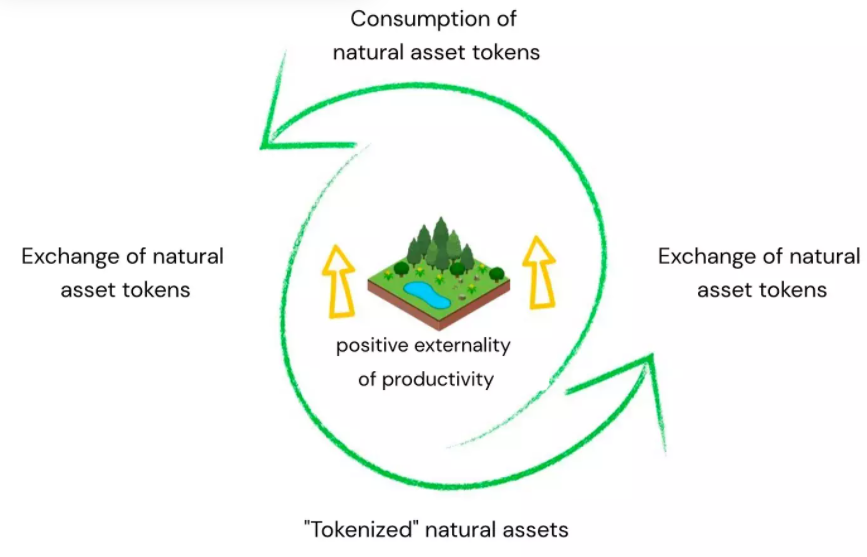

Our current monetary system fails to value the role natural assets play in developing and sustaining human society. Capital-driven industrial growth has created negative externalities, including greenhouse gas emissions, habitat destruction, and social inequality. Many projects aim to use Web3 tools to tackle climate issues, most falling under the emerging field of ReFi.

Regenerative Finance (ReFi) is a financial movement focused on leveraging blockchain and Web3 to address climate change, support conservation and biodiversity, and build a fairer, more sustainable financial system.

ReFi uses various forms of capital to drive sustainable, systemic, positive change for all stakeholders. By bringing real-world natural assets on-chain via blockchain, it reflects a cultural shift toward funding communities and public goods rather than maximizing founder returns. Money and capital are treated as programmable tools—enabling climate and environmental solutions through communities built on regenerative natural resource consensus. As Kei Kreutler, director at Regen Network, notes, Regen focuses on bioregional DAOs organized around geographic areas like the Amazon rainforest and guild DAOs integrating other communities.

Key ReFi Projects Analysis

To stabilize our climate and restore ecosystems, we are seeing increasing experimentation in the ReFi space. By categorizing projects by technology layer, we identify emerging initiatives at the infrastructure, platform, and DAO levels.

Infrastructure: Celo, Toucan Protocol

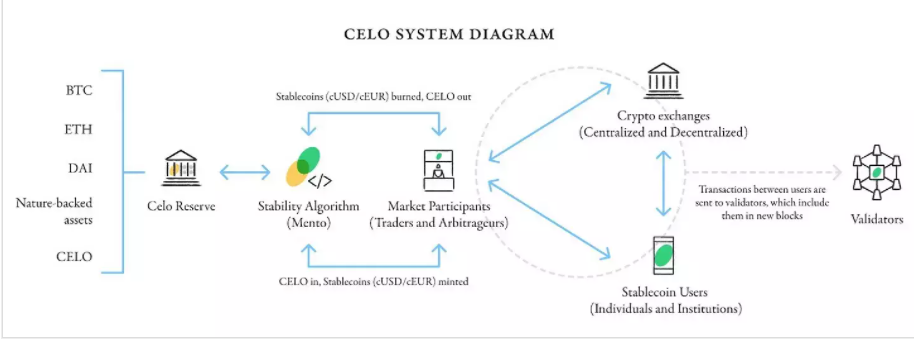

Unlike many market-oriented Layer 1 blockchains, Celo prioritizes enabling unbanked users—especially in Africa and developing nations—to access DeFi products. By the end of 2021, Celo's total value locked (TVL) reached approximately $139 million, with DeFi, wallets, and social impact projects accounting for 26%, 24%, and 10% respectively.

Celo plays more of an enabling role—providing a low-impact platform for other projects, though it does not directly handle carbon credits itself.

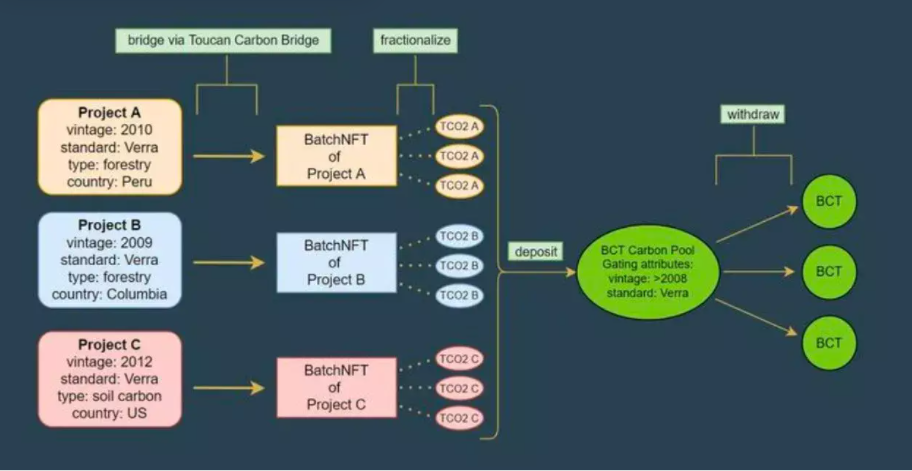

Toucan Protocol, built on Polygon, treats carbon as currency in Web3. Its goal is to transform carbon credits into programmable digital assets and improve price discovery and liquidity in carbon markets. The protocol achieves tokenization primarily through two mechanisms: the Carbon Bridge and Carbon Pools.

The process of transferring traditional carbon credits onto the blockchain via Toucan Protocol is as follows:

- First, a batch of carbon credits from a specific project and year is purchased from the traditional market—typically verified by centralized bodies like Verra.

- Second, these credits are transferred on-chain via Toucan’s Carbon Bridge, becoming a "BatchNFT"—an NFT containing details such as carbon type, year, location, and tonnage. To enhance liquidity, BatchNFTs are fractionalized into fungible TCO2 tokens.

- Then, TCO2 tokens are deposited into different "carbon pools" based on specific criteria, allowing depositors to exchange them for reference tokens like BCT.

Currently, most ReFi protocols aim to establish carbon standards, boost market liquidity, and enable speculation and pricing—similar to what Toucan does. Some worry these new standards could fragment the market, harming liquidity, transparency, and accountability. Given that Toucan controls over 85% of the on-chain carbon market share, we believe opportunities for other infrastructure innovations are limited.

Platforms: Moss.earth, Nori, FlowCarbon

Moss Earth is a climate tech company focused on environmental services, using blockchain to enable traceable and transparent carbon offsetting. In 2020, it backed 150,000 annual carbon credits generated by the Amazon rainforest. By locking Verra-verified credits, it mints MCO2 tokens as on-chain tradable assets. Users can buy, hold, and stake MCO2 to protect the environment.

Moss Earth has partnered with several major companies: Amazon purchased over $15 million worth of MCO2, helping preserve around 800 million trees. Brazil’s largest airline, Gol, uses MCO2 to offset in-flight emissions. The Celo community also approved a proposal to allocate 0.5% of its cUSD reserves to MCO2.

At the platform level, many competing products exist, most offering vertical solutions for specific carbon credit applications. For example, Nori is building a marketplace for carbon removal credits, targeting double-counting and fraud in existing markets.

FlowCarbon is an open-source carbon credit protocol backed by prominent venture firm A16z and built on Celo, aiming to create a transparent, permissionless carbon trading market to help businesses achieve net-zero or net-negative emissions.

FlowCarbon’s GNT token is fully backed by the real-time value of off-chain credits and can serve as collateral, treasury asset, stablecoin reserve, or for on-chain carbon offsetting. We believe more innovation will emerge at the platform application layer—potentially creating vertically integrated carbon businesses encompassing financing, corporate emission services, carbon trading, and deep-liquidity carbon pools.

DAO: KlimaDAO

KlimaDAO attracted significant attention by accumulating over $110 million in assets within less than a month of launch. The KLIMA token is backed by real-world carbon assets—Base Carbon Tonnes (BCT). Token price is determined by supply and demand dynamics between KLIMA and underlying carbon assets.

By buying and locking large volumes of carbon credits in its treasury, KlimaDAO drives up carbon asset prices, incentivizing emission reductions. Rising carbon prices force polluters to either bear higher compliance costs or rapidly cut emissions. Simultaneously, more expensive offsets may encourage additional climate-friendly projects to enter the market and sell credits. Users earn returns by staking KLIMA in Klima DAO, with APY peaking at 37,000%.

We can conclude that Klima DAO’s tokenomics follow a Ponzi-like model, sustained by strong consensus around climate action. The more people support it, the higher the demand for KLIMA and BCT. Demand for BCT helps push KLIMA’s price upward and supports the DAO’s treasury, funding real-world carbon offset programs. However, as the crypto market entered a bear phase this year, Klima DAO’s TVL and token price have declined significantly.

Achieving long-term success comparable to BTC or ETH is difficult for DAOs like Klima DAO. Currently, most ReFi DAOs follow similar economic models. For instance, Kumo, a “green” version of MakerDAO, also employs Ponzi-style economics: the more KUSD in circulation, the greater the carbon emissions, and the more funding flows to carbon projects. While the market remains young and there’s room to develop novel crypto-economic models, focusing on more sophisticated designs could make DAOs more stable and sustainable.

Controversies and Bottlenecks

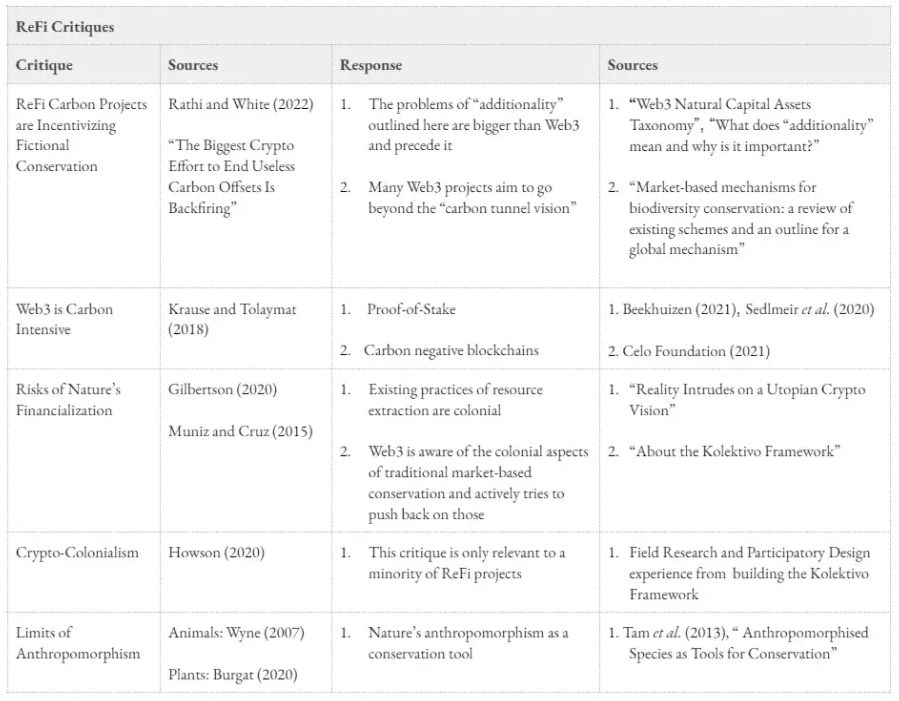

ReFi is still immature, with relatively few projects. Thus, the controversies and bottlenecks in its development deserve attention, as addressing them could accelerate industry progress. According to Curvelabs, critiquing ReFi requires understanding two domains: market-based ecological conservation and cryptocurrency economics.

Because the overall carbon trading process is highly complex and still relies on centralized verification bodies like Verra and Gold Standard, the impact of tokenization is significantly reduced. Ultimately, today’s decentralized systems are built upon centralized bottlenecks.

Speculative trading also applies to carbon credit tokens: some ReFi project tokens are traded purely for short-term profit, without fulfilling genuine environmental responsibilities. Clearer, standardized regulatory procedures are needed in this area.

Conclusion

Dana Gibber, CEO of FlowCarbon, said: “There are powerful economic incentives around the world to destroy nature, but voluntary carbon markets offer a brilliant financial mechanism that creates balanced incentives for reforestation, restoration, and conservation.”

Our current economic system is designed to concentrate wealth and power, disregarding impacts on climate and nature. Money tells a story of extractive profit—mining people’s natural resources.

Compared to traditional carbon governance, tokenizing carbon credits could create a more efficient trading market and a more transparent regulatory environment, further advancing global decarbonization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News